The service allows you to:

- Prepare a report

- Generate file

- Test for errors

- Print report

- Send via Internet!

report on the targeted use of funds (Form F-6)

The form of the report on the targeted use of funds was approved by Order of the Ministry of Finance of Russia dated 07/02/2010 No. 66n (as amended by Order of the Ministry of Finance of Russia dated 03/06/2018 No. 41n).

What’s new in this form as of May 27, 2020: the “Note” column has been added to the table of the F-6 accounting form, in which it is necessary to enter the Note number for a separate line of the report.

We report on the correct use of funds

At the end of the year, any organization that during this time received funds in the form of additional payments, be it membership fees or voluntary donations, as well as other sources of material income, is required to report on their use. The report itself has a clearly regulated and legally approved form No. 6 (OKUD 0710006). The document also reflects those funds that the company did not use during the reporting period. It is worth taking a closer look at how exactly all sections of this document are filled out.

"Opening balance"

This section contains data on the amounts of target cash receipts and funds received by the company from its core activities at the beginning of the period under review or at the end of the previous one.

“Funds have arrived”

This section is filled in with data on all membership, voluntary or entrance fees received by the organization. In addition, this is where you should record the amount that was received as a result of your main business activity, as well as money received from the sale of the company’s fixed assets and as government support.

"Funds Used"

This section contains justification for all company costs. In particular: Expenses for targeted activities, Expenses for the maintenance of the management apparatus, Acquisition of fixed assets, inventory and other, Other expenses.

"Balance at the end of the year"

This displays the amount remaining from previously received funds at the beginning of the reporting period. At the same time, it is worth knowing that if expenses exceed the funds available to the enterprise, the “remaining” indicator is indicated in parentheses, and an explanatory note is attached to the document.

How to fill out form No. 6 report on the intended use of funds - brief instructions

To better understand the principle of working with a document, you should consider in detail the principle of filling it out line by line.

Section 1

Line 6100 (“Fund balance at the beginning of the reporting year” reflects the amount of the credit balance in account 86 “Targeted financing” at the beginning of the year). If a credit balance appears in this line, it means the company did not manage to use all the funds received before the end of the reporting period. Here it is proposed to indicate the total commercial profit of the organization minus mandatory tax deductions.

For non-profit organizations, reporting is submitted in a simplified version with a mandatory reflection of the balance sheet, as well as reports on profits, expenses and the intended use of funds received.

Section 2

Line 6200 (“Total Funds Received”, consisting of the total amount of values in lines 6210-6250, except for the information entered in line 6100):

Lines 6210 (“Entry fees”) and 6215 (“Membership fees”) contain data on contributions received and to be received.

Line 6220 (“Targeted Contributions”) includes information about:

- charitable amounts;

- grants;

- shared financing of major repairs of apartment buildings;

- budget funds allocated for the implementation of the statutory activities of non-profit organizations;

- material income from the founders;

- property transferred to religious organizations for the implementation of their statutory activities;

- cash contributions from gardeners and summer residents for the purchase of public facilities;

- money for the formation of target capital.

Line 6230 (“Voluntary property contributions and donations”) is relevant if funds were allocated for the company’s statutory activities by other legal entities and individuals. The same line records the debt of organizations and individuals for contributions and donations.

Line 6240, dedicated to the company's business profits, is filled in with data from the income statement. It states the net profit received in the reporting year.

Line 6250 reflects all cash receipts related to the statutory activities of the organization of a non-profit plan that are not included in other sections.

Section 3

Line 6300 (“Total funds used”) The sum of these lines 6310-6330, 6350 is entered here. The data in lines 6311-6313 and 6321-6326 are excluded from the calculation. Line 6310, displaying expenses for targeted activities, is the sum of indicators in lines 6311-6313.

Line 6311 indicates data on social and charitable assistance. Moreover, this charitable support can be either in cash or in the form of certain works or services.

Line 6312, which is called “Conferences, meetings, seminars” contains data on expenses for all listed events. Costs for events that do not have charitable purposes are displayed in Line 6313 (“Other events”).

The amount of data specified in Lines 6321-6326 fits into Line 6320, dedicated to the costs of maintaining the management apparatus.

Payroll costs are recorded in line 6321. They include payments of salaries, bonuses, incentives and vacation pay. All other benefits and additional payments are reflected in Line 6322.

Line 6323 (“Expenses for official travel and business trips”) usually does not cause any difficulties for those filling out. It includes the costs of travel, accommodation, as well as obtaining a visa and passport.

The costs of maintaining movable and immovable property (except for repairs) are recorded in line 6324. This may include rent, utility bills, fuel costs, and so on.

Well, the repair itself, that is, the costs associated with it, are entered in line 6325. Everything that is not included in the full list of lines of this document, in particular: payment of telephone communications, Internet and other expenses is indicated in line 6326.

As for the amount of actual expenses for the purchase of fixed assets and inventories, it is recorded in line 6330.

Payments related to property and land taxes, as well as payments for various types of services of banks, audit firms and similar organizations are entered in Line 6350.

Section 4

The final touch of the voluminous report is line 6400 entitled “Fund balance at the end of the reporting year.” The credit balance for account 86 current at the end of the reporting period is recorded here. It is the sum of the indicators in lines 6100 and 6200 with the exception of line 6300.

The formula looks like this: Page. 6400 = page 6100 + page 6200 - page 6300.

If all receipts are used for their intended purpose, then there will be a dash in line 6400, since this is how the document reflects the complete absence of a difference between receipts and expenses.

New form “Report on the intended use of funds received”

officially approved by the document Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n (as amended by Orders of the Ministry of Finance of the Russian Federation dated October 5, 2011 No. 124n, dated April 6, 2015 No. 57n).

More information about using the “Report on the intended use of funds received” form:

- Reports of joint stock companies

Balance sheet; -income statement; -report on changes in capital; -cash flow report; -a report on the intended use of the funds received (in case...) to the financial statements. -balance sheet; -income statement. In that case… ; priority areas of activity; report of the board of directors (supervisory board) on the results of development in... in monetary terms; development prospects; report on the payment of declared (accrued) dividends for... - Donations to a sports institution

Income of the current period based on a report on the intended use of donation funds provided to the donor 2,401 ... authorities at the place of their registration a report on the intended use of funds received as part of the tax return (in ... 07 “Report on the intended use of property (including monetary funds), works, services received within the framework of... charitable activities, targeted income, targeted financing" (hereinafter referred to as the report... - Gifts, donations, sponsorship: how to take them into account for income tax purposes?

Non-cash funds or use of property provided by the benefactor to the institution; obtain information about the intended use... accounting report on the intended use of the funds received as part of the tax return. Such a report is sheet 07 “Report on the intended use of property... (including funds), work, services received... - We submit financial statements for 2020.

