If the decision to organize your own business is firmly ingrained in your thoughts, do not waste time and boldly carry out the procedure. The Federal Tax Service has created a lot of convenient ways to register an individual entrepreneur. You can submit documents either in person or through the online service.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

In the process you will have to pay a state fee. We will consider all the nuances associated with generating a receipt, subsequent payment and providing confirmation to the tax office in this article.

What it is

A state duty is a monetary fee that is levied on taxpayers for carrying out any legally significant actions. In this case, the fee is levied on an individual who decides to become an individual entrepreneur.

The amount is fixed and amounts to 800 rubles, regardless of the applicant’s registered address, method of submitting documents and type of planned activity.

The fee is charged for the procedure for state registration of an individual as an individual entrepreneur, for issuing a certificate and extract from the Unified State Register of Individual Entrepreneurs.

The fee is paid according to the established details, after which confirmation of payment is provided to the tax office.

Where to pay

The state fee for registering an individual entrepreneur can be paid at any organization that makes payments. The most popular way is to pay through a bank. In most banking structures, payments can be made either with the help of specialists or using self-service devices.

When paying through a bank, no additional fees may be charged. You only pay the amount of the duty itself, and nothing more.

Any actions of the bank aimed at charging additional fees when paying state duties are illegal and unlawful. If you notice such a violation, contact your local prosecutor's office with a statement about the violation of your rights.

The procedure can also be carried out through the tax service website. After filling in information about the payer, a window will be presented in the appropriate section to select a service provider.

The Federal Tax Service provides a convenient payment service where you can select the desired bank or payment system from the list provided and, following the instructions of the system, transfer funds using the specified details.

You can pay via:

- Sberbank Online;

- Portal of state and municipal services;

- Military Industrial Bank;

- Qiwi Bank;

- NPO “MOBI.Money”;

- Bank Center-Invest;

- Gazprombank;

- Alfa Bank;

- Bank "Saint-Petersburg;

- Promsvyazbank;

- Credit Ural Bank;

- Bank of Kazan;

- PSKB Bank;

- Bank Primorye;

- Conservative Commercial Bank;

- Chelyabinvestbank;

- Almazergienbank;

- Moscow Industrial Bank;

- Bashkomsnabbank.

You can also make payments through the websites of payment systems and banks that provide online payment services. Electronic payment systems such as WebMoney and Yandex.Money provide the opportunity to make instant payments with a minimum commission.

How to register an individual entrepreneur online is described in the article: registering an individual entrepreneur online. A sample application for individual entrepreneur registration can be found in this article.

Filling out a paper receipt form

If you plan to pay at a bank branch, you need to fill out the form correctly.

To ensure that the receipt for payment of the state duty for opening an individual entrepreneur 2020 is filled out correctly, you can visit the tax office website. The receipt must contain the following information:

- Full name and tax identification number of an individual;

- place of residence;

- recipient details: account, bank name and code;

- amount to be paid;

- purpose of payment.

Submit the completed form to the cashier at the bank branch for payment. Save the received receipt; it must be attached to the package of documents for individual entrepreneur registration.

It is important to fill out the form carefully and legibly. If incorrect information is provided, the money paid will not be returned and the applicant will be denied registration.

If the payment has been made, but plans have changed and the individual does not submit documents for registration of an individual entrepreneur, you need to write an application to the NI and attach a receipt for a refund.

We recommend you study! Follow the link:

How and in what amount the state duty is paid for opening an individual entrepreneur in 2019

How to pay

You can pay in several ways. The most convenient and preferable looks like this:

- generation of a payment document on the official website of the Federal Tax Service in the “Payment of state duties” section;

- making payments through the services provided by the site online.

Thus, you can pay the state fee without leaving your own home.

Second way:

- generate a receipt for payment through the Federal Tax Service website;

- go to the nearest bank and pay there with the help of an employee or through self-service devices.

Third way:

- get a receipt from the nearest branch of the Federal Tax Service;

- fill it out;

- pay via bank, self-service devices or the Internet.

Since there is a convenient way to generate a payment document on the tax service website, the third option seems to be the least preferable.

We recommend using the first two methods, which will allow you to complete the procedure in just a couple of minutes.

Let's take a closer look at the most convenient and fastest method - generating a receipt and paying via the Internet:

- go to the Federal Tax Service website in the section “Payment of state duties”;

- from the drop-down lists presented, select the second one – “State fee for registration of individual entrepreneurs”;

- select the menu item “State fee for registration of a sole proprietor as an individual entrepreneur”;

- click “Next”;

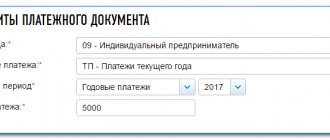

In the window that opens, the required BCC for paying the state fee for individual entrepreneur registration, the amount and name of the payment will already be indicated. You just need to fill in the payer information.

In the submitted forms you need to enter your Taxpayer Identification Number (TIN), full name and address of residence. Fields marked with a red asterisk are required.

It is not necessary to indicate the TIN to generate a payment document with subsequent payment in cash at a bank or self-service devices. When paying online, you must indicate your TIN.

You can find out by using the tax service’s online service using the appropriate link. By filling out the required information, you can find out your own or someone else’s TIN. The same opportunity is available on the State Services portal.

The address of residence is not entered independently, but by filling out a special form. You need to enter an index, select a region from the list, start entering the street name, and then indicate the number of the house, building (if any) and apartment.

The system itself will generate the necessary data and insert it into the appropriate field. After entering your personal information, click “Next”. Check the details and click “Pay”.

To pay state fees in cash:

- in the new tab that opens, click “Generate payment document”;

- The document will begin downloading in PDF format. Once the download is complete, you can print it.

By cashless payment:

- in the payment method selection menu, select “Cashless payment”;

- click on the logos of financial institutions providing online payment services that appear;

- follow further system instructions.

How to fill

There are three options for filling out the receipt.

Manually.

The following fields must be filled in on the receipt: • OKTMO code; • FULL NAME; • payer's address; • passport details of the payer; • the name and account of the bank that will receive the fee; • recipient details (BIC, INN, KPP, KBK); • indicate the amount of duty. The document must be filled out with a blue or black pen, excluding corrections and cross-outs, otherwise the receipt may not be accepted for payment, and even if accepted at the bank, it will not be accepted at the tax office.

Via the Internet on the official website.

To do this, you need to go to the website of the Federal Tax Service (Federal Tax Service), select the phrase “payment of state duty” in the menu, and fill out according to the step-by-step instructions. Enter the Federal Tax Service code, fill in the “district” and “city” cells, select the “State duty for an individual as an individual entrepreneur” item in the next menu. Important: make sure that the amount of 800 rubles is indicated, the system will determine the status automatically. Then you need to enter your TIN (identification code), full name, then select the “cash payment” item in the payment options and click “generate a payment document.” It will be available electronically in PDF format. Then all you have to do is save the papers, print them, put the date and signature, and you can pay at the bank or any terminal.

With the help of third parties.

Such organizations provide paid services for filling out and processing official papers. For a moderate amount, a specialist will do everything instead of an entrepreneur.

A receipt for payment of the state duty for registration with the tax service of an individual entrepreneur is a document that is not accepted in the form of a copy! According to the law, the inspector responsible for carrying out the registration takes the original. Therefore, to be on the safe side, you should first make a copy in case of unforeseen circumstances or loss of the original.

Receipt for payment of state duty for individual entrepreneur registration

A receipt for payment of the state fee can be obtained:

- in electronic form through the official website of the Federal Tax Service;

- in paper form at the territorial tax authority.

It does not matter how you receive the document. The receipts will be absolutely identical in both cases.

Since the most convenient and fastest way is to generate a receipt on your home PC according to the specified data, print it and pay at the nearest bank, the second method is less preferable.

Moreover, the tax office will give you a form that you will need to fill out. To avoid mistakes and unnecessary problems, we recommend using a convenient online service.

The generated payment document using the electronic service will already contain:

- unique receipt index;

- payer data, such as full name, registration address and TIN;

- payment amount in rubles;

- name of the receiving bank;

- BIC, INN, KPP, account and account code of the recipient bank;

- KBK and OKTMO.

