Certificate of number

The form of the certificate of headcount is approved at the legislative level by the Federal Tax Service of Russia.

It has been operating for ten years, since 2017. The form for a certificate of the number of employees of the organization is given below: The form requires the following information:

- Taxpayer Identification Number (TIN) and checkpoint (only for companies).

- Code and name of the tax office where the certificate is provided.

- Full name of the company or full name of a private businessman.

- The value of the staffing indicator. If the calculation results in an incomplete number, it must be rounded in accordance with mathematical rules.

- The date on which the indicator was calculated and is current. For long-established companies, this is the first of January of the current year, and for newly registered companies, this is the first day of the month following the month of registration.

- Full name of the head of the company, as well as his personal signature and company stamp, or the full name of a private businessman and his personal signature. In both cases, the date of formation and signing of the document is indicated.

- If a representative is filling out the certificate, information about him must be indicated. Also, the number and name of the document confirming his rights is indicated, and a photocopy of it is attached.

The taxpayer must fill out all fields of the certificate himself. The only exception is the lower right section. It will be filled out by a tax specialist.

A sample certificate of staffing levels is given below:

What does the number of employees affect?

An indicator such as the number of employees can have a direct impact on some aspects of the enterprise’s activities, for example:

- If we are talking about organizations that apply a simplified taxation system. In this case, subject to a number of certain conditions, the company will indeed have the legal right to pay tax in accordance with the current simplified system. The main condition includes the following: the average number of employees for the last annual period should not exceed 100 people. In this case, even if the company has not previously applied the simplified taxation system, it will be able to switch to it. To do this, she will need to collect certain documents and contact the local tax authority.

- If we are talking about organizations that pay UTII or just want to switch to this regime. These actions can also be carried out by companies, but subject to certain conditions. In particular, the main one will still be the fact that the number of employees does not exceed 100 people.

- If we are talking about organizations that have separate divisions and pay income tax established by the state. In this case, the average headcount indicator will be involved in a procedure such as calculating advance payments that will need to be paid for separate units.

- If we are talking about organizations whose authorized capital consists entirely of public contributions. This may include companies that employ employees with disabilities. In this case, the company will be able to qualify for a number of different benefits and certain privileges. However, here you need to remember some important conditions that must always be met. In particular, the organization must have at least 50% of its total employees with disabilities. In addition, the total share of remuneration for people with disabilities must be at least 25% of the total capital of the organization.

Essence of the question

The number of employees is: payroll, average and average. For different purposes, different numbers need to be determined. The general indicator is the average number - it most fully covers all categories of workers. Next comes the payroll number, and from it the average payroll is calculated.

Reason for compilation

There may be several reasons for drawing up a certificate. The main one is the requirements of tax legislation.

Employees of the Federal Tax Service determine which organizations/entrepreneurs must submit reports on paper and which electronically based on the average indicator.

If the number does not exceed 100 people per year, you can report on paper declarations. Therefore, all legal entities and entrepreneurs must report from 2008 on the average number of employees for the previous calendar year. The certificate is also drawn up when creating, reorganizing, liquidating, or closing an enterprise.

The average number is used to confirm the right to the simplified tax system, the calculation of UTII for certain services, such as repairs, car washing, veterinary, and household services. Also for preferential confirmation for organizations that have disabled employees.

Information on the average headcount does not apply to declarations, therefore failure to submit may result in fines for the organization and its management:

- in the amount of 200 rubles – for a legal entity or entrepreneur;

- in the amount of 300 - 500 rubles - per official.

In addition, certificates of headcount in any form may be needed by banks, credit institutions, company owners and other users.

Feeding organs

The average headcount in the form of a certificate is submitted by all taxpayers, regardless of the registration form:

- To the Federal Tax Service by January 20 for the previous year. When a new legal entity is created or an old legal entity is reorganized, the certificate must be submitted by the 20th day of the month following the month of creation or reorganization. For example, a company was registered on May 18, a certificate must be submitted by June 20 reflecting information as of June 1.