The results and cash flows for the reporting period, which... @. Statement of financial results Statement of changes in capital Statement of cash flows Statement of the intended use of funds received Subjects... PA-4-6/ Statement of financial results Non-profit organizations Accounting... -01-10/46137. Report on financial results Report on the intended use of funds Accounting statements can be... completed balance sheet and income statement. Important! ... - Features of accounting and reporting of a private institution

Consists of a balance sheet, a report on the intended use of funds and a report on financial results (clause 2 ... for profit. At the same time, funds received by institutions for the maintenance and management ... accounting of such funds and their use in accordance with conditions of receipt. Upon completion... is obliged to submit to the tax authority a report on the intended use of the funds received (sheet 07 of the tax return... 2, Article 149 of the Tax Code of the Russian Federation). Targeted funds received by associations (entrance and membership fees... - Features of accounting and reporting of a public association

From the balance sheet, a report on the intended use of funds and a report on financial results (item ... income tax. Important! Funds received by associations for the maintenance and management ... targeted receipts not subject to taxation, only in that in the event that the funds received... are required to submit to the tax authority a report on the intended use of the funds received (sheet 07 of the declaration under... Article 149 of the Tax Code of the Russian Federation).Earmarked funds received by associations (entrance and membership fees... - Features of accounting and reporting of non-state educational institutions

Consists of a balance sheet, a report on the intended use of funds and a report on financial results (clause 2 ... income tax. At the same time, funds received by institutions for the maintenance and management ... accounting of such funds and their use in accordance with conditions of receipt. Upon completion... is obliged to submit to the tax authority a report on the intended use of the funds received (sheet 07 of the tax return... .146 of the Tax Code of the Russian Federation). At the same time, the target funds received by the non-state educational institution (entrance and membership fees... - Types of “zero” reporting

... "Statement of financial results Statement of changes in capital Statement of cash flows Report of the intended use of funds received For ... entrepreneurship in electronic form" Statement of financial results For non-profit ... PZ-1/20015. Report on financial results Report on the intended use of funds Important! An individual entrepreneur is allowed... does not have registered vehicles, then submit reports not... during the reporting period of cash flows; lack of taxable items for... - Tax benefits for NPOs, confirmation procedure (Part 2)

The list is exhaustive. At the same time, funds received by NPOs for their maintenance and... accounting for such funds and their use in accordance with the conditions of receipt. Upon completion... is obliged to submit to the tax authority a report on the intended use of the funds received (sheet 07 of the tax return... profit). Property received within the framework of targeted revenues and used for other purposes is taken into account... benefits and reasons for their use by taxpayers. For example, they are exempt from... - Reorganization of the company: we draw up a transfer act and balance sheet (Part 2)

Making a corresponding entry in the Register (about emerging organizations - during reorganization... forms of merger, division and transformation, on the termination of the activities of the last of the affiliated... dates of entry in the Unified State Register of Legal Entities on the termination of the activities of the affiliated legal entity person... balance sheet; statement of financial results; statement of changes in capital; statement of cash flows; report on the intended use of funds received. How... the date of making an entry in the Unified State Register of Legal Entities on the creation of a new company. If... - Arbitration practice: misuse of budget funds and compulsory medical insurance funds

Receipts. The main documents in accordance with which these funds are spent are the law on... state (municipal) financial control on compensation for damage to the Russian Federation, a subject of the Russian Federation... with income. When heat supply organizations provided reports on the actual volumes of thermal energy, ... the court came to the conclusion about the misuse of funds from the regional budget in the amount of ... 25% of the amount of funds received from the budget of the budget system of the Russian Federation, used for other purposes. - Funds from owners of premises in apartment buildings for repairs: accounting by the management company of

what the taxpayer received as part of targeted financing. Funds of targeted financing include property received by the taxpayer and used... by him for the purpose determined by the organization (individual) - the source of the targeted... 07 “Report on the targeted use of property (including funds), work, services received within the framework of... - Analysis of judicial practice: inappropriate use of budget funds

How inappropriate use of budget funds. Arguments of the FSIN Department about the subsequent restoration of funds used for other... issued funds from the organization's cash desk against the report for travel expenses, which... according to the estimate, these actions indicate misuse of budget funds (see Resolution of the AS VSO... % of the amount of funds received from the budget budget system of the Russian Federation, used for purposes other than their intended purpose. Let us remind you... - Features of accounting and reporting of HOAs

Consists of a balance sheet, a report on the intended use of funds and a report on financial results (clause 2... funds received as targeted financing are exempt from taxation. Funds of targeted financing include property... that received targeted financing, these funds are considered as subject to taxation from the date of their receipt....146 Tax Code of the Russian Federation). At the same time, the targeted funds received by the HOA (entrance and membership fees... - Features of accounting and reporting of funds

Fund accounting is the organization of accounting for targeted financing. In the standard program “1C... 1 “Assignment of target funds”, subconto 2 “Agreements”, subconto 3 “Movement of target funds”). However, this... No. 7-FZ). That is, income received from such activities is accounted for... funds in the bank). The net profit received from commercial activities is included in the target... consists of a balance sheet, a report on the intended use of funds and appendices thereto (p...

A report on the intended use of funds received is prepared by non-profit organizations, including public organizations and associations and their structural divisions. It reflects the amounts received in the reporting and previous year as entrance, membership, voluntary contributions, and amounts of other income. In addition, the amount of money spent in the reporting year and in the previous year is deciphered. Non-profit is recognized

an organization that does not have profit making as the main goal of its activities and does not distribute the profits received among participants.

Non-profit organizations that are engaged in entrepreneurial activities are required

to prepare reports in full.

The Report form is given in Order No. 66n and is of a recommendatory nature; the report reflects data both for the reporting period and for the previous one. Initially, the balance of funds at the beginning of the reporting period is reflected.

This line reflects the amount of targeted financing (incoming credit balance on account 86 “Targeted financing”).

Section “Received funds”

1. This section reflects receipts in the form of various

contributions

in the reporting and previous year:

a) line “Entry fees”, “Membership fees”, “Target contributions”.

These lines reflect the amounts of contributions received in the reporting year and in the previous period from the budget, from participants and founders of the organization, sponsors, etc. according to analytical accounting data for account 86 “Targeted financing”.

b) Voluntary property contributions and donations

: Contributions can be transferred to a non-profit organization not in cash, but in the form of property.

Such receipts are reflected in the debit of the accounts of material assets (08 “Investments in non-current assets”, 10 “Materials”, etc.) in correspondence with the credit of account 86 “Targeted financing”. c) Profit from business activities

.

The profit received by a non-profit organization after the accrual of income tax is added to the funds for targeted financing. This operation is reflected by the posting: Debit 99 Credit 86 - reflects the amount of profit received from business activities, which is added to the funds for targeted financing. d) Other.

This line reflects other income not reflected in other lines (amounts of state assistance, amounts received for the implementation of any specific purposes, amounts received as a result of the sale of fixed assets and other property, etc.).

Page Total funds received

is the total line of this section.

If the organization did not carry out entrepreneurial activities (except for the sale of property), the line indicators must coincide with the credit turnover in account 86 “Targeted financing” of the reporting and previous periods. Section “Funds Used”

The section reflects the total amount spent in the following breakdown: 1.

Targeted activities

.

These lines reflect the amounts of expenses incurred by a non-profit organization in connection with the activities provided for by its charter: social and charitable assistance; holding conferences, meetings, seminars, etc.; other activities (Debit 86 Credit 20). 2 .

