Deadline for submitting a business trip report

The employee must fill out an advance report for travel expenses and submit it to the chief accountant or the person replacing him within 3 working days from the date of return from the business trip. Moreover, in this case it does not matter what business trip the employee was on: foreign or on the territory of the Russian Federation. This period is specified in the Bank of Russia instruction dated March 11, 2014 No. 3210-U. You can violate the 3-day deadline only for a good reason - for example, illness or when sent on another business trip. , the employee must submit an advance report within 3 days

There are cases when an employee actually lives on business trips. This is especially true for truck drivers. They bring cargo, unload and leave again. Sometimes a new business trip can begin on the same day as the previous one ended, or within a couple of days after its end. In this case, we recommend that the employee not delay in submitting the reporting documents for the business trip, so as not to lose or damage the supporting documents.

Documents for a business trip in 2019: sending an employee on a trip

Any business trip begins with the execution of an administrative document - an order. If you use unified forms, compose it according to the form:

- T-9, if you are sending one person;

- T-9a, if several.

You will find both forms in this article. A sample business trip order can be downloaded here.

Based on the order, issue an advance to the employee. Its amount should cover the daily allowance for all days of the trip, as well as approximate expenses that the employee will have during the trip. To issue money, draw up a cash order.

In general, no further documents will be required for a business trip at this stage. Thus, travel certificates and official assignments are no longer needed for a long time. But there may be nuances.

If, for example, an employee leaves, returns from a business trip, or is on the road on a weekend or holiday, or while on a business trip, he will work on such days (and this is not provided for by his regular schedule), you must obtain written consent from the employee to work on a day off and issue an appropriate order. If the business traveler will be on vacation on a weekend or holiday, these papers will not be needed.

For more details, see: “How is a business trip paid on a day off (nuances)?”

One-day business trips and part-time business trips are processed according to the same rules. There are no documentary features for them. Just keep in mind that employees are not entitled to daily allowances for one-day business trips. But there is still a way to pay them for such expenses.

See: “How is a one-day business trip paid?”

How to fill out an advance report for a business trip

The travel report form is not legally approved. Therefore, the employer has the right to approve its report form (advance report) or use the AO-1 form. Let's look at filling out an advance report on a business trip using the AO-1 form as an example.

In such a report, after a business trip, the employee must fill out columns 1 – 6 of the reverse side of the advance report based on the documents that he brought with him.

How to fill out a job assignment

When an organization decided to use a unified form f. T-10a, what data should be reflected in this document and in what way? You can fill out the form both “on paper” and electronically. First, the personnel officer (or other responsible person of the employer) must draw up an order to send a specialist on a trip on company business. Then the T-10a form itself is filled out.

What information should be included in the sections of the business trip assignment:

- Document header - here is the exact name of the company, OKPO code. The task number (in order), the date of completion is also entered, and the full name (full name) of the seconded person and his personnel number are indicated.

- Columns 1 to 10 with business trip data - this section of the table provides general information about the employee’s upcoming trip. What information should I enter? The structural unit of the enterprise in which the individual works must be indicated. His position or profession is given separately. Next, fill in where the traveler is going geographically and to which organization. Then the dates of the planned business trip are entered: the departure date indicates the beginning, the arrival date indicates the end. For example, a company manager flies to Moscow on 05.22.18 at 22.30, and arrives on 05.29.18 at 01.30. In this case, the business trip lasts 8 days, the days of departure and arrival are included in full. On pages 7-8 the total period of the trip is filled out, on page 9 it is indicated which company is paying the expenses, and on page 10 - the documentary basis for the business trip. This may be a memo or letter, or another form.

- Column 11 with data on the task - the purpose of the trip is formulated using this line. This section can be filled out by the employee’s immediate supervisor if the company is large, or by the director of the company if the business is a small-scale enterprise. After the data is entered on page 11, completion of the task is suspended until the day the seconded person returns to the organization.

- Column 12 with data on completion - a business trip report, an example of writing will be given below, is compiled by the employee upon returning to the place of employment. This part of the service record briefly describes what was done during the trip.

- Certification of the form – the document is signed by several responsible persons. First of all, this is the employee himself, who was on a business trip. In addition, this is the head of a structural unit of the company (if any), and finally, the head of the entire enterprise. At the same time, the director makes a conclusion by summing up the results of the trip.

Supporting documents for a business trip

The list of supporting documents for a business trip is not established .

The advance report must be accompanied by documents confirming the expenses incurred during the business trip. These can be reporting documents for staying in a hotel or renting housing:

- hotel invoice and online receipt or certificate of services rendered;

- reporting documents for living in an apartment - a lease agreement or a lease deed and a document for payment (receipt, card extract, other payment document).

Travel costs to and from your destination can be supported by the following documents:

- passenger ticket and baggage receipt, boarding pass;

- Railway tickets;

- documents for other types of transport (for intercity bus, ferry, etc.);

- documents for renting a vehicle (lease agreement, certificate of services rendered and document for payment).

Business trip expenses: how to confirm and how to pay

What documents are needed to confirm an advance report for a business trip?

By type of professional activity, every fifth employee goes on business trips, which are paid for by the employer and taken into account in accounting on the basis of documents. Below are answers to important questions: what expenses are reimbursed by the employer, what documents are needed to confirm travel expenses, how to pay per diem without documents.

Content:

1. Types of travel expenses

2. How to correctly reflect the order

3. What documents are needed to confirm travel expenses:

3.1. How to confirm travel expenses for a business trip

3.2.documents confirming travel expenses for rental housing

3.3. what documents are required to confirm travel expenses for daily accommodation

3.4. what document to confirm travel expenses for other employee needs

3.5. foreign business trip: documents for preparing an advance report

4. How to reflect travel expenses without supporting documents.

Organization of a business trip

In Russia, the organization of business trips is regulated by the Labor Code of the Russian Federation and the Regulations on the specifics of sending employees on business trips (dated October 13, 2008, No. 749).

The following types of travel expenses are distinguished:

- for travel – payments for public transport, payment for a travel ticket and the provision of bed linen on the train;

- for booking and renting accommodation at the place of business trip or stopover;

- personal expenses (daily allowance) – for food and personal needs of the employee;

- other costs for telephone, internet, banking and other services.

When traveling abroad, the employer also pays for:

- state fee when applying for a passport or visa;

- consular and airport fees;

- fees for entry or transportation of a vehicle;

- payment for health insurance;

- other necessary payments.

How to correctly reflect the order of business trips

The procedure and amounts for the return of travel expenses are regulated by the company’s regulations (Article 168 of the Labor Code of the Russian Federation). The employer indicates here the exact amount of payments, calculation rules and confirmation of travel expenses, supporting documents, and the costs to be reimbursed are listed.

It is important to note that not all costs are justified. Therefore, it is better not to include in the list of travel expenses:

- payment for services in bars and restaurants;

- payments for lounge services for officials and delegations at airports;

- costs of using third party services.

So, such expenses do not reduce the amount of income when calculating the tax base for the income tax (clause 1 of Article 252 of the Tax Code of the Russian Federation).

What documents are needed to confirm travel expenses?

After arriving from a business trip, the specialist is required to submit an advance report in a standard form within three working days, indicating here the costs for the period of departure, and documents for payment of travel expenses.

Depending on the type of travel expenses, the employee provides documentary evidence. How to confirm travel expenses for a business trip:

- When traveling on public transport (plane, train), bus, trolleybus, passenger car or truck, river or sea vessel, a ticket is provided; baggage check when checking things in, boarding pass, coupon or printout of an electronic ticket;

- A business trip in your own or a company car will be confirmed by a waybill, route sheet (if the place of travel is not indicated in the waybill), cash documents (cheque, invoice, receipt, memo;

- When traveling by taxi, a cashier's check, receipt, work order is handed over;

- When traveling by transport of an organization that provides services under a contract: an agreement on the provision of transport services, an act of acceptance of the transfer, an invoice and a payment order.

When purchasing an electronic ticket for railway transport, the employee presents a control coupon for reporting, and for an electronic ticket for an airplane - an itinerary receipt for the airline ticket and a boarding pass. Paying for a ticket with a bank card does not require confirmation by a bank statement.

