How is the INV-23 magazine used?

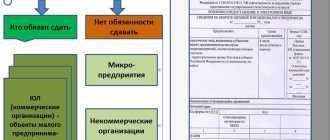

The journal, compiled according to the INV-23 form, which was approved by the State Statistics Committee of the Russian Federation in Resolution No. 132 dated August 18, 1998, is used for the purpose of recording issued orders to carry out a procedure such as inventory.

The order initiating the inventory is the main document regulating this procedure. Quite a large number of them can be published: inventories are not only planned, which are carried out relatively rarely, but also unscheduled. Such orders may include a wide range of information. For example, about the content of the inventory procedure, the timing of its implementation, and the composition of the commission carrying out the inventory.

Inventory orders are drawn up according to their unified form (INV-22) or, if this is necessary due to the large amount of information, on the form of a regular order, but with the inclusion of data required for an inventory order. If there is a large volume of property subject to inspection, several orders may be issued simultaneously.

Read more about the design of INV-22 in the material.

Filling out the document

Form

Organizations have the right to develop the form of the document that will be used to check goods being transported independently. But you can use a ready-made Inventory Report of an existing unified form No. INV-6. The document was approved by the State Statistics Committee of Russia in Resolution No. 88 of August 18, 1998 “On approval of forms for recording cash transactions and inventory results.”

Most enterprises and firms use special computer programs for accounting, so filling out this kind of document for inventory of goods and materials that are in the process of transportation occurs automatically. But you can draw up an Act in form No. INV-6 and with your own hand.

The document in form No. INV-6 is filled out as follows:

- on the main page at the very beginning the details of the company or organization conducting the inspection are indicated;

- at the top of the Act, the basis on which the inventory was started is written down (order of the manager, order of the chief accountant);

- in the upper right corner of the document indicate the start and end date of the inspection;

- the tabular part of the Act is filled out on the basis of an agreement, invoice, payment order or invoices;

- a separate position is opened for each type of inventory;

- the document contains the name of the goods or materials, item number, unit of measurement, date of shipment, name of the supplier, name of the accompanying document and date of its issue, quantity, cost in rubles;

- the Act includes accounting data (quantity of goods or materials, amount in rubles);

- if goods or materials have already been paid for, then this fact must be reflected in the notes, indicating the date and document number;

- At the end of the document, the results are summed up and all the data are summarized;

- The act is signed by the chairman and all members of the commission.

What are the features of the structure and filling of the document?

The INV-23 form provides:

- information about the company that conducts the inventory (or about the structural unit performing the corresponding task);

- Full name of employees who are financially responsible for the completeness and safety of certain resources;

- information about inventory orders;

- data on the composition of the commission carrying out the inventory;

- types of assets (or liabilities) being inventoried;

- corresponding to the order, as well as the actual dates of the beginning and completion of the inventory;

- inventory results - preliminary, final (indicating shortages or surpluses);

- dates of approval of the inventory results by the head of the company;

- the date of taking the necessary measures to respond to the identified deficiency (in the form of its repayment or sending the case to the law enforcement agencies).

The journal for registering inventory orders must be signed by a responsible employee of the enterprise.

Read about what forms are intended to reflect deviations identified during the inventory process in the articles:

- “Unified form No. INV-18 - form and sample”;

- "Unified form No. INV-19 - form and sample."

and a sample of filling out the INV-6 form

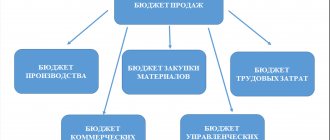

During the inventory process at an enterprise, several types of forms are compiled:

- inventory list INV-3 for inventory items stored in a warehouse,

- inventory list INV-4 goods and materials, at the time of inventory already shipped to the buyer,

- inventory list INV-5 of goods and materials received for safekeeping, including with an incomplete package of accompanying documents.

To draw up an act, one of the members of the inventory commission is involved, which is created by order (instruction, resolution) of the head for each inventory.

The form is filled out on the basis of data from registered accompanying documents to inventory items - goods, waybills, payment, settlement and payment documents, as well as in correlation with accounting data.

Where can I download the INV-23 log and a sample of how to fill it out?

You can download the form corresponding to the INV-23 form approved by Goskomstat on our portal. The document available to you is presented in a convenient Word format.

At your disposal is also a sample log of inventory orders filled out by us in the INV-23 form.

Rules for filling out the INV-6 form

The act is drawn up in two copies: for accounting and for storage in the warehouse where the inventory took place.

The INV-6 form indicates:

- name of the organization, its OKPO code, type of activity code, name of the structural unit in which the inventory is being taken;

- name and date of the document on the basis of which the inventory is carried out;

- inventory timing;

- number and date of the INV-6 Act itself;

- in the tabular part (it consists of two pages, but if necessary, it can be more) the inventory items, their characteristics, the number and date of documents accompanying the inventory items, the quantity and cost of goods and valuables are indicated - according to these documents and according to accounting data. At the end of each table, the total figures for this sheet are displayed.