Expenses for maintaining the management staff (Debit 86 Credit 26): expenses related to wages (including accruals);

payments not related to wages; expenses for business trips and business trips; maintenance of premises, buildings, vehicles and other property (except for repairs); repair of fixed assets and other property; others.3. Expenses associated with the acquisition of fixed assets, inventory and other property are reflected separately. 4. Other. This line reflects the amounts of targeted financing used that are not included in other lines of the section. The line “Total funds used”

is the final line for the section.

It reflects the entire amount of targeted financing used by the organization in the reporting and previous years. The line “Fund balance at the end of the reporting year” is

the final line of the Report form. It reflects the amount of unused funds of targeted financing received by the non-profit organization in the reporting and previous periods, as well as the amount of profit received as a result of business activities. The line value should be equal to the account balance 86 at the end of the period. If the account balance is 86 in debit, then the indicator is negative and should be enclosed in parentheses. The explanatory note should explain the reasons for the formation of such a result.

A report on the intended use of funds received demonstrates the receipt of money and the structure of their expenditure in non-profit organizations, drawn up in Form No. 6, OKUD code 0710006, in accordance with strictly regulated norms and rules. Also in this accounting register the money unused during the reporting period is indicated. This document is one of the annexes to the final annual balance sheet of the institution and is submitted to the following authorized authorities:

- territorial tax inspectorates;

- statistical authorities.

The report may also be requested by interested third parties to disclose information about the movement of contributions made and money allocated.

Form No. 6 is provided annually by absolutely all non-profit organizations (clause 2 of Article 14 of Federal Law No. 402 of December 6, 2011) regardless of the accounting system or taxation regime (general or special). Those institutions that are noted in Part 4 of Art. 6 402-FZ, has the right to use the simplified form No. 6 of the report on the intended use of funds; we will analyze how to fill it out using a specific example for an NPO.

Reports are submitted within a three-month period after the end of the reporting year.

Tell the tax authorities where the targeted funds went

Leading expert of EZH Gennady KUZMIN talks about all the nuances and subtleties of drawing up a Report on the intended use of funds received.

Based on synthetic and analytical accounting data, all Russian organizations are required to prepare financial statements (Clause 1, Article 13 of the Law of November 21, 1996 No. 129-FZ “On Accounting”).

The reporting year for all organizations is the calendar year: from January 1 to December 31 inclusive. The first reporting year for newly created organizations is considered to be the period from the date of their state registration to December 31 of the current year. For organizations created after October 1, the first reporting year is considered to be the period from the date of their state registration to December 31 of the following year (Article 14 of the Accounting Law).

Data on business transactions carried out before the state registration of organizations is included in their financial statements for the first reporting year.

Accounting statements are submitted to the tax authority (subclause 4, clause 1, article 23 of the Tax Code of the Russian Federation), to the territorial statistics body, as well as to other interested users (for example, donors and grantors).

According to paragraph 2 of Art. 13 of the Law on Accounting and clause 5 of PBU 4/99 “Accounting statements of an organization”,

approved by Order of the Ministry of Finance of Russia dated July 6, 1999 No. 43n, the annual financial statements consist of:

• balance sheet (Form No. 1);

• Profit and loss statement (Form No. 2);

• Capital flow statement (Form No. 3);

• Cash flow statement (Form No. 4);

• Appendixes to the balance sheet (Form No. 5);

• Report on the intended use of funds received (Form No. 6);

• explanatory note;

• an auditor's report confirming the reliability of the organization's financial statements, if they are subject to mandatory audit in accordance with federal laws.

Non-profit organizations, in the absence of relevant data, have the right not to include in their financial statements the Statement of Changes in Capital (Form No. 3), the Statement of Cash Flows (Form No. 4) and the Appendix to the Balance Sheet (Form No. 5). This right is established in clause 4 of the Instructions on the scope of financial reporting forms,

approved by Order of the Ministry of Finance of Russia dated July 22, 2003 No. 67n.

For your information!

- However, it is recommended that all non-profit organizations include in their financial statements a Report on the intended use of funds received (Form No. 6).

Public organizations (associations) that do not carry out entrepreneurial activities and do not have, except for disposed property, turnover in the sale of goods (works, services), do not present in their financial statements:

• Statement of changes in capital (Form No. 3);

• Cash flow statement (Form No. 4);

• Appendix to the balance sheet (Form No. 5);

• Explanatory note.

In addition, public organizations (associations) are required to submit only annual financial statements to the tax authorities (within 90 days after the end of the reporting year), while other non-profit organizations also submit quarterly ones (within 30 days after the end of the quarter) (clause 4 of Art. 15 of the Accounting Law).

As financial reporting forms, an organization has the right to use both sample forms approved by Order of the Ministry of Finance of Russia dated July 22, 2003 No. 67n, and independently developed forms, subject to compliance with the general requirements for financial reporting and the reporting forms themselves, defined in PBU 4/99.

Since filling out other forms when preparing annual financial statements was described in detail in previous issues of the “Accounting Supplement” of the weekly “Economy and Life”, today we will pay attention to Form No. 6.

Form No. 6

The report on the intended use of funds received (Form No. 6) characterizes the movement of funds at the disposal of non-profit organizations. This form must be submitted only by public organizations (associations) that do not carry out entrepreneurial activities and do not have, except for disposed property, turnover in the sale of goods (work, services). All other non-profit organizations are only recommended to include it in their annual financial statements. However, in practice, all non-profit organizations, as a rule, submit to the tax authorities a Report on the intended use of the funds received.

If separate articles are not provided for any significant data in the sample Form No. 6, organizations independently determine the necessary transcripts and include additional articles in the report form, since the specified sample report is only recommended.

By Order of the Ministry of Finance of the Russian Federation dated July 22, 2003 No. 67n, the coding of the lines of Form No. 6 was excluded, therefore, for the convenience of filling it out, organizations can independently assign each line their own code.

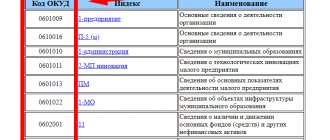

A report on the intended use of funds received as part of the annual financial statements is sent not only to the tax authorities, but also to the territorial statistical authorities. Therefore, the joint Order of the State Statistics Committee of Russia No. 475 and the Ministry of Finance of Russia No. 102n dated November 14, 2003 approved special codes for indicators of annual financial statements of organizations, the data for which are subject to processing by state statistics bodies.

It should be borne in mind that Order No. 475/102n applies only to financial reporting forms submitted to territorial statistical bodies. The coding of reporting indicators for other users, including tax authorities, is not regulated.

Nevertheless, for uniformity, as well as saving accountants’ time and effort, we can recommend the use of mandatory coding of annual financial statements indicators for all its users.

So, let’s, for convenience, assign each line of Form No. b a code from Order No. 475/102n, let’s figure out how to fill it out correctly.

On line 100 “Balance of funds at the beginning of the reporting year”

the organization shows an amount equal to the credit balance of the account.

86 “Targeted financing”

at the beginning of the year.

As a rule, a credit balance on the specified account arises when target programs are designed for several years. After all, it is not necessary that the target funds be fully used at the end of the year - they are spent throughout the entire duration of the program.