Documents confirming travel expenses for renting housing are divided from renting a hotel room or apartment. So the specialist will confirm the hotel rental by attaching to the report a receipt, check, invoice, coupon or agreement on the provision of room rental services. It is important that the document contains information about the landlord, the employee, the terms and price of delivery.

In the case of staying in rented housing during the departure period, the employee provides a rental agreement or rental agreement for the apartment, proving payment with a receipt from the landlord.

What documents are required to confirm travel expenses for daily accommodation?

Daily expenses are the employee’s personal expenses (for example, food). But when the business trip is one day, the daily allowance is not accrued. The amount of daily allowance payable for a business trip in Russia is 700 rubles, for a trip abroad – 2,500 rubles (Clause 3, Article 217 of the Tax Code of the Russian Federation). If the amount spent exceeds the limit, the difference is subject to personal income tax.

What document can be used to confirm travel expenses for other employee needs? Proof of other expenses on a business trip will be checks, receipts or invoices for payment of telephone, Internet, banking, courier or postal services.

Foreign business trip: documents for preparing an advance report. Such trips are confirmed by the same payment documents as in Russia. Since a foreign passport is required for a business trip abroad, when it is issued by an employee, the employer reimburses the payment of the state duty. Also, expenses for traveling abroad are confirmed by bank statements for currency conversion. When paying exchange costs, the company's accounting department takes into account the exchange rate at the time of cash withdrawal.

How to reflect travel expenses without supporting documents

In the absence of documentary evidence, the accounting department will not include travel expenses as general expenses for calculating income tax. But you can set the period of your business trip by attaching a hotel invoice indicating the number of days of stay. Or an employee draws up a notice to confirm a business trip in case of a lost ticket.

To summarize, it is important to note that documents confirming travel expenses and the rules for their execution are specified in the company’s regulatory documentation. Within three working days upon arrival, the employee submits supporting documents for the advance report for the business trip, in addition to the daily allowance. All proven costs are subject to reimbursement from the organization’s funds.

Reporting documents on business trips abroad

Upon returning from a trip abroad, the employee must attach documents confirming his expenses to the report. a copy of the passport with customs control marks on border crossing must be attached to the report An employee may also have consumable documents for currency exchange, obtaining a visa, translation services, compulsory medical insurance, fees for the right to enter vehicles, consular fees, etc.

All reporting documents, including those for accommodation, must be translated into Russian line by line. The translation can be done in a specialized company or performed by a full-time employee who is responsible for translating documents.

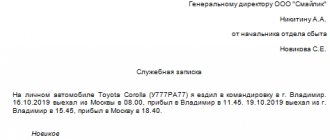

Business trip report

The preparation of a business trip report for management can be prescribed in the company’s local regulations. Such a report should not be confused with an advance report.

The business trip report contains information on the fulfillment of official assignment , which was issued for the period of the business trip.

EXAMPLE OF COMPLETING A REPORT ON A BUSINESS TRIP:

Took part in working meetings with ..... (for example, representatives of a partner company).

Resolved issues regarding the further implementation of work on project 11-A/2019 (to ensure reliable power supply during the preparation and holding of the EEF in 2020):

…. (disclose the list of issues worked out and the result of the solution).

The company may approve travel report forms. Or it is written as a free-form memo.

How to write a job assignment for an employee on a business trip

The regulatory procedure for sending employers' personnel on business trips is regulated by the Government of the Russian Federation in Resolution No. 749 of October 13, 2008. It was in this document that until 2020 the obligation of enterprises to draw up official assignments for business trips was provided. However, with the entry into force of Resolution No. 1595 of December 29, 2014, this requirement lost its effect.

Nevertheless, many companies still prefer to maintain the usual workflow when registering business trips and continue to draw up this form. It's not so much a matter of habit as of expediency. It is in the service manual that it is clearly formulated who is going on a business trip and where, with what goals and objectives, for what period. Simultaneously with the task, the manager issues an order-the basis for the trip. And upon returning, the employee fills out a short report on the completion of the task on a business trip - an example is posted below.

Travel certificate - sample