Debt forgiveness between individuals involves the release of the debtor from the obligations specified in the loan agreement. This operation must be documented. The law does not prohibit forgiveness of debts orally; however, an oral agreement is less reliable than one reflected in the text of an official document. When a debt forgiveness deal is concluded, the borrower (creditor) can no longer demand that the borrower (debtor) pay the debt, and it will be impossible to collect the debt through the court. Let's figure out what the rights and obligations of each party to the transaction are, what are the features of drawing up a debt forgiveness agreement.

Debt forgiveness between individuals - basic provisions

When it comes to debt forgiveness between individuals, in most cases we mean the termination of obligations under a loan agreement. The possibility of forgiveness of a debt to a borrower is regulated by Article 415 of the Civil Code. According to the provisions of this article, the lender (creditor) has the right to cancel the borrower’s debt in full or in part.

The main thing is that the following conditions are met, otherwise debt forgiveness will not be considered valid:

- on the part of the debtor there should be no objections to the forgiveness of his debt (if the lender subsequently refuses to accept funds to pay the debt, the borrower can transfer the money to the court or a notary);

- the rights of third parties related to the creditor's property must not be infringed.

It is important to take into account some features of the debt forgiveness transaction - if due diligence is not exercised, the transaction will be qualified as the conclusion of a gift agreement.

To prevent this from happening, 3 conditions must be met:

- the creditor’s will to forgive the debt must be free of charge - see Art. 572 of the Civil Code of the Russian Federation (that is, the creditor should not present any additional requirements that will make debt forgiveness possible);

- the court must determine the fact that the creditor is going to relieve the borrower from the need to pay the debt as a gift - see paragraph 3 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 104;

- the debt forgiveness agreement must indicate the lender’s lack of intention to benefit the borrower (for example, you can explain the expediency of debt forgiveness and write that such a concession will help continue cooperation with the borrower or recover at least part of the funds without filing a lawsuit).

Registration of debt forgiveness for the borrower

Quite rarely, debt forgiveness between legal entities is called a free transaction. As an example, we can cite such an economic tool as discounts that the buyer receives for fulfilling certain conditions. When considering the issue of debt forgiveness, it is necessary to separate the term “gratuitous transfer”, since these are completely different concepts. In the case of a gratuitous transfer of funds or goods, the buyer significantly simplifies calculations related to the taxation of profits and reduces losses from VAT. Forgiveness of debt obligations on a gratuitous basis Gratuitous closure of a debt can be considered a situation when the creditor does not require the debtor to provide funds or property that he must give to pay off the debt.

This issue is regulated by Article 572 of the Civil Code of the Russian Federation. According to it, when donating, one party (donor - bank/lender) gratuitously transfers or undertakes to transfer to the other party (done - borrower):

- thing in property;

- property right (claim) to oneself or to a third party;

- releases or undertakes to release her from property obligations to himself or to a third party.

Also see “Gift Tax on a Valuable Gift: Secrets to Accurate Taxation.”

Debt forgiveness between individuals - grounds for drawing up an agreement

An individual can write off the debt of another individual. The grounds for debt forgiveness may be as follows:

- Refusal to collect debt.

- Showing initiative by the lender or debtor.

- Achieving mutually beneficial agreements (settlement agreement).

How is debt forgiveness between individuals processed?

Important!

According to Art. 61.2 of Federal Law No. 127-FZ of October 26, 2002, the area of debt should not be incurred on the eve of bankruptcy.

According to the instructions of paragraph 1 of Art. 415 of the Civil Code of the Russian Federation, before formalizing debt forgiveness, you should make sure that such a decision of the creditor will not violate the rights of persons who are related to the lender’s property. In the case of a creditor who is an individual, such persons may be his spouse, co-founders of the company, or counterparties in other transactions.

Further, paragraph 2 of Art. 415 of the Civil Code of the Russian Federation requires preliminary notification of the debtor that the creditor is going to forgive him the debt. For this purpose, the borrower is sent a written notice of the desire to release him from debt obligations to the lender.

The law does not establish a unified form of notification; such a document can be drawn up in any form. However, it is strongly recommended that you include the following information in your notice:

- details of the initial loan agreement;

- the amount of existing debt;

- information about the creditor’s desire to forgive the debt in whole or in part;

- information about the reason for the need for debt forgiveness.

