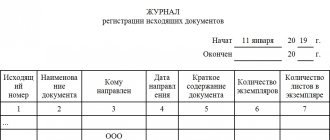

Journal of registration of executive documents

Journal of registration of enforcement documents for alimony

------------------------- (name of company) --------------------- ——————————————————————————— ¦ N ¦ Date ¦ Number and date ¦ Amount ¦ Term ¦ Defendant ¦ Recipient ¦ Marks on termination of alimony withholding ¦ ¦p/p¦ receipts of ¦executive¦ monthly ¦withholdings+————————+—————+——————————————+ ¦ ¦executive¦ writ, when ¦ deductions ¦ ¦Last name, ¦Address ¦Personal record ¦Last name, ¦Address¦ Date ¦ Availability ¦ Date ¦ ¦ ¦ sheet ¦ and by whom issued ¦ and amount ¦ ¦ name, ¦ ¦ number ¦ name, ¦ ¦ and reason ¦ debt¦ directions ¦ ¦ ¦ and incoming ¦ ¦debt,¦ ¦patronymic¦ ¦ ¦patronymic¦ ¦termination¦ ¦executive¦ ¦ ¦ number ¦ ¦ subject ¦ ¦ ¦ ¦ ¦ ¦ ¦ deductions ¦ ¦ sheet ¦ ¦ ¦ ¦ ¦ repayment ¦ ¦ ¦ ¦ to the executor ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ (person, ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ receiving ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ alimony) ¦ +—+—————+———— —+—————+———+———+——+———+———+——+————+————-+—————+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ 9 ¦ 10 ¦ 11 ¦ 12 ¦ 13 ¦ +—+—————+—————+—————+———+— ——+——+———+———+——+————+————-+—————+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ —- +—————+—————+—————+———+———+——+———+———+——+————+———— -+—————-

Source - “Official materials for accountants. Comments and consultations", 2012, No. 10

What are the features of a payment order to bailiffs of the 2019–2020 model?

Let's start with the fact that the procedure for filling out payments to the bailiffs will be different for tax deductions and for non-tax payments of the employee (for example, alimony, judicial penalties).

There are no special rules regarding non-budgetary collections, as well as official instructions on the procedure for processing payments. Therefore, we believe that a regular payment order is issued for them, without filling out the “tax” fields, including payer status, BCC, etc. In this case, all information identifying the payment is provided in the “Purpose of payment” field.

So, it indicates the type of deduction (for example, alimony for such and such a period), details of the writ of execution, alimony case, you can provide information about the recipient of the amount withheld from the employee. The specific composition of the information can be clarified with the bailiffs.

For more information about the details indicated in the payment document, read the material “Basic details of a payment order” .

If, according to a writ of execution, you transfer an employee’s personal taxes to the account of the FSSP department, the payment order is issued according to the rules provided for payments to the budget.

The features of such a payment are as follows.

- Payer's TIN (field 60). The TIN of the individual whose tax obligation is being fulfilled is indicated. If he does not have a TIN, 0 is entered.

- Payer checkpoint (field 102). Set to 0.

- Payer's name (field 8). The short name of the organization that transfers the withheld amounts to the budget, i.e. yours, is given.

- Payer status (field 101). For these payments, Appendix 5 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n provides the status “19”.

Read about other possible payer statuses here.

- Code (field 22). If there is a unique accrual identifier, it is provided (20 or 25 characters). If there is no UIN, 0 is entered.

- KBK (field 104). Here they put 0, since BCCs are not provided for such transfers.

For information about the cases in which it is necessary to indicate the KBK in the payment order when transferring funds to bailiffs, read the Ready-made solution from ConsultantPlus.

- OKTMO is brought to the location of the bailiff service.

- Document number (field 108). For payer status with code 19, field 108 requires the identification of information about the individual. Such an identifier can be SNILS, series and number of a passport or driver’s license, series and number of a car registration certificate, etc. Before the identifier in field 108, enter its 2-digit code. For example:

- 01 — passport of a Russian citizen;

- 04 - military personnel identification card;

- 14 — SNILS;

- 22 - driver's license;

- 24 - vehicle registration certificate.

