Why do you need a certificate?

salary

certificate is an official document of an organization confirming an employee’s income for a specific period, necessary for calculating various benefits and payments, applying for loans, etc.

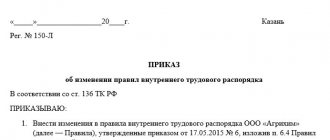

According to the Labor Code of the Russian Federation, upon a written application from an employee, an enterprise is obliged to draw up and issue this document within 3 days. At the same time, the application must reflect what type of information should be and where it is being submitted.

Currently, many competent authorities request a standard document in form 2-NDFL, or provide a blank sample certificate of employment that needs to be filled out. This saves time and costs for both the employee and responsible persons at the enterprise.

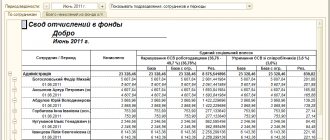

However, there are situations when it is necessary to provide information in free form. In this case, the company must have a developed form that the accountant uses as the need arises. Many specialized accounting programs allow you to automatically generate this document; to do this, you need to select a billing period and an employee.

What needs to be reflected in the certificate of average earnings for the employment center

Art. 3 of the Law of the Russian Federation of April 19, 1991 N 1032-1 “On Employment of the Population in the Russian Federation” establishes a specific algorithm for acquiring unemployed status in Russia. P.2. The above-mentioned article contains a list of necessary documentation for recognizing an individual as unemployed - an identity card, a work book, a certificate of salary for the last quarter of work. For those looking for employment for the first time, you will only need an ID card and proof of education.

The average salary certificate required by the exchange to determine unemployment benefits in 2020 must include the following materials:

- seal of the institution;

- activity code;

- the title of the document itself;

- to whom it is issued;

- duration of work activity;

- average payment for the last quarter;

- number of weeks worked;

- the presence of time intervals that do not relate to the period of paid labor activity;

- payment papers, which are the basis for calculating payment volumes;

- facsimile of the manager and accountant;

- number.

Thus, the content of the salary certificate for determining the amount of unemployment benefits in 2020 is clearly stated in the functioning legislative norms, and the lack of established information can become a factor in remission.

Where is the salary certificate prepared?

The main authorities that require confirmation of an employee’s income are credit institutions, tax authorities, employment services, the committee for labor and social protection of the population, bailiffs, the migration service department, etc.

Credit institutions request certificates in form 2-NDFL when an employee applies for various loans and borrowings, as confirmation of his solvency. These certificates contain information about accrued income withheld by personal income tax. Recently, banks, like many other institutions, have begun to use their own form, which is issued to the person applying for the loan to fill out at the enterprise. It is supplemented with such sections as the employer’s full bank details, other deductions (for example, alimony), the amount of take-home pay, and others.

A 2-NDFL certificate must be submitted when submitting an annual 3-NDFL return to the tax office in cases provided for by law, as well as for processing deductions, tax refunds, etc.

A salary certificate to the employment center is drawn up for dismissed workers in order for them to apply for unemployment benefits. A sample income certificate is developed and applied by the employment service separately in each region.

In practice, many employees fill out certificates from KTSZN to receive subsidies, free dairy for newborns, free lunches in schools, receive social scholarships, etc. Standard enterprise forms are used to issue these certificates. The main requirement: the period reflected in them must be 3 or 6 months, and this document is valid for a month.

The bailiff service requests certificates from the place of work of persons for whom enforcement cases are being conducted in order to verify the correctness of deductions under writs of execution. These certificates must contain information about accrued income, withheld personal income tax, and the amount of alimony.

When applying for a foreign passport at the migration service department or visas at foreign embassies, you must also provide a certificate of your salary. In this case, the total accrued income for the last 12 months is indicated.

Certificate of average earnings to determine unemployment benefits

Many Russians are facing the loss of their main place of employment, especially in the context of the ongoing economic crisis. Having high qualifications and extensive experience in a certain field of activity, people still cannot always immediately find suitable employment. While searching for a job, individuals turn to labor exchanges for two main reasons - state assistance in searching and obtaining. To establish a general procedure for recording such citizens and more efficient operation of services, special legislation has been developed.

The main legal acts regulating legal relations arising between the state and unemployed persons are considered:

- in paragraph 3 of Article 37, it fixed the most important prerogative of the population - protection from unemployment. The inclusion of this topic in a separate paragraph of the country’s basic law indicates the interest of the state itself and the existing degree of importance of the regulated issue.

- The Law of the Russian Federation of April 19, 1991 (as amended on July 29, 2017) “On Employment of the Population in the Russian Federation” provides for the procedure for classifying individuals as unemployed (Article 3), terms, and a basic list of guarantees. Lists the necessary documents for registration of status for various groups of applicants.

- developed a certificate of average unemployment wages and a form required by the Employment Center. But if the employer independently compiled a certificate and included all the essential materials to establish the amount of compensation, then there is no reason for remission.

