Formation of product costs

Enterprises engaged in the production of products are faced with the need to calculate the cost of manufactured products. What does the cost include, how is the cost of finished products formed, what is costing and costing items? We will discuss all these questions below.

There are such concepts as “full cost” and “production cost”.

Any production is accompanied by certain costs: raw materials, semi-finished products, materials, wages, social contributions, depreciation, etc. All these costs form the production cost of the finished product.

The total cost includes, in addition to costs associated with production, also costs associated with the sale of these products that arise at the sales stage.

During the production process, costs are accumulated in the accounts associated with the production process. When finished products are sent for sale, the accumulated costs associated with the production of these products are written off as expenses of the organization. The income from the sale will be the proceeds from the sale.

Expenses and income participate in the formation of the financial result from the sale of products.

So. The process of forming the cost of finished products begins with the accumulation of costs associated with its production. All costs are collected by debiting the accounts involved in production. What accounts are used for savings?

Accounts for recording production costs:

20 “Main production” - used to form the actual cost of finished products; direct costs of the main production are collected here.

21 “Semi-finished products of own production” - the debit of this account collects all costs incurred in connection with the production of semi-finished products.

23 “Auxiliary production” - costs of auxiliary production, for example, costs associated with equipment repair, transport services, energy provision, etc.

25 “General production expenses” - the debit of this account collects costs associated with servicing the main and auxiliary production.

26 “General business expenses” - the debit of the account collects expenses for administrative and managerial needs

28 “Defects in production” - this account collects all losses from defective products.

Product cost calculation

What does the cost include? Costs associated with the production and sale of finished products.

Costs are formed using the so-called costing method.

All costs are grouped by costing items. Costing is the calculation of costs according to costing items.

The costing object is each individual type of product (product, semi-finished product, work, service), for which its cost can be determined by breaking it down into costing items.

In the process of forming the cost price for each costing object, you need to select a costing unit - a unit of production for which the cost will be determined. The calculation unit can be expressed in natural or conditionally natural form. In the first case, the calculation unit can be kilograms, tons, liters, meters; in the second case, the unit is determined by calculation methods using various coefficients.

Costing items:

- Raw materials

- Returnable waste

- Semi-finished products and purchased products

- Fuel and energy

- Depreciation of fixed assets and intangible assets

- Employees' wages

- Insurance contributions from employees' salaries

- Preparation and development of production

- General production expenses

- General running costs

- Losses from marriage

- Other costs associated with production

- Expenses on sales of products

All these costing items form the full cost of production. If we exclude the last point, we get the production cost.

Classification of production costs

What are the costs?

Direct and indirect

All costs, according to the method of inclusion in the cost, are divided into direct and indirect.

Direct – relate to a specific type of product (materials, semi-finished products, depreciation).

Indirect – evenly distributed across all types of products (general economic, general production). Indirect costs accumulate over the course of a month, at the end of which they are written off as cost.

Basic and invoices

According to their economic role in the production process, costs are divided into basic and overhead.

The main ones are directly related to the process of manufacturing products, performing work, services (materials, wages, depreciation).

Invoices - related to the maintenance and administration of the production process (general production and general economic).

Single element and complex

According to their composition, costs are divided into single-element and complex.

Single-element - consist of one element (depreciation, raw materials, semi-finished products).

Complex - consist of more than one element (general plant, workshop).

Variables, conditionally variable and conditionally constant

In relation to production volume, costs are divided into variable, semi-variable and semi-fixed.

Variables - depend proportionally on the volume of products produced (semi-finished products, raw materials).

Conditional variables are not a direct dependence on the volume of products produced (general production).

Conditionally constant - practically do not depend on the volume of production (general economic).

Productive and unproductive

Depending on their effectiveness, costs can be either productive or unproductive.

Productive - for the rational production of products of established quality.

Unproductive - arising due to imperfections in the production process (defects, downtime).

Current and one-time

Based on the frequency of occurrence, costs are divided into current and non-recurring.

Current - occur with a certain frequency (raw materials, supplies).

One-time — one-time costs (launching new equipment).

Industrial and commercial

Based on their participation in the production process, they are divided into industrial and commercial.

Production - related to the production of products.

Commercial - related to the sale of products.

https://youtu.be/XMmvVuq6Knc

How to calculate the cost

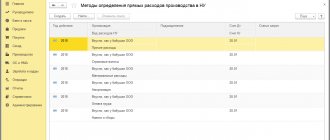

Costs associated with the production of products should be taken into account on account 20 “Main production”. In this case, use the following costing methods or combinations thereof:

- custom;

- process-by-process;

- transverse.

The custom method is used:

- for single or small-scale production;

- when performing work under contracts or paid services;

- in the production of technically complex products. For example, in shipbuilding, aviation industry, etc.;

- when producing products with a long production cycle. In particular, in construction, power engineering, etc.

With the order-by-order method, all costs are taken into account for a specific order or for a group of similar orders. For each order, a card is opened. Since there are no standard forms of cards, you can develop them yourself. The card usually indicates the order number, description of the work, the time required to complete the order, as well as the number of units of product that need to be produced. Costs for each order are recorded as the product moves through the stages of production.

Direct costs that are directly related to the fulfillment of the order are reflected in the debit of account 20 in correspondence with the expense accounts. To ensure analytical cost accounting, it is worth opening separate sub-accounts for each open order. These subaccounts can be named, for example, by order numbers: “Order No. 1,” “Order No. 2,” etc.

Record costs as follows:

Debit 20 Credit 10 (70, 69, 60...) – direct costs of executing the production order are taken into account.

Indirect, that is, general production and general business expenses, accumulate on accounts 25 and 26 of the same name. At the end of the month in which the order was completed, write off these amounts as a debit to account 20. At the same time, distribute these expenses for each order in proportion to the indicators that must be established in the accounting policy for accounting purposes (clause 7 of PBU 1/2008). For example, in industries with a significant share of manual labor, it is advisable to distribute indirect costs in proportion to the salaries of the main production workers.

When assigning indirect costs to the cost of production, make the following entries:

Debit 20 Credit 25 (26) – general production (general business) expenses are taken into account as part of the costs of order fulfillment.

When accounting for general business expenses, do not use this procedure if you take them into account immediately into account 90 “Sales”. Such an indication is in paragraph 9 of PBU 10/99. For more information about this, see How to write off general production and general business expenses.

An example of reflecting in accounting the costs of a structural unit of an organization to fulfill a production order. The organization uses the order method of cost accounting. The structural unit fulfills an internal order

In July, the tool shop of OJSC Proizvodstvennaya completed an in-house order for the production of 200 steel fasteners for the assembly shop. Master's accounting policy provides for the use of the order method of accounting for actual costs. To reflect the actual costs of the tool shop to complete the order, a subaccount “Order No. 1” was opened to account 20.

In July, the tool shop received 240 kg of steel from the warehouse to fulfill the order. The cost of 1 ton of steel is 11,500 rubles. (without VAT).

The direct costs of order fulfillment include:

- cost of materials used - 2760 rubles. (0.24 t × 11,500 rub./t);

- salary of production workers in the tool shop - 40,000 rubles;

- contributions for compulsory pension (social, medical) insurance, as well as insurance against accidents and occupational diseases - 12,080 rubles.

General production costs attributable to the order (depreciation on fixed assets used in production) amounted to 2,866 rubles.

The following entries were made in the “Master’s” accounting:

Debit 20 subaccount “Order No. 1” Credit 10 – 2760 rub. – materials were written off to fulfill the order;

Debit 20 subaccount “Order No. 1” Credit 70 – 40,000 rub. – wages were accrued to the workers of the tool shop;

Debit 20 subaccount “Order No. 1” Credit 69 – 12,080 rub. – contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases have been accrued;

Debit 20 subaccount “Order No. 1” Credit 25 – 2866 rub. – depreciation on fixed assets used in production is written off as costs for order fulfillment.

The actual cost of the completed order is reflected by the posting:

Debit 10 Credit 20 subaccount “Order No. 1” – 57,706 rubles. (RUB 2,760 + RUB 40,000 + RUB 12,080 + RUB 2,866) – the cost of fasteners manufactured according to order No. 1 and transferred to the warehouse was written off.

All costs for the intercompany production order were reflected in the card.

The use of the process method is typical for industries in which finished products are created as a result of sequential processing of raw materials. The process can take place in one or more technological departments. At the same time, the results of processing raw materials at intermediate stages cannot definitely be considered either finished products or semi-finished products. The method is often used in the mining and textile industries, in the production of cement, chemical fiber, plastics, paints and varnishes, etc.

With the process-by-process method, cost accounting is carried out for each process. For this purpose, so-called calculations are opened. In practice, it is convenient to use production cost sheets as calculations. They must be maintained for the entire production output or for each division. There are no standard forms for production cost accounting sheets, so you can develop them yourself. The statements are filled out on the basis of primary accounting documents. Such as invoices, payroll statements, advance reports, etc. For example, costs for raw materials and supplies can be reflected on the basis of limit cards or invoice requirements. For which you can use standard forms No. M-8 or No. M-11.

Reflect direct costs in the debit of account 20 in correspondence with the expense accounts:

Debit 20 Credit 10 (68, 69, 70, 60...) – direct costs of the production process are taken into account.

At the end of the month, write off general production expenses accumulated on account 25 of the same name to the debit of account 20:

Debit 20 Credit 25 – general production expenses are taken into account as part of the costs of the production process.

General business expenses accumulated on account 26 of the same name are also written off to the debit of account 20 at the end of the month:

Debit 20 Credit 26 – general business expenses are taken into account as part of the costs of the production process.

This procedure is not used if costs are taken into account immediately into account 90 “Sales”. Such an indication is in paragraph 9 of PBU 10/99. For more information about this, see How to write off general production and general business expenses.

The volume of work in progress using the process-by-process method of cost accounting can be assessed using conditionally natural indicators. For example, by the equivalent number of finished products. To calculate the equivalent quantity of finished products, you need to know the product readiness ratios at each stage of the production process. The value of these coefficients is set by the manufacturer’s technological service (i.e., yours).

An example of reflecting the costs of producing finished products in accounting. The organization carries out cost accounting and cost calculation using a process-by-process method.

OJSC "Proizvodstvennaya" is engaged in the production of cotton fabrics. Master's accounting policy provides for the use of a process-based method of cost accounting and cost calculation.

The production process includes four stages. Work in progress is valued at an equivalent quantity of finished goods (fabric). For raw materials completely processed at each of the four stages, the organization’s chief technologist has approved the following availability factors:

- primary processing of cotton – 37 percent;

- preparation of cotton fibers – 58 percent;

- spinning (production of cotton threads) – 91 percent;

- production of finished fabric – 100 percent.

The output of finished products is measured in meters. In accordance with the technical documentation, the cotton consumption rate for fabric production is 0.2 kg/m.

According to the accounting policy, the organization's general business expenses are written off as expenses in proportion to the area of production premises. The area of workshops involved in the fabric production process occupies 70 percent of the entire area of the “Master”.

In April, 2,000 kg of cotton were put into production with a total cost of 81,000 rubles. (without VAT). According to technological standards, 10,000 m of fabric should be produced from this amount of raw material (2000 kg: 0.2 kg/m). As of April 30, 8,000 m of fabric were delivered to the finished products warehouse.

Direct costs for fabric production in April were:

- cost of materials – 81,000 rubles;

- wages of production workers and contributions to compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases - 243,000 rubles.

The amount of overhead costs is RUB 96,840.

The amount of general business expenses for the organization as a whole is 230,000 rubles.

In April, the following entries were made in the “Master’s” accounting:

Debit 20 Credit 10 – 81,000 rub. – materials for fabric production were written off;

Debit 20 Credit 70 (69) – 243,000 rub. – wages for production workers and contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases are accrued;

Debit 20 Credit 25 – 96,840 rub. – general production expenses are written off;

Debit 20 Credit 26 – 161,000 rub. (RUB 230,000 × 70%) – part of general business expenses was written off for production.

As of April 30, the remains of raw materials that had undergone complete intermediate processing were recorded in the amount of 350 kg, including:

- at the stage of primary processing of cotton – 90 kg;

- at the stage of preparation of cotton fibers – 180 kg;

- at the spinning stage – 80 kg.

The total volume of raw materials released into production, but not undergone intermediate processing, amounted to 50 kg. Processing of this raw material will be completed next month.

Based on these data, the accountant determined the equivalent amount of finished goods in the balances at each stage of the production process. The volume of work in progress in equivalent units was:

- at the stage of primary processing of cotton - 167 m (90 kg: 0.2 kg/m × 37%);

- at the stage of preparation of cotton fibers - 522 m (180 kg: 0.2 kg/m × 58%);

- at the spinning stage – 364 m (80 kg: 0.2 kg/m × 91%).

The volume of work in progress in equivalent units as of April 30 was: 167 m + 522 m + 364 m = 1053 m.

Total production output for April (including work in progress) is equal to: 8000 m + 1053 m = 9053 m.

The total amount of production costs (including the cost of purchasing raw materials that have not undergone intermediate processing) for April is: 81,000 rubles. + 243,000 rub. + 96,840 rub. + 161,000 rub. = 581,840 rub.

The actual cost of finished products delivered to the warehouse is reflected by the posting:

Debit 43 Credit 20 – 514,163 rub. (RUB 581,840: 9053 m × 8000 m) – the actual cost of finished products for April was written off.

The cost of work in progress balances at the end of April is equal to: 581,840 rubles. – 514,163 rub. = 67,677 rub.

In May, 500 kg of cotton worth 20,250 rubles were transferred to production. At the end of the month, 4,500 m of fabric were delivered to the finished products warehouse. Thus, in May, all released raw materials were processed, including raw materials, the processing of which began in April: 8000 m + 4500 m = (2000 kg + 500 kg): 0.2 kg/m.

Direct costs for fabric production in May were (the cost of purchasing raw materials that did not undergo intermediate processing in April is not taken into account):

- cost of materials – 20,250 rubles;

- wages of production workers and contributions to compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases - 100,000 rubles.

The amount of overhead costs is RUB 73,800. The amount of general business expenses for the organization as a whole is 150,000 rubles.

As of the end of May, there were no balances of work in progress in the “Master” workshops.

