When is it necessary to restore accounting records?

It’s good if your business does not experience any problems, including in accounting.

Unfortunately, there are times when it is the work of the accounting department that needs urgent intervention. Sometimes businesses even require a complete accounting restoration.

Let's explain with an example.

Example

Ippolit Vorobyaninov decided to start his own business. No sooner said than done! And now he is already the owner of his own individual entrepreneur using a simplified taxation system (or, in simple terms, “simplified taxation”).

This choice was not accidental. I heard Ippolit from his friends that there is no hassle with an individual entrepreneur using a simplified system! You submit your declaration once a year and that’s it! Therefore, he did not hand over the accounting of individual entrepreneurs to the wrong hands.

Business was going well, things were going well! Ippolit finished the financial year with a turnover of 84 million rubles. Having spent the New Year holidays cheerfully, Vorobyaninov hurried with his tax return.

Nothing foreshadowed trouble... However, the tax authorities did not accept the declaration, and they even said that IP Vorobyaninov “flew” from the simplified tax system back in November (income at that time exceeded 79,740 thousand rubles, which means that the individual entrepreneur loses the right to apply simplified system and automatically switches to the general one).

The general system is no longer a joke: VAT, income tax and much more. The matter was further complicated by the fact that Ippolit did not keep accounting records as required and did not pay advance payments.

It is unknown how the matter would have ended if Vorobyaninov had not contacted the accounting department and drawn up an agreement to restore accounting.

The reason from the example is not the only one.

Let's consider other reasons when entities need to restore accounting:

- change of chief accountant;

- unprofessional accounting service;

- an unreliable “primary document” (primary documentation) was discovered;

- complete or partial loss of accounting documents;

- no records are kept;

- interruptions in record keeping;

- violation of the procedure and deadlines for submitting reports.

If at least one of the above reasons is consistent with the state of accounting in your company, immediately begin to resolve it.

First of all, decide who you plan to entrust with the restoration of accounting. There are few options here.

Pros and cons of the main methods of accounting restoration:

| № | Way | Minuses | pros |

| 1 | Hire new accounting staff | At the initial stage it is difficult to determine the level of professionalism | Fixed payment |

| 2 | Transfer the process to a private consultant | It is difficult to determine the level of professionalism, there are no guarantees. | None |

| 3 | Entrust the restoration to an accounting firm | Cost of services | Professional approach, guarantees, flexible prices, any deadlines, submission of corrective reports on recovered data with the necessary explanations and justifications |

So, the table makes it clear that the best option for restoring accounting is the help of a professional accounting company.

Fortunately, many specialist firms offer recovery accounting services.

What does the owner of the company receive in this case:

- the company's accounting fully complies with regulatory requirements;

- all interested parties have the opportunity to obtain reliable information for making management decisions;

- claims from regulatory authorities will be lifted;

- only work performed is paid, not a full-time position;

- Restrictions on bank accounts are lifted.

The main goal of the restoration is to bring the company into full compliance with legal accounting standards.

What factors influence the cost of accounting restoration services - 4 main factors

To determine the optimal cost of accounting restoration services, you need to know what factors influence its formation.

There are many such factors, but I suggest familiarizing yourself with the main ones.

Factor 1. Scope of work

The cost of any service depends, first of all, on the scope of work. The larger the volume, the higher the cost.

Restoring the accounting records of a small company with small turnover and similar operations will cost less than similar work in a large company operating in several areas, engaged in foreign economic activity and securities transactions.

Factor 2. Tax system used

According to Russian legislation, taxes and fees are calculated and paid in the manner prescribed by the taxation system used: general, simplified, imputed, patent and unified agricultural tax.

Not only the procedure for taxation of business activities depends on these systems, but also the cost of services of accounting firms for the restoration of accounting.

Most often, accounting is restored using the general and simplified systems, since according to statistics these are the most common taxation systems in the Russian Federation.

The cost of services also affects the form of the customer’s business: the services of an accountant for restoring accounting in an LLC will cost more than restoring accounting for an individual entrepreneur.

Factor 3. Urgency of recovery

Recovery time varies from several weeks to several months. If the customer company needs to speed up this process for some reason, then the executing company, by agreement, is ready to complete the work faster - of course, for an additional fee.

Surcharge for urgency is usually a percentage of the total cost of services under the contract, which ranges from 5 to 30%.

Such an additional payment is quite justified, since with a constant volume of services, the time to perform them is reduced, which forces specialists to either work more or attract additional employees.

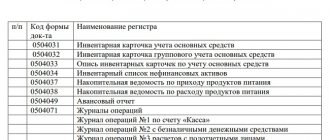

Factor 4. Recovery method

Restoration is carried out both in full and partially.

In partial restoration, auditors work on one or more areas. Very often, restoration of the site for accounting of fixed assets, calculations of wages, etc. is ordered.

Full restoration implies putting in order all areas of the customer’s accounting.

Advice for entrepreneurs

If the head of a company realizes the need to restore accounting, then he must order the appropriate service from a suitable organization as quickly as possible. This is due to the fact that the possibility of further functioning of the organization depends on the accuracy of accounting.