At the end of the form, on the fourth page, both the data for the last table are indicated (or dashes are placed if it is empty) and the total figures for all three sheets. The total amount is written in capital letters below the table. Empty lines in the table and the empty space next to the total amount are crossed out.

The company's property that is subject to inventory includes not only those inventory items that are in storage locations, but also those that have not yet arrived. For inventory items that are in transit, use the corresponding settlement inventory report in the INV-6 form. A special commission is convened to carry out the procedure and draw up the document. We will describe in detail the features of such an inventory and filling out the INV-6 form in the article.

FILES

Results

An important point in the inventory procedure is the organization of recording orders for its implementation.

It allows you not only to compile a list of such documents, but also to monitor the quality and timeliness of various inventory procedures, as well as to effectively plan further inspections. Form INV-23 is one of the most optimal options for solving these problems. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Fill out the INV-6 form

The form consists of 4 pages. The main part of the document is a table with data on inventory items that are in transit. It begins on the first page, continues on the second and third, and ends on the fourth. If there are not large quantities of inventory items, then you can use only the first and fourth pages. Let's take a look at them.

First page

First, enter information about the company, document and inventory dates:

- name of the economic entity, structural unit;

- OKPO code;

- OKVED code;

- the document that is the basis for the inventory, its number and date of preparation;

- inventory timing;

- type of operation;

- number and date of drawing up the act to be filled out.

Then the tabular part begins. The table includes information such as:

- Number in order.

- Name and brief description of goods and materials in transit, their code or item number.

- Data on units of measurement: OKEI code and name.

- The date when the inventory items were shipped.

- Information about the supplier company: name and OKPO code.

- Name of the shipping document, date of its preparation and number.

- Quantity and amount according to commodity transport and payment documents.

- Quantity and amount according to the company's accounting information.

- Note.

As already mentioned, the second and third pages continue the table. Each one is summarized on a page.

Fourth page

The table also continues. At the end of it, the total for the page and for the act in general is noted. Next, indicate the total amount in words.

At the end, the chairman and all members of the commission sign.

Attention! If at least the signature of one of the commission members is missing, the document will be considered invalid.

Form inv-23: logbook for monitoring the implementation of inventory orders

One order may contain an order to conduct an inventory of various types of property and liabilities, while in order to correctly reflect the results of the audit, it is reasonable to distribute the inspected objects into separate lines depending on the type. Filling out the columns of the INV-23 form: Column number Information to be filled in 1 Serial number of the line to be filled in, sequential line numbering is used. 2 Enter the name of the unit, department, site to which the property or liabilities being inspected belongs. If the object being inspected does not belong to a specific division, and the inventory in relation to it is carried out for the entire enterprise, then it is written “as a whole for the organization” - for example, deferred expenses, accounts payable or receivable, financial investments.

Changes in the work plan of the State Budgetary Institution IMC

You can download the form corresponding to the INV-23 form approved by Goskomstat on our portal. The document available to you is presented in a convenient Word format.

In this case, the unified statement INV-26 is a primary accounting document . It will be used by the accounting department:

- to write off shortages within the limits of natural loss (if we are talking about goods that may lose weight during storage);

- to attribute shortages to financially responsible persons (deductions will be made from wages);

- for capitalization of surplus (the unified form will be used when determining the profit tax base);

- to fill out accounting registers;

- for reporting.

For more information about the standards of procedure and the sequence of stages of preparation and the process itself, see the section “carrying out an inventory.” The service itself can be ordered by calling the Interprime agency listed on our website.

Our website allows for an inventory list, which will allow you to exercise control over the inventory assets of the enterprise. There is an example of filling out a document taking into account current requirements. The specialist will help you find samples of other documentation, advise on how to fill them out correctly and answer your questions.

The manager can initiate not only planned, but also unscheduled inventory. Cases when financial monitoring is possible are listed in paragraph 27 of Order of the Ministry of Finance No. 34n, adopted on July 29, 1998. The following cases are indicated there:

- soon it is necessary to prepare a tax report for the year;

- there has been a change in the financially responsible person in the organization (this includes cases when property assets are transferred to a third party);

- the organization suffered from an emergency - fire, flood or other disaster;

- there was a suspicion of theft or damage to property.

Lease agreement for land, land share, plot → Sample. Agreement on the provision of a plot of land for use on a lease basis in the city.

Inventory and materials become the property of the organization when they are purchased, according to the contract, from the seller and are accounted for on the basis of invoices on the buyer’s balance sheet. If materials or goods have already been purchased, but they have not yet arrived, then they are called goods and materials in transit.

Column 5 indicates the date of actual expenses incurred if they are one-time (one-time), or the date of completion of work if they are related to work on the development of new equipment, production and other work carried out over a certain period of time.

