Business trip by personal transport. The legislative framework

Chapter 24 of the Labor Code is devoted to business trips, which in its articles defines such a business trip and also establishes:

- guarantees for an employee when he is sent on a business trip;

- procedure for reimbursement of travel expenses in various conditions of business trips.

The general norms of the Labor Code of the Russian Federation are specified in the Regulations on the specifics of sending employees on business trips (approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749) - the main document establishing the procedure for sending employees to another location to perform tasks.

ATTENTION! The employer must prescribe the procedure for processing and paying for a business trip in a local regulatory act, for example, in the regulations on business trips. Read about the nuances of document preparation in the material “How to draw up a regulation on business trips for 2020 - 2020.”

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

What does the law say?

The procedure for business trips, including employee transport, is regulated by the Labor Code of the Russian Federation and by-laws.

In ch. 24 of the Labor Code of the Russian Federation provides a definition of a business trip, outlines guarantees for the employee and the procedure for reimbursement of amounts spent in various conditions of business trips.

The specifics of sending employees on business trips are established by the Regulations put into effect by Decree of the Government of the Russian Federation No. 749 of July 29, 2008.

As explanatory documents, Order No. 33n of the Ministry of Finance of the Russian Federation was introduced in 2020. Taxation issues are explained in Letter of the Ministry of Finance No. 03-03-06/2238 (Explanations of the Department of Tax and Customs Tariff Policy).

Do I need to enter into a car rental agreement?

There are 2 answers to the question “Should I enter into an agreement with an employee to rent a personal car?”

- It is safer to conclude an agreement and specify the amount of compensation. The amount of compensation for fuel and lubricants can be any, but only standard indicators can be taken into account in expenses:

- 1,200 rub. per month - if the engine volume is less than 2000 cm 3;

- 1,500 rub. per month - in case of exceeding 2,000 cm3.

IMPORTANT! Be sure to take a copy of the car registration certificate (Letter of the Ministry of Finance dated January 23, 2018 N 03-04-05/3235).

2. If an agreement is not concluded, then the employee is paid the entire amount for gasoline according to the advance report. The same amount is taken into account in tax expenses. In this case, disputes with tax authorities are possible, because They recommend paying for fuel and lubricants in accordance with the standards in this case as well.

In any case, issue a waybill. The document will serve as proof of real gasoline costs, because it indicates mileage, route, etc.

Using a personal car on a business trip - compensation

Many professions require travel for business. To get to the destination, the employee can use public transport, a company car or a personal car. The law does not provide for restrictions in this matter, although this information must also be indicated in the business trip report.

However, if a personal car is used, then the director of the organization must reimburse the expenses incurred during its operation. What type of compensation is provided? How to register it? What documents will be needed? You will find answers to these and other questions below.

A business trip in a personal car has a certain design. It is standard regardless of the type of transport used to travel to the place of work. The only caveat is the provision of additional documents.

So, to arrange a business trip, you need to perform the following procedure:

- Prepare documents;

- Draw up a job assignment that is transferred to personnel officers, if necessary;

- Issue an order with information about sending the employee to his vehicle;

- Apply for compensation for the use of the vehicle;

- Calculate daily allowance;

- Compile a report on the results upon return;

- Write a memo.

This procedure is regulated at the legislative level, so it must be strictly followed. Since 2020, it has become optional to complete a job assignment. Therefore, the manager independently decides on its necessity.

Using a personal car on a business trip requires the preparation of certain documents.

According to Government Decree 749, the mandatory documents include the following:

- Travel certificate;

- Note on the use of transport;

- Documents for renting housing;

- Travel documents;

- A report indicating all expenses.

If necessary, the manager can issue an official assignment. With this type of transport, it is important to draw up a memo. Such a trip involves the provision of a waybill when traveling in your own vehicle.

The waybill makes it possible to confirm the fact that the vehicle was used for official purposes. It also allows you to keep records regarding the calculation of gasoline costs.

The form of the waybill is legally approved by Resolution of the State Statistics Committee of the Russian Federation No. 78, or the institution can develop it independently in view of the characteristics of the enterprise itself.

