It is very important for young aspiring businessmen to know that even before registering their business, they need to think about such an important point as tax collection. The chosen taxation system largely determines what contributions and, most importantly, how much you will have to pay monthly. Tax systems change every year, some become more complex, others, on the contrary, become simpler.

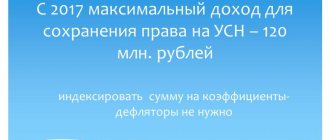

Currently, the simplified taxation system or simplified tax system is considered the most profitable for individual entrepreneurs. Its main feature is that the individual entrepreneur pays minimum contributions and submits a minimum of reports. Having switched to this system, it is necessary to pay a single tax levy and submit only one declaration per quarter. Such a fee allows individual entrepreneurs not to pay contributions such as VAT, personal income tax, etc.

Who shouldn't?

A single tax is an excellent taxation system. However, not everyone has the right to use it. So, the restrictions concern:

- Individual entrepreneur whose staff includes 100 or more colleagues;

- those whose annual income is less than 60 million rubles;

- those who have commercial real estate worth 100 million rubles or more.

According to the innovations, those who previously worked under a simplified system are required to immediately switch to the OSN if the above-mentioned limits are exceeded. In this case, the tax office must be notified of this within 15 days. In addition, there is a list of activities that initially do not fall under the simplification. These include gambling activities, individual entrepreneurs working in the extraction and processing of minerals, and those who produce excise goods.

It is prohibited to work under the simplified system for insurers and bankers, funds and pawnshops, notaries and lawyers, as well as organizations that have branches.

Income tax

The tax service described in detail how the amount of the trade fee should be reflected in the income tax return in letter No. GD-4-3/14174 dated August 12, 2015. Tax officials even gave a clear example of filling out reports.

Payers of income tax have the right to reduce the amount of tax (advance payment) calculated based on the results of the tax (reporting) period by the amount of trade tax actually paid from the beginning of the tax period until the date of payment of the tax (advance payment). In this case, only that part of the tax that is credited to the consolidated budget of the subject of the Russian Federation, which includes the municipal entity (today this is the budget of the city of Moscow), is subject to reduction. Basis - clause 10 of Art. 286 Tax Code of the Russian Federation.

Before making changes to the income tax return, the form and procedure for filling which were approved by Order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600, the tax authorities recommended that trade tax payers fill out the declaration in the following order.

We reduce tax

As we have already said, when calculating income tax, the trade tax actually paid to the budget of the city of Moscow from the beginning of the tax period until the date of payment of the tax (advance payment) is taken into account. For example, if the trading fee for the third quarter of 2020 was paid on October 15, then the amount of this fee may reduce the amount of the calculated advance payment of income tax to the budget of the city of Moscow in the tax return for the nine months of 2020. Paid trading fee for the third and fourth quarters 2020 will reduce the corresponding amount of assessed tax on your 2020 tax return.

Tax officials drew attention to the fact that clause 10 of Art. 286 of the Tax Code of the Russian Federation allows you to reduce the amount of tax in the declaration for the tax period (year) by the amount of the trade tax for the fourth quarter or reduce advance payments in the declaration for the first quarter of the next tax period.

If the amount of the trade fee exceeds the amount of the advance payment (income tax) calculated at the end of the corresponding reporting (tax) period, then the trade fee is taken into account in the declarations within the amount of the advance payment (tax).

We draw up a declaration

The current income tax return form does not contain special lines to take into account the trade tax when calculating income tax. In this regard, the tax authorities recommended using lines 240 and 260 of Sheet 02, line 090 of Appendix No. 5 and 6 to Sheet 02 to reflect the trade tax. Let us recall that these lines reflect the amount of tax paid outside the Russian Federation and counted towards the payment of income tax . The procedure for filling out the declaration will depend on whether the company has separate divisions or not.

