When do you need printing on documents?

All organizations must have a seal.

In particular, this is provided for by the Laws on LLCs and JSCs <1>. But this does not mean that it needs to be put on all documents in a row. We will talk about why a seal is needed, on what documents it should be present, when it can be done without it, and whether entrepreneurs need it. <1> Clause 7 of Art. 2 of the Federal Law of December 26, 1995 N 208-FZ “On Joint-Stock Companies”; clause 5 art. 2 of the Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies”.

https://youtu.be/i4dq2mnGvZI

Latest publications

August 19, 2019

Is an organization located in the Far North obliged to compensate for the costs of travel for employees to and from their vacation destination? Does she have the right to take these expenses into account for the purposes of calculating income tax, including if the vacation location is not the territory of the Russian Federation? What documents can be used to confirm the expenses incurred?

If an autonomous institution incurs expenses for the official reception of representatives of other organizations at the expense of funds from income-generating activities, then it has the right to take these expenses into account when calculating the income tax base. What conditions must be met in this case? What documents should you have on hand so that the Federal Tax Service inspectors do not exclude them from tax expenses? What is the procedure for rationing entertainment expenses? What are the features of deducting “input” VAT on these expenses?

Until recently, when bringing officials of budgetary institutions to administrative responsibility for violating requirements for accounting and preparation of financial statements, Art. 15.11 Code of Administrative Offenses of the Russian Federation. Federal Law No. 113-FZ dated May 29, 2019 amended the Code of Administrative Offenses of the Russian Federation, in particular the provisions of this article, and now Art. 15.15.6 Code of Administrative Offenses of the Russian Federation, the norms of which have also been adjusted. We will talk about the new amounts of administrative liability and the types of violations for which these penalties are applied below.

05 August 2019

A government institution, within the framework of income-generating activities provided for by the constituent document, sells finished products to customers. The proceeds from this go directly to the budget. What transactions should be used to complete this operation? Is such a sale subject to VAT? Are income from it taken into account for profit tax purposes?

Which depreciation group should include prefabricated buildings that are made up of a metal frame with walls made of sandwich panels or mineral wool slabs? Unfortunately, there is no consensus on this issue, including among judges considering tax disputes. Read more in the article.

Author: Irina Starodubtseva , expert auditor RosCo – Consulting & audit

Federal Law No. 82-FZ of April 6, 2015 “On amendments to certain legislative acts of the Russian Federation regarding the abolition of the mandatory seal of business companies” (hereinafter referred to as Law No. 82-FZ) introduced changes regarding the mandatory seal for legal entities. Law No. 82-FZ came into force on April 7, 2020 (with the exception of certain provisions). Let us analyze the consequences of the abolition of the round seal for legal entities.

The adopted Law No. 82-FZ was preceded by debate regarding the degree of protection of a document without a seal, since the signatures of officials are easy to forge.

As Russian Prime Minister Dmitry Medvedev noted, “... the round seal is a legacy of the past, and now it does not have the importance that was given to it in the pre-revolutionary and post-Soviet periods and the Soviet period. With the modern development of technology, the presence of a seal does not guarantee the authenticity of a document; the use of a round seal is not prohibited, but the use of other identification methods is allowed, such as an electronic signature, special company letterheads, holographic seals” (https://ria.ru/politics/).

The abolition of the seal is intended to facilitate the registration procedure of legal entities.

Before considering the consequences of the abolition of the round seal, let's analyze the degree of importance of seals among organizations. In the practice of business entities, a document without a seal was not perceived as a legally significant document. However, is this really so? The function of the seal is to certify the authenticity of an official’s signature on documents certifying the rights of persons recording facts related to financial assets, as well as on other documents that provide for certification of an authentic signature (clause 3.25 of GOST R 6.30-2003 “Unified documentation systems. Unified system organizational and administrative documentation. Requirements for the preparation of documents", adopted by Decree of the State Standard of Russia dated March 3, 2003 No. 65-st).

Read more Complaint to the store for a refund for the goods

Which participants in civil transactions were required to have a seal? We systematize the list of such economic entities in table. 1.

Table 1. Which participants in civil transactions were required to have a seal?

List of economic entities

Base

Rule of law (until April 6, 2015)

Clause 7 of Art. 2 of the Federal Law of December 26, 1995 No. 208-FZ

The company must have a round seal containing its full corporate name in Russian and an indication of its location. The seal may also indicate the company's company name in any foreign language or language of the peoples of the Russian Federation. The company has the right to have stamps and forms with its company name, its own emblem, as well as a trademark registered in the prescribed manner and other means of individualization

Limited Liability Companies

Clause 5 of Art. 2 of the Federal Law of February 8, 1998 No. 14-FZ

Clause 4 of Art. 3 of the Federal Law of January 12, 1996 No. 7-FZ

A non-profit organization has a seal with the full name of this non-profit organization in Russian and has the right to have stamps and forms with its name

Clause 3 of Art. 2 of the Federal Law of November 14, 2002 No. 161-FZ

A unitary enterprise must have a round seal containing its full corporate name in Russian and an indication of the location of the unitary enterprise

Starting from April 7, 2020, a legal entity has the right to have a seal, stamps and forms with its name, its own emblem, as well as a trademark registered in the prescribed manner and other means of individualization. Federal law may provide for the obligation of a company to use a seal. In this case, information about the presence of a seal must be contained in the Charter of the company. Such changes have been made in relation to joint stock companies and limited liability companies. True, in terms of non-profit organizations, as well as unitary enterprises, the norm on the presence of a seal has remained unchanged.

Let us note that the changes made do not apply to individual entrepreneurs, since entrepreneurs still have the right to work without a seal (Federal Law of August 8, 2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”).

If the document is drawn up by an organization

So, since all organizations must have a seal, only one question arises: on which documents must it be present? The purpose of affixing a seal impression is to certify the authenticity of an official’s signature on documents <2>. There is no general procedure obliging to put a stamp on all documents that contain the signature of an official. However, in some cases, the legislation still provides for the need to affix a seal. Let's look at some of them.

<2> Clause 3.25 GOST R 6.30-2003 “Unified documentation systems. Unified system of organizational and administrative documentation. Requirements for the preparation of documents”, adopted by Resolution of the State Standard of Russia dated 03.03.2003 N 65-Art.

To stamp orders or not

Issues related to the provisions for the storage and use of seals for organizations are clearly addressed in the Unified State Record Management System. These standards are recommended for use by all institutions that require it. The corresponding resolution was adopted quite a long time ago, but it remains relevant to this day.

Stamps and basic concepts

A stamp is a solid form of cliche made of rubber. This form is used for making impressions on documents. Otherwise, it is not possible to verify their authenticity. One of the standards of the GOST R series sets out the requirements that seals must comply with.

But nothing is said about the practical rules by which seals are used, even in the texts of state-level standards. Many questions arise about how many stamps enterprises should keep. And in what cases is their use mandatory? Or about the appointment of someone responsible for the storage process. All these problems must be resolved personally by management.

There are three main types of seals:

From the very beginning, the development of official seals was carried out only for government agencies. They are also used by institutions that have the appropriate powers. This applies, for example, to private notary offices.

Round seals with the full name and address can be used in joint stock communities.

As for commercial organizations, they are characterized by the use of seals equivalent to stamp stamps. Typically, such instruments depict a company emblem or logos. Or names are applied to them. Indicating the number of the state registration certificate along with the TIN is mandatory for any organization.

https://youtu.be/Ryl18XVNUAc

Private entrepreneurs also do not carry out work without their own stamps. They are equal to stamp ones according to their status. But the stamps do not depict coats of arms with emblems, but the name, surname and patronymic of the entrepreneur, location, tax identification number with registration number.

