The legal topic is very complex, but in this article we will try to answer the question “Compensation upon dismissal, personal income tax code 2020.” Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

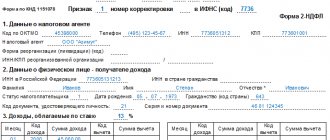

Income tax on compensation paid upon dismissal of an employee is levied on citizens of the Russian Federation, as well as foreign citizens working in Russia and residing in the country for at least 183 days a year. The form of the 2-NDFL certificate and the procedure for filling it out were approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/

When does compensation arise for unused vacation upon dismissal?

As we have already said, as a general rule, such a thing as compensation for vacation is a consequence of the dismissal of an employee. Such a payment is included in the amount of the final settlement with the employee on his last working day (Article 140 of the Labor Code of the Russian Federation). At the same time, personal income tax is withheld. You can pay it to the budget the next business day or immediately.

The article is relevant for the following regions of the Russian Federation:

Republic of Adygea (Maikop), Republic of Altai (Gorno-Altaisk), Republic of Bashkortostan (Ufa), Republic of Buryatia (Ulan-Ude), Republic of Dagestan (Makhachkala), Republic of Ingushetia (Magas), Kabardino-Balkarian Republic (Nalchik), Republic of Kalmykia (Elista), Karachay-Cherkess Republic (Cherkessk), Republic of Karelia (Petrozavodsk), Republic of Komi (Syktyvkar), Republic of Crimea (Simferopol), Republic of Mari El (Yoshkar-Ola), Republic of Mordovia (Saransk), Republic of Sakha (Yakutia) ( Yakutsk), Republic of North Ossetia-Alania (Vladikavkaz), Republic of Tatarstan (Kazan), Republic of Tyva (Kyzyl), Udmurt Republic (Izhevsk), Republic of Khakassia (Abakan), Chechen Republic (Grozny), (Chuvash Republic (Cheboksary), Altai region (Barnaul), Transbaikal region (Chita), Kamchatka region (Petropavlovsk-Kamchatsky), Krasnodar region (Krasnodar), Krasnoyarsk region (Krasnoyarsk), Perm region (Perm), Primorsky region (Vladivostok), Stavropol region (Stavropol), Khabarovsk region (Khabarovsk), Amur region (Blagoveshchensk), Arkhangelsk region (Arkhangelsk), Astrakhan region (Astrakhan), Belgorod region (Belgorod), Bryansk region (Bryansk), Vladimir region (Vladimir), Volgograd region (Volgograd), Vologda region (Vologda) ), Voronezh region (Voronezh), Ivanovo region (Ivanovo), Irkutsk region (Irkutsk), Kaliningrad region (Kaliningrad), Kaluga region (Kaluga), Kemerovo region (Kemerovo), Kirov region (Kirov), Kostroma region (Kostroma), Kurgan region (Kurgan), Kursk region (Kursk), Leningrad region (St. Petersburg), Lipetsk region (Lipetsk), Magadan region (Magadan), Moscow region (Moscow), Murmansk region (Murmansk), Nizhny Novgorod region (Nizhny Novgorod) , Novgorod region (Veliky Novgorod), Novosibirsk region (Novosibirsk), Omsk region (Omsk), Orenburg region (Orenburg), Oryol region (Oryol), Penza region (Penza), Pskov region (Pskov), Rostov region (Rostov-on -Don), Ryazan region (Ryazan), Samara region (Samara), Saratov region (Saratov), Sakhalin region (Yuzhno-Sakhalinsk), Sverdlovsk region (Ekaterinburg), Smolensk region (Smolensk), Tambov region (Tambov), Tver region (Tver), Tomsk region (Tomsk), Tula region (Tula), Tyumen region (Tyumen), Ulyanovsk region (Ulyanovsk), Chelyabinsk region (Chelyabinsk), Yaroslavl region (Yaroslavl), Moscow, St. Petersburg, Sevastopol, Jewish Autonomous region (Birobidzhan), Nenets Autonomous Okrug (Naryan-Mar), Khanty-Mansiysk Autonomous Okrug - Yugra (Khanty-Mansiysk), Chukotka Autonomous Okrug (Anadyr), Yamalo-Nenets Autonomous Okrug (Salekhard).

