Receipt of materials

In accordance with paragraph 2 of section. 2 guidelines for accounting of inventories, approved by Order of the Ministry of Finance dated December 28, 2001 No. 119n, the concept of “materials” includes a wide range of enterprise inventories with a useful life of less than a year. Materials include:

- raw materials necessary for the production of semi-finished or finished products;

- auxiliary materials that are not included in the finished product, but are used to ensure the operability of the equipment, as well as any technological needs;

- fuels and lubricants;

- spare parts;

- container;

- purchased semi-finished products;

- waste production;

- others.

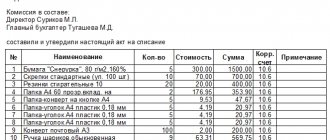

In an organization that has warehouses, the manager’s order approves a list of materially responsible persons (MRPs) responsible for the safety and maintenance of warehouse records of materials for each warehouse.

Inventory and materials received from suppliers have a set of shipping documentation, represented by an invoice (form TORG-12, M-15 or another accepted by the supplier), an invoice, a waybill, and a specification. Of these, the invoice serves as the basis for capitalization. In the absence of shipping documents, materials can also be capitalized.

Read about the rules for such posting in the article “How to post goods without accompanying documents?”

Upon acceptance, materials must be checked for compliance of the actual quantity, quality and assortment with the data stated in the supplier’s accompanying documents.

If no discrepancies were identified during the verification process, the MOL issues a receipt order in Form M-4. It is allowed to put a stamp on the supplier's documents instead of receipt orders. The stamp must reflect all M-4 details.

If, after the inspection, discrepancies are still identified, it is necessary to issue a statement of discrepancies in the TORG-2 form.

For the form and sample of filling out this form, see the material “Unified form TORG-2 - form and sample” .

Another way to receive materials is their purchase by accountable persons at retail outlets. In this case, the primary source is invoices or sales receipts attached to the expense report.

Main features of the program:

- The program can be translated into any language convenient for you.

In addition, you can work with several languages at once. Any language - You can sell any product, conveniently classifying everything at your discretion

Any product

- For clarity, you can save an image of each product by capturing it from a web camera. It will also be displayed when making a sale.

Product photo

- The program can work with any number of departments and warehouses. All branches will work in a single database via the Internet

Warehouses and shops

- You can easily enter initial balances using the import function from modern electronic formats

Import

- The program can notify the right employees about important processes or matters: for example, that a certain product is running out of stock

Alerts

- Our program can work with many types of retail and warehouse equipment

Equipment - Integration with TSD will help optimize the operation of large warehouses, provide your employees with mobility, and make it easier to carry out an inventory of all

TSD - At any time, you can conduct an inventory of any warehouse by instantly downloading the planned quantity from your program and comparing it with the actual quantity using a barcode scanner or TSD

Inventory - When selling, various documents may be generated.

The receipt can be printed with or without fiscalization on a regular receipt printer Documents - You will have a unified database of contractors and suppliers with all the necessary contact information

Counterparty database

- You will be able to send bulk SMS messages or set up the sending of individual messages

SMS mailing - Email distribution will allow you to send any electronic document to your counterparty

Email

- The program will even be able to make a call on behalf of your organization and communicate any important information to the counterparty by

voice Voice mailing - All payments made will be under your full control

Payment statistics

- The report will show which of the suppliers you have not yet fully paid off with

Debts

- You can find out all sales statistics for each legal entity separately

Legal faces

- The program will help you find the most profitable branch of your chain of stores

Chain of stores

- All financial movements will be under your complete control. You can easily track what you spend the most money on for any period

Cost control

- The program will show any movements of goods and balances for each warehouse and branch for the specified period

Inventory control

- You will find out which products are in high demand

Popular product

- Thanks to the statistics of requests for products that are not in the assortment, you will be able to make an informed decision on expanding your product range

Did not have

- The program will tell you what goods need to be purchased and allow you to automatically generate a request

Minimum

- Using the analysis of stale goods, you can optimize warehouse resources

Stale goods

- The goods supply forecast will help you always have the right amount of the most popular items

Forecast

- The supplier report will show the best prices and data on recent purchases

Supplier Analysis

- Integration with the latest technologies will allow you to shock your clients and deservedly gain the reputation of the most modern company

Exclusivity

- The ultra-modern function of communication with a PBX will allow you to see the caller’s data, shock the client by immediately addressing him by name, and not waste a second searching for information

Telephony - The necessary data can be uploaded to your website to monitor the status of the order, display the balance of goods in a warehouse or branch and prices - there are many possibilities!

