VAT: basic concepts

In Russia, the value added tax appeared in 1992, and its history begins with the German economist Wilhelm von Simenson, who in 1919 proposed a “refined turnover tax.” In tax practice, the French were the first to levy VAT in 1954, but not on the territory of their country, but in the colony of Cote d'Ivoire. Today, VAT with various modifications exists in tax practice in more than 50 countries around the world.

In the legislation of the Russian Federation, Chapter 21 of the Tax Code of the Russian Federation is devoted to VAT. In addition, the Ministry of Finance and the Federal Tax Service constantly issue letters and clarifications for ambiguous situations.

The essence of VAT is the withdrawal from the budget of part of the value added at each stage of production of a product or creation of a service. VAT refers to indirect taxes, in contrast to direct taxes, which are levied directly on the financial results of the taxpayer’s activities or his property; VAT is included in the price of each product. And the actual tax payers are citizens, since they regularly buy goods or use services. Businessmen, in fact, only transfer the tax amount to government agencies.

The advantage of VAT as an indirect tax is that revenues from it to the budget do not dry out: even in a crisis situation, the population needs to make purchases, even the most minimal ones, only what is necessary for life.

According to Art. 143 of the Tax Code of the Russian Federation, organizations, entrepreneurs and persons moving goods across the borders of the Customs Union are required to pay VAT. Taxpayers in special regimes, as well as a number of companies organizing major sporting events in the Russian Federation, are exempt from VAT.

The Tax Code of the Russian Federation provides for tax exemption in several other cases. Read more in the material “How to properly exempt from VAT” .

The object of taxation is the sale of goods or the provision of services, the performance of construction and installation work on one’s own, the importation of goods into the Russian Federation, the transfer of goods or the provision of services for the company’s own needs (Article 146 of the Tax Code of the Russian Federation).

What business processes are not subject to tax, read the article “Transactions not subject to taxation: types and features” .

The taxpayer will calculate the amount of VAT payable to the budget as the difference between the “outgoing” tax (that is, the tax presented to buyers of his goods or (that is, the one allocated by his suppliers in invoices).

The basic VAT rate in 2019-2020 is 20%. For socially significant goods, reduced tax rates are provided: 10 and 0% (Article 164 of the Tax Code of the Russian Federation). In addition, a number of transactions are exempt from taxation: education, banking, ritual, religious services, transportation of passengers.

The tax period for VAT is quarterly. At the end of each quarter, the taxpayer submits a declaration and pays tax to the budget.

NOTE! The VAT return is submitted only electronically.

In 2020, the deadlines for submitting VAT reports (including transfers) are as follows:

- for the fourth quarter of 2020 - until January 27, 2020;

- for the first quarter of 2020 - until April 27, 2020;

- for the second quarter of 2020 - until July 27, 2020;

- for the third quarter of 2020 - until October 26, 2020;

- for the fourth quarter of 2020 - until January 25, 2021.

NOTE! Due to the coronavirus epidemic, deadlines for filing returns and paying taxes, including VAT, have been extended. See the table from the Federal Tax Service with the new deadlines.

In order for the declaration to pass control at the Federal Tax Service, and for the payment order to be correctly executed by the bank, the accountant must indicate the correct KBK VAT 2019-2020.

Who pays and when

According to Art. 143 of the Tax Code of the Russian Federation, taxpayers for this type of fee are legal entities and individual entrepreneurs, but it is believed that ultimately it is paid by the buyer. The fact is that value added tax is indirect. With its help, the state seeks to receive part of the premium that the manufacturer or seller sets on the price of the product at each stage of production or sales. The tax is calculated by the manufacturer and the seller, but it is included in the cost of the product; in addition, the entrepreneur deducts the input VAT already paid when purchasing goods for production. Thus, the buyer is the source of the collection, but in the legislative act - in the Tax Code - individuals are not mentioned as VAT payers; they do not calculate or transfer it.

This financial commitment is of great importance for the budget and not only in terms of revenue. The state, by introducing a value added tax, ensures the contribution of funds to the budget earlier than the final sale of products, which increases the efficiency of the obligation and its collection.

IMPORTANT!

From 01/01/2019, VAT has been increased from 18% to 20%.