Sample of filling out an inventory report INV-6

The act must include general information about the organization that is conducting the inventory, the period of the inspection, the type of property being inspected - inventory items that are in transit. Date of inventory.

In the tabular section, general information about inventory items in transit is filled in, indicating the following data:

- Name;

- unit of measurement;

- date of shipment by the seller;

- information about the seller;

- information from settlement and payment or shipping documents on quantity, price, cost, indicating the details of the document on the basis of which the data in the inventory report is filled out;

- information from accounting for the same items of inventory.

As a rule, organizations use automated accounting systems for accounting indicators, and therefore the act is prepared taking into account the data contained in this program. Often, members of the inventory commission only have to fill out the data from the documents confirming payment for goods and materials or accompanying them in transit, and also sign the specified data.

Documentary and accounting data are compared in the act; if discrepancies are identified, then there is no need to additionally transfer them to the matching sheets, since the comparison is carried out directly in the act itself, which in this case includes the functions of the matching sheet.

The inventory report INV-6 is signed by each member of the inventory commission. One copy of the act should be submitted to the accounting department, the accountant who accepted and checked the completed inventory act on the way, puts his signature at the bottom of the form.

Sample for free download

Inventory report of goods and materials in transit form form INV-6 - .

Inventory report of goods and materials in transit, sample of filling out INV-6 - .

Property owned by the organization is subject to inventory. It doesn’t matter whether it is in the organization’s warehouse, in the warehouses of other organizations, or in transit. A feature of the inventory of inventory items that have not yet arrived at the organization is that it is impossible to determine their actual presence; you can only check how valid the data on “unarrived” inventory items are in accounting. To complete such a check, use the INV-6 form, a sample of which we will consider.

Inventory report

The inventory act is one of the most important documents, drawn up by the inventory commission in a special established form, approved by the relevant resolution, and is nothing more than documented confirmation of the actual presence of all material assets of the company, its cash and forms, existing records in the relevant registers maintained on accounting company.

At the same time, inventory acts may well have forms and contents that differ from each other, for example, the following documents are different in format: a cash register inventory act, an act of checking debt for shortages and thefts, an inventory act of settlements with customers, suppliers, as well as other creditors and debtors , an act of inventory of materials and goods in transit, or, for example, an act of inventory of future expenses. Each of these acts has its own approved form of the established form.

Inventory forms

Inventory forms are something that no inventory can do without, carried out according to the rules and modern standards, and each stage of its implementation has its own form with its own approved document form.

We have tried to collect in one section all the forms of necessary documents for recording inventory results for enterprises; here you can find and download all the basic and necessary samples of inventory documents : inventory act , inventory list, matching sheet, and other inventory forms .

Approved forms of documents related to the inventory: acts and inventory forms, inventory, statements and samples of other documents

Note: all forms and inventory reports presented in this section are approved by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88

| Shape index | Document Format | Name | Archive format |

| Form INV-1 | inventory | Inventory list of fixed assets | .rar (.xls + .jpg) |

| Form INV-1a | inventory | Inventory list of intangible assets | .rar (.xls + .jpg) |

| Form INV-2 | label | Inventory label | .rar (.xls + .jpg) |

| Form INV-3 | inventory | Inventory list of inventory items | .rar (.xls + .jpg) |

| Form INV-4 | Act | Inventory report of shipped inventory items | .rar (.xls + .jpg) |

| Form INV-5 | inventory | Inventory list of inventory items accepted for safekeeping | .rar (.xls + .jpg) |

| Form INV-6 | Act | Act of inventory of inventory items in transit | .rar (.xls + .jpg) |

| Form INV-8 | Act | Inventory act of precious metals and products made from them | .rar (.xls + .jpg) |

| Form INV-8a | inventory | Inventory inventory of precious metals contained in parts, semi-finished products, assembly units (assemblies), equipment, instruments and other products | .rar (.xls + .jpg) |

| Form INV-9 | Act | Act of inventory of precious stones, natural diamonds and products made from them | .rar (.xls + .jpg) |

| Form INV-10 | Act | Inventory report of unfinished repairs of fixed assets | .rar (.xls + .jpg) |

| Form INV-11 | Act | Act of inventory of future expenses | .rar (.xls + .jpg) |

| Form INV-15 | Act | Cash inventory report | .rar (.xls + .jpg) |

| Form INV-16 | inventory | Inventory list of securities and forms of strict reporting documents | .rar (.xls + .jpg) |

| Form INV-17 | Act | Act of inventory of settlements with buyers, suppliers and other debtors and creditors | .rar (.xls + .jpg) |

| Form INV-18 | statement | Comparison statement of the results of inventory of fixed assets | .rar (.xls + .jpg) |

| Form INV-19 | statement | Comparison sheet of inventory inventory results | .rar (.xls + .jpg) |

| Form INV-22 | order | Order (decree, order) to conduct an inventory | .rar (.xls + .jpg) |

| Form INV-23 | magazine | Logbook for monitoring the implementation of orders (decrees, instructions) on inventory | .rar (.xls + .jpg) |

| Form INV-24 | Act | Act on the control check of the correctness of the inventory of valuables | .rar (.xls + .jpg) |

| Form INV-25 | magazine | Logbook for control checks of the correctness of inventories | .rar (.xls + .jpg) |