About the location of the seal imprint

The rules state that the prints are only on the bottom. Usually - in the same place where the directors put their signature. The seal may partially cover the position designation. The main thing is that it does not end up on the signature along with the transcript.

Documents are sometimes marked with a mark indicating the location where the seal should be placed. This saves specialists a lot of hassle. Letters to designate such a place usually take up space on title pages in work books, accounting documents and certificates.

What exactly are stamps for?

It is impossible for documents to acquire legal force without seals. This is a tool for determining the authenticity of signatures of officials and the absence of forgeries. But this detail is not required for every personnel document. The current legislation does not have clear definitions as to when a seal is affixed and when it is not.

Sometimes documents prepared by the accounting department are certified with seals. The same applies to various agreements, collective labor agreements, and constituent documents of the company.

There is the following list of papers for which the presence of seals has become a mandatory requirement:

What are stamps placed on?

- Work records

- Rules with instructions, descriptions of regulations and state schedules. And any other local regulatory acts

- Warranty letters after goods delivered, work performed

- Powers of attorney related to the implementation of certain actions

- Certificates and copies taken from the archive

- Service IDs

- Diplomas and certificates that are created specifically for employees

- Submissions and petitions that are tied to awards

- Mandatory for references and recommendations from places of work

- For travel certificates

- For acts

- When drawing up employment contracts along with additional agreements, civil documents, contracts for full financial liability

Rules for certification of documents in office work

If a seal is placed on an order or personnel letter, nothing bad will happen.

Very disastrous consequences are possible only in a situation where the seal does not certify a document that really needs it. For example, some kind of agreement.

Without a seal, it simply has no legal force. And in the event of court hearings, government authorities simply will not accept the document as evidence.

Therefore, it is recommended to prescribe in advance the order in which printing is used within a particular organization.

Stamps for various documents

First, a list of documents that require a seal in any case is determined. Then they move on to drawing up special instructions for use. It also writes about where and when seals and stamps are placed, and how to use them correctly. The question of who is responsible for storing seals and the storage process itself deserves special consideration.

The optimal solution is to make such instructions an annex to the general rules that relate to the company’s office work.

If there are no general rules, then the instructions can be made as an independent document or as an addition to the charter.

The manager will then need to issue a special order if it is necessary to certify a document with a seal that is not included in the local regulatory act. Over time, it is permissible to make changes to the list of documents requiring certification.

Separately, it is necessary to specify the order in which obsolete seals are destroyed.

A little about use and storage

The head of the organizational department usually has the main seal, which has a round shape. A special safe is used to store it. If the head of the organizational department is absent for a long time, the seal can be issued to employees against signature. Or if the device needs to be used on weekends or holidays.

As for auxiliary types, they are given personally to employees of the organization vested with the appropriate powers.

Auxiliary types of seals must be stored inside tables that must be closed. A sealable safe is needed to preserve the main and auxiliary seals, and the address stamp. Only authorized employees responsible for storage should have access to them.

A special journal is kept in order to organize the accounting of devices. This document is maintained according to general rules that relate to strict reporting. Store such a magazine in a cabinet protected from fire to the maximum extent possible.

Stamping orders

Printing on orders

Many people are interested in this issue. Orders are internal administrative documents of a particular organization. They usually do not require special certification or confirmation of authenticity. Therefore, the legislation does not have any clear requirements or prohibitions regarding printing on these papers.

Certification with a seal is required only for those orders that go to external organizations. For example, some banks may require this. In general, each organization has the right to determine for itself which internal documents must be stamped.

More about seals in office work

The manager must issue a separate order in order to practically approve a list of documents that require printing. A separate order or instruction requires a list of officials who have the right to sign documents.

For legal entities, printing also becomes mandatory. Acts on industrial accidents, magazines and books, powers of attorney - this is just a small list of papers that require the use of this material. The use of seals in office work simplifies doing business. Moreover, the lack of printing makes it difficult to solve many problems.

Some legal entities are required by law to have this tool, regardless of whether they plan to use it in practice. For public organizations and cooperatives, for example, this is not a mandatory requirement. In work books, stamps are placed only in three situations:

- When the document is issued for the first time.

- If an employee's personal information changes.

- If there is a dismissal.

The only serious problem at present is the lack of rules for canceling erroneously placed seals.

It is permitted to use trademarks and trade names on seals as long as this does not violate the rights of others. Thanks to this, management has an additional tool for individualization. This helps you stand out from your competitors.

The right to use a trademark arises immediately after its registration is completed. You can make a seal for an organization at any company that provides the relevant services. It is acceptable to use additional protection against counterfeiting.

To do this, drawings are applied that remain visible or invisible.

Each leader decides for himself whether to use the seal or refuse it. Some regulations do not provide for the mandatory use of a seal at all.

Select it and press Ctrl+Enter to let us know.

I try to put a stamp on all orders, even minor ones, so that there are no complaints later. Especially when you need to show it to employees, because a piece of paper without a stamp does not inspire confidence.

We recommend reading: What documents are needed for SNILS

As for storing seals, everything is beautiful only on paper. No matter how much you had to work, the seal lay anywhere and no one covered it; you could stamp as many blank sheets with seals as you wanted.

Agreement

Civil law does not require a seal on contracts. However, the provision that the contract and amendments to it must be sealed by the parties to the contract is sometimes included in the text of the contract itself. In this case, the absence of a seal may result in:

- recognition of the written form of the transaction as non-compliance. This means that the parties will not be able to refer to witness testimony in disputes <3>;

- recognition of the contract as invalid if such a consequence is expressly stated in the contract <4>.

Here is an excerpt from the contract, which stipulates the requirement for a seal.

- This agreement, as well as all appendices, additions and amendments to it, are valid only if they are made in writing, signed by authorized representatives and sealed by the Parties.

Buyer: Seller: General Director of Alpha LLC General Director of Gamma LLC Ivanov Ivanov I.I. Petrov Petrov V.P. ———— ————— ———— ————— Seal of Alpha LLC Seal of Gamma LLC M.P. M.P.

Advice

It is better to affix the seal impression in such a way that it does not capture the entire signature, but only part of it.

<3> Clause 1 of Art. 160, paragraph 1, art. 162, paragraph 1, art. 434 Civil Code of the Russian Federation. <4> Clause 2 of Art. 162 of the Civil Code of the Russian Federation.

Is a seal required on contracts?

Many inspectors believe that a transaction is invalid if there is no seal on the contract. In doing so, they refer to Article 162 of the Civil Code of the Russian Federation. However, this article says that a “simple written form” of the transaction is required, but nothing about seals. What do the courts think about this? They just occupy the position of firms. An example is the Resolution of the Federal Antimonopoly Service of the Moscow District dated February 26, 2004 in case No. KA-A40/799-04. The court pointed out that “the tax authority’s requirement to provide copies of agreements with the signatures and seals of the parties is not based on the law.”

Enterprises argue about seals on contracts not only with officials, but also among themselves. Thus, the tenant company went to court because the owner of the property, without its knowledge, submitted documents for state registration of the agreement. The tenant believed that this was also illegal because the agreement did not bear his stamp. In this case, the court did not support the company. After all, either party can apply for state registration. This is stated in Article 26 of Federal Law No. 122-FZ of July 21, 1997 “On state registration of rights to real estate and transactions with it.” As for the seal, it is not a necessary requisite of the transaction form. This is the decision of the Federal Antimonopoly Service of the Moscow District in the Resolution of February 15, 2002 in case No. KG-A40/384-02.

