A list of cost items is created in the accounting department of each enterprise. Grouping is carried out in accordance with the current accounting principles specified in the main regulations.

Cost items - one of the reference books for the 1C software product. It indicates information for analytical accounting for certain accounts, for example, 08; 25; 29; 44. Each of them has a subconto with the same name, which shows turnover without balances. Correct entry of data into the directory is extremely important, since on its basis the company’s financial statements will be generated in the future. To avