How is a business trip arranged at the expense of the host party?

All transactions related to the business activities of the company must be reflected in documents - primary documentation forms, which are then stored by an accounting employee. A business trip is precisely one of these events, and therefore it must be properly formalized.

When an enterprise sends an employee on a business trip, the following mandatory documents are drawn up:

- official assignment (on a unified form T-10a);

- travel certificate (on the unified form T-10);

- order of the head of the company or his order to send an employee on a business trip (in form T-9 or T-9a).

Although labor legislation obliges employees' managers to pay them for travel expenses, there are no specific guidelines regarding methods and procedures for financing business trips.

Due to the fact that the methods for compensating an employee’s travel expenses are not defined by law, both the direct employer and the organization to which the employee went to perform any duties can reimburse the expenses. To provide the employee with guarantees of payment for his work, before the trip he signs an agreement with the employer, which will indicate which company will have to pay the money and what specific costs will be reimbursed.

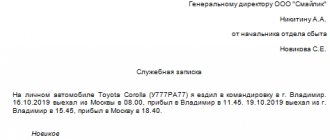

The manager's order to send a subordinate on a trip must contain information about the source of funding for the trip. In the case of payment for the trip at the expense of the enterprise to which the employee will go, it is stated that the business trip is at the expense of the receiving party.

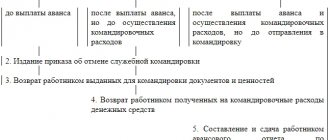

Procedure for registering a business trip in 2020

Any daily allowance can be established, including internal regulations that may provide for different amounts of daily allowance for different positions, as well as for different places of business trip.

But at the same time, according to the norms of Art. 217 of the Tax Code of the Russian Federation there is a maximum amount of daily allowance from which income tax is not charged. These values are 700 rubles. for business trips in Russia and 2,500 rubles. for foreign business trips. How to calculate contributions from excess daily allowances, information in the article “It has become clear at what point to calculate contributions from daily allowances.”

From January 1, the list of documents for business trip documents has changed. For the full list, see the article in Simplified magazine.

Business trip documents

The 2020 business trip report for the accounting department must contain:

- advance report;

- documents confirming living expenses;

- documents confirming travel expenses;

- other documents confirming the agreed expenses (for example, a ticket to an exhibition, the purpose of which was a business trip, etc.).

There are no exceptions for the CEO. The registration of his official trip is carried out according to the general rules. Accordingly, how to report for a business trip in 2020 does not depend on the position of the person being sent.

The only difference is that an organization can establish increased daily allowances for the director of an enterprise by internal regulations, but the issue of taxation of daily allowances will not change - the entire amount in excess of the norm will be the basis for calculating personal income tax.

Documentation of a business trip in 2020, if it lasted only one day, has one feature related to the calculation of daily allowances.

Part 1

Conventionally, the T-9 form can be divided into 3 parts. The first thing that needs to be indicated in the business trip order: the name of the company indicating its organizational and legal status (IP, LLC, CJSC, JSC). Then the OKPO code is entered into the order (it is taken from the title documents), the order number for internal document flow, as well as the date it was filled out.

How is a business trip paid for at the expense of the host party?

Before sending employees on a business trip, the company must include a clause determining the amount of payment for travel in local regulations and the collective agreement.

The employee must receive payment for travel expenses on time and in full when he provides the host company with documentation of expenses, including payment documents for housing (rental agreement or receipts for payment of a hotel room), train or plane ticket. If the contract stipulates payment of any other expenses during your stay on a business trip, you will need to collect more paperwork.

According to the approved rules, an employee cannot claim daily payments in an amount greater than 700 rubles per day . However, if we are talking about a trip abroad, the daily allowance increases significantly - up to 2.5 thousand rubles per day .

Per diem – payment for all days, without exception, spent by an employee on a business trip, taking into account weekends, holidays, periods of travel and forced stops.

Even if the host party undertakes to pay for the business trip, the employee’s employer still pays him some amounts. The receiving enterprise will pay the cost of travel to the destination and for the rental of residential premises, and the employee’s supervisor will pay:

- salary for the entire period of stay on a business trip in the amount of the average monthly salary;

- compensation of daily expenses for all days of travel, including compensation of expenses incurred with the permission of the employer (for paperwork, for mobile communication services).

While an employee of an enterprise is on a business trip, he cannot be fired, deprived of his position or workplace. The position is retained for the time spent en route to the destination and back.

Basic provisions

In many cases, the reimbursable expenses that the contractor insists on are expenses associated with the travel of its employees. In this regard, the question arises: can the customer compensate for the travel expenses of the contractor organization without prejudice to himself? Let us answer right away that the obligation for such compensation in accordance with the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation) does not arise, since labor legislation provides for compensation for travel and accommodation expenses only for “our” employees sent on a business trip (Articles 166, 168 Labor Code of the Russian Federation).