Home / Labor Law / Employment / Hiring

Back

Published: 05/09/2017

Reading time: 6 min

1

7714

In some cases, employers require a TIN or taxpayer identification number to be presented when hiring a new employee. But since receiving it is not mandatory for citizens of the Russian Federation, a completely logical question arises: how legitimate are such employer demands?

To answer this question, it is necessary to refer to the labor legislation in force in 2020, namely Article 65 of the Labor Code . This article provides a complete list of documents required for hiring, which the applicant for a vacant position must provide to the personnel department.

- What does the law say?

- In what cases is it necessary to present it?

- What to do if an employer requires a TIN?

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

Inn of the organization of the employer, founder and employee: how to find out

At LLC Roof, the number of orders increases during the season. New employees are actively recruited to carry out this work. So in January 2020, the company hired 15 new employees.

From the article you will learn what to do if an employee has two TINs, the certificate of TIN assignment is lost, how to fill out form 2-NDFL if the employee does not have a TIN at all, and other nuances of using this code.

Sometimes, when applying for a job, in addition to a passport, work book and education diploma, HR department employees require information about the TIN from candidates for a vacant position. If you don’t have a TIN, it is recommended to get one. Often, employers include provisions for various fines in the contract or record a ban on part-time work. These are errors that may constitute an administrative offense, so be careful.

Additional legislative confusion was also introduced by Federal Law No. 385 dated December 29, 2015, according to which the employer is required to indicate the taxpayer identification number when sending reporting documentation to the local branch of the Pension Fund. However, the law obliging everyone in Russia to obtain a taxpayer identification number has not yet been adopted.

The bank, through its security service, “pushes” your employer’s identification number (for the existence of the company, for debts, and other data).

It is necessary to distinguish between the employment relationships you noted (labor relations) and tax relationships in which the employer is a tax agent.

In this case, in add. The agreement must indicate that it comes into force from the moment of signing, but extends its effect to the relations of the parties that arose from the moment the employment contract was concluded.

In what cases is it necessary to present it?

The exception is employment in the public service. This category of workers must present to the personnel department the assigned Taxpayer Identification Number (in accordance with Federal Law No. 79, adopted in July 2004).

For other categories of workers, the presence or absence of the specified number cannot be an obstacle to employment.

Some legislative confusion in this matter is associated with entrepreneurial activities and the activities of legal entities. The Tax Service, in a separate letter drawn up in December 2015, indicated the impossibility of accepting reporting information in the absence of a TIN. But already in the next letter under the number BS-4-11/1068, sent in January 2020, it was confirmed that it is not necessary to require this document when applying for a job.

Another not entirely clear point is contained in Federal Law No. 385, which, from the second quarter of 2020, obliges to indicate the taxpayer number when sending reports to the local branch of the Pension Fund. Such a report is submitted by individuals and legal entities on a monthly basis.

This measure allows you to avoid problems with the tax service and extra-budgetary funds.

Additional payments and salary supplements in our interesting article.

You will find all the information you need about applying for a pension here.

Read about how the sensational increase in the retirement age will happen in this article.

https://youtu.be/XQquROJJCmM

Why does an employer need an employee's TIN?

Since the field exists, representatives of the organization believe that the employer has the right to demand a TIN. However, it is not. The fact that an employee is not required to provide a TIN is confirmed not only by Article 65 of the Labor Code, but also by other regulations.

Or is this done by my tax agent/employer upon hiring? After all, I should be given a certificate of registration with the tax authority, which I do not have.

When concluding an employment contract for the first time, a work book and an insurance certificate of compulsory pension insurance are issued by the employer. (edited)

The legislation of the Russian Federation (TC) does not require you to receive and provide a number (although it is most likely assigned to you) when applying for a job or studying at a university (if you do not have an individual entrepreneur).

Where can I get a TIN

If an employee decides to obtain a TIN, he needs to contact the tax authority at his place of residence. There are several ways to do this.

The simplest of them is to use the Internet service of the tax service. In addition, the applicant can submit an application to the Federal Tax Service himself. Along with such an application, it will be necessary to provide a document that identifies the identity and confirms the validity of information regarding the registration of the citizen at his place of residence. And if for any reason he cannot appear at the Federal Tax Service Inspectorate at his place of residence in person, there is the option of submitting an application through a representative using a power of attorney certified by a notary.

No later than five days from the date on which such an application was submitted, the Federal Tax Service will register the applicant for tax purposes and at the same time provide him with the requested certificate.

Sometimes it is more convenient to send an application by mail or submit it to the tax authority using telecommunication channels. Then the period of five days is calculated from the date the Federal Tax Service Inspectorate receives from the authorities specified in clauses 3 and 8 of Article 85 of the Tax Code of the Russian Federation information on the reliability of the information specified in the application. On the same date, the Federal Tax Service must send a certificate of registration to the applicant’s address (but only if it was not issued earlier).

