Currently watching: 748

In this article, I will not rewrite the regulations (but will only list them below) that regulate the accounting of materials at a manufacturing enterprise. This is quite enough on the Internet. Here I will talk about practical accounting of materials in production.

Accounting for materials in production is regulated by:

– PBU 5/01 “Accounting for inventories” (Order of the Ministry of Finance dated 06/09/2011 No. 44n); – Methodological guidelines for accounting of inventories (Order of the Ministry of Finance dated December 28, 2001 No. 119n); – Methodological guidelines for accounting of special tools, special devices, special equipment and special clothing (Order of the Ministry of Finance dated December 26, 2002 No. 135n).

As I explain at seminars, learn to read and apply the law, and you will be happy.

But in fact, accounting for materials in the production of products is a fairly voluminous area of work. Moreover, if your company produces finished products for a wide range of consumers. Consequently, the success of the company’s development and its further existence depends on the correct management of this area. Let's look at the stages of movement and accounting of raw materials and materials in production.

MATERIALS MANAGEMENT

If we delve a little deeper into financial accounting, we will understand where the materials for production come from. Firstly, a sales plan for finished products is drawn up, and from there the following are drawn up:

- production plan;

- procurement plan for this production of materials;

- labor cost plans;

- and other company plans and budgets.

types of budgets in production

That is, the plan for the purchase of raw materials and supplies is taken based on the production plan! Next, the company's suppliers select suitable suppliers according to their parameters and order raw materials for the production of products.

Write-off act

To write off damaged products, the commission draws up a report in 3 copies. Each of them is signed by all members of the commission. If the products being written off may threaten the health of people and animals or contribute to the emergence of dangerous diseases, then representatives of the sanitary inspection or other supervisory authority must be invited to write off.

One copy of the act is transferred to the company’s accounting department. Based on the report, the accountant will write off damage from the financially responsible employee. The remaining copies will need to be given to the employee who is responsible for the damaged product and to the department.

RECEIPT OF MATERIALS

Materials arrive at the warehouse. An organization may have several warehouses. This may be one common warehouse, or it may be a division of warehouses into production workshops. Depending on the number of warehouses, responsible material persons for the receipt and release of materials must be identified and documented. This will be useful to the accountant at the end of the month to calculate the actual cost, based on the results of the inventory.

So, the materials have arrived at the warehouse, the MOL (materially responsible person) accepts this material into the warehouse and signs the receipt on the delivery note. One copy of the invoice is returned to the supplier, and the other to the accounting department. This is the arrival of raw materials to the warehouse. There may be several receipts within a month. Accordingly, these receipts are reflected in the accounting and storekeeper records.

Accounting for materials in production - accounting entries:

1) Dt 10 Kt 60 – receipt of materials from the supplier.

2) If you work with VAT, then separate out from the amount of VAT receipts: Dt 19 Kt 60 – VAT on materials is reflected

3) And if the supplier gave you an invoice that you can accept for deduction, then you accept this VAT for deduction: Dt 68.2 Kt 19 – we accept VAT for deduction.

Example A supplier shipped us materials worth 120,000 rubles, including 20% VAT. Based on the invoice, the accountant makes the following entries: Dt 10 Kt 60 – 100,000 rubles (we take into account the material without VAT); Dt 19 Kt 60 – 20,000 rubles (we reflect VAT on receipt); Dt 68.2 Kt 19 – 20,000 rubles (we accept VAT for deduction based on the invoice).

Task for independent solution:

Prepare accounting entries.

The supplier shipped material in the amount of 162,000 rubles, including 20% VAT.

If not all issued production inventories have been used

Inventory released from the warehouse, but not used in the current period, should not be displayed in the expenses section. They are not taken into account either in accounting or tax accounting.

In such a situation, the mapping is carried out according to subaccount 10 “Materials in the workshop” , as the movement of materials from the warehouse to the production department.

At the end of the month, an additional document will be drawn up - an act on the expenditure of inventories, which will display the directions and purpose of using the reserves.

Decor:

- Funds are issued and immediately take part in the activities of the organization. In this case, only the demand invoice will suffice.