In addition, the driver must present invoices or cash receipts for the purchase of gasoline during the trip in order to write off money from the enterprise budget. It is also advisable to provide other documents indicating compliance with the business trip route. For example, these could be invoices from the supplier or tachograph printouts.

An order for a business trip in a personal car does not have a unified template.

You can draw it up in any form, namely by including the following information in the sample:

- Information about the organization;

- Date, order number;

- Data of the employee, his position, structural unit;

- Information regarding the travel location where the task will be performed;

- Date of departure and arrival from the trip;

- Purpose of the trip;

- Information about using your own transport;

- Details of the organization that undertakes to pay the costs.

At the end of the sample order, it is necessary to put a signature, both by the manager and by the employee who is being sent.

The use of transport on a business trip means mobility of movement and efficiency in completing the tasks assigned to the employee. Let us consider in detail how to pay for a taxi or reimbursement for the operation of your own vehicles on a business trip.

Labor legislation provides for reimbursement of expenses incurred by an employee on a business trip (Article 167 of the Labor Code of the Russian Federation). Using your own car on a business trip is no exception (Article 188 of the Labor Code of the Russian Federation). To properly register the use of personal vehicles for business purposes, it is necessary to comply with some formalities.

It is mandatory to issue an order to send the employee on a business trip and a waybill. The service note does not confirm the use of the car on a business trip; it can only determine its duration.

A waybill is the main document confirming the fact of using personal transport for business purposes and the target consumption of fuels and lubricants. Confirmation of costs for fuel and lubricants is made by receipts from gas stations (gas stations).

The order is issued in any form, or according to the unified T9 or T9A template. Form T9A is intended for sending a group of employees on a business trip.

The order must contain information that the employee’s personal vehicle will be used during the business trip; the procedure for reimbursement of vehicle operating costs must also be determined and the structure of compensation payments must be indicated.

The payment structure is determined by agreement between the employer and employee and may be approximately as follows:

- vehicle depreciation;

- fuel and lubricant costs;

- routine maintenance;

- possible unscheduled repairs.

Other documents, such as a job assignment, travel certificate and business trip report, are not mandatory in 2020; their execution can only be regulated by the internal regulations of the organization. Read about how a business trip is documented in this article https://otdelkadrov.online/6638-dokumenty-dlya-oformleniya-odnodnevnoi-komandiroi-komandiroi-v-vyhodnye-dni

A waybill is a standard document. A form developed directly by the company or a sample approved by Goskomstat (now Rosstat) by Resolution No. 78 of November 28, 1997 can be used.

The waybill must contain the following items:

- document details: name and number;

- validity;

- data of the owner of the car and data of the driver of the car (if these are different persons):

- surname, first name, patronymic,

- passport details;

- information about the vehicle used:

- government number,

- details of the vehicle passport (PTS)

note

Per diem allowance for a business trip is calculated from the day the business trip actually began and includes weekends and holidays. Even if the employee left at 23.55 on Sunday, this day must be paid by the employer. Details are in this article.

Payment of expenses incurred when using your own transport is possible only if the employee submits a number of documents:

- completed waybill;

- copies of the vehicle title that was used on a business trip;

- receipts confirming the purchase of fuels and lubricants;

- advance report;

- a memo reflecting the specific timing of the employee’s stay on a business trip.

If unforeseen circumstances arise during a business trip, for example, urgent car repairs, receipts for the purchase of necessary spare parts or technical fluids (antifreeze, motor oil, etc.) must be attached to the advance report. All reporting documents must be submitted to the accounting department no later than 3 working days after the employee returns from a business trip.

It should be noted that the write-off of fuel and lubricants when traveling in a personal car is carried out in accordance with the fuel consumption standards approved by the Ministry of Transport of the Russian Federation in Order No. AM-23-r dated March 14, 2008.

Registration for the use of a personal car on a business trip is possible not only through direct reimbursement of expenses for its operation, but also by temporarily renting this vehicle from the employee.

In this case, the tenant is the organization sending the employee on a business trip, and the lessor is the owner of the car or a person acting on the basis of a notarized power of attorney from the owner (Civil Code (Civil Code) of the Russian Federation, Article 606).

The lease agreement is concluded in writing. Car rental can be of 2 types: with and without a crew. The wording “With crew” assumes that the lessor acts in two guises: as a driver and as a lessor.

a company sending an employee on a business trip.

Taxi expenses on a business trip in 2020 must be reimbursed to the employee by the organization that sent him on business trips. Art.

168 of the Labor Code of the Russian Federation states that all expenses incurred by an employee during a business trip must be compensated by the employer.

In this case, these expenses and their amounts must be authorized or specified in a collective agreement or in any local act of the company. An employee should take this provision into account before using taxi services on a business trip.

If expenses for taxi travel are recorded in the above documents or are authorized by the employer, then the employee should attach to the advance report a receipt on a strict reporting form or a cash register receipt issued after the trip by the taxi driver. In the absence of these documents, reimbursement of costs for taxi services cannot be made. An electronic check sent by email by the carrier is not a supporting document.

The strict reporting form receipt must contain the following information:

- receipt details: series, number;

- name of the carrier, his TIN;

- fare amount;

- date of issue of the receipt;

- signature with a transcript of the person who issued the receipt.

Reimbursement for taxi services is included in the organization's expenses, by the amount of which its income tax base is reduced.

A prerequisite is documentary evidence that the trip was made (a check or receipt for strict reporting) and confirmation that the trip was part of an activity aimed at making a profit.

A business trip is an integral part of the activities of any organization, therefore the costs of its implementation are included in the expense item.

Sometimes in personnel practice there are cases when, sending an employee on a business trip, the organization cannot, for a number of reasons, provide him with transport. In this regard, the employee can use public transport, or can drive his own car for business purposes.

Features of preparing a waybill for a business trip in your car

If an employee goes on a business trip in his own car, it is strongly recommended to issue a waybill. Despite the fact that the tax service does not require the submission of such a document when checking an organization’s expenses, with a completed waybill it will be much easier to confirm both the fact of using the car for business purposes and the given calculation of gasoline consumption.

The waybill is drawn up in a form approved by Decree of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78, or independently developed by the organization. The use of the waybill form developed at the enterprise is permitted by the Ministry of Finance of Russia (letter of the Ministry of Finance of the Russian Federation dated August 25, 2009 No. 03-03-06/2/161) provided that the document contains the mandatory details established by Order of the Ministry of Transport of Russia dated September 18, 2008 No. 152 .

Such details include (Section 2 of Order No. 152 of the Ministry of Transport of the Russian Federation):

- name and number of the waybill;

- information about the validity period of the document;

- information about the car owner;

- vehicle information;

- driver information.

How to issue a waybill for a passenger car, see here.

How to make a waybill

A waybill is a confirmation of the use of a car on a trip, as well as the purchase and consumption of fuels and lubricants. It is drawn up on form No. 3 or according to a form approved by the organization and contains:

- Name and serial number.

- Validity period (duration of business trip).

- Personal data of the employee.

- Information about the vehicle (make and model, car number, information from the registration certificate).

- Fuel consumption.

IMPORTANT! The route sheet is provided to the employer within three days after returning to the place of work. A mandatory addition to the document is checks, receipts from gas stations, workshops, catering places and temporary residence.

Sample

Basic document samples:

- Standard intersectoral form No. 3 for drawing up a waybill.

- An example of filling out a waybill.

How do you go on a business trip?

As of January 1, 2016, some documents previously issued for business trips were canceled. So, now there is no need to formalize:

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

- official assignment;

- travel certificate;

- trip report.

In addition, the obligation to keep a log of posted workers has been abolished. To be fair, it is worth noting that some employers remained faithful to the previous procedure for documenting business trips and established the obligation to draw up the listed documents by internal orders of the organizations. However, even in such cases, the main document for sending on a business trip from the point of view of legislation is an order.

The specific form of the order is not approved by law. In this case, enterprises prefer to use unified forms of order No. T9 (on sending an employee on a business trip) or No. T9a (on sending a group of employees on a business trip), approved. Resolution of the State Statistics Committee of the Russian Federation dated 01/05/2004 No. 1, although from 01/01/2013 the use of forms of primary accounting documents is not mandatory.

