The organization received a decision on an administrative fine for speeding, recorded on a video camera. The car is registered to the organization. Who should pay the fine: the organization or the driver? If it is an organization, then is it necessary to withhold the amount of the fine from the driver’s salary? Will the driver have income subject to personal income tax if the amount of the fine is not withheld from him? How is a fine taken into account in accounting and tax accounting? The organization is on the general taxation system.

I. Kireeva, Voronezh

Despite the fact that the actual violator of traffic rules is the driver, the fine in this situation must be paid by the organization that owns the car. The fact is that for violations of traffic rules, if they are recorded by special technical means that have photo and video recording functions, the owner (owner) of the vehicle is brought to administrative responsibility (Article 2.6.1 of the Code of Administrative Offenses of the Russian Federation).

According to Art. 238 of the Labor Code of the Russian Federation, the employee is obliged to compensate the employer for direct actual damage caused to him. This means a real decrease in the employer’s available property or a deterioration in its condition, as well as the need for the employer to make expenses or unnecessary payments for the acquisition or restoration of this property. In accordance with paragraph 2 of Art. 130 of the Civil Code of the Russian Federation, money is recognized as movable property. Consequently, by his actions, the driver caused damage to the organization in the form of costs for paying the fine, which led to a decrease in its movable property. The fact that the amounts of the fine paid by the organization relate to direct actual damage is confirmed by Rostrud (letter dated October 19, 2006 No. 1746-6-1). Thus, the organization has the right to recover from the driver the amount of the fine paid. But she may refuse such a penalty, taking into account the specific circumstances in which the damage was caused (Article 240 of the Labor Code of the Russian Federation).

Let's consider both options for the organization's actions.

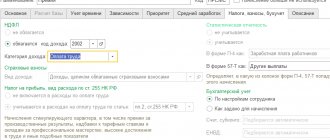

No fine is collected from the employee

Since the employee is exempt from bearing the costs of reimbursing the amount of the fine, the question arises: does he have an object of taxation under personal income tax? The Russian Ministry of Finance believes that the object of taxation under personal income tax will be. In letters dated 08/22/2014 No. 03-04-06/42105, dated 04/12/2013 No. 03-04-06/12341, dated 04/10/2013 No. 03-04-06/1183, he indicated that if the employer established the amount of damage caused by the employee damage, the cause of its occurrence and the limit of the employee’s financial liability, refusal to recover the damage caused from the guilty employee leads to the emergence of income (economic benefit) received in kind, subject to personal income tax.

But according to the Federal Tax Service of Russia, the amount of the fine paid cannot be considered as income received by the driver of a vehicle owned by the company. Consequently, there is no object of taxation under personal income tax (letter dated April 18, 2013 No. ED‑4-3/ [email protected] ).

We agree with the tax authorities. The specifics of determining the tax base for personal income tax when receiving income in kind are established by Art. 211 of the Tax Code of the Russian Federation. From its provisions it follows that income in kind appears when the employer pays for goods (work, services) in the interests of the taxpayer. Payment of the fine is carried out in the interests of the organization, since it is on it, and not on the employee, that the fine was imposed. The list of income in kind is given in paragraph 2 of Art. 211 of the Tax Code of the Russian Federation. It does not mention income received as a result of the employer's refusal to collect damages from the at-fault employee. Let us note that this point of view is supported in court (resolution of the Federal Antimonopoly Service of the Moscow District dated 03/15/2006, 03/09/2006 No. KA-A40/1434-06).

Attention

Fines and other sanctions transferred to the budget are not taken into account in “profitable” expenses, paragraph 2 of Art. 270 Tax Code of the Russian Federation.

This is a situation that occurs all the time. A company driver, while driving a company car during working hours, violated traffic rules, for example, exceeded the speed limit. This fact is recorded by CCTV cameras, and after some time the organization that owns the car receives a so-called photo fine by mail, which it must pay. 12.9, part 1 art. 2.6.1, part 3 art. 28.6 Code of Administrative Offenses of the Russian Federation; Question 10 of the Review of Legislation and Judicial Practice. approved Resolution of the Presidium of the RF Armed Forces dated June 16, 2010.