For more information about the standards of procedure and the sequence of stages of preparation and the process itself, see the section “carrying out an inventory.” The service itself can be ordered by calling the Interprime agency listed on our website.

https://youtu.be/1TajQzyVU_w

ORDER AN INVENTORY

Source: https://xn--80ajigpcphbq.xn--p1ai/%D0%B0%D0%BA%D1%82-%D0%B8%D0%BD%D0%B2%D0%B5%D0%BD% D1%82%D0%B0%D1%80%D0%B8%D0%B7%D0%B0%D1%86%D0%B8%D0%B8-%D0%B1%D0%BB%D0%B0%D0 %BD%D0%BA%D0%B8/

On the obligation to maintain form INV-23

Students who successfully complete the program are issued certificates of the established form. Students who successfully complete the program are issued certificates of the established form. Having considered the issue, we came to the following conclusion: 1. The order to conduct an inventory does not indicate a specific number, but the period of the inventory, the start and end date. Inventory records reflect the accounting balances as of the initial date of the inventory.

The current legislation does not provide for the mandatory completion of the “Note” column in inventory records if this is not necessary. Public sector institutions draw up primary documents according to the forms established in accordance with budget legislation.

The current regulatory documents do not establish the obligation to fill out the “Note” column in inventory records. Rationale for the conclusion: In terms of organizing and maintaining accounting, budgetary institutions must be guided by the following regulations: - Federal Law “On Accounting” dated At the same time, when developing an inventory procedure, the norms of the Methodological Guidelines for Inventory of Property and Financial Liabilities, approved by order of the Ministry of Finance, are used Russia from Note that the procedure for conducting an inventory must be established by the accounting policy of the institution in the form of a section of the accounting policy or an appendix to it.

This requirement is established in part. Mandatory inventory is established by the legislation of the Russian Federation, federal and industry standards of the letter of the Ministry of Finance of Russia from According to paragraph. Inventory should be carried out in relation to any accounting objects, including off-balance sheet accounts. The obligation to conduct an inventory of assets and liabilities before drawing up annual reports is also determined by paragraph.

As a general rule, the results of the inventory are reflected in the accounting and financial statements of the month in which the inventory was completed. An exception to this rule is the inventory carried out for the purpose of preparing annual financial statements. So, in paragraph. That is, even if the inventory commission signed the protocols and acts of the annual inventory in January, its results must be taken into account when preparing reports for the past year.

Previously, the wording “before compilation” was used and on this basis some inspectors did not recognize the inventory materials signed in January as documents confirming the accuracy of the annual report. Regulatory acts do not regulate the timing of inventory. The institution independently determines the start and end date of the inventory based on its structure and the volume of assets and liabilities subject to inventory.

As for the annual inventory, the main condition is that the inventory should begin no earlier than October 1 and be completed before the end of the financial year, that is, before December 31 inclusive. The order of the institution approves the period for conducting the inventory and the inventory commission of the commission.

The chairman and members of the inventory commission must sign in the journal confirming their familiarization with the order. For example, in accordance with the order of the institution, the inventory begins on November 30 and ends on December 11 of the current year. Accordingly, as of November 30, the inventory records will indicate the balances according to accounting data.

This day is the start date of the inventory, but its results should be reflected in the accounting records upon completion of the inventory on December 11. Before checking the actual availability of property and other accounting items, including on off-balance sheet accounts, the inventory commission receives the latest receipts and expenditure documents and or reports on the movement of material assets and cash at the time of inventory.

On this basis, accounting determines the balance of property at the beginning of the inventory according to the accounting data. During the inventory period, the institution may receive valuables, as well as their disposal. In this case, information about such movement should be entered in separate inventories. Based on part. Thus, at present, a budgetary institution must necessarily use unified forms: - requirements for the execution of which are provided for by the provisions of the order of the Ministry of Finance of Russia dated In other cases, forms developed by the institution independently may be used; the procedure for their application and completion must be provided for by the accounting policy.

Based on inventory lists of comparison sheets, and in case of discrepancies - Statement of discrepancies based on inventory results f. The act is submitted for review and approval to the head of the institution with the attachment of inventory documents. Thus, the following conclusions can be drawn: 1. At the same time, in the order to conduct an inventory, it is not necessary to indicate the phrase “conduct an inventory on such and such a date.” You can determine the start and end dates of the survey and the list of inventory items, not forgetting the wording “for the purpose of preparing” financial statements.