Who submits:

- enterprises of any tax regime and type of activity;

- individual entrepreneurs with employees.

Who does not submit:

- individual entrepreneurs without employees - from 01/01/2014 (Article 80 of the Tax Code of the Russian Federation). There is no longer any need to report for 2013.

The certificate is submitted at the place of registration of the entrepreneur or at the place of registration of the organization’s head office.

- Information on payroll numbers is also submitted to the Social Insurance Fund and the Pension Fund as part of the 4-FSS and RSV-1 calculations.

- Information on the average number is submitted to the statistical authorities using forms P-4, PM, MP-micro as necessary.

A large staff is difficult to control. Find out how to request an explanation from an employee.

An application for an appointment with the General Director is not required. See why.

Letter on the number of employees

Also, a certificate of the number of employees is required by tax authorities in order to know which companies are required to submit various reports only in electronic format, and which have the right to report in paper form.

In some cases, information about the number may be required by the Pension Fund or a credit institution.

A firm's headcount is the number of employees required for production plans. This value must be indicated in the staffing table, which is drawn up based on this indicator. Also, based on the value of this indicator, the payroll is formed.

The form requires the following information:

- Taxpayer Identification Number (TIN) and checkpoint (only for companies).

- Code and name of the tax office where the certificate is provided.

- Full name of the company or full name of a private businessman.

- The value of the staffing indicator. If the calculation results in an incomplete number, it must be rounded in accordance with mathematical rules.

- The date on which the indicator was calculated and is current. For long-established companies, this is the first of January of the current year, and for newly registered companies, this is the first day of the month following the month of registration.

- Full name of the head of the company, as well as his personal signature and company stamp, or the full name of a private businessman and his personal signature. In both cases, the date of formation and signing of the document is indicated.

- If a representative is filling out the certificate, information about him must be indicated. Also, the number and name of the document confirming his rights is indicated, and a photocopy of it is attached.

The taxpayer must fill out all fields of the certificate himself. The only exception is the lower right section. It will be filled out by a tax specialist.

Long-established private businessmen must submit a certificate before the twentieth of January of the year following the reporting year. Newly registered companies and entrepreneurs are required to submit a certificate by the twentieth day of the month following the month of registration.

Responsibility for failure to provide a certificate of the number of employees is a fine of 200 rubles. Also, persons responsible for the generation and submission of this report may receive a fine. The fine for them will be from 300 to 500 rubles.

Rules for counting list data:

- All persons registered under employment contracts are included.

- Owners are hired and paid for their labor.

- Both present and absent persons are taken into account.

- The data must match the data in the timesheets.

Average Average number is used in calculating various activity coefficients: labor productivity, average pay level. The average number also includes:

- Persons entered into under civil contracts. They are considered as ordinary employees hired into the organization for full time. The exception is entrepreneurs.

- External part-time workers. They are considered as part-time employees.

Information can be provided to external and internal users in a statutory or free form.

Attention

The general indicator is the average number - it most fully covers all categories of workers.

Next comes the payroll number, and from it the average payroll is calculated.

There may be several reasons for drawing up a certificate. The main one is the requirements of tax legislation.

Employees of the Federal Tax Service determine which organizations/entrepreneurs must submit reports on paper and which electronically based on the average indicator.

Each enterprise develops its own standards. Ш = Н x Кн, where Ш is the regular number, N is the standard number, Кн is the planned absenteeism coefficient, defined as: Кн = 1% of absenteeism/100 Often the normative data on the number is called turnout, and the regular data is called list data.

The list data must match the information from the timesheets recording attendance at the enterprise.

- employees on additional leave for training and admission without pay are not taken into account when determining the average data;

- substitute specialists;

- employees on leave without pay with the consent of management;

- striking employees;

- women on maternity leave or adoption leave are not taken into account when determining the average data;

- employees who have taken leave for study and receive wages;

- employees on vacation according to the Labor Code, including those resigning after the vacation;

- persons on leave;

- shift workers;

- Foreigners;

- persons under investigation.

When calculating information for a month, it is necessary to summarize the daily indicators, taking into account that weekends and holidays are taken according to the last working day before them.