We will look at the main questions that accountants have when paying fines for drivers.

Order for damages

0 If an employee, as a result of his guilty illegal behavior (action or inaction), caused damage to the employer, such employee becomes financially liable to the employer ().

The amount and procedure for compensation for damage are established by the Labor Code of the Russian Federation and other federal laws (). Recovery by the employer of damage caused to him by the employee is made on the basis of an order. We will tell you in our material how an employer can draw up an order to recover material damage.

As a general rule, an employee’s financial liability for damage caused to the employer is limited to the average monthly salary (). However, if the law allows the conclusion of an agreement on full financial liability with a specific employee and such an agreement was concluded with the employee, then all direct actual damage can be recovered from the employee ().

The list of works and categories of workers with whom agreements on full financial responsibility can be concluded is given in.

In addition, regardless of the presence or absence of an agreement on full financial liability, damages from the employee can be recovered in full if such damage was caused (): or intentionally; or in a state of alcoholic, narcotic or other toxic intoxication; or as a result of criminal actions established by a court verdict; or as a result of an administrative violation established by the relevant government body; or not while performing work

Is it possible to “shift” a fine from the company to the driver himself?

The Ministry of Internal Affairs believes that the experiment in introducing cameras has justified itself and should be continued. Thus, by 2014, they plan to install 800 cameras in Moscow alone (there are currently about 30)

Yes, you can. The owner of the car is released from administrative liability if he confirms that at the time the violation was recorded, someone else was driving and part 2 of Art. 2.6.1 Code of Administrative Offenses of the Russian Federation.

To do this, you need to write and send a corresponding application within 10 days from the date of receipt of the fine receipt, part 1 of Art. 30.2, clause 3, part 1, art. 30.1 Code of Administrative Offenses of the Russian Federation:

- addressed to the superior official of the traffic police department whose employee issued the resolution on the administrative offense;

- to a higher authority of the traffic police;

- to the district court at the location of this traffic police department.

The application must be accompanied by documents confirming that a specific driver was using the car on the day of the violation (for example, a waybill).

Sokolieds.ru

Content:

A person, having received a salary, may be surprised - part of his income was transferred to the benefit of the enterprise or some third party. In what cases and how much can they withdraw from wages?

How can an employer document this? The grounds are prescribed exclusively in federal legislation.

The prerogative in this area belongs exclusively to the Federal Assembly (State Duma and Federation Council). Regional authorities have no authority in this matter.

The law provides a limited list of cases that give the right to make additional deductions from an employee’s income: The employee received money in advance, but it was not worked out for him.

He received funds for a business trip, moving to another area, but did not go on a business trip or to another area.

Failure to comply with production standards, but payment was made beyond the established standard. The employee received a large payment due to an accounting error, and this was his fault.

Deductions for an unfinished working year in which full leave was received. The employee's actions resulted in downtime.

Is it possible to deduct the amount of the fine from the driver’s salary?

Quite. After all, the employee is obliged to compensate the employer for direct actual damage caused to him b Art. 238 Labor Code of the Russian Federation. Such damage includes, among other things, the amount of fine paid by the employer due to the commission of an administrative offense by the employee.

In our case, the driver bears limited financial liability - within the limits of his average monthly earnings and Art. 241 Labor Code of the Russian Federation.

One fine is unlikely to exceed the driver's average earnings. For example, the largest “photo fine” that can come to an organization is part 3.1 of Art. 4.1 Code of Administrative Offenses of the Russian Federation, - 5000 rubles. This is exactly how much it costs now to enter oncoming traffic, recorded by video cameras and part 4 of Art. 12.15 Code of Administrative Offenses of the Russian Federation. Therefore, the amount of damage can be recovered from the driver by written order of the director of the organization. It must be issued no later than 1 month from the date of receipt of the fine receipt and Art. 248 Labor Code of the Russian Federation. By the way, even if your driver is one of the worst traffic violators and the entire amount of fines imposed on the organization because of him in a month turns out to be more than the driver’s average monthly earnings, it can still be collected by order of the manager. After all, each fine is a separate case of causing damage. They don't add up.

