Tutorial 1C: Accounting 8

You and I already know how to move inventory items around warehouses and transfer fixed assets into operation. It's time to produce something using the equipment. In this lesson we will consider such issues as product release and write-off of raw materials and inventories for production.

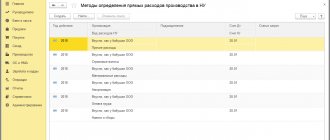

Let's consider such capabilities of the 1C Accounting 8 program as an item specification. When producing certain products, the range of raw materials used is known in advance and certain standards for these raw materials are known. This can be specified in the specifications. There may be several specifications for each item in the nomenclature, for example, depending on the raw materials used and the technologies used. Let's learn how to create such specifications and use them.

Next, let's look at how material and production costs are written off to the cost of manufactured products.

At the next step, we will release the products over the weekend and receive them into the warehouse. In conclusion, we will have a practical task in which you can practice this material.

Let's start looking at the "Production" module. In the “Production” section we have access to such documents as a demand invoice. We have already looked at it in the “Warehouse” section. Using this document, you can assign the cost of inventory items in the warehouse to 20 expense accounts.

The main document that we will use in this lesson is the “Shift Production Report”.

The document “Production Report for a Shift” is intended to reflect operations for the production of finished products, semi-finished products and the provision of services. The document can be entered based on the document Sales of processing services.

When entering a document, you must indicate the following details in the header:

- Cost account - an account for recording production costs and work-in-process balances from previous periods attributable to the cost of production.

- Cost division is a production division of an organization that produces products and provides services.

To reflect the output of products and semi-finished products, you need to fill out the Products tab. This tab indicates:

- Products - the name of manufactured products, semi-finished products, materials or goods. Can be filled in automatically for products made from materials from a third-party customer, based on the document Sales of processing services .

- Nomenclature group - type of manufactured products, semi-finished products, materials or goods. Can be filled in automatically for products made from materials from a third-party customer, based on the document Sales of processing services .

- The planned amount is the planned cost of manufactured products, semi-finished products, materials or goods. Can be filled in automatically for products made from materials from a third-party customer, based on the document Sales of processing services . Based on the data in this field, the direct costs of the production unit are distributed according to the types and names of products produced by it when performing the routine operation Closing accounts 20, 23, 25, 26.

- Specification is a list of cost standards required for the production of products, semi-finished products, materials or goods. Can be filled in automatically for products made from materials from a third-party customer, based on the document Sales of processing services . Specification field will be used when filling out the Requirement-invoice document, Materials .

For organizations paying income tax, the total estimate of direct costs attributable to production is reflected in the same way as in accounting - in planned prices. When closing the month when performing the routine operation Closing accounts 20, 23, 25, 26, its value is adjusted to the actual amount of expenses.

To reflect the transaction in the tax accounting of an individual entrepreneur applying the general tax regime, you should fill out the tabular section Materials .

To reflect the provision of services to your own production units, you need to fill out the Services tab. This tab indicates:

- Nomenclature - the name of the services provided.

- Nomenclature group - type of services provided.

- Quantity, Planned price, Planned amount - the volume of service provided, expressed in quantitative and/or cost terms. Based on the data in these fields, the direct costs of the production unit are distributed by type of services provided when performing the routine operation Closing accounts 20, 23, 25, 26. If the quantity is filled in, then the price and amount do not need to be filled in. If the amount is filled in, the quantity can be left blank.

- The planned amount is used to distribute direct costs, regardless of whether the quantity is filled.

- Cost division is the division to which the services are provided.

For organizations paying income tax, the total estimate of direct costs attributable to the provision of services is reflected in the same way as in accounting - in planned prices. When closing the month when performing the routine operation Closing accounts 20, 23, 25, 26, its value is adjusted to the actual amount of expenses.

To reflect the transaction in the tax accounting of an individual entrepreneur applying the general taxation regime, you should fill out the tabular section Materials .

To reflect the release of returnable waste, you need to fill out the Returnable waste tab. This tab indicates:

- Nomenclature - the name of the released returnable waste.

- Cost account - an account for recording the costs of producing products, semi-finished products, materials or goods for which the amount of production costs is reduced by the amount of returnable waste.

- Nomenclature group is a type of manufactured product, semi-finished products, materials or goods for which the amount of production costs is reduced by the amount of returnable waste.

- Cost item is an item of accounting for the costs of producing products, semi-finished products, materials or goods for which the amount of production costs is reduced by the amount of returnable waste.

For organizations paying income tax, the Amount indicates the estimate of the cost of returnable waste, formed in accordance with the requirements of paragraph 1 or paragraph 2 of paragraph 6 of Article 254 of the Tax Code of the Russian Federation.