A certificate of the average number of employees is required to be filled out by all enterprises that used hired labor to carry out their activities in the previous calendar year.

Since the beginning of 2014, individual entrepreneurs without employees have been exempted from providing information on the average headcount for the previous calendar year.

Only created and reorganized companies are required to submit reports several times:

- immediately after creation;

- at the end of the year;

- immediately after the reorganization.

We invite you to familiarize yourself with the form of certificate of employment in the organization

The procedure for submitting a report according to KND form 1110018:

- Information on the average number of individual entrepreneurs is submitted at the place of registration of the individual entrepreneur.

- Enterprises submit a report at the place of registration of their legal address.

A certificate of the number of employees, the form of which is presented on our portal, is not submitted for separately located divisions of the organization.

The form for information on the average number of employees must be completed and submitted for the previous year:

- In paper form - then you need to submit the certificate in two copies. One of them will remain with the tax authority, the second, endorsed, will be returned to you as confirmation of the timely submission of the report.

- The average headcount form can be sent by mail with the attachment described. In this case, the date indicated on the receipt will become the date of submission of the report.

- A report on the average headcount can be transmitted electronically via the Internet in accordance with the agreement using the service on the Federal Tax Service portal or an EDI operator.

When submitting a certificate of average headcount on paper, please note that it is often necessary to additionally provide an electronic version of the document.

Late submission of the SSC or headcount may result in a fine being assessed for failure to comply with the reporting deadlines. Its size is small, it is 200 rubles.

, but officials: the head of the organization, the chief accountant can be punished more harshly, with a fine of up to 500 rubles.

However, a report on the average headcount in the form of a paper or electronic document will still have to be submitted.

The average headcount is calculated based on the following indicators:

- information on the number of employees working a full shift;

- the number of employees who were at work part-time;

- the final calculation of the number of workers is carried out by adding the two above indicators.

When calculating the average number of employees, it is necessary to take into account all employees of the enterprise, regardless of whether they are present at work or on a business trip or vacation.

- Services:

For the purposes of stat.

Free legal advice: All Russia TC;

- striking employees;

- employees who have taken leave for study and receive wages;

- employees on leave without pay with the consent of management;

- persons under investigation.

- women on maternity leave or adoption leave are not taken into account when determining the average data;

- substitute specialists;

- shift workers;

- employees on additional leave for training and admission without pay are not taken into account when determining the average data;

- employees on vacation according to the Labor Code, including those resigning after the vacation;

- Foreigners;

- persons on leave;

When calculating information for a month, it is necessary to summarize the daily indicators, taking into account that weekends and holidays are taken according to the last working day before them.

It is impossible to give a resigning employee a copy of SZV-M. According to the law on personal accounting, when dismissing an employee, the employer is obliged to give him copies of personalized reports (in particular, SZV-M and SZV-STAZH).

However, these reporting forms are list-based, i.e. contain information about all employees.

At the end of the form, you must enter the title of the document that confirms the capabilities of the representative.

Does your organization own the premises where you operate? This category also includes persons on parental and adoption leave.

For proper filling, tips have been developed, which are given in the appendix to the letter of the Federal Tax Service of the Russian Federation dated 26. Information about the number of personnel of an organization may intrigue any government agency, including the tax inspectorate.

The “Personnel” system is necessary for centralized storage and retrieval of information about company employees. With its help, you can view the company structure, quickly find the phone number of the required employee, and also find out how to contact an absent employee and who is replacing him.

Employees

Note: Buttons for adding and editing documents are available only to HR employees. All other users can only view documents.

How is a certificate of the number of employees of an organization prepared? (sample)

The form of the form on the average headcount was approved by order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25/ [email protected] For correct completion, recommendations have been developed, given in the appendix to the letter of the Federal Tax Service of Russia dated April 26, 2007 No. ChD-6-25/353a. KND form code 11100018.

When preparing a certificate, you must indicate the following information:

- document's name;

- full name of the Inspectorate of the Federal Tax Service;

- full name of the legal entity or entrepreneur making the settlement;

- TIN/KPP;

- number as of the required date;

- date of filling out the form;

- transcript and signature of the official.