Order to deduct from wages - sample

/ / June 24, 2020 0 Share it depends on the situation in which there is a need to draw up such a document.

Let's consider these cases and the nuances of publishing orders to deduct from wages in various situations in our article, and also provide samples. The list of grounds on which it is possible to withhold a debt to an organization from an employee’s salary is listed in Art. 137 Labor Code of the Russian Federation. Withholding is made in cases where the employee, for some reason, received more funds than he was owed. For example, when an employee did not pay off the advance payment that was given to him towards his salary.

The grounds for withholding wages may be contained in other federal laws, in addition to the Labor Code of the Russian Federation.

Within a month, the company can return the discovered debt.

To do this, you must obtain written consent from the employee to deduct from your salary.

Will the driver have taxable income from the forgiven fine?

Reader's opinion

“ We sell building materials and, at the customer’s request, deliver them to him in our Gazelles. The client coverage is large: the entire Moscow region and several adjacent regions. “Photo fines” are coming to us in batches. We don't bother with any kind of retention. We just look at which driver was driving this car on the day of the violation, hand him a receipt and send him straight to the nearest bank.”

Louise, accountant, Moscow

In such a situation, tax officials can regard the amounts of fines paid by organizations for their drivers and not collected from them as the driver’s income received in kind (clause 2 of Art. 211 Tax Code of the Russian Federation. As a result, the company will be fined for failure to fulfill the duty of a tax agent to withhold and transfer personal income tax from these amounts (Art. 123 of the Tax Code of the Russian Federation, and will also charge penalties for non-payment of NDF L Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 12, 2010. But this can be disputed, because the organization that owns the car is considered the violator. And the fine was imposed on her, and not on the driver. By the way, there is a similar precedent.

Thus, drivers of one company in company cars became involved in an accident. The company, as the owner of the cars, paid for the damage caused to third parties. At the same time, nothing was collected from the drivers. During the audit, the tax authorities did not miss the opportunity to find fault with this. However, the FAS Moscow District indicated that, based on the norms of civil legislation, in this case the damage was paid for by the enterprise itself, which is the owner of the vehicles, in Resolution of the FAS Moscow Region dated 03/15/2006, 03/09/2006 No. KA-A40/1434-06.

Order to withhold funds from wages

3407 is a fundamentally important document in the interaction between employee and employer. The employer has a month to sign it. Subsequent attempts to reduce the employee’s salary will not fit within the framework of existing legislation.

FILES Russian legislation firmly regulates official deductions from employees' wages: types of deductions are described in the Tax Code of the Russian Federation (mandatory - these are taxes, at the initiative of employers and at the will of the employee himself); How enforcement proceedings are carried out is stated in Federal Law No. 229 dated 02.

October 2007; the salary accruals by which the amount of alimony payments are calculated are specified in Government Decree No. 841 of August 18, 1996. procedure for withholding alimony, transfers

What if the employee was fined personally, but the organization paid for it?

Most often, this happens not with ordinary employees, but with the head of the company (who, as a rule, is its sole owner).

It is managers who often sin by “passing” their own fines imposed on them to the accounting department for payment:

- as against ordinary “physicists” (for the same traffic violation);

- as officials.

And the accountant has no choice but to obediently pay these receipts.

We warn the manager

If the director’s personal fine is paid from the company’s account, an additional personal income tax in the amount of 13% of the amount of the fine paid will have to be withheld from his next salary. And you will have to charge insurance premiums from the amount of the fine.