Situation one: an organization located in Moscow does not have separate divisions. In this case, on lines 240 and 260 of Sheet 02 of the declaration, she indicates the amount of paid trade tax on an accrual basis from the beginning of the tax period in the order stated above. In this case, the amount of the trade fee cannot exceed the amount of tax (advance payment) on line 200 of Sheet 02 of the declaration.

Example

For nine months of 2020, the advance on income tax for payment to the budget of the city of Moscow amounted to 1,800 rubles. For the third quarter, the company paid a trading fee in the amount of 2,000 rubles. A similar amount of trade fee was transferred for the fourth quarter.

In the declaration for nine months, the organization can take into account the trade tax in the amount of only 1,800 rubles.

As for the declaration for the tax period (calendar year), the company will be able to take into account the amount of the trading fee for the third and fourth quarters in the amount of 4,000 rubles. only if the amount of the calculated income tax to the budget of the city of Moscow at the end of 2015 turns out to be more than the amount of the trade tax.

In practice, a situation may arise when an organization offsets the tax paid outside the Russian Federation and pays a trade tax. In this case, the amounts of creditable tax and trade fee for filling out the above declaration lines are summed up. In this case, the summarized indicator on line 260 of Sheet 02 cannot exceed the amount of tax (advance payment) reflected on line 200 of Sheet 02 of the declaration.

Tax service specialists drew attention to one important point. Since the trading fee when calculating income tax is taken into account on an accrual basis from the beginning of the year, and tax liabilities are determined taking into account previously accrued advances, double counting of the same fee amounts may occur. To prevent this from happening, when calculating the indicator on line 230 of Sheet 02, the amount of accrued advance payments is reduced by the amount of the trade fee taken into account in the tax reduction (advance payment) in the declaration for the previous reporting period. For example, by the amount of the trade fee taken into account on line 260 of Sheet 02 in the reduction of advance payments for the nine months of 2020, the indicator on line 230 of Sheet 02 of the declaration for 2020 is reduced.

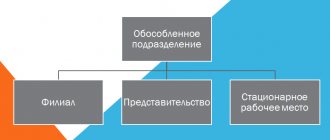

Situation two: a Moscow organization has separate divisions in other constituent entities of the Russian Federation, or an organization located outside the city of Moscow has separate divisions on the territory of Moscow.

Such companies show the paid trade fee on line 090 of Appendix No. 5 to Sheet 02 (with codes 1, 2, 3, 4 according to the details “Calculation prepared (code)”). In this case, the amount of the trade fee cannot exceed the amount of the calculated tax (advance payment) indicated on line 070 of this application. If the company not only pays the trade tax, but also credits the tax paid outside the Russian Federation, then the amount of the credited tax and the amount of the trade fee cannot collectively exceed the amount indicated on line 070.

To avoid double counting of trade tax amounts, tax authorities recommended that when determining the indicator on line 080 of Appendix No. 5 to Sheet 02, the amount of accrued advance payments should be reduced by the amount of the trade tax taken into account in reducing the advance payment in the declaration for the previous reporting period. For example, by the amount of the trade fee taken into account on line 090 in the reduction of advance payments for the nine months of 2020, the figure on line 080 of the declaration for 2020 is reduced.

In addition, such organizations reflect the paid trade tax not only in Appendix No. 5 to Sheet 02, but also when calculating the indicators on Sheet 02 of the declaration. Thus, in this Sheet, the trade fee is taken into account when generating indicators for lines 240 and 260, and when calculating indicators for lines 210 and 230, the accrued amounts of advance payments are reduced by the amount of the trade fee taken into account in reducing the advance payment in the declaration for the previous reporting period.

Interest rates for simplified tax system

Individual entrepreneurs on the USN can pay:

- 6% of income;

- 15% of income minus expenses.

Let's take a closer look at both options.

2.1. Six percent rates

The 6% rate applies to general income. This rate is especially beneficial for those who provide services; materials are not written off, purchases are not made, and goods are not sold.

