Individual entrepreneurs and legal entities whose activities, in one way or another, involve the need to use motor vehicles, as a rule, register the waybills issued to drivers in a special journal.

Based on such a journal, expenses incurred on fuel are recorded, which allows reducing the taxable indicators of the enterprise. In addition, the log of waybills is used when calculating wages for drivers involved in the work of the organization.

Is a journal necessary and is it compulsory to keep one?

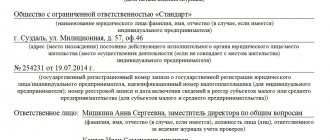

Any organizations and individual entrepreneurs whose field of activity is related to the provision of transport and transportation services are required to keep a journal of waybills. The instruction is based on the norms of Federal Law No. 259-FZ dated November 18, 2007 and Order of the Ministry of Transport dated September 18, 2008 No. 152.

As for enterprises that are not directly related to the provision of transport and transportation services, but use vehicles in the course of their activities, the presence of a waybill log is not mandatory for them, but can be used to systematize and simplify the recording of data used in their work.

The waybill accounting journal, form 8, was approved by Goskomstat Resolution No. 78 in 1997, but on January 1, 2013, Federal Law No. 402-FZ came into force, abolishing the existing unified form 8. From this date, transport enterprises that previously kept a waybill accounting journal sheets according to Form 8, were given the opportunity to develop their own, the most optimal version of the accounting sheet, provided that the main sections of the unified Form 8 will be duplicated.

Form of the Logbook for the movement of waybills

The journal for recording the movement of waybills (Form No. 8) is filled out on a unified form approved by Decree of the State Statistics Committee of the Russian Federation No. 78 dated November 28, 1997. Unlike the waybill form, which, due to legislative innovations, has undergone some changes in recent years, Form No. 8 of the Journal accounting for the movement of waybills has remained unchanged since the introduction of the document in 1997.

From 1997 to 2013, enterprises and organizations filled out the document exclusively in accordance with the approved form. Since 2013 (that is, since the abolition of obligations to maintain the Journal), Form No. 8 has been of a recommendatory nature. In other words, business entities have the right to change the form, adding new columns to it and excluding unnecessary ones, based on the specifics of the activities of a particular organization.

If the company decides on the need to maintain a Journal, then this fact must be recorded in the accounting policy, along with the selected document form (standard or modified).

Is it possible to conduct electronically?

There are no restrictions regarding the maintenance of a logbook of waybills in electronic form in any legal act of the current legislation; therefore, it is allowed to create an accounting sheet in electronic format.

Note! You can use any most convenient management option, be it regular Excel or 1C.

For organizations with an extensive fleet of vehicles and a significant staff of drivers, maintaining an electronic version is more preferable than manual registration, due to the significant labor intensity of the process. At the same time, it is desirable that it be possible to print the magazine on paper if necessary.

How are waybills accounted for?

5527 Page contents Accounting for fuels and lubricants (fuels and lubricants) by business entities is carried out using waybills. The form is unified; it contains fields to reflect fuel consumption, indicate the route and actual mileage.

Waybills can be used to control the consumption of gasoline, diesel fuel, and lubricants.

The obligation to prepare special documentation arises for organizations that have at least one vehicle. The document flow system at the enterprise must be organized taking into account the specifics of filling out and storing documents related to the use of fuels and lubricants. For each case of vehicle operation, a waybill must be issued.

Information about the completed forms is entered into the journal according to Form No. 8.

Enterprise management must ensure the safety of travel documents for 5 years.

To write off fuel and lubricants, you must submit fuel payment receipts to the accounting department. If inaccuracies or errors are found in the completed fields of the waybill, changes can be made to it.

This is done subject to the approval of the correction by two responsible specialists. IMPORTANT! If employees use personal transport for work needs, they have the right to receive compensation for this.

To do this, a note is made on the waybill about the ownership of a particular car by the employee. Journal form No. 8 is unified; lines or blocks cannot be deleted from it.

Enterprises are allowed to expand the list of indicators indicated in the document.

Who can sign a waybill for a mechanic? Do I need to keep a log of the waybills?

Here you can find information about the brand of fuel, its quantity (what was issued and what you had to buy at gas stations), the remaining fuel in the tank before the trip, as well as the amount remaining after the end of the trip.

Before filling out the waybill, the dispatcher checks the planned gasoline (gas, diesel) consumption indicators, which are given in one of the orders of the Ministry of Transport of the Russian Federation. By comparing data on actual and planned consumption, the amount of savings or overexpenditure is calculated.

How to Journal

Log Sheet

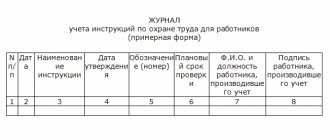

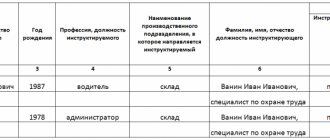

The log sheet of travel sheets, Form 8, is made in tabular form, representing a statement divided into columns. There are nine such columns. They include the following data:

- Serial numbers of issued sheets;

- Dates of issue;

- Full name of drivers;

- Personnel numbers of employees;

- Garage numbers of vehicles;

- Signatures of the driver, dispatcher and accountant;

- Notes if necessary.

Note! If an organization keeps records using its own developed statement form, the accounting journal may contain additional columns used specifically by the organization.

If erroneous data is entered into the accounting book, corrections may be made in accordance with the provisions of 9 Federal Law No. 402-FZ. If an error is made, the entry is corrected as follows:

- An erroneous entry is crossed out with one line;

- O is written next to it, and the correct information is entered;

- The date the corrections were made is indicated;

- Corrections made must be signed by the person responsible for maintaining the accounting record;

Important! When crossing out an erroneous entry, it is necessary to draw a line so that the incorrect entry itself remains readable after it is crossed out.

