Purpose of payment, what to write when paying for a patent to a foreigner

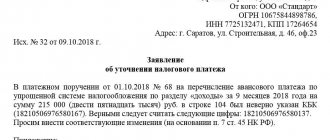

When paying through a client bank for a foreign citizen's patent, he made a mistake in the tax period. The payment time is not overdue, and the date of the period instead of September is again specified as August. How can I correct the situation so that the payment is not considered overdue and the money is not wasted?

You can pay again, but then there will be a clear delay. (as amended by Federal Law No. 229-FZ of July 27, 2010) The tax authority notifies the taxpayer of the decision made to clarify the payment within five days after the decision is made. (paragraph introduced by Federal Law No. 229-FZ of July 27, 2010) I believe that it makes sense to send a notification to the Federal Tax Service indicating the payment details and asking them to consider the assignment of payment with the offset of this amount for September as an error.

There are also explanations of this nature: How to correct the situation so that the payment is not considered overdue and the money is not wasted?

Send an application with an explanation to the Federal Tax Service, attaching a copy of the payment order.

What is SUIP?

When reviewing each electronic receipt, the payer will notice this abbreviation. SUIP is a unique identifier of specific payment documentation processed within the Sberbank structure. Thanks to the specified number, the financial institution accurately identifies the transaction.

The first letter of the word indicates the name of the banking institution. Each financial transaction in the structure of Sberbank contains an electronic check. Receipt values are personal and contain their own combination of letters and numbers.

- UIP in a payment order: what is it?

- What do the numbers on the Sberbank card mean?

- Sberbank online user ID

Why did a unique payment identifier appear?

The abbreviation began to be included in electronic payment forms in 2014. The unique SUIP payment number includes sixteen characters: the first twelve contain numbers, the remaining four contain capital Latin letters.

Expert opinion

Alexander Ivanovich

Financial expert

The Sberbank identifier is located in each payment order. The SUIP occupies the central part of the electronic form next to the transaction amount and information about the client’s wallet.

Why is a unique payment number required?

The payment identifier is primarily intended to recognize a financial transaction, specifically in the Sberbank electronic system. The massive transition of citizens to remote transaction methods has significantly reduced the traditional method of making payments.

How to find out the details of a Sberbank card?

The colossal volume does not exclude the occurrence of a system error or technical failure. When entering the recipient's data, the information may be entered incorrectly. After completing any electronic transaction, it is recommended to save the payment order until the funds arrive in your account. If a failure occurs and the money is not delivered, a unique payment identifier will allow you to track the movement of money.

It was the increased number of transactions in the electronic system that prompted the country's largest financial institution to create a unique code for each payment. SUIP will help you find out exactly the information regarding a monetary transaction of any category. If the money has gone to the wrong address, then using a unique identifier you can correct the movement of finances.

When paying for a patent to a foreign citizen, what address to put?

- Middle name (if you have a middle name, this field is required)

- Your Taxpayer Identification Number

- Name

- Last name

Filling in details when paying for a patent online.

However, the courts think differently.

In decisions dated March 4, 2020 in case No. 7-2033/2016, dated December 22, 2020 in case No. 7-14080/2015, the Moscow City Court considers payment of a patent later than the issue date indicated on the patent to be a violation of the deadline. Such a citizen can get a job somewhere in his specialty with the same rights as other people. But not every foreigner can obtain a patent.

And at the end of the first year, you need to re-register the patent again. All this paperwork can intimidate visitors. But everything is not so scary, because you can make the payment through the largest state bank - Sberbank.

Differences between UIP and UIN

The first abbreviation is a unique transaction identifier containing information:

- type of money transfer;

- information about the receiving party;

- documentation requiring payment to be made.

The second value shows the unique accrual identifier assigned to each transaction carried out towards a state or municipal body of Russia. The main purpose of the UIN is to obtain information regarding money received into the state budget treasury.

Expert opinion

Alexander Ivanovich

Financial expert

To check the number of each value in the payment order, you should study column number 22. The main difference is that the UIP is intended for transferring funds to the account of non-governmental organizations. The UIN is formed by the relevant government agencies such as the Federal Tax Service, and the unique payment identifier is formed by the receiving person.

