Persons liable to pay

The list of SS payers is given in Article 24.1 of the Federal Law “On Industrial Waste”. These include:

- persons importing cars to the Russian Federation;

- car manufacturers operating within Russia;

- buyers of transport (if payment has not been made previously);

- car owners who did not pay the tax due to the ongoing customs procedure.

The tax is also paid by persons who purchase a car abroad. If it is imported for up to six months, no duty is charged. Funds are deposited through a bank into the account of the National Treasury. A passport is required, the receipt is kept.

Who is exempt from the recycling fee?

Exemption from payments is established by part 6 of Article 24.1 of Federal Law No. -FZ. The list has several categories of cars:

- imported into the Russian Federation by an individual who is a voluntary migrant. To do this, you need to participate in the program for the return of compatriots from abroad or be a refugee, as well as a forced migrant. The last two options require an established procedure for recognition as such;

- imported by various international organizations that enjoy privileges and participate in various fields of activity under international law, diplomatic missions or consulates. In addition, duty-free import is allowed to employees of such organizations and their families in the form of close relatives;

- with an age of more than 30 years. At the same time, they should not be used in commercial activities. Requires original engine, body, frame, if any. The vehicle has an original condition, which is defined by type and category by law;

- with an age of less than 3 years during the customs procedure in the Kaliningrad region in the Special Economic Zone. The exception is vehicles used for international transport.

Important! Exemption from payment of the amount established by law is not automatically granted when falling into a preferential category. For this process, it is necessary to provide the appropriate set of documents to the customs authority.

When reselling such a vehicle, the tax will have to be paid by the buyer. For this reason, when making purchases, it is necessary to check the presence of a mark in the PTS.

Read also: Law on Immunoprophylaxis

Who is exempt from payments

The law provides for conditions under which payments to the treasury do not need to be made. The first owners of cars are exempt if more than 30 years have passed since the date of manufacture of the car. There is a clarification: the engine and body must be “original”.

Fellow immigrants who come to the Russian Federation for permanent residence do not pay the recycling fee. The car must be their property, the fact of acquisition must be proven.

There is no need to pay duty on vehicles that belong to political organizations, foreign consulates, or international companies. If the listed categories sell a car to residents of Russia, a duty is paid.

What is recycling fee?

The fee is paid immediately upon purchase or customs clearance of a car.

This rule was established back in 2012 by federal legislation. According to the law, a fee is a one-time payment that goes to the state budget. Important! Each vehicle owner must pay the established amount of payment when purchasing a new car. This will also need to be done when purchasing a used car, if the previous owner did not do this.

Collection is carried out to ensure the safety of the ecological type of the environment and protect the health of citizens. All amounts received are subsequently used for recycling processes that comply with established environmental standards.

Size

The amount is set taking into account the characteristics and design features of the transport. The basis of the value is the base rate, equal to:

- 20,000 rubles for passenger transport;

- 150,000 for trucks.

The coefficient is affected by the year of manufacture, dimensions, and weight of the car. To find out the amount of tax, the key tariff is multiplied by the parameter approved in the special resolution of the Government of the Russian Federation No. 1291 of December 26, 2013.

Online calculators have been developed to independently calculate the recycling fee.

How is the recycling fee calculated?

The DC is calculated using this formula:

CS = BS * K

Where:

- US – fee amount;

- BS – base rate;

- K is the coefficient used, which is determined on the basis of the List of CM sizes established by Government Decree No. 81 dated 02/06/2016.

There are only two bets:

- 20 thousand rubles for passenger cars that are not used in commercial activities.

- 150 thousand rubles for trucks, buses, as well as passenger vehicles that are used in commercial activities.

The coefficients are set by law. There are many of them, and they are determined based on the following factors:

- Dimensions.

- Weight.

- Engine capacity.

For example, the coefficient for a passenger car older than three years weighing less than 2.5 tons will be 0.88. This is the value that will be used in the calculations.

Calculation example

An imported bulldozer (weighing no more than 10 tons) with a service life of less than 3 years was purchased. The base rate will be 150,000 rubles, since special equipment will be used for commercial purposes. The coefficient for a car of the type in question is 4. The following calculations are made:

150,000 * 4 = 600,000 rubles.

This is the amount that will need to be paid when importing a car of the type in question from abroad.

CS for special equipment

These are highly specialized vehicles (truck cranes, fire trucks, tow trucks, etc.). The duty was introduced to increase demand for original cars. Its size is directly related to the “age” of the vehicle.

The base rate is 150 thousand rubles (for new cars), the amount reaches 1 million for vehicles purchased over 3 years ago. For tractors, the duty starts from 60,000 rubles. The funds go to the state budget.

Benefits of collecting:

- recycling for special equipment in 2020 will reduce buyer interest in foreign cars;

- domestic products will be sold more;

- the number of used equipment with a small residual resource will decrease;

- The country's budget will be replenished with funds.