Another case: the former tenant tried to invalidate the agreement on the transfer of rights and obligations to the new tenant, since one of the parties did not put a stamp on this agreement. Once again, the judges were not impressed by such arguments. As a result, the court stated that “the sealing of the agreement is not a prerequisite for compliance with the simple written form of the transaction” (Resolution of the Federal Antimonopoly Service of the Moscow District of March 9, 2004 in case No. KG-A40/945-04). A similar decision was made by the Federal Antimonopoly Service of the Moscow District in its Resolution dated January 19, 2004 in case No. KG-A40/10923-03-P.

Primary

Expenses accepted for tax purposes and VAT deductions must be confirmed by primary documents <6>. All mandatory details of primary accounting documents are listed in the Accounting Law. There is no seal imprint among them. However, if a unified form is approved for the primary document (for example, for a consignment note - unified form N TORG-12 <7>), then it is necessary to use it <8>. And if it contains such details as a seal imprint, but it is not there, then the tax authorities may consider such a document to be drawn up with violations, which, in turn, may lead to a refusal to deduct VAT or recognize expenses. If the imprint of its seal is missing, the organization can correct this at any time by putting it on the document. But if there is no stamp of the counterparty, then there may be problems with affixing it, especially after the execution of the transaction. And then the tax authorities’ claims can be withdrawn in court. After all, the Instructions for the use and completion of forms of primary accounting documentation are only by-laws. And the absence of a stamp on documents confirming the purchase of goods (works, services) does not indicate their gratuitous acquisition.

Is printing on the “primary” required?

It is known that all company expenses must be confirmed by primary documents. Moreover, if there is a unified form of the primary document, then it should be used. If the required form is not provided in the albums of unified forms of primary accounting documentation, then you can develop your own, the main thing is that it contains the required details. This is the name of the document, the date when it was drawn up, the name of the organization on behalf of which it was executed, the essence of the operation, its measures in kind and monetary terms, as well as the positions and signatures of the responsible persons. Such requirements for the “primary” are listed in Article 9 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting” (hereinafter referred to as Law No. 129-FZ).

Please note: stamps are not among the required details. This means that the document will be valid without it.

If we are talking about primary documents that the company develops independently, then everything is clear; a seal is not needed. But what if there is no seal on a document that is drawn up according to a unified form approved by the State Statistics Committee of Russia? After all, it is usually marked “M.P.” - place of printing. Is it possible to write off expenses based on such a document if there is no stamp on it?

It all depends on what is said in the instructions for filling out the unified forms. Not every one of them contains the phrase that the operation must be confirmed by the seals of the companies. Let's take the explanations for filling out forms for recording trade transactions - they are given in Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132. This document does not say a word about stamps, it only indicates what this or that invoice is intended for, how many copies it is in need to be compiled.

The fact that a stamp is required is stated, for example, in the instructions for filling out a waybill. However, it must be stamped with the organization's own stamp. And this can be done at any time, even during a tax audit.

Stamps of the consignor and consignee are required on the consignment note, the form of which is approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 N 78. Will a consignor's consignee without a seal be considered a document on the basis of which the cost of goods can be written off as expenses in tax accounting? Unfortunately, problems with the inspector may arise. In such a situation, tax authorities refer to Article 252 of the Tax Code of the Russian Federation, which states that “documented expenses mean expenses supported by documents drawn up in accordance with the legislation of the Russian Federation.” And since the unified form provides for a seal, then without it the document is considered executed in violation of the law.

In this case, in our opinion, it is better to ask the counterparty to put a stamp on the document.

Printing for documents when used

Such disputes are rare. And there are courts that side with taxpayers <9>.

If there is no unified form of the document and you use an independently developed form of the primary document <8>, you don’t even need to put a stamp <10>. But then do not include the “Printing Place” detail in this form.

As for the unified primary forms for recording labor and its payment, it is mandatory to affix a stamp only on the following documents <11>:

- travel certificate (form N T-10). The stamps in it certify the notes on the arrival of the posted worker at the place of business trip and departure from it. Travel certificates that do not bear the seal of the organization to which the employees are sent on a business trip were once recognized by the court as improperly executed and, as a result, not confirming travel expenses <12>;

- act on the acceptance of work performed under a fixed-term employment contract concluded for the duration of a specific work (form N T-73). The seal certifies the signature of the head of the organization that approved the act, or a person authorized by him to do so.

In other unified forms of primary personnel documents (orders, time sheets, pay slips) there is no need to put a stamp.

<6> Clause 1 of Art. 172, paragraph 1, art. 252, paragraph 3 of Art. 346.5, paragraph 2 of Art. 346.16 Tax Code of the Russian Federation. <7> Approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132. <8> Clause 2 of Art. 9 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting”. <9> Resolutions of the Federal Antimonopoly Service of North Caucasus of March 20, 2007 N F08-1197/2007-5080A; Thirteenth Arbitration Court of Appeal dated March 28, 2007 in case No. A42-3793/2006. <10> Resolution of the Federal Antimonopoly Service of Ukraine dated January 29, 2008 N F09-9195/07-C2. <11> Resolution of the State Statistics Committee of Russia dated January 5, 2004 N 1. <12> Resolution of the Ninth Arbitration Court of Appeal dated December 24, 2007 N 09AP-16734/2007-AK.

List of documents on which the organization’s seal is required (optional)

Financial documents

Material documents by type of transaction

Material documents by type of property

Personnel documents

Tax documents

Financial statements

| Documentation | Is a seal required? | Base |

| Financial documents | ||

| Documents for recording cash transactions | Mandatory: – on the last page of the cash book (Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88, Methodological guidelines approved by order of the Ministry of Finance of Russia dated December 15, 2010 No. 173n); – on a receipt for a cash receipt order (form KO-1), which is transferred to the depositor of money (paragraph 5, clause 5.1 of the Bank of Russia Directive No. 3210-U dated March 11, 2014); – in the payroll (form T-49), payroll (form T-53) – if the entry “deposited” is not made opposite the names and initials of employees to whom money was not issued (paragraph 3, clause 6.5 of the Bank of Russia instructions dated March 11, 2014 No. 3210-U)* | Unified forms of primary accounting documentation for accounting of cash transactions, approved by resolutions of the State Statistics Committee of Russia dated August 18, 1998 No. 88, dated January 5, 2004 No. 1, order of the Ministry of Finance of Russia dated December 15, 2010 No. 173n |

| Optional : on all other documents. In particular, on the cash receipt order (form KO-2) and in the book of accounting of funds accepted and issued by the cashier (form KO-5) | ||

| Payment documents (payment order (application for cash expense), letter of credit, statement, etc.) | Mandatory : on all payment documents for which the organization transfers funds. An exception is applications for cash expenses that are processed by government agencies* | Regulation of the Bank of Russia dated June 19, 2012 No. 383-P, Section IX of the Procedure approved by Order of the Treasury of Russia dated October 10, 2008 No. 8n |

| Optional : on a bank statement, if the document is printed using computer technology, on a personal account statement | Clause 2.1 of section 2 of part 3 of the Rules approved by the Regulations of the Bank of Russia dated July 16, 2012 No. 385-P, paragraphs 159–168 of the Procedure approved by order of the Treasury of Russia dated December 29, 2012 No. 24n, Appendix No. 7 to the Procedure approved by the order Treasury of Russia dated December 29, 2012 No. 24n Resolutions of the Federal Antimonopoly Service of the North-Western District of January 16, 2007 No. A56-46035/2005, of the Moscow District of December 14, 2006 No. KA-A40/12070-06 and of the West Siberian District of January 13, 2005 No. F04-9440 /2004(7787-A45-25) | |