Sample salary certificate

[ads-pc-2] [ads-mob-2]

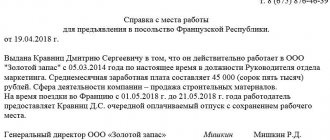

This document is drawn up on the organization’s letterhead or the header must contain the name of the company in accordance with the registration documents, its tax identification number and checkpoint, full address, and contact phone number.

The income certificate must have a registration number, which must be recorded in a special register or in the journal of outgoing correspondence, and the date of preparation.

Next, write down your full name. employee (position, if necessary), and the period for which information is filled out.

After this, the monthly breakdown of the employee’s income is indicated. If necessary, the tabular part of the certificate can be expanded with additional columns: take-home pay, withheld personal income tax, etc.

The accountant must summarize the total indicators and display the average monthly salary, which it is advisable to write down in words.

In the certificate you can write down the basis for its preparation. This document must contain information where it is being submitted. In exceptional cases, you can indicate “Issued for presentation at the place of request.”

The salary certificate must be signed by the director and chief accountant of the company. It must be certified by the company's seal.

In what cases do you need a certificate of average earnings?

The above paper is not a necessary document when registering as unoccupied in the CZN. However, it is precisely this that determines the future amount of payments. For this reason, it is in the interests of the individual himself to obtain the paper and submit it to the authorized institution. Otherwise, the amount of compensation will be 850 rubles - the lower limit established by the Government.

A certificate of average earnings to determine the amount of unemployment benefits will not make sense if a worker is removed due to a disgraceful factor, that is, due to his own fault (appearing drunk, frequent tardiness, and other issues). In this case, the applicant can expect payments only with their minimum amount.

https://youtu.be/yYSz-VSuSTw

Nuances

[ads-pc-4] [ads-mob-4]

When accepting an application from an employee for the payment of wages, it is also recommended to obtain from him consent to the disclosure of his personal data, which indicates specifically what information he allows to be disclosed and to whom.

In practice, it is the employee’s relatives who come to receive a salary certificate, not the employee himself. In this case, it is necessary that the request be submitted only by him, and his representatives have a correctly executed power of attorney when receiving the certificate. The certificate is issued on the basis of a corresponding application.

Also, each employer must issue a certificate upon dismissal in the form approved in Appendix No. 1 to the Order of the Ministry of Labor, approved on April 30, 2013 under number 182n (Certificate 182n). It is necessary in order to calculate sick leave for the employee’s new place of work. The help can be supplemented with lines or, if necessary, the font can be enlarged so that all the necessary information can fit in it.

https://youtu.be/kM0uvGA5e9c

When going to court

In court, a certificate may be required to confirm property rights (for example, to prove that a citizen bought property from his salary, but the opposite party does not have such an opportunity and makes claims unreasonably).

If a citizen is sued to collect debt or other financial obligations, then a certificate is also needed that confirms the possibility or impossibility of fulfilling them.

https://youtu.be/oNAxL2Mb4iQ

For what period is information provided (for how many months)

The provisions of the regulations establish that a certificate of average earnings must be issued for three full months of the employee’s work that preceded his dismissal. Therefore, this calculation does not apply to the standard method of determining the average salary of an employee.

That is, if a person terminated his employment agreement on September 21, then upon receiving a request from him, the employer must prepare a certificate for the period - June, July, August.

It should be taken into account that the following times should be removed from the billing period:

- The period of paid leave provided by law while the employee retains his job.

- The length of time the employee was on sick leave.

- Periods of downtime in work when they were the fault of employers.

- Vacation periods at your own expense.

- Periods of caring for children when employees retain their place of work and are paid.

- The time of the strike, if the employee did not take part in it, but because of this event he could not carry out his work activities.

- Another period when the employee did not work, but he was paid full or partial wages.

- Periods when the employee was granted time off.

Attention: Sometimes, a situation arises when an employee does not have accrued wages for the payroll period in question, as well as days of work. Then, the certificate can be completed for the previous full three months before these three months.

That is, if an employee terminated the contract on September 21, he has been on sick leave since June, then March, April, May can be taken as the billing period.

certificate for the employment center 2018

How is average earnings calculated?

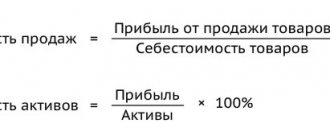

The determination of average earnings is carried out by an accountant in accordance with the rules developed by the Labor Code:

- The average salary is obtained by dividing the actual monthly earnings by the actual amount of time worked.

- Average daily income is calculated differently. You need to take all your income for the year, divide the amount by 12 months, and then multiply by 29.3.

Expert opinion

Chadova Svetlana

Leading HR specialist, lawyer, labor law consultant, website expert

For example, an employee worked in the last company for 8 months, and in the first 4 he received a salary of 30 thousand rubles, and in the second – 35 thousand rubles. Then the average earnings will be (30,000*4+35,000*4)/8 = 32,500 rubles.