Recently, my friend told me a funny story - she works as an individual entrepreneur, she doesn’t have a seal (if you didn’t know - it’s easier for an individual entrepreneur to work without a seal if it is not necessary for the type of activity, because the presence of a seal obliges you to have a whole hemorrhoid with its receipt, storage and disposal). And her employee needed a personal income tax certificate 2 to apply for a mortgage loan. And the bank gave her a nightmare for almost a month, until they were sent by registered mail the norms of the current legislation along with a notarized certificate (without a stamp). But there the bank agreed to meet them halfway; they could have refused. If you don’t know whether you need a stamp on this certificate, look at the materials on this page and good luck in your difficult task)

Rules of law

The content of the certificate is regulated by Order of the Federal Tax Service of Russia dated October 30, 2015 N ММВ-7-11/ [email protected] It describes a new type of this document.

The order does not say anything about the mandatory affixing of a seal. The Tax Code also does not provide for this. Therefore, the management of the companies themselves decides whether to affix a seal.

Currently, there are rules in place that allow LLCs and JSCs to completely abandon it.

If stamps are not placed at all, then they are not placed on certain types of certificates.

The question of whether a seal is needed or not is decided on the spot.

Composition of the document

Contains information about the income received by an individual.

It states the following:

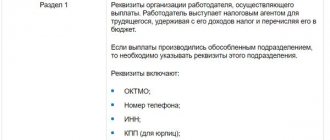

- Tax agent information. Print its name. They also give his phone number. Inform about OKTMO, INN and checkpoint codes.

- Information about who receives income.

- List of taxable income.

- Tax rates.

- Various tax deductions.

- Total amounts of income and tax deductions.

The certificate also states:

- TIN issued in Russia and abroad, last name, first name, patronymic, code designation of an identity document, address and information about place of residence in the Russian Federation, code of a subject of the Federation or a foreign state. The series and number of the passport are also imprinted.

- The income table indicates the month of receipt, the designation of the types of income and their amounts for each type. This also applies to deductions.

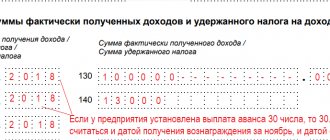

- In the final part, print or enter the total amount of income and taxes that were withheld. The certificate also includes the amount of accrued and over-withheld taxes.

- In the appropriate columns indicate the total cost of the fixed advance payments made. Information is also provided on the amount of taxes that were not subject to withholding.

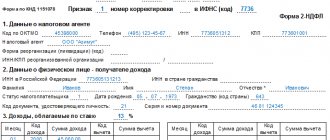

Here is a sample document:

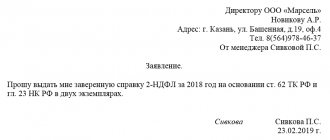

You will find the application form for obtaining a 2-NDFL certificate here.

Is it necessary to put a stamp on an order, confirmation of the type of activity of the organization, or a personal income tax certificate?

In 2020, no changes were made to the legislation of the Russian Federation regarding the design of this document, so to the question of whether it is necessary to put a stamp on the 2-NDFL certificate from 2020, the answer is unequivocal: no.

In accordance with the Tax legislation of the Russian Federation, legal entities that have hired employees must provide the tax authorities with a certificate of income of individuals in form 2-NDFL for each individual employee. This document can be sent in one of two ways:

Is a stamp required on the 2-NDFL certificate in 2020?

In the new certificate form, the MP clause was removed. It stands for print space. It is not provided.

Information must be submitted to the tax authorities electronically. The right to submit in paper form remained with tax agents who provided income to no more than 25 people.

Let us remind you that the new form does not require printing.

If an organization operates within the framework of these laws or uses seals at will, then it puts its seal. However, the certificate is still signed by the manager or his authorized person. E

The certificate will be valid even without a stamp.

In order for it to be used legally, it requires the following information already mentioned:

Information about the tax agent (we wrote about it above).

- Identification data of the individual who received the income.

- Amounts of income for the period specified in the certificate.

- Deductions made.

- Results of income and tax calculations.

Also, the document in question should always indicate the date of preparation. In addition, they write down his number, under which he is listed in the reporting. It is signed by responsible employees.

All information about the recipient should be taken only from the passport. The certificate should be drawn up very carefully, since it may be necessary both for the employee and for the institution, say, for a bank.

Actually, it doesn’t need to be placed. But many firms, financial and other institutions may ask for a document to be certified with a seal.

If it is used regularly or when desired, it can be placed in one of two places:

- on a signature made by an authorized person;

- under the above signature.

Usually they put stamps of any kind there.

The optionality of the certificate indicates the possibility of accepting it without a stamp.

The absence of a stamp does not mean that it is invalid. If the certificate contains all the necessary information, then it should be considered complete.

An exception applies to organizations for which a seal is required.

This rule applies to non-profit organizations.

A seal is also required in circumstances specified by law.

Is a 2-NDFL certificate issued for a foreign citizen on a patent? Information here.