Why does an employer need an employee's tax identification number?

According to Art. 57 of the Labor Code of the Russian Federation, an employment contract must contain an indication of the direct amount of wages (salary) or a clear procedure for determining the employee’s salary (for example, if he is hired not on a time-based basis, but on a piece-rate basis).

However, such a check often raises questions among employees and applicants. We conducted a small study with the participation of UNIRATE24 users and compiled a list of the most common questions. You can use the answers to them in your work with employees and applicants.

Independent searches for information on the Internet led to the fact that 1. obtaining a TIN for an individual is not necessary; 2. They have no right to force people to contact the tax office to obtain a TIN.

However, such a check often raises questions among employees and applicants. We conducted a small study with the participation of UNIRATE24 users and compiled a list of the most common questions. You can use the answers to them in your work with employees and applicants.

Your votes are very important and allow us to identify truly useful materials that are interesting to a wide range of professionals. At the same time, useless or frankly advertising texts will be hidden from visitors and search engines (Yandex, Google, etc.).

The requirement to have a TIN is contained in tax legislation. Its purpose and structure are established in accordance with the Procedure approved by the Federal Tax Service of the Russian Federation on June 29, 2012. Order No. ММВ-7-6/435.

If the inspection has not fulfilled this obligation, and the citizen does not know his TIN, there is no reason to refuse to conclude an employment contract, as well as to send him to the tax office to obtain a TIN.

Novin LLC has a vacancy for the position of sales manager. Svetina K.R. passed three stages of the interview and was invited to work. A few days before going to work, Svetina K.R. I received a letter in the mail from the HR manager of Novin LLC with a list of documents that need to be brought on the first working day.

No, it is not needed in this case either. Because taxes will be paid in any case if the office submits information. Because the taxpayer is actually identified either by full passport data, including permanent registration address and actual residence address, or by TIN. Both methods cannot be used at the same time - that’s how their program works.

By referring to the standards of the current legislation, you can get a clear answer to the question of whether a TIN is needed when applying for a job in 2020.

The documents required to be provided by the applicant include:

- an identification document (usually a passport);

- SNILS;

- special documents for employees subject to conscription for military service (military ID or registration certificate);

- education document;

- work book (if available). When applying for an official job for the first time, the employee cannot present this document;

- other certificates and documents depending on the position for which the new employee is applying (for example, for a police officer, a mandatory document will be a certificate of no criminal record).

The taxpayer identification number has been assigned to legal entities since 1993, to individual entrepreneurs - since 1997. The organization's tax identification number consists of 10 digits: NNNNXXXXX With where: In accordance with paragraph 7 of Article 84 of the Tax Code of the Russian Federation, each taxpayer is assigned a single identification number for all types of taxes and fees taxpayer.

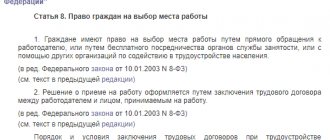

This list is exhaustive; exceptions to this list can only be established by special regulations. It is prohibited to require from a person applying for a job documents other than those provided for by this Code, other federal laws, decrees of the President of the Russian Federation and decrees of the Government of the Russian Federation (Article 65 of the Labor Code).

It is used during:

- signing a legally binding agreement with counterparties;

- generation and submission of reports to authorized regulatory authorities;

- participation in organized government auctions;

- signing a loan agreement and so on.

Inn for employment: is it necessary or not? 2019

The documents that must be presented for employment are listed in Article 65 of the Labor Code of the Russian Federation. Each document in this list carries a certain semantic meaning.

- passport (or other identification document) – necessary to make it clear with whom the employment contract is actually being concluded;

- work book – confirms the presence of work experience (if applying for a job for the first time, of course, it is absent);

- insurance certificate of compulsory pension insurance (SNILS) - needed to keep individual records of the insurance period - something that will later affect the amount of the pension;

- military registration documents are also understandable: for keeping records of those liable for military service;

- documents on education (qualifications) - if necessary, confirm that the applicant has the skills, knowledge, and training necessary for this particular job;

- a certificate of no criminal record - needed to confirm that the applicant can be allowed to work (of course, not everyone needs it).

The list is closed, i.e. The future employer does not have the right to add any other documents to it at his own request. Yes, in fact, this is expressly prohibited.

and require a TIN. This is an “additional document”!

Well, this employer is wrong about this. Additional documents may be required in some special cases. For example, for a part-time worker this is a certificate about the nature and working conditions at the main place of work - and not always, but only when applying for a job with hazardous conditions.

When applying for employment in the Far North and equivalent areas, a medical certificate is additionally required; when accepting a foreigner - a patent and temporary residence permit; in the civil service - a certificate of income and property. And so on.

As you can see, the TIN certificate is not in the list of required documents. Consequently, it is not mandatory for employment and the employer has no right to demand it.