The form is filled out in two copies: one for the tax authority, the second remains with the filler with a mark and date of receipt.

To summarize, it should be noted that:

- The average number of employees is submitted to the tax authorities using a form with KND code 11100018.

- data on the payroll number is provided to the Social Insurance Fund and the Pension Fund of Russia;

- Information on the average number is provided to statistical authorities.

A form for a certificate of the number of employees can be found here:

Form for certificate of average number of employees

Average salary for the period

The calculation is made on the basis of information on the payroll, taken into account daily, using the arithmetic average formula, taking into account the required period - month, quarter or year. First, the monthly indicator is calculated, from which the quarterly and annual indicators are calculated.

When making calculations, you should be guided by FSGS Resolution No. 56 of 10/09/2006, which regulates the rules for assigning categories of workers.

To begin with, based on time sheets and personnel documents, it is necessary to calculate the number of employees. All employees are taken into account: those at work, sick, absent.

The payroll does not include:

- business owners without wages;

- employee-apprentices on the basis of a vocational training contract;

- military;

- lawyers;

- employees registered under civil law contracts;

- persons located abroad;

- employees sent to other enterprises and not receiving payment for their work;

- employees who submitted a letter of resignation and stopped working earlier than the appointed date or without warning the administration;

- employees working under contracts with state-owned enterprises;

- external part-time workers.

The average number of employees looks like this:

Sample certificate of average number of employees

Included in the payroll:

- regular employees;

- seconded employees while maintaining wages, including employees sent abroad for a short period of time;

- sick employees;

- employees with government powers;

- truants;

- employees registered for part-time or part-time work. The operating time is taken proportionally. An exception is the categories of persons entitled to reduced work hours in accordance with the law: minors; persons employed in hazardous conditions; nursing mothers; disabled people of groups I and II (when calculating they are taken as 1);

- accepted with a probationary period;

- homeworkers;

- persons of special ranks;

- temporary employees of other enterprises, if the former does not maintain wages;

- practicing students, if they are registered according to the Labor Code;

- employees on additional leave for training and admission without pay are not taken into account when determining the average data;

- substitute specialists;

- employees on leave without pay with the consent of management;

- striking employees;

- women on maternity leave or adoption leave are not taken into account when determining the average data;

- employees who have taken leave for study and receive wages;

- employees on vacation according to the Labor Code, including those resigning after the vacation;

- persons on leave;

- shift workers;

- Foreigners;

- persons under investigation.

When calculating information for a month, it is necessary to summarize the daily indicators, taking into account that weekends and holidays are taken according to the last working day before them. Then the figure is divided by the number of days of the month according to the calendar and rounded to the nearest whole number.

Information for a quarter/year is calculated as follows: information for all months is summed up and divided by 3/12. The final total must be rounded to the nearest whole number; in this case, the subtotal for the month does not need to be rounded.

Documents that may be needed when calculating data:

- orders on hiring/dismissal;

- orders on vacations and transfers;

- travel orders;

- personal cards of employees;

- working time sheet;

- salary calculations;

- statements containing information about payments and settlements.

Watch also the video about submitting information about the average headcount

Regular

Staffing is the number of employees of the enterprise according to the staffing table.

This term is used in business planning of personnel in management matters.

It can be enshrined in statutory documents, but this mainly applies to government agencies; it is rarely used in commercial structures due to the complexity of this procedure.

Calculated based on labor standards, taking into account planned absenteeism according to accounting data.

Each enterprise develops its own standards.

W = N x Kn,

where Ш is the number of staff,

N – standard number,

Кн – planned absenteeism coefficient, defined as:

Kn = 1 + % absenteeism/100

Often normative data on the number are called turnout, and regular data are called list data. The list data must match the information from the timesheets recording attendance at the enterprise.

Rules for counting list data:

- All persons registered under employment contracts are included.

- Owners are hired and paid for their labor.

- Both present and absent persons are taken into account.

