Document 2-NDFL (personal income tax) is a tax reporting form. It contains information about the income of an individual. Certificates are generated for each individual who has received income and remuneration, and are filled out by the tax agent. This is the direct employer for whom the employee works under an employment or civil law contract. 2-NDFL certificates are made for the period of the year and submitted to the tax office in accordance with the deadlines specified in the legislation.

What it is

The form provides information about the employee and his income. To be completed separately for each personal income tax rate. In them, the employer enters information about himself and the employee.

The form also contains information about the employee:

- passport details,

- resident or not,

- information about income and taxes withheld from income,

- withheld and remitted income tax.

What does it look like

2-NDFL was approved by order of the Federal Tax Service of the Russian Federation (Federal Tax Service of the Russian Federation) dated October 30, 2015 No. ММВ-7-11/485. Starting with reporting for 2020, a new version of the document is applied.

The form has a header and 5 sections:

- the header indicates the reporting year, number, date of compilation, attribute, adjustment number, tax code,

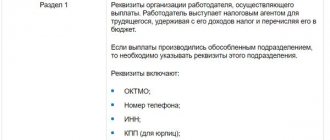

- Section 1 indicates information about the tax agent - employer: OKTMO code corresponding to the location of the agent, contact telephone number, INN (individual tax number) and KPP (reason code for registration) of the agent or legal successor, abbreviated name of the company or full name. O. of the entrepreneur, information on the legal successor,

- Section 2 reflects data about the individual who received the income: TIN, surname, first name, patronymic in full, status, date of birth, citizenship code, document code,

- section 3 reflects income monthly and in general, codes of income and deductions, amounts of deductions,

- Section 4 reflects deductions: standard, social and property,

- Section 5 groups the total amounts of income, the tax base, the calculated amount of tax and fixed payments, the amount of tax withheld, transferred, excessively withheld, and not withheld.

The certificate is signed by the tax agent or a representative of the tax agent.

Responsibilities of the employer

An organization - a tax agent is obliged to: calculate, withhold, transfer tax on payments to individuals. And also provide timely reporting on income, withheld and transferred taxes.

Is it possible to get a mortgage without 2-NDFL?

Work certificate 2-NDFL is a document that:

- fixes the amount of your income;

- confirms that you are employed in accordance with labor laws;

- guarantees that the employer fulfills the obligations to pay taxes and contributions to the budget.

Based on this certificate, your solvency is assessed, which directly affects the loan amount. For example, Sberbank takes into account that loan payments do not exceed 50-60% of your official income.

Many banks allow you to confirm your income with a certificate filled out from them. Sberbank, for example, in this case will increase the rate by 0.5%. If you receive a salary on a bank card where you apply for a mortgage, you do not need to confirm your income and employment.

In some banks, for example, VTB, you can get a mortgage without proof of income. In this case, you must make a large down payment (40-50%), and the loan rate will be 1.5-2% higher than the basic conditions.

There are cases when a mortgage applicant works without official employment. In this case, it is impossible to obtain this form. Serious financial institutions try not to deviate from the established procedure for providing loans for the purchase of real estate, since the loan amounts are quite high, the terms are long, and the bank must be confident that the borrowed money will be returned without problems.

But many financial institutions allow their borrowers to take advantage of the opportunity to obtain a loan by issuing a certificate of income received in a form developed by the bank. In this case, you need to know that the mortgage interest rate will be much higher, as well as the size of the down payment.

We invite you to familiarize yourself with the amount of alimony in the LPR

After reviewing this document, the lending manager will be able to assess the applicant’s solvency, level of income, and regularity of receipt. Salary information is necessary to calculate the mortgage loan amount. If the monthly income received by the client according to the documents provided is not high enough to provide a loan for a large amount, the bank may not approve its issuance with a minimum contribution.

If it is not possible to obtain form 2-NDFL, you should not resort to trickery and get a fake certificate in the hope that the bank will not check the amount of the applicant’s income. Lenders take the verification of provided documents seriously, and often carry out this procedure in two stages. First, the loan officer deals with this issue.

It checks the authenticity of the document, signatures, seals, address data of the company indicated in the certificate, etc. Next, the verification is carried out by the security service. A bank employee can call the accounting department of the loan recipient’s enterprise to check whether the salary indicated in the certificate corresponds to the amount actually received by the employee as announced by the accountant.