To fill out a payment statement, you must enter the twenty-digit digital combination indicated on the form instructing you to make the payment. A striking example is payment to the tax office, when it is required to be based on a resolution. The documentation form will contain the required details for filling out the payment.

How to apply for a Union Pay card at Sberbank?

Occasionally, cases arise when at a bank branch it is required to enter the UIP value on the payment order form, but the resolution contains the UIN. An ambiguous situation will require you to enter UIP data, and Sberbank will carry out the financial transaction. Modern computer programs and banking structures are gradually abandoning these abbreviations in favor of the phrase “payment identifier”.

Patent fee

An individual entrepreneur who has switched to a patent taxation system pays tax to the inspectorate at the place of delivery for registration within the following periods: 1) if the patent was received for a period of up to six months - in the amount of the full amount of tax no later than the expiration date of the patent; 2) if the patent was received for a period of six months to a calendar year: - in the amount of 1/3 of the tax amount no later than 90 calendar days after the patent came into effect; - in the amount of 2/3 of the tax amount no later than the expiration date of the patent (clause 2 of Article 346.51 of the Tax Code of the Russian Federation). The tax period is a calendar year, with the exception of two situations.

We recommend reading: Stole an item in a store, what happens

Firstly, if a patent is issued for a period of less than a calendar year, then the tax period is the period for which the patent was issued.

Entrepreneurs in Moscow and the Moscow region, starting from February 6, 2020, write other details in their tax payments: the name of the recipient's bank, checkpoint and correspondent account (see.

table).

Fill in field 109 in the payment order in 2020

Field 109 in the 2020 payment order is filled in when transferring taxes.

What should you pay special attention to when filling out field 109 “Document date”? What field of the payment order is it related to? What to do if you find it difficult to choose a value for this field? The answers to these questions are given in our article. Field 109 “Document date” is filled in when generating payment orders for transferring taxes to budgets of all levels.

In this case, you must be guided by the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation, approved by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. In field 109 “Document date” the date of payment is indicated. The field in question consists of 10 characters:

- the first 2 characters indicate the calendar day and take a value from 01 to 31 in accordance with the number of days in the month;

- The 3rd and 6th characters are separating characters and are filled with the symbol “.”;

- The 4th and 5th digits indicate the month and take values from 01 to 12 in accordance with the number of months in the year;

- The 7th to 10th digits indicate the year.

It is important to immediately note that field 109 “Document date” is interconnected with field 106 “Base of payment”.

Its values directly depend on the values of this field.

For payments of the current period, when the TP indicator is indicated in field 106 “Basis for payment”, and the tax is paid in accordance with the declarations, the date of signing of the declaration submitted to the tax authority is entered in field 109 “Document date”.

In case of voluntary repayment of tax payables, provided that they are discovered independently, 0 is indicated in field 109 (the value of field 106 is ZD). In exceptional cases established by law, a specific date is entered in field 109 “Date of document”. This happens when field 106 “Basis of payment” has the value:

- TR - date of the tax authority's request;

- RS - date of the document in which the decision on installment plan was made;

- OT - date of the document corresponding to the decision to defer;

- RT - date of the document in which the decision on restructuring was made;

- PB - the date of the arbitration court’s decision to initiate bankruptcy proceedings;

- PR - date of the document on suspension of collection;

- AP - the date of the decision to bring or refuse to bring to justice for committing a tax offense;

- AR - date of the executive document;

- IN - the date corresponding to the decision to provide an investment tax credit;

- TL - the date of the arbitration court’s decision to satisfy the statement of intention to pay off the claims against the debtor.

In the event that an organization pays an advance tax payment or finds it difficult to select a value for field 109, the value 0 can be specified.

This was confirmed by officials in a letter from the Russian Ministry of Finance dated February 25, 2014 No. 02-08-12/7820. Let's look at several examples of filling out field 109 “Document date”.

Example 1 An organization pays the current income tax payment. The date for signing the declaration submitted to the tax authority is 03/28/2020.

Then field 106 “Basis of payment” has the value TP, therefore, field 109 will indicate: 03/28/2020. Example 2 An organization independently identified an underpayment of property tax for 2020 and transfers it. In this case, field 106 should have the value ZD, and field 109 should have the value 0.

Example 3 An organization pays tax at the request of the tax authority dated February 23, 2020. Field 106 indicates the TR value, and field 109 indicates the date of the request: 02/23/2020. Example 4 An organization pays an advance payment for land tax.

There are no values in field 106 “Basis of payment”; field 109 will contain 0.

For information on how to correctly fill out a payment order for payment of land tax, see the article. Field 109 “Document date” does not contain key information about the payment being made and does not lead to non-transfer of tax to the budget, as well as the accrual of penalties. However, the rules for filling out this field are enshrined in law, so every accountant needs to familiarize themselves with them before starting to generate payment orders.

We recommend reading: Who can you go to for legal advice?

in the article.

Payment for a work patent

In order to independently calculate the cost of a monthly payment for a patent, you must apply the following formula: Thus, in the specified formula there is only one variable - the regional coefficient, and therefore the amount of payment for a patent depends on the Russian region in which it is issued. In order not to lose the right to carry out labor activities on the territory of Russia, foreign citizens must comply with the deadlines and procedure for making payments to pay for the patent.

These include: Failure to make payment on time will result in cancellation of the document and the need to collect all documents again. Any commercial bank that carries out cash transactions can make payments for this purpose. On the website of the tax service or regional government agency in charge of labor migration issues, go to the page for generating a receipt.

What happens if you miss the patent tax payment deadline?

For each day of late payment, a penalty is charged in the amount of 1/300 of the Central Bank refinancing rate of the unpaid amount. An individual entrepreneur who pays a patent fee late is not subject to a fine. He only pays penalties.

A fine is imposed only on those entrepreneurs who have not paid the tax at all or have underestimated its amount. In accordance with Article 122 of the Tax Code, the fine will be 30% of the amount not received into the budget. This applies only to those situations where the tax office does not detect any signs of wrongdoing.

If tax offenses are detected under Art. 129.3 and 129.5, the amount of fines will be higher: from 30,000 rubles.

When should foreigners pay for a patent?

At the next step, you will be asked to select a payment method: Advice from Alliance TM lawyers: save all paid checks, and also make copies, since the ink on the check will be erased over time.

What data should I enter when paying? If a foreign citizen has kept the first check, and no details in it will change during further payments, then in the terminal you must enter the data indicated on the check.

Important: we draw your attention to the fact that the data is entered not by the company in which the foreigner works, but by the district tax service to which the organization is linked at its legal address.

VAT registration in Europe and the Russian Federation

To conduct trading activities, you must have a VAT payer identification number. This number is required when conducting international activities. This concept in Russia is often confused with TIN.

For participants in trade with EU member states, it is mandatory to obtain a VAT combination. This is due to the fact that since 2010, changes have been added to EU legislation regarding the rules for collecting fees. When carrying out import or export operations, if the party does not have BAT, the payer of the fee has the right to refuse cooperation.

VAT is needed when registering a European company whose purpose is to conduct business in the EU. Payment is made when selling goods or services in the EU. The combination is assigned by tax authorities to individuals and legal entities and allows for verification of the payer.

Translated into Russian, the abbreviation stands for value added payer number. The form of taxation is used within the framework of production, distribution of the cost of products or services.

How to issue a receipt for payment of a patent for an individual entrepreneur on PSN?

Good afternoon, dear entrepreneurs!

Now let's look at typical mistakes associated with determining the validity period of a patent and payment for a patent. The main mistake of a migrant worker is to focus when paying for a patent not on the issue date printed on the patent, but on the date printed on the check for the first personal income tax payment.

A few instructions on how to generate a receipt for paying for a patent for an individual entrepreneur.

Many people fill them out manually, but in fact, there is a wonderful (and official!) service right on the website of the Federal Tax Service of the Russian Federation. I highly recommend using it. We go to the website of the tax office of the Russian Federation and fill out a special form: · If you do not know the Federal Tax Service code, then simply click the “Next” button. Enter all your address information.

Each time you press the “Next” button.