The following entries were made in the organization’s accounting records in May:

Debit 20 Credit 10 – 20 250 rub. – materials for fabric production were written off;

Debit 20 Credit 70 (69) – 100,000 rub. – wages for production workers and contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases are accrued;

Debit 20 Credit 25 – 73,800 rub. – general production expenses are written off;

Debit 20 Credit 26 – 105,000 rub. (RUB 150,000 × 70%) – part of general business expenses was written off for production;

Debit 43 Credit 20 – 366,727 rub. (RUB 20,250 + RUB 100,000 + RUB 73,800 + RUB 105,000 + RUB 67,677) – the actual cost of finished products for May was written off.

The actual cost of a batch of fabric produced in April–May (12,500 m) is equal to 880,890 rubles. (RUB 514,163 + RUB 366,727). The cost of 1 m of finished fabric is 70.47 rubles. (RUB 880,890: 12,500 m).

The object of cost calculation when using the incremental cost accounting method is one or another stage of the production process. That is, redistribution. If the production structure is organized in such a way that each processing stage is performed by a specialized workshop, section or team, then determine the cost for each of them. Thus, the object of cost calculation using the step-by-step method can be both finished products and semi-finished products manufactured at each technological stage.

The step-by-step method is usually used for production processes in which groups of constantly repeating technological operations can be distinguished. For example, in metallurgy, oil refining, chemical, food industries.

With the transfer method, take into account direct expenses on account 20:

Debit 20 Credit 10 (21, 23, 29, 69, 70...) – direct costs of production are taken into account.

Write off general production expenses accumulated on account 25 of the same name to the debit of account 20 at the end of the month:

Debit 20 Credit 25 – general production expenses are taken into account as part of the costs of the production stage (process).

General business expenses accumulated on account 26 of the same name are also written off to the debit of account 20 at the end of the month:

Debit 20 Credit 26 – general business expenses are taken into account as part of the costs of the production stage (process).

Take into account general business expenses this way if you do not immediately reflect them on account 90 “Sales”. Such an indication is in paragraph 9 of PBU 10/99. For more information about this, see How to write off general production and general business expenses.

An example of reflecting in accounting the costs of producing finished products using the incremental costing method. The organization uses the semi-finished method of consolidated cost accounting

The Master oil refining organization produces straight-run and high-octane gasoline. The organization has certificates for the production and processing of straight-run gasoline. The accounting policy of “Master” provides for the use of a semi-finished method of cost accounting using account 21.

“Master” has a workshop production structure. In shop No. 1, straight-run gasoline is produced (processing unit No. 1). Workshop No. 2 produces Premium-95 gasoline (processing unit No. 2). Straight-run gasoline is used as the feedstock for the production of Premium-95 gasoline, to which various additives are added at processing stage No. 2. To reflect the actual costs of production stages, sub-accounts “Workshop No. 1” and “Workshop No. 2” were opened to accounts 20, 21 and 25.

In the reporting period, Master produced 1,250 tons of straight-run gasoline:

- 500 tons (40% of production) were sold to an organization that has a certificate for processing straight-run gasoline, at a price of 15,000 rubles/t (including VAT and excise tax);

- 750 tons (60% straight-run gasoline) were transferred to workshop No. 2 for further processing.

Direct costs for the production of straight-run gasoline in workshop No. 1 during the reporting period amounted to RUB 9,602,000.

Direct costs for the production of Premium-95 gasoline in workshop No. 2 amounted to RUB 3,517,800.

The total amount of direct costs for two workshops is 13,119,800 rubles. (RUB 9,602,000 + RUB 3,517,800).

The amount of overhead costs is:

- for workshop No. 1 – 391,280 rubles;

- for workshop No. 2 – 144,720 rubles.

The amount of general business expenses is RUB 360,000.

The accounting policy of “Master” provides for the distribution of general business expenses between production areas (shops) in proportion to direct costs. The share of direct costs for each stage in the total amount of direct costs is:

- for workshop No. 1: RUB 9,602,000. : RUB 13,119,800 = 0.73;

- for workshop No. 2: RUB 3,517,800. : RUB 13,119,800 = 0.27.

The organization's accountant distributed the amount of general business expenses for the reporting period between divisions in the following proportion:

- for workshop No. 1: RUB 360,000. × 0.73 = 262,800 rubles;

- for workshop No. 2: RUB 360,000. × 0.27 = 97,200 rub.