| Strict reporting forms (SSR) | Mandatory An exception to this rule is BSO without the “seal” requisite, approved by federal executive authorities In addition, in some cases, it is sometimes possible to prove that the absence of a seal does not deprive a document of BSO status (Resolution of the Federal Antimonopoly Service of the North-Western District dated January 22, 2007 No. A56-12475/2006)* | Clauses 3, 5 and 6 of the Regulations approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359 |

| Documents for recording cash settlements with the population when trading with cash registers | Mandatory : if required by instructions for completing a specific document form. For example, in the cashier-operator’s journal (form KM-4) or in the journal according to the KM-5 form* | Instructions approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132 |

| Optional : in all other cases. For example, in the certificate-report of the cashier-operator (form KM-6) | ||

| An invoice for payment | Optional : in all cases. The invoice must contain only the details listed in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. The stamp is not included in the list of required details | Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ |

| Material documents by type of transaction | ||

| Certificate of acceptance and transfer in any form | Optional : this is not required by the list of mandatory details of primary documents. At the same time, it is safer for the seller if the buyer puts his own stamp. This will be an additional argument if the buyer refuses to pay, citing the fact that the document contains the signature of an unauthorized person. | Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ, paragraph 7 of the Instructions for the Unified Chart of Accounts No. 157n |

| Documents for accounting of trade transactions | Mandatory : only in the consignment note (TORG-12 form) and the goods journal of a small retail trade employee (TORG-23 form) - space for printing is provided in the document forms. However, the instructions for filling out these documents say nothing about printing* | Instructions approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132 |

| Optional : in all other cases. For example, in the act of acceptance of goods (form TORG-1), invoice for internal movement, transfer of goods, containers (form TORG-13), act of write-off of goods (form TORG-16), goods report (form TORG-29) and etc. | ||

| Documents for recording trade operations when selling goods on credit | Mandatory : only in a certificate for the purchase of goods on credit (form KR-1) and an order-obligation (form KR-2) - space for printing is provided in the document forms. However, the instructions for filling out these documents say nothing about printing* | Instructions approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132 |

| Documents on accounting for trading operations in commission trading | Optional : There is no space for printing on these documents. Therefore, it is not necessary to put a stamp, in particular, on the list of goods accepted for commission (form KOMIS-1) and the certificate of sale of goods accepted for commission (form KOMIS-4) | |

| Documents for accounting operations in public catering | Optional : There is no space for printing on these documents. Therefore, it is not necessary to put a stamp, in particular, on the menu plan (form OP-2), invoice for goods release (form OP-4), purchasing act (form OP-5), order-invoice (form OP-20) | Instructions approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132 |

| Documents for recording work in capital construction and repair and construction work | Mandatory: On document forms that provide space for printing. For example, an act of acceptance of work performed (form KS-2), a certificate of the cost of work performed and expenses (form KS-3), a general journal of work (form KS-6), an act of acceptance of a completed construction project (form KS-11) Instructions for filling out this category of documents require stamping only for the general work log (form KS-6)* | Instructions approved by Resolution of the State Statistics Committee of Russia dated November 11, 1999 No. 100 Instructions approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a |

| Documents for recording the operation of construction machines and mechanisms | Mandatory : in the report on the operation of a tower crane (Form ESM-1) and the work order report on the operation of a construction machine (mechanism) (Form ESM-4), as well as in the certificate for payments for work performed (services) (Form ESM-7) stamp is placed by the customer* | Section 1 of the instructions approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78 |

| Optional : in all other documents (for example, a waybill for a construction vehicle (Form ESM-2) and a report on the operation of the construction vehicle (Form ESM-3)) | ||

| Documents for recording work in road transport | Mandatory : on waybills for all types of vehicles, for example, waybills for a passenger car (form 3), waybills for a bus (form 6). The consignment note (Form 1-T) only requires the consignor's stamp. But it is better for him that the consignee (when transferring ownership of the cargo) also puts a stamp. This will be an additional argument if the buyer refuses to pay, citing the fact that the document contains the signature of an unauthorized person* | Section 2 of the instructions approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78 |

| Optional : on the waybill | Clause 9 of the rules approved by Decree of the Government of the Russian Federation dated April 15, 2011 No. 272 | |

| Material documents by type of property | ||

| Documents on inventory accounting | Mandatory : on the act of recording the material assets received during the dismantling and dismantling of buildings and structures (form M-35). This document is stamped by the customer and the contractor* | Section 3 of the instructions approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a |

| Optional : powers of attorney (forms M-2, M-2a), signed by the head or other authorized person, are valid without the organization’s seal | Clause 4 of Article 185.1 of the Civil Code of the Russian Federation, section 3 of the instructions approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a | |

| Optional : on documents on internal movement and accounting of goods and materials (forms M-8, M-11, M-15, M-17) and the act of acceptance of materials (form M-7), which is drawn up if there is a discrepancy between the actual data and the data specified in accompanying documents | Section 3 of the instructions approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a | |

| Documents on accounting of fixed assets and intangible assets | Mandatory : on all acts of acceptance and transfer (delivery) of fixed assets (forms OS-1, OS-1a, OS-1b, OS-3), act of acceptance and transfer of equipment for installation (form OS-15) and act of identified equipment defects (form OS-16)* | Instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7 |

| Optional : on inventory cards (forms OS-6, OS-6a, OS-6b, 0504031, 0504032), acts of write-off of fixed assets (forms OS-4, OS-4a, OS-4b), invoice for internal movement of fixed assets funds (form OS-2) and certificate of acceptance (receipt) of equipment (form OS-14) | ||

| Documents for accounting of small business enterprises | Optional | Section 4 of the instructions approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a |

| Documents for recording inventory results | Optional: There is no space for printing on these documents. Therefore, it is not necessary to put a stamp, in particular:

| Instructions approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 No. 88, Methodological guidelines approved by Order of the Ministry of Finance of Russia dated December 15, 2010 No. 173n |

| Personnel documents | ||

| Employment history | Mandatory : stamp placed on the first page* | Clause 2.2 of the Instruction approved by Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69 |

| Mandatory : the stamp is placed after the employee’s dismissal record* | Clause 35 of the Rules approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225 | |

| Certificate of acceptance of work performed under a fixed-term employment contract concluded for the duration of a specific job (form T-73) | Mandatory : in the T-73 form - space for printing is provided in the document form. However, the instructions for filling out this document say nothing about printing* | Instructions approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1 |

| Travel certificate (form T-10)** | Mandatory : check mark at each destination* | Sections 1 and 2 of the instructions approved by Decree of the State Statistics Committee of Russia dated January 5, 2004 No. 1, Methodological guidelines approved by order of the Ministry of Finance of Russia dated December 15, 2010 No. 173n |

| Other documents (orders, instructions, staffing table (form T-3), personal card of the employee (form T-2), official assignment for sending on a business trip and a report on its implementation (form T-10a)*, time sheet ( in commercial organizations - form T-13, in state (municipal) institutions - either form T-13 or form 0504421), payroll (in commercial organizations - form T-49, in state (municipal) institutions - form 0504401 ), personal accounts (forms T-54, T-54a), etc.) | Optional : neither the forms themselves nor the instructions for filling them out provide this | |

| Tax documents | ||

| Invoice | Optional | Law No. 57-FZ of May 29, 2002 amended paragraph 6 of Article 169 of the Tax Code of the Russian Federation, Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 |