And now a little about the testimony itself and its necessity.

At the same time, we will dispel some downright myths associated with it.

TIN – taxpayer identification number. It is assigned by the tax authorities and is intended for accounting of taxpayers. At its core, it is simply a record number about a specific person in the unified state register of taxpayers. And nothing else.

TIN is a very convenient form of accounting. Because it is individual and does not change in any way, no matter what happens to the person himself. Change of surname or first name, gender or age, moving, divorce or marriage - the set of numbers will remain the same and quite simply allows us to determine with whom we are dealing. Therefore, in fact, government agencies assign TIN en masse, almost from birth, and happily use it.

However, the same Tax Code, which establishes in which cases a person receives a TIN, mentions: if an individual is not registered as an individual entrepreneur, it is not necessary to indicate the TIN. The TIN indication can be replaced by a combination of full name and passport data - they are quite sufficient to identify the payer.

Does an accountant need an employee's TIN? Actually, no, it’s not needed.

The accounting department withholds personal income tax (income tax) from employees' salaries and transfers it to the budget. For the calculation itself, the payer's number is not needed at all.

For transfer? The employer transfers personal income tax withheld from employees to the budget on its own behalf, indicating the special status of payment, in one amount. The list of employees from whom tax is withheld is not attached, and the transfer itself is taken into account by the employer, and not by employee. Well, why do you need to know the employee’s tax identification number under these conditions?

To fill out a 2-NDFL certificate? The information on these certificates is again taken into account by the employer. Yes, the certificate is individual - for each employee, but the “TIN” details are not allowed to be filled out in it (it is replaced by a combination of full name and passport data). If nothing is included in this detail, the certificate will still be accepted. Then why demand it?

In addition to income tax, the accounting department also lists insurance payments. Here they are – individual, i.e. for each employee separately. But the insurance record and transfers for each person are kept on the basis of SNILS - it is for this reason that this document is required for employment.

We suggest you read: How scammers can take out a loan using someone else’s passport

As you can see, the presence or absence of a TIN does not in any way prevent or help the accountant to transfer taxes for the employee and submit information about him to the tax authority, pension fund or social insurance fund. So, when applying for a job, you do not need a TIN certificate. At all.

At the request of the employer, the employee can provide him with his TIN data - the numbers themselves. Or maybe not provide it. It won't interfere with anything.

And if an employer really needs an employee’s TIN, nothing prevents him from going to the Federal Tax Service website in the “Find out TIN” service and getting the coveted numbers. Moreover, he has the passport data that is needed for this.

Is a TIN required when hiring, or can new employees be limited to providing passport data and SNILS number? To answer this question, you need to understand what kind of reporting employers will subsequently have to submit and what information should be reflected in it. This is discussed in our article.

When filling out personnel documents, the employer needs to obtain certain information from employees. This includes passport data, the number of the insured person in the Pension Fund, the taxpayer number, etc., without which it is difficult, and sometimes impossible, to correctly submit information about employees to the regulatory authorities.

The main documents that a newly hired employee submits in accordance with Art. 65 of the Labor Code of the Russian Federation is:

- employment history;

- SNILS number;

- passport details;

- military registration documents;

- other information (education documents, criminal records, etc.).

To receive additional benefits during the subsequent calculation of remuneration, the employee has the right to present certificates of income from previous places of work (including for calculating sick leave), as well as information about the presence of minor children.

According to the Labor Code of the Russian Federation, it is not necessary to present a TIN certificate to the employer when taking up a new position. However, in some cases you cannot do without it.

For more detailed information on this issue, see the article “2-NDFL will undergo face control at the inspection and without a TIN.”

Considering the question of whether a TIN is required when applying for a job, we can state: despite the fact that according to the Labor Code of the Russian Federation this certificate is not included in the set of documents required when applying for a job, in some cases, according to the law, the employer will need to have such information.

More detailed information about the activities of personnel service workers can be found in the article “HR records management from scratch - step-by-step instructions 2018.”

Why does an individual need a TIN when applying for a job? Art. 65 of the Labor Code of the Russian Federation contains a clear list of necessary documentation required for employment:

- identification;

- employment history;

- SNILS;

- military ID (for those liable for military service);

- diploma of education;

- a certificate of no criminal record and a certificate of involvement in administrative punishment regarding drugs or psychotropic substances (for certain organizations).

This listing does not contain an ID number. Accordingly, the labor law does not oblige employed citizens to present a TIN certificate to the employer. This paper is required only in the process of entering the civil service (Article 23 of the Law on State Civil Service).

Free legal consultation We will answer your question in 5 minutes!

The employer needs the certificate to transfer income tax to the budget. Therefore, to avoid mistakes, it is better to provide it when applying for a job. The employer's request to bring the document is considered illegal. It is also impossible not to get a job because of his absence.

