Bookmarked: 0

As required by law, the state duty form to the court is a prerequisite when filing a claim. The receipt must have already been paid at the time of contacting the government agency, as evidenced by a tear-off part of the document certified by a bank cashier, a check or other evidence. Like all unified state templates, the payment sheet is distinguished by a standardized form - the state duty form for the court is the same for the constituent entities of the Russian Federation, and only the data for filling it out differs.

In general, about the state duty form for the court and the payment itself

The need to pay a contribution to the treasury is regulated by Article 333 of the Tax Code of the Russian Federation. If an agreement has been concluded with a legal consultant, he probably has a state duty form for the court, so that from the first visit to the secretary all the papers are immediately accepted for work. In the case where the plaintiff prepares the claim and other papers himself, he should take care in advance to receive a sheet of the form for payment. This can be done upon a preliminary visit to the government agency in the reception area, download the state duty form to the court in free access on its official website or trusted Internet resources. At the same time, if the sample - the state duty form for the court - was taken from open sources, you should carefully check the details of the receiving party so as not to pay someone else's bill.

The amount of the contribution to the treasury varies greatly depending on the claims of the plaintiff or plaintiffs and the proportions of the shares assumed in the case. For example, the standard rate is about 2% of the disputed property, but the state duty cannot be less than one and a half and no more than sixty minimum wages. You can calculate the exact amount yourself: there are special calculators online that take into account a maximum of factors. However, if you have a financial opportunity, you should contact a lawyer with this question. Due to the slightest inaccuracy that the electronic settlement scheme allows, the state duty form to the court may be invalid, and the hearing on the case will be postponed. A professional will not make such mistakes.

There is no point in arguing about the amount of the contribution with the court or trying to reduce it. The amount of the duty is clearly stated in the legislation of the Russian Federation; it does not provide for concessions or benefits.

However, for some court filings, payment of the ticket is not required. These include complaints and statements the scale of which is not sufficient for a claim, as well as some other procedures:

- closure of the case by resolution or act;

- postponing and changing the order of consideration of the case by the court;

- review based on newly discovered circumstances;

- review of the amount of a fine already imposed by the court or its cancellation;

- fixes and additional solutions;

- typographical or arithmetic errors in rulings and decisions;

- restoration of what was missed or expiration of a court decision, etc.

You need to find out on your own about the circumstances that allow you not to use the established template - replace the state fee form to the court with a receipt with a smaller amount or not pay at all. The court is not interested in additional work, and determining the right to a free hearing will take time and resources.

https://youtu.be/_KBeGC_1Bns

Receipt confirming payment of state duty

In the event of the death of an individual (reorganization of a legal entity, assignment of a claim, transfer of debt and in other cases of change of persons in obligations), the state duty is paid by such successor, if it was not paid earlier by the departing party.

- on claims for ownership of a real estate object owned by a citizen by right of ownership - based on the value of the object, but not lower than its inventory estimate. In the absence of an assessment - not lower than the estimated value of the object under the insurance contract (for an object of real estate owned by the organization - not lower than the balance sheet value of the object);

We recommend reading: Transport tax payment table

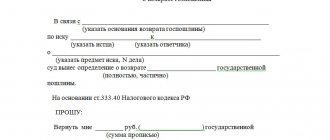

How to correctly draw up a state duty form for the court

Citizens do not need to prepare a document from scratch. The legislation provides for an established template; the state duty form for the court is the same for the entire executive system of the country. The unified sheet contains the required lines:

- details of the payee (court);

- full name and address of the payer;

- amount and purpose of payment;

- date, signature.

It is important to check each number in the recipient’s details and the purpose of the contribution. The accounts of different courts differ, and a payment credited to the wrong recipient will have no effect. If you are unsure of the information you have, contact the court where the case will be heard directly. Ask for a payment document there: the state duty form for the court will most likely already have the recipient’s details, and you will only have to enter your personal data, the amount and, possibly, the purpose of payment, as well as the date and signature. Even if all the columns are empty, the secretary will not refuse to provide a correctly completed example.

How to confirm payment of the duty and why it is needed

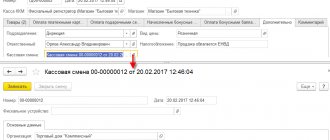

- Firstly , you can calmly wait four days and only after that go to a branch of the RF Security Council that is convenient for you.

- Secondly , prepare for the bank employee the full name of the payer, the amount, date and time of payment, preferably not forgetting about the document index if you paid by index.