| Tax return | Required, but not always: stamps should be placed only where required by the instructions for completing the form. That is, there is no need to stamp all the sheets that have the signature of the manager or representative. Special rules apply for JSCs and LLCs: such organizations have the right, but are not required, to have seals. In this regard, until appropriate changes are made to the orders of the Federal Tax Service of Russia, documents submitted (sent) to the tax authorities will be accepted regardless of the presence (absence) of a stamp in them. This was stated in the letter of the Federal Tax Service of Russia dated August 5, 2020 No. BS-4-17/ [email protected] | Orders of the Ministry of Finance of Russia and the Federal Tax Service of Russia on the approval of declaration forms |

| Form 2-NDFL | Optional : no space provided for printing | Order of the Federal Tax Service of Russia dated October 30, 2020 No. ММВ-7-11/485 |

| Form 6-NDFL | Optional : no space provided for printing | Order of the Federal Tax Service of Russia dated October 14, 2020 No. ММВ-7-11/450 |

| Financial statements | ||

| Forms of financial statements provided for by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n | Optional | Accounting (financial) statements are considered prepared after signing a copy of it on paper by the head of the economic entity (Part 8, Article 13 of the Law of December 6, 2011 No. 402-FZ). The same requirement is contained in paragraph 17 of PBU 4/99. These regulations do not require stamping. In addition, the accounting reporting forms do not provide for stamping the accounting (financial) reporting |

| Forms of accounting (budget) reporting of state and municipal institutions | Optional : no space is provided for printing on the accounting (budget) reporting forms | Accounting (financial) statements are considered prepared after signing a copy of it on paper by the head of the economic entity (Part 8, Article 13 of the Law of December 6, 2011 No. 402-FZ). The instructions for submitting reports (both accounting and budget) also do not contain a requirement for a seal on the reporting forms - the signatures of the responsible persons are sufficient (clause 5 of the Instructions, approved by order of the Ministry of Finance of Russia dated March 25, 2011 No. 33n, clause 6 of the Instructions , approved by order of the Ministry of Finance of Russia dated December 28, 2010 No. 191n) |

* On April 7, 2020, the Law of April 6, 2020 No. 82-FZ came into force. Articles 2 and 6 of this Law provide that joint stock companies and LLCs now have the right (and not the obligation) to have a seal. The company reflects information about the presence of a seal in the charter.

At the same time, by-laws continue to be in force, which provide for the affixing of a seal to documents. For example, such a requirement is in paragraphs 2.2, 2.3 of the Instructions for filling out work books (approved by Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69).

Official explanations about whether a seal is required or not are contradictory. We recommend that you continue to use printing. Do this until changes are made to the bylaws.

** It is not necessary to issue an official assignment and travel certificate for an employee, as well as to require a report from him, from January 8, 2020 (Resolution of the Government of the Russian Federation of December 29, 2014 No. 1595).

Invoice

The Tax Code of the Russian Federation does not require a seal on the invoice <13>.

But when corrections are made to the invoice, they must be certified by the signature of the manager and the seal of the seller, indicating the date of their introduction <14>.

25 February 3, 2009 INVOICE N - from “-” ———————— (1)

| Name of goods (description of work performed, services rendered), property rights | Unit | Quantity | Price (tariff) per unit of measurement | Cost of goods (work, services), property rights, total without tax | Including excise tax | Tax rate | Tax amount | Cost of goods (work, services), property rights, total including tax | Country of origin | Number of customs declaration |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| Fertilizer “For flowers” | kg | 50 | -40- 45 | -2000- 2250 | — | 18 | -360- 405 | -2360- 2655 | Russia | — |

| Total payable | -360- 405 | -2360- 2655 |

Nikitin (Nikitin V.A.) Alekseeva (Alekseeva T.P.) Head of the organization (signature) (full name) Chief accountant (signature) (full name) Corrected: in column 4 - 40 on 45 in column 5 - 2000 by 2250 in column 8 - 360 by 405 in column 9 - 2360 by 2655 02/19/2010 Head of the organization Nikitin Nikitin V.A. Stamp of LLC "Vasilek" <13> Clauses 2, 5, 5.1, 6 art. 169 of the Tax Code of the Russian Federation. <14> Clause 29 of the Rules for maintaining logs of received and issued invoices, purchase books and sales books when calculating value added tax, approved. Decree of the Government of the Russian Federation dated December 2, 2000 N 914; Letter of the Federal Tax Service of Russia dated 05/06/2008 N 03-1-03/1924.

Documents submitted to the tax authorities

Reports, applications, and cover letters submitted to the Federal Tax Service must have a seal, otherwise tax authorities simply will not accept these documents.

When conducting audits, tax authorities have the right to request from you documents confirming the correctness of calculation and timely payment of taxes <15>. Since the Federal Tax Service Inspectorate submits not originals, but copies of documents, they must also be certified by the signature of the head and seal <16>.

<15> Subclause 1, clause 1, art. 31, paragraph 1, art. 93 Tax Code of the Russian Federation. <16> Clause 2 of Art. 93 Tax Code of the Russian Federation.

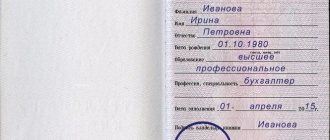

Employment history

The seal imprint is a mandatory requisite of the work book <17>. It must be entered <18>:

- when drawing up a work book - on the first page (title page) containing information about the employee;

- when changing the last name, first name, patronymic or date of birth of an employee - on the inside cover, where the documents on the basis of which such changes are made are indicated.

Moreover, in these cases, both the seal of the organization itself and the stamp of the personnel service can be affixed.

In addition, upon dismissal of an employee, all entries made in the work book during his work in the organization are certified by the employer's seal <19>.

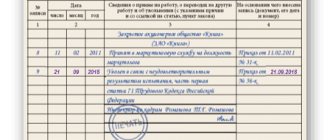

Here is a sample of filling out the inside cover of the work book and the title page of the work book.

The surname has been changed to the surname ¦ Vasiliev’s work book on the basis of ¦ marriage certificate ii-KYu ¦ Vasiliev N 545324 dated 01/15/2010, issued by ¦ -Ivanov- Academic Department of the Civil Registry Office ¦Surname ——————————- Moscow ¦ Antonina ¦Name ———————————— Inspector Volkova ¦ Nikolaev HR Department ——- V.L. Volkova ¦Patronymic —————————— Seal ¦ June 15, 1979 Bulochka LLC ¦Date of birth ————————- ¦ (day, month, year) ¦ higher ¦Education ——— —————— ¦_______________________________________ ¦ accountant ¦Profession, specialty ————— ¦_______________________________________ ¦ August 01, 03 ¦Filling date “—” ———- 20— ¦ Ivanova ¦Signature of the owner of the book ————— ¦ ¦M.P. Signature of the person responsible ¦ Seal for maintaining work books ¦ Volkova LLC ¦"Bun" —————————- ¦ (legible)

And this is how records for the time spent working in an organization are certified.