The T-9 form can be downloaded from the link below.

In any case, the order must indicate the following information (Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ):

- name of company;

- date of preparation and number of the administrative document;

- employee details, name of his position;

- information about the place where the employee is sent to complete the task;

- duration of the business trip (dates of departure and arrival);

- purpose of the trip;

- details of the use of transport (personal, business, public, etc.);

- information about the organization that will reimburse the employee for travel expenses.

The order is signed by the head of the organization or an authorized employee. The posted worker must also sign the order, thus confirming the fact of familiarization with it.

A sample of filling out an order on form T-9 can be downloaded from the link below.

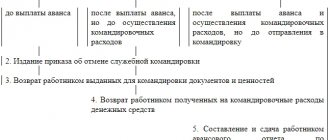

Procedure for registration of a business trip

First of all, the head of the company writes an order to send the employee on a trip in a personal car. It can be drawn up in free form or on T-9 form. After review, the employee expresses consent by signing the document. Additionally, you can issue a work assignment and a travel certificate.

The second stage is drawing up a waybill. This is a distinctive feature of business trips in a personal or company car. After this, the amount of the advance payment for gasoline and the citizen’s accommodation is agreed upon.

An employee returning from a trip must submit a waybill or expense report to the accounting department within three days. These documents contain information about the money spent. Checks and receipts must be attached to account for costs. If the advance amount is exceeded, the organization undertakes to pay the difference within three days. If there is a balance on the advance payment, the employee will have to return it.

List of documents

Using a personal car involves preparing the documents necessary to complete a business trip. These include:

- order to dispatch an employee;

- waybill;

- a copy of the vehicle registration certificate (confirmation of vehicle ownership);

- receipts and checks confirming expenses.

Additionally, a memo and an advance report can be drawn up.

Reimbursement of travel expenses

According to Art. 168 of the Labor Code of the Russian Federation and clause 11 of Decree of the Government of the Russian Federation No. 749, the posted employee is reimbursed for the following expenses:

- for travel in both directions;

- for renting housing;

- daily allowance;

- other expenses determined by the employer.

Each organization sets the daily allowance amount independently (with the exception of government agencies). At the same time, it is important to remember that in accordance with the Tax Code of the Russian Federation (clause 3 of Article 217), only amounts in the amount of 700 rubles for business trips in Russia and 2,500 rubles for business trips abroad are not subject to tax on the income of individuals. Amounts above these standards are subject to taxation.

Upon returning from a business trip, the employee must submit an advance report to the accounting department, which is drawn up according to form No. AO-1, approved. Resolution of the State Statistics Committee of the Russian Federation dated August 1, 2001 No. 55. The following must be attached to the report:

- documents confirming housing expenses (receipts from the hotel or receipts for receiving money if the housing was rented from an individual);

- receipts for fuel and lubricants;

- waybill;

- memo.

The memo is intended to confirm the duration of the business trip. Such a document is drawn up in any form, however, in order to avoid misunderstandings during tax audits, it is recommended to establish the form of an internal memo in the internal documents of the organization.

An example of a service design:

If several employees were sent on a business trip in a personal car, then the waybill is issued only for the driver. Accordingly, if only the driver paid for gasoline, other business travelers should not submit receipts for payment for fuel and lubricants. If repairs to a personal vehicle are required during a business trip, maintenance costs will be reimbursed by the employer as part of the vehicle use agreement concluded between the employer and employee. Also, by agreement, the employee may be compensated for expenses associated with an accident that occurred while on a business trip (of course, if it was not the fault of the posted employee).

Compensation of expenses

The employee is compensated:

- payment for fuel and lubricants, repairs;

- daily allowance;

- other expenses.

The accounting department is responsible for calculating expenses. It also determines the validity of the employee’s personal expenses for using the car for work purposes. The amount of compensation is ultimately determined by the employer.

How to confirm?

Expenses can be confirmed by any documents. The main thing is that the costs correspond to the purposes of the trip.

Receipts, checks and other payment information can be used as documents.

