The ESM-7 certificate is used in organizations that specialize in providing services for the provision of special construction machines. The unified form ESM-7 was approved by Decree of the State Statistics Committee of Russia dated November 28, 1997 No. 78. The document is used to confirm the work performed by construction machines or mechanisms and for the organization’s settlements with customers.

How to fill out the ESM-7 form? What information needs to be included in the certificate, on what basis to fill out the document, and who should participate in filling it out, we will consider in detail below.

ESM-7 (filling sample)

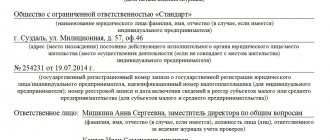

In the header of the document, you must fill in the date the certificate was completed, information about the organization (name, company address, contact phone number, OKPO code). In the process of filling out ESM-7, detailed information about the customer is also indicated: name of the company that is the customer, address, contact phone number, OKPO code.

The ESM-7 certificate contains data about the object (name of the object and address of its location), name and make of the car, state license plate. In addition, it is necessary to indicate the driver’s details (last name, first name, patronymic).

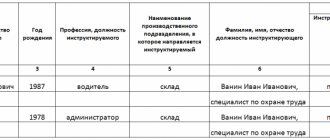

Filling out the ESM-7 certificate should not cause any difficulties. The form consists of one sheet. The main part of the help contains a table of five columns in which the following information must be reflected:

- Name and code of the type of work;

The number of machine hours worked by construction equipment;

The cost of one machine hour and the work performed (all machine hours worked).

Below the table you need to summarize the data. In addition, ESM-7 (certificate of work performed, services) contains data on downtime due to the fault of the customer - they must be displayed under the table with the data. Next, you need to reflect the total data, the amount of tax (VAT) and the total amount including VAT. In the completed ESM-7 (sample presented below) you can see how this needs to be done. Under the table, you must write down the number of machine hours in words, by hand. The cost of work (or services) is indicated in the contract prices at which settlements between the customer and the contractor are made.

The ESM-7 certificate (a sample form is provided at the end of the article) must be signed by the customer and the contractor, indicating the position and a transcript of the signature. The ESM-7 certificate is drawn up in one copy by representatives of the customer and the organization performing the work or services. To fill out the ESM-7 certificate, you must use the data from the waybill (the waybill is filled out using the ESM-2 form) or data from reports.

A report on the operation of the tower crane is filled out using Form ESM-1. This document is used to account for the operation of various types of cranes (tower, stationary, self-propelled, etc.). The report is the basis for obtaining initial data when calculating wages for drivers.

A report is filled out using the ESM-3 form to record the work of construction equipment at an hourly rate, which is the basis for obtaining initial data when calculating wages for service personnel.

Thus, when filling out the certificate, you must use the information specified in the listed documents. It must be remembered that for each waybill for the operation of a machine or other mechanism, a separate ESM-7 certificate must be issued (you can find the certificate at the end of the article).

For example, the equipment worked for several days for one customer. A separate vehicle waybill has been compiled for each day (form ESM-2). In this case, the number of issued certificates will be equal to the number of vehicle waybills. For example, five waybills have been issued. This means there should also be five certificates.

The ESM-7 certificate (a sample and certificate form can be found at the end of the article) must be certified by the customer’s seal. The completed certificate is sent to the accounting department of the organization, which uses it as an attachment to the document that will be issued to the customer for payment. Thus, the only copy of the certificate is transferred to the accounting department and the other party does not have a copy in hand.

We rent out special equipment. For each trip we fill out ESM-2 (waybill). At the moment, the equipment worked on 02/17, 02/20, 02/25, 03/03, 03/06 (the total number of hours for these days is 40) for one customer. We have five ESM-2.

For each waybill in the ESM-2 form, a separate ESM-7 certificate is issued (Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78). You cannot issue one certificate. For each ESM-7 certificate you need to create an invoice.

The lessor must issue an invoice within five calendar days from the moment the services for leasing special equipment were provided (clause 3 of Article 168 of the Tax Code of the Russian Federation). The date of provision of services under the equipment rental agreement is determined by the ESM-7 certificate. Indeed, according to the Decree of the State Statistics Committee of Russia dated November 28, 1997 No. 78, the certificate is used to make settlements between the organization and customers and to confirm the work (services) performed by construction machines (mechanisms).