- Thirdly , without leaving the cash register, check that the confirmation is correct. It must indicate: the payer’s full name, his address, information about the payment (when and to which account the money was transferred), the employee’s signature and the bank’s seal.

With a sudden feeling of deep and sincere hostility towards individual employees of Sberbank and, to be honest, towards the entire banking sector as a whole, I went to the branch on Skhodnenskaya. I waited in line for half an hour. Explained the essence of the problem. The bank employee (thanks to her for her understanding) turned out to be much quicker and smarter than her colleague, and literally 10 minutes later she gave me a new confirmation, unfortunately, not on company letterhead, but it was done correctly (sorry for the quality, the photo was taken in the 46th tax office ).

Where to pay the bill?

A receipt for payment of the state fee is of great importance, so it is not possible to pay it in every institution. However, citizens are offered a choice of three methods, each of which has advantages in certain circumstances:

- Deposit money at a Sberbank branch. The funds will be credited to your account quickly, up to 5 business days; you will need to pay a commission at the cash desk.

- Use a transfer from Russian Post. As a rule, the commission for the service will be less, but the time it takes for the money to arrive in the account will increase.

- Pay online - quickly and often without commission (or minimal).

The State Services website provides an opportunity not only to quickly pay the state duty form to the court, but also to save significantly. Since 2017, contributions to the country's treasury made through the portal are made in the amount of 70% (that is, with a 30% discount). To pay for a template - a state duty form for the court - through the State Services portal, you need to register on it and confirm your identity offline in one of the government bodies, for example, the Pension Fund.

What is the state duty paid for?

According to Article 333.16, State duty is a fee collected from persons when applying to state bodies, local government bodies, other bodies and (or) officials who are authorized in accordance with the legislative acts of the Russian Federation, legislative acts of the constituent entities of the Russian Federation and regulatory legal acts of local government bodies, for the performance of legally significant actions in relation to these persons, with the exception of actions performed by consular offices of the Russian Federation.

In other words, payment of the state duty is made in:

- government agencies;

- local government bodies;

- other organs

behind:

- performing legally significant actions in relation to state duty payers.

Article 333.18 of the Tax Code of the Russian Federation provides an explanation of the reasons that are mandatory for paying the state duty:

- when contacting judicial authorities to submit a request, petition, application, statement of claim, administrative claim, complaint;

- when applying for notarial acts;

- when applying for the issuance of documents (their duplicates);

- when applying for an apostille.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

What to pay attention to

The legal literacy of the population currently remains insufficient; a striking example of this is the state duty form for the court. There are many misconceptions and mistakes around the contribution:

- Often, along with a property claim, they simultaneously submit an application without property claims, believing that the state fee will have to be paid once. The law is clear: for each document a payment will be accrued in accordance with the law.

- Counterclaims are not exempt from paying state fees, despite popular belief.

- If the amount of the claim increased during the hearings, the plaintiff will have to pay the difference in the state fee.

- If the amount of the claim is reduced, you can get the difference in the state duty back by filling out an application.

- A previously unconsidered case of reclaiming the due share of an inheritance is subject to state duty as a non-property claim.

When submitting a package of documents to the executive authorities, the payment slip - the state duty form to the court - is of particular importance. Without a paid receipt, the consideration of the case will not begin, and the hearings will be postponed. You can fill out and pay for the document yourself, having at hand a sample or an example and a blank template - a state duty form for the court, the main thing is to treat each point carefully.

How to confirm payment of the duty and why it is needed

When asked by an employee of the Federal Tax Service about the receipt/check for payment of the duty, I told my short and sad story, but ended with the optimistic assurance that the duty had definitely been paid and the inspector would probably see this payment in the State Information System on State and Municipal Payments. In response, I heard: “This system doesn’t work for us, so if you submit without confirmation of payment, you will definitely get a refusal.”

On the fourth day, after the traditional 30 minutes in line, I finally heard the good news: the payment went through. And just two hours later I had in my hands a document confirming the transfer of funds, printed on a beautiful letterhead of the Security Council of the Russian Federation, with which I immediately went to the 46th Federal Tax Service Inspectorate.

Sixteenth Arbitration Court of Appeal

In this regard (taking into account the provisions of Article 45 of the Code), it is necessary to keep in mind that evidence of payment of the state duty in non-cash form is a payment order, on which the date of debiting the funds from the payer’s account is entered in the field “Written off from the payer’s account” (if partial payment - the date of the last payment), in the "Bank Marks" field - the stamp of the bank and the signature of the responsible executor (clause 3.8 of part 1 of the Regulations on non-cash payments in the Russian Federation, approved by the instruction of the Central Bank of the Russian Federation dated October 3, 2002 No. 2-P (with subsequent changes).