The text of paragraph 65 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated June 23, 2015 No. 25 states that the creditor can send a notice to the debtor in any way convenient for him, but at the same time he must have documentary evidence of the fact of sending the letter

. For example, if you send a notice by mail, you should send it by registered mail with the notice and a list of attachments in order to retain the postal receipt as evidence. Further, the procedure depends on whether the debtor takes any measures:

- if the borrower sends a response notification that he has no claims regarding debt forgiveness, you can begin the procedure for completing the transaction;

- if the debtor does not raise objections within a reasonable time (the response time can be taken from clause 2 of Article 314 of the Civil Code of the Russian Federation) and does not respond to the notice in any way, it is also allowed to begin drawing up a debt forgiveness agreement;

- if the debtor has stated that he has objections to debt forgiveness, the debt write-off procedure should be canceled (if it is not possible to reach an agreement and reach a compromise).

If there are no obstacles to debt forgiveness, a separate debt forgiveness agreement or an additional agreement to the existing loan agreement between individuals is drawn up.

Follow the link to view ⇒ a sample debt forgiveness agreement.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

How to apply for debt forgiveness, sample agreement

In order not to wait for the statute of limitations on bad debts to expire, there is an official document with the help of which an agreement to terminate debt obligations is drawn up. Based on the signed papers, you can write off the forgiven debt as expenses, and thereby save on taxes. As an alternative, the debtor may agree to return part of the funds in exchange for writing off a certain amount of debt.

Whatever the terms of the agreement, such a document must be completed in accordance with the requirements of the tax authorities. In order to avoid unpleasant moments with regulatory authorities, the debt closure agreement must necessarily be paid. The document must contain basic information about the debt, the reason for non-repayment of the amount of money, the amount of interest and fines.

In the case of a partial refund, which is most preferable from a tax point of view, you must indicate the exact amount of the new obligation and the timing of its repayment.

If the parties nevertheless decided to forgive the debt free of charge, then the reason for such an agreement may have to be explained to the tax inspector. In this regard, it is recommended to properly formalize debt forgiveness. The tax consequences that may result from non-compliance can significantly impact a lender's finances.

Debt forgiveness between individuals (peculiarities of drawing up a debt forgiveness agreement)

In order to officially forgive a debt to an individual, it is necessary to draw up an act of reconciliation of mutual settlements with the debtor, after which the terms of the transaction are recorded in writing:

- a clearly and precisely formulated desire of the lender to forgive the borrower’s debt;

- information about the debtor’s obligation existing at the time of debt forgiveness with reference to the loan agreement (if there is no information about the existence of a debt, the court has the right to recognize the debt forgiveness agreement as not concluded, see Resolution of the Federal Antimonopoly Service of the Eastern Military District dated September 10, 2009 in case No. A39-1176/2009 );

- amount of debt;

- conditions for debt forgiveness, if any.

For a debt forgiveness transaction to be considered concluded, it is necessary to conclude a separate agreement, an additional agreement to the concluded agreement, or a gift agreement.

You can familiarize yourself with a sample agreement on debt forgiveness for an individual by clicking on the following ⇒ link.

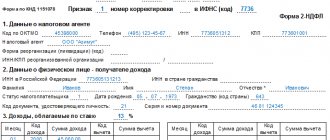

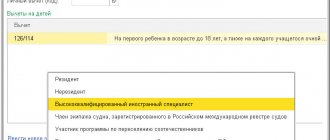

Debt forgiveness between individuals - individual taxation

According to paragraph 1 of Art. 41 of the Tax Code of the Russian Federation, when a debt is forgiven to an individual under a loan agreement, an economic benefit arises - the individual’s income in the amount of the forgiven loan and interest (in the case of issuing an interest-free loan). Income is taxed on a general basis - personal income tax at a rate of 13%. See Letter of the Ministry of Finance of the Russian Federation dated October 17, 2016 No. 03-04-07/60359, paragraph 1 of Art. 224 Tax Code of the Russian Federation, clause 1, art. 210 Tax Code of the Russian Federation.

Important!

If we are talking about forgiveness of an interest-free loan, there is no material benefit for the individual from saving on interest for the payer, as well as taxable income. See Letter of the Ministry of Finance of the Russian Federation dated October 28, 2014 No. 03-04-06/54626.

If the debt is forgiven by the employer, he acts as a tax agent for the individual and withholds personal income tax in the general manner. In other cases, the payment of personal income tax on the taxpayer’s income is carried out by the individual himself on the basis of a notification from the tax service - information to the Federal Tax Service of the Russian Federation must come from the employer. If an individual is not employed, the obligation to pay tax remains with him - he should fill out a declaration and pay personal income tax at a rate of 13% to the budget immediately after the loan debt is forgiven.