KBK for VAT for 2019-2020

There is an excellent mechanism for interaction with the budget, reflected in the KBK - budget classification codes. In order not to describe in a payment order or declaration exactly under which tax it is submitted and to which specific budget, there are digital codes that are strictly regulated. Thanks to the KBK, each tax or report is processed by the relevant government agency. KBC for government agencies and taxpayers is like the address to which a tax or declaration should be received.

KBK consists of 20 digits. Each KBK has 4 groups of numbers - carriers of certain information.

The first 3 digits of the KBK (from left to right) contain information about the payment administrator, that is, who you are reporting to at the moment: for tax collections these are numbers 182.

The next KBK digit is the type of receipt: 1 - tax, 2 - gratuitous receipt and so on. Then there are 2 digits indicating what kind of income the taxpayer is reporting for: 01 - profit and income tax, 06 - property tax, 08 - duty, etc. Next come 5 digits of articles and sub-items of income to the budget.

Numbers 12 and 13 KBK characterize the budget level: 01 - federal budget, 02 - budget of a subject of the country, 03 - local budget, etc. The next 4 digits indicate the type of payment: for taxes and fees it is 1000, for penalties - 2100, for fines - 3000.

The last 3 digits of the BCC indicate economic activity in accordance with the Budget Code: 110 - tax income, 160 - deductions for social needs, etc.

The BCC for VAT in 2019-2020 is as follows:

| VAT | KBK | ||

| for tax | for penalties | for fines | |

| For goods, works or services sold on the territory of the Russian Federation | 182 1 0300 110 | 182 1 03 0100001 2100 110 | 182 1 03 0100001 3000 110 |

| For goods imported from Belarus and Kazakhstan | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| For goods imported into the Russian Federation from other countries (administrator - Federal Customs Service) | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

Example of decoding KBK for VAT

182 1 0300 110:

182 means that the payment administrator is the Federal Tax Service;

1 - tax payment;

03 - tax on products or services sold in the Russian Federation;

01000 - articles and sub-items of income according to the Budget Code;

01 - tax is paid to the federal budget;

1000 is a direct payment, not a penalty (2100) or a fine (3000);

110 - payment is state income.

https://youtu.be/TC8ISPsbPPg

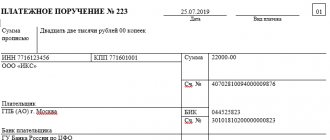

How to fill out a payment form

Budget classification codes are indicated in field 104; they are the same for the entire country. When filling out the payment form, it is necessary to take into account that the details are indicated by the tax office to which the payer is assigned in accordance with his location. The registration rules are specified in the Regulation of the Central Bank of the Russian Federation No. 383-P dated June 19, 2012 and Order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013, as amended.

When filling out, you must also correctly indicate:

- payer status (check in the article “What is the payer status in a payment order and how to fill it out”);

- payment amount (integer);

- quarter for which payment is made (in the form “KV.01.2019”).

How to fill out a payment order for VAT payment according to the new rules?

So that you can know for sure that you have fulfilled your obligation to calculate and pay VAT, we will tell you how to correctly fill out a payment order to transfer tax to the budget.

Let's start filling out the payment order from top to bottom. Some data, for example, the name of the taxpayer, his tax identification number, checkpoint, as well as bank details, the accounting program will insert into the document independently. We focus on those details that are specific to tax payments in general and specifically for VAT.

Field 101, which indicates the status of the payer, can take the value 01 - if the payer is a legal entity, 09 - if an individual entrepreneur pays (for individual entrepreneurs, the TIN is required).

NOTE! If you pay VAT when importing imported goods, then field 101 should contain the value 06. If you act as a tax agent for VAT, then code 02 should be entered.

The amount of tax payable is rounded to the nearest ruble (Clause 6, Article 52 of the Tax Code of the Russian Federation). The details of the payee, that is, the Federal Tax Service Inspectorate to which the company belongs, can be obtained on the inspection website or clarified by calling the Federal Tax Service Inspectorate hotline.

The type of transaction for any payment orders is 01. The order of payment for VAT is 5.

The UIN in field 22 is 0. From now on, the payment type (field 110) no longer needs to be filled in: banks will accept a payment slip with an empty field value, as required by the Federal Tax Service.