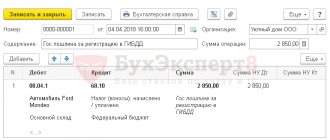

Payment and refund of fees for registration of individual entrepreneurs and LLCs

In this article:

Amount of state duty when registering an individual entrepreneur or LLC

If you need to open an individual entrepreneur or LLC, you must pay a state registration fee.

To register an LLC you will need to pay 4,000 rubles, for an individual entrepreneur – 800 rubles. Previously, it was necessary for the state fee for registering an LLC to be divided by the number of founders, depending on the share of participation in the organization, and to be paid by each individual. However, Federal Law No. 401 amended paragraph 1 of Art. 45 of the Tax Code of the Russian Federation, according to which “Payment of tax can be made for the taxpayer by another person.” Thus, any individual or legal entity can pay for registration. The procedure for filling out a payment order for payment by third parties is specified in the letter of the Federal Tax Service dated March 17, 2020 No. ZN-3-1/ [email protected] “On consideration of the application.” According to this letter, the required fields are: payer’s TIN; payer checkpoint; Payer (full name); Purpose of payment (this field indicates the INN and KPP (only for legal entities) of the person making the payment and the full name (name) of the payer for whom the payment is made).

The validity period of the receipt for payment of the state fee is not limited, however, you should not postpone registration until later. It is preferable to pay the state fee at the moment when all the documents have already been collected.

If suddenly from the time of payment of the fee to the day of submission of documents for registration, its size has increased, you must additionally pay the difference.

Many MFCs and notaries submit documents for registration to the Federal Tax Service electronically. This means that when submitting documents through them, you will also not have to pay a fee.

The need to re-pay the fee upon receipt of a refusal to state registration of an individual entrepreneur or LLC has been canceled since January 1, 2020.

Payment methods for state fees

There are several ways to pay the state fee:

- using a bank receipt;

- through an ATM using the barcode indicated on the receipt;

- on the State Services website;

- on the Federal Tax Service website;

- via Internet banking.

A receipt with payment details can be obtained from the Federal Tax Service or downloaded on the Internet. For those who do not want to spend time preparing a package of documents, we offer to use our free service. Go through a few steps and receive a ready-made set of documents for registering an individual entrepreneur or LLC. A receipt for payment of the state fee will be generated automatically along with all documents for registration.

The receipt must indicate the full name, address of the payer and his Taxpayer Identification Number; OKTMO code; name and account of the financial and credit organization for which the fee is intended; recipient details (BIC, INN, KPP, KBK); payment amount.

Payment of state duty on the official website of the Federal Tax Service.

To receive a receipt or pay for it, you can use the “Pay Taxes” service. on the Federal Tax Service website. Select the section “Payment of state fees”, then Type of payment (for registration of a legal entity or individual entrepreneur).

After filling out all the fields, click the “Next” and “Pay” button. In the window that opens, you must select a payment method. Having selected the “Cash payment” item, the “Generate payment document” button will appear – click. You will receive a generated receipt with details for paying the state fee, print it and pay at any bank convenient for you or through an ATM.

If you select “Cashless payment”, you will be presented with a list of services through which you can pay the state duty. Choose the one that suits you and pay the state fee online.

Payment of state duty at a bank branch.

The employee responsible for organizing work with the cash register in a banking institution is required to present a receipt or details to the tax office where you will submit documents.

Payment of state duty by barcode.

If the receipt has a barcode, then paying the fee through the terminal will not be difficult.

Insert the bank card through which you will make payments into the terminal. Select “pay in cash”, then click “payment by barcode”, present the receipt to the reader. All information from the receipt will be displayed on the screen; all you have to do is click the “pay” button. Based on the results of the procedure, the terminal will give you a receipt with the payment completed.

Payment of state duty on the State Services portal.

This is one of the most common methods of paying state fees. You must register on the portal. After you have entered your personal account, you need to select the “Payment” section and the “Payment of state fees” item. From the proposed list of services for payment, select “State registration of an individual as an individual entrepreneur”, all the necessary information is contained on the page, follow the instructions.