With a simplified taxation system, in the Expenses (EC) , you need to indicate whether material expenses were included in those accepted at the time of transfer to production.

To reflect the transaction in the tax accounting of an individual entrepreneur applying the general taxation regime, you should fill out the tabular section Materials .

To reflect the write-off of materials as production costs, you need to fill out the Materials tab. This tab indicates:

- Nomenclature - name of materials.

- Cost account is an account for recording the costs of producing products, semi-finished products, materials or goods to which the cost of materials is attributed.

- Product group - the type of manufactured products, semi-finished products, materials or goods to which the cost of materials is assigned.

- Cost item is an item of accounting for the costs of producing products, semi-finished products, materials or goods, which takes into account the costs of writing off materials.

, the Expenses (EC) field indicates the procedure for reflecting expenses in tax accounting.

To reflect the transaction in the tax accounting of an individual entrepreneur applying the general taxation regime, you should fill out the tabular section Materials .

The following printed forms are available for the Shift Production Report

- MX - 18

- M - 11

- The act of providing services

Based on the Shift Production Report , you can enter the following objects:

- Request-invoice

- Sales of processing services

Also in the 1C Accounting 8 program there are two documents:

- provision of production services;

- WIP inventory.

The document “Provision of production services” is intended to reflect operations for the provision of production services. The document can be entered based on the document Invoice for payment to the buyer .

You need to fill out the bookmarks in the document:

- Services

- Cost account

- Settlement of advances

- Settlement accounts

- Additionally

Services tab indicates the content of the service provided, quantity, price, VAT rate, as well as accounts for income, expenses and VAT.

- If the provision of services is of a permanent nature, then it is recommended to enter the name of the service in the Nomenclature directory. If the service is one-time in nature, then you can enter the content of the service in the Service content, additional information .

- Item accounting accounts can be filled out automatically for each item (item group) based on the Item Accounting register.

- The income, expense and VAT account analytics must be specified in the Subconto .

On the Cost Account , the account for accounting production costs for the provision of services and its analytics are indicated.

- Cost account - an account for recording the expenses of the main or auxiliary production, which records the costs associated with the provision of this service.

- Division is the production division of an organization.

- Nomenclature group - type of services provided.

The data in the Settlement of Advances tab must be filled out if the method of Settlement of Advances By Document is selected in the document header.

for the document Provision of production services :

- The act of providing services

- Help-calculation “Ruble amount of document in currency”

Based on the document Provision of production services, you can enter the following documents:

- Cash receipt

- Receipt to the current account

- Invoice for payment to the buyer

- Invoice issued

- Reflection of VAT accrual

- Request-invoice

The document “Inventory of work in progress” is intended to reflect the results of the inventory of work in progress by production divisions and types of output (item groups).

A document must be created in the following cases:

- During the month, the release is reflected; at the end of the month, the total estimate of WIP balances is not equal to zero.

- During the month there is no issue, the beginning balances of work in progress and direct expenses of the current month are recognized as the final balances of work in progress, and the accounting policy on the work in progress establishes the method of accounting for work in progress “Using the document “Inventory of work in progress.”

A document does not need to be created in the following cases:

- During the month, the release is reflected; at the end of the month, the total estimate of WIP balances is zero.

- During the month there is no issue, the initial balances of work in progress and direct expenses of the current month are recognized as the final balances of work in progress, and in the accounting policy on the work in progress , the method of accounting for work in progress is established “In the absence of release, direct expenses are considered as expenses of work in progress.”

When entering a document, you must indicate the following details in the header:

- Cost account - an account for recording WIP balances and direct expenses of the current month.

- Division is the production unit of the organization, which includes the remainder of the work in progress.

In the table section you need to fill in the following details:

- Product group - the type of products manufactured (semi-finished products) or services provided, work performed, the cost of which will include the balances of work in progress in the following periods.

- Remaining amount is the total estimate of WIP balances according to accounting data, calculated based on inventory results.

For organizations paying income tax, the Remaining Amount (RA) indicates the total estimate of work in progress balances according to tax accounting data, calculated based on inventory results.

For organizations using PBU 18 “Accounting for income tax calculations”, permanent and temporary differences in the assessment of work in progress balances are calculated automatically when performing the routine operation Closing accounts 20,23,25,26 in the case of accounting for an issue without using account 40 (accounting policy of organizations , tab Release of products, services ).

, the Expenses (EC) field indicates the procedure for reflecting expenses in tax accounting. This field is available only if the accounting policy for expenses of the simplified tax system states that material expenses are subject to reduction by the amount of work in progress balances.