We recommend reading: A driver’s license does not pass when applying for a compulsory motor insurance policy due to an accident

We see the codes of the Federal Tax Service and OKTMO, which are determined automatically. · Then select the type of payment document “Payment document”; · Select “Payment Type”. This

“Payment of tax, fee, payment, duty, contribution, advance (prepayment)”

.

Click the “Next” button if we don’t know the BCC; · Select the tax to be paid.

This is where everything is quite complicated, since there are a lot of different payments in the drop-down list.

How and where to pay the consular fee for a US visa

All applicants are required to make an appointment to submit documents before visiting the US Embassy. As we have already explained in previous parts of our blog, all registration and application actions will need to be completed only online. First of all, we recommend that you pay the consular fee, without which it is impossible to book the date and time of the interview at the Embassy.

The consular fee is paid only at Raiffeisen Bank Aval branches using a pre-filled receipt. Please note that this receipt is not issued at the bank, so you need to make sure to print it out and fill it out in advance. The receipt can be downloaded from the US Embassy website and is usually valid for 3-5 days. Such a short validity period is explained by the fact that the consular fee, fixed only in US dollars, is paid only in national currency. The same 160 dollars in a week will be a different amount in hryvnia. An example of a completed receipt for payment of the consular fee for obtaining a US visa can be found below.

Purpose of payment when paying for a patent through Sberbank

See also: Which bank to open a current account in.

From 2020, tax contributions can be clarified if the correct bank name and correct beneficiary account were provided. The specifics of this document are as follows:

- The validity period of one patent is thirty calendar days;

The countdown for the validity of a patent begins from the moment it is issued.

For example, a foreign citizen received an invitation from a Russian employer. Upon arrival in Russia, he filed a patent. When registering, he is required to pay tax (personal income tax) in order to start the validity of the patent.

Payment for a patent for individual entrepreneurs in 2020 is carried out in two parts:

- The remaining funds are transferred throughout the remaining period, but no later than the last day.

- One third of the amount of taxes under PSN is paid no later than 3 months from the start of work.

You can set the payment period yourself, taking into account the validity period of the patent.

Fill in field 108 in the payment order in 2020-2020

Often used when calculating income tax.

- TL. The number of the arbitration court ruling that satisfies the application for repayment of claims against the debtor is indicated.

- ID. The number of the executive document serving as the basis for payment is indicated.

- BY. The existing customs receipt order number is indicated.

- THAT. Applies if customs duties are paid upon request.

- IN. The number of the collection document is indicated.

- DE or CT. The last 7 digits of the customs declaration are written down.

- DB. Number of the document created by the accounting department of the customs authorities.

- KP.

For details, see the material. In the case of customs transfers, field 108 can take numeric values when the following payment grounds are indicated in field 106:

How to properly pay a patent to a foreign citizen

- 1 A little about the patent

- 2 How to pay 2.1 Terminal

- 2.2 Payment online

A little about the patent Since last year, all citizens who arrived from other states for the purpose of employment are required to draw up a document common to all, which is called a patent. Payment receiver; 2. TIN of the recipient; 3. Current account; 4.

- in cash at the migration service office;

- via terminal;

- through online banking on the Sberbank website.

back to contents Terminal To make a payment through the terminal, you need to make sure that you have the following information: Important: if you delay payment even for 1 day, the patent will be revoked.

And in order to continue to be able to work, you will have to apply for a new labor patent.

Requirements for a company applying for a VAT number

VAT ID is VAT. Each country has its own requirements for companies that pay the fee and submit documents to obtain registration value. There are standard rules that apply in almost all jurisdictions.

A registered office is required, the fact that real transactions related to trade are carried out is important - the sale of goods or services in the country where it is planned to receive the combination. It is necessary to have at least one director who is a resident of the country where you need to obtain the BAT. When using a nominee service, you must provide information about the real owners of the company and confirmation that they are responsible for the operations.

Patent payment for individual entrepreneurs

Let's find out how you can pay for a patent, within what time frame and what you should never forget about. Since 2020, there has been a scheme that simplifies the payment for a patent, which is a significant plus, primarily for those who want to purchase this license to start their own business and are not ready spend a lot of money, because the investment is already considerable.

For 2020, the rules are such that a patent can be paid for in two installments. The first is paid in the amount of one third no later than the end of the third month from the date of validity of the patent.