BCC for VAT for payment of the tax itself is 182 1 0300 110 (goods or services are sold in the Russian Federation), BCC for payment of VAT on imports depends on the importing country (182 1 0400 110 for goods from Belarus and Kazakhstan, for other countries - 153 1 04 0100001 1000 110).

Field "Base of payment" - TP, payment of the current period. Next, you need to indicate the tax period - the quarter for which the tax is transferred. In the “Document number” field you need to put 0, and in the “Document date” field - the date of signing the tax return.

OKTMO in a payment order consists of 8 or 11 characters; its meaning can be clarified in the Federal Tax Service or on the Internet. It is mandatory to indicate it.

We recommend indicating the purpose of the payment as follows: “1/3 of VAT for the _ quarter of 20__ by the payment deadline “___”________20___.”

Please note: the tax can be transferred in parts, or in one amount at once. On what this depends, read the article “In what cases is it possible to pay VAT in 1/3 (shares)?” .

ConsultantPlus experts have prepared a sample payment order for VAT transfer. Get trial access to the system for free and proceed to the sample and comments on filling it out.

When transferring VAT penalties, it matters whether the defaulter repays the debt on his own or at the request of the Federal Tax Service. In the first case, in the payment order in the “basis of payment” field, you need to put the PO, and in the purpose of the payment, the UIN must be set to 0.

If the tax authorities demanded that penalties be paid, then you need to enter the UIN number specified in the request in field 22 “Code”, and if it is not in the request, then 0.

See also: “Do I need a UIN on a fine payment?” .

The basis of payment in this case is TR. Payment deadline - the deadline for repaying the debt to the budget in accordance with the requirements of the inspectors. The “Document number” field is the request number, “Document date” is the request date.

See a sample payment slip for payment of VAT penalties in the ConsultantPlus system. Get access to K+ for free and download the sample along with comments on how to fill it out.

The payment order for the transfer of the VAT fine is filled out in the same way.

How to calculate VAT penalties?

Article 174 of the Tax Code of the Russian Federation states: VAT is paid before the 25th day of the month following the previous quarter. In case of delay, we pay a penalty.

Explanation of the formula:

- SRTsBRF – refinancing rate of the Central Bank of Russia.

- KDP – number of days of overdue payment.

- VAT is the amount of tax not paid on time.

The payer missed the deadline for mandatory payment of VAT and paid the tax only on 02/03/2017. Its amount was 18,000.00 rubles. The rate of the Central Bank of the Russian Federation is 8.25%. 1/300 x 8.25% x 9 days. x RUB 18,000.00 = 44 rubles 55 kopecks.

In paragraph 1 of Art. 75 of the Tax Code reflects that penalties are a liability expressed in money for missed deadlines for making mandatory payments. Penalties will be accrued for each missed day of payment, from the day following the day established for the payment deadlines for such payments.

What to do if there is an error in the VAT KBK?

The company may indicate an erroneous BCC in the declaration or payment order. In the first case, an error is unlikely, since most companies generate the declaration in a special accounting program, which itself enters the correct BCC. The main thing is to remind the programmer before each reporting period that the program needs to be updated. In addition, the company must submit a VAT return only according to the TKS - the report will not be sent to the tax office if the code data is incorrect.

But it is much easier to make a mistake in a payment order. If the BCC in the payment order is incorrect, the transferred funds may end up either in the budget of a different level or in unclear payments. This oversight can be corrected by writing a statement to the tax office to clarify the payment details. Based on this application, the tax office will accept the tax for crediting, and as of the day of payment. That is, penalties (if the inspectors managed to accrue them) will be canceled.

How to fill out a sample application for clarification of payment details, look in the article “Sample application for clarification of tax payment (error in KBK).”

What if you didn’t notice that the tax went to the wrong KBK and you didn’t submit an application to the inspectorate? Then, after the deadline for paying the tax, the inspectors will decide that you have not fulfilled your obligation to the budget. And they will impose fines and penalties. They can be challenged, guided by arbitration practice and clause 3 of Art. 45 of the Tax Code of the Russian Federation, since the company still transferred money to the budget, albeit to the wrong address.

Arbitration practice in this case is on the side of the taxpayer: regardless of whether the company correctly indicated the BCC in the payment order, the payment to the budget took place, which means that the company fulfilled its obligations to the budget. If you have a dispute with inspectors about this, rely, for example, on the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 23, 2013 No. 784/13, the determination of the Supreme Arbitration Court of the Russian Federation dated June 10, 2010 No. VAS-4111/10, etc.

The Ministry of Finance and the Federal Tax Service also recognize that errors in the BCC are not grounds for recognizing the obligation to pay tax as unfulfilled (see letters from the Ministry of Finance of Russia dated January 19, 2017 No. 03-02-07/1/2145, dated July 17, 2013 No. 03-02- 07/2/27977 and dated March 29, 2012 No. 03-02-08/31, Federal Tax Service of Russia dated October 10, 2016 No. SA-4-7/ [email protected] ).

About whether the error in the KBK is critical,

KBK: UTII 2020

There have been no innovations in terms of imputed tax codes. As before, the KBK UTII 2020 for individual entrepreneurs will be the same as for “imposed” legal entities:

| KBK | Decoding |

| 182 1 0500 110 | Single tax on imputed income for certain types of activities |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

Results

The BCC for VAT did not change in 2019-2020: the codes themselves depend on whether the goods were sold in the Russian Federation or imported from abroad, as well as on the type of payment: current payment, fine or penalty. An error in indicating the KBK is not critical for the company, but it is better to check our article when indicating the KBK, so as not to worry about whether the payment was received to the budget on time, and not to argue with the tax authorities.

You can read about the BCC for other taxes in our articles:

- “Deciphering the KBK in 2020 - 18210102010011000110, etc.”;

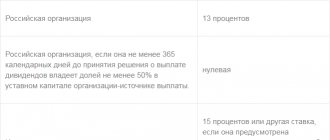

- “KBK for payment of personal income tax on dividends in 2019”;

- “KBC for land tax in 2020 for legal entities”;

- “KBK for insurance premiums for 2020 - 2020 - table”;

- "KBK for payment of UTII in 2020 - 2020 for individual entrepreneurs."

Sources:

- Tax Code of the Russian Federation

- Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 23, 2013 No. 784/13

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

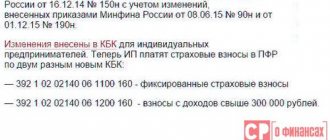

KBK 2020: insurance premiums

Codes for insurance premiums (PFR, FSS, MHIF) have undergone significant changes since 01/01/2017, when their administration was entrusted to tax authorities. They will remain so in 2020. Insurance premiums for “injuries” will continue to be paid directly to the Social Insurance Fund, and the BCC for it also remains unchanged.

BCCs for insurance premiums for 2020 do not differ based on the policyholder - when paying contributions for personnel, they are the same for both legal entities and individual entrepreneurs.

As for the fixed payments of individual entrepreneurs (PFR and MHIF), here it is necessary to apply separate KBK, provided specifically for the payment of contributions by entrepreneurs “for themselves”. Individual entrepreneurs fixed payment 2019 for “pension” contributions is paid to the previous code (182 1 0210 160), but in the new order No. 132n the Ministry of Finance erroneously changed the wording of this BCC: now it contains the phrase that the code is used for insurance contributions from income, not exceeding that specified in Art. 430 of the Tax Code of the Russian Federation (300 thousand rubles), with a separate code for contributions from income over 300 thousand rubles. not entered. This is an inaccuracy that the Ministry of Finance must correct by introducing appropriate changes to Order No. 132n.

| KBK | Decoding |

Pension Fund insurance premiums | |

| 182 1 0200 160 | Insurance contributions to the Pension Fund for the payment of insurance pensions for periods expired before January 1, 2020 |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance contributions to the Pension Fund for the payment of insurance pensions, for periods starting from January 1, 2020 |

| 182 1 0210 160 | penalties |

| 182 1 0210 160 | interest |

| 182 1 0210 160 | fines |

| 182 1 0200 160 | Insurance contributions to the Pension Fund for the payment of funded pensions |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | Insurance contributions paid by coal industry companies to the Pension Fund for pension supplements |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance premiums at an additional rate for persons employed in the work specified in clause 1, part 1, art. 30 of Law No. 400-FZ of December 28, 2013, for the payment of an insurance pension (regardless of the results of a special assessment of working conditions (List 1) |