Remains should be removed and inventory lists should be generated on the initial date of the inventory for a certain type of property of the institution, and the results should be documented in the Inventory Results Act f. Inventory is carried out by the institution in the manner determined by its accounting policy, taking into account the provisions of the legislation of the Russian Federation, as well as the characteristics of the types of activities it carries out and the objects being inventoried. When setting the timing of the inventory, it is recommended to take into account the timing provided by the founder.

We also recommend that you familiarize yourself with the following material: — Encyclopedia of solutions. How to organize and conduct an inventory for the public sector. The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service. This norm does not contradict the provisions of current regulatory legal acts on accounting in public sector institutions.

Therefore, a budgetary institution has the right to establish in its local act a provision on the procedure for conducting an inventory of property and financial obligations in terms of fixed assets, selectively conducting an inventory at intervals of once every three years, no earlier than October 1 of the reporting year.

Please note that a special norm for conducting an inventory is not provided for annually by the Methodological Instructions only for fixed assets and library collections. Consequently, an inventory of intangible and non-produced assets before preparing annual financial statements is carried out annually.

Advanced training program “On corporate orders” Federal Law from News and analytics Legal consultations Accounting in the budgetary sector Should the federal state budgetary educational institution, hereinafter referred to as the Federal State Budgetary Educational Institution, in the order to conduct an inventory indicate “conduct an inventory on such and such a date”, if in a unified form N INV there is no such detail according to the order of the Ministry of Finance, the institution is obliged to carry out an inventory before the annual reporting in the period from On what date to remove accounting balances, on what date to make inventory lists The Federal State Budgetary Educational Institution has a large list of assets on one day the inventory cannot be carried out?

Is it necessary to fill out an inventory note for each inventory item and item number? If so, what does the note indicate? Should the federal state budgetary educational institution further - FSBEI in the order to conduct an inventory indicate “conduct an inventory on such and such a date”, if in the unified form N INV there is no such detail according to the order of the Ministry of Finance, the institution is obliged to conduct an inventory before the annual reporting in the period from

Debt inventory report, sample

Document section: Document samples, Inventory

Download “Inventory list of settlements with buyers, suppliers and other debtors and creditors”

Download “Inventory list of settlements with buyers, suppliers and other debtors and creditors”

Source of documents in the “Inventory” section: https://dogovor-obrazets.ru/sample/Inventory

We also recommend looking at:

INVENTORY LIST N ______________ settlements with buyers, suppliers and other debtors and creditors ———¬ ¦ CODES ¦ +——-+ OKUD form ¦0504089¦ +——-+ dated “__” ________ 200_ Date ¦ ¦ +— —-+Institution ________________________________ according to OKPO ¦ ¦ +——-+Unit of measurement: rub. according to OKEI ¦ 383 ¦ L———

———¬ ———¬Order (instruction) number ¦ ¦ date ¦ ¦ taking inventory: L——— L———

Place of inventory _____________________________________

———¬ Inventory start date ¦ ¦ L———

———¬ Inventory end date ¦ ¦ L———

Place of inventory __________________________________Name of payment type _______________________________________

By the time the inventory begins, all budget funds are confirmed by bank statements and debt approval documents.

Conclusion of the commission ________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Chairman of the commission _______________ _____________ _____________________ (position) (signature) (signature transcript)

Members of the commission: ______________ _____________ _____________________ (position) (signature) (signature transcript) _____________ _____________ _____________________ (position) (signature) (signature transcript) _____________ _____________ _____________________ (position) (signature) (signature transcript) _____________ _____________ _____________________ (position) (signature ) (full name)

“__” ____________ 200_

Form 0504089 p.

Inventory act of settlements with buyers and suppliers: sample

2

According to budget accounting data, the following was established:

1. Accounts receivable

————-T————T—————————————- Name¦Account number¦ Amount of debt on the debtor’s balance sheet ¦ +——T—————————— —- ¦ ¦total¦ including ¦ ¦ +———T————T———— ¦ ¦ ¦confirmed-¦not confirmed-¦with expired ¦ ¦ ¦denied ¦expired ¦ ¦ ¦debitors ¦pressure ¦ ¦rams ¦ ¦ness————-+————+——+———+————+———— 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6————-+————+——+———+————+———-¦ ¦ ¦ ¦ ¦ ¦ ¦+————+———— +——+———+————+———-+¦ ¦ ¦ ¦ ¦ ¦ ¦+————+————+——+———+————+—— —-+¦ ¦ ¦ ¦ ¦ ¦ ¦+————+————+——+———+————+———-+¦ ¦ ¦ ¦ ¦ ¦ ¦+———— +————+——+———+————+———-+¦ ¦ ¦ ¦ ¦ ¦ ¦L————+————+——+———+—— ——+———-+ Total ¦ ¦ ¦ ¦ ¦ L——+———+————+————

2. Accounts payable

————-T————T—————————————- Name¦Account number¦ Amount of debt on the balance sheet of the creditor ¦ +——T—————————— —- ¦ ¦total¦ including ¦ ¦ +———T————T———— ¦ ¦ ¦agree- ¦disagree- ¦with expired ¦ ¦ ¦bathroom with ¦bathroom with ¦expired ¦ ¦ ¦creditors ¦pressure ¦ ¦ ¦rams ¦ ¦ness————-+————+——+———+————+———— 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6————-+————+——+———+————+———-¦ ¦ ¦ ¦ ¦ ¦ ¦+————+———— +——+———+————+———-+¦ ¦ ¦ ¦ ¦ ¦ ¦+————+————+——+———+————+—— —-+¦ ¦ ¦ ¦ ¦ ¦ ¦+————+————+——+———+————+———-+¦ ¦ ¦ ¦ ¦ ¦ ¦+———— +————+——+———+————+———-+¦ ¦ ¦ ¦ ¦ ¦ ¦L————+————+——+———+—— ——+———-+ Total ¦ ¦ ¦ ¦ ¦ L——+———+————+————

The table provides general data on debts, as well as supporting documents. The basis for reference is primary accounting, which includes documents on accepted work, invoices, reconciliations, and invoices issued. It happens that several accounts serve as the basis. In this case, all numbers and dates are indicated in columns 8 and 9, although the amount for the counterparty remains total.

— several payment orders for one debt Please note that the certificate does not define the final figures, since both debit and credit obligations are placed in the form. Amounts are displayed only in INV-17. It is not necessary to put dashes in empty lines. If there are not enough rows in the table, you can increase their number by adding a row to the table. The same applies to the main act.

Sample of filling out form inv-17

The inventory of settlements with debtors and creditors is accompanied by the execution of an act in the standard form INV-17. This act is prepared in two identical copies - for the commission and the accounting department. Data in the INV-17 act is entered by members of the inventory commission appointed by order of the director of the company.

Important

Responsible persons of the commission enter into the INV-17 form information about the balances of accounts reflecting mutual settlements with debtors and creditors (suppliers, buyers and other counterparties).

All members of the commission must sign the completed act form, after which one copy must be submitted to the accounting department, which will check the correctness of the INV-17 form.

The completed report form must be kept for five years.

The act of inventory of settlements with suppliers and buyers can be found at the bottom of the article, where we also suggest filling out INV-17.

Help for inv-17 (filling sample)

Attention

Upon completion of filling out, the commission certifies the act with its signatures. You can fill out the INV-17 form and its attachments with us. act of inventory of settlements with suppliers and customers.

Form and form INV-17 Download sample forms for inventory at the enterprise:INV-1 Inventory listINV-1a Inventory list of intangible assetsINV-3 Entering data into the inventory listINV-4 Inventory of shipped goods and materialsInv-5 Inventory of goods and materials accepted for storageInv-6 Inventory of goods and materials located on the wayINV-15 Inventory of cash availabilityINV-18 Comparison sheet of inventory resultsINV-19 Comparison sheet TMSINV-22 Order for inventoryINV-26 Accounting for inventory resultsHow is an inventory of materials carried out? Rate the quality of the article.

Inventory report of settlements with debtors and creditors inv-17

The certificate is a mandatory addition to the INV-17 act and serves as the basis for drawing up the inventory act itself. The certificate explains the amount of debt for each debtor and creditor, the reason for its occurrence, the date the debt arose, and its amount. Unlike the inventory report, the certificate is drawn up in one copy and is also stored for five years.

An example of filling out the INV-17 act and a certificate for it can be downloaded below.

Free legal assistance

Inventory report of settlements with debtors and creditors, form INV-17 form - download. Act sample of filling out INV-17 - download. Help for the INV-17 act - download.

Help sample filling - download.

Inventory of settlements with buyers and suppliers according to form inv-17

Info

To reflect information on transactions with suppliers and other persons as accurately as possible, a special form INV-17 is used. Before filling out the INV-17 act, you must complete a certificate application. It can be found here. This document contains the necessary information on creditors and other persons, as well as their contacts.

In addition, the application certificate contains information about the reason for the debt, date, quantity, and documentation on which it appeared. Only after completing the completion of filling out the appendix to the INV-17 form is an act of “inventory” of transactions with suppliers and other persons completed.

These applications and the act can be found here. Act of inventory of settlements with suppliers and customers. The process of filling out the form Only upon completion of filling out the annex to the INV-17 form is an act of “inventory” of transactions with suppliers and other persons completed.

Unified form No. inv-17 - form and sample

Form INV-17 is an “inventory” act used to display information about transactions with suppliers or other persons. A certificate appendix is attached to this document; it is the basis for drawing up the inventory report INV-17. You can use the INV-17 form, certificates and all kinds of applications.