How to use personal transport on a business trip

The term of the Agreement may be extended by the Parties by mutual agreement by concluding an additional agreement to the Agreement. 10.3. All changes and additions to the Agreement are valid if made in writing and signed by both Parties.

The corresponding additional agreements of the Parties are an integral part of the Agreement. 10.4. The Agreement may be terminated early by agreement of the Parties or at the request of one of the Parties in the manner and on the grounds provided for by the current legislation of the Russian Federation. eleven.

FINAL PROVISIONS 11.1. The Agreement is drawn up in two copies, one for each of the Parties. 11.2.

Attention These include the name and date of the document, the name of the organization, the content of the business transaction, the physical measurement value - the number of days of travel, the signature of the employee.

We also recommend that you provide information that is usually contained in any travel document: time and place of departure and arrival. Upon returning from a business trip, the employee submits a memo to the employer.

He attaches supporting documents to it confirming the use of personal transport to travel to and from the place of business trip. For example, waybills, invoices, receipts, cash receipts, etc.

This is stated in paragraph 7 of the regulation approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749. Personal car: personal income tax and insurance premiums Compensation for the use of an employee’s personal car is not subject to: - personal income tax (clause 3 of Art.

- cash and (or) sales receipts;

- slips (if gasoline was paid for with a fuel card);

- receipts issued at parking lots;

- auto repair shop bills, etc.

The employee must attach documents confirming travel expenses to the advance report. The mileage of the car during a business trip is confirmed by waybills.

Prepare waybills: – either according to standardized forms; – or according to forms developed by the organization independently and approved by the head of the organization. This conclusion follows from Part 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

Tax Code of the Russian Federation);

- contributions for compulsory pension (social, medical) insurance (clause 2, part 1, article 9 of the Law of July 24, 2009 No. 212-FZ);

- contributions for insurance against accidents and occupational diseases (clause 2, part 1, article 20.2 of the Law of July 24, 1998 No. 125-FZ).

The procedure for calculating other taxes depends on what taxation system the organization uses.

Company car: income tax Expenses for travel on a business trip reduce taxable profit (subclause 12, clause 1, article 264 of the Tax Code of the Russian Federation).

For more information on how to take into account travel expenses when calculating income tax if an employee of an organization is sent on a business trip to purchase a fixed asset, see below.

How to determine the initial cost of a fixed asset in tax accounting.

The Lessor transfers to the Lessee the Vehicle with all the documents necessary for its operation, including: - vehicle registration certificate series N, issued » » 20

A copy of the Vehicle Registration Certificate is attached (Appendix No. 2); (the following paragraph is included in the Agreement if the obligation to provide civil liability insurance for vehicle owners is assigned to the Lessor (if the appropriate condition is selected under clause 2.1.4 of the Agreement) / otherwise the paragraph should be deleted) - MTPL policy.

The conclusion on the compliance of the Vehicle with mandatory vehicle safety requirements is contained in the Diagnostic Card, registration number valid until » » 20.

A copy of the Diagnostic Card is attached (Appendix No. 3). 1.6.

Now we want to send it! him to another city on a business trip to advertise our product, and he plans to go there not by train, but by his car.

The manager does not object, but I doubt it - is it possible to send an employee on a business trip using personal transport? I have been working as a personnel inspector for several years now, but I have not encountered such a case yet. I haven't found the answer anywhere. Help resolve the situation.

For an employee, of course, it would be nice to go on a business trip in his “swallow”, and his desire is quite understandable.

The employee will not depend on public transport schedules. Anyone who has ever been on a business trip knows what incidents happen: the plane’s departure is delayed, there are queues at the ticket office, there are no tickets - you can’t count it all.

And sometimes this entails unpleasant consequences, up to and including failure to complete an official assignment.

And if an employee has a personal car, then he is relatively free to move and can use the work time allotted to him with greater benefit for his business.

At first glance, everything is quite convincing. But this is from the employee’s perspective and only at first glance. Now let's look at this situation from the point of view of the law and the practice of its application.

According to the general rule established by the Labor Code of the Russian Federation (even the Labor Code of the Russian Federation), the obligation to provide workers with equipment, tools, and other means necessary for the performance of their labor duties rests with the employer (Article 22 of the Labor Code of the Russian Federation).