Income code for compensation for unused vacation upon dismissal in 2020

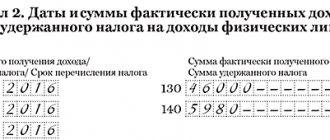

If in a situation where the vacation period falls within the framework of one month, everything is clear, then what to do with “rolling” vacations, the end date of which does not fall in the month when they were paid? The answer to this question has been repeatedly given by both tax authorities and the Ministry of Finance, including in the letters that we mentioned earlier: regardless of the start and end dates of the vacation, the period for receiving income will be the month in which the vacation pay was actually paid. Read about reducing the tax base for individuals in the article “Main types of tax deductions for personal income tax in 2017.” Results In the 2-NDFL certificate, payments to vacationers must be separated from wages and accounted for under a separate income code. This will allow you to comply with the requirements of tax legislation regarding the procedure for tax accounting and filling out reports.

https://youtu.be/gldN2UlsJdg

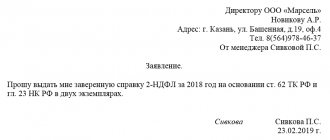

What certificates are issued upon dismissal of an employee at his request?

The responsible HR employee can explain to the dismissed employee what certificates are issued upon dismissal at his request. Here is a list of possible requests:

A copy of the order or order on termination of the employment contract. The paper must be certified with the necessary signatures and the seal of the organization; Certificate for the current year on wages in form 2-NDFL. It may be useful to a person if he wants to apply for a loan or mortgage, receive a tax deduction, etc., issued by the accounting department; Certificate of average salary for the previous three months. Necessary if the employee plans to receive unemployment benefits; Copies of any documents that contain information about the employee’s work activity in this organization are also included in the certificates issued upon dismissal. These may be orders for bonuses or penalties, extracts from documents on wages or insurance contributions, and others.

The reason for the employee’s dismissal is noted by the HR employee in his work book. Accordingly, all of the above certificates are issued upon dismissal of an employee at his own request and for other reasons for termination of the employment contract.

As a result, any person who plans or is forced to change his field of activity needs to remember what certificates are given upon dismissal. This knowledge will help prevent negligence on the part of HR employees and will allow you to avoid paperwork, as well as save enough time in the future.

spmag.ru

Vacation income code in personal income tax certificate 2

- All income codes that are used in the process of creating personal income tax certificate 2 are listed in Appendix No. 3, order of the National Assembly of Russia dated November 17, 2010 No. MMV-7-3/611;

- There is a specialized code that reflects data on a person’s vacation - 2012;

- Vacation funds are subject to mandatory tax deduction in the amount of 13%.

Thus, it becomes clear that when filling out the document, you will need to indicate code 2012 if the person was on vacation at some point.

A very serious point is compensation for vacation that was not used. It should be immediately noted that data on the type of income should definitely be reflected in the personal income tax certificate format 2. We need to talk about the design of this element in more detail.

Rules for document execution

The type of declaration was approved on October 30, 2020. The mandatory requirements when filling out 2nd personal income tax include completing the following fields:

Information about the employer, details. Reductions are allowed only in accordance with the statutory acts;

information about the recipient of the profit - individual. face; profit subject to taxation; deductions that were applied in the reporting period; the amount of profit and personal income tax.

In the information field about the agent, you must indicate complete information about the legal entity.

In the information column about physical the person is told the following:

Last name, first name, patronymic; citizenship and status as a taxpayer; place of registration and place of residence; passport details.

Profit on which personal income tax is withheld is reflected by month. At the same time, indicate the code of income and tax deductions indicating the amounts. If physical the person had the right to other deductions - social or property, this information is reflected in certificate 2 and indicates that such a right was presented.

The form must be certified by the manager or other authorized person and stamped. The certificate is considered invalid without a stamp.

In relation to the calculation of 2nd personal income tax, the registration procedure applies: corrections are not allowed, if errors are detected, a new form is issued as soon as possible.

For misrepresentation of information or delay in time, administrative sanctions are applied to the tax agent.

Compensation for unused vacation personal income tax code 2019

Income from transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices

In addition to the benefits of hiring employees, the company has a number of responsibilities. The employer must calculate and transfer mandatory contributions to Russian state funds. Responsibilities also include the need to perform the functions of a tax agent for income tax.

How to get a certificate if the company is liquidated

Some employees, when terminating an employment contract, do not immediately think about receiving an income statement for a certain period.

If the company, as before, is on the Unified State Register of Legal Entities and carries out its production activities, there will be no problems. However, the situation may change if the company receives the status of liquidated organizations.

To obtain a certificate of income for a former employee, it is enough to contact the tax office at the place of registration of the legal entity.