On personal income tax taxation of debt forgiveness on an interest-free loan

Due to the fact that the situation is ambiguous, each company makes a decision based on its knowledge of the laws. Can a bank forgive a loan debt? Forgiveness of contractual obligations related to obtaining a loan always occurs at the initiative of the bank. If the creditor decides to unilaterally forgive the debtor, then an official notification of such intention is sent to him. Forgiveness of a debt to a related party: tax consequences It is good if in the tax accounting of the buyer the debt forgiven on a reimbursable basis was included in income as written off accounts payable, that is, on the basis of clause 18 of Art. 250 of the Tax Code of the Russian Federation. Then VAT on this debt can be included in non-operating expenses. This is what paragraphs allow you to do. 14 clause 1 art. 265 of the Tax Code of the Russian Federation. The situation is much worse if the forgiven debt was taken into account in income as property received free of charge.

Common mistakes

Error:

There was forgiveness of debt between individuals. The loan debt amounted to 3,500 rubles. The debtor paid personal income tax to the budget on the amount of economic benefit received.

A comment:

If the amount of debt is 4 thousand rubles or less, personal income tax is not paid. Also, no tax needs to be paid if the debt was forgiven as a gift.

Error:

When a debt was forgiven between individuals, no act of reconciliation of mutual settlements between the lender and the debtor was drawn up; the debt forgiveness was agreed upon orally, and the rights of third parties were infringed.

A comment:

In the event that there is no act of reconciliation of mutual settlements, there is no written agreement on debt forgiveness, there is no evidence of sending the debtor a notice of the desire to forgive him the debt, the rights of third parties related to the creditor’s property are infringed, or the reconciliation act contains contradictory provisions, the transaction debt forgiveness may be recognized as not concluded in court.

In what case is debt closure not subject to income tax?

Free debt forgiveness cannot be subject to income tax if material assets or funds were received from the founder of a company with a 50% participation or from a company that has the same share. You can take advantage of this benefit provided that the property has not been transferred to third parties during the year.

Tax authorities have an ambivalent attitude towards such a privilege, since they believe that forgiveness of a debt by the founder is a transfer of property rights, and not of commodity values. For those who are ready to defend their point of view in court, it is recommended to take advantage of the judicial practice that has developed in similar cases.

Answers to common questions about debt forgiveness between individuals

Question #1:

Should an individual pay insurance premiums to extra-budgetary funds from the amount of forgiven debt under a loan agreement?

Answer:

Amounts that are transferred to an individual under a GPC agreement (including under an agreement the subject of which is the transfer of ownership of money) are not subject to insurance premiums on the basis of clause 4 of Art. 420 Tax Code of the Russian Federation.

Question #2:

What are the consequences of refusing to pay personal income tax on the amount of debt forgiven to an individual?

Answer:

If an individual does not fill out a declaration and does not transfer personal income tax at a rate of 13% of the amount of debt forgiven, a fine will be imposed on him, or the person will be subject to criminal punishment (imprisonment for up to 3 years) on the basis of Article 198 of the Criminal Code of the Russian Federation.

Debt forgiveness frees you from financial benefits - but not from all of them

The Ministry of Finance indicated that when the debt on this loan is forgiven, personal income tax does not arise from last year’s financial benefit. However, personal income tax on financial benefits for the period from 01/01/2016 to the date of forgiveness inclusive is retained. It must be calculated on the last day of each month included in this period, taking into account the key rate in effect on this date. Plus, on the date of forgiveness, personal income tax must be calculated from the amount of the forgiven debt at the rate

Tax must be withheld from any income paid to an individual from the date of its calculation. Tax must be transferred to the budget no later than on the business day following the withholding.

The commented Letter is consistent with the summer clarifications of the Ministry of Finance that such interest-free loans will provide a financial benefit for periods before

- did not need to be accrued as of 01/31/2016;

- must be calculated according to last year’s rules, that is, in the understanding of the Ministry of Finance, on the date of repayment (partial repayment) of an interest-free loan, using for the calculation the key rate of the Central Bank in force on the repayment date (details in 2016, No. 20, p. 13 ).

This is interesting: Which medical poles need to be changed

It is clear why the Ministry of Finance decided that when debt is forgiven on an old interest-free loan, there will be no financial benefit for periods before 2020 - because there is no repayment.

However, at the beginning of this year, the financial department gave opposite explanations (details - in 2016, No. 1, p. 26 ; - that financial benefits for periods before 2020 should be recognized as income as of January 31, 2016 and personal income tax should be calculated from it. And Many tax agents did just that. And now, when the debt on such an interest-free loan is forgiven, this personal income tax turns out to be excessively calculated, and if it was also withheld, then it is also excessively withheld.