If it is not possible to provide the bank with a 2-NDFL certificate, you can submit other documents confirming the client’s solvency:

- extract from personal account;

- documents confirming receipt of regular active or passive income.

Today it is no longer uncommon to have a mortgage without certificates. But it should be taken into account that the interest on such loans will also be quite high. You can get a loan to purchase housing if the amount of the down payment is in the range of 35-50% or more.

An unemployed person can receive a certificate of income received in the form of unemployment benefits at the employment center. All you have to do is submit an application and then pick up the completed certificate. But this will not be Form 2-NDFL. If an individual has not worked for more than three years and is not registered with the employment center, then there is simply nowhere for him to get a certificate of income, because officially there was none.

If a non-working person had income from other sources, it is necessary to report them by indicating in the 3-NDFL declaration. In addition, you will need to calculate the tax yourself and transfer it to the budget. In this case, evidence of income received and taxes paid on it will be a copy of the tax return.

Pensioners receiving payments from non-state pension funds can request 2-NDFL from the local branch of their fund. But disabled citizens who receive state pensions will not be able to obtain such a certificate from the Pension Fund of the Russian Federation, since such pensions are not subject to personal income tax.

As mentioned above, starting from 2020, 2-NDFL is issued on a new form. Or rather, on two forms:

- The first - it is now called 2-NDFL - is used for submission to the Federal Tax Service.

It has a new structure: it consists of some kind of title page, three sections and one appendix. At the very beginning of the document, information about the tax agent is provided, in section 1 - information about the individual in respect of whom the certificate is being filled out, in section 2 - information about the total amount of income, tax base and personal income tax, in section 3 - deductions provided by the agent: standard, social and property, and the appendix provides a breakdown of income and deductions by month.

- The second form, which is issued to the employee, is simply called “Certificate of income and tax amounts of an individual” (without the usual “2-NDFL”). It almost completely repeats the previous form (from the order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/ [email protected] ).

For what period is a certificate required?

There are several options - it all depends on where and why it is being done.

For what period is the 2-NDFL certificate issued?

- The document is submitted to the Federal Tax Service for the past year in full. This is determined by tax legislation.

- If an employee resigns, he is given a certificate to provide to the next employer. The certificate is completed for the entire current period worked by the employee.

- The certificate may be provided to the employee upon his/her application for presentation at the place of request. For example, to a bank to fill out a loan application, to social security authorities, to obtain a visa. In these cases, the employee determines the period himself in the application.

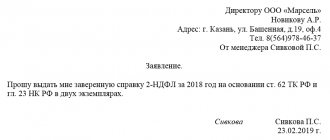

How long does it take to obtain a 2nd personal income tax certificate according to the law?

If necessary, submit a 2nd personal income tax report to a third-party organization. the person submits a written application for the issuance of the form to the accounting department. Here they indicate how many copies to prepare and for what period. There is no need to indicate the location of the presentation.

According to Art. 62, the company has three working days to fill out the certificate. If these deadlines are violated, the employee has the right to file a complaint with the labor inspectorate. The management of the organization will be held administratively liable for violating the law.

Please be aware that the certificate is issued free of charge, regardless of the number of applications from the same person, and a number of forms are prepared upon request.

After receiving the declaration 2 personal income tax, physical. the person checks the presence of the signature of the authorized representative for the preparation, seal and registration.

Where and when is it compiled?

Form 2-NDFL is drawn up by the tax authority or handed to the employee. When submitted to the tax authority, 2-NDFL will be a reporting form, therefore it is submitted within the deadlines established by tax legislation.

Any person may need the document to confirm income. Upon application to the accounting department of the enterprise, it must be prepared no later than 3 working days from the date of submission of the application.

Where is 2-NDFL required:

- for a new job to receive deductions for children and to pay for sick leave,

- to the bank to obtain a consumer loan, mortgage,

- to social security authorities to receive benefits and benefits,

- to the visa center,

- to the Federal Tax Service to receive a tax deduction by filing a 3-NDFL declaration, which must include information about income and tax from 2-NDFL.