Website integration - Use a telegram robot so that your customers can independently submit requests or receive information on their orders from your

Telegram bot - A special program will save a scheduled copy of all your data in the program without the need to stop working in the system, automatically archive and notify you when it is ready

Backup - The scheduling system allows you to set up a backup schedule, receive important reports strictly at a certain time, and set any other actions of the

Scheduler - Our organization, taking care of its customers, has developed an official mobile application that will speed up and simplify doing business.

Employee app - The mobile application is convenient to use for customers who regularly interact with the company regarding its services and/or products in which customers are constantly interested.

Application for clients - The Modern Manager's Bible is an addition to the program for directors who consider themselves professionals or want to become one.

BSR - Reliable control will be ensured by integration with cameras: the program will indicate data on the sale, payment received and other important information in the captions of

the video stream. Video surveillance - You can quickly enter the initial data necessary for the program to work. This is done using convenient manual data entry or import.

Fast start

- We have added many beautiful templates to make working in our program even more enjoyable

Beautiful design

- The program interface is so easy that even a child can quickly figure it out.

Easy program

Order now

Language of the basic version of the program: RUSSIAN

You can also order an international version of the program, into which you can enter information in ANY LANGUAGE of the world. You can even easily translate the interface yourself, since all the names will be placed in a separate text file.

A materials balance sheet helps company management quickly receive data on the need for procurement. Thanks to modern technologies, this process can be easily automated. In the software, in the statement of accounting balances, it is possible to sort and group values. Thus, it will be immediately clear which goods are in excess and which ones are running low.

A record of warehouse balances in an automated program is maintained throughout the entire business activity. For each group, the available assortment is monitored and the expiration date is determined. Expired material must be avoided to avoid non-production costs. The planning department uses warehouse material balance sheets to calculate the approximate volume of purchases. In accordance with the planned target, a supplier is determined at an acceptable price to meet the expense schedule.

The “Universal Accounting System” is used in any industry. It is being implemented in manufacturing, cleaning, construction and other organizations. This software maintains total control over the balance of goods in warehouses. For each type, a separate statement is generated, which indicates the material, article, quantity and other additional data. All warehouses are entered into the system so that you can quickly move between them.

The list of remaining materials in the warehouse is filled out automatically based on the created invoice requirements. The storekeeper determines the remaining material using the program and authorizes issue. An inventory of objects is systematically carried out, where actual values are compared with accounting records. There may be shortages or surpluses. At best, the data should be identical. Thus, it shows that the employees' work is smooth and accurate.

The “Universal Accounting System” generates financial statements, maintains books and journals, helps calculate amounts and analyze the factors that influenced the financial result. The resulting data influences management decisions. Using the balance sheet, you can determine how much you need to purchase for the normal functioning of the organization. It is necessary to have a minimum amount of inventory. Excess can quickly deteriorate and become unclaimed. To do this, they monitor the industry and determine the needs of the population. This affects internal accounting.

The balance sheet consists of several columns, where the name of the object, its quantity, supplier and responsible person are recorded in chronological order. A separate entry is made for receipts and expenses. To ensure accurate and reliable data, you need to check the documentation and actual availability before registering. For some materials, misgrading, drying out or shrinking may occur during work. For special groups, it is necessary to make purchases strictly only when necessary, as this affects the final profit. Every organization strives to optimize its costs and increase income. In this way, it is possible to achieve a stable position in the market.

Organization of warehouse accounting of materials

Accounting for inventory items in the accounting department and in the warehouse can be carried out using the quantitative-total and balance method.

When using the 1st option, both in warehouses and in accounting departments, inventory records are kept by quantity and amount simultaneously.

If the accounting policy has approved the balance method, then in the warehouse inventory items are taken into account by quantity, and in the accounting department - in total terms.

Maintaining warehouse records of materials is possible in 2 ways: batch and grade.

- Batch method.

In this case, each batch of inventory items is stored separately. Batch is homogeneous material received according to 1 document. For each batch, MOL issues a batch card in 2 copies: 1st - for the warehouse, 2nd - for the accounting department. The form is approved by the company independently, depending on the type of inventory.

