Form P-4 is a form for statistical accounting of enterprises and organizations, in which information about the number of their employees and wages is entered. The document is regular and must be submitted to the territorial office of Rosstat:

- once a month , provided that the enterprise employs more than 15 people (until the 15th day of the month following the reporting month),

- or once a quarter if there are less than 15 employees on staff (in a similar mode).

Who is required to submit reports in Form P-4

Most legal entities involved in medium and large businesses must report to the state using this form. Moreover, if any company has representative offices and branches, then a separate form must be filled out for each of the separate divisions.

FILES

It is worth noting that some enterprises and organizations are exempt from the need to submit form P-4 to the statistical accounting service. In particular, organizations engaged in small businesses, as well as public organizations and various cooperatives have the right not to transfer it. However, it should be remembered that such a possibility must be agreed upon and approved by the state statistical agency.

Individual entrepreneurs are also not required to submit this type of statistical reporting by law.

Procedure for using the waybill

The legislation does not establish a mandatory form of waybill, so enterprises can develop it independently, observing the mandatory requirements for accounting documents and the rules of the Ministry of Transport of the Russian Federation.

Rosstat has approved two of its varieties - the standard interindustry form 4 p, used for time-based payment for machine work, and form 4 c, used for piecework. Firms can use both of these forms in their activities.

When delivering cargo, the first form of waybill 4 p is used, which also includes two more tear-off coupons. They are the basis for issuing invoices to contractors for payment for services.

The vehicle's waybill is issued by responsible officials in the company and recorded in the registration log. It must be marked by the mechanic, medic, refueler, and during the task, the driver himself, as well as representatives of the customer. When transporting goods to third parties, a consignment note may be attached to it.

Filling out travel sheets is carried out for each day (shift), and the driver must first submit this form for the previous date. Upon returning, he passes the document to the dispatcher, who notes it in the registration log, calculates it and transfers it to the accounting department.

https://youtu.be/DodhyHgabzU

Features of report design

Form P-4 is a standard unified form that is mandatory for use. The use of any other samples or your own document developments to provide this type of reporting is not permitted.

Form P-4 can be divided into three parts:

- title page,

- main sections,

- certification block.

The main sections are presented in the form of tables into which individual digital values are entered. The form provides some explanations in the form of short comments below the tables. In order for fewer questions to arise when filling out the document, the specialist involved in this matter must first familiarize himself with the various types of all-Russian classifications, as well as know exactly the information about the number of employees at the enterprise and the internal payroll data.

It must be said that when filling out the tables of form P-4, inexperienced specialists often have questions about how to determine the average number of employees. It’s very simple: the average number of employees per month is calculated by adding the number of employees for each day of the month (according to the calendar) and dividing the result by the number of days of the month (also according to the calendar). The average number of employees for the quarter is calculated by adding the average number of employees for each month of the quarter and dividing the result by three.

As for the very concept of “headcount”, these are all those employees who are included in the organization’s time sheet.

How to fill out a report

The accounting regulations, which were drawn up back in 2011, fully describe all the principles and rules according to which Form 4 of the financial statements must be filled out.

- It should be remembered that all negative indicators (the meaning of numbers is negative) that are included in the report must be reflected in parentheses and without the minus sign.

- If indicators must be deducted to recalculate taxes, then the same should be done with them.

The units of measurement used in the Form 1 report are thousands or millions of rubles. Thus, if the indicator is 130 thousand rubles, then you do not need to write 130,000 in the column, you should write just 130, and in the name of the column it should be noted that all numbers are given with the dimension “thousand”. R".

The cash flow statement is described in detail in this video:

Compound

Form 4 of the financial statements contains the following information regarding the movement of finances:

- Current activity;

- investment activities;

- financial activities.

Each variety is divided into the following sections:

- financial flows from current operations;

- financial flows from investment activities;

- financial operations.

Cash flows should be understood as all payments of the enterprise, as well as financial receipts. Receipts of property that has material value (material equivalent) are also taken into account as cash flow.

It should be remembered that there are income that do not significantly affect the total amount of funds. These do not need to be taken into account in Form 4. It is very important for an accountant to be able to separate “important” indicators from “unimportant” ones.

Stitches

In order to describe in detail the principles of filling, we will indicate what should be contained in each specific line.

- Line "4310". Total receipts are displayed here. The value of this line can be obtained by summing 4311-4319.

- Line "4311". The amount of all loans that the company received from banks should be indicated here. The amount is indicated without interest.

- Line "4312" and "4313". Here you should write the contribution that was made by the owner of the enterprise.

- Line "4320". The total payment amount is indicated here. The essence of line 4320 is the sum “4321” - “4329”.

- Line "4321". This displays the total number of all loans that the company managed to repay.

- Line "4322". This displays the amount of dividends that the company paid to the founders of the company.

- Line "4300". This line requires you to indicate the balance of financial flows from operations. Subtracting the line “4320” from “4310”, we get “4300”.

- Line "4400". The balance of the entire financial flow is taken into account here. The content of the line is the sum of “4100”+”4200″+”4300″.

- Line "4450". In this line you must indicate the balance of money at the beginning of the next reporting year. This value must also be written in the explanations to Form 4 of the financial statements.

- Line "4500". The balance of all finance and material equivalents at the end of the year is indicated here. This indicator is easily calculated: “line 4400” + “line 4450” + “line 4490”.

- Line "4490". The difference that arises when recalculating the financial flow and the balance of funds is displayed here. If there are more negative numbers than positive ones, then the contents of the line “4490” should be written in parentheses.

Instructions for filling out statistics on Form P-4

Title page

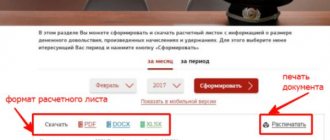

The first thing you need to put on the title page is the reporting period for which the document is being drawn up (month and year). Further, information about the company is entered here: its full name, postal address (if the legal and actual addresses are different, both must be indicated), OKPO code (all this can be found in the company’s constituent documentation).

Part one

The next part, entitled “ Number of employees, accrued wages and hours worked ,” includes a table that contains data on the average number of employees during the reporting period (i.e., all those employees who work in the organization on a permanent basis, according to temporary labor contracts, part-time workers, etc.). It should be noted that information must be reflected both for the enterprise as a whole, and depending on each type of its activity separately (OKVED codes are indicated in the corresponding column).

If any rows in the table are in doubt, short reference explanations can be found below it.

Part two

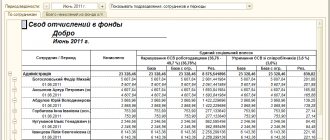

The second table of form P-4 reflects the following values:

- the exact number of man-hours worked (and the data is broken down by employee category) for the first quarter, six months, 9 months and a year,

- information about accrued wages (for full-time employees, part-time workers and those who work under civil contracts),

- information about all social payments made (if any).

At the end, the document must be certified by the employee who is responsible for the accuracy of the information entered into it (usually the head of the organization). Here you need to indicate his position (CEO, director, etc.) and sign with a transcript. Below you should write your contact information (in case a Rosstat specialist has any questions), as well as the date the document was completed.

Form 6

The obligation to compile registration data of those liable for military service arose for each organization on the basis of Federal Law No. 53. The legislative act obliges each company to begin activities to maintain a registered license from the moment of its registration.

And also, the rules for maintaining the Unified State Register of Legal Entities, which operate on the basis of Resolution No. 438 of the Government of the Russian Federation, establish that the body registering the company is obliged to transfer data about the newly created legal entity to certain authorities within the prescribed time limits. The list of these structural bodies also includes the commissariat of territorial subordination.

In turn, the military registration and enlistment office, having received information about a newly registered enterprise, automatically registers it. From this moment on, the company administration has an obligation to maintain relevant documentation and provide timely reporting.

According to the law, companies that have assumed the responsibilities of employers have the following obligations to the military registration and enlistment office:

- Account for your employees according to office work instructions.

- Provide timely information about all changes occurring in personnel matters.

- Transmit data on the current state of personal accounting matters.

Personnel officers of companies have different views on the complexity of reporting to the commissariat. For some, it does not raise questions, but there are times when an employee is faced with a difficulty in how to fill out the form, which can only be resolved with the help of the law.

Each HR inspector, when performing his duties, must be guided by the following standards:

- Federal Law No. 61 “On Defense”, namely, Article 8.

- Federal Law No. 31 – Article 9 “On mobilization”.

- Regulations on military registration at the enterprise.

In accordance with these standards, the chief and the personnel officer are responsible for carrying out work on interaction with the commissariat. According to the regulations, it is the personnel officer who is appointed responsible for such work, but in large enterprises a separate responsible person can be identified who will deal only with HR issues.

Each organization maintains a military records file.

The procedure for determining responsible persons is as follows:

- For a number of employees of up to 500 people (members of military service) – 1 employee (usually a part-time personnel officer).

- If there are from 501 to 2000 persons liable for military service, one specialist is appointed.

- Over 2000 persons – two authorized persons.

The assignment of duties occurs by order. The direct work of the appointed person is to compile F6 for the district military registration and enlistment office. Form 6 for the military registration and enlistment office is called “Report on the number of working and reserved citizens in reserve.”

Sample

The document form has a uniform form, regardless of the form of ownership, the size of the enterprise, the number of its employees and other factors. An example of filling is given below.