Of course, in an amicable way, the administrative fine must be paid by the person who was brought to justice and part 1 of Art. 32.2 Code of Administrative Offenses of the Russian Federation. But if the organization does it instead, nothing bad will happen. You just need to indicate something like the following in the purpose of payment: “By order. (date and number), for. (Full name of the head). Otherwise, the transferred money may be lost in the depths of our budget system, and when the period allotted for paying the fine expires (it is about 40 calendar days, part 1 of article 32.2, part 1 of article 30.3, paragraph 1 of article 31.1 Code of Administrative Offenses of the Russian Federation), the manager may be additionally fined for failure to pay the initial fine and part 1 of Art. 20.25 Code of Administrative Offenses of the Russian Federation (see 2011, No. 15, p. 4).

Deduction from wages at the request of the employee

August 24, 2020 at 1:50 p.m. Deduction from wages is the withdrawal and transfer of money from an employee’s income for certain needs, which are carried out on the basis of a written request.

The procedure is carried out on the basis of Russian legislation and local enterprise standards.

Related articles Contents If you find an error in the text, please let us know by highlighting it and pressing Ctrl+Enter. An employee, in addition to mandatory deductions for taxes or alimony, has the right to transfer money for any purposes he needs and pay other bills. It’s more convenient for him not to waste time paying on his own if his employer can do everything for him.

When writing an application, an employee indicates any amount within the limits of his monthly salary and other income, since the legislation of the Russian Federation does not impose restrictive barriers.

We recommend reading: Agreement for the provision of website administration services

The employer has the right, but not the obligation, to consider and make a positive decision on deductions from the employee’s earnings.

Collection of a fine from an employee imposed on an organization. How to issue an order to withhold a fine from an employee for violating traffic rules

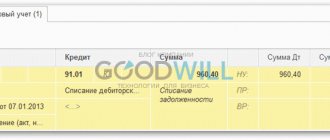

If an organization paid a fine for violating traffic rules by an employee and did not withhold this amount from him, make an entry in the accounting records Debit 91-2 Credit 73.

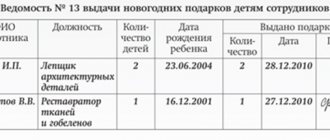

In the 2-NDFL certificate, indicate the amount of the fine as income received by the employee in , according to income code 2520. Reflect the deduction of the fine from the employee’s salary by posting Debit 70 Credit 73. How to reflect in accounting the deduction from wages of material damage caused to the organization How to take into account the deduction when taxing from the salary of material damage caused to the organization.

The organization applies a special regime Situation: is it necessary to withhold personal income tax if the administrative fine for an employee was paid by the organization (for example, for violating traffic rules on the organization’s car) Yes, it is necessary.

Although the explanations of the regulatory agencies are ambiguous. According to representatives of the financial department, the cost of paying an administrative fine is damage caused to the employer.

Can an employer punish in rubles by signing a fine order?

- a punitive measure often practiced by employers; some companies even have penalty “price lists” that determine the amount of deduction for one or another.

Meanwhile, in the Labor Code there is no such thing as deduction from wages.

The Labor Code (Article 192) clearly defines the types of penalties applicable to employees for various disciplinary offenses (absenteeism, being intoxicated at the workplace, etc.):

- .

- ;

- ;

Content:

The employer has no right to fine employees, regardless of the severity of the offense. Thus, the very fact of the fine and the accompanying documentation (an order for the enterprise to recover funds) are illegal.

In fact, deduction from fine amounts is equivalent to.

5.27 Code of Administrative Offences. If his guilt is confirmed, the employer will have to pay:

- if repeated - from 10 to 20 thousand rubles. and from 50 to 70 thousand rubles. respectively.

- for the first violation - from 1 to 5 thousand rubles. — for individual entrepreneurs or officials, from 30 to 50 thousand rubles. — for legal entities;

If the illegal deduction of part of an employee’s salary is carried out for 3 months in a row, he will be liable under Art.

For this, the employer can be held liable under Art.

145.1 of the Criminal Code. If you want to find out how to solve your particular problem in 2020, please contact us through the online consultant form or call:

- Saint Petersburg: .

- Moscow: .

In this case, he faces a considerable fine (up to 500 thousand rubles.

according to recent amendments)