In the incoming part of the document, data is entered according to the primary document received from the supplier, in the outgoing part - data on the fact of write-off of materials. After the complete release of the entire batch of goods and materials, the batch card is closed, the MOL draws up an act of consumption of goods and materials and transfers the entire package of documents to the accounting department for verification.

- Varietal method.

Warehouse accounting of materials in this way is carried out by names and grades of goods and materials, regardless of the date of receipt and price. For each name of material, a materials accounting card (form M-17) is created, which is registered in a special accounting register. This card is maintained throughout the year.

When maintaining warehouse records using the sort method, warehouse space is used economically and material balances are easily managed. However, it is not possible to track the price of receipt of goods and materials, and the material is written off at the average cost using the FIFO method or at the unit price (clause 73 of order No. 119n).

Read more about the M-17 form in the article “Material Warehouse Card - Form and Sample.”

In organizations that take into account materials using the operational accounting (balance) method of accounting, a Sheet of accounting for the balance of materials in the warehouse is maintained (form No. M-14).

The balance sheet is filled out according to the data from warehouse cards verified by the accounting department. The correctness of the transfer of balances to the statement is confirmed by the signature of the inspector. [p.135] Essentially, with automated processing of data on the accounting of raw materials and supplies, the Warehouse Accounting Card (form No. M-12), Limit Fence Card (form No. M-8), Record Sheet of Material Remaining in Warehouse (form . No. M-14) become output documents and are generated by computer technology. [p.137] List of remaining materials in the warehouse, General Ledger, etc. [p.322]

Accounting registers in which registration of business transactions is carried out in a specific system (grouping) are usually called systematic registers. Grouping is carried out on synthetic and analytical accounts. Synthetic accounting accounts are maintained, for example, in such a systematic register as the General Ledger (see clause 7.4). As an example of a systematic register of analytical accounting, there may be a Statement of Accounting for Material Remains in a Warehouse (form No. M-14), Inventory List of Commodity and Material Assets (form No. Inv.-Z), etc. [p.328]

This balance must correspond to the same balance at the end of the day of the last record of the goods movement transaction for the current month. The warehouse manager transfers the withdrawn balances from the cards to the balance sheet of materials in the warehouse (form No. M-14), the balance book, which is stored in the accounting department. It is allowed to transfer data on balances from cards to an employee of the organization's accounting department, but in this case the warehouse manager certifies the correctness of the transferred data with his signature. [p.45]

If the balance on material resource accounts 10 and 11 at the beginning (end) of the month in the valuation at accounting prices, shown in the statement of forms No. 10, 10-A or 5 (for small enterprises), coincides with the similar balance from the statement of balances of materials in the warehouse , then this indicates the absence of errors in the taxation of primary documents for accounting for the movement of materials, the correctness and completeness of posting data on operations to warehouse accounting cards. [p.53]

Every day or at other established times (usually at least once a week), an accounting employee checks the accuracy of the entries made by the storekeeper in the materials accounting cards and confirms them with his signature on the cards themselves. At the end of the month, the warehouse manager, and in some cases the accounting employee, transfers quantitative data on balances on the 1st day of the month for each item number of materials from the material accounting cards to the accounting sheet for the balance of materials in the warehouse (without receipts and expenditures). [p.124]

At the end of the month, the balances displayed on the warehouse accounting cards are recorded in the balance sheet of materials in the warehouse (balance book). After taxation, the value of the balances determined in this statement is compared with the value of the balances by sections of materials in the grouping sheet, eliminating any identified discrepancies. [p.109]

In accounting, a card index of materials is not kept and accounting is carried out according to the balance sheet of materials in the warehouse (balance book). On every 1st day of the month, balances from warehouse cards are transferred to the book, the entries in which are verified against primary documents. [p.132]

Record sheet for remaining materials in the warehouse [p.153]

REPORT OF MATERIAL REMAINS IN THE WAREHOUSE - an operational document for recording the availability of material resources in warehouses as of the beginning of the month. It is carried out at enterprises that take into account materials using the operational accounting (balance) method of accounting. Filled out according to warehouse records cards verified by the accounting department. The correctness of the data transfer is confirmed by the signature of the inspector. The standard interdepartmental form of primary accounting documentation for enterprises and organizations of ministries and departments of the USSR and union republics is form No. M-20. [p.20]