The “Taxpayer Personal Account” service allows you not to collect certificates for filing a declaration; they are already entered there. Thus, filling out and submitting 3-NDFL has become much easier.

When a citizen is dismissed, he is provided with 2-NDFL for the current year along with other documents. It will be needed to confirm income and provide deductions at a new place of work. And also for the previous two years - for calculating temporary disability benefits.

How to prepare a certificate in form 2 personal income tax

Each bank independently develops a package of business papers for obtaining a loan or mortgage, and determines the validity period of the submitted 2 personal income tax certificates.

Declaration 2 of personal income tax is an official certificate signed by a trustee, which must contain reliable information about the employee’s earnings, applied deductions, calculated, withheld and transferred personal income tax to the treasury. Information is provided at the place of official employment or study. faces.

Based on this document, a bank’s solvency calculation is made, deductions are applied at the place of next employment, and the form is considered a reason for taxation. Therefore, to avoid mistakes and possible penalties, you should carefully check the submitted information.

For which tax periods should it be issued?

The document is drawn up:

- For the quarter. For a certain period of time, the document is usually required by social authorities, banks, and visa centers. The application for the certificate simply indicates the period - a quarter.

- Over the past years. Also, at the request of an employee, including a former one, forms for the past years are generated in full. For example, they are needed for calculating certificates of incapacity for work for pregnancy and childbirth, filing a 3-NDFL declaration for past years.

2-NDFL with a register relate to tax reporting. Shelf life is no more than 5 years. After which the documents can be destroyed. The deadlines are set out in the Tax Code, the laws “On Archiving in the Russian Federation” and “On Accounting”.

How long is personal income tax certificate 2 valid for obtaining a bank loan?

Each bank independently develops a package of business papers for obtaining a loan or mortgage, and determines the validity period of the submitted 2 personal income tax certificates.

After contacting the physical person to a credit institution, a complete list of requirements for registration is issued, indicating the expiration date of each of them. For example, they will establish that the validity period of a certificate in Form 2 of personal income tax is 1 month from the date of registration.

Also, the bank considers income for the last six months or a year, in this case, they prepare a report for this period, but the validity period will still be 1 month. And if physical the person will contact the bank in a couple of months, the certificate will have to be updated.

Depending on the amount requested by the borrower, according to the bank’s requirements, the certificate contains income for a specified period:

- Loan amount 300 thousand rubles – income of the last 4 months;

- amount up to 1 million rubles - income is calculated for 8 months;

- loan over 1 million rubles - income statement for 3 years (the period is reduced at the discretion of the bank).

And the second question asked by the taxpayer is whether the bank checks the information in the report when applying for a loan. Without a doubt, every bank has a security service that monitors the legality of issuing such certificates. If false information is identified, physical a person or legal entity is subject to punishment.

This is interesting: Deadline for transferring personal income tax from wages

Rules for document execution

The certificate was approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485 “On approval of the form of information on the income of an individual, the procedure for filling it out and the format for its presentation in electronic form”, valid from 2020, but starting with reporting for 2017, that is, changes have been made to it since 2020. According to the order, it is filled out by the tax agent based on the information contained in the tax registers. The filling procedure is regulated by the same orders.

In the 2020 form, new income and deduction codes, new lines have been added, the barcode has been adjusted, and data on the individual’s place of residence has been removed.

Data correction

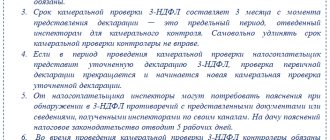

No one is immune from an error, so to correct it, corrective data is submitted.

An adjustment is made if:

- typos,

- counting error

- technical.

If an error is found in the submitted report, a new form with clarifying information is submitted. The document serial number cannot be changed. Incorrect information is corrected. And also the column “adjustment number” is changed: instead of “.00”, “.01” is put, if 2-NDFL is subject to change for the first time.

Registration process

The certificate is issued in accordance with the procedure established by legislative acts. You need to focus on the standards of the Federal Tax Service of Russia.

It is important to reflect reliable information in each of the paragraphs in the document. If this is not done, then obtaining a loan will be impossible due to the lack of a positive decision from the bank.

The help contains the “Sign” field. If it contains code “1”, it is issued on the basis of Article 230 of the Tax Code of the Russian Federation. The line with the name of the Federal Tax Service must be filled in with the digital designation of the department where the employer is registered.