In addition, it may be the amount of business profits and other income remaining at the disposal of the non-profit organization after taxation and not used in the previous year.

According to lines 210 “Entry fees”

and 220

“Membership

fees” reflect received (subject to receipt) contributions, which are formed mainly in public associations, unions and associations, as well as consumer cooperatives. That is, in member organizations.

Entry and membership fees usually refer to both one-time and regular contributions to cover administrative and business expenses. Moreover, the procedure and possibility of collecting them must be provided for by the charter of the non-profit organization.

On line 230 “Voluntary contributions”

contributions received (to be received) from other legal entities and individuals for the statutory activities of the non-profit organization should be indicated.

Receivable (accrued) target contributions mean the debt of legal entities and/or individuals to pay contributions or funds to an NPO. For example, according to Chapter 32 of the Civil Code of the Russian Federation “Donation”,

If a gift agreement is concluded in writing and contains a clearly expressed intention to make a gratuitous transfer of a thing or right to a specific person in the future, and not at the time of signing the agreement, then the donor is obliged to transfer his gift after the expiration of the stipulated period and does not have the right to refuse his promise, for except for the cases specified in Art. 577 Civil Code of the Russian Federation.

As a rule, such contributions are formed by autonomous non-profit organizations and foundations, since these are the organizational and legal forms of non-profit organizations that are established by citizens and legal entities on the basis of voluntary property contributions (Articles 7 and 10 of the Law on Non-Profit Organizations).

According to line 240 “Income from business activities of the organization”

shows the amount of revenue from business activities according to accounting data.

The amount of revenue is determined taking into account all discounts (mark-ups) provided and the negative (positive) amount difference that arises when the counterparty makes payment in rubles in an amount equivalent to the amount in foreign currency (conventional monetary units).

Despite the fact that in accounting, revenue is reflected together with indirect taxes (VAT, excise taxes), this line indicates revenue without them, since they are not recognized as income of the organization (clause 3 of PBU 9/99).

Thus, according to the line 240

show credit turnover by account.

90 “Sales”,

reduced by debit turnover on the same account in correspondence with the account.

68 “Calculations for taxes and fees”

or the difference between the credit turnover in subaccount 90-1

“Revenue”

and the debit turnover in the subaccounts

“Value Added Tax”

and

“Excise Taxes”

account. 90 (if the NPO keeps records in account 90 for the specified sub-accounts).

It should be borne in mind that entrepreneurial activity is recognized as the profit-generating production of goods and services that meet the goals of creating a non-profit organization, as well as the acquisition and sale of securities, property and non-property rights, participation in business companies and participation in limited partnerships as an investor (p 2 Article 24 of the Law on Non-Profit Organizations).

Therefore, in our opinion, other non-operating and operating income that cannot be qualified as income from business activities is shown as part of other income on line

250.

Keep in mind!

- The legislation of the Russian Federation may establish restrictions on the types of activities that individual non-profit organizations have the right to engage in. If a non-profit organization has entered into a transaction that conflicts

with

the goals of activity defined in its constituent documents, then such a transaction may be declared invalid by the court (Article 173 of the Civil Code of the Russian Federation).

On line 250 “Other”,

usually indicate:

• amounts of grants actually received from individuals and non-profit organizations, including foreign and international ones;

• funds and other property received for charitable activities;

• allocations from budgets of all levels for the implementation of individual projects, programs, and activities;

• donations recognized as such according to the State Property Fund;

• funds and other property received by religious organizations to carry out their statutory activities;

• the value of property transferred to non-profit organizations by will in the order of inheritance, and the like.

In addition, non-operating and operating income should be taken into account as part of other funds received (subaccount 91-1 “Other income”).

In particular:

• the amount of positive exchange rate differences resulting from the revaluation in accordance with the established procedure of assets and liabilities, the value of which is expressed in foreign currency;

• income from the sale of foreign currency at a rate higher than the rate of the Central Bank of the Russian Federation;

• interest accrued by the bank on cash balances in the accounts of a non-profit organization;

• surplus material assets identified during inventory;

• proceeds to compensate for losses caused to the organization;

• profit of previous years identified in the reporting year;

• interest on securities, deposits, etc.;

• the amount of unclaimed accounts payable for which the statute of limitations has expired;

• the amount of insurance compensation;

• income from the sale of unnecessary property;

• the cost of material assets received in connection with the write-off of fixed assets;

• amounts of penalties for non-fulfillment (improper execution) of contracts and the like.

By

line

260

“Total funds received” reflects the sum of lines

210

-

250.

Data from line

100

are not taken into account.

By

line

310

“Expenditures on targeted activities” shows

the total amount of funds spent on targeted activities.

Targeted activities refer to projects and programs that are carried out by a non-profit organization for the purposes for which it was created.

Data displayed by line 310,

are the sum of the indicators in lines

311, 312

and

313,

which characterize in more detail the essence of the funds spent on targeted activities.

By

line

311

“Social and charitable assistance” shows the amounts actually spent on providing social and charitable assistance to citizens and/or legal entities.

These types of assistance, as a rule, include gratuitous (or on preferential terms) transfer of property, including funds, gratuitous work, provision of services, etc. Moreover, in relation to citizens, this can be both “non-addressed” (impersonal) and “targeted” (to a specific person) assistance.

Note!

- Directing money and other material resources, providing assistance in other forms to commercial organizations, as well as supporting political parties, movements, groups and campaigns are not charitable activities (Clause 2 of Article 2 of the Law of August 11, 1995 No. 135-FZ “On Charitable Activities” and charitable organizations").

According to line 312 “Conducting conferences, meetings, seminars, etc.”

expenses are usually reflected for:

• production and distribution of invitations to event participants;

• rent of a conference room;

• fees for invited lecturers, including contributions to extra-budgetary funds;

• transport services for event participants;

• food and accommodation in a hotel room for event participants, etc.

According to line 313 “Other events”

expenses are reflected for targeted events that are not expenses for holding conferences, meetings, seminars, round tables, and do not relate to social or charitable assistance, but are targeted events carried out for the purpose of creating a non-profit organization.

Such events may be programs and projects pursuing cultural, educational, scientific and managerial goals, as well as those carried out to protect the health of citizens, develop physical culture and sports, satisfy the spiritual and other non-material needs of citizens, protect the rights and legitimate interests of citizens and organizations, resolving disputes and conflicts, providing legal assistance, and more.

By

line

320

“Expenses for the maintenance of the management apparatus” shows the total amount of funds used for the maintenance of the management apparatus of the non-profit organization, as well as its other expenses related to the implementation of management and coordinating functions, the performance of other statutory tasks (including the organization of work to obtain financial resources for achieving the goals provided for by the charter).

In line 320

there should be the sum of lines

321

-

326,

revealing the structure of expenses for maintaining the management apparatus.

By

line

321

“Expenses related to remuneration (including accruals)” reflects the expenses of a non-profit organization for remuneration of management staff (accruals in favor of employees in accordance with employment contracts concluded in accordance with the Labor Code of the Russian Federation, as well as copyright agreements) taking into account accruals to extra-budgetary funds .