At the end of the month, based on warehouse accounting data, the accountant writes out the quantitative balances of materials by their individual types in a special balance sheet for accounting for the balance of materials in the warehouse (without receipts and balances). Then the accountant carries out taxation and calculation of the total balances of materials at fixed discount rates for each accounting group of materials and for the warehouse as a whole. [p.71]

Cards for warehouse accounting of materials (type f. No. M-17) book (statement) for accounting for the balance of materials in the warehouse register of delivery of documents upon receipt of the warehouse (type form no. M-18) register of delivery of documents for consumption (type f. No. M-18) [p.334]

The connection between the quantitative and grading accounting of materials in the warehouse with their accounting in accounting in total terms with the operational accounting method of accounting is ensured using the statement of accounting for the remaining materials in the warehouse, form M-14 (Table 3.13). It is opened in the accounting department for each warehouse in the context of groups, subgroups and item numbers, indicating units of measurement, accounting prices and balances in physical and monetary terms for each first day of the month for the year. During the month, the inventory record of materials in the warehouse is kept in the accounting department and is used for reference purposes. [p.128]

In conditions of predominance of manual processing of primary documents or when using small-scale mechanization means, to ensure the relationship of warehouse sort accounting with synthetic accounting data and for reporting, the accounting department must open a statement (book) of accounting for the balance of materials in the warehouse, which is opened for the year. [p.181]

Draw up a turnover sheet for analytical accounting of material balances in the warehouse for the reporting period. [p.263]

Drawing up registers (documents) of the warehouse for receipts and expenses on established dates Taxation of the balance sheet of materials of each warehouse at accounting prices [p.255]

The remaining materials in the tank farm warehouse are reflected in the balance sheet. The results of the turnover sheet at the end of the month are calculated and compared with warehouse accounting data. At oil depots with mechanized accounting, the role of turnover sheets is “performed by tabulagrams compiled by machine counting stations (MG) based on quantitative accounting data from warehouse accounting cards. Separate tabs of balances, receipts and consumption of materials are transferred to the supply department, where, on their basis, statistical reports on the movement of materials for the month are compiled in forms 1-SN and 4-SN. [p.115]

Important accounting documents are a statement of the balance of materials in the warehouse and a signal certificate indicating the deviation of the actual balance from the established standards. The first document serves to reconcile two accounting records: warehouse and accounting. The second document allows management to decide on the need for additional purchases of materials. [p.124]

As of the first day of each month, the financially responsible person transfers quantitative balances from the cards to the material balance accounting sheet f. No. M-14. This statement is opened by the accounting department for the year for each warehouse. It is stored in the accounting department and issued to the storekeeper the day before the end of the month, and on the 1st-2nd of the month following the reporting month, he returns it to the accounting department. The responsibility of the financially responsible person includes monitoring the compliance of actual balances according to item numbers, established inventory standards (maximum, minimum) and reporting deviations to the marketing department. [p.154]

In other cases, the preparation of these reports can be carried out on the basis of verified data on the balances of materials in warehouses and storerooms at the beginning and end of the reporting month, available in the balance sheets (books), as well as on data obtained by counting primary documents. To do this, first, the total receipt of materials, their internal movement, as well as outsourcing and documented write-offs are determined from the document file. [p.182]

Thus, with the balance method, warehouse (operational) accounting of materials is combined with accounting. The accounting department does not keep quantitative and total records of materials by receipt and expenditure and does not prepare turnover sheets for the entire range of materials. This significantly reduces the amount of accounting work. With the balance method, timely receipt of information about the balances of materials in the warehouse at any time is ensured, accounting control over the state of accounting and stocks of materials in warehouses is strengthened, and the gap between analytical accounting of materials and their synthetic accounting is eliminated. [p.124]

In practice, inventory accounting is carried out mainly by accounting and logistics authorities. At the same time, there is duplication of data on the state of material inventories in the books (statements) of material balances in warehouses compiled by OMTS (they reflect the balance of materials at the beginning of the year, then by month - receipts, consumption and balance, balance of materials at the end of the year), in warehouse cards and turnover sheets. In addition, in some cases there is a delay in accounting information and the possibility of its use in the management process is not ensured. [p.102]

Balance book (book of remaining materials) is an accounting register used in the balance method of accounting for inventory items.” SKs are opened for a year for each place where valuables are stored (materially responsible person). They indicate item numbers, name, units of measurement, accounting prices and material balances for each first number. In this case, the list of materials is given in the context of their groups or synthetic accounting accounts. The balance of materials as of January 1 is recorded in the accounting department. Subsequently, quantitative balances of materials are recorded in the inventory book by the warehouse manager (storekeeper) based on verified warehouse accounting data. The cost of remaining valuables at accounting prices is determined in the accounting department and recorded in the accounting system. The total amounts according to the accounting price must correspond to the data of the accounting department that keeps records of materials in monetary terms. SK provides the relationship between accounting for materials in the warehouse and in the accounting department. Instead of a book, balance sheets can be used (see Balance (operational accounting) method of accounting for inventory items). [p.156]

With the operational accounting method of accounting for materials, maintaining cards for warehouse accounting of materials and balance sheets (books), manual reconciliation of data is carried out in the accounting department on a monthly basis according to statements of balances of materials in warehouses and turnover sheets of quantitative and total accounting of materials [p.56]

Accounting for materials in the warehouse. Sorted accounting of materials in oil depot warehouses reflects their movement and balances in kind, recorded on the basis of data from primary documents. Forms of cards for warehouse accounting of materials are strict reporting forms. The cards are opened by the accounting department and handed over to the warehouse manager (storekeeper) against signature in the balance sheet (book) for accounting for remaining materials. The cards reflect the operation of the movement of materials, and after each operation the balance is displayed. [p.111]

To reconcile the warehouse accounting data with the accounting data, a balance book (statement) is kept, which is then transferred to the storekeeper to fill in the balances of materials for individual types and grades. The accountant evaluates the quantitative balances of materials, taxes and displays final data for the warehouse, which is compared with synthetic accounting data. If discrepancies are detected between analytical and synthetic accounting data, materials are checked directly at the warehouse. Oil depots with a small volume of materials consumption use a system of reports from materially responsible persons on the receipt, release and balance of materials. Primary income and expense documents are attached to the report. Such a report is submitted to the accounting department within the established time frame. With this system, there is no need to maintain warehouse records cards. Proper accounting of materials in the warehouse contributes to [p.112]

The correspondence of the amounts in the book of material balances and statement No. 10-c indicates the correctness of maintaining quantitative and grading records of materials in the warehouse and storerooms of the construction organization. [p.96]

The report in Form No. 1-SN is drawn up on the basis of warehouse accounting data verified with accounting data. The report includes balances in the enterprise's warehouses, remaining materials in workshops, as well as materials released for production in the reporting month, but not actually consumed by the end of the month. Balances in workshops at the end of the month are identified through inventory. The cost of unused materials in the workshops must be written off from the production account to the corresponding material accounts, and at the same time, for the difference in the balances of materials at the beginning and end of the month according to the inventory sheets of the workshops, the balances in warehouses are adjusted to include data in the report of form No. 1-SN. In warehouse cards for quantitative and assortment accounting, in the upper right corner for item items that are included in the report, the report line number f. No. 1-sn. Depending on the method of analytical accounting of material assets, one or another technique for drawing up a report of form No. 1-SN is used. The report form of form No. 1-SN is adapted for development on an accounting machine SR-22 or SR-42. However, you must first prepare an appropriate grouping of data to be posted on the report form, adjust balances and expenses for quantitative inventory data in workshops and eliminate internal transfers. [p.137]

More progressive is the balance method of accounting for materials, in which accounting, based on warehouse cards on the 1st day of the month for each item number of materials, transfers quantitative data on balances to the balance sheet of materials (without turnover of receipts and expenses). Remaining materials are processed at fixed accounting prices and results are displayed for groups of materials and for the warehouse as a whole. [p.130]

On the first day of the month and on the day of inventory, the financially responsible person, according to the materials accounting cards, counts the number of incoming and outgoing materials and determines the balance of materials. Data on the balance of materials in the context of item numbers is transferred to the Balance sheets. Balance sheets are compiled by warehouses and by financially responsible persons and show the balance of materials in the warehouse without the turnover of receipts and expenditures. In the balance sheet, quantitative data on the balance of materials is taxed (the quantity of materials is multiplied by the accounting price) and totals are displayed for individual accounting groups of materials and for the warehouse as a whole. [p.234]