This cipher is separated from the identifier by a semicolon. The signs “No” and “–” are not indicated in field 108. If the individual’s TIN is filled in, the value 0 is allowed in this field.

- In fields 106 “Base of document”, 107 “Tax period” and 109 “Date of document” enter 0.

Alimony: registering writs of execution

According to clause I of Appendix 1 to the Methodological Recommendations on the procedure for fulfilling the requirements of writs of execution for the collection of alimony, approved by the Federal Bailiff Service of Russia on June 19, 2012 N 01-16, the orders of the bailiff and copies of the writ of execution received by the organization must be registered in a special journal.

Note. Registration is a record of accounting data about a document in the prescribed form, recording the fact of its creation, sending or receipt (clause 2.2.2 of GOST R 51141-98).

Journal of registration of writs of execution

The standard form for registration of writs of execution has not been approved. The article “Alimony: what an accountant should know” recommends using for this purpose the form given in the Appendix to the Decree of the Government of the Russian Federation of July 31, 2008 N 579. However, the employer will not be able to use it. This form is intended for registration of forms of writs of execution that are stored in the courts. In the absence of a unified form, you can:

- register writs of execution in the journal of incoming correspondence. But this option is inconvenient for controlling their movement. After all, all documents received by the enterprise are recorded in the incoming correspondence journal. This journal is kept in the secretariat. It will be difficult for an accountant to track the movement of writs of execution.

If you still decide to use this method, do not forget to stamp “In. N ____ from ______", containing the registration index and date of receipt of the document;

- develop a magazine form yourself;

- use the form proposed by the magazine “Salary”, which is given below.

Sample

Journal of registration of writs of execution for payment of alimony

| N p/p | receipt date | Number of the writ of execution, when and by whom it was issued | FULL NAME. and address of the collector | FULL NAME. and debtor's address | Amount of monthly deductions | Availability of debt | Where and when the writ of execution was sent | FULL NAME. the employee who sent the writ of execution to the bailiff | |

| on admission | upon departure | ||||||||

| VS N 012233619 | Uskova Nadezhda Ivanovna, 125438, Moscow, st. Onezhskaya, 22, apt. 13 | Uskov Artur Petrovich, 125438, Moscow, st. 2nd Likhachevsky lane, 1, apt. 13 | 25% | No | No | Department of Bailiffs for the Northern Administrative District of Moscow 01/10/2013 | Krasina I.E. | ||

The registration log must be kept for at least five years (clause “o” of Article 459 of the List, approved by Order of the Ministry of Culture of Russia dated August 25, 2010 N 558).

Note. When an employee is dismissed, the writ of execution is returned to the bailiff (Part 4, Article 98 of Federal Law No. 229-FZ of October 2, 2007).

January 2013

Home — Documents

Latest publications

October 18, 2018

Personal protective equipment (PPE) for workers is technical means used to prevent or reduce the impact of harmful and (or) hazardous production factors on workers, as well as to protect against pollution (Article 209 of the Labor Code of the Russian Federation). Providing workers with special clothing, shoes and other personal protective equipment is carried out at the expense of the employer. In addition, funds from the Social Insurance Fund may also be used for these purposes. In what cases is this possible and what is the procedure for purchasing PPE from the fund, we will tell you in the article.

Information has appeared on the website of the Federal Treasury on the results of the adoption of accounting (budget) statements based on the results of 2020, in which a special place is given to the analysis of typical violations and errors identified by employees of the Federal Treasury during a desk audit of reporting forms. In our opinion, this information will be of interest to both auditors and accountants, so we considered it necessary to discuss it with you.

This is interesting: Job description for the general director of an LLC: sample 2020

Does the employer have the right to indicate in the local regulatory documents of the institution that employees are required to behave tactfully at work? Is it possible to hold an employee accountable for tactless behavior - impose a disciplinary sanction or reduce the size of the bonus?

October 17, 2018

Federal Law No. 302-FZ dated August 3, 2018 introduced significant changes to the rules for conducting tax audits. Innovations apply from 09/03/2018. Let's take a closer look at them.