How to document the receipt and consumption of inventories in a warehouse

The release of material into production is usually carried out on the basis of approved limits. When releasing materials from the warehouse to their own departments, limit and intake cards (form No. M-8), requirement-invoice (No. M-11), and invoice (No. M-15) are drawn up.

Limit cards are used when the same materials are systematically released into production. Also, the purpose of their use is to monitor compliance with established limits.

Download the form of limit-fence cards form M-8 on the website.

Form No. M-15 is used when transferring inventories to geographically remote divisions of the organization.

For the form M-15 and the procedure for filling it out, see the article “Unified form No. M-15 - form and sample.”

Based on the received primary documents at the places where inventories are stored, the materially responsible person keeps their quantitative records in warehouse accounting cards, and if the quantity of items is small, the cards can be replaced with a warehouse accounting book. Their forms and sample filling can be found in the articles:

- “Material warehouse card - form and sample”;

- “Material inventory book according to form M-17 - sample.”

Material assets transferred for use lose their quality over time. For example, such goods as inventory and tools are subject to deregistration upon expiration of their service life. For this purpose, an act is drawn up, the form of which can be found in the article “Act for writing off low-value and wear-and-tear items.”

Output

We will arrange the release of products. We will write materials according to specifications

- Date: 01/30/2015

- Cost division: Production department

- Products: Yolka

- Quantity: 100

- Planned price: 1000 rubles.

- Accounting account: 43

- Specification: Christmas tree Branch - 1200 pieces

- Needle - 60,000 pieces

- Barrel - 100 pieces

- Small cone - 600 pieces

We will arrange the release of products. We will write materials according to specifications

- Date: 01/31/2015

- Cost division: Production department

- Products: Pine

- Quantity: 110

- Planned price: 1100 rubles.

- Accounting account: 43

- Specification: Pine Branch - 1,980,000 pieces

- Needle - 165,000,000 pieces

- Barrel - 110,000 pieces

- Large cone - 1,100,000 pieces

Thus, the 1C Accounting 8 program reflects production and production operations. You can proceed to completing independent practical tasks.

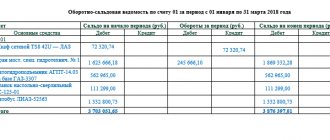

Results

When documenting the receipt and consumption of inventories, the requirements of the law must be observed, especially regarding the presence in the documentation of all mandatory details.

The inventory accounting system must be organized in such a way that it ensures timely, reliable and complete reflection of material assets on accounting accounts, and it is possible to maintain proper control over their movement. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Practical task

Arrange product release. Write off materials according to specification

- Date: 02/20/2015

- Cost division: Production department

- Products: Yolka

- Quantity: 120

- Planned price: 1000 rubles.

- Accounting account: 43

- Specification: Christmas tree

Arrange product release. Write off materials according to specification

- Date: 02/23/2015

- Cost division: Production department

- Products: Pine

- Quantity: 150

- Planned price: 1100 rubles.

- Accounting account: 43

- Specification: Pine

Arrange product release. Write off materials according to specification

- Date: 03/23/2015

- Cost division: Production department

- Products: Yolka

- Quantity: 70

- Planned price: 1000 rubles.

- Accounting account: 43

- Specification: Christmas tree

Arrange product release. Write off materials according to specification

- Date: 03/23/2015

- Cost division: Production department

- Products: Pine

- Quantity: 160

- Planned price: 1100 rubles.

- Accounting account: 43

- Specification: Pine

Next Previous

These features are available to both users of local versions and cloud solutions, for example 1C:Fresh, 1C:Ready Workplace (WWW) . To purchase boxed versions or rent the 1C:Accounting 8 program in the cloud, please call +7(499)390-31-58, or e-mail: [email protected]

We recommend that you read the sections

Cash accounting in 1C Accounting

| 1C Accounting setting up accounting parameters |

| Directories. Documentation. Operations. |

| Standard accounting reports in 1C Accounting |

| Preparing to work with 1C Accounting |

Voluntary certification

Voluntary certification of food production occurs on the basis of a review of the provided documentation and analysis of the production line. The applicant can submit documents in any accredited system. The certifier operates its own government-accredited system. This allows you to prepare documents in a short time and at an affordable price. To receive an initial consultation, fill out the feedback form and specialists will contact you as soon as possible.

A voluntary certificate is issued for a period of validity of 3 years. It is important to note that the manufacturer is required to undergo annual inspection control (IC). In case of refusal of verification, the certificate will be revoked. During inspection control, an audit of both production and documentation is carried out. The applicant is given documents confirming the passage of the IC.