Payment of state fees via Internet banking.

In order to pay the state fee via online banking, it is not necessary to receive and print a receipt; it is enough to know the details where the funds should be transferred.

There is no need to carry a receipt for payment of the state duty to the Federal Tax Service, because the payment is entered into the GIS GMP system (State Information System on State and Municipal Payments), where the inspector accepting documents for registration will see the payment. However, we recommend that you take the original receipt with you to avoid any disputes.

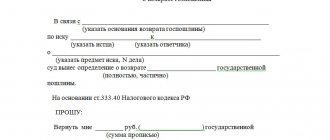

Refund of paid state duty

You can return the paid state duty if:

- physical a person or organization transferred an amount exceeding the established tax amount;

- the state duty was transferred to the wrong bank account due to inaccuracies in the payment documents;

- the applicant who has paid the state fee abandons his intention to register.

If there was an appeal, but after the application was withdrawn, it will not be possible to return the amount of money paid.

The state duty cannot be returned if the Federal Tax Service has refused to register the applicant as an individual entrepreneur or LLC.

Organization or individual a person has the right, within 3 years from the date of payment of the state duty, to request the return of the paid funds. If this period is exceeded, only through the court.

What should be your actions to return the paid state duty:

The first step is collecting the necessary documents. If you want to return the paid state duty in full, you will need checks, receipts, payment orders and other documents evidencing payment.

The second step is drawing up an application. There is no specific form for it, but at the same time the application must include:

- information about the state duty payer;

- purpose of payment;

- reason for return;

- bank account details for transferring back state fees.

The third step is sending an application to the Federal Tax Service. It is required to transfer it to the Federal Tax Service that accepted payment of the state duty. If the application is delivered in person, a receipt will be required. You can send the document by mail in the form of a notification letter; you cannot submit an application via the Internet.

Fourth step

- waiting for the final decision. The authorized body makes a decision on the possibility of refunding the state duty within 10 days. Funds will be transferred to the account specified by the payer within one month.

State duty amount

Current legislation has established a fixed amount of state duty for registering an individual as an individual entrepreneur - 800 rubles.

This amount must be paid by an individual who intends to register as an individual entrepreneur without fail. A document confirming payment must be submitted to the territorial tax authority along with an application in form P21001.

The size of the state duty is quite liberal and is unlikely to hit the wallet of a novice businessman who has decided to open his own business.

Until 2010, the fee for registering an individual entrepreneur was 400 rubles, which is two times less than the current one. However, the constantly growing rate of inflation in the country may also affect the further increase in state duties in the near future.

However, compared to other mandatory expenses when starting your own business, 800 rubles seems like a very small amount. And this is very good - almost every citizen of the Russian Federation can organize their own business by paying the state only a symbolic amount of money.

Payment details

One of the mandatory payments to be made by a new entrepreneur is the payment of state duty - a tax contribution for registering a private business. Without this there will be no progress.

The cost of the state fee for registration of the initial registration of individual entrepreneurs in 2020 does not differ from 2020 and is 800 rubles. Payment can be made at any bank branch. Details for the receipt can be obtained from the territorial tax office or found on the IFTS website nalog.ru.

Documents for download (free)

- Receipt for payment of the fee for registration of individual entrepreneurs

If you pay at a bank, you will need to fill out a receipt. If you decide to go to the nalog.ru website, you can generate a receipt there in a certain form, in which the customer only needs to enter his personal data and print out the receipt.

Filling out the receipt yourself

There is a personal computer with Internet access in almost every home. However, situations may arise in which it is impossible to use the Internet and go to the Federal Tax Service website to generate a receipt automatically. In this case, you will have to fill out the payer’s information and transfer details yourself.

When filling out a payment document to pay the state duty yourself, there are a number of nuances that need to be taken into account:

- Please be careful when filling out your payment details. If there is an error in the data, the payment will not reach the addressee. In this case, the state fee will have to be paid again, and the previous payment can be cancelled;

However, this will take a lot of time and nerves, so be extremely careful. The current details for paying the state fee for registering an individual entrepreneur can be clarified at the nearest branch of the Federal Tax Service.