IMPORTANT. Since last year, regions can reduce the rate to 1%. But for this, a local law must be adopted; when there is none, the minimum tax under the simplified tax system can be calculated only according to generally accepted rules, i.e. the fee will be 6%.

2.2. Fifteen percent

A rate of 15% is provided for those who have expenses for conducting business. The 15% fee can be calculated using a simple formula: income minus expenses. The taxable amount (fee) is the income that the individual entrepreneur reduces to expenses. 15% is calculated from this amount. It is these 15% that are the contributions that an individual entrepreneur must necessarily pay to the state.

IMPORTANT. As in the previous version, the single minimum tax under the simplified tax system can be reduced from 15 to 5%, but only if it is provided for by local law. If for some reason it is not accepted, the rate is traditionally 15%.

How to reflect the amount of trade tax in the declaration?

Information about the trade fee is indicated in section 2.1.2 of the declaration, which is filled out according to the form introduced by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected]

When filling out this section, please keep in mind that:

- it is filled out only if the trade fee is deducted from the simplified tax system, that is, under the simplified tax system “income”;

- lines 110–143 and 130–133 of the section indicate data only on trade activities (while lines 110–143 and 130–133 of section 2.1.1 indicate data on all types of activities);

- in lines 150–153, the vehicle amount is reflected on an accrual basis;

- lines 160–163 of the section reflect the difference between the indicators in lines 130–133 and 140–143 of the section, if the amount of tax reduced by contributions is less than the vehicle amount;

- in lines 160–163 indicate a value identical to that specified in lines 150–153, if the amount of tax reduced by contributions is greater than or equal to the vehicle;

- the value indicated in lines 160–163 cannot be greater than the difference between tax and insurance premiums.

Payers of the simplified tax system at a rate of 15% include vehicle amounts as expenses in the usual manner and do not fill out section 2.1.2 of the declaration.

***

An individual entrepreneur or a legal entity under the simplified tax system that has begun trading activities in a city where laws on collecting trade fees have been adopted (now this is only Moscow) becomes obligated to pay both tax and vehicle tax. With the simplified tax system “income”, it is possible to reduce the calculated tax by the amount of the vehicle. In this case, separate accounting of income by types of activities for which no TS is established is required. Under the simplified tax system, “income minus expenses” of the vehicle is included in expenses in order to reduce the tax base.

Which is more profitable?

In principle, there is no particular difference between the simplified tax system of 15 and 6%, but only if expenses are equal to 60% of income. But there are other options: if expenses are less than 60%, a rate of 6% is more profitable, if expenses are more than 60% - 15%

Income and expenses must be documented, otherwise they will not be taken into account. Payment and shipping documents for individual entrepreneurs (in no case for an individual) can confirm expenses. The expenses that are taken into account are listed in Art. 346.16 of the Internal Revenue Code.

3.1. For trade tax payers

It is noteworthy that the tax under the simplified tax system also further reduces the trade fee. However, the trading fee will only work if certain conditions are met:

- simplified tax rate 15%;

- registration of place of residence and business are the same (accordingly, the simplified tax system and trade tax are paid at the place of residence and registration of the individual entrepreneur).

If the conditions described above are met, it is possible to reduce taxation under the simplified tax system on trade fees. But only the trading fee that is listed for the same period (reporting/tax). Example: trading fee paid for the 4th quarter of 2020 can be taken into account when calculating the simplified tax for 2020.

Sometimes a person’s place of residence is in one city, but he registers an individual entrepreneur in another. In this case, in order to pay the trade fee (and, most importantly, that this trade fee will help reduce the single tax), you need to register with the tax office at the place of business of the individual entrepreneur. You need to pay trade tax according to the details of the city (region) in which you operate. In order for a trade tax to cover others under the simplified tax system, you need to draw up an application and submit it to the tax authority.

Accounting for trade tax under the simplified tax system with the object “income” - new features of “1C: Accounting 8” ed. 3.0

In “1C: Accounting 8” (rev. 3.0), starting with version 3.0.42.72, it became possible to automatically calculate tax on the simplified tax system with the object “income” for payers of trade tax. Now the program supports the method of separate accounting of income and expenses for activities subject to trade tax as part of activities on the simplified tax system for the application of paragraphs 3. and 8 of Article 346.21 of the Tax Code of the Russian Federation in accordance with the recommendations of the Ministry of Finance of the Russian Federation.

From July 1, 2020, Moscow Law No. 62 dated December 17, 2014 introduced a trade tax in the capital. For taxpayers who use the simplified tax system with the object “income minus expenses” and pay a trade tax, keeping records under the new conditions should not cause difficulties. Such taxpayers fully take into account the amount of paid trade tax in expenses on the basis of paragraphs. 22 paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation (letters of the Federal Tax Service of Russia dated 08/12/2015 No. GD-4-3/14233, Ministry of Finance of Russia dated 03/27/2015 No. 03-11-11/16902, dated 07/23/2015 No. 03-11-09/ 42494). But for simplifiers with the object “income”, who pay a trade fee and carry out several types of activities, accounting becomes significantly more complicated.

We remind you that with a simplified taxation system with the object “income” (hereinafter referred to as the simplified tax system “income”), the calculated amount of tax (advance payment) can be reduced by the expenses listed in paragraph 3.1 of Article 346.21 of the Tax Code of the Russian Federation. These expenses include insurance premiums paid in the current tax (reporting) period, temporary disability benefits, payments (contributions) under voluntary personal insurance contracts. In this case, the amount of tax (advance tax payments) can be reduced by no more than 50 percent.

In addition to the amounts established by clause 3.1, the taxpayer has the right to reduce the tax on the paid trade fee (clause 8 of Article 346.21 of the Tax Code of the Russian Federation). Please note that the 50% limit established for insurance premiums and benefits does not apply to the trading fee (Letter of the Ministry of Finance dated October 7, 2020 No. 03-11-03/2/57373).

Keep in mind that if you simultaneously apply the simplified tax system “income” and pay a trade fee, you can reduce the tax calculated only in part of the type of business activity in respect of which the trade fee is established by the amount of the trade fee. Consequently, the named taxpayers, for the purpose of applying paragraph 8 of Article 346.21 of the Tax Code of the Russian Federation, are required to keep separate records of income (letter of the Ministry of Finance of the Russian Federation dated July 23, 2015 No. 03-11-09/42494). It turns out that paid contributions and benefits, by which the amount of tax is reduced, also need to be divided between types of activities subject to and not subject to trade tax. The methodology for separate accounting of income and expenses is not established by law.

For taxpayers using the simplified tax system “income” in “1C: Accounting 8” (rev. 3.0), the calculation of tax (advance payment) and the generation of tax reporting are fully automated and include:

- separate accounting of income in case of payment of trade tax;

- determining the amount of insurance premiums and benefits that reduce tax, taking into account the 50% limit;

- calculation of the tax amount taking into account paragraphs 3.1 and 8 of Article 346.21 of the Tax Code of the Russian Federation;

- filling out a tax return taking into account the recommendations of the Ministry of Finance.

In order to summarize information on settlements with customers for sales related to activities subject to the trade tax, off-balance sheet accounts have been added to the chart of accounts:

- USN.04 “Settlements with buyers for activities at the trade collection”;

- USN.24 “Settlements with buyers in foreign currency for activities at the trade fee.”

Settings for calculating and charging the trading fee are made in the Trading fee

, accessed via the hyperlink of the same name from the section

Directories - Taxes

.

From the Trade Fee

you can get to the

Trade Points directory,

where information is stored about the outlets for which the trade fee is paid, and to the regulated reporting form

Notification of registration as a trade fee payer.