Free legal consultation

We will answer your question in 5 minutes!

Additionally, you can study: how to find out the TIN of an organization by name.

Which TIN should an accountant use if an employee has several of them?

Thus, the likelihood of conflicts with authorized regulatory authorities is reduced.

Thus, it is legally possible not to provide a taxpayer identification number during employment.

For work in hazardous working conditions, the Employee is entitled to an additional annual paid leave of 7 calendar days. 3.4. For working with easily washable contaminants, the Employee is given free soap or liquid hand detergents - 200 g of toilet soap or 250 ml of liquid detergent in a dispenser.

Thus, all the problems that may arise due to someone's tax identification number are solved.

Is it possible to get a job without a TIN and why does the employer need the employee’s TIN?

Check an employee's credit history When an employer requires information about loans, he does not have the goal of convicting this or that employee of having debt or identifying the negative. Everything why employers need to know about employee loans is to assess the risks of trust in an employee or applicant for company resources - monetary, informational, human .

At the same time, if a citizen is not an entrepreneur, then he may not indicate his TIN, but instead he will have to provide his full personal data, including passport details, information about the date and place of birth, name, registration address, as well as gender, citizenship.

In Russia, do we need an individual taxpayer number (TIN) when applying for a job using a work book?

Due to legal requirements, the tax identification number is indicated by the tax service in all documents addressed to the taxpayer, including citizens.

We understand the indication of TIN in reporting

The TIN indication is provided when filling out the 2-NDFL certificate and the SZV-M form. However, this is an optional requisite. 2.2, 4 tbsp. 11 of the Law of 01.04.96 No. 27-FZ; Letters from the Federal Tax Service dated 02/16/2016 No. BS-3-11/ [email protected] , dated 02/02/2016 No. BS-3-11/ [email protected] Therefore, it is safer not to indicate it at all if you do not know the employee’s TIN or doubt his correctness.

You can check whether the change of an employee’s last name is taken into account in the tax register, for example:

- using the “Find out your/other’s TIN” service on the website of the Federal Tax Service of Russia;

- by asking the employee for a printout of the initial page from the taxpayer’s personal account on the Federal Tax Service website.

Please note that if you indicate an incorrect TIN, old last name of an employee, or other irrelevant personal data in the 2-NDFL form, your organization may be fined 500 rubles. for each certificate with false data. 1 tbsp. 126.1 Tax Code of the Russian Federation; Letters of the Federal Tax Service dated 08/09/2016 No. GD-4-11/14515, dated 02/16/2016 No. BS-3-11/ [email protected]

The same fine is 500 rubles. for an error in one TIN - the organization faces the threat when submitting SZV-Mst. 17 of the Law of 01.04.96 No. 27-FZ.

Accountant questions about employee tax identification number

This means that you may have certain problems with accounting and receiving salaries without providing them with a taxpayer identification number.

The employer's TIN is most often required for banking transactions, in particular when applying for a loan. This is due to the fact that the bank needs to know how capable you are of repaying the loan. For the same thing, you also need certificates that indicate your income.

The HR department often interacts with the accounting department, and often disagreements arise between these two departments. One of the reasons is the lack of a taxpayer identification number in the 1C program. A registration certificate is issued by an individual independently; not all citizens have it.

If we are talking about hiring for a job in the public service, the new employee is required to present the TIN assigned to him to an employee of the personnel department. This is directly stated in Federal Law No. 79 of July 27, 2014. For all other positions and categories of employees, this requirement does not apply.

In some cases, taking into account the specifics of work, this Code, other federal laws, decrees of the President of the Russian Federation and decrees of the Government of the Russian Federation may provide for the need to present additional documents when concluding an employment contract.

The TIN of an individual includes 12 digits: the first 4 serve to designate the tax authority in which the registration was made, the next 6 are the actual individual number, and the last 2 are control numbers, specially calculated according to a certain formula.

The tax authority indicates the taxpayer identification number assigned to the organization (individual) (for the organization - also the checkpoint) in all notifications sent, as well as in the certificate of registration with the tax authority and in the notice of registration with the tax authority.

Why is this done?

There is information that in order to increase tax collection (by numbers it seems easier for them to control). But at the same time, this provision, without the adoption of a law in serfdom, requires individuals (violating the Labor Code) to obtain a Taxpayer Identification Number (TIN).

- Certificate 2-NDFL will not be accepted without TIN: what should an accountant do: https://www.klerk.ru/buh/articles/437039/

- Temporary relief: https://www.klerk.ru/buh/articles/437844/

- People rushed to “do it”: https://www.moe-online.ru/news/view/33510…

| 10 lifehacks of children of the USSR Many people believe that there is a huge gap between people living in the USSR and modern society. In this article you can find information about 10 life hacks of children of the USSR, which replaced modern toys and gadgets for them. |