What is the material assistance code in the 2-NDFL certificate? Find out here.

How to indicate the TIN in 2-NDFL

If a company makes payments to individuals, then they are required to submit 2-NDFL tax certificates annually (230 Tax Code of the Russian Federation). This document indicates the certificate attribute: “1” or “2”. A certificate with attribute “1” is submitted for individuals to whom payments were made throughout the year. A certificate with attribute “2” is submitted if tax was not withheld from any income by the tax agent. The deadlines for submitting certificates vary depending on what feature it contains.

The second section of the 2-NDFL certificate contains the following fields:

- “TIN in the Russian Federation”;

- "TIN in the country of citizenship."

If the certificate is drawn up for a citizen of the Russian Federation, then the TIN in the Russian Federation is written in the field. If a foreigner is employed in an organization, then the employer should find out information about the availability of a number that is similar to the TIN. If this number is available, then it is entered in the “TIN in the country of citizenship” field.

If an employee has a TIN, but does not know it, the employer can determine it himself. To do this, you can use the special “Find out TIN” service on the website nalog.ru. The service will request the following data: full name of the individual, date of birth and passport details. If this person really has a TIN, it will be indicated on the computer. Otherwise, the employer will have only one option - to submit a certificate without this number. And we repeat once again, this will not be a violation.

Important! If a company submits 2-NDFL certificates electronically, it has the right to submit it without a TIN. If the taxpayer does not have this number, then the “TIN in the Russian Federation” field simply remains blank.

Stamp on a 2nd personal income tax certificate for an employee

The accounting department is obliged to issue 2-NDFL certificates to its employees or contractors based on their applications. This is required by paragraph 3 of Article 230 of the Tax Code of the Russian Federation). Often, employees apply for a certificate to obtain a bank loan. You also do not have to put a stamp on the issued certificates. Any bank is obliged to accept 2-NDFL certificates without stamps, since their affixing is not mandatory by law.

If you find an error, please select a piece of text and press Ctrl+Enter.

Is a certificate without a stamp valid or not?

Certificate 2-NDFL without a stamp is valid. Many accounting or bank employees may still ask to bring them a certificate not only with a signature, but also with the seal of the organization. You have the right to refuse them, and this will not be a violation. After all, some organizations may refuse to use print altogether. Then, no matter how hard you try, you will not be able to fulfill their request.

The main requirement now is the signature of the head of the organization or the person acting on the basis of the issued power of attorney. This could be, for example, an accountant (Articles 26, 27, 29 of the Tax Code of the Russian Federation). If the organization met the employee halfway and put a stamp on the 2-NDFL certificate, it is better to do this above or below the tax agent’s signature. That is, where there was space for printing on previous 2-NDFL forms.

***

Having considered the question of whether or not a stamp is needed on the 2-NDFL certificate, we came to the conclusion that there is no need to put a stamp on the certificate. There is no space for this on the form. But if the employee asks to put it on, for example, when the bank insists on having a stamp in order to receive a loan, the organization can accommodate the employee. This will not be considered a violation.

Composition of the document

Contains information about the income received by an individual.

It states the following:

- Tax agent information. Print its name. They also give his phone number. Inform about OKTMO, INN and checkpoint codes.

- Information about who receives income.

- List of taxable income.

- Tax rates.

- Various tax deductions.

- Total amounts of income and tax deductions.

The certificate also states:

- TIN issued in Russia and abroad, last name, first name, patronymic, code designation of an identity document, address and information about place of residence in the Russian Federation, code of a subject of the Federation or a foreign state. The series and number of the passport are also imprinted.

- The income table indicates the month of receipt, the designation of the types of income and their amounts for each type. This also applies to deductions.

- In the final part, print or enter the total amount of income and taxes that were withheld. The certificate also includes the amount of accrued and over-withheld taxes.

- In the appropriate columns indicate the total cost of the fixed advance payments made. Information is also provided on the amount of taxes that were not subject to withholding.

Here is a sample document:

Is it possible to submit 2-NDFL without a TIN? Details are in the article.

You will find the application form for obtaining a 2-NDFL certificate.

Is a stamp required on the 2-NDFL certificate in 2020?

In the new certificate form, the MP clause was removed. It stands for print space. It is not provided.

Information must be submitted to the tax authorities electronically. The right to submit in paper form remained with tax agents who provided income to no more than 25 people.

Let us remind you that the new form does not require printing.

If an organization operates within the framework of these laws or uses seals at will, then it puts its seal. However, the certificate is still signed by the manager or his authorized person. E

The certificate will be valid even without a stamp.

In order for it to be used legally, it requires the following information already mentioned:

Information about the tax agent (we wrote about it above).

- Identification data of the individual who received the income.

- Amounts of income for the period specified in the certificate.

- Deductions made.

- Results of income and tax calculations.

Also, the document in question should always indicate the date of preparation. In addition, they write down his number, under which he is listed in the reporting. It is signed by responsible employees.