Labor costs include, in particular:

• amounts accrued at tariff rates, official salaries, piece rates or as a percentage of revenue in accordance with the forms and systems of remuneration accepted in the organization;

• accruals of an incentive nature, including bonuses for production results, bonuses to tariff rates and salaries for professional excellence, high achievements in work and other similar indicators;

• accruals of an incentive and (or) compensatory nature related to working hours and working conditions, including bonuses to tariff rates and salaries for night work, multi-shift work, for combining professions, expanding service areas, for working in difficult conditions , harmful, especially harmful working conditions, for overtime work and work on weekends and holidays;

• the amount of average earnings accrued to employees, retained for the duration of their performance of state and (or) public duties and in other cases provided for by labor legislation;

• expenses for wages retained by employees during vacation;

• monetary compensation for unused vacation;

• cost of goods issued as payment in kind;

• payments due to regional regulation of wages (based on regional coefficients, coefficients for work in desert, waterless areas and high mountain areas, percentage bonuses to wages for work experience in the Far North, in equivalent areas and other areas with difficult natural conditions -climatic conditions), and others.

Charges mean:

• unified social tax, including insurance contributions for compulsory pension insurance;

• contributions for compulsory social insurance against accidents at work and occupational diseases.

On line 322 “Payments not related to wages”

the organization's expenses for social payments, as well as other payments not related to wages, are reflected.

These payments include, in particular:

• pension supplements for retirees working in the organization;

• one-time benefits to retiring labor veterans;

• insurance payments (contributions) paid by the organization under personal, property and other insurance contracts in favor of its employees;

• contributions for voluntary health insurance of employees;

• payment of vouchers for employees and members of their families for treatment, recreation, excursions, and travel;

• payment for travel to the place of work by public transport;

• financial assistance provided to individual employees for family reasons, funeral expenses, and so on;

• the cost of uniforms issued free of charge, remaining in personal permanent use, or the amount of benefits in connection with their sale at reduced prices;

• the cost of issued workwear, special footwear and other personal protective equipment, soap and other detergents, disinfectants, milk and medical and prophylactic nutrition or reimbursement of costs to employees for the workwear, special footwear and other personal protective equipment purchased by them in case of non-issuance of them by the organization, and so on. .

According to line 323 “Expenses for business trips and business trips”

travel expenses of the organization are reflected, as well as expenses for business trips, both within the territory of the Russian Federation and abroad.

A business trip is understood as a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work (Article 166 of the Labor Code of the Russian Federation). The place of permanent work should be understood as the place of work (including a structural unit) in which the employee constantly performs the labor function specified in the employment contract.

Business travel expenses include, in particular:

• travel cost;

• expenses for renting residential premises;

• additional expenses associated with living outside the place of permanent residence (per diem);

• costs for processing and issuing visas, passports, vouchers, invitations and other similar documents;

• consular, airfield fees, fees for the right of entry, passage, transit of automobile and other transport, for the use of sea canals, other similar structures and other similar payments and fees;

• other expenses incurred by the employee with the permission or knowledge of the employer.

Business trips, according to the EJ expert, should be understood as business trips of employees whose permanent work is carried out on the road or has a traveling nature, since such trips are not recognized as business trips.

According to line 324 “Maintenance of premises, buildings, vehicles and other property (except for repairs)”

operating costs for the maintenance and servicing of buildings, premises, structures, equipment, inventory and the like are shown, as well as the costs of maintaining company cars.

Expenses of a non-profit organization for the repair of fixed assets are reflected separately, on line 325.

Expenses for the maintenance of premises, buildings, vehicles and other property, as a rule, include:

• costs of renting premises;

• payment for the cost of services for electricity, heat, water supply, sewerage provided by specialized organizations, etc.;

• costs of servicing computers, faxes, copiers and so on;

• costs of renting automobiles and other vehicles;

• payment of the cost of fuel and other materials consumed during the operation of the vehicle;

• payment of fees associated with the operation of the vehicle (port fees, paid parking, toll roads, and so on);

• fee for state technical inspection of vehicles;

• insurance of the vehicle and/or liability for damage that may be caused by the vehicle or in connection with its operation;

• preventive inspection of the vehicle, carried out by a specialized repair organization, and more.

According to line 325 “Repair of fixed assets and other property”

the organization's costs for current, medium and major repairs of fixed assets and other property, carried out both by contract and by business methods, are reflected.

Current and medium repairs include work to systematically and timely protect property from premature wear and tear and maintain it in working condition.

Carrying out a major overhaul involves comprehensive correction of damage to an object. In this case, there is no change in the technological or service purpose of the object, no new qualities are given to it.

Carrying out major repairs of buildings and structures involves replacing worn-out structures and parts or replacing them with more durable and economical ones that improve the operational capabilities of the facility being repaired (with the exception of the complete replacement of the main structures, the service life of which in this facility is the longest). When overhauling equipment and vehicles, the unit is completely disassembled, base and body parts and assemblies are repaired, all worn parts and assemblies are replaced and restored with new and more modern ones, the unit is assembled, adjusted and tested.

On line 326 “Other”

other expenses of the organization are indicated, in particular for payment:

• communication services;

• Internet access;

• consulting and information services and others.

Line 330 “Purchase of

fixed

assets, inventory and other property” should indicate the organization’s expenses for the purchase of fixed assets and inventories.

The cost of acquired fixed assets and inventories is reflected in the amount of the organization's actual costs for their purchase (PBU 6/01 and PBU 5/01).

On line 340 “Expenses related to business activities”

The purchase price of goods shipped to customers, the amount of costs for the production of products (works, services), as well as commercial expenses associated with the sale and administrative expenses associated with the management of the organization are shown.

The indicator on line 340 is equal to the amount of debit turnover in subaccount 90-2 “Cost of sales”

account.

90

"Sales".

On line 350 “Other”

expenses of the organization are indicated that are neither expenses for the maintenance of the management apparatus, nor expenses for targeted activities, nor expenses related to business activities. In particular, such expenses include:

• expenses associated with the sale, disposal and other write-off of fixed assets and other assets;

• interest paid by an organization for providing it with funds (credits, loans) for use;

• expenses related to payment for services provided by credit institutions;

• costs associated with the audit or audit of the financial and economic activities of the organization;

• land tax;

• tax on property of organizations;

• corporate income tax (both on business activities and on other income);

• fines, penalties, penalties for violation of contract terms;

• compensation for losses caused by the organization;

• losses of previous years recognized in the reporting year;

• amounts of receivables for which the statute of limitations has expired, and other debts that are unrealistic for collection;

• expenses associated with participation in other organizations;

• the amount of negative exchange rate differences resulting from the revaluation in accordance with the established procedure of assets and liabilities, the value of which is expressed in foreign currency, and others.

In line 360 “Total funds used”

show the sum of lines 310, 320, 330, 340 and 350, the data of lines 311-313 and 321-326 are not taken into account.

In line 400 “Balance of funds for

end

of the reporting year"

enter the amount of the balance of funds (taking into account the balance at the beginning of the reporting period), which is equal to the credit balance of the

account.

86

“Targeted financing”

at the end of the reporting period (line 100 + line 260 - line 360).

If the amount of expenses of a non-profit organization is equal to the amount of target funds received, taking into account the balance at the beginning of the year, then a dash is placed in line 400 (the sum of lines 100 and 260 is equal to the indicator in line 360).