The law also directly states that the employee is guaranteed reimbursement of travel expenses associated with a business trip (Part 1 of Article 168 of the Labor Code of the Russian Federation).

You should know this

Business trip - a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work.

Please note two points: first, the law talks about expenses “for travel,” but does not say on what type of transport, second, it talks about expenses incurred by the employee “with the permission or knowledge of the employer.” Thus, an employee may well go on a business trip in his personal car, but with the consent or knowledge of the employer, and the latter will be required to reimburse all expenses associated with such a trip.

You should know this

The procedure and amount of reimbursement of expenses associated with a business trip are determined by a collective agreement or local regulations (Part 2 of Article 168 of the Labor Code of the Russian Federation)

When using the employee’s personal property with the consent or knowledge of the employer and in his interests, the latter is paid compensation for the use, wear and tear (depreciation) of tools, personal transport and other technical equipment and materials belonging to the employee, as well as reimbursement of expenses associated with their operation (Article 188 Labor Code of the Russian Federation).

You should know this

The employer is responsible for everything that an employee does with the knowledge or on behalf of the employer.

So, for a business trip in an employee’s personal car to be legal, the following conditions must be met.

Condition 1. The employee expressed a desire to go on a business trip by personal transport.

Condition 2. The employer agrees to this method of travel on a business trip.

Condition 3. The parties have entered into a written agreement on reimbursement of expenses.

Condition 4. The procedure and amount of reimbursement of expenses related to business trips are provided for in the collective agreement or in a local regulation.

EXAMPLE

Such a local regulatory act could be, for example, the Regulations on Business Travel, which stipulates all possible compensation payments and their amounts.

At this point we could put an end to it and close the topic. But not everything is as simple as it seems at first glance. Figuratively speaking, we have only looked at the visible part of the iceberg...

On the road, as we know, anything can happen, for example, an employee may get into a traffic accident. In this regard, the question arises: will the employer bear the risk of compensation for damage to a third party in the event of such an event?

This is confirmed by clause 1 of Art. 1068 of the Civil Code of the Russian Federation.

According to it, a legal entity or a citizen compensates for damage caused by its employees in the performance of their labor (official, official) duties.

In the same time..

… disagreements with the tax authorities may arise on the issue of reimbursement of travel expenses. Despite the fact that in Art. 264 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) directly states that the costs of an employee’s travel to the place of business trip and back to the place of work reduce the tax base for income tax; officials of the Ministry of Finance and the Federal Tax Service think differently, citing the following arguments.

Firstly, neither the Labor Code of the Russian Federation nor the Tax Code of the Russian Federation directly speaks about compensation of travel expenses for travel specifically in a personal car.

Secondly, the Instruction of the USSR Ministry of Finance dated 04/07/1988 No. 62 “On business trips within the USSR”, which is valid in the part that does not contradict labor legislation, mentions the payment of travel expenses by public transport modes, but there is nothing there about personal transport said.

How are costs reimbursed?

If an employee goes on a business trip in a personal car, the employer undertakes to reimburse the expenses incurred by the subordinate. Calculation of compensation payments for expenses is carried out on the basis of documents submitted by the employee. These include:

- Waybill filled out with the necessary information;

- A copy of the technical passport of the vehicle that was used on the business trip. The act is presented by the employee to confirm the fact that the car is his personal property;

- Advance report, if the employer requires you to fill it out;

- Service note. Issued on the initiative of the head of the organization;

- Receipts, checks and other acts confirming the employee’s expenses for the purchase of fuels and lubricants, food, accommodation and other unscheduled expenses, for example, payment for repair work or the purchase of required parts.

Proper documentation is transferred to the accounting department no later than three days from the moment the subordinate returns from a business trip in a personal car.

The question of how to take into account fuels and lubricants when using a personal car on a business trip deserves special attention. The amount of funds to pay for fuel and lubricants is established based on: distance from the destination, cost of fuel, engine size and time spent performing work duties. This procedure was approved by the Ministry of Transport of the Russian Federation in the content of Order No. AM - 23 - r .