- check the correctness of your personal information. If an error is made in the data, the tax office may refuse to register an individual entrepreneur;

- The payment receipt must contain only the applicant's details. It is unacceptable for a friend or relative to pay the fee. In order to grant such rights to a third party, a power of attorney must be issued by a notary in the prescribed manner;

- You must correctly indicate the payment amount. The fee is fixed and amounts to 800 rubles. The tax office has the right to refuse registration of an individual entrepreneur due to incomplete payment of the state duty;

- The payment receipt must be kept for presentation to the registration authority. Without a confirmation document of payment, the Federal Tax Service will not accept documents for registration.

Sample receipt for payment of state duty for opening an individual entrepreneur in 2020

Opening an individual entrepreneur is a simple process, so it is quite possible to refuse the services of third-party organizations. The package of documents includes a copy of the passport, code and a completed application for opening an individual business. In addition, the state fee for registering an individual entrepreneur must be paid in 2020; the receipt must be filled out by an individual independently or using the service on the NI website.

Preparation of documents

You can register your business yourself, or with the help of an organization that provides such services. There are advantages and disadvantages of each method.

Self-submission of documents:

- An individual independently fills out form P21001, prepares copies of the passport and code, and pays the state fee.

- The advantages include saving money, gaining experience in communicating with registration authorities or skills in using special services for submitting documents.

- The disadvantages include the risk of being rejected if the application is filled out incorrectly or an incomplete package of documents is provided.

- Registration will not require additional costs and will cost only 800 rubles.

As you can see, there is nothing complicated, and if you have a little free time, you can go through the procedure yourself.

- The registrar assumes responsibility for collecting the necessary documents, filling out form P21001 and paying the state fee. By agreement with the client, the representative submits documents to NI and receives a certificate.

- The advantages include saving time and the possibility of obtaining a refund of the paid state duty if the NI is refused due to the fault of the registrar.

- Disadvantages include unnecessary costs for services and transfer of personal information to a third party.

- For services you need to pay another 1000-4000 rubles in addition to the state fee. In addition, there will be notary expenses of about 1000 rubles.

Having assessed all the disadvantages and advantages of each form of filing documents, the future businessman can choose the most suitable option.

Registration of a receipt on the website of the Federal Tax Service

Future businessmen no longer need to stand in queues and waste their precious time submitting documents to open their own business.

First, decide where you will send the package of documents:

- MFC.

- NI (tax office).

The receipt for payment of the state fee for registering an individual entrepreneur in 2020 is filled out very simply, on the Federal Tax Service website.

Stages of filling out a receipt and payment:

- go to the Federal Tax Service website and select the Pay taxes tab, a section for legal entities and individual entrepreneurs is required;

- then go to the Payment of state duties tab, which contains a list of possible taxes and contributions. Choose the state duty for registering an individual entrepreneur;

- the service will offer two payment options, they depend on where you are going to submit documents: to the MFC or the Federal Tax Service;

- Next, you need to fill out a simple form, indicating your full name, tax identification number, and registration address;

- at the next stage, a receipt form with filled in details will appear;

- Click the Pay button, select the electronic option and indicate your bank.

Print out the receipt, it will be useful to you when submitting documents to NI.

A receipt for payment of the state fee for registering an individual entrepreneur can be paid in the following ways:

- Online on the Federal Tax Service website.

- In the NI terminal.

- Through the post office.

- In Sberbank.

A future entrepreneur can choose the most convenient option; the main thing is to fill out the form correctly and indicate the necessary details.

Filling out a paper receipt form

If you plan to pay at a bank branch, you need to fill out the form correctly.

To ensure that the receipt for payment of the state duty for opening an individual entrepreneur 2020 is filled out correctly, you can visit the tax office website. The receipt must contain the following information:

- Full name and tax identification number of an individual;

- place of residence;

- recipient details: account, bank name and code;

- amount to be paid;

- purpose of payment.