The use of computers in accounting for materials makes it possible to abandon the maintenance of the above-mentioned accounting registers and compile, on the basis of primary documents, machinograms-statements of movement and balances of materials. They are maintained in the context of warehouses and financially responsible persons with automatic removal of residues after each operation. When compiling sorting turnover sheets on a computer, control over the organization of accounting for materials in the warehouse is weakened, therefore the balance method of accounting remains one of the most effective for manual processing of accounting data. However, accounting in this case remains labor-intensive, since hundreds of item numbers of materials have to be recorded in the turnover sheet. [p.47]

In the context of the functioning of automated control systems and automated warehousing, instead of materials accounting cards, systematically compiled machine diagrams-statements of movement and balances of materials are used. Based on primary documents, they reflect the same data as in warehouse accounting cards. However, unlike numerous cards, machine data sheets only lead to warehouses and financially responsible persons. Machine diagrams are used to monitor the movement and condition of materials in the warehouse and operational production management. [p.123]

Intra-warehouse movement of goods and materials

In the course of business activities, an enterprise needs to move materials between warehouses or structural divisions. The primary document in this case is the demand invoice (form M-11). It is issued by the MOL of the sending party in 2 copies: the 1st remains with the transferring party and serves as the basis for writing off materials from the register, the 2nd is transferred to the MOL of the receiving party and is the basis for accepting the goods and materials for registration.

For information on filling out a demand invoice, read the material “Procedure for filling out form M-11 demand invoice.”

Possibilities for monitoring and managing the material balance sheet

The following is a short list of the capabilities of the warehouse Universal Accounting System program. Depending on the configuration of the developed software, the list of capabilities may vary.

- High performance software;

- Continuous monitoring of residues;

- Modern configuration;

- Timely updating of components;

- Various reference books and classifiers;

- Identification of damaged goods;

- Determination of demand;

- Profitability calculation;

- Quick mastering of the configuration;

- Unlimited creation of departments and services;

- Interaction between departments;

- Moving materials between warehouses;

- Use in large and small companies;

- Piecework and time-based forms of remuneration;

- Personnel accounting;

- Cash book;

- Fiscal checks;

- CCTV;

- Manufacturing of any products;

- Accounting and tax reporting;

- Compliance with laws;

- Statements and calculations;

- Transaction log;

- Templates for forms and contracts;

- Cash flow control;

- Payment orders and requirements;

- Analysis of financial condition and financial position;

- Demand calculation;

- Warehouse accounting;

- Optimization of production capacity;

- Determination of output and productivity;

- Management of internal processes;

- Login using login and password;

- Loading images into the program;

- Automated automatic telephone exchange;

- Mass and individual mailings;

- Selection of methods for assessing receipts and sales;

- Delegation of powers;

- Synthetic and analytical accounting;

- Advanced analytics;

- User settings;

- Special reports and charts;

- Control over the safety of fixed assets;

- Financial operations;

- Waybills;

- Waybills;

- Accounting for surpluses and shortages;

- Payrolls.

Inventory

In order to identify the actual availability of inventory items listed in the accounting records, an inventory is carried out in the organization. It can be carried out as necessary by order of the manager, and also without fail in the following cases (clause 22 of order No. 119n):

- when selling materials;

- when changing MOL;

- when identifying cases of damage or theft of inventory items;

- in the 4th quarter before the preparation of annual accounting reports;

- in case of emergency (fire, flood, etc.);

- upon liquidation of the company.

The frequency of the audit may also be reflected in the accounting policy of the enterprise.

The audit procedure is regulated by methodological guidelines for inventory of property, approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49.

First of all, the enterprise issues an order to conduct an inventory indicating the persons - members of the commission (at least 3 people) and is endorsed by the manager (INV-22 form). Such a commission has the right to conduct an audit only in full force in the presence of the MOL. Before carrying out the inspection, the MOL writes a receipt in any form stating that all inventory items have been taken into account and the documents have been transferred to the accounting department.

Inspectors check the actual availability of materials with a list called the inventory list (INV-3 form).

Read about the inventory list used when checking the availability of materials in the article “Unified form INV-3 - form and sample” .