The amount of payments for the use of a personal vehicle for a business trip should not exceed 1,500 rubles per month. If the expenses incurred by the employee exceed the designated amount, they are subject to tax. This applies to business trips of a subordinate in a personal car within Russia. If a work trip is planned outside the Russian Federation, amounts over 2,500 rubles are subject to tax. The basis for providing compensation is the order of the manager.

In case of an accident or repair

Before sending a subordinate on a business trip in a personal car, the company director must make sure that he has an insurance policy for the car. Because this will help to avoid additional costs in the event of a traffic accident for which the employee was not found to be at fault.

The employer undertakes to compensate for damage incurred by the employee if there was a preliminary agreement or the corresponding condition is specified in the content of the employment contract. If an employee sent on a business trip in a personal car causes an accident, compensation payments are not provided.

In addition to the possibility of reimbursement of expenses in case of emergency situations, the employee must separately negotiate the conditions for payment of compensation as a result of a machine breakdown. Such cases are often considered controversial, since the director cannot be sure that the damage did not occur as a result of a long-standing breakdown. In any case, if an employee intends to return unplanned funds spent, he is required to provide documents, checks, receipts indicating the amount of losses.

Terms of payment for business trips by personal transport

The terms of payment for a business trip in an employee’s personal car differ from the standard ones only in that the head of the company is responsible for reimbursement of funds for the operation of the car. In addition, the following are paid:

- Cash for renting a home or hotel room;

- Daily payments to pay for food and other expenses;

- Cash to pay for travel days.

The procedure, amount and conditions for providing advance funds and payment for the work of a subordinate during a business trip and when using a personal car are specified in the content of the local acts of the enterprise. Wages for the time a worker performs professional duties on a business trip are calculated according to the standard tariff rate for one working day. The exception is situations where the employee was forced to work on weekends or holidays. In such a case, the average daily earnings per working day doubles.

( 3 ratings, average: 4.33 out of 5)

New procedure for confirming the length of stay on a business trip

The actual duration of an employee’s stay on a business trip, as before, can be confirmed by travel documents. The changes affected the procedure for confirming the length of stay on a business trip if the employee did not get to the place of business trip by public transport.

The employee drove his own or company transport

The new version of paragraph 7 of the Business Travel Regulations provides a list of documents confirming the period of stay on a business trip if the employee traveled by vehicle.

An employee can get to the place of business trip and back:

- in a company car;

- personal vehicles;

- a car driven by proxy;

- passing transport.

In the first three cases, the basis for using these types of transport is a written decision of the employer (paragraph 2, paragraph 7 of the Business Travel Regulations). This decision must be reflected in the order for sending on a business trip. It will be the basis for issuing a waybill to the employee.

The Business Travel Regulations do not directly indicate that it is necessary to obtain written permission from the employer to travel on associated transport. Rostrud recommends establishing the procedure for using associated transport in the company’s local regulations (letter dated May 15, 2015 No. 1168-6-1).

Service memo

If an employee went on a business trip by car, upon returning from the business trip he must draw up a memo (paragraph 2, clause 7 of the Business Travel Regulations). It must indicate the actual length of stay on the business trip. Such recommendations were previously given by Rostrud specialists (letters dated May 15, 2015 No. 1168-6-1 and dated April 10, 2015 No. 831-6-1). A sample memo is given below (sample 2).

Sample 2 Service memo when traveling on a business trip in a personal car

Documents attached to the memo

The employee must attach documents confirming the length of stay on a business trip to the memo. Their list will depend on the circumstances of travel and accommodation on a business trip (see table below).

Table Documents confirming the duration of the employee’s actual stay on a business trip

If there are no documents for travel and accommodation

In the memo, the employee can explain the reason for his lack of documents confirming travel and accommodation expenses. In this case, you can confirm the actual length of stay on a business trip by letter to the receiving company (paragraph 4, clause 7 of the Business Travel Regulations). The letter to the receiving company must indicate the start and end dates of the period.

See a fragment of the memo below (sample 3).

Sample 3 Fragment of a memo when traveling on passing transport and free accommodation on a business trip