Oleg the Good,

Head of the Corporate Income Tax Department of the Department of Tax and Customs Policy of the Ministry of Finance of Russia

How often should the landlord invoice the tenant? The lease agreement is concluded for a long term. According to the agreement, monthly acts on the provision of rental services are not drawn up

The procedure for issuing invoices does not depend on the preparation of acts on the provision of rental services. The lessor must issue an invoice within five calendar days from the moment the services for leasing the property were provided (clause 3 of Article 168 of the Tax Code of the Russian Federation). This is explained by the fact that services are sold (consumed) in the process of their provision (Clause 5, Article 38 of the Tax Code of the Russian Federation). Documents confirming the provision of rental services are:

- lease contract;

- act of acceptance and transfer of property to the tenant.

Thus, unless otherwise provided by the lease agreement, monthly preparation of acts on the provision of services for the provision of property is not necessary.

With regard to lease agreements, the validity of which covers more than one tax period for VAT, the financial department provides the following explanations (letter of the Ministry of Finance of Russia dated April 4, 2007 No. 03-07-15/47). If the terms of the lease agreements do not provide for advance payment for services, then the lessor must determine the VAT tax base on the last day of the quarter in which the services were provided (March 31, June 30, October 31 and December 31). Accordingly, within five calendar days after the end of each quarter, the lessor must issue an invoice to the lessee for services provided in the expired period. It is explained this way. For tax purposes, a service is recognized as an activity whose results do not have material expression (clause 5 of Article 38 of the Tax Code of the Russian Federation). As part of the lease agreement, the lessor provides rental services to the tenant continuously (daily) during the entire term of the agreement. Therefore, the lessor is obliged to determine the tax base for VAT based on the results of each quarter (clause 1 of article 54, clause 4 of article 166 and the Tax Code of the Russian Federation). It is impossible to issue invoices ahead of schedule (until the period in which rental services are provided is completed) (letters from the Ministry of Finance of Russia dated February 8, 2005 No. 03-04-11/21 and dated July 2, 2008 No. 03-07- 09/20

From the legal framework

RESOLUTION OF THE GOSCOMSTAT OF RUSSIA DATED 28.11.1997 No. 78 “On approval of unified forms of primary accounting documentation for recording the work of construction machinery and mechanisms, work in road transport”

Certificate for settlements for work (services) performed

(Form N ESM-7)

“Used for making settlements between the organization and customers and for confirming work (services) performed by construction machines (mechanisms).* For each report (waybill) for the work of a construction machine ( mechanism) a separate certificate is issued. Drawed up in one copy by representatives of the customer and the organization performing the work (services) based on the data of the waybill (form N ESM-2) or reports (forms NN ESM-1, ESM-3).* The certificate is certified by the customer’s seal and transferred to the organization’s accounting department , which uses it as an attachment to a document issued to the customer for payment. The cost of work (services) is indicated in contract prices at which settlements between the customer and the contractor (mechanization department) are made.”

Question answer

Fill out form No. ESM-7

A construction organization rents an excavator. He worked 200 hours in a month. Is it possible in

Form No. ESM-7

indicate the total number of hours or do you need to schedule the work by day?

You can enter the total number of hours for the month.

The fact is that form No. ESM-7 is a derivative document, since it is drawn up on the basis of contractual documents and forms

Which subject is it used by?

It is used in organizations specializing in the provision of services for the provision of construction machines (mechanisms).

How many copies are compiled?

Compiled in one copy.

Which employee compiles

Compiled by representatives of the customer and the organization performing the work (services).

4.

Rules for preparing accompanying documents

Basic documents confirming the completion of the work and technical specifications:

download samples of waybills:

Waybill

Waybill ESM-2

Waybill ESM-7

Waybill for an automobile (self-propelled jib) crane

The waybill for a truck crane is a primary document used to record the work of a jib self-propelled truck crane using the hourly method of remuneration, and is also the basis for calculating the driver’s wages. The document must include the following details:

• Date of issue of the waybill, stamp of the vehicle owner’s organization;

• Information about the organization that owns the vehicle;

• Information about the crane driver;

• Information about the truck crane, state number;

• Data on the operation of the truck crane, time of departure from the garage, time of arrival and start of work at the customer’s site, downtime and their reasons. The dispatcher is responsible for issuing the waybill. The waybill is drawn up in one copy.

If necessary and at the request of the customer, it is possible to issue a second copy and transfer it directly to the customer. The travel form must be filled out on both sides. The front side is intended for filling out data about tasks for the driver.

Information about the nature of the work and the number of hours worked, as well as about possible downtime, is entered on the reverse side and signed and stamped by the customer daily.