If expenses incurred in the reporting period exceed the target funds received (taking into account the balance at the beginning of the reporting period), then the difference is reflected on line 400 in parentheses. In this case, explanations on this fact are given in the explanatory note, and in the balance sheet the specified data is reflected as other current assets.

It should be noted that in column 3

Form No. 6 shows data for the reporting year, and in

column 4

- for the previous one.

EXAMPLE 1

- The Edge of Art Foundation was established by citizens in 2005. The amount of voluntary property contributions from citizens and organizations for 2005 amounted to 2,500,000 rubles.

The amount of income from the foundation’s entrepreneurial activities was 800,000 rubles, and the amount of expenses associated with it was 500,000 rubles. In addition, the fund received income in the form of interest accrued by the bank on the cash balances in the current account in the amount of 1000 rubles. The amount of income tax paid by the fund was RUB 72,000. [(RUB 800,000 – RUB 500,000 + RUB 1,000) x 24%]. During the reporting year, target funds were not fully used. In total, funds were used in the amount of RUB 2,101,000, including for:

• holding conferences and seminars - RUB 1,300,000;

• wages - 300,000 rubles;

• business trips - 51,000 rubles;

• rent of premises - 200,000 rubles;

• payment for communication services - 40,000 rubles;

• acquisition of fixed assets and inventories - 200,000 rubles;

• payment for bank services for settlement and cash services—RUB 10,000.

The report on the targeted use of funds received for 2005 by the Facets of Art Foundation is presented in table. 1.

Table 1

Report of the Foundation "Faces of Art"

on the intended use of funds received for 2005

thousand rubles.

| Name of sections and articles | Line code | For the reporting year | For the previous year |

| Balance of funds at the beginning of the reporting year | 100 | 2,0 | — |

| Funds received | |||

| Entry fees | 210 | — | — |

| Membership fee | 220 | 42,0 | 40,0 |

| Voluntary contributions | 230 | — | — |

| Income from business activities of the organization | 240 | — | — |

| Others | 250 | — | — |

| Total funds received (sum of lines 210-250) | 260 | 42,0 | 40,0 |

| Funds used | |||

| Expenses for targeted activities | 310 | 30,0 | 25,0 |

| including: social and charitable assistance | 311 | — | — |

| holding conferences, meetings, seminars, etc. | 312 | — | — |

| other events | 313 | 30,0 | 25,0 |

| Expenses for maintaining the management staff | 320 | 10,0 | 9,0 |

| including: expenses related to wages (including accruals) | 321 | 8,0 | 8,0 |

| non-wage payments | 322 | — | — |

| expenses for official travel and business trips | 323 | — | — |

| maintenance of premises, buildings, vehicles and other property (except for repairs) | 324 | — | — |

| repair of fixed assets and other property | 325 | 2,0 | 1,0 |

| other | 326 | — | — |

| Acquisition of fixed assets, inventory and other property | 330 | — | — |

| Expenses related to business activities | 340 | — | — |

| Others | 350 | 4,0 | 4,0 |

| Total funds used (lines 310 + 320 + 330 + 340 + 350) | 360 | 44,0 | 38,0 |

| Balance of funds at the end of the reporting year | 400 | — | 2,0 |

How to fill out

In the report on the intended use of funds, two columns are filled in, illustrating similar data for the current and previous periods (years).

In the section under code 6100 “Balance of funds at the beginning of the reporting period,” the amount of funds remaining with the organization at the end of the previous period and transferred to the beginning of the current period is indicated. This value is located on Kt account 86 “Targeted financing”. This indicator also includes the profit received by the NPO from doing business.

Section code 6210 “Funds received” reflects the entire amount of financial receipts for the reporting year, including entrance and target fees, voluntary donations, profits from income-generating activities, government funding, and money received from the sale of property.

In the “Funds Used” section, the institution’s expenses are entered in the context of areas where the proceeds are spent:

- 6310 - “Expenses for targeted events” (social and charitable programs, seminars, conferences and other events).

- 6320 - “Expenses for maintaining the management apparatus.” These include wages (accruals for wages, compensation, incentives and bonus payments), payments not related to payroll (vacation pay, etc.), compensation for travel expenses, costs of maintaining buildings, structures, premises, repairs of fixed assets And so on. These costs are written off through the core activities of the non-profit organization.

- 6330 - “Purchase of fixed assets, inventory and other property.” Here the costs of the institution for the purchase, technical re-equipment, reconstruction, and OS update are noted.

- 6350 - “Other”. Financial costs in the debit of account 86 “Targeted financing”, not included in other groups.

Section 6400 “Fund balance at the end of the reporting year” reflects the amount of unused money at the end of the current (previous) period. If, based on the results of the financial and economic activities of the NPO, the expenditure side exceeds the income side, the actual discrepancy is entered in parentheses, and the responsible accountant draws up an explanatory note.

As part of the current forms of annual financial statements recommended for use (approved by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n), there is a document called a report on the intended use of funds. It is often also called Form 6, despite the fact that the serial numbering of the forms for reports given in Order No. 66n is not used, and only five report forms are given in this document. Where did the name come from, referring to the form number, and is its use legal?

The origin of the name, Form 6 of the report on the intended use of funds, is due to Order No. 67n of the Ministry of Finance of Russia dated July 22, 2003 - a document that is no longer in force, which, before Order No. 66n came into force (and it became mandatory for use in reporting for 2011), approved recommendations for use accounting forms. Order No. 67n contained 6 report forms, and in each of them, under the official text name, there was an indication of the serial number of the form. The numbers were distributed as follows:

- No. 1 - balance sheet;

- No. 2 - profit and loss statement;

- No. 3 - statement of changes in capital;

- No. 4 - cash flow statement;

- No. 5 - appendix to the balance sheet;

- No. 6 - report on the intended use of the funds received.

The forms approved by Order No. 66n do not have an indication of the form number, and only five forms themselves are given in this document: the form corresponding to the appendices to the balance sheet is excluded from them. However, for accountants who compiled reports for the years preceding 2011, the use of numbering of the compiled forms, which simplifies the indication of their name, remained common. However, such a reference can only be used informally, since the current document approving the accounting forms does not contain report numbers.

In 2020 (Order of the Ministry of Finance of Russia dated 04/06/2015 No. 57n), the names of two of the reports approved by Order No. 66n were adjusted: the profit and loss statement became known as the financial results statement, and the word “received” was removed from the title of the report on intended use.

Contents and order of filling

For this report, the legislation provides for Form No. 6. The Ministry of Finance, in its order No. 66 dated 07/02/10, established a list of codes that are used to submit this document to the territorial representative offices of Rosstat and other executive authorities. This form is advisory in nature; organizations can, as necessary, supplement it with their own indicators for a more optimal display of data.

Let's look at what sections the document in question contains and the contents of each of them. It’s worth mentioning right away that filling out takes place in two columns - the reporting year and the previous year.

Balance of funds at the beginning of the reporting period. Here you must indicate the carryover amount of the balance from the previous period, that is, funds that were not spent last year. This balance is taken from the credit of account 86. The profit that the organization received while engaging in entrepreneurial activities is also entered here.