All information about the recipient should be taken only from the passport. The certificate should be drawn up very carefully, since it may be necessary both for the employee and for the institution, say, for a bank.

Actually, it doesn’t need to be placed. But many firms, financial and other institutions may ask for a document to be certified with a seal.

If it is used regularly or when desired, it can be placed in one of two places:

- on a signature made by an authorized person;

- under the above signature.

Usually they put stamps of any kind there.

The optionality of the certificate indicates the possibility of accepting it without a stamp.

The absence of a stamp does not mean that it is invalid. If the certificate contains all the necessary information, then it should be considered complete.

An exception applies to organizations for which a seal is required.

This rule applies to non-profit organizations.

A seal is also required in circumstances specified by law.

Why do you need a register of 2-NDFL certificates? Read in the article.

Is a 2-NDFL certificate issued for a foreign citizen on a patent? Information.

What is the material assistance code in the 2-NDFL certificate? Find out .

According to the above-mentioned Federal Law, the use of a stamp is optional and its presence does not make the document valid.

The certificate receives legal force if it contains all the necessary information.

There is no need to put a stamp. But, if it is used, then it is best to put it in place of the signatures of authorized persons or under them.

The main thing is to be careful when drawing up this document and enter or type in all the information about the income that was earned or otherwise received by the person.

It is also necessary to indicate all the required information about the person who, according to the law, calculates, withholds and pays taxes to the budget, and to affix the signatures of the chief accountant or senior manager of the enterprise, affixed in the right place in accordance with the traditions of issuing certificates.

Thus, the absence of the need to affix a stamp greatly simplifies the use of this certificate.

Which documents need to be stamped with a stamp, and which ones need a seal for documents?

In accordance with this procedure, the bodies on whose seals the State Emblem of the Russian Federation is placed approve acts that determine which documents are affixed with the state emblem.

1) licenses issued to commercial banks and credit institutions for the right to carry out banking activities, amendments and additions to them, charters of commercial banks and credit institutions, amendments to them;

We recommend reading: Tariffs for Hot Water in the Moscow Region 2019

Is a stamp required for 2-NDFL?

If your company prepares reports in electronic format, then the issue of printing disappears. In this case it is not used.

Order of the Federal Tax Service No. ММВ-7-11/ [email protected] dated 10/02/2018. 2-NDFL does not inform about the new type of certificate about the need to affix a stamp. This information is not included in the articles of the Tax Code. Since the information is not specified in regulations, then representatives of the tax service cannot refuse to accept a 2-NDFL certificate without a stamp.

In 2020, regulations continue to apply allowing LLCs and JSCs not to use printing at all. If your organization initially refused to put an imprint on the documents, then it is not needed on the 2-NDFL certificate itself.

In cases where a company has its own seal, the latter is required to be used only in situations specified by law.

So is a stamp needed for 2-NDFL? The absence of information about the seal in legislative norms does not force one to abandon it. If you wish, you can install it. Such a document will not lose its validity.

How to properly stamp a new form

A new sample certificate is certified only by the signature of the tax agent, as well as his legal representative by power of attorney.

At your own request, you can add a round seal to the document. If an organization uses a print in its activities, then it must be used in reporting in accordance with established standards.

Since there is no space for a stamp on the 2-NDFL certificate in the updated format, the stamp is placed in different ways.

It will be considered correct to use it in the following places in the document:

- On the signature of the responsible person;

- The signatures below.

Putting a stamp in this way is an unspoken generally accepted norm. It is used by analogy with the previous sample certificate, in which the letters “M. P." pointed to the place of printing.

In what situations is printing needed?

If your company uses a seal in its activities, then in 2019 you can affix it to the 2-NDFL certificate at your own request. The tax authorities will definitely not issue a fine for its presence or absence, since this process is not regulated by law.

This certificate can be used for various purposes. One of your employees may, for example, go to the bank to apply for a loan. In this case, no stamp is required. But in order for the employees of the credit institution to have no doubts about issuing money, it is better to leave an imprint on the document.

If the organization’s seal is not affixed, then the bank, in its own interests, can make calls to the employer to clarify the information and confirm its accuracy. To avoid such inconveniences and not do unnecessary work, you should immediately issue a 2-NDFL certificate with a stamp. This simple action will help you avoid unnecessary questions and intrusive calls.

The absence of a seal is not a violation, but for your own peace of mind you can affix it. The imprint will make your life much easier, as it increases the confidence of third parties in the authenticity of the document.

What documents are affixed with the official seal of the institution?

- letters of guarantee for performing certain types of work or receiving services;

- all kinds of orders (pension, payment, banking, payment);

- various statements related to letters of credit, refusals of acceptance, etc.;

- powers of attorney (to carry out the procedure for obtaining inventory items).

Our company has been in the market for stamp production services for over 18 years. All our activities are based on providing only high-level services. In our work, we did not try to find easy ways that contradict legal requirements. All this was rewarded by our regular and numerous customers who trust us and the quality of our products.