| 182 1 0220 160 | Insurance premiums at an additional rate for persons employed in the work specified in clause 1, part 1, art. 30 of Law No. 400-FZ of December 28, 2013, for the payment of an insurance pension (depending on the results of a special assessment of working conditions (List 1) |

| 182 1 0200 160 | penalties (for periods expired before 01/01/2017) |

| 182 1 0210 160 | penalties (for periods starting from 01/01/2017) |

| 182 1 0200 160 | fines (for periods expired before 01/01/2017) |

| 182 1 0210 160 | fines (for periods starting from 01/01/2017) |

| 182 1 0210 160 | Insurance premiums at an additional rate for persons employed in the work specified in paragraphs. 2-18 hours 1 tbsp. 30 of Law No. 400-FZ of December 28, 2013, for the payment of an insurance pension (regardless of the results of a special assessment of working conditions (List 2) |

| 182 1 0220 160 | Insurance premiums at an additional rate for persons employed in the work specified in paragraphs. 2-18 hours 1 tbsp. 30 of Law No. 400-FZ of December 28, 2013, for the payment of an insurance pension (depending on the results of a special assessment of working conditions (List 2) |

| 182 1 0200 160 | penalties (for periods expired before 01/01/2017) |

| 182 1 0210 160 | penalties (for periods starting from 01/01/2017) |

| 182 1 0200 160 | fines (for periods expired before 01/01/2017) |

| 182 1 0210 160 | fines (for periods starting from 01/01/2017) |

Compulsory medical insurance premiums | |

| 182 1 0211 160 | Insurance premiums for compulsory medical insurance credited to the FFOMS budget for periods expired before January 1, 2020 |

| 182 1 0211 160 | penalties |

| 182 1 0211 160 | fines |

| 182 1 0213 160 | Insurance premiums for compulsory medical insurance, credited to the FFOMS budget for periods starting from January 1, 2020 |

| 182 1 0213 160 | penalties |

| 182 1 0213 160 | interest |

| 182 1 0213 160 | fines |

Social insurance contributions | |

| 182 1 0200 160 | Insurance contributions in case of temporary disability and in connection with maternity for periods expired before January 1, 2020 |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance premiums in case of temporary disability and in connection with maternity for periods starting from January 1, 2020 |

| 182 1 0210 160 | penalties |

| 182 1 0210 160 | interest |

| 182 1 0210 160 | fines |

| 393 1 0200 160 | Insurance contributions paid to the Social Insurance Fund for compulsory social insurance against accidents at work and occupational diseases (for “injuries”) |

| 393 1 0200 160 | penalties |

| 393 1 0200 160 | fines |

Fixed payments for individual entrepreneurs “for themselves” | |

| 182 1 0200 160 | Fixed contributions of individual entrepreneurs for the payment of an insurance pension (from income not exceeding 300 thousand rubles) for periods expired before January 1, 2017 |

| 182 1 0200 160 | Fixed contributions of individual entrepreneurs for the payment of an insurance pension (1% of income received in excess of 300 thousand rubles) for periods expired before January 1, 2020 |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Fixed contributions of individual entrepreneurs for the payment of an insurance pension, for periods starting from January 1, 2020 |

| 182 1 0210 160 | penalties |

| 182 1 0210 160 | interest |

| 182 1 0210 160 | fines |

| 182 1 0200 160 | Fixed contributions of individual entrepreneurs for the payment of funded pensions |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0211 160 | Fixed contributions to compulsory medical insurance for periods expired before January 1, 2017 |

| 182 1 0211 160 | penalties |

| 182 1 0211 160 | fines |

| 182 1 0213 160 | Fixed contributions to compulsory medical insurance for periods starting from January 1, 2017 |

| 182 1 0213 160 | penalties |

| 182 1 0213 160 | fines |

For penalties and fines

The KBK “VAT Penalties” in 2020 also operates similar to those used in 2020. The table shows the current indicators of BCC when paying VAT.

| Type of collection | KBK VAT, penalties | Fines |

| Value added tax on goods, as well as works and services sold on the territory of the Russian Federation | 182 1 0300 110 | 182 1 0300 110 |

| Value added tax on goods imported into the Russian Federation from Belarus and Kazakhstan | 182 1 0400 110 | 182 1 0400 110 |

| Value added tax on goods imported into the territory of the Russian Federation (the payment administrator in this case is the Federal Customs Service of Russia) | 153 1 0400 110 | 153 1 0400 110 |

If the payment deadline is missed, VAT penalties will apply; BCC 2020 will be required when filling out a payment order for the transfer of penalties on your own initiative or at the request of the tax authority.