- The data must match the data in the timesheets.

Average

The average number is used in calculating various activity coefficients: labor productivity, average pay level.

The average number also includes:

- Persons entered into under civil contracts. They are considered as ordinary employees hired into the organization for full time. The exception is entrepreneurs.

- External part-time workers. They are considered as part-time employees. If the result is a small digital indicator, leave one sign after the decimal point.

Average number = average number + civil servants + external part-time workers.

Calculation of the average number of employees

The average number of employees is calculated in accordance with established rules. To begin with, the responsible person must calculate the total number of employees in the organization. It should be noted that this indicator should include the following persons:

- Ordinary employees who were employed by this organization on the basis of the main document, namely, an official employment agreement.

- Employees who, at the time of settlement, are on a business trip. It should be noted that even those employees who were posted abroad should be included here. The main thing is that this trip is not equated to a long-term business trip.

- Employees who, at the time of settlement, are on sick leave. It should be noted that even those employees who are on sick leave with their young child may be included in this category.

- Employees who are absent from their workplace for 4 hours or more. It should be noted that for now they must still retain their jobs. This rule will be canceled if the employer imposed the most serious disciplinary sanction for absenteeism, namely unilateral dismissal.

- Employees who have recently been employed by this organization and are still on a probationary period. In accordance with established rules, such employees must be treated as full-fledged members of the team.

- Employees who are absent from their workplace due to prior registration of several days off at their own expense.

- Employees on officially registered study leave. In accordance with the current rules, such employees must retain their jobs. Therefore, training employees should also be included in the average headcount.

- Employees who fulfill their professional obligations in accordance with the shift work schedule established at the enterprise, etc.

In order for the calculation of the average headcount to be carried out as accurately as possible, the person in charge will definitely need important personnel documents of the company. This may include: orders on the hiring of employees or their dismissal, orders on granting vacations to employees, working time sheets, personal cards of employees, orders on sending subordinates on business trips, etc.

Calculation nuances

When calculating the number of employees, some features of the procedure should be taken into account:

- If an organization/entrepreneur operates for less than a full month, the number of calendar days per month is taken when calculating the number. This situation is possible for a new enterprise, or for an enterprise operating seasonally. Example: an enterprise was registered on September 18 with 20 employees. Headcount for September = (20 people x 13 days) / 30 days = 8.66 people, rounded to 9.

- If the organization/entrepreneur has been operating for less than a full year, when calculating, we still divide by 12 months.

- If there was a reorganization or liquidation procedure, it is necessary to take into account the data of predecessors when calculating.

- If work at the enterprise has been suspended, the general rules apply.

- If employees work voluntarily part-time, then in the payroll they are counted as a whole unit, and in the average payroll in proportion to the time they work. It should be remembered that if part-time work is related to the law or the initiative of the employer, then such persons are always counted as a unit.

Part-timers

Accounting is carried out depending on the type of part-time job. Part-time employees of an internal nature are taken as one, regardless of the rate at which they are registered. Part-time workers of an external nature are not considered, since they are taken into account at the main job.

Maternity maids

Persons on maternity leave are counted differently depending on the type of headcount.

When calculating the average data, they are not taken, but are included in the payroll.

This category also includes persons on parental and adoption leave.

Child care is an inviolable right of an employee. Read whether it is possible to fire a pregnant woman during a probationary period.

Deregistration of a cash register with the tax authorities is mandatory in many cases. Read more in the article.

It’s not difficult to get a loan for an individual entrepreneur from Sberbank. See instructions

Part-time

Employees transferred by management to part-time work or with reduced work hours according to legislation (for example, disabled people, minors, nursing mothers) are taken as one.

Employees with part-time work at their discretion are taken into account when calculating:

- in proportion to working time - when calculating average list information;

- as a unit per day – when calculating list information.

When calculating the average number of employees per month for people with part-time work, you should be guided by the following formula:

total working time of such employees in hours per month / duration in hours of work per day / established number of days of work in a month.