What documents must be given upon dismissal?

Since one of the obligations of the liquidated enterprise is to provide financial statements for all employees, the applicant will be able to obtain information about his income within 3 days.

Income code for personal income tax in 2018 when receiving compensation for dismissal

Attention

The difference between payments for time worked and for annual rest is significant, since they provide for different points for calculating the taxable base for personal income tax:

- earnings for days worked - the last day of the month of its accrual or the day of termination of the working relationship (clause 2 of Article 223 of the Tax Code of the Russian Federation);

- vacation pay - the day of the expense transaction for their payment (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

That is, the tax agent is obliged to calculate and withhold personal income tax at the time of payment of vacation pay, and he has the right to transfer the withheld amount to the budget until the last day of the month in which the payment was made. This judgment was officially confirmed by the Russian Ministry of Finance in its letter dated January 17, 2017 No. 03-04-06/1618. Thus, a separate reflection of the vacation pay code in the 2-NDFL certificate is required so that tax authorities can monitor compliance with the deadlines and amounts of tax transfers.

Adjustment of 2-NDFL

If the tax service has identified inconsistencies and found inaccuracies, they will have to be corrected. The company's accountant is required to make new calculations. When entering corrected information in the form, a code of 01 or more is entered in a line specially designated for this, which corresponds to the number of corrections.

It is impossible to correct errors in an already completed form; the accountant will have to draw up a new form, marking it as correcting previously submitted information. Each correction is subject to mandatory penalties.

Corrected forms are submitted with the actual filing date included. They must be transferred to the tax service using standard methods for the organization:

- Electronic.

- In paper version.

When filling out a corrective report, only corrected data is entered into it.

Compensation for unused vacation income code

Income code 2014 - severance pay. Income code 2611 is a forgiven debt written off the balance sheet. Income code 3021 - interest on bonds of Russian companies. Income code 1010 - transfer of dividends. Income code 4800 is a “universal” code for other employee income that is not assigned special codes.

For example, daily allowance in excess of the tax-free limit or sick leave supplement. See the full list of income and deductions for reference 2-NDFL Income codes that are subject to personal income tax when the limit is exceeded Income code 2720 - cash gifts to an employee. If the amount exceeds 4,000 rubles, then tax is charged on the excess. In the certificate, the amount of the gift is shown with income code 2720 and at the same time with deduction code 503. Income code 2760 - financial assistance to an employee or former employee who has retired. If the amount of assistance exceeds 4,000 rubles, then a tax is levied on the excess.

Severance pay upon dismissal personal income tax code 2020

The monthly benefit may also be subject to taxation under the Russian Tax Code. By agreement If dismissal occurs by agreement of the parties, then severance pay upon dismissal is not paid by personal income tax.

Other payments, including wages for hours worked, vacation pay, bonuses, everything that is provided for in the collective agreement, are subject to taxation. The severance pay for the above-established income has an income code of 4800 “Other income”.

Is severance pay subject to personal income tax upon dismissal? When is severance pay paid upon dismissal with personal income tax? On the day of dismissal.

Personal income tax when paying severance pay

- According to Article 84 of the Labor Code of Russia, payment is made upon termination of an employment contract due to a violation of the rules of conclusion. This is done if the misconduct is not on the part of the employee, but the continuation of the performance of labor functions is impossible;

- according to Article 178 of the Labor Code of Russia, it is possible to receive a payment if the company is liquidating or reducing its staff position;

- according to Part 3 of a similar legal act, termination of an employment contract is possible in connection with the conscription of employees into the Armed Forces;

- according to paragraph 5 of a similar legal act, it is possible to receive payments due to the employee’s refusal to be transferred to another location to perform work duties.

The list of all circumstances is not closed.

Online magazine for accountants

- three times the average monthly salary - for ordinary employers;

- sixfold - in the Far North and equivalent areas

2301 fines and penalties paid by an organization on the basis of a court decision for failure to voluntarily meet consumer requirements in accordance with the Law of the Russian Federation dated 02/07/92 No. 2300-1 2611 bad debt written off in the prescribed manner from the balance sheet of the organization 3021 income in the form of interest (coupon ), received by the taxpayer on the circulating bonds of Russian organizations, denominated in rubles and issued after January 1, 2020 Deductions 619 positive financial result on transactions accounted for in an individual investment account Where the income code is indicated for compensation upon dismissal in 2020 Income codes are needed when filling out a certificate 2-NDFL.