Submit the completed form to the cashier at the bank branch for payment. Save the received receipt; it must be attached to the package of documents for individual entrepreneur registration.

It is important to fill out the form carefully and legibly. If incorrect information is provided, the money paid will not be returned and the applicant will be denied registration.

If the payment has been made, but plans have changed and the individual does not submit documents for registration of an individual entrepreneur, you need to write an application to the NI and attach a receipt for a refund.

Cost and validity period of the receipt

In 2020, you need to pay a registration fee of 800 rubles. There are preferential categories of citizens who are exempt from paying.

These are defined as:

- Childhood disabilities of 3 groups.

- Citizens referred from the Employment Center.

When registering through the MFC, you need to pay an additional fee.

An application to open an individual entrepreneur is considered only after the state fee has been transferred. Otherwise, registration will be denied.

Consideration of an application to open an individual business takes place within 3 working days. If all documents are in order and there are no restrictions for a specific individual, a document is issued confirming the registration of the individual entrepreneur.

The statute of limitations for a receipt for payment of state duty is limited to three years. But if the payment occurred several years ago, the cost may change and then an additional payment must be made. It is recommended not to transfer the fee if you are not sure that you are definitely ready to open your business. You can get your money back, but it will take a long time.

To return the amount paid to the budget, you need to submit an application to the tax office with an attached copy of the receipt. The permissible limitation period is 3 years. If payment was made earlier, the money will not be refunded.

When can NI refuse?

Only legally capable persons who are not government employees or military personnel can submit an application to open an individual entrepreneur.

The tax office may issue a refusal in the following cases:

- contacting a service other than your place of registration;

- incomplete package of documents;

- the application contains errors, corrections, or inaccurate data;

- the individual is already registered as an individual entrepreneur. Re-opening is not possible until the existing business is liquidated.

- The individual entrepreneur is closed, but the entrepreneur is declared bankrupt and has not repaid his debts;

- there is no signature on the application;

- documents are not certified by a notary when submitted by a representative;

- payment of duty on incorrect details.

As of October 1, 2018, a law should come into force that allows you to resubmit documents after correcting errors without paying the fee again. But today, if the NI refuses to register an individual entrepreneur, the next time you submit a package of documents, you need to pay 800 rubles again.

Deadlines

The state fee for registering a sole proprietor as an individual entrepreneur must be paid before performing a legally significant action.

That is, payment can be made at any time, but until the final submission of the full package of documentation to the tax office. Without a supporting document, the tax office has the right to refuse to accept the application.

The state fee for registering an individual entrepreneur is a mandatory payment that must be made by any individual who wants to open their own business.

You can pay either online or at any nearest bank at your place of residence. The state duty is 800 rubles and does not depend on any external conditions.

It is very convenient to use the electronic service of the Federal Tax Service for generating a payment receipt. This will not only avoid errors when filling out, but will also ensure that the entire procedure is completed in just a few minutes.

How to register an individual entrepreneur through public services is described in the article: registration of individual entrepreneurs through public services. Information about the individual entrepreneur registration certificate is discussed here.

What documents are issued when registering an individual entrepreneur, read on this page.

The amount of state duty for registering an individual entrepreneur in 2020, how to pay and where to get a receipt

Hello! In this article we will talk about the state duty for registering an individual entrepreneur.

Today you will learn:

- Where can I get a receipt for paying the state fee?

- What is the amount of the state fee for registering individual entrepreneurs in 2020;

- Why may they refuse to register an individual entrepreneur?

When performing any legally significant action, an individual or legal entity is obliged to pay a fee to the state - a state duty.

Registration as an individual entrepreneur is no exception. The fee for the operation is fixed and does not depend on the area of activity of the individual entrepreneur, as well as the place of its registration (the fee is the same throughout the Russian Federation).

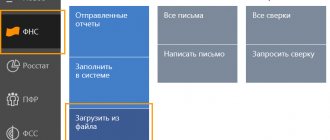

How to pay state duty through the tax website

More recently, in order to receive the coveted receipt, private entrepreneurs had to stand in line at the tax office.

You can use this method now, or you can save your time and nerves and receipts online.