Such a document contains a column with data on the amount of materials accounted for in accounting, and an empty column in which inspectors can reflect the actual presence of inventory items. After a complete recalculation of values, the commission signs this statement. The MOL records on the last page that the inspection was carried out in its presence and that there are no complaints against the commission.

If, as a result, discrepancies are identified between the accounting and actual quantities, a document is drawn up - a matching statement, in which all such discrepancies are recorded (form INV-18).

Read about the specifics of filling out this statement in the material “Unified Form INV-18 - Form and Sample” .

If a surplus is identified, it must be taken into account. It is considered the income of the enterprise and is recorded in the credit of the 91st account.

If misgrading of inventory items is detected, the result can be offset against each other. Such an offset is possible only for 1 MOL for 1 audited period and only for similar types of products in equal quantities (clause 32 of Order No. 119n).

If a shortage is identified, first of all it is necessary to find out whether there was a natural loss (for example, shrinkage, shrinkage). The shortfall within the limit is considered an expense of the enterprise and is written off as a debit to the 26th (44th) account; the excess limit and the actual shortfall must be reimbursed by the MOL. To reflect the identified discrepancies, the INV-26 form can be used.

For the procedure for filling out this form, see the article “Unified Form No. INV-26 - Form and Sample” .

Section 6. accounting of materials in warehouses

The cost of unused materials in the workshops must be written off from the production account to the corresponding material accounts, and at the same time, for the difference in the balances of materials at the beginning and end of the month according to the inventory sheets of the workshops, the balances in warehouses are adjusted to include data in the report of form No. 1-SN. In warehouse cards for quantitative and assortment accounting, in the upper right corner for item items that are included in the report, the report line number f.

No. 1-sn. Depending on the method of analytical accounting of material assets, one or another technique for drawing up a report of form No. 1-SN is used. The report form of form No. 1-SN is adapted for development on an accounting machine SR-22 or SR-42.

Disposal of materials

The write-off of materials from the warehouse must be accompanied by one of the documents: a limit card (Form M-8), an invoice for the release of materials to the third party (Form M-15), a demand invoice (Form M-11) or a consignment note (Form TORG- 12).

- Limit-receipt card is a document intended for the release of one item of materials to another warehouse of the enterprise or to a third party. For example, baking bread requires flour. Form M-8 reflects the daily write-off of flour from the storage warehouse to production. This document is maintained for a month in 2 copies: one each for the releasing and receiving parties. The card contains data on the quantity of materials issued, which are endorsed by the signatures of the person who issued and accepted the MOL. At the end of the period, the cards are handed over to the accounting department.

- The demand invoice is issued once for each release of goods and materials in 2 copies: one for each of the parties.

- An invoice for the release of materials to a third party is issued as a result of the disposal of materials to a third-party legal entity (when selling or, for example, transferring materials as customer-supplied raw materials) or to a geographically remote division of the company. The document is issued in 2 copies. If the release was made to a third-party organization, a power of attorney from the recipient of the goods and materials must be attached to Form M-15.

The form M-15 can be found in the material “Unified form M-15 - form and sample” .

- When selling materials to a third party, an invoice is issued in the TORG-12 form in 2 copies: the 1st remains with the seller’s company, the 2nd is transferred to the buyer. If inventory items are transported by road, it is also necessary to draw up a TTN (Form 1-T).

For information about the documents drawn up during transportation, read the article “Confirmation of transportation expenses - with what documents?”