This documentation is completed by a special inventory commission. This commission is implemented on the basis of an order, which is drawn up in the INV-22 form. As a result, 2 copies of the act are filled out.

The first form is handed over to the chief accountant, the second remains.

During the “inventory” of debts (receivables and payables), it is necessary to carry out a verification analysis of transactions with personnel, funds, suppliers and customers, in general, with all participants.

Debt inventory: reconciliation of settlements with counterparties

This facilitates not only the correct completion of the balance sheet, but also the timely identification of inconsistencies between accounting data and information available to counterparties.

Unified form according to OKUD 0504089

Approved by Order of the Ministry of Finance of the Russian Federation

dated December 15, 2010 N 173n

1 INVENTORY LIST N —— settlements with buyers, suppliers and other debtors and creditors ———— ¦ CODES ¦ +———-+ OKUD form ¦ 0504089 ¦ January 11, 13 +———-+ from “—” —— - 20— Date ¦11.01.2013¦ Federal State Institution “Zvezda” +———-+ Institution ——————————————— according to OKPO ¦ 01234567 ¦ +———-+ Unit of measurement : rub.

according to OKEI ¦ 383 ¦ ———— Order (instruction) on —————— ———— inventory: number ¦ 1-inv ¦ date ¦11/20/2012¦ —————— ———— office N 7 Place of inventory ———————- ———— Start date of inventory ¦11.01.2013¦ ———— ———— End date of inventory ¦11.01.

2013¦ ———— Place of inventory ___________________________________________ settlements with accountable persons Name of type of settlement ———————————————— By the beginning of the inventory, all budget funds were confirmed by bank statements and debt reconciliation documents.

Conclusion of the commission: When conducting an inventory of settlements with accountable ————————————————————————— persons, the amount of receivables amounted to 160,000.00 rubles, the amount ——— —————————————————————— Accounts payable - RUB 8,200.00, which corresponds to accounting data.

————————————————————————— Unconfirmed (agreed) debt and expired debt ———————————————— ————————— No statute of limitations has been identified. —————————————————————————— Deputy. head of the institution Charkov A.V.

Unified form INV-17 “Act of inventory of settlements with suppliers and customers” + sample

Chairman of the commission ————- ___________ ———————— (position) (signature) (signature transcript) Chief accountant Nalimov O.V. Members of the commission: ————- ___________ ———————— (position) (signature) (signature transcript) Senior engineer Brovko I.V. ————- ___________ ———————— (position) (signature) (signature transcript) Economist Burova E.A.

————- ___________ ———————— (position) (signature) (signature transcript) January 11, 13 “—” ——— 20— Form 0504089 p. 2 According to accounting data, the following is established: 1.

Accounts receivable ————————————————————————————————— Name¦ Account number ¦ Amount of debt on the debtor’s balance sheet ¦ +——— ———————————————— ¦ ¦ total ¦ including ¦ ¦ +————————————————- ¦ ¦ ¦ confirmed¦ not ¦ with expired ¦ ¦ ¦ by debtors ¦ confirmed by the limitation period ¦ ¦ ¦ by debtors ¦ limitation —————+—————————+———-+—————+—————+ ————— 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ —————+—————————+———-+—————+—————+ —————+ ¦Kozlov K.K. ¦99908014409900111120822560¦ 30,000.00¦ 30,000.00 ¦ — ¦ — ¦ +————-+—————————+———-+—————+————— +—————+ ¦Mikhailov M.M.¦99908014409900111120831560¦ 90,000.00¦ 90,000.00 ¦ — ¦ — ¦ +————-+—————————+——— -+—————+—————+—————+ ¦Tarasov T.T. ¦99908014409900111120822560¦ 40,000.00¦ 40,000.00 ¦ — ¦ — ¦ —————+—————————+———-+—————+—————+ —————+ Total ¦160,000.00¦ 160,000.00 ¦ — ¦ — ¦ ————+—————+—————+————— 2. Accounts payable —— —————————————————————————————— Name¦ Account number ¦ Amount of debt on the balance sheet of the creditor ¦ +———————— ——————————- ¦ ¦ total ¦ including ¦ ¦ +———————————————— ¦ ¦ ¦agreed¦ not agreed¦ with expired ¦ ¦ ¦ with creditors ¦ with creditors ¦ limitation period ¦ ¦ ¦ ¦ ¦ limitation ————-+—————————+——-+————-+——————+——— —— 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ ————-+—————————+——-+————-+——————+——— ——+ ¦Demidov D.D.¦99908014409900111120822560¦8200.00¦ 8200.00 ¦ — ¦ — ¦ +————+————————+——-+————-+ ——————+—————+ ¦ — ¦ — ¦ — ¦ — ¦ — ¦ — ¦ +————+—————————+——-+———— -+——————+—————+ ¦ — ¦ — ¦ — ¦ — ¦ — ¦ — ¦ ————-+—————————+——-+—— ——-+——————+—————+ Total ¦8200.00¦ 8200.00 ¦ — ¦ — ¦ ———+————-+——————+—— ———