This is what the sample looks like:

Below are step-by-step instructions for paying the state fee for opening an individual entrepreneur.

1. Go to the official website of the Federal Tax Service (hereinafter referred to as the FTS).

2. On the main page of the site, select the “Pay taxes” tab. You will be taken to a page with two subsections: for individuals and for legal entities and individual entrepreneurs. Accordingly, we turn to the second section.

3. In the required subsection, select the “Payment of state duty” tab. A list of all possible contributions will open in front of you; we need to select “State fee for registration of individual entrepreneurs”. She is currently second on the list.

4. You will see a list of fees with checkboxes: two for registration and two for closing.

Why two? The first version of the receipt assumes that you will independently collect and submit all the necessary documents to the Federal Tax Service. The second option involves the taxpayer using the “one window” service, the MFC.

The second method is certainly more convenient. You will spend 15-20 minutes on the entire procedure, the registration period will be the standard 3 days, as when registering directly. The only thing you need to know is the need to pay for the center’s services.

5. Select the checkbox that suits us and click next.

6. Before you is a small form with the following fields: TIN, Last Name, First Name, Patronymic, Address.

The TIN and Address fields are optional, however, if you want to pay for the service by card, you should fill in the TIN field.

In the Address field, you will also need to indicate the subject of the Russian Federation in which you are registering the individual entrepreneur, and your place of residence: street, house, building, apartment.

After you have filled out all the fields mentioned above, click “next”.

7. Your individual entrepreneur payment form will appear in front of you. It will contain all the necessary data: KBK, as well as payment details that you filled out on the previous page. At the bottom there will be a “pay” button.

Don’t forget to request and print a receipt for payment of the state duty from your bank; it will serve as a supporting document when applying to the tax office.

8. When paying, you must select “electronic payment”, and also find and select your bank from the list.

By the way, in addition to the tax office and the website of the federal tax service, you can pay the state duty in the terminal at the tax office itself or with the help of a trusted person who will collect all the documents necessary for registration (in this case you need a power of attorney).

Please note that when paying state duty through the Federal Tax Service website, tax details are filled in automatically.

State duty amount in 2020

As we have already said, the amount of the state duty is fixed and amounts to 800 rubles.

However, there are categories of citizens who are exempt from payment. These include category 3 disabled children and persons who register individual entrepreneurs through the employment center.

The MFC, as well as the terminal, take their own commission. In this case, the payment amount will be slightly more than 800 rubles.

You can make payment via the Internet or at any Sberbank branch.

We draw your attention to the fact that by Law No. 234-FZ of July 29, 2018. Changes have been made to the payment for registration actions. If documents are submitted in electronic format - through the official tax website or government services portal, then entrepreneurs are exempt from paying state duty.

After you have submitted all the necessary documents to the tax office (IFTS), paid the state fee for opening an individual entrepreneur and provided a receipt, your application will be accepted for consideration.

The review period is 3 business days (previously it was 5 business days). This means that in three days your individual entrepreneur will be registered or you will receive a response about the refusal to register the individual entrepreneur.

If you are denied registration of an individual entrepreneur, you will have to pay the registration fee again in the same amount, so you will be careful when preparing documents.

You may be refused in the following cases:

- You have not provided all the documents necessary for opening;

- You contacted the wrong organization;

- You have previously registered as an individual entrepreneur or less than a year ago you were declared bankrupt due to the inability to pay money to creditors (by court decision);

- The registration application is not notarized or is not certified properly (if you are submitting documents through a representative);

- The entrepreneur's signature is missing;

- The application was filled out with errors, and the information on the receipt was entered incorrectly.

The applicant must be at least 21 years old at the time of submitting documents for registration of an individual entrepreneur. If you are not yet 21 years old, you will need to attach parental consent to the standard document package (from 18 to 21 years old).

Also, the entrepreneur must have permanent registration on the territory of the Russian Federation and must not be in government or military service. And, of course, the applicant must have legal capacity.

There are other mistakes, but the ones mentioned are the most common; don’t make them and you won’t have problems with registering an individual entrepreneur.