According to current legislation, all organizations and individual entrepreneurs that use objects in commercial activities that have a negative impact on the environment must pay for this (NVOS fee). The obligation to make this payment arises regardless of the taxation regime and whether the object is owned. Only so-called office companies are exempt from this obligation. How to obtain the appropriate exemption? How to take into account the fee for the tax assessment in tax accounting in the absence of an exemption? We will talk about all this within the framework of this material.

Alimony: registering writs of execution

According to clause I of Appendix 1 to the Methodological Recommendations on the procedure for fulfilling the requirements of writs of execution for the collection of alimony, approved by the Federal Bailiff Service of Russia on June 19, 2012 N 01-16, the orders of the bailiff and copies of the writ of execution received by the organization must be registered in a special journal.

Note. Registration is a record of accounting data about a document in the prescribed form, recording the fact of its creation, sending or receipt (clause 2.2.2 of GOST R 51141-98).

Journal of registration of writs of execution

The standard form for registration of writs of execution has not been approved. The article “Alimony: what an accountant should know” recommends using for this purpose the form given in the Appendix to the Decree of the Government of the Russian Federation of July 31, 2008 N 579. However, the employer will not be able to use it. This form is intended for registration of forms of writs of execution that are stored in the courts. In the absence of a unified form, you can:

- register writs of execution in the journal of incoming correspondence. But this option is inconvenient for controlling their movement. After all, all documents received by the enterprise are recorded in the incoming correspondence journal. This journal is kept in the secretariat. It will be difficult for an accountant to track the movement of writs of execution.

If you still decide to use this method, do not forget to stamp “In. N ____ from ______", containing the registration index and date of receipt of the document;

- develop a magazine form yourself;

- use the form proposed by the magazine “Salary”, which is given below.

Sample

Journal of registration of writs of execution for payment of alimony

| N p/p | receipt date | Number of the writ of execution, when and by whom it was issued | FULL NAME. and address of the collector | FULL NAME. and debtor's address | Amount of monthly deductions | Availability of debt | Where and when the writ of execution was sent | FULL NAME. the employee who sent the writ of execution to the bailiff |

| on admission | upon departure | |||||||

| VS N 012233619 | Uskova Nadezhda Ivanovna, 125438, Moscow, st. Onezhskaya, 22, apt. 13 | Uskov Artur Petrovich, 125438, Moscow, st. 2nd Likhachevsky lane, 1, apt. |

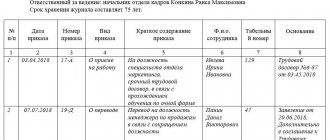

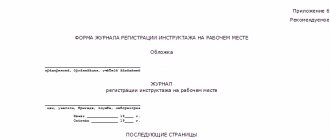

Components of the magazine

The structure of the document is quite simple: a cover plus a main section. The title of the magazine and its start date are indicated on the cover (there is a special column for the end date, but it can only be filled in at the final stage of filling out). A separate space is allocated for indicating the name of the organization. Some forms have fields to indicate the document retention period.

Important point! If the journal is a continuation of the previous one, then this information should be indicated on its cover with dates and links to the previous document.

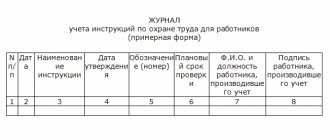

But the main thing in the document is the main section, consisting of a table with the following columns:

- The number of the line to be filled. Certificates are classified by date and recorded in the journal in chronological order.

- Date of issue. This data must match the date of the issued certificate. If requests in the organization are assigned registration numbers, then this is also indicated in the same column.

- Full name of the employee. An application for issuance on behalf of this employee should already be with the personnel officer or another employee whose duties include maintaining the journal. His position, the department in which he works, and his profession are also indicated. If necessary, indicate the address and telephone number of this person for quick communication.

- Help contents. Briefly, this column tells you what exactly the certificate was issued about. Basically, employees request certificates about the amount and calculation of wages.

- Date plus registration number of the certificate issued.

- Receipt for receipt. If the employee is unable to receive the certificate in hand, then the date and form of sending the certificate are recorded in this column. For example, by registered mail, through a courier service (with its name), etc.

- Note. This column may indicate that fundamentally important information that was not provided in other columns. For example, the motive that prompted the employee to apply for a certificate.