For example, at 0.5 employee rate (with 20 working days in a month): 80/8/20 = 0.5

Temporary workers

Counted only at one enterprise to avoid double counting. If these are persons sent on a temporary basis, their salaries are usually paid by the enterprise where the work is carried out.

There they are included in the number.

It is the responsibility of their managers to provide information about the status and number of personnel at an enterprise, regardless of its form of ownership. This information is important for statistics and social protection authorities.

Previous article: Hiring a general director Next article: Job description of a leading engineer>Certificate of the average number of employees - sample

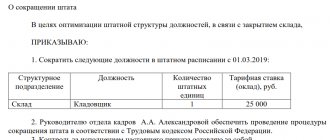

What orders should be used to approve the ShR?

The staffing table in government organizations is drawn up according to the T-3 form, while in non-government organizations they can use a form developed independently.

But no matter how it is drawn up, it must be approved by the Order of the head. But the “staff” cannot be approved once and for all; sometimes various changes have to be made to it. In this case, the manager issues an order to change the staffing table.

https://www.youtube.com/watch{q}v=upload

By making changes to the staffing table, the manager controls the structure of the enterprise, the number of staff, and its material support. The employer has the right to issue an order to amend the staffing table (SH), if necessary, at any time during its activities. In particular, you can:

- eliminate vacant positions or entire divisions of the company due to organizational changes;

- introduce new units if it is necessary to expand production, sales or increase the volume of services provided;

- reduce the number of employed units due to a reduction in the number or staff of the organization (individual entrepreneur);

- change salaries;

- rename departments or positions.

In any case, the decision on this is made by the manager, and it must be formalized by a special order. In this case, amendments to the ShR can be made in two ways:

- change an old document;

- approve the new ShR.

Let's consider a sample order issued in connection with the reduction of an entire structural division of an enterprise - the accounts receivable department. All positions in the department are unoccupied, so the new conditions come into force two days later - on the first working day after the signing of the local act. There is no need to introduce anyone to the document.

Formation of a new structural unit

Salary changes

What is a certificate of average number of employees

The regulatory requirement for the obligation to provide information on the average number of employees is contained in clause 3 of the article. 80 NK. According to this article, data is submitted by those taxpayers (organizations or individual entrepreneurs) who have hired employees. If the entrepreneur does not have employment contracts concluded with individuals and runs the business alone, there is no need to provide the form. However, the above does not apply to legal entities without staff, since if there is only one director on staff, you will still have to report on the average headcount.

List and turnout numbers

The current form of a certificate of average number (or payroll average) is submitted in 2020 for 2020 in the form approved by the Federal Tax Service in Order No. MM-3-25 / [email protected] dated March 29, 2007. The document (KND 1110018) is provided for 2020 to the territorial division of the Federal Tax Service by January 22, taking into account the postponement of holiday dates. When a company is just being created or undergoing reorganization, it should report no later than the 20th day of the calendar month following the month of opening (carrying out reorganization measures). The format for submitting the certificate is electronic or paper. The first is mandatory for all taxpayers with more than 100 employees.

Note! The certificate is submitted to the tax authorities at the registration address of the legal entity or the tax authorities at the residence address of the entrepreneur. If the report is prepared by an OP (separate division), the document must be submitted to the tax office at the place of registration.

Documentation confirming the number of personnel

- At the top of the form, the taxpayer fills out the TIN and KPP fields, guided by the Tax Registration Certificate.

- Further, after the words “Submitted to,” the full name of the tax accounting authority where the information must be submitted is indicated, and its code is indicated in the cells of the corresponding field.

- The next line contains the name of the person conducting business activities, or the full name of the organization submitting the information, in accordance with the constituent documentation.

- In the field below, the reporting date for submitting information is indicated - January 1 of this year in the order “day-month-year”.

The TIN and KPP at the location of the branch (branch, representative office) of a foreign organization operating on the territory of the Russian Federation are indicated on the basis of a Certificate of registration with the tax authority in Form N 2401 IMD and (or) an information letter on registration with the tax authority of the branch foreign organization in form N 2201I, approved by Order of the Ministry of Taxes of Russia dated 04/07/2000 N AP-3-06/124 “On approval of the regulations on the peculiarities of accounting by tax authorities of foreign organizations” (registered with the Ministry of Justice of Russia on June 2, 2000, registration number 2258 ; “Bulletin of normative acts of federal executive bodies”, June 19, 2000, No. 25).