The following entries were made in the organization's accounting:

Debit 20 subaccount “Workshop No. 1” Credit 10 (69, 70...) – RUB 9,602,000. – expenses for the production of straight-run gasoline were written off;

Debit 20 sub-account “Workshop No. 1” Credit 25 sub-account “Workshop No. 1” – 391,280 rubles. – general production expenses are taken into account as part of the costs for the production of straight-run gasoline;

Debit 20 subaccount “Workshop No. 1” Credit 26 – 262,800 rub. – general business expenses are taken into account as part of the costs for the production of straight-run gasoline;

Debit 21 sub-account “Workshop No. 1” Credit 20 sub-account “Workshop No. 1” – 10,256,080 rubles. – straight-run gasoline was capitalized at actual cost;

Debit 62 Credit 90-1 – 7,500,000 rub. (500 t × 15,000 rubles/t) – revenue from the sale of straight-run gasoline of our own production is reflected;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 1,144,068 rubles. (RUB 7,500,000 × 18/118) – VAT is charged on the sale of straight-run gasoline;

Debit 90-4 subaccount “Excise taxes” Credit 68 subaccount “Calculations for excise taxes” - 2,359,500 rubles. (500 t × 4719 rub./t) – excise duty is charged;

Debit 90-2 Credit 21 subaccount “Workshop No. 1” – 4,102,432 rubles. (RUB 10,256,080 × 40%) – the cost of straight-run gasoline sold was written off;

Debit 20 sub-account “Workshop No. 2” Credit 21 sub-account “Workshop No. 1” - 6,153,648 rubles. (RUB 10,256,080 – RUB 4,102,432) – straight-run gasoline was transferred for further processing;

Debit 20 subaccount “Workshop No. 2” Credit 10 (69, 70...) – RUB 3,517,800. – expenses for the production of Premium-95 gasoline (processing unit No. 2) were written off;

Debit 20 subaccount “Workshop No. 2” Credit 25 subaccount “Workshop No. 2” – 144,720 rubles. – general production expenses are taken into account as part of the costs for the production of straight-run gasoline;

Debit 20 subaccount “Workshop No. 2” Credit 26 – 97,200 rub. – general business expenses are taken into account as part of the costs for the production of straight-run gasoline;

Debit 43 Credit 20 subaccount “Workshop No. 2” – 9,913,368 rubles. (RUB 6,153,648 + RUB 3,517,800 + RUB 144,720 + RUB 97,200) – Premium-95 gasoline was credited to the finished products warehouse at actual cost.

Postings for accounting for production costs

The full cost of finished products includes production costs and sales costs. How production and sales costs are accounted for in accounting, what accounts are used and what postings are made.

Accounting accounts for production costs

There are several accounting accounts for recording production costs. In the chart of accounts, Section 2 is devoted to the production process, which provides a list of accounts involved in this process.

Main production (count 20)

Direct costs of main production are collected in the debit of the account. 20.

Account 20 “Main production” is intended to take into account the direct costs of the main production and form the actual cost of production.

The direct costs are:

- Raw materials - posting Debit 20 Credit 10

- Semi-finished products of own production - posting Debit 20 Credit 21

- Depreciation of fixed assets - posting Debit 20 Credit 02

- Amortization of intangible assets - posting Debit 20 Credit05

- Staff salaries – posting Debit 20 Credit 70

- Insurance premiums from staff salaries - posting Debit 20 Credit 69

- Services of third parties – posting Debit 20 Credit 60

Postings for cost accounting of main production:

| the name of the operation | ||

| 20 | 02 | Depreciation was calculated on fixed assets used in the main production |

| 20 | 05 | Depreciation was accrued on intangible assets used in the main production |

| 20 | 70 | Wages accrued to employees of main production |

| 20 | 69 | Insurance deductions are calculated from the salaries of production workers |

| 20 | 10 | Raw materials and supplies released into production are taken into account |

| 20 | 21 | The cost of own semi-finished products was written off to the main production |

| 20 | 60 | The cost of third-party services for main production is taken into account |

Ancillary proceedings (account 23)

Account 23 “Auxiliary production” is intended to account for the direct costs of auxiliary production, which include the repair of fixed assets involved in the production process, transport services, and power supply.

The postings for accounting for these costs look similar, only instead of invoice. 20 is taken count. 23.

General production expenses (account 25)

This account is intended to collect costs associated with the maintenance of main and auxiliary production. These are indirect costs that are collected in the debit of the account during the month. 25

The same costs include depreciation, staff salaries and deductions from them, materials, etc. The postings for accounting for general production expenses look the same as for the main production, only instead of invoices. 20 is taken count. 25.

General expenses (account 26)

The debit of this account collects expenses for administrative and managerial needs, these are also indirect expenses that are collected throughout the entire month in the debit of the account. 26.

Defects in production (count 28)

Another type of cost that must be taken into account in the production process is losses from defects.

If defective products are produced during the production process, then eliminating them will require certain costs, which include depreciation, materials, raw materials, semi-finished products, wages and deductions from them. Accounting for the costs of correcting defects occurs on account 28 “Defects in production”, in the debit of the account. 28, all these costs are collected using the postings indicated above (instead of account 20, account 28 is taken).

Thus, at the end of the month, according to the debit of the account. 20 collected direct costs associated with basic production in the debit of the account. 23 – direct costs associated with auxiliary production, in the debit of the account. 25 – indirect overhead costs, in the debit of the account. 26 – indirect general business expenses, in the debit of the account. 28 – costs associated with defective products.