KBK “VAT fine” 2020 for legal entities is required when drawing up a payment document for payment of a fine, which is imposed for untimely or improper fulfillment of a financial obligation (for example, in case of incomplete payment of the established fee).

According to the Tax Code of Russia, delay in payment of VAT leads to the accrual of penalties. If the tax was underpaid or not paid at all, and this fact is revealed as a result of the audit, then the legal entity will be held accountable and penalties will be imposed on it. Separate codes are used to pay penalties and fines; they cannot be paid together with the main payment.

For example, VAT for the 2nd quarter of 2020 must be transferred to the tax agent to the state treasury no later than July 25, August 27 (25-26 weekends, the deadline is transferred to the first next working day) and September 25, 2019. This payment schedule must be followed in the following quarters.

According to Art. 75 of the Tax Code of the Russian Federation, a penalty is accrued and paid by the taxpayer if he is late in paying the tax. In this case, the organization can either calculate the penalty on its own or receive a request from the tax authority.

A tax fine is a sanction for offenses (Article 114 of the Tax Code of the Russian Federation), one of which is non-payment or incomplete payment of tax (Article 122 of the Tax Code of the Russian Federation).

Below are the BCCs for paying penalties and VAT fines in 2020. They remained the same as the previous year.

| Type of tax | VAT penalties | VAT fines |

| Value added tax on goods (work, services) sold in Russia | 182 1 0300 110 | 182 1 0300 110 |

| Value added tax on goods imported into Russia (from Belarus and Kazakhstan) | 182 1 0400 110 | 182 1 0400 110 |

| Value added tax on goods imported into Russia (payment administrator - Federal Customs Service of Russia) | 153 1 0400 110 | 153 1 0400 110 |

If the taxpayer made a mistake in indicating the KBK, Art. 78 and 79 of the Tax Code of the Russian Federation give the right either to return the amounts paid, or to offset them with other taxes if there is arrears on them. Also in paragraph 7 of Art. 45 of the Tax Code of the Russian Federation gives the opportunity to clarify the payment if an error was made in the BCC, but the money was received into the account of the Federal Treasury.

In 2020, the amount of penalties must be calculated according to new rules (they are in effect from 10/01/2017).

Find out more from the material “How to correctly calculate VAT penalties?”.

Are you having difficulty calculating penalties? Use our auxiliary service “Fine Calculator”.

KBK: trading fee 2020

The fee was introduced in the capital by Moscow Law No. 62 dated December 17, 2014; it is not collected in other regions.

| KBK | Decoding |

| 182 1 0500 110 | Trade tax paid in the territories of federal cities |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

Kbk VAT 2019 for legal entities table of budget classification codes with changes

The article contains the KBK table for VAT for legal entities, taking into account changes in 2020, including penalties and fines, as well as free samples of payment documents, reference books, and useful links.

Our reference books and sample documents will help you calculate VAT correctly and pay it to the budget on time. Download for free:

KBK is a 20-digit digital budget encoding that contains data on non-cash transfers. The KBK code encrypts information about the type of payment, its administrator and final recipient, the budget where the payment should go, etc. Therefore, for any non-cash transfer, the payment document must indicate the KBK.

Legal entities and entrepreneurs are faced with budget coding, for example, when making tax or non-tax mandatory payments. In this case, a payment order is issued, in field 104 of which the BCC must be indicated. Using the code, the bank determines exactly where to send the non-cash payment.

Useful documents

After reviewing the current CBC for VAT in 2020 for legal entities, do not forget to look at the following documents, they will help in your work:

Kbk vat 2020: what is important to know

The principles for encoding information about non-cash transfers in KBK are the same for all transactions. From 2020 These rules, including the KBK VAT 2020, are determined by the document from the order dated 06/08/18 No. 132n.