The following recommendations are taken into account:

- it is important to regularly cooperate with various outsourcing companies that are professional enterprises;

- It is advisable to use the services of these companies even in the absence of any problems, since in this case you can quickly identify various errors or violations in different documents;

- Only companies that draw up a formal agreement and provide highly qualified specialists for cooperation are selected;

- You can contact several companies at once for an independent free consultation to evaluate the services offered;

- An audit should be carried out periodically, consisting of checking, studying and monitoring accounting documentation, since in this case you can be convinced of the professionalism of the selected chief accountant, as well as quickly identify errors.

Is it possible to make money on a bank deposit? Read more here.

What is accounting? Answer in video:

https://youtu.be/dGccvxzBA1s

Accounting restoration must be performed by experienced specialists. This is especially true if the owner of the company does not have the necessary knowledge and skills for independent verification. Through this process, you can prevent various disagreements with tax authorities.

Who provides accounting restoration services - review of the TOP 3 companies

There are plenty of companies offering accounting restoration services. How not to make a mistake with your choice?

To get started, we recommend that you read our review.

1) My business

The Russian one is still quite young (established in 2009), but this does not prevent it from receiving recognition from clients, of whom there are already more than 50 thousand.

What causes the trust in the company of such a large number of different firms and enterprises? The answer is simple: the benefits that the client receives by working in the service!

Some advantages of the company:

- cloud technologies on a modern IT platform, allowing you to keep records from anywhere in the world;

- mobile app;

- intuitive and convenient service interface;

- the ability to keep records with any level of training;

- a large selection of forms and templates for documents required for work;

- professional consultants and friendly support;

- integration with many Russian banks.

Internet accounting “My Business” offers its clients ample opportunities.

Firstly, you can conduct accounting for your company yourself. Moreover, in the service you can easily and quickly restore accounting if for some reason it was not kept or was kept incorrectly.

Secondly, if you don’t have the time (or desire), accounting can be completely entrusted to the professionals of the “My Business” company.

This is not only convenient, but also safe, since professional liability is insured for 100 million rubles.

“My Business” offers its clients a wide range of services.

Main services of the service:

- maintaining accounting and tax records;

- generation and submission of reports;

- reconciliation with the tax office;

- settlements with employees regarding wages;

- verification of counterparties;

- preparation of documents for registration of LLCs and individual entrepreneurs;

- accounting outsourcing;

- consulting

With an extensive list of services provided by the “My Business” service, the tariffs are pleasantly surprising.

A nice bonus for new clients is a free trial period. Registration on the service is extremely simple and does not take much time.

2) Intercomp

- outsourcing company. For more than 20 years, the company has been offering its clients outsourcing services in such areas as personnel, finance, accounting, IT technologies and legal services.

The professionalism of Intercomp employees allows the company to achieve high ratings according to various Russian and international rating agencies. Professional liability is insured for the amount of RUB 180 million.

Intercomp has quality certificates according to three international standards: ISO 9001, SSAE 16 and ISO 27001. Such standardization helps improve the quality of services, customer focus and information security.

Throughout its activities, the company, thanks to its professionalism, high quality services and impeccable reputation, has formed a base of regular customers (more than 800 companies). A wide branch network (7 offices) makes the company’s services available not only in the Russian Federation, but also in neighboring countries.

3) Uniservice

The group began its activities in 1995 as a legal entity - it is a Group of companies consisting of three divisions: Business support, Audit and Consulting.

The Group offers its clients a wide range of services in several areas:

- registration of companies;

- accounting services;

- legal services;

- audit;

- IFRS;

- grade;

- construction SRO;

- consulting services.

At the end of 2020, Uniservice Group took 27th place in the ranking of the 50 largest Russian audit organizations. Uniservice also occupies fairly high ratings in other areas (for example, 30th place according to the Business Rating).

Uniservice Group of Companies insured its liability with Ingosstrakh for 5 million rubles.

By contacting this company, clients receive professional services, flexible prices, and free consultations.

How to prevent unpleasant situations associated with incorrect accounting

In order to prevent such unpleasant situations associated with the need to restore accounting, in any case, care should be taken to take measures to prevent similar situations in the future, to develop recommendations for accounting employees on the further maintenance of accounting in your company. This may require consultation with a private qualified accountant, contacting a consulting firm, or recommendations from auditors.

In addition, in order to reduce the likelihood of the need to restore accounting due to the fault of the chief accountant of your company, it is necessary to prepare a personal agreement with him, which carefully spells out all his responsibilities, as well as measures of liability for improper performance of his professional duties. Indicate also the measures of financial liability to the employer in the event that his actions cause damage to the enterprise or lost profits. In the event of such damage to the chief accountant, the provisions of Article 247 of the Labor Code of the Russian Federation should be applied; it will require a written explanation of the cause of the damage and, if necessary, draw up an appropriate act.

Incorrect accounting or tax accounting can lead not only to fines and sanctions from the tax office, banks, but also to problems with creditors, partners, and counterparties. All this, ultimately, always leads to the fact that the organization’s management will not be able to control the current financial position of the organization in the future.

https://youtu.be/-iiRey9rizI