The next step in the formation of production costs is the distribution of auxiliary production costs between main production, general production and general economic needs.

Postings for distribution of costs of auxiliary production:

| Debit | Credit | the name of the operation |

| 20 | 23 | The cost of auxiliary production allocated to the main production was written off |

| 25 | 23 | The cost of auxiliary production allocated for general production needs was written off |

| 26 | 23 | The cost of auxiliary production allocated for general business needs has been written off |

The next step in the formation of product costs is the write-off of general production and general business expenses.

Postings for writing off these costs are D20 K25 and D20 K26.

General production costs can be written off proportionally:

- Salaries of main production personnel

- Wasted materials

- Amount of direct costs

- Revenue from the sale of manufactured products

General business expenses are written off:

- By distribution between types of products

- In full at the end of the month

The last step is to write off losses from marriage.

Accumulated by debit account. 28, the costs of correcting defective products are written off to the debit of account 20 by posting D20 K28.

As a result of the manipulations performed on the debit of the account. 20 the production cost of products is formed.

The next stage is the formation of the cost per unit of production using calculation.

The concept and main tasks of accounting for the production process

The funds of the enterprise, participating in economic activities, circulate. The movement of funds is determined by three relatively independent processes: supply, production, sales.

The production process is a process during which enterprises make certain expenses and receive finished products. Production with the help of labor combines objects and means of labor to create goods, perform work and provide services.

Accounting for the production process is the primary link in the formation of financial statements, since it is at this stage that finished products are formed from raw materials. Properly organized accounting allows you to assess what costs the enterprise incurs for main production and the work of auxiliary workshops, analyze the dynamics of these costs and take the necessary measures in a timely manner.

The main objectives of accounting for the production process are:

- Recording of all incurred costs;

- Proper division of costs incurred between finished products and products at the work-in-progress stage;

- Formation of production costs for the enterprise as a whole and per unit;

- Conducting trend analysis in order to determine the dynamics of key indicators, identify negative reasons for changes in costs and formulate appropriate proposals.

Product cost calculation

Product costing is the calculation of the cost of manufactured, finished products.

A costing object is a separate type of product for which the cost can be determined by breaking it down into costing items.

Costing items are costs associated with the production of products. We talked earlier about costing and costs. Let us dwell in more detail on the methods and methods that are used to form the cost of a unit of production using calculation.

In fact, the cost of production is the sum of all costs associated with the production of this product.

To determine the cost, you need to allocate production costs between finished goods and work in progress. Work in progress includes those products that have not passed all the necessary stages of production, testing and acceptance, as well as materials, raw materials, semi-finished products that have already entered production and are already involved in the process (their processing has begun), but the finished product has not yet been received .

Having data on total production costs for the month and on the balances of work in progress, you can determine the costs of finished products and the cost per unit.

Costing methods

- Cost summation method

- Normative method

- A way to eliminate costs for by-products

- Method of proportional distribution of costs

- Direct calculation method

- Combined method

Of these six methods, the first is the most popular.

Cost summation method

The method consists of summing up the costs of individual parts of a product or its manufacturing process. For each individual type of product, the total production costs for the month are calculated, the balance of work in progress at the beginning and end of the month is recorded, and losses from defects for the month are determined. Based on these data, the cost of finished products is calculated using the formula presented below.

Formula for calculating cost using the cost summation method:

Cost = Work in progress beginning month. + monthly costs – work in progress end month. - losses from marriage.

To calculate the cost per unit of production, you need to divide the resulting value by the number of units.

Standard method of calculating cost

It is used with the standard method of cost accounting and calculation, which consists of preliminary calculation of the standard cost for each product based on established standards and cost estimates. The essence of the method is to determine deviations from current standards.

A way to eliminate costs for by-products

The method is actively used in non-ferrous metallurgy, chemical and oil refining industries. It lies in the fact that in production all products are divided into by-products and main products; when determining the cost of the main products, the costs of by-products are not taken into account and calculations are not made for them. This method is appropriate if it is possible to divide all products into by-products and main ones, while the by-products make up a small proportion of the main ones.

Direct calculation method

The simplest way to calculate the cost of finished products. All costs for the production of a product are distributed among costing items, the sum of all costs is divided by the number of units of the product.

Combined calculation method

This method consists of an appropriate combination of several cost calculation methods.

Enterprise cost accounting

The methods chosen by the enterprise for compiling production costs must be justified, determined by regulatory documents, industry instructions and methodological recommendations, and recorded by the accountant in the accounting policies of the enterprise.

Mandatory reflection in accounting policies also depends on the methods of allocating costs between specific goods.

Cost accounting in the accounting of an enterprise must be carried out in strict accordance with regulatory documents and be timely, complete and reliable.

Accounting for defects in production

Defects in production are a normal phenomenon that we have to put up with. It is important to know how to correctly account for losses from defects and what postings to make depending on its type.