Funds have arrived. Here, cash receipts for the entire period are displayed line by line. These include various types of contributions:

- introductory - funds that are payable once upon entry of new members and are used for the initial formation of fixed assets;

- Membership fees are most often paid annually by NPO participants and are used to carry out the activities for which the institution was created and for its operating expenses;

- targeted contributions are proceeds that go towards specific purposes and cannot be spent on something else;

- voluntary (including donations) are made by any persons - legal entities, individuals, as well as non-residents of the Russian Federation on a voluntary basis.

Also included here are the profits that the institution receives (from business activities) and other income. The latter may be funds from government funding, money from the sale of the organization’s property, etc.

Funds used . This section reflects the purposes for which the received funds were spent. They are divided into:

- Expenses for targeted events, which usually include social and charitable assistance and all various seminars, conferences, etc.

- Expenses for the maintenance of the management apparatus can be written off only in that part that went to the implementation of the main activities of the organization, but not entrepreneurial ones. These include: wages and everything connected with it - bonuses, compensation, accrued contributions to extra-budgetary funds, etc.;

- amounts the payment of which is not related to wages - most of them are vacation pay, including payment for unused vacation, etc.;

- compensation for travel expenses and expenses for business trips;

- costs of maintaining buildings, premises (including their rental), transport and other similar property intended for carrying out the activities of the organization specified in its charter;

- repair of OS and other property;

- other costs, which may include payment for communications, provision of office supplies to the organization, costs for legal and other similar assistance, etc.

Balance of funds at the end of the reporting year . If, at the end of the reporting period, the expenditure side exceeds the revenue side, then the difference is indicated in parentheses, and an explanatory note is attached to the document.

Thus, a report on the intended use of funds is a mandatory document for all non-profit organizations. Its simple shape does not require much effort when filling. And if necessary, institutions can independently supplement it with other indicators.

Reporting on the intended use of funds: who submits it?

So who is required to submit a report on the intended use of funds?

In Order No. 67n, the answer to this question was unambiguous: Form 6 was recommended to be drawn up by non-profit organizations (clause 4 of the instructions on the scope of accounting forms). A similar recommendation (albeit with a slightly different wording, referring to public organizations that do not conduct entrepreneurial activities) was also in the original version of Order No. 66n (subparagraph “c”, paragraph 1). But since 2013 (Order of the Ministry of Finance of Russia dated December 4, 2012 No. 154n), the indication of who is affected by the preparation of a report on earmarked funds has been excluded from the text of Order No. 66n. Thus, all recipients of targeted funding will have to draw up this form, i.e. not only non-profit structures, but also commercial organizations receiving targeted funds.

Organizations that do not receive targeted funds do not prepare a report on them, since they do not have the data to fill it out.

Options for a report form on the intended use of funds

- complete, given in Appendix No. 2.1;

- simplified, contained in Appendix No. 5.

Simplification implies a reduction in the number of lines in the report by combining data on a number of indicators (subparagraph “a”, paragraph 6 of Order No. 66n) and the absence in the form of a column intended to indicate the number of explanations.

The simplified form can be used by persons who have the right to simplify accounting and the formation of simplified accounting records. These persons include (Clause 4, Article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ):

- small businesses that meet the criteria specified in the law “On the development of small and medium-sized businesses...” dated July 24, 2007 No. 209-FZ;

- non-profit organizations subject to the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ;

- participants of the Skolkovo project who received this status in accordance with the law “On the Skolkovo Innovation Center” dated September 28, 2010 No. 244-FZ.

Simplification of reporting is not available (Clause 5, Article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ):

- for legal entities required to audit their accounting records;

- housing and housing-construction cooperatives;

- credit consumer cooperatives and microfinance organizations;

- public sector organizations;

- political parties;

- associations of lawyers and notaries, legal consultations;

- non-profit structures acting as a foreign agent.

Regardless of which form the report is generated on, its copy, which is to be sent to the Rosstat authorities, must have lines encoded with special digital codes. These codes for the full form of the report are contained in Appendix No. 4 to Order No. 66n, and in its simplified version, the code for the line should be selected according to the indicator with the highest share in the aggregated indicator shown for this line (clause 5 of Order No. 66n).

Information about which target funds should be included in the report?

First of all, let’s figure out what information about which targeted funds should be included in the report. Firstly, about the property received by the AU and ANO within the framework of targeted financing (clause 14, clause 1, article 251 of the Tax Code of the Russian Federation). Funds of targeted financing include property received by the taxpayer and used by him for the purpose determined by the organization (individual) - the source of targeted financing or federal laws, in the form of grants, funds received from funds named in the Tax Code, etc.

Note. Targeted financing also includes subsidies allocated to autonomous institutions, but information about them does not need to be included in the report. This is indicated in clause 15.1 of the Procedure for filling out a tax return for corporate income tax.

The report must also include information about targeted revenues from the budget and targeted revenues for the maintenance of non-profit organizations and their conduct of statutory activities, received free of charge from other organizations and (or) individuals and used by the specified recipients for their intended purpose (clause 2 of Article 251 of the Tax Code RF). Targeted revenues for the maintenance of non-profit organizations and the conduct of their statutory activities include, among other things:

- entrance fees made in accordance with the legislation of the Russian Federation on non-profit organizations. According to paragraph 1 of Art. 10 of the Law on Non-Profit Organizations, ANO is established by citizens and legal entities on the basis of voluntary property contributions;

- donations recognized as such in accordance with the civil legislation of the Russian Federation;

- funds and other property received for charitable activities;

- proceeds from owners to institutions created by them used for their intended purpose;

- funds received by non-profit organizations for the formation of endowment capital.

Federal Law of January 12, 1996 N 7-FZ.

Procedure for filling out the intended use report

The procedure for filling out a report on the intended use of funds is not separately described anywhere. The logic for entering data into it follows from the content of the report itself and the notes available under the main table.

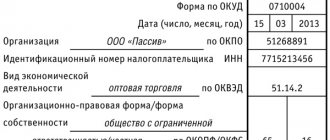

The main table is preceded by data about the reporting entity (its name and codes characterizing basic information about it: OKPO, INN, OKVED, OKOPF, OKFS), as well as information about the year for which the report is being prepared, the date of creation and the applied unit of measurement of the entered indicators.

The purpose of filling out the main table is to reflect, taking into account the analytics of receipts and disposals, the process of changing the balance of target financing funds accounted for in the organization (when applying the chart of accounts of accounting, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, they are shown on account 86). In this case, a comparison of data from the current and previous years is provided.

The top and bottom rows of the table indicate information about fund balances, respectively, at the beginning and end of the year. Intermediate lines are divided into two groups: with information about receipts and about the expenditure of funds received. For each of the groups, the forms given in Order No. 66n offer a specific breakdown of analytical lines, focused on the most frequently occurring reasons for receipts and expenditures. In full form, for these reasons, the following are highlighted:

- in receipts - lines: for entrance, membership and target fees;

- voluntarily contributed funds;

- income resulting from the activities of the reporting entity;

- other funds received;

- for the purposes for which the legal entity received appropriate funding, highlighting information about expenses for charity and social assistance, informational events, and other procedures;

In a simplified form, revenues combine data on contributions and voluntarily contributed funds, and in expenditures there is no detailing of the four main groups of lines. In addition, the simplified form is distinguished by the absence of total figures related to income and expenses.