The structure of any budget code is typical, it is shown in the diagram below:

Groups of code bits have different purposes, namely:

- categories 1 to 3 determine the administrator of the non-cash transfer;

- categories 4 to 6 – budget income group and subgroup;

- categories from 7 to 11 – type of budget income;

- categories from 12 to 13 – which budget to send the payment to;

- categories from 14 to 17 – type of transfer;

- categories from 18 to 20 - an indication of budget revenues or withdrawals from the budget.

The main disadvantage of the KBK digital encoding of 20 characters is that with the slightest inattention on the part of the accountant filling out the payment slip, a typo or error can easily creep into the code.

This also applies to the CBC for VAT in 2020 for legal entities. As a result, the transfer will not be received as intended, which may result in financial losses for the company or entrepreneur due to tax sanctions.

Therefore, we recommend that you always check the KBK in your payments.

Finding or checking any KBK is not a problem - just click on the button below and find the required code:

Check KBK

Kbk VAT 2020 in the payment document

In addition to the budget code in field 104, the payment order contains dozens of mandatory details, including:

- names and BIC of the banks of the payer and its administrator;

- TIN and KPP of the depositor and administrator;

- contributor status;

- basis for transfer, etc.

All this information is prepared strictly according to the rules established by the Bank of Russia. For instructions on filling out the payment fields, see the window below, you can download it:

Kbk for VAT in 2020 for legal entities

VAT administration in 2020 entrusted to two federal services - tax and customs.

https://youtu.be/X0xdZlHY978

VAT is transferred to the Federal Tax Service on domestic Russian shipments and on import transactions when importing property from EAEU member countries.

VAT on import transactions when importing property from outside the EAEU is transferred to the Federal Customs Service.

Accordingly, in the first three categories of the Code for VAT in 2020, different figures are indicated for legal entities:

- If the payment administrator is the Federal Tax Service, then the BCC begins with the numbers “182”.

- If the payment administrator is the Federal Customs Service, then the BCC begins with the numbers “153”.

The current tax codes are shown in Table 1.

Table 1.

Kbk for VAT in 2020 for legal entities

| VAT payment | Codes for payment to the budget | ||

| For tax | For stumps | For fines | |

| Domestic sales – shipment of property, performance of work, services | 18210301000011000110 | 18210301000012100110 | 18210301000013000110 |

| Import (import) of property from a member country of the EAEU | 18210401000011000110 | 18210401000012100110 | 18210401000013000110 |

| Import (import) of property from a country outside the EAEU | 15310401000011000110 | 15310401000012100110 | 15310401000013000110 |

Kbk for VAT in 2020 for legal entities in payment

The current sample payment form containing the KBK VAT 2020 is shown in the window below, this document can be downloaded:

General concept of BCC

KBK is a budget classification code that must be indicated in payments to ensure that the payment was sent exactly to the department where the taxpayer pays the tax. The payer must indicate this code when filling out a receipt for the transfer of: insurance premiums, tax transfers, payment of fines, tuition fees and other payments that are transferred to the state budget system.

Budget classification codes are approved by the Russian Ministry of Finance; if any changes are made, they are necessarily posted on the official website of the ministry, including the publication of the order itself, on the basis of which the changes took place. All current KBK are presented in the “Special KBK Directory”

Main directions of KBK:

- When paying taxes, namely: transport, property, land, VAT, personal income tax, income tax, as well as other payments to the Federal Tax Service from legal entities;

- Paying tax when using a simplified taxation system for individual entrepreneurs and other organizations;

- Payment of a single tax on temporary income;

- Payment of state fees, this may include payments for replacing a passport, a copy of the charter, a fee by decision of an arbitration court, as well as other fees;

- Insurance contributions, in this section, insurance contributions are transferred for any employee, as well as payments to the Pension Fund, to the Compulsory Medical Insurance Fund, to the Social Insurance Fund;

- Fines for compensation of damage, namely fines in the traffic police, fines in the Ministry of Internal Affairs and other departments, including those sanctions imposed by bailiffs;

- Payments sent for mineral resources, payments in this direction are made from legal entities that produce gas, oil, water, including Gazprom;

- Transgaz;

- Use of subsoil resources, in this area, funds are paid for the lease of subsoil resources located on the territory of Russia.

This list can be continued for a long time, we have presented the main directions.