- A write-off act is drawn up - the inventory is transferred on the basis of the demand invoice and undergoes a gradual process as it is used, which is confirmed each time by this document. Its form is approved in the accounting policy. It contains information: item number, quantity of material used, price at which accounting was carried out for each product, serial number or specified order code for which stocks were used, established standards for quantities and amounts, and the degree of their excess.

The memo for writing off inventory items must contain the following information :

- Document details. In small enterprises, only the date can be indicated; in large companies, in addition to the date, a number is indicated.

- The addressee is registered. This can be either a director or his deputy, authorized to deal with security issues of the organization.

- Text with a request.

- A table with information about the materials and equipment subject to the process due to their use or failure. It should contain columns with the following names: line numbering, name of material, volume of production, number assigned by the inventory commission and cost in accordance with balance sheet data.

- The grounds that serve to carry out the procedure. Documents confirming the fact and necessity are displayed here.

- Information about the person in charge.

- Period. It is established depending on the approved reporting period - month, quarter.

- List of applications. Documents that will be attached.

- The full name and position of the compiler are written down. This can be a person from the Moscow Region or the head of a department - this is regulated in the rules of the enterprise.

- Confirmation marks. The note is compiled by at least two persons - the financially responsible employee and the head of the department. The first one puts his signature, and the second one endorses it, thereby confirming the accuracy of the information provided.

After this, the document is sent to the addressee, after which it is sent to the accounting department, where procedures are carried out to bring the balance into the appropriate form.

You can learn how materials are written off in 1C from this video.

https://youtu.be/967o2LqQ_K8

Share with friends on social networks

Telegram

RELEASE OF MATERIALS FOR PRODUCTION

Through the receipt/receipt of material, we have formed current assets in the warehouse. And these assets should be used in the production of products, and not lie idle and overstock our warehouse with dead weight. In order to release material from the warehouse into production, it is necessary for the person in charge at production (and perhaps in each workshop) to make a request to the storekeeper to release the material into production. This application must indicate the quantity of material required. If a given amount of raw materials and supplies is available, then the storekeeper releases this asset to the foreman (the responsibility for receiving material into production can be assigned to any person in the production workshop, but as a rule, this is the workshop foreman).

Here is a sample Request for release of material into production.

request for release of material from warehouse

The storekeeper accumulates data from applications for the release of material into production within a month. Then it is transferred to the accounting department. Each company sets the frequency of transfer of these applications independently, depending on the production process.

And thus, during the month, the accounting department reflects: - documents of receipt of material at the warehouse (based on invoices); – documents for release of material into production (based on requests from foremen). And this is enough to carry out an inventory of the main warehouse. Where the credentials will appear:

- balance at the beginning of the month

- plus arrival within a month

- minus monthly consumption

- and what should be left at the end of the month.

These are credentials. But the actual data will be determined by conducting an inventory.

Accounting entries for the release of material into production:

Dt 20 kt 10 – release of material into production.

How to draw up an act for writing off materials

There is a unified form of act for write-off of materials, which is approved by the State Statistics Committee of the Russian Federation. The act must contain the following elements:

- date and place of its composition

- Full name, position of each commission member, his signature

- Table with a list of materials to be written off, their quantity, reason for write-off (write-off for production, unsuitability for further use, theft, gratuitous transfer)

- price and total amount for each type

- At the very bottom, the total amount for which the goods are written off is written in words.

Each member of the commission signs the act, and then it is approved by the head of the company or enterprise. The commission may include a representative of the sanitary and epidemiological inspection or other regulatory organization. The signature of the manager approving the write-off is placed in the upper right corner of the document indicating the position and the transcript of the signature, as well as the date of approval of the document.

If materials are moved within the organization for its needs, for example, for the production of some products, for the needs of office workers or service personnel, then they are written off for production. In this case, the materials are issued from the enterprise warehouse.

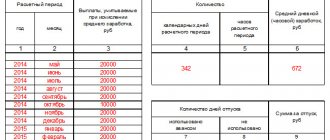

METHODS FOR RECORDING MATERIALS INTO PRODUCTION

When materials are released into production, they can be assessed in three ways:

- at the cost of each unit;

- at average cost;

- using the FIFO method.

Let's talk about each:

At the cost of each unit - this method is used quite rarely, and in certain types of activities. For example, when writing off precious stones in jewelry production. Since it is difficult to evaluate two different diamonds based on their average cost