Job details

| N entries | date | Information about hiring, transfer to another permanent job, qualifications, dismissal (indicating reasons and reference to the article, clause of the law) | Name, date and number of the document on the basis of which the entry was made | ||

| number | month | year | |||

| 1 | 2 | 3 | 4 | ||

| Society with limited | |||||

| responsibility | |||||

| "Bun" | |||||

| (LLC "Bulochka") | |||||

| 1 | 01 | 08 | 2003 | Hired | Order |

| accountant | from 01.08.2003 | ||||

| N 57 | |||||

| 2 | 18 | 09 | 2008 | Transferred to position | Order |

| deputy chief | from 09/18/2008 | ||||

| accountant | N 73 | ||||

| 3 | 05 | 04 | 2010 | Fired on my own | Order |

| desired, point 3 | from 04/05/2010 | ||||

| Part 1 Article 77 | N 12 | ||||

| Labor Code | |||||

| Russian Federation | |||||

| Human resources department inspector | |||||

| Volkova V.L. Volkova | |||||

| Stamp of LLC "Bulochka" | |||||

| With records in labor | |||||

| I have read the book | |||||

| Vasilyeva Vasilyeva |

<17> The form of the work book is approved by Decree of the Government of the Russian Federation of April 16, 2003 N 225. <18> Clauses 2.2, 2.3 Instructions for filling out work books, approved. Resolution of the Ministry of Labor of Russia dated October 10, 2003 N 69. <19> Clause 35 of the Rules for maintaining and storing work books, producing work book forms and providing them to employers, approved. Decree of the Government of the Russian Federation of April 16, 2003 N 225.

Is it necessary to put a stamp on the original document?

The law only provides for the possibility of abandoning the round seal in favor of modern identification methods. But organizations still have the right to produce any number of seals and stamps of any shape, color and degree of protection.

What can replace printing?

You can replace the seal, for example, with an electronic signature, special company forms or holographic seals.

How to refuse printing?

Make changes to your organization's charter. Information about the presence of a seal must be in this document.

Is it necessary to put a stamp in standard documents where such details are provided?

There have been no official clarifications on this issue yet. But the Federal Tax Service of Russia, the Pension Fund of Russia and the Federal Tax Service of Russia explain that immediately after the law comes into force, the company has the right to transfer to them any documents without a seal. My only wish is that if you decide to refuse the seal, notify the inspectors about this by letter.

Is it necessary to put a stamp on the primary product, the forms of which the company has developed itself?

No no need. The seal is not listed among the mandatory details of the primary documents listed in Part 2 of Article 9 of the Law of December 6, 2011.

No. 402-FZ.3

Is it necessary to use a seal in contracts, for example, in a purchase and sale agreement?

No, not necessarily. It is necessary to put a stamp in an agreement with counterparties only if this is expressly provided for in the agreement (Clause 1 of Article 160 of the Civil Code of the Russian Federation). Therefore, if a round seal is not used by one of the parties, simply make sure that the requirement to affix it is removed from the contract.

Will banks require stamps on documents?

No, they will not do. Representatives of banks report that the signature of the general director on any documents is enough for them if the company refuses the seal.

Is it now possible not to put stamps in work books?

It's risky to do this for now. After all, the rules for filling out work books still state that the entry on the title page and records of dismissal must be certified with a seal (clause 2.2 of the Instructions, approved by Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69).

Based on materials from glavbukh.ru

If the document is drawn up by an entrepreneur

Unlike organizations, entrepreneurs are not required to have their own seal <20>. After all, neither the Civil Code of the Russian Federation nor the Federal Law of 08.08.2001 N 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs” makes such a requirement for entrepreneurs. But the law does not prohibit entrepreneurs from having their own seal if they want to use it. The courts also confirm that whether to have a seal or not is a personal matter for each entrepreneur <21>. For example , it often happens that an entrepreneur has to create a seal because counterparties want to see it on the documents he prepares. And it is easier and more profitable for him to fulfill such a request than to lose these counterparties and look for new ones. And some regulations provide for the mandatory presence of a seal on certain documents drawn up by entrepreneurs. However, the fact that any regulatory legal act that approved the form of the document provides for such details as a seal impression does not mean that the entrepreneur is obligated to have one.

What documents are stamped on? All about printing and its use

| Stamp on a document: which one to put? |

According to the methodological recommendations for the implementation of GOST R 6.30–3003, a seal is a mechanical device, a device containing a printing block for subsequent imprinting on paper.

The seal on the document gives it legal force and certifies the authenticity of the official’s signature.

In GOST R 6.30–2003, the name of the attribute has changed compared to GOST R 6.30–97 (the attribute was called “seal”), the new name is “seal imprint”. The essence of the props remains the same.

Technical requirements for official seals - their shape, size, text and symbols placed on them - are set out in the state standard GOST R 51511–2001. Technical requirements for seals without a coat of arms are not specified in state standards.

https://youtu.be/_l-g_AeAE3o

See below for the list of documents on which the organization’s seal is affixed.

What types of seals are there?

- Stamp. According to the federal constitutional law “On the State Emblem of the Russian Federation” dated December 25, 2000 (as amended on March 12, 2014), the state emblem of the Russian Federation is placed on the seals of federal government bodies, other government bodies, organizations and institutions, on the seals of bodies, organizations and institutions regardless of the form of ownership vested with certain state powers, as well as bodies carrying out state registration of acts of civil status. The right to use the official seal is granted to the first managers, officials from among the employees of the preschool educational institution or financial service.

- Round seal with the name of the organization (without reproducing the coat of arms). Every organization must have it to certify the authenticity of the signatures of officials.

- Stamp of structural units, as well as round and triangular seals that have a narrow functional purpose (for packages, passes, etc.).

Both the stamp and the round seal usually indicate the TIN of the organization, the number of the state registration certificate, as well as its location.

What document is used to secure seals in an organization?

Each organization develops instructions for using seals. The instruction is approved by the manager and has the following sections:

— a list of seals used in the organization;

— storage locations and positions of persons entitled to use seals;

- procedure for using seals.

The instructions must also contain lists of documents certified by all types of seals. Lists of documents are compiled on the basis of regulatory legal acts and our own experience in the organization.

The lists establish who personally and in what cases has the right to certify the authenticity of a document’s signature.

The right to have and use a seal should be recorded in the regulations on the structural unit

The instructions also determine the storage location of the seals and the persons authorized to organize the storage and use of the seal and monitor its correct use.

The instructions should also contain a list of seals , which includes:

— the name and number of copies of each seal authorized for use (the permitted number of copies of each seal is not specified in regulations);

- positions of persons authorized to store and use seal impressions and control the correctness of their use.

The procedure for using seals is established by the organization in accordance with current regulations and taking into account the specifics of the organization’s activities.

Changes and additions to the list are allowed only on the instructions of the head of the organization.

The use of seals in the organization is permitted only to employees specially appointed by order of the manager.

The seal impression is affixed only to correctly executed and signed documents.

Stamps are subject to registration in the preschool educational institution service and are issued to structural units to users against receipt in the registration and accounting form. In departments, prints are stored in securely locked cabinets.

The destruction of seals occurs in cases of liquidation of an organization, termination of activities as a result of a merger, annexation, transformation, renaming of an organization or a separate structural unit, as well as mechanical wear of the clichés.

Destruction is carried out according to an act with a mark in the registration and accounting forms. Registration and accounting forms of seals, as well as sheets with their imprints certified by the preschool educational institution service are included in the nomenclature of the organization’s files.

Where is the stamp placed?

The location of the official seal imprint in relation to the signature is not established in current legal acts. It is recommended to place the seal imprint so that the signature and all information on the seal imprint are clearly visible.

An approximate list of documents on which the official seal (seal of the organization) is affixed:

Acts (acceptance of completed construction facilities, equipment, work performed; write-offs; examination, etc.).

Powers of attorney (for receiving inventory, conducting business in arbitration, etc.).

Agreements (on financial liability, supplies, contracts, scientific and technical cooperation, rental of premises; on the execution of work, etc.).

Tasks (for the design of facilities, technical structures, capital construction; technical, etc.).

Conclusions and Reviews of abstracts.