Personal income tax from severance pay upon dismissal

Such payment occurs only by written order on the day the employment relationship ends. An additional order for processing payments is not required from management.

According to Article 178 of the Labor Code of Russia, severance pay is payable in the following situation:

- upon dismissal of an employee due to liquidation of the company;

- upon termination of the employment relationship due to a reduction in staff position or staff size.

Definitions Dismissal is a procedure in which final settlement is made between the employee and the employer.

A resignation letter is a document on the basis of which further document flow takes place.

It is written in free form indicating specific details.

Payment of personal income tax upon dismissal in 2020

Legislation The issue is regulated by legal acts:

- Article 84 of the Labor Code of Russia;

- Article 178 of the Labor Code of Russia;

- Article 226 of the Tax Code of Russia;

- Chapter 23 of the Tax Code of Russia.

Cases in which severance pay is paid Severance pay is taxed at a preferential rate and on grounds. Considered compensation established by federal or local law.

Preferential taxation does not include payments of wages paid for time worked, bonuses expected to be paid on the basis of a collective agreement.

Compensation for unused vacation upon dismissal in 2018: income code

Personal income tax." Who is obliged to calculate, withhold and pay personal income tax? In accordance with Article 226 of the Tax Code of the Russian Federation, the following counterparties are required to calculate from an individual (taxpayer) and pay a certain amount of tax to the budget:

- organizations registered in the Russian Federation;

- entrepreneurs (obliged to pay both for themselves personally and for employees);

- privately practicing notaries;

- lawyers who have organized private law offices or consultations;

- separate divisions of companies whose head offices are registered in foreign countries, but divisions are located on the territory of the Russian Federation

Responsibility for calculating, withholding and paying personal income tax rests not with the employee as a taxpayer, but with the employer.

Cash payments without dismissal

At the request of the employee, the employer will replace days of rest with vacation payments, but this is done only in relation to days exceeding the established norm. For example, an additional three days of rest due to employees with irregular working hours is replaced by a cash payment. Teachers who are entitled to a 45-day vacation can also replace part of their vacation (up to 17 days).

https://youtu.be/3OSut2ut1IA

For “harmful” people, vacation is replaced with money only if it exceeds the minimum norm - 7 days. For example, for working in hazardous conditions, an employee is entitled to an additional 10 days, seven of them are issued, and the remaining three are replaced with compensation.

Also, you cannot replace rest with money for the following categories of workers:

- Pregnant employees;

- minor workers.

The income code in 2nd personal income tax is the same as compensation upon dismissal - 2013.

Compensation for unused vacation in 2020

This position is reflected in the Certificate of Income of Individuals. Calculation of compensation The Tax Code of the Russian Federation does not specify what the grounds for dismissal should be in order to exempt compensation payments from tax.

The Ministry of Finance of the Russian Federation draws attention to the fact that it does not matter for what reasons the employee was dismissed. Most often, termination of a contract occurs by agreement of the parties

Personal income tax on vacation pay - when to pay in 2020 The employer’s consent is not required for an employee to go on vacation

It is important to notify the employer six months before making a decision

First of all, this applies to women who plan to go on maternity leave, minors, citizens who have adopted a child or children under the age of three. According to Article 122 of the Labor Code of the Russian Federation, only a statement from the employee is sufficient.

What to do if documents are not issued

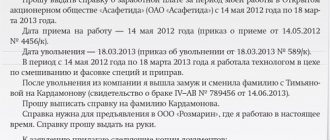

In Art. 62 of the Labor Code of the Russian Federation states that the employer is obliged to provide his resigning employee with all documents related to his work activity with this employer. Some documents are issued on a mandatory basis, while others are issued upon a written application from the employee.

Documents must be prepared and issued to the employee within three calendar days after submitting a written request. As a rule, the application is written to the head of the personnel department and to the chief accountant. There are no problems with issuing papers.

But it may also happen that the employer does not want to issue documents, citing various reasons. For example, the boss is on vacation and cannot certify copies. This is the most “popular” reason for refusal.

There are no valid reasons for refusing to issue documents to a resigned employee. This is the direct responsibility of the employer, and he has no right to evade it. For evasion, he can be brought to administrative responsibility.

If the employer does not want to hand over the documents, the former employee has two legal options:

write an application requesting extradition in two copies and submit it through the secretary. He will register the paper as an incoming document, write down the date of acceptance and the serial number in the journal. He will indicate exactly the same information on the employee’s copy; send the application by registered mail with notification and an inventory of the contents. The notice must be given to the employee who receives the mail. He will sign for receipt. This will be considered the fact that the application has been accepted for consideration.