The second (or the rest, if the board is divided into more parts) - until the last day of the patent.

Patent tax rate

The tax rate for a patent is set by the constituent entities of the Russian Federation.

Rate 0%

According to paragraph 3 of Art. 346.50 of the Tax Code, regions can provide tax holidays for 2 years for individual entrepreneurs who registered for the first time to provide household services to the population or work in the scientific, social and industrial spheres.

Rate 6%

The tax holiday period ends in 2020. If such a law applies in your region and you have registered an individual entrepreneur for the first time, then you do not need to pay for a patent for two years. Otherwise, the patent rate will be 6%.

Rate 4%

Patent tax payment will be less in the Republic of Crimea and Sevastopol. For these entities in the period from 2020 to 2021, a rate of up to 4% applies.

General information about US visa fees

Everyone, children and adults, is required to pay this fee, except for those citizens who are on the list of those exempt from payment. The consular fee for an American visa to the USA, regardless of the outcome of the interview, is non-refundable.

Even if you are not issued a visa or you do not make an appointment, it is impossible to return the amount spent.

The table below shows the fees for 2020:

| Visa type | Purpose | Fee amount |

| B | Tourist and business trips | 160$ |

| C-1 | Transit | |

| D | For crew members of ships and aircraft | |

| F, M | Long-term student visas, vocational training | |

| I | For journalists and media workers | |

| J | For exchange program participants | |

| T | For victims of human trafficking | |

| TN/TD | For workers from NAFTA countries | |

| U | For victims of criminal activity | |

| H | For trainees and temporary work visas | 190$ |

| L | For employees transferring within the company | |

| O | For gifted individuals | |

| P | For athletes, artists | |

| Q | For participants of international exchange programs | |

| R | Religious visas | |

| E | For traders, investors and Australian citizens | 205$ |

| K | For brides, grooms and spouses of American citizens | 265$ |

Before you pay the consular fee for a US visa, you need to decide on the type of visa. The amount of the main duty, as well as the presence of additional duties, depends on this. The following list contains brief information that you should read first:

- The fee is paid before scheduling an interview in any case;

- Payment of the consular fee for a US visa is made in rubles, but at the rate established by the American Embassy. The prices themselves are indicated in dollars;

The exchange rate of the Embassy does not always coincide with the rate of the Central Bank of the Russian Federation!

Current contact information can always be found on the official website of the American Embassy https://www.usembassy.gov/russia/ The addresses and telephone numbers of the US Consulates in Moscow, Yekaterinburg, St. Petersburg, and Vladivostok are published there.

Errors in payment slips for payment of contributions: what are they and how to correct them

The fact is that all errors made when filling out a payment order can be divided into critical and non-critical.

The first are those due to which the amounts did not reach the required Treasury accounts.

In this case, you will have to make the payment again. And non-critical errors can be considered those that do not lead to the non-receipt of money to the budget of the Pension Fund of the Russian Federation or the Social Insurance Fund, so they are corrected by simply clarifying the payment. Using the example of a payment order for the payment of contributions to the insurance part of a labor pension for February 2012, we will show in which columns of the payment order the errors will be critical (they are highlighted in red), and in which - not (they are highlighted in blue).

PAYMENT ORDER No. 3 03/06/2012 Date Type of payment 01 Payer status Amount in words Sixteen thousand rubles 00 kopecks INN 7723045954 KPP 772301001 Amount 16000-00 Marathon LLC Payer Account.

No. 40702810838110104803 Moscow Bank of Sberbank of Russia (OJSC)

MoscowBank payer BIC 044525225 Account.

Elimination of additional visa fees for Russian citizens

Plan your interview time to avoid having to pay the visa fee again. The consular fee is non-refundable.

An application for this type of document is requested by those who plan to move to the United States for permanent residence, marry an American citizen, reunite with relatives, etc.

Step 1. You must read and agree to the terms of payment of the consular fee, which are given in the first paragraph, and also enter the applicant’s date of birth, the name of the card holder and select the required fee amount. Be careful when filling out the contact information field. Please ensure that you have entered a valid email address and that you have not made a mistake when entering your phone number.