Applications for tickets for travel on public transport.

Applications (for a letter of credit; refusal of acceptance, etc.).

Writs of execution.

Consumption rates.

Samples of seal impressions and signatures of employees who have the right to carry out financial and business transactions.

Correspondence with foreign missions.

Submissions and petitions (for awarding orders and medals, prizes, etc.).

Letters of guarantee (for work, services, etc.).

Orders (budgetary; banking; pension; payment (consolidated, to the bank, to receive foreign currency from accounts; currency transfer; for imports, etc.).

Regulations on organizations.

Registers (checks; budget orders) submitted to the bank.

Cost estimates (for the maintenance of the management staff; for the costing of the contract).

Agreements.

Certificates (limit; on payment of insurance amounts; on the use of budget allocations for salaries; on accrued and due wages, etc.).

Specifications (products, products, etc.).

Title lists.

Certificates.

Charters of organizations.

The indicative list is not exhaustive and may be changed in accordance with a written order (instruction) of the head of the organization.

Find out how to properly approve documents>>

Find out how to work with documents “For official use”>>

“,”author”:”втор: Инна”,”date_published”:”2014-01-09T00:00:00.000Z”,”lead_image_url”:”https://2.bp.blogspot .com/-DjfGJvQpfao/VA88zW_wPqI/AAAAAAAAASQ/IiH8V7ZY4mE/w1200-h630-pk-no-nu/%D0%BF%D0%B5%D1%87%D0%B0%D1%82%D1%8C.jpg”, ”dek”:NULL,”next_page_url”:NULL,”url”:”https://www.docdelo.ru/2014/09/na-kakih-documentah-stavitsya-pechat.html”,”domain”:”www .docdelo.ru”,”excerpt”:”Ра каких документах Ñ Ñ‚Ð°Ð²Ð¸Ñ‚Ñ Ñ Ð¿ÐµÑ‡ What about? What's wrong? What's wrong with you? docdelo.ru,”word_count ”:789,”direction”: ”ltr”,”total_pages”:1,”rendered_pages”:1}

* * *

If you have any doubts about whether a document needs a stamp, it is better to put one on it. After all, even if the law does not provide for affixing a stamp on a document, and you do this, you will not violate anything.

<20> Letter of the Federal Tax Service of Russia for Moscow dated February 28, 2006 N 28-10/15239. <21> Resolution of the Federal Antimonopoly Service of the Far East Branch of September 12, 2008 N F03-A51/08-2/3390.

A.L. Sudakova

Economist

It is not surprising that in our bureaucratic world, people feel so uncomfortable and uncomfortable without the necessary document. To protect information and give the paper a certain status, seals and stamps are provided.

Definition

A stamp is a tool designed to transfer an imprint from a hard storage medium onto paper, cardboard and other surfaces. It can have different shapes, including irregular ones, and also contain a certain set of information. In modern office work, a stamp is a data carrier that is used to optimize document flow processes. With its help, you can speed up sending letters and filling out papers. For example, a corner stamp contains information about the institution and is affixed to outgoing documents.

A seal is a tool designed to certify the authenticity of documents, certify a signature, and give papers an official status. They are used by individuals and legal entities for various types of activities, including commercial and non-profit. Stamps are affixed to the front side of documents; either paint or high pressure is used to transfer the imprint, which pushes through the paper.

Comparison

Historically, these concepts were similar, printing was included in the scope of the stamp category, but at the moment this is no longer relevant. Now each tool is included in a separate group and performs different functions. The main difference is the legal force of these instruments. The seal certifies the authenticity of the document and is sufficient to seal the agreement. The stamp only standardizes the official paper and indicates its affiliation with a particular institution. At the same time, it does not give it sufficient legal force to perform certain actions.

In accordance with the law, it is mandatory for a legal entity to have its own seal. If it is lost, you must contact the appropriate government agency for a replacement, and if found, the old one must be immediately destroyed. It is not necessary for legal entities to have a stamp, but this is permitted in accordance with the law. Its loss does not entail any legal consequences for the owner. There can be as many of them as you like, free replacement and addition of new ones is allowed.

The stamp is affixed to the free space of the document, usually in the upper left corner. It is allowed to enter handwritten data inside free fields: number of the outgoing document, date, last name, etc. The seal is placed on top of the signature or elastic layer. It does not require any additional information; its inclusion is not provided for in the instrument format.

"Contractual" seal

Traditionally, there is little trust in an agreement without a seal. However, within the meaning of paragraph 3 of paragraph 1 of Art. 160 of the Civil Code of the Russian Federation, sealing contracts is necessary if this is established by law, other legal acts or agreement of the parties. That is, the seal on the contract refers to additional requirements and is affixed if this is established by legal requirements or the terms of the contract. For example, an agreement between business entities may provide that the text of the agreement is sealed by both parties.

And only in this case, the absence of a seal on the contract can lead to the consequences provided for non-compliance with the simple written form of the transaction, if such consequences are specified in the contract. And the consequences may be the deprivation of the parties’ ability in the event of a dispute to refer to witness testimony (clause 1 of Article 162 of the Civil Code of the Russian Federation), as well as the invalidity of the transaction (clause 2 of Article 162 of the Civil Code of the Russian Federation).

In other situations, a seal on the contract is not necessary, which is confirmed by numerous arbitration practices. The decision of the Eighteenth Arbitration Court of Appeal dated January 19, 2015 No. A76-22079/2014 and the decision of the Arbitration Court of the Altai Territory dated June 24, 2014 No. A03-4194/2014 emphasized that the fact that there is no seal on the contract does not indicate non-compliance with the written form transaction, since the agreement is sealed in accordance with paragraph 3, clause 1, art. 160 of the Civil Code of the Russian Federation is an additional requirement that may be established by law, other legal acts or agreement of the parties, which is not the case in this case.

And the absence of a seal in the contract does not in itself indicate the falsity of the contract (resolution of the Seventeenth Arbitration Court of Appeal dated December 25, 2014 No. A60-37054/2014).

Thus, a seal is not a mandatory requisite when concluding an agreement; mandatory sealing of concluded agreements is not provided for by law (decision of the Arbitration Court of the Altai Territory dated 03/19/13 No. A03-675/2013, resolution of the Second Arbitration Court of Appeal dated 08/24/12 No. A29-1921/2012).

Conclusions TheDifference.ru

- Legal force. A seal certifies the authenticity of a document, while a stamp only indicates that it belongs to a certain type.

- Principles of use. Every legal entity in the Russian Federation must have its own seal for official documents, and a stamp is optional.

- Adequacy. The seal does not require additional information to be added, and on the stamp the data can be added by hand.

- Place and features of application. The stamp is placed in the upper left corner of the document in the empty space, the seal is placed on top of the signature at the place where it was made.

Where are the stamps placed?

In our country, it is generally accepted that without a stamp, a document is invalid, so stamps are often placed on all papers in a row, regardless of whether a stamp is needed there or not. However, in reality, only some documents are subject to mandatory “stamping”.

Where to put the organization's seal

This is the main seal of any company. And when it is necessary to put a stamp on an important document, that is what they put. The organization's seal must be present on documents signed by the company's top officials:

- founders,

- director,

- deputy directors,

- chief accountant.

Where to put the official seal

Only government agencies and government institutions have the right to use official seals.

Where and where can I stamp documents?

A seal for documents on a contract, can it be used as a full replacement for the main one? The use of an additional stamp is not limited in any way, unless it concerns working with government agencies, filing reports and other papers where the use of only the main round seal is prescribed. However, some difficulties may arise when working with partners. An additional stamp can be used if the presence of a stamp is not necessary or the terms of the contract do not provide for the mandatory use of the main one.