The customer, represented by an authorized representative at the site, is obliged to enter information into the waybill about the operating time of the truck crane, its downtime and the end of work. The waybill MUST be signed by the customer's representative, with a clear indication of the name and position of the representative.

If the representative has a personal seal or an organizational seal at the facility, then the waybill must be stamped. This simple procedure for filling out a waybill will help in the future to avoid misunderstandings when exchanging accounting documents between our companies.

Unfortunately, many foremen ignore such simple rules for filling out waybills, which leads to dissatisfaction with accountants. The waybill is a document of strict accountability, and therefore requires filling out in accordance with the requirements of the regulatory authorities. You can download the form for the waybill for an automobile (self-propelled jib) crane from the link, as well as see that it is filled out correctly and completely.

Construction vehicle waybill. Form ESM-2

The work of an automobile (self-propelled jib) crane is subject to accounting in the ESM-2 form called “Construction Vehicle Waybill.” This form is used by some enterprises as a source of initial data for calculating wages to employees.

This waybill can be issued for one work shift or for several work shifts. The dispatcher is responsible for issuing the waybill. He also carries out registration of departure and arrival of the truck crane to the garage. In our organization, this function is performed by the chief mechanic or truck crane operator in the absence of the chief mechanic.

A waybill in the ESM-2 form can be used for waybills for construction vehicles:

• Tractor waybill

• Bulldozer waybill

• Excavator waybill

• Pipelayer waybill The waybill form must be filled out on both sides. The front side provides fields for the name of the organization, customer contact information, make and number of the machine, and the driver’s full name.

The address of the facility, the time of arrival at the facility and a stamp on the time worked must also be indicated. Individual columns are filled in with data on fuel consumption. At the bottom of the form, actual and standard fuel consumption is calculated.

The reverse side of the form consists of two parts. One part is filled out by the customer, the second by the car owner. Here they reflect information about downtime, cost of work, amount of time worked, types of work.

These forms must be signed by the responsible person on the customer’s side and, if possible, the customer’s stamp must be affixed.

Report on the operation of a construction machine (mechanism). Form ESM-3

The work of construction machines at each enterprise using such equipment must be taken into account using the ESM-3 form, this form was approved by Decree of the State Statistics Committee No. 78 in 1997. This form is called “Report on the work of a construction machine (mechanism).” For a period of work of up to 10 days, one copy of this report is issued.

This can be done by an official authorized to carry out calculations, as well as a foreman or site or construction manager. Both sides of the report form must be filled out – front and back.

On the title side they indicate general information about the vehicle, the full names of the drivers, the company that owns the vehicle, the name and address of the customer.

In addition, the front side provides two tables - one for indicating the operations performed in specific areas, and the other for entering data on fuel consumption and confirming the health of the machine. On the reverse side of the form, information about the main indicators for calculating payment for the work done is entered. The following data is entered into the tabular form:

• Name of the customer's company;

• Customer contact information;

• Address of the object;

• Cost of work;

• Downtime hours with codes for their reasons and the culprit;

• Payroll indicators;

• Signatures and seals of the customer (affixed daily). After the stated scope of work has been completed, the report must be signed by the foreman, driver, site manager and persons responsible for the calculations. Filling out the report must be taken seriously and be sure to have the seals and signatures of the responsible persons. After this, the document can be sent to the accounting department.

Help for payments for work (services) performed. Form ESM-7

To confirm the work performed by truck cranes and other construction mechanisms, as well as for the organization’s settlements with customers for these works, a certificate for payments for services performed in the ESM-7 form is used. The ESM-7 certificate is issued for each construction machinery report or its waybill.

As a rule, a certificate in the ESM-7 form is filled out by the contractor’s accounting department on the basis of the waybill. Since the certificate is issued for a separate mechanism operating at the site, information about these mechanisms is entered on the title side after entering information about the name and address of the organization of the contractor and the customer. It is also necessary to indicate the full name of the truck crane operator.

The tabular part of the form displays the types of work done with codes and the number of hours worked. The cost of the work performed is indicated in the contract prices specified in the contract or in the application. The cost of work is added to the cost of downtime due to the fault of the customer, if any. The total cost of the work is indicated first without VAT, then including VAT.

The certificate must be certified by the contractor and sent to the customer’s accounting department.

Source: https://www.avtokran77.ru/oformlenie

Help for payments for work (services) performed. Form ESM-7

Which confirms

The certificate confirms the volume and cost of work performed (services provided).