Blanker.ru

- The next field contains the average number of employees.

- The lower left section confirms the accuracy of filling out the form. An individual entrepreneur puts his signature and the day the document was drawn up. If the taxpayer is an organization, its head enters his personal information, the day the form was drawn up, and the signature and seal of the organization in the appropriate field.

- If the certificate is certified by a legal representative who is an individual, he signs the form, indicating his name and the day the form is filled out.

- If the organization is also represented by an organization, its head confirms the completed form with his signature, indicating the full name of the organization, the day of compilation and affixing the organization’s seal.

- The name of the document giving the representative the corresponding authority is indicated below.

Certificate of average number - example

The form is placed on one sheet and includes a minimum of indicators. Externally, the form resembles the title page of any reporting declaration or calculation. Recommendations for specifying data are contained in Letter No. CHD-6-25 / [email protected] dated April 26, 2007. What information is reflected in the form?

List of required data in the certificate of average headcount:

- INN and KPP of the taxpayer - information is entered in accordance with the registration documentation of the enterprise or individual entrepreneur. Entrepreneurs do not fill out the checkpoint.

- Line “Submitted in...” – you should fill in the exact name of the Federal Tax Service and the inspection code.

- Name of organization/individual entrepreneur – this line provides the full exact name of the legal entity or full name of the businessman.

- Line “Average headcount” - here indicates the headcount indicator (average) calculated according to regulatory rules as of 01.01 of the calendar year that precedes the current delivery period. In some cases, the calculation is performed on the 1st day of the month preceding the creation of a business or its reorganization.

- Block confirming the accuracy of the data - here the report is signed by the director of the legal entity or entrepreneur, and the date of generation of the document is indicated.

- Block with data for employees of the Federal Tax Service Inspectorate - this section is not compiled by the taxpayer, since it is intended to be filled out by specialists of the territorial division of the Federal Tax Service Inspectorate.

Note! For more information on how to correctly determine the average number of personnel, see Order of Rosstat No. 498 dated 10.26.15, Instructions dated 09.17.87.

and a sample certificate of average number - here:

(Form) Certificate of average number of employees

(Sample of completion) Certificate of average number of employees

If you find an error, please select a piece of text and press Ctrl+Enter.

>Sample certificate of average number of employees

Results

Thus, the procedure for drawing up a certificate of average headcount will include the following steps:

- First, the responsible person will need to prepare all important documents, on the basis of which further calculations will be made. The list of such papers includes the following: various internal personnel orders of the organization, time sheets, some individual company regulations, the current staffing table, etc.

- Next, all employees will need to be summed up to obtain the total number of personnel. The full list of employees who must be included in the average payroll is established at the legislative level.

- And finally, the resulting number will need to be divided by the exact number of months that are included in the corresponding billing period. The resulting indicator will be the average number of employees of the organization.

Sample certificate of the number of employees of the organization: how to fill out and when to submit

According to Art. 80 of the Tax Code of the Russian Federation, business entities are required to report on the number of employed citizens immediately after formation or reorganization. About a month is given to prepare the information: it is submitted by the 20th day of the second month of work to the Federal Tax Service at the place of registration.

In addition, the number of employees must be reported annually: based on the results of the previous year - before January 20 of the following year. Violation of deadlines will result in a fine of 200 rubles.

This is what a correctly compiled sample of filling out a certificate of average number of employees looks like. The picture shows an example for an LLC, which employed 15 people at the end of last year. But a certificate of the number of employees of less than 15 people is prepared according to the same rules.

Let's look in detail at how to fill out a report for tax authorities:

- Indicate the name of the Federal Tax Service inspection where you are sending the form. Please note that separate divisions do not have to report such information separately. Therefore, the main organization reports, indicating the total number of persons, including those employed in branches and representative offices.