REPORT OF MATERIAL REMAINS IN THE WAREHOUSE. FORM no. M-20

Sample title (1st page) __________________________ (enterprise, organization) Standard interdepartmental form N M-20 APPROVED by Order of the Central Statistical Office of the USSR dated June 2, 1982 N 300a ———-¬ OKUD code ¦0303016 0¦ L———- REPORT OF MATERIAL REMAINS IN THE WAREHOUSE FOR 19__ Materially responsible person _________________________________ (position, full name) ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ Signature of the financially responsible person ______________________ Checked by an accountant ___________________________________________ Using the samples of the 2nd and 3rd pages, print loose sheets in 2A4 format 3rd page of form N M-20 (4th page blank) ———-T— ——T———T———T———T———¬ ¦ Remainder ¦ Remainder ¦ Remainder ¦ Remainder ¦ Remainder ¦ Remainder ¦ ¦ on ______¦ on ______¦ on ______¦ on ______¦ on ______¦ on ______ ¦ +—-T—-+—-T—-+—-T—-+—-T—-+—-T—-+—-T—-+ ¦number-¦sum-¦number-¦sum- number of sum ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—-+—-+—-+—-+—-+—-+—-+—- +—-+—-+—-+—-+ ¦ 22 ¦ 23 ¦ 24 ¦ 25 ¦ 26 ¦ 27 ¦ 28 ¦ 29 ¦ 30 ¦ 31 ¦ 32 ¦ 33 ¦ +—-+—-+—-+—- +—-+—-+—-+—-+—-+—-+—-+—-+ +—-+—-+—-+—-+—-+—-+—-+—-+ —-+—-+—-+—-+ +—-+—-+—-+—-+—-+—-+—-+—-+—-+—-+—-+—-+ + —-+—-+—-+—-+—-+—-+—-+—-+—-+—-+—-+—-+ +—-+—-+—-+—-+— -+—-+—-+—-+—-+—-+—-+—-+ +—-+—-+—-+—-+—-+—-+—-+—-+—- +—-+—-+—-+ L—-+—-+—-+—-+—-+—-+—-+—-+—-+—-+—-+—— etc. . to the end of the ruling through 16 points with its own back with the inscription “Insert sheet for form N M-20.” Insert sheet for form N M-20 ———T———¬ ———-T———- Remainder ¦ Remainder ¦ ¦ Remainder ¦ Remainder on ______¦ on ______¦ ¦ on ______¦ on ______ —-T—- +—-T—-+ +—-T—-+—-T—— count-¦sum-¦ count-¦sum-¦ ¦ count-¦sum-¦ count-¦sum in ¦ma ¦in ¦ma ¦ ¦in ¦ma ¦in ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ —-+—-+—-+—-+ +—-+—-+—-+—— 18 ¦ 19 ¦ 20 ¦ 21 ¦ ¦ 14 ¦ 15 ¦ 16 ¦ 17 —-+—-+—-+—-+ +—-+—-+—-+—— —-+—-+—-+—-+ + —-+—-+—-+—— —-+—-+—-+—-+ +—-+—-+—-+—— —-+—-+—-+—-+ +—- +—-+—-+—— —-+—-+—-+—-+ +—-+—-+—-+—— —-+—-+—-+—-+ +—-+— -+—-+—— —-+—-+—-+—— L—-+—-+—-+—— etc. to the end of the ruling after 16 points. Print with your own backdrop.

REFERENCE-CALCULATION FOR PROVIDING A SUBSIDIARY FROM THE FEDERAL BUDGET TO THE BUDGET FOR RECOVERY OF PART OF THE COSTS OF PAYING INTEREST ON LOANS RECEIVED BY CITIZENS RUNNING PERSONAL HOUSEHOLDING »

Standard forms, contracts »

Storage

An organization can create a warehouse designed to store materials from third-party organizations and receive a certain remuneration for storage services. This activity is regulated by Art. 909 of the Civil Code of the Russian Federation.

In this case, a public agreement is concluded between the counterparties. That is, anyone has the right to deposit their inventory items. Acceptance of materials based on quality, quantity and assortment is carried out by the storage warehouse's MOL. The depositor has the opportunity to inspect or check, as well as pick up his valuables at any time in the presence of the MOL.

The entire storage procedure is documented with primary documents. Let's look at the main ones.

Acceptance of goods and materials for storage is accompanied by an act of acceptance and transfer of goods and materials (form MX-1), which is issued in 2 copies: one for each party. The MOL records the receipt of inventory items for storage in a special journal (form MX-2).

Upon expiration of the storage period, as well as if the depositor wishes in writing, the storage warehouse returns the materials. This procedure is accompanied by a certificate of return of goods (form MX-3).

All data on the quantity and movement of inventory items are recorded by the MOL in special journals (MX-4, -5, -6, -7, -8).

Forms for forms MX-1 and MX-3 and the procedure for filling them out can be found in the materials:

- ,

- “Unified form No. MX-3 - form and sample”.

Results

For efficient and uninterrupted operation of the company, it is necessary to properly organize the work of warehouses. In order to track the movement of inventory and materials in warehouses, it is very important to issue accompanying and primary documents in a timely manner, the circulation of which should be recorded in the document flow schedule in the accounting policy of the enterprise.

Sources:

- Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n

- Civil Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.