Source: https://3zprint-msk.ru/akt-inventarizacii-zadolzhennosti-obrazec/

| This form of inventory list is formed based on the results of the inventory of materially responsible persons of the organization for compliance of the actual availability and declared characteristics of fixed assets with accounting data. The inventory list is drawn up in two copies and signed by members of the commission and materially responsible persons separately for each storage location. For fixed assets leased, an inventory is drawn up in triplicate separately for each lessor. Form INV-1. Instructions for filling Form INV-1a. Inventory list of intangible assetsThis form of inventory is formed based on the results of an inventory of materially responsible persons of the organization to determine whether the actual presence of intangible assets corresponds to accounting data. When making an inventory of intangible assets, the availability of documents confirming the organization’s rights to use it and the correctness of its reflection in the organization’s balance sheet is checked. The inventory list is drawn up in two copies and signed by members of the commission and materially responsible persons. Form INV-1a. Instructions for filling Form INV-3. Inventory list of inventory itemsThis form of inventory is formed based on the results of an inventory of inventory items in the organization’s storage areas (reported to materially responsible persons) to ensure that the actual availability of assets matches the accounting data. The inventory list is drawn up in two copies and signed by members of the commission and materially responsible persons. Relevant reports are drawn up for unusable or damaged materials and finished products identified during inventory. Form INV-3. Instructions for filling This form of act is formed based on the results of the inventory of unfinished repairs of fixed assets (buildings, structures, machinery, equipment, etc. ) for compliance of actual costs and accounting data. The inventory report is drawn up in two copies and signed by members of the commission and financially responsible persons. One copy is transferred to the accounting department, the other - to financially responsible persons. Form INV-10. Instructions for filling Form INV-11. Act of inventory of future expensesThis form of the act is formed based on the results of an inventory of future expenses to ensure that actual costs, confirmed by primary accounting documents, correspond to accounting data. The inventory report is drawn up in two copies and signed by the responsible members of the commission. One copy is transferred to the accounting department, the other remains with the commission. Form INV-11. Instructions for filling Form INV-15. Cash inventory reportThis form of the act is formed based on the results of an inventory of the organization’s cash register to ensure compliance with the actual availability of funds, stamps, check books, etc. with accounting data. The act is drawn up in two copies (except for the situation with a change of financially responsible persons) and signed by all members of the commission and persons responsible for the safety of valuables. Form INV-15. Instructions for filling This form of inventory list is formed based on the results of the inventory of materially responsible persons of the organization for compliance of the actual availability, securities and forms of strict reporting documents with accounting data. The inventory is compiled in two copies and signed by members of the inventory commission and materially responsible persons. When there is a change in financially responsible persons, the inventory is drawn up in triplicate. Form INV-16. Instructions for filling Form INV-17. Act of inventory of settlements with buyers, suppliers and other debtors and creditorsThis form of the act is formed based on the results of an inventory of settlements with buyers, suppliers and other debtors and creditors for compliance with actual receivables and payables, confirmed by primary accounting documents, and accounting data. The inventory report is drawn up in two copies and signed by the members of the commission. One copy is transferred to the accounting department, the other remains with the commission. Form INV-17. Instructions for filling Form INV-18. Comparison statement of the results of inventory of fixed assetsThis form of comparison statement is generated to reflect the results of the inventory of fixed assets and intangible assets for which deviations from accounting data have been identified. The matching statement is drawn up in two copies by the accountant. One copy is kept in the accounting department, the second is transferred to the financially responsible person. Form INV-18. Instructions for filling Form INV-19. Comparison sheet of inventory inventory resultsA comparison sheet in the INV-19 form is generated to reflect the results of the inventory of inventory items for which deviations of actual indicators (quantities, amounts) from accounting data have been identified. The matching statement is drawn up in two copies by the accountant. One copy is kept in the accounting department, the second is transferred to the financially responsible person. Form INV-19. Instructions for filling Form INV-22. Inventory orderAn order in the INV-22 form is a written task specifying the content, volume, procedure and timing of the inventory of the inspected object, as well as the personal composition of the inventory commission. The order is signed by the head of the organization and handed over to the chairman of the inventory commission. Form INV-22. Instructions for filling Form INV-23. Logbook for monitoring the implementation of inventory ordersThe journal in the INV-23 form is used to document inventory and control checks of the correctness of the inventory. This journal records orders for inventory, drawn up in the INV-22 form. Form INV-23. Instructions for filling Form INV-24. Act on the control check of the correctness of the inventory of valuablesThe results of control checks of the correctness of the inventory are drawn up in an act in the form INV-24 and are registered in the Logbook of control checks of the correctness of the inventory in the form INV-25 Form INV-24. Instructions for filling |