- Write the name of the reporting entity - company or individual entrepreneur.

- Enter the reporting date. For an annual report, for example, for 2019 the date is 01/01/2019, and for 2020 - 01/01/2020. If the company has just opened, you must enter the 1st day of the second month of operation. For example, an organization was registered on 04/09/2019, the report must be submitted by May 20, but in the third section you should enter 05/01/2019.

- Using Rosstat Order No. 772 dated November 22, 2017, calculate the average list indicators. They do not take into account part-time workers (external), maternity workers, employees under GPC contracts, young mothers or other employees who do not work in connection with caring for babies. If there are no subordinates, write “0”.

- Sign and mail on paper, electronically, or in person. The report sent by the representative is accompanied by a document confirming his authority.

>Information on the average number of employees for the calendar year (Form)

Document subject: Information Text version file: 1.8 kb Share:

>Open document in gallery:

‹ ×

What does a sample certificate from the place of work to the court look like?

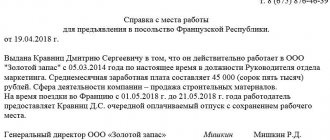

During court hearings, the presentation of a certificate of employment is usually required to confirm the employment and income of the plaintiff or defendant, for example, to assign alimony. In this case, the defendant may be required to submit a certificate indicating:

- his full name, position;

- salary or average earnings;

- work experience in the company.

The document must be certified by the seal of the employing company (if any), as well as the signature of the head of the company.

What else to download on the topic “Information”:

- Information on the amounts of accrued interest for using the loan

- Information about the shopping center

- Information about the retail facility

- Information on the progress of the investment project “Reconstruction and repair of the complex of buildings and structures of the national film studio “Belarusfilm” with the construction of technological facilities and a block of residential buildings on the territory cleared from industrial buildings”

- Information on the progress of implementation of the provisions of the Law of the Republic of Belarus “Ab ahove gistoryka-cultural spadchyny of the Republic of Belarus”

- Information about business entities that control the property of other legal entities

- Information on partial fulfillment of an obligation secured by a mortgage

- Information about the seizure of an undocumented mortgage

- Information on manufactured and released control means

- Information about the controls used

- What should a properly drafted employment contract be like? An employment contract defines the relationship between the employer and the employee. The compliance of the parties with the rights and obligations provided for by it depends on how thoroughly the terms of the relationship between the parties who entered into it are taken into account.

- How to competently draw up a loan agreement Borrowing money is a phenomenon that is quite characteristic and widespread in modern society. It would be legally correct to issue a loan with subsequent documented repayment of funds. To do this, the parties draw up and sign a loan agreement.

- Rules for drawing up and concluding a lease agreement It is no secret that a legally competent approach to drawing up an agreement or contract is a guarantee of the success of the transaction, its transparency and security for counterparties. Legal relations in the field of employment are no exception.

- A guarantee of successful receipt of goods is a correctly drawn up supply agreement. In the course of business activities of many companies, the supply agreement is most often used. It would seem that this document, simple in its essence, should be absolutely clear and unambiguous.

The responsibilities of firms and private businessmen include submitting a report to the tax service on the average number of their hired personnel. They can do this with the help of a special certificate. You can find a sample certificate of the average number of employees in this article.

Varieties of numbers

The maximum and actual number of employees are important indicators that characterize the required number of personnel to achieve the main goal of the financial and economic activities of the enterprise - making a profit. At the same time, the limit implies the maximum number of employees required to complete the work, and the actual reflects the real state of affairs.

For the purposes of statistical observation and other reporting, several more varieties are distinguished:

- List (staff) - represents the number of units in the staffing table.

- Average payroll - calculated for a certain period of time based on the payroll.

- Turnout - represents the number of workers necessary to ensure continuity of the work process.

Listed and actual number of employees are varieties, the main difference of which is that the first illustrates the total number of employees at the enterprise, taking into account those on vacation, maternity leave, sick leave, etc., and the second shows the number of employees directly performing their duties at work places on a specific date.