It is necessary to take into account that the certificate is a derivative document, since it is drawn up on the basis of contractual documents and forms ESM-1, ESM-2, ESM-3.

Application procedure

The certificate is used to make settlements between the organization and customers and to confirm the work (services) performed by construction machines (mechanisms).

It is compiled in one copy by representatives of the customer and the organization performing the work (services) based on the data from the waybill (form N ESM-2) or reports (forms NN ESM-1, ESM-3).

The certificate is certified by the customer's seal and submitted to the accounting department of the executing organization, which uses it as an attachment to the document issued to the customer for payment (for example, an attachment to an invoice, etc.).

Thus, a single copy of the certificate is transferred along with the invoice from the accounting department of the executing organization to the accounting department of the customer organization.

A separate certificate is issued for each report (waybill) for the work of a construction machine (mechanism).

The cost of work (services) is indicated in contract prices at which settlements between the customer and the contractor (mechanization department) are made.

Storage

The certificate is stored in the accounting department of the customer organization along with the payment document (as an attachment to the invoice, invoice, etc.).

Scheme for compiling a certificate

Arbitration practice

Arbitration practice in tax disputes

1. An organization carrying out activities for the reception and disposal of solid waste has the right to take into account the costs of paying for environmental protection works, regardless of the availability of standard forms ESM-1, ESM-2, ESM-3 and ESM-7, since it is not a specialized construction organization (Resolution of the Federal Antimonopoly Service NWZ dated 06/04/2007 N A56-11660/2006).

Comments on this case are set out in the “Arbitration Practice” for the report on the operation of a tower crane in Form N ESM-1.

2. The decision of the court of first instance was overturned, the case was sent for a new trial, since the court did not evaluate the arguments of the tax authority about the absence of standard forms ESM-6 and ESM-7 when documenting expenses (Resolution of the Federal Antimonopoly Service of the Central District of May 31, 2005 N A64-5332 /04-17).

A construction vehicle waybill (form ESM-2) is an important document that serves as the basis for transferring wages to employees: those who work on tractors, graders, bulldozers, excavators, pipe layers and other construction machines.

FILES

Construction vehicle waybill form ESM-2 (sample form)

No. 152. In addition, the organization can exclude from the unified form columns that are not required for waybills. The use of a waybill for a construction vehicle in the ESM-2 form is necessary to account for the operation of special equipment on motor vehicles in a specialized organization.

xlsSize: 43 kb

A permit is required to operate construction equipment. To do this, fill out a special form for construction equipment waybill, which is a source of data about workers performing certain actions. Based on waybills, wages are calculated and work processes are monitored.

Application procedure

The form of the waybill can be developed independently at the enterprise, but most often a unified form is used, which contains all the required data and is the most convenient to use. It is this form that allows not only to calculate wages, but also to write off fuel and other fuels and lubricants based on the results of work performed.

The sheet is issued for one shift or per day; it is possible to fill out the sheet for a decade if the type of activity allows for this, for example, when working with a truck crane. The form is filled out in one copy; this is done by the dispatcher before leaving for the site. For some businesses, this responsibility falls to the driver or mechanic.

Filling out the sheet is required in the following cases:

- for working with pipe layers;

- for the use of motor graders;

- when working with loading equipment - tractors, bulldozers, excavators;

- when working with truck cranes and other construction equipment.

After completing a shift or ten days, the sheet is signed and submitted to the accounting department, where further calculations are carried out.

The waybill must be filled out on both sides; it is mandatory to indicate the name of the organization, contact information, and the name of the facility where the work will be performed. When filling out the form, the name of the equipment, its technical condition, and the name of the operator receiving the permit are indicated.

On the reverse side of the sheet the customer of the work, all types of work and individual stages are indicated. There are also special columns in which comments on the operator’s work will be displayed.

A fully completed form after the end of the shift is submitted to the accounting department, where it will be stored for five years.

offers prompt printing of waybills, magazines and other forms required for the activities of the enterprise. We provide our customers with the following benefits:

- printing is carried out according to standard layouts or those developed by our design department;

- the ability to fulfill orders according to designs provided by the customer;

- printing is carried out only in our own production using high-quality materials;

- We fulfill orders on time;

- our prices are the most attractive.

Leave a request right now, call us by phone in St. Petersburg or 8 (812) 903-76-78. Our managers will be happy to advise you and help you place your order.

If an organization has a construction vehicle, the organization is obliged to issue a waybill for it, for which a special form ESM-2 has been developed. It was approved by Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78, but companies can not use this form, but their own template developed on its basis.