Let's start by defining what marriage is and what it can be like.

If during the production process a product, product, or part is received that does not meet the approved standards and specifications, its operation and use for its intended purpose is not possible or is possible only after making certain adjustments, then the received product will be considered defective.

Further actions may be as follows:

- Correction (if possible)

- Write-off (if correction is not possible)

You also need to take into account that defective products can be identified at the enterprise itself, or maybe after they are sold to the buyer after some time. Accounting in these two cases will be noticeably different. In the case when a defect is detected at the enterprise, it is called internal, when at the buyer it is called external.

So, marriage happens:

- Correctable and Incorrigible

- Internal and external

Whatever it is, its write-off or correction is accompanied by certain costs, called losses from marriage. To account for them in accounting, accounting account 28 is used.

First, let's look at the features of accounting for defective products identified within the organization.

Accounting for internal correctable defects

During the production process, defective products were received; as a result of the analysis of the defects, it was determined that they can be corrected.

In this case, the first thing to do is to determine the cost of correcting the defective product or part. Cost is formed by expenses, therefore all costs associated with correcting defects are collected in the debit of the account. 28. Costs may include:

- Raw materials (posting for cost accounting D28 K10)

- Semi-finished products (wiring D28 K21)

- Remuneration of personnel involved in correction (posting D28 K70)

- Insurance premiums for compulsory insurance from the salaries of this personnel (entry D28 K69)

- Services of third parties, if they were involved (D28 K60)

In the course of studying the causes of the defect, the guilty employee may be identified. In this case, penalties may be applied to him, which will reduce the cost of corrections. Amounts collected from the guilty employee are accounted for under credit account 28 (entry D73 K28). Further, the amount can be withheld from the salaries of the guilty persons (D70 K73) or deposited by them into the cash desk of the enterprise (D50 K73).

Thus, the debit of account 28 collects all losses related to the correction of defects, and the credit of the amount of collections from the guilty persons. The difference between debit and credit will be the final loss, which is written off by posting D20 K28.

For convenience, we will collect all the above transactions in one table.

Postings for accounting for correctable defects:

| Debit | Credit | the name of the operation |

| 28 | 10 | Materials and raw materials written off |

| 28 | 21 | Semi-finished products written off |

| 28 | 70 | Employees' salaries taken into account |

| 28 | 69 | Insurance premiums are calculated from the salaries of these employees |

| 28 | 60 | The cost of third-party services is reflected |

| 73 | 28 | The amount of recovery from the guilty employee is reflected |

| 70 | 73 | The amount of the recovery is withheld from the salary of the culprit |

| 50 | 73 | The recovery amount was paid in cash to the cash desk |

| 20 | 28 | Losses from defects are written off to the cost of production |

Accounting for internal irreparable defects

If a defective product cannot be corrected, it must be written off. The cost at which it will be written off is determined using calculation.

All actual costs for the production of a given product are collected, that is, the cost of defects is determined. After which a posting is made for the received amount D28 K20.

If the guilty parties are identified, the total amount of losses or part of it can be recovered from them (entry D73 K28). The recovery amount will reduce the overall losses from the defect.

At the end of the month, the total amount of losses on account 28 is determined and written off by posting D20 K28.

When disposing of discarded defective products, waste may remain. If they are useful for further use, then they are supplied with D10 K28 wiring. This amount will also reduce the overall losses.

Postings for accounting for irreparable defects:

| Debit | Credit | the name of the operation |

| 28 | 20 | The actual cost of an irreparable defect was written off |

| 10 | 28 | Returnable waste has been capitalized for further use. |

| 73 | 28 | The amount of recovery from the guilty employee is reflected |

| 20 | 28 | Losses from defects are written off to the cost of production |

Accounting Recommendations

The organization of cost accounting in different industries is characterized by its own characteristics. They are related to the conditions of a specific industry. Ministries have developed sectoral cost accounting guidelines. These recommendations detail and clarify the provisions of federal and industry cost accounting rules for the production of a particular industry.

In recommendations for cost accounting in a specific industry, an economic entity finds its own classification of methods and methods for cost accounting, forms of source documents for their accounting, cost distribution schemes, nomenclature of cost items and principles for calculating the cost of various products.

What is reflected in production accounting

To record the dynamics of the production process, the accountant should take into account:

- expenses arising in the process of manufacturing the finished product;

- funds spent on finished products and on those goods whose production has not yet been completed;

- the sum of all resources for creating products;

- fluctuations in cost, factors of its growth and reduction possibilities.

Forms of production costs

Production costs are those costs incurred by an enterprise during the transformation of raw materials into products. All manifestations of these costs are taken into account:

- material;

- financial;

- resource.

In fact, these costs represent one or both options for the movement of monetary (sometimes non-monetary) funds:

- payment to third parties;

- increase in obligations to counterparties.

Classification of production costs

The division of costs is due to a different approach to their accounting:

- Fixed (overhead) and variable costs - characterize the relationship of costs to the production process. The first ones are related to the organization of the production process; they do not change, even if the volume of goods grows. The second group ensures the production process itself - the purchase of raw materials and payment of labor, so this part of the costs is subject to dynamics.

- Direct and indirect costs are associated with the attribution of expenses to cost. The former are included directly in it, reflecting the connection with the production of each individual unit (for example, the cost of materials). The latter are distributed across several types of products at once; they must be included in the cost within the framework of the methodology adopted by the enterprise.

What is included in production costs

We list the main items of the enterprise’s expenses for creating products, which must be reflected in accounting:

- wages for personnel – workers, maintenance, management;

- the cost of objects of labor that were spent on production and household needs;

- depreciation of equipment, as well as premises, household equipment, etc.

NOTE! In these expenses, part is included in the cost directly (direct costs), and part is distributed indirectly.

Accounting at standard cost without using account 40

Within a month, as finished products are released from the workshops to the warehouse, the products arrive at standard cost. In this case, do the wiring:

Debit 43 subaccount “Finished products at standard cost” Credit 20 - reflects the standard cost of finished products produced and delivered to the warehouse.

When selling products:

Debit 90-2 Credit 43 subaccount “Finished products at standard cost” - the sold part of finished products is written off at standard cost.

At the end of the month, when the actual cost of manufactured products is known, determine the deviations from the standard cost:

Debit 20 Credit 10 (70, 68, 69, 25, 26...) – reflects the actual cost of manufactured products.

If the standard cost is greater than the actual cost, make reversal entries:

Debit 43 subaccount “Finished products at standard cost” Credit 20 – the cost of finished products manufactured per month is reduced;

Debit 90-2 Credit 43 subaccount “Finished products at standard cost” - the cost of finished products sold in the current month is reduced.

If the actual cost is higher than the standard cost, the postings will be as follows:

Debit 43 subaccount “Deviations of the actual cost of finished products from the standard” Credit 20 - reflects the deviation of the actual cost of finished products from the standard;

Debit 43 subaccount “Finished products at standard cost” Credit 43 subaccount “Deviation of the actual cost of finished products from the standard” - the deviation of the actual cost of finished products from the standard in terms of products in the warehouse is written off;

Debit 90-2 Credit 43 subaccount “Deviations of the actual cost of finished products from the standard” - the deviation of the actual cost of finished products from the standard in terms of products sold is written off.

Accounting at standard cost using account 40

Within a month, as finished products are released from the workshops to the warehouse, receive them at standard cost. In this case, do the wiring:

Debit 43 Credit 40 – reflects the standard cost of finished products produced and delivered to the warehouse.

At the end of the month, when the actual cost of finished products is known, reflect it in the debit of account 40. At the same time, write off the deviations of the actual cost from the standard cost. In this case, make the following entries:

Debit 40 Credit 20 (23) – reflects the actual cost of finished products;

Debit 90-2 Credit 40 – reversed, the amount of excess of the standard cost of manufactured products over the actual cost is written off;

or

Debit 90-2 Credit 40 – the amount of excess of the actual cost of manufactured products over the standard cost is written off.

This procedure is provided for in the Instructions for the chart of accounts (accounts 40 and 43).

Differences in accounting and taxation in production

There are many differences between tax and accounting in production. In this regard, permanent and temporary differences arise, requiring more detailed consideration, which cannot be carried out within the framework of a short article. Fortunately, this issue was considered in great detail by ConsultantPlus experts in a Ready Solution. Get free trial access to the system, go to the material and learn everything about the application of PBU 18/02, the procedure for working with which there were significant changes in 2020.

How are production costs recorded?

Modern production accounting, as a rule, includes accounting for costs and income according to the following analytics:

- by their types;

- by department;

- by type of product (product groups).

In various industries and industries, the object of cost accounting can be products, their parts, a group of homogeneous products, a separate order, the volume of production as a whole for the enterprise or in its individual sections. The choice and features of accounting objects are often determined by the specifics of the business.

All accounts that take into account production costs in transactions are active. Expenses of the main production are maintained on account 20, auxiliary - on account 23, general production and general business expenses - on accounts 25, 26.

At the end of the month, accumulated expenses on the debit of accounts 25 and 26 are transferred to the debit of accounts and/or, while the accounts are closed and have a zero balance. Account 28 takes into account defects in production, account 29 – servicing production.

Learn more about postings to production costs.

Categories of articles on production

- Postings for manufacturing defects

- Postings to work in progress

- Accounting entries for overhead costs

- Accounting entries for production waste

- Cost calculation and calculation methods

- Cost accounting using the direct costing method: postings, examples, nuances

- Accounting entries for sales of finished products

- Accounting for finished products: postings, examples, nuances

- Postings to the cost of production in accounting

- Accounting entries for main production

- Accounting entries for auxiliary production

- Accounting for production costs in transactions