We recommend reading: Scholarship Application

If the applicant fails to submit, within the period determined by the arbitration court, a document confirming the payment of the state duty in the established manner and amount or the right to receive a benefit in the payment of the state duty, or a request for a deferment, installment plan, or reduction in the amount of the state duty, the appeal is returned in accordance with paragraph 5 of Part 1 article 264 of the Arbitration Procedure Code of the Russian Federation.

Blue stamp for state duty (Ermolinskaya T

In accordance with the requirements of the Civil Procedure Code of the Russian Federation and the Arbitration Procedure Code of the Russian Federation, a document confirming payment of the state duty is attached to the statement of claim, appeal and cassation complaint. If the specified document is missing, the statement of claim or complaint may be returned to the applicant. Payment of the state duty can be made by transferring funds by bank. For a legal entity this is the most convenient option. Transfers of funds by banks are carried out by order of the client electronically or on paper. According to Art. 333.18 of the Tax Code of the Russian Federation, the fact of payment of the state duty by the payer in non-cash form is confirmed by a payment order with a note from the bank or the relevant territorial body of the Federal Treasury (another body that opens and maintains accounts), including one that makes payments in electronic form, about its execution. The rules for transferring funds are regulated by Bank of Russia Regulation No. 383-P dated June 19, 2012. In accordance with clause 4.6 of Regulation N 383-P, the execution of an order in electronic form for the purpose of transferring funds to a bank account is confirmed by the payer’s bank by sending the payer a notice in electronic form about the debiting of funds from the payer’s bank account indicating the details of the executed order or by sending the executed order in electronic form indicating the execution date. In this case, the specified notice from the payer’s bank can simultaneously confirm the acceptance of the order for execution in electronic form and its execution.

A court of general jurisdiction, when resolving the issue of submitting a document confirming payment of the state duty, proceeds from the fact that the applicant must submit a duly certified payment order. In other words, a payment order with the bank’s blue seal, certified by a bank employee, is required. For example, cassation rulings of the Moscow City Court dated 02.09.2015 N 4g/2-9494/15, dated 26.06.2015 N 4g/2-6865/15 returned cassation appeals. The court motivated the return by the fact that the attached printout of the payment order form from the electronic system is not properly executed and is not certified in the prescribed manner: it does not contain the signature of a bank employee on the bank’s mark on acceptance of the payment order, the bank’s seal and the mark on the transfer of state duty to the budget, duly certified. Similar requirements for a payment order when transferring state fees electronically were presented, for example, in case No. 33-2119 (Appeal ruling of the Kirov Regional Court dated June 17, 2014).

Sample receipt for payment of state duty

The decision to return to the payer the overpaid (collected) amount of state duty is made by the body (official) carrying out the actions for which the state duty was paid (collected).

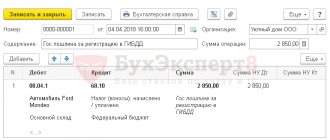

The inventory revealed a fixed asset. The initial cost was determined by an independent assessment. We paid a state fee for registering property rights of 22,000 rubles. We are not using the property yet.

In this case, the bank's mark is not placed on the payment documents.* After receiving the payment, the check order, together with the payment document, is returned to the payer.

Details Interregional operational UFK Ministry of Culture of the Russian Federation lch 04951000540 payment State duty for issuing a duplicate document confirming the presence of a license.

I filed a statement of claim in court, they held the case for 2 and a half months, it turned out that I needed to make changes to the cadastral passport of the land plot of my deceased husband, he was the owner of the plot.

A payment, called a state fee, is paid by the applicant when drawing up an application or request for legal action, the issuance of official documents registering or confirming the applicant’s status or authority.

Please explain how the state duty is written off to attract foreign citizens: at a time when paying or as foreigners are registered for work? Is any documentary evidence required to write off this state duty as an expense?

A payment, called a state fee, is paid by the applicant when drawing up an application or request for legal action, the issuance of official documents registering or confirming the applicant’s status or authority.

Hurry up to pay the cost of paying the state duty at a time. In tax accounting, include the costs of paying state duties as other expenses.

This offset is made upon the payer’s application submitted to the authorized body (official) to which he applied to perform a legally significant action.