Within three days after receiving the application, the employer must prepare copies of the originals of all documents related to the applicant’s employment. If he does not do this, the employee has the right:

write a complaint to the labor inspectorate;

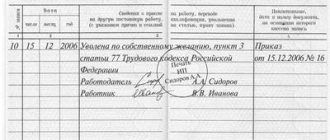

Compensation upon dismissal, personal income tax code 2018 in an individual’s income certificate

In accordance with stat. 127 of the Labor Code of the Russian Federation, in the event of an employee’s dismissal, he is entitled to monetary compensation for the entire period of unused vacation. The amounts of compensation payments are subject to inclusion in the 2-NDFL certificate. In the future, this document will be useful to the specialist when registering as a member of the staff of another enterprise.

From what date do the changes take effect? The Order itself does not contain precise explanations on this matter. To determine the period, it is necessary to count 10 days (calendar) from the moment of the official publication of the normative act - the indicated Order of the Federal Tax Service was registered with the Ministry of Justice on December 21, 2017, its effective date falls on January 1, 2018. This means that certificates for 2020 were required already indicating the new code “2013”.

Note! Vacation compensation is indicated in section 3 of form 2-NDFL. Such amounts refer to the period (month) of final settlements with the employee (stat.

140 Labor Code of the Russian Federation). For example, if an individual quit and received a paycheck in November, the amount of monetary compensation for “non-vacation” vacation should be indicated in payments for November.

What documents and certificates need to be given to an employee upon dismissal?

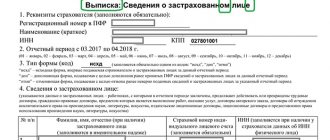

Kristina32, good afternoon! It is necessary to issue certificates in form 2-NDFL and 182-n, as well as mandatory personal accounting information: SZV-M, SZV-STAZH

,

copies of sections 6 and 3 of forms RSV-1 and Calculation of insurance premiums

. Excerpt from No. 7-2016 of the electronic magazine “Simplified” (O.I. Prygova, Deputy Manager of the Pension Fund Branch for Moscow and the Moscow Region, N.G. Sazonova, expert of the magazine “Simplified”):

Form SZV-M. The monthly report contains individual data not only of the dismissed employee, but also of other employees. But they cannot be disclosed (Article 86 of the Labor Code of the Russian Federation and Article 7 of the Federal Law of July 27, 2006 No. 152-FZ). Therefore, do not give a regular copy of the report in the SZV-M form to the employee upon dismissal. Proceed as follows.

Note: Accounting information should be given to employees not only upon dismissal. But also after their submission to the Pension Fund, within the prescribed period. You can generate reports according to the rules of this article.

If you keep records in an accounting program, then print out the SZV-M form from it for only one employee - the dismissed one. The number of reports in the SZV-M form should be equal to the number of months that the employee worked for your company or for an individual entrepreneur. For example, if a citizen worked for six months, he needs to be issued six SZV-M forms for him alone. If you do not have a program, you will have to independently create the SZV-M form for the dismissed person, based on the number of months of his work. That is, re-compile reports for a specific person.

An important circumstance: You cannot issue the entire SZV-M form upon dismissal. This is the disclosure of personal data of other employees

Therefore, provide information only about the person to whom you are issuing the document. .

Section 6 of the RSV-1 Pension Fund form. You fill out this section for each employee. Therefore, you can provide the employee with regular copies of Section 6 for the reporting periods that precede the employee's dismissal. That is, those sections 6 that you have already submitted to the Pension Fund of the Russian Federation. Or which you will only transfer to the fund for the reporting period falling at the time of dismissal. . Take confirmation from the dismissed employee that he received personalized data from you upon dismissal.

The form of the document is arbitrary (Part 4 of Article 1 of Law No. 27-FZ). Nuances that require special attention On the day of dismissal, you need to provide the employee with accounting information.

They are contained in section 6 of the PFR form RSV-1 and in the SZV-M report. Print SZV-M from the program only for one person - the fired person, based on the number of months of his work. It is impossible to issue the entire SZV-M form. This is the disclosure of personal data of other employees.

You create Section 6 of the RSV-1 Pension Fund form for each employee. Therefore, upon dismissal, you can issue regular copies of the sections that you have already submitted to the Pension Fund. Or copies of those forms that you will submit for the period surrounding your dismissal.

www.buhonline.ru