Requirements for filling out the journal

Form No. 8 is a journal whose title page states the name of the company, its status and period of coverage. The journal itself is a table in which information about all waybills issued by the company is entered. Even if any of them is incorrectly filled out and damaged, it is attached to the journal with the mark “Spoiled,” and its number must be entered in general chronological order in the journal.

Like many registration books, the journal has continuous numbering of sheets, is stitched, certified by the signature of the head and the seal of the organization (if there is one). Responsibility for filling out the document and the accuracy of the information in it rests with the employee assigned to perform this work by order of management or in accordance with job responsibilities. Travel log, form 8, can be downloaded below. It looks like this:

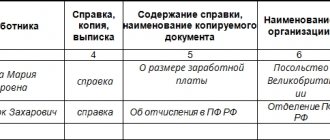

All fields of this form are required to be filled out. They reflect in chronological order information about the license plate number, date of issue, full name of the driver to whom it was issued and his confirming signature. When returning a waybill, a note is made on the date of its return and confirmed by the signature of the dispatcher, who accepts the sheet and passes it on to the accountant for processing. The accountant also confirms the transfer of vouchers with a signature on receipt.

Shelf life

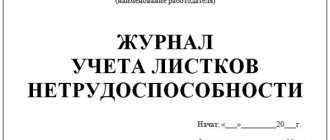

Waybills are issued to employees working on vehicles once per working day or shift. The registration journal itself is created for an annual period, but if necessary, the period of maintenance can be reduced to one month, for example, if we are talking about single long trips such as business trips.

Due to the fact that the accounting record is primary documentation, its subsequent storage period is 5 years, after which the journal can be disposed of. It should be noted that the five-year storage period applies not only to paper, but also to electronic media.

General concept of waybill

Such a sheet, as a rule, serves as a primary document in order to monitor fuel consumption and record the total mileage of the vehicle driven. Issue must be carried out once per driver’s work shift. Most often it is issued at the beginning of the working day. Also, if the driver goes on a long business trip, it can be issued for a period of no more than one calendar month. Such a certificate must be recorded in a special journal.

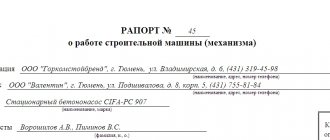

Waybill - sample

Note that they are especially important for large organizations that carry out quite a lot of freight transportation or travel of its representatives. Here it is worth highlighting separately enterprises involved in transport transportation, which have minibuses, trams and buses on their account. Also such are those enterprises that specialize in the transportation of goods.

According to the legislation of the Russian Federation, companies, legal entities and individual entrepreneurs who use vehicles due to the scope of their activities have an obligation to issue a waybill to its driver. Based on this provision, we can conclude that a waybill is a document granting the driver the right to use a company vehicle.

It should reflect provisions on the route that the vehicle must travel, as well as how much fuel it will be allocated for this task and how much time it will take to complete this task.

Most trucking companies are required by law to issue such sheets every day, the only exception being when the driver goes on a long business trip. Other companies that have vehicles can issue such sheets for a period from one day to a calendar month.

Is it necessary to flash

The travel logbook form 8 has sequential page numbering. When introducing it, it is necessary to maintain chronological order. The title page must be signed, indicating the start date. There, on the title page, the main details of the organization itself and its full name are written.

After accounting is completed, the journal is stitched. The bound book is certified by the signatures of the management of the enterprise, the chief accountant of the company and the seal of the organization, after which it is transferred for storage to the archive of the enterprise.

Sample form: required details

As of 2020, the standard form is in the form of bound papers. The page contains a table of 9 columns. When developing a sample for your enterprise, you can arrange them in the most convenient order, remove unnecessary columns or include additional ones.

On the first page of the sample travel log, the name of the enterprise or organization and the period for maintaining the register are indicated. In the specially designated fields on the right, codes for OKUD and OKPO are entered.

The table below follows. It includes:

- Waybill number.

- Date of issue of the document.

- Driver details. Enter your full name and personnel number.

- Car number.

- Signatures of the driver, dispatcher (with the date the form was taken from the driver) and accountant (with the date the documentation was accepted).

- Additional Information. The final column is filled in if necessary.

All other pages are printed using the same template. In most cases, approximately the same data is entered into the lines. When the free pages are gone, the travel log of waybills should be sent to the archive. There it will be stored for 5 years (according to the rules for primary documentation).

Who fills it out and the sample

The responsibility for keeping records of waybills in a specialized journal can be assigned to an employee appointed by order of management, or to an employee whose job responsibilities, outlined in the employment contract, include the functions of maintaining accounting records in the organization.

Most often, such work is performed by an accountant, personnel officer or secretary-clerk. In the absence of a person maintaining such a statement within the enterprise, an agreement can be concluded with third-party organizations servicing vehicles, provided that such an agreement will provide for a clause on the need to maintain records.

Travel log book (Form 8): form and sample form download

Great article 0

Where can I download the form 8 travel log and a sample of how to fill it out?

Many beginners, and sometimes even experienced workers, need to have a sample of the journal for issuing waybills in front of them in order to correctly enter data. The easiest way to download it is by following the link on the website. Since Form 8 is no longer mandatory, we provide you with a sample that could be developed in-house.

***

All companies operating vehicles must issue waybills and keep a corresponding log. Without these documents, the company is unlikely to be able to write off fuel and lubricants expenses in tax accounting.

Similar articles

- Sample of filling out a waybill for individual entrepreneurs

- Waybills: forms in 2020

- The nuances of drawing up an order on waybills - sample

- Sample of drawing up a waybill for a truck

- Bus waybill: form and sample