The use of a waybill for a construction vehicle in the ESM-2 form is necessary to account for the operation of special equipment on motor vehicles in a specialized organization. In addition, the document is needed to calculate wages for the driver and service personnel.

Description of the parties

The document must be completed on both sides. This design is convenient when signing. On the one hand, the contractor (persons who provide services related to the work of the construction machine itself) signs, and on the other, the customers. Also on the second side there is a special column for an accountant who calculates the salary of a specific employee.

First side

The first one contains:

- OKUD form (0340002);

- reference to Resolution No. 78 of the State Statistics Committee of November 28, 1997, according to which the paper forms were adopted (this particular one received the number ESM-2);

- the name of the logistics company that provides transportation services, or the name of another company that fulfills the order (with address and telephone number);

- Full name or company name of the customer who hires a construction machine for any of his needs (also with written contact details);

- make and name of the car, its state number, as well as inventory and service records (below);

- Full name of the driver;

- transaction type code;

- period of work (indication of duration of activity);

- information about the column or work area (if available).

After this informative part comes the tabular part. If we are talking about one day, then only one line is filled in. If several days (shifts) are required to complete the work, then each new line should contain information about a separate day.

The tabular section states:

- the date and month in which the service was provided;

- name and address of the object;

- dispatcher signature (separate for each line);

- when the car left, speedometer readings when leaving (in km);

- the driver’s signature stating that the car was in good working order upon departure; the mechanic’s signature will also be required to express his agreement with this fact;

- the time when the equipment arrived at its permanent location, which was visible on the speedometer;

- signatures of the driver - in the delivery of the car and mechanic - that he accepted it upon arrival at the garage (in one column).

A special place in the document is given to fuel consumption. And this is not an accident. Lack of control over the consumption of fuels and lubricants usually leads to their shortage. Thus, the penultimate column of the table is dedicated to fuel and is divided into several sub-items, filled out separately:

- how much fuel was in the tank (or cylinder, if it is gas) when leaving;

- how much was issued to complete the work;

- how much is left upon arrival at the garage.

Also (at the very end of this column of the table) it is necessary to indicate what the actual consumption was and what it should be according to the standards.

Completes the tabular part of the column “Signature of the driver (refueler)”. At its level there are also the names of those who have taken responsibility for performing this type of work. Moreover, there is a place for both parties (on the part of the customer and the contractor). The riggers are not forgotten either. When filling out, it is advisable to write down their full name and service ID numbers.

Components of a report

The paper is filled on both sides. The title side lists information about the date the report was compiled, its number, the OKUD and OKPO form. At the top of the title page, in addition to the phrase “Report on the operation of the construction machine (mechanism)” with the paper number, there must be the name of two organizations: the customer and the contractor of the construction work. The name, brand of the car and the person driving it are also indicated.

After, on the right, in the report there is a small plate with columns to indicate:

- code of the type of operation performed;

- period of work, from what date to what date (practice has shown that it is most convenient to draw up a report for a decade);

- section or column (if available);

- inventory and personnel number of the mechanism (machine), its brand or model.

The introductory part of the document takes up a lot of space. The subsequent document space is occupied by a table divided in two.

The left side of the table indicates the serial number of the record, the name and address of the facility where the machine worked.

On the right side of the table is fuel consumption data. Its type is indicated, how much was given out, how much was at the beginning of the shift and how much was left at the end, and the actual amount spent is compared with the normative ones.

If the territory has not changed for several days, then it is possible to combine several rows into one in the second column. The reverse side of the report on the work of the construction machine also contains a double table. The left part is filled in by the customer. He must indicate:

- the exact time frame within which the work was completed;

- code, name and address of the object;

- work type code, stages;

- cost of work performed;

- whether there were any downtimes, how long they lasted and whose fault they were;

- your signature.

The owner of the machine on the right side of the reverse side indicates all the information necessary for the correct calculation of wages: whether the driver worked at night, on weekends or holidays. Attention is also paid to overtime hours (the first two and subsequent ones).

The results of the table are summed up and the average cost of one machine hour is calculated based on the data from this particular report.

Also on the back of the document there is a separate table for recording the amount of work performed by the driver. Their unit of measurement, quantity, is written down. It is possible to indicate several names if the work was performed by more than one specialist. There are also columns for indicating the rank, personnel number of the employee, and the number of hours worked (night and overtime are indicated separately).

At the very end there are signatures of the responsible persons with a transcript, a place for possible customer complaints about the work performed.