This is interesting: How to apply to a university

List of options where you can put a stamp:

- Various contracts for the provision of services and goods, both external and internal.

- Additional agreements.

- Work acceptance certificates.

- Information and characteristics.

- Travel documentation.

- Petitions and letters of guarantee.

- Work books.

- Additional internal papers, instructions, schedules, etc.

In general, there are really many situations when printing for documents is used and most of them represent daily work processes. Therefore, additional cliches are in great demand among entrepreneurs of various sizes. But in the process of work, misunderstandings may arise. Not all partners will entrust this or that transaction to papers certified by an additional seal. And to prevent such situations from happening, such moments of cooperation must be discussed in advance. And the purpose of printing for documents can be completely different. The only important thing is that the organization’s stamp for documents is not suitable for certifying bank forms, invoices, financial reports to tax and statistical authorities, funds, etc.

Once again about printing

If a private company puts the coat of arms of the Russian Federation on its seal without special permission, and then wants to put a stamp on documents, it will automatically break the law. The official seal is affixed to the following documents:

- Agreements,

- Acts,

- Powers of attorney,

- Travel certificates,

- Applications,

- Letters of guarantee,

- Protocols,

- Registers,

- Statutes,

- and others.

Why do you need a “For Documents” stamp?

Most often, this is an additional seal of the organization, which is not located by the head of the enterprise, but in the accounting department. It has legal force if it is made in accordance with the requirements. It is used when you need to put a stamp on any documents, with the exception of financial banking documentation. Such stamps are placed on:

- Invoices,

- Reconciliation acts,

- Accounts,

- Internal documents of the organization.

Stamp

A stamp is a seal of any shape other than round, which also has no legal force. Therefore, to the question: Where can I put a stamp? - the answer will be simple: Everywhere where an official seal is not required. You can put a stamp on the following documents:

- Help,

- Invoices,

- Warranty documents

- Internal documents.

Stamps from

is the leader in St. Petersburg in the production of stamp products. We offer all types of seals and stamps made from high quality materials. Order fulfillment time is from one hour. From us you can not only order seals and stamps, but also get expert advice on complex issues. If you do not know which documents need to be stamped and for which a stamp is sufficient, please contact us.

We are waiting for you! Contact us.

- price

- portfolio

- order online

- delivery

- Printing LLC "Romashka" manual equipment price for 1 piece.

- Printing Institute of Business automatic main. price for 1 piece

- Seal LLC "Kolos" automatic main. price for 1 piece

- Print MDM Bank pocket main. price for 1 piece

- Automatic stamp stamp price for 1 piece

- Stamp Bank "Petrovsky" automatic main. price for 1 piece

- Stamp RECEIVED automatic main. price for 1 piece

- Facsimile automatic main. price for 1 piece

- Flash printing LLC "Pobeda" manual base. price for 1 piece

- Bookplate by A.V. Chizhov pocket base. price for 1 piece

Delivery within the Ring Road is free for orders over 3,000 rubles, or 300 rubles.

All residents of the post-Soviet space believe from an early age that any document can be considered legitimate if it bears a seal. Therefore, we sculpt it wherever necessary and without saying: “it won’t be superfluous.” How important is the presence of a seal imprint on a particular document? (The article Is a seal needed on a contract will tell you about this?) So why do you need a seal? Let's start from the beginning:

What is a seal?

A seal is a round cliché that is used to make impressions on certain documents in order to confirm their belonging to your organization and their authenticity. special requirements and rules (GOSTs) for seals for organizations and individual entrepreneurs .

Using seal for documents

Using printing for documents is extremely convenient and functional. The introduction of such additional tools allows you to competently distribute responsibility and organize the certification of any papers. An additional bonus is the distribution of the load on the cliché, which extends the service life of the main copy several times.

At the time of making the decision to introduce additional stamps, each director already knows the answer to the question of why he needs a stamp for documents. The main reason: to ensure that the main seal will have a limited number of users, down to one. This approach allows you to track all important papers and eliminate possible fraud on the part of staff. Where to put a seal on documents, and where to use the main one, the manager decides for himself, based on the acceptable level of trust in employees and security for his business. In general, the use of such a stamp is equal in strength to the main one, however, this is only relevant in cases where the parties agree to the introduction of a seal for documents.

The additional tool is a universal solution. And if you are wondering how to properly design a seal for documents and have taken into account all the requirements for the main cliche, then you get a tool that is suitable in many situations and will not cause any problems.

How do you open a seal for documents, and how do you close a seal for documents?

Depending on a particular company, during production you will have to submit various documents confirming the existence of the company, its director, etc. The full list of such certificates may vary from workshop to workshop. When it comes to closing a seal, everything is quite simple. When withdrawn from circulation, the company should destroy it, and the company can perform this action: on its own, or contact a workshop or stamp registration authority. The easiest way is to remove the cliche yourself, and at the time of this procedure, a destruction act is drawn up, which records the information:

- place and time of destruction;

- composition of the commission;

- reason for destruction;

- imprint of the seal being destroyed;

- method of destruction: filing in 2 lines, burning or cutting;

- the commission’s conclusion on the unsuitability of this stamp for use and their signature.

Thus, you record the presence of this seal in the past and its legality, while completely eliminating the possibility of fraud, since the use of an old print after recorded destruction will be quite easy to track and prove your case in the fight against fraudsters. It is recommended to keep records of all seals and stamps used in production.

How to put a stamp correctly? Should the seal affect the signature?

There are only general requirements for organizations; these requirements, by analogy (in the case of making a seal for an individual entrepreneur ), can also be applied to seals for an individual entrepreneur : the 1st seal must have a round shape; The 2nd seal must contain the full name of the organization; The 3rd seal must contain an indication of the location of the organization (the region of the Russian Federation is sufficient).

What is a stamp?

A stamp is a cliche containing any information of any shape with the exception of round. Stamps come with company details, or confirming: “the copy is correct”, “paid”, “approved”, etc.

Why are seals and stamps needed?

So why do you need seals and stamps ? To begin with, a seal is an additional confirmation of the authenticity of a document coming from your company, as well as additional protection for the manager’s signature. In some cases (especially in relations with government agencies), without a seal, a document may be considered invalid and not accepted. A stamp is used in most cases to save the time of your employees when it is necessary to apply repetitive information to internal company documents; it is usually used in office work or accounting.

Official seal and seal for documents: what is the difference?

In modern business relations, stamps are indispensable. Any company must have so-called official stamps or equivalent seals. It is worth immediately pointing out that the official seal is a unique category that is intended for government bodies and direct government institutions. In addition, this type of seal can be used by organizations that have the appropriate authority. Otherwise, the presence of a main imprint is assumed, which in its functionality is equivalent to a stamp stamp, but is not one.

- The coat of arms must be made on a round block and include the following elements: the state coat of arms in the center, the name of the organization around the circumference.

- The main one has a round shape and contains: the full name of the company in Russian, as well as the address, INN, OGRN, etc. It is acceptable to duplicate the company name in a foreign language, have your own emblem, trademark and other individual differences.

Using one main seal is not always convenient. After all, each copy is assigned to an employee who has the right to use it. In the matter of the main stamp, which has absolute power, such functions are allowed only to the director, and not everyone is ready to hand over such a powerful instrument to strangers. In order to delineate the responsibilities of employees, organize documentation and protect the business from fraudsters, many companies, along with the main seal, use a cliche with an inscription for documents. They have a number of distinctive features, but in basic content they are based on the same requirements as the main tool.