The first paragraph is necessary to reflect information about the employer.

- Checkpoint (when working in an institution);

- TIN (if an individual independently submits information to the tax office);

- last name, first name, patronymic of the individual entrepreneur or name of the enterprise;

- OKATO code (by region of business).

Next, the taxpayer's information is displayed.

- surname, first name, patronymic;

- tax status (“1” – for residents of the Russian Federation; “2” – for non-residents of the Russian Federation, “3” – for qualified specialists who are not residents of the Russian Federation);

- date of birth, indicating first the day, then the month, and then the year;

- citizenship data (OKSM code);

- passport information (series and number);

- address at the place of registration.

Information about a person’s income is reflected in the third section. The amounts that are subject to taxation are stated here.

The data is entered into a table that has sections:

- the amount of the deduction;

- deduction code;

- amount of income;

- income code;

- the reporting month.

Next, the deductions that were applied to the taxpayer’s income are reflected. In this case, special codes are assigned that relate to each type.

The last section fully reflects the personal income tax, and all lines contain information about transactions with the taxpayer’s income:

- The total amount of income is calculated without taking into account deductions. It shows how much money a citizen received in a calendar year or other period.

- The tax base specifies the amount on which tax is taken into account. The deduction is not taken into account in this case.

- The line with the tax amount reflects the full amount of the tax contribution.

- The withheld tax column indicates the amount that was withheld by the employer from the employee.

- Funds transferred to the state budget are reflected in a separate column.

Basic Rules

The legislation regulates the issuance of certificates to employees and their submission as a report to the tax authority.

Deadlines established by law:

- tax withheld, the indicator is indicated “,1” - provided no later than April 1 of the year following the reporting year,

- tax not withheld, attribute “,2” - provided until March 1 of the year following the reporting year.

According to Article 62 of the Labor Code of the Russian Federation, the employer, no later than three days from the date the employee submits the application, issues him a form with information about income. But there is no liability for non-delivery. If any difficulties arise, you should go to court.

Terms from banks

If a citizen applies for a loan, he is required to provide information about his income. Based on the amounts specified by the employer, banks decide on approval of the application and the amount of the credit limit.

The security service and bank specialists check the certificate:

- appearance - cleanliness, literacy,

- correctness of filling - arithmetic, compliance with the recommendations of the Federal Tax Service, correct filling of all fields,

- correspondence between the print data and the head of the certificate - comparison of the identification number and the name of the organization,

- calculations - arithmetic component,

- income and deduction codes - they must comply with current legislation.

In cases of inconsistencies in the document identified by the bank, they may refuse the loan and blacklist the intended borrower. Therefore, you need to know how banks check the 2-NDFL certificate.

Next comes a more detailed check of the borrower. Banks have access to the database of the Federal Tax Service and the pension fund.

Sberbank and some other banks do not request a certificate if employers have a salary project in these organizations, and accordingly, the employee has a salary card.

Document production time

A certificate in form 2-NDFL is submitted by the tax agent:

- In relation to tax withheld from an individual - annually to the Federal Tax Service (no later than March 1 of the year following the reporting year). Certificates are prepared for each employee who was paid income during the calendar year. If an employee worked during the tax period in several divisions of one enterprise, then to fill out form 2-NDFL you should use the recommendations from the letter of the Ministry of Finance of Russia dated July 23, 2013 No. 03-02-08/28888.

- In relation to the tax that the employer was unable to withhold from an individual - annually to the Federal Tax Service (no later than March 1 of the year following the reporting year).

IMPORTANT! Officials have reduced the deadline for submitting 2-personal income tax with sign 1 by 1 month. Now, regardless of the established criteria, the form must be submitted by March 1st. But for the report for 2020, the deadline is postponed to 03/02/2020, because... 03/01/2020 - Sunday. For details, see the material “The deadline for submitting 6-NDFL and 2-NDFL has been shortened.”

To learn about the consequences of failure to submit a certificate to the tax authority, read the article “What is the responsibility for failure to submit 2-NDFL?”

- At the request of the employee an unlimited number of times, and the employer cannot deny the employee his right (letter of the Federal Tax Service of Moscow dated February 24, 2011 No. 20-14/3/16873). The employee may also require several original certificates to be provided at once.

In Art. 230 of the Tax Code of the Russian Federation does not stipulate the period for issuing a certificate after the employee’s application. At the same time, in Art. 62 of the Labor Code of the Russian Federation for issuing a salary certificate establishes a three-day period from the date of receipt of the employee’s written application.

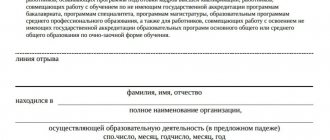

Does this mean that in order to obtain a certificate it is necessary to write an application? Not always. Some employers issue such documents at the employee’s verbal request, as well as upon dismissal - without reminders (in accordance with Article 84.1 of the Labor Code of the Russian Federation). If the enterprise is large or the employer has taken the position that nothing will be provided without an application, you should write a petition in any form.

In the application, it is important to correctly indicate your personal data, as well as the period (measured in years) for which the certificate is required. The certificate must be issued as many times as necessary upon the employee’s request within a three-year period for which his income is taken into account.

How long does it take to issue 2-NDFL to a resigning employee, as well as to an individual (not your employee) who received income from you, ConsultantPlus experts told. Proceed to the explanations by signing up for a free trial access to the system.

The number of requests for this form by a company employee is not limited.

Form 2-NDFL must be fresh. The bank must verify the client's solvency at the time of applying for a mortgage loan. Therefore, a certificate taken in September will not be suitable for providing to the lender when applying for a loan, for example, in December. It is necessary to clarify this information with the bank’s credit manager or ask this question through the hotline of the financial institution where the mortgage will be issued.

The validity period of the certificate will depend on the requirements of the person requesting it. As a standard, the 2-NDFL certificate does not have a validity period. It is provided for the past period and does not reflect the current state.

We invite you to familiarize yourself with the nuances when applying for a mortgage

It's a different matter when contacting a bank. The lender is interested not only in last year’s income, but also in the applicant’s current financial situation. Therefore, most banks put forward a mandatory term limit. But not by the validity period, but by the period of coverage of this certificate. Therefore, it turns out that creditors will not be satisfied with the 2-NDFL certificate received six months ago. Not because the deadline has expired, but because it does not reflect the current situation.

The higher the loan amount, the stricter the terms requirements. Some banks, if the size of the mortgage loan is more than 1 million rubles, require that the personal income tax certificate for the mortgage be issued no later than two weeks before the application.

If a citizen knows that a 2-NDFL certificate will be required to obtain a loan, he should also take into account the deadline for its production by the employer. After contacting the accounting department, the document must be generated within three working days. Those. If an employee requests a certificate on Monday morning, he can expect to receive it on Wednesday evening or Thursday morning (maximum). But the certificate will be provided on these same days if the employee requests it on Friday evening.

Derogation from these rules is prohibited. Failure to provide a certificate on time is a reason for a complaint to the Labor Inspectorate. The rule must be observed even if the employee requests 10 copies of the certificate. Or he will apply for its registration very often.

When applying for a mortgage loan, the bank will definitely request a certificate of income from the potential borrower. The lender decides for how long it needs to be completed. There are no clear instructions on this matter. As a rule, we are talking about obtaining a 2-NDFL certificate. It should be requested from the accounting department of the enterprise where the borrower works.

Certificate from individual entrepreneur

An individual entrepreneur, if he hires employees, is the same tax agent as legal entities. He calculates and pays wages, calculates taxes on them, and submits reports for employees. This means that an employee can apply to an individual entrepreneur for a certificate of income.

The deadline for issuing a certificate is no different from the deadline for issuing a legal entity. The letter of the Ministry of Finance of the Russian Federation and the Labor Code are valid for all employers. According to the application - within three days.

Refusal to issue a certificate

A refusal to issue a personal income tax certificate 2 to an employee is permitted only if the person requests a document with an expired storage period. In other situations, the employer issues a form:

- on the day of application - to an employee on staff;

- within 3 days - to the dismissed employee.

For an unlawful refusal, an organization or entrepreneur will face a fine under Art. 5.27 Code of Administrative Offenses of Russia.

Table. Penalties for refusal to issue personal income tax certificate 2 to an individual.

| Penalty amount | Officials and individual entrepreneurs | Entity |

| For first offense | 1,000 - 5,000 rub. | 30,000 - 50,000 rub. |

| For repeat offense | 10,000 - 20,000 rub. An official may be disqualified for up to 3 years | 50,000 - 70,000 rub. |

We recommend additional reading: How to obtain a certificate of income 2 personal income tax through State Services

Where to go if you are not given the required form:

- to the labor inspectorate;

- If the case cannot be resolved in the first way, file a claim in court.

Important! To prove the infringement of your rights, have in your hands a written application for the issuance of a certificate with the date, signature and mark of the employer’s office that your appeal in a second copy has been accepted for consideration.

Delay in payment of wages

Delay in payment of wages is a very serious violation. The Labor Code of the Russian Federation obliges the employer to pay wages at least twice a month. Exact deadlines are specified in internal documents.

If wages are delayed, an employee has the right to contact the labor inspectorate with a statement. The labor inspectorate inspects the enterprise and issues an order. From the first day of delay, the employer pays employees compensation in the amount of 1/150 of the refinancing rate for each day. The employer may be issued a fine.

Non-standard situations

Some unexpected situations may be non-standard.

For example:

- Transition period – accrued wages for December, paid in January. The inspection has already made recommendations to reflect the December salary in December of the reporting year.

- If additional accrued wages for previous periods were paid in January, it will be reflected in the certificate in January.

- Under civil contracts, the payment period coincides with the period of income accrual.

- The certificate contains a column “excessively withheld tax,” which is filled in if the tax was not adjusted in the reporting period, but transferred to the next one.

If an error is identified in a report that has already been submitted, a clarification is submitted with corrected indicators. In this case, the certificate number does not change, but in the column “correction number” a number is entered indicating the time it is corrected.

If the company is liquidated

When a company is liquidated, there is usually a legal successor; all responsibilities for storing documents are transferred to him. Therefore, you can get a certificate from him.

Is it possible to make a certificate yourself?

On the website of the Federal Tax Service of the Russian Federation today it is possible to independently generate a certificate of income for the required period. To do this, you only need to create a taxpayer’s personal account on this resource.

After registering in the LC, you will need to go to the “Income Tax” section, and from there to the “Information about certificates...” subsection. Next, all that remains is to indicate for how many months and what year you need data.

With this method of document execution, you do not have to wait three days. Information search is carried out in real time. You will receive the results of your request within a couple of minutes. If necessary, they can be immediately printed from the screen.

This method has a couple of disadvantages:

- the site stores data only for the last three years;

- Not every organization will accept a printout from a website that is not certified by the employer or the tax office.

But in emergency situations, when the original document is delayed for some reason, it is quite possible to negotiate with the receiving organization to temporarily provide a printout from the website.

https://youtu.be/woSXlxCkZZo

VKontakte BEST LOANS OF THIS MONTH>For what period is 2-NDFL issued?

The outcome of many life situations depends on the 2-NDFL certificate. Let's figure out how and for what period you can get it. And what can you possibly demand?

Document validity period

The validity period of 2-NDFL for the tax authority is unlimited. When submitting a 3-NDFL declaration, the documents attached to it have no validity period. If the 3-NDFL declaration is submitted through your personal account, a certificate is not needed. Since she is already in her personal account.

Banks usually give a 30-day period for 2-personal income tax. Or here’s the situation: you came to apply for a loan on October 5, but the document did not include the September accruals - the bank will ask you to redo the certificate.

Social security authorities also limit the validity period to 30 days. Similarly, the visa center – 30 days.

Let's sum it up

You can take advantage of the right to receive a tax deduction due to the fact that you are a citizen of our country and have it from the very beginning. You can return funds when purchasing real estate, paying for educational services, undergoing expensive or simply paid treatment , etc. However, to do this, in any case, you will have to collect a significant number of documents, the list of which will necessarily include a 2-NDFL certificate.

Be sure to check whether all the information specified in the certificate is true; even experienced accounting workers can make mistakes when compiling it

When you receive it, do not forget to check whether the information given in the document is true, whether there are corrections in the paper, or any marks or additions that should not be there according to the rules, and whether all seals and signatures have been affixed. In general, take control of the situation into your own hands and quickly get the desired document.