At the same time, if necessary, the report writer can supplement the form proposed by Order No. 66n with the required number of lines (clause 3 of Order No. 66n).

Line by line filling

In the reporting for 2011, there is no coding of lines in the report. For ease of comparison of indicators, we recommend using codes in accordance with Appendix No. 4 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

Line 6100

“Balance of funds at the beginning of the reporting year” reflects the amount of the credit balance in account 86 “Targeted financing” at the beginning of the year.

The presence of a credit balance means that at the end of the year all target funds were not used. The amount of profit received from commercial activities, minus taxes, is also reflected here.

Public organizations and their structural divisions that do not carry out entrepreneurial activities submit financial statements once at the end of the reporting year in a simplified format: balance sheet, profit and loss statement, report on the intended use of funds received.

Line 6200

“Funds received - total” - the sum of lines 6210-6250, excluding the data in line 6100.

Filling lines 6210

“Entry Fees” and

6215

“Membership Fees” are straightforward and reflect contributions received and to be received.

Line 6220

“Targeted contributions” reflects:

- funds for charitable activities;

- grants;

- funds allocated for shared financing of capital repairs of apartment buildings;

- amounts of financing allocated for the implementation of the statutory activities of non-profit organizations from budgets of various levels, state extra-budgetary funds;

- proceeds from the founders;

- property and property rights received by religious organizations to carry out their statutory activities;

- funds contributed by members of a horticultural, gardening, dacha non-profit partnership or partnership for the purchase of public facilities;

- funds received for the formation of target capital.

Line 6230

“Voluntary property contributions and donations” is filled in if contributions have been received from other legal entities and individuals for statutory activities.

It also reflects the debt of legal entities and individuals to pay contributions and donations.

The formation of endowment capital is provided for funds of an autonomous non-profit organization, public organization, public foundation or religious organization.

Donations are accepted only by institutions: medical, educational, social protection, charitable, scientific, educational, foundations, museums, public and religious organizations.

Line 6240

“Profit from business activities of the organization” is filled out simply; the net profit of the previous year is entered from the profit and loss statement.

Line 6250

“Other” allows you to reflect all receipts related to the statutory activities of a non-profit organization that are not listed in other lines.

Line 6300

“Funds used - total” is filled out simply, you need to add up the indicators of lines 6310-6330, 6350. It is important to remember that the data in lines 6311-6313 and 6321-6326 are not taken into account.

Line 6310

“Expenses for targeted activities” is the total amount of lines 63116313.

Line 6311

“Social and charitable assistance” is the amount of targeted and non-addressed, impersonal assistance provided free of charge or on preferential terms. This can be either cash, work performed, or services provided.

On line 6312

“Conducting conferences, meetings, seminars, etc.” you can reflect all the expenses associated with the specified events: rental of premises, delivery and accommodation of event participants, expenses for stationery for participants.

According to the meaning of the name of line 6313

“Other events” is clear that it reflects the costs of targeted events that are not social or charitable, for example, events carried out for educational purposes to promote a healthy lifestyle and spiritual values.

Line 6320

“Expenses for maintaining the management apparatus” is the sum of indicators in lines 6321-6326 and reflects the total amount of funds used for the management apparatus.

An example of filling out a report on intended use

Let's look at an example of filling out a report on the intended use of funds using specific figures.

Example

For the Nadezhda charitable foundation, which is engaged in helping people who find themselves in difficult life situations, the main source of funds that allows them to carry out the activities provided for in the charter are voluntary donations from legal entities and individuals. The balance of unused funds at the beginning of the year amounted to 30,000 rubles. In 2020, the fund received 7,000,000 rubles as voluntary donations.

In addition, the foundation organizes educational events that generate income from the sale of entrance tickets to them. The net profit from this activity for 2020 amounted to RUB 1,000,000.

The expenses incurred by the fund in 2020 were as follows:

- for charitable payments to people who find themselves in difficult life situations - 6,400,000 rubles;

- for wages, taking into account insurance premiums accrued on the amount of the employee’s income - 1,400,000 rubles;

- for business trips to check the reality of difficult life circumstances for people who need help - 70,000 rubles;

- for cosmetic repairs of premises occupied by the foundation on a lease basis - 100,000 rubles.

The situation was similar in 2020. That is, there were two types of income: voluntarily donated amounts (5,500,000 rubles) and profit from business (900,000 rubles). Funds were used for charitable payments to people in need (5,200,000 rubles), wages and insurance premiums (1,100,000 rubles) and business trips (80,000 rubles). Unused funds at the beginning of the year amounted to 10,000 rubles.

In the main table of the report, fund balances at the beginning of the year will be shown in line with code 6100, and balances at the end of the year - in line 6400. Moreover, the data in line 6100 for 2020 (at its beginning) and line 6400 for 2020 (at its end ) must be the same.

Receipts will be reflected in lines 6230 (voluntary donations) and 6240 (profit from business). Their total amount will appear in line 6200.

In relation to expenses for targeted activities, lines 6310 will be used (it will show their total value) and 6311 (it is intended for expenses in the form of charitable assistance).

As for the costs of maintaining the fund itself, lines 6320 will be used (their total amount will be reflected here), 6321 (expenses related to wages), 6323 (travel expenses) and 6325 (property repair expenses).

The total amount of expenses incurred, equal to the sum of lines 6310 and 6320, will fall into line 6300.

The balance of funds at the end of each year is calculated from the amount of their balance at the beginning of the year by adding the total amount of receipts and subtracting the total amount of expenses from this term, i.e. according to the formula (if compiled using report line codes): 6100 + 6200 - 6300 = 6400.

Please see the completed report on our website.

Filling out the report line by line

1) Line 6100 displays the amount of targeted financing that is at the disposal of the organization at the beginning of the reporting period or at the beginning of the previous year.

If we turn to the accounting accounts, then this is the credit balance of account 86 - “Targeted financing”. By the way, if a public organization received profit from business activities, then it should also be displayed in line 6100.

2) Section on receipt of funds with code 6200. The amount of receipts for the reporting period is displayed here in the context of their target orientation:

- Entry fees - line code 6210;

- Membership fees - line code 6215;

- Target contributions - line code 6220;

- Voluntary contributions in the form of property and other donations - line code 6230.

Please note that if the contribution amount was received in kind, it is displayed in line 6230.

- Profit from business activities - line code 6240. When filling out this line, an explanation for the annual financial statements is also drawn up.

- Other receipts - line code 6250. Other receipts include: state assistance aimed at achieving specific goals; funds received from the sale of fixed assets and other property.

Results

A report reflecting information on the dynamics of targeted financing funds is generated if the reporting entity has such funds. When creating it, the form recommended by the Ministry of Finance of Russia is usually used, which has two forms (full and simplified) and, if necessary, can be supplemented with the necessary lines. Simplification of the report is achieved by combining indicators and is not available to all users of this form. There are no special instructions for filling out the current form, so you need to enter data into it based on the logic of the report form itself.