To ensure separate accounting of income from activities subject to trade tax, as part of the income of the simplified tax system, in the sales documents it is necessary in the field Income in NU

select the value

Activities at the trading fee

(Fig. 1).

Rice. 1. Accounting for income from activities at the trade fee

Similar choices are available in the following documents:

- Sales (deed, invoice

); - Retail sales report

(when selling goods in a retail store and at a manual point of sale (NTP) when maintaining records at the cost of acquisition); - Receipt of cash

(in NTT when maintaining records at sales value).

In documents Receipt of cash

and

an advance payment received from the buyer

into the current account To do this, in the Advance in NU

, select the value

Income from activities on the trading fee

.

For taxpayers using the simplified tax system “income” who pay the trade fee, in the last month of the quarter processing Closing the month

includes, inter alia, the following regulatory operations:

- Calculation of trade fee;

- Calculation of expenses that reduce the simplified tax system;

- Calculation of the simplified tax system.

When performing an operation Calculation of expenses that reduce the simplified tax system

According to the accounting system, paid insurance premiums and benefits that reduce the amount of tax are determined.

Expenses related to activities subject to the trade tax are determined automatically in proportion to the income from this activity in the total amount of income (Fig. 2). For the calculation, data on the reflection of income in tax accounting by type of activity on an accrual basis from the beginning of the year until the end of the period of expenses is used. If necessary, expenses related to activities subject to trade tax can be reflected manually using the document Entry of the book of income and expenses of the simplified tax system

(section

Operations

) on the

IV Tax-reducing expenses tab.

. 2. The result of the distribution of expenses by activity at the trade fee

Automatic calculation of the tax on the simplified tax system “income” with the simultaneous payment of trade fees is carried out using the routine operation Calculation of tax on the simplified tax system.

An explanation of the calculation can be obtained using the

Help-calculation report of the tax paid in connection with the application of the simplified tax system

(Fig. 3). The report contains a column reflecting the amounts of the trade fee that reduce the tax. There is also an additional table explaining the calculation of tax on activities subject to the trade tax and the procedure for calculating the trade tax deductible from the tax.

Rice. 3. Certificate of tax calculation under the simplified tax system and activities at the trade fee

The procedure for filling out the tax return paid in connection with the application of the simplified taxation system has been amended in accordance with the letter of the Federal Tax Service of Russia dated August 14, 2020 No. GD-4-3 / [email protected] Amounts of trade duty that reduce tax (advance payment ), are reflected on an accrual basis in lines 140-143 of the declaration together with the amounts of insurance premiums paid to employees of temporary disability benefits and payments (contributions) under voluntary personal insurance contracts provided for in paragraph 3.1 of Article 346.21 of the Tax Code of the Russian Federation.

IS 1C:ITS

- about the organization of tax accounting under the simplified tax system, see the reference book “Accounting when applying the simplified tax system” from the section “Accounting and tax accounting”, read the link https://its.1c.ru/db/accusn/content/217/hdoc/;

- For information about the trade fee, see the “Trade Fee” directory from the “Taxes and Contributions” section - follow the link https://its.1c.ru/db/taxtrfee.

Calculation of simplified taxes

How is the simplified tax system calculated and the rates reduced? To understand how the simplified fee is calculated, let's look at an example. As an example, let’s take an individual entrepreneur who has a 6% interest rate. To calculate contributions, you need to multiply gross income (GI) for a certain reporting period by 6% (tax rate). At the same time, the FD includes funds that were received during the specified period to current accounts and/or to cash desks). The amount received is the fees that must be paid.

Another example concerns a 15% rate. Again, we take the initial amount as VC. Expenses should be deducted from it (we remind you that they must be confirmed and justified). When purchasing goods for resale, only the costs of goods sold during the reporting period are considered expenses.

To make the example clearer, imagine that we purchased a ton of milk for sale, but only managed to sell half. It turns out that when a single fee is calculated, only the cost of half the milk sold is taken into account.

Who is the payer of the trade tax?

In accordance with Article 411 of the Tax Code of the Russian Federation, payers of the fee are recognized as:

| Trade tax payers | Explanation |

| Organizations | carrying out types of business activities in the territory of a municipal entity (federal cities of Moscow, St. Petersburg and Sevastopol), in respect of which the regulatory legal act of this municipal entity (laws of the federal cities of Moscow, St. Petersburg and Sevastopol) established the specified fee, using facilities movable and (or) immovable property on the territory of this municipal entity (federal cities of Moscow, St. Petersburg and Sevastopol) |

| Individual entrepreneurs |

Trade tax is charged only when movable or immovable property is used in carrying out business activities.

In the Letter of the Ministry of Finance of Russia dated July 15, 2020 N 03-11-10/40730 “On the procedure for calculating the trade fee” and in Art. 413 of the Tax Code of the Russian Federation explains that trading activities include the following types of trade:

- trade through stationary retail chain facilities that do not have sales areas (with the exception of stationary retail chain facilities that do not have sales floors, which are gas stations);

- trade through objects of a non-stationary trading network;

- trade through stationary retail chain facilities with trading floors;

- trade carried out by releasing goods from a warehouse.

How do insurance premiums affect the simplified tax system?

If an individual entrepreneur pays insurance premiums on time, he has the opportunity to reduce taxation:

- if the simplified tax system is 6%, the single tax is reduced;

- if the simplified tax system is 15%, the tax base is reduced (insurance premiums are included in expenses).

The first example assumes a tax reduction of no more than half if the individual entrepreneur has employees, and by 100% if there are none. Let's look at an example of calculating a 6% tax. We multiply the gross income (our example assumes that this is 90,000 rubles) by 6%, and from the resulting amount we subtract the insurance premiums paid (in 2020, this amount was 6,997.50 rubles). It turns out: 90 thousand rubles * 6% -6997.50 rubles = 0

If the annual limit is exceeded at RUB 300,000, additional contributions are paid (1% of the amount that exceeds).

How does a trade fee reduce tax under the simplified tax system “income minus expenses”?

The trading fee under the simplified tax system - income minus expenses - is applied differently.

In this case, the vehicle amounts are equated to other expenses (as well as insurance premiums) and are taken into account in the book of income and expenses on a cash basis. That is, they reduce the tax base according to the simplified tax system on the day the fee is paid (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation). Thus, the calculated tax at a rate of 15% cannot be reduced by the vehicle paid.

It does not matter for what type of activity the simplified tax system is calculated: when calculating the tax, expenses for all types of activity, including trading, are taken into account. Thus, there is no obligation to keep separate records of income and expenses under the simplified tax system and the tax system, as is the case with the simplified tax system “income”.

Payers of the simplified tax system “income minus expenses” can be registered in any region - they will not lose the right to apply expenses in the form of the vehicle paid in the capital to reduce the tax base.

Let's take a closer look at how the trade tax is recorded under the simplified tax system of 6%.

Reports on the simplified tax system

Reports to the simplified tax system must be prepared and submitted to a minimum. But at the same time, you cannot violate the deadlines and regulations for their submission. Reports differ for individual entrepreneurs with and without employees (staff). Moreover, in the latter case there are generally minimal reports. If there is a staff (regardless of whether it has 3 colleagues or 98), you will have to work hard on the reports.

7.1. If there are no employees

So, if an individual entrepreneur works without staff, you must provide the following reporting documentation:

- declaration according to the simplified tax system;

- form “1-Entrepreneur” in Rosstat.

7.2. If there are employees

For tax purposes you will need to collect:

- declaration according to the simplified tax system;

- a list of employees;

- calculations of insurance premiums;

- 6 and 2 personal income tax.

The pension fund requires SZV-M. The Social Insurance Fund requires documentation of injuries (the deadlines depend on whether you submit reports in writing or electronically).

Questions and answers

- We are growing mushrooms and plan to supply them to cafes and restaurants in our city. Will we have to pay a trade fee?

Answer: No, your activities are not subject to payment of trade tax in accordance with Letter of the Ministry of Finance of Russia dated July 15, 2020 No. 03-11-10/40730.

- In the office we plan to organize a showcase where the products we produce will be presented. In this case, will we have to pay a sales tax if the office is not a store?

Answer: It will be extremely difficult for you to prove the absence of trading activity in the office if the storefront is organized. In this regard, the Ministry of Finance of Russia, in its letter dated July 15, 2015 No. 03-11-10/40730, clarifies that entrepreneurs who use premises for concluding trade transactions and agreements are exempt from paying the trade tax, but on the condition that the area used is not provides for the display and sale of goods. In this regard, you will have to pay a sales tax.

Advantages of the simplified tax system

In view of all of the above, we can draw a small conclusion, which will once again confirm that the simplified tax system for individual entrepreneurs is the most profitable taxation option.

So, among the undeniable advantages:

- Minimum amount of documentation. Among the regular ones are only reporting on employees - insurance premiums, injuries, personal income tax. If the staff is not too large, and the salary is stable and fixed, generating such reports will not be difficult.

- The only declaration. To compile it quickly, it is enough to record income (if the rate is 6%) and reflect expenses (if the rate is 15%).

- Accounting only for salary and taxes on it at a rate of 6%.

- The ability to change the tax rate from 6 to 15%, the main thing is to notify the tax authorities in a timely manner.

- Application of benefits regulated by local legislation.

- Possibility to reduce the single tax by the amount of insurance premiums paid.

- Tax holiday valid for a period of 2 years (but only for new individual entrepreneurs).

If an entrepreneur works under the regular tax system, he also has the right to switch to the simplified tax system (unless, of course, he is included in the list of restrictions).

But only from the beginning of the calendar year, and in December you need to notify the tax office about the transition. During initial registration, individual entrepreneurs can use the simplified tax system immediately by submitting the necessary application.

Trade fee as an expense (under the simplified tax system “income minus expenses”): main correspondence

The first option for using trade tax (TC) in tax accounting is to include it in expenses. This is possible if:

- The payer works according to the simplified tax system of 15%.

In this case, the vehicle is included in expenses on a general basis and reduces the tax base (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation).

The accountant reflects the fact of payment of the vehicle and its inclusion in expenses in the accounting registers using correspondence: Dt 91.2 Kt 68 (sub-account “TS”).

- For some reason, the payer does not have the right to apply the vehicle as a deduction under the simplified tax system of 6% or the special tax system (for example, if he has not registered the retail facility).

In this case, vehicle amounts cannot be included in expenses for tax purposes (clause 19 of Article 270, clause 2 of Article 346.16 of the Tax Code of the Russian Federation). But it can be reflected in accounting using entries according to the following table.

| Dt | CT | Operation description |

| 68 (“TS”) | Vehicle accrual recorded | |

| 99 (“PNO”) | 68 (“Income tax”) | Fixed liability reflected |

| 68 (“TS”) | Payment of trade tax reflected | |

| 68 (“Income tax”) | 99 (“PNO”) | Reflects a decrease in PIT due to the use of a vehicle (in practice, it is not included in expenses and does not change the tax base) |

Another possible scenario is the use of TS as a deduction that reduces tax under the OSN (in terms of the regional payment - for corporate income tax, in full - for the personal income tax of an entrepreneur) or the simplified tax system “income”.

Read us on Yandex.Zen Yandex.Zen

Disadvantages of the simplified tax system

As you can see, there are really a lot of advantages, and switching to the simplified tax system is not particularly difficult. However, there are also some shortcomings, as, in principle, in every tax system (ideals, unfortunately, do not exist). The example given above is that the simplified tax system does not apply to all individual entrepreneurs.