Negative point: the cost of special foreign-made equipment will increase. As a result, trade in this area will develop poorly.

There is no tax on semi-trailers.

Promotion in 2020

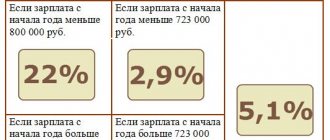

The latest changes were adopted on April 1, 2020. The coefficients increased by 15% for all vehicle groups. As practice has shown, as a result of this, the retail price of the car has increased. The indicators are presented in the table.

| Vehicle type depending on engine volume (cubic cm) | Coefficient for calculating the amount until 2020 | After April 1, 2020 |

| Electric motor | 1,42 | 1,63 |

| Up to 1,000 | 1,42 | 1,65 |

| 1 000–2000 | 2,21 | 4,2 |

| 2 000–3 000 | 4,22 | 6,3 |

| over 3,500 | 9,08 | 9,08 |

For heavy vehicles, the index remained unchanged. The coefficient will not increase for vehicles used for personal purposes. Whether the SS in 2020 will remain at the same level or will it be increased is an open question.

Legal entities

Enterprises buy vehicles for further sale. To calculate the amount of the payment, an increasing index is used. Tax calculations for legal entities are carried out when receiving a new car passport. Calculations are accompanied by certificates:

- PTS;

- certificate of conformity;

- certificate of security of the machine device;

- receipts, checks;

- statement;

- decision on crediting the payment;

- title papers.

The amount of the fee for legal entities is several times higher than the amount established for individuals. 3 days after paying the tax, entrepreneurs present the amount of the fee to the Tax Service (a sample can be found on the Federal Tax Service website).

Liability for non-payment

If the technical equipment passport does not contain an entry confirming the repayment of the recycling tax, it will not be able to be registered with the MREO. Responsibility for failure to pay the tax is not provided for by law, but a fine is imposed for driving an unregistered car:

- 500–800 rubles for the first stop by traffic police officers;

- 5000 rub. or deprivation of a driver's license for a period of 1 to 3 months if repeated.

The temporary number is valid for 20 days - that’s exactly how long you’re allowed to travel without paying the tax. If there is no mark on the PTS (except for the grounds specified by law), then the owner of the car deliberately refused to pay the fee.

Duty refund

It happens that tax is paid by mistake. In this case, they contact the institution that accepted the duty: the customs service (if the car is imported to the Russian Federation) or the tax office (if the vehicle was released in Russia). To receive a refund, fill out an application. The form is issued by the authorized body.

The following documents are provided: the car owner’s passport, PTS, receipt confirming payment for the fee. The decision is made within 30 days. The limitation period is 3 years.

There is no indexation of the amount: the money is returned without taking into account commission fees. Erroneously deposited funds are transferred to the citizen’s current bank account.

Procedure for paying the recycling fee

First of all, you will need to prepare documents for the vehicle upon purchase or customs control. Payment of the duty is made in rubles using a separate payment document. You need to calculate the amount and enter the appropriate code. You can pay at customs or at the regional tax department.

Important! The duty is not tax income received by the federal budget into the account of the Federal Treasury, and therefore does not apply to standard taxation.

If a fee has already been paid and its amount has been exceeded, the balance can be credited to the current payment. In this case, the balance cannot be transferred in addition to other types of payments, since it has a different financial nature.

Read also: Responsibilities of the HOA

Only after payment is it possible to register the vehicle. Payment deadlines have not been established, but when using a vehicle without a mark in the PTS, penalties are imposed.

Sample payment receipt

Marks in PTS

Confirmation of payment of the fee is recorded in the “special marks” of the vehicle passport (red stamp). The absence of a designation is allowed in the following cases:

- The title for a native car was issued before 2012 or the imported car was imported before this date;

- foreign transport was personally imported into the territory of the Russian Federation.

Responsibility for payment lies with the purchaser and carrier of the vehicle to Russia. If a disposal fee is not collected, an entry must be made in the vehicle title indicating the reason for the exemption.

If the title for a domestic car was issued from 2012 to 2013, instead of a record of payment of tax, there may be another one - about the acceptance of an obligation. In this case, it makes sure that during the period of its receipt the manufacturer was not excluded from the Cadastre.

Who must pay the recycling fee in 2020?

All recycling fee payers can be divided into two categories: manufacturers and vehicle owners.

Domestic car manufacturers are required to pay the fee in any case. There are, however, exceptions, but we will talk about this later.

Owners have this responsibility in the following cases:

- import of vehicles into Russia. As for importation, the responsibility falls on both individuals and legal entities;

- purchasing a vehicle:

- for persons exempt from this payment in accordance with the law;

- from persons who have not paid the fee in violation of the law.

The fee is paid for each wheeled vehicle, as well as for self-propelled vehicles and their trailers. The list of such machines and trailers was approved by a decree of the Government of the Russian Federation dated February 6, 2016. These include bulldozers, excavators, cranes, tractors, combine harvesters, etc.