In addition, if an entrepreneur works on the simplified tax system, there can be no talk of expansion - a staff of 100 or more people, branches, etc.

The absence of VAT payment is, on the one hand, a big plus. But on the other hand, there is a big minus. Often this fact becomes an obstacle to concluding profitable partnership deals and agreements. After all, it’s no secret that large companies mostly operate under VAT and choose their partners under the same tax conditions. This means that large profits can be lost from such unconcluded transactions.

Who is not a trade tax payer?

According to clause 2 of Article 411 of the Tax Code of the Russian Federation, organizations and individual entrepreneurs conducting their activities using the following taxation systems are exempt from paying the trade tax:

- patent tax system;

- Unified Agricultural Sciences.

In addition to the taxation systems specified in the Tax Code of the Russian Federation, organizations and individual entrepreneurs are exempt from paying trade taxes (Letter of the Ministry of Finance of Russia dated July 15, 2015 N 03-11-10/40730):

- selling products of their own making, without using commercial objects;

- selling food products through catering facilities;

- selling collateral through pawn shops;

- using premises for concluding trade transactions and agreements, but provided that the area used does not provide for the display and sale of goods;

- providing household services and selling related products.

Example:

IP Pirozhkov P.P. engaged in the production of leather accessories. The entrepreneur does not have retail space, and therefore he is exempt from paying the sales tax, but only until the retail space appears.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Bottom line

If you think logically and take into account all the advantages and disadvantages of the simplified tax system, you can easily come to the conclusion that such a system is acceptable only for beginning businessmen who do not plan to expand or explore other regions and types of activities. On the other hand, the simplification was developed for this purpose - so that every person has the opportunity to start his own activity with minimal costs and on the most favorable terms for him. Only in this case can you get stable income.

https://youtu.be/IZAMAulNol8

How is the trade tax paid?

If the activity meets the conditions specified in Art. 413 of the Tax Code of the Russian Federation, it is necessary to pay a trade tax.

The transfer of the trade fee to the budget is carried out quarterly, but no later than the 25th day of the month following it:

| Reporting period | Payment deadline |

| 1st quarter | no later than April 25 |

| 2nd quarter | no later than July 25 |

| 3rd quarter | no later than October 25 |

| 4th quarter | no later than January 25 |

It is important to note that the payment of the trade fee is made even if a single case of activity has been recorded that implies payment of the trade fee.

Is it possible to take into account for the purposes of income tax and the simplified tax system (“income minus expenses”) the amounts of trade fees?

At the same time, the “unrefunded” difference is 2,550 rubles. (60,750 rubles – 58,200 rubles) does not reduce the amount of the advance payment for the single tax on income from catering activities.

Thus, the total amount of the advance payment, which must be accrued for payment to the budget based on the results of the first quarter, is:

RUB 130,200 – 65,100 rub. – 58,200 rub. = 6900 rub.

Quick navigation: Catalog of articlesOther issues Reflection of trade fees in accounting (Rogozina O.)

Introductory information

Paragraph 10 of Article 286 of the Tax Code of the Russian Federation names the conditions under which an organization has the right to deduct the amount of trade tax from the amount of income tax (advance payments). We list these conditions:

- You can reduce only that part of the tax (advance payment) that is credited to the budget of the subject of the Russian Federation where the trade tax has been introduced (remember that so far the trade tax has been introduced only in Moscow; see “Trade tax in Moscow: who, how and when should pay it").

- The tax (advance payment) can be reduced by the amount of the trade tax actually paid from the beginning of the year until the date of payment of the tax (advance payment);

- if an organization has not submitted a notification of registration as a trade fee payer, then the tax (advance payment) cannot be reduced by the amount of the fee (see “From July 1, a notification in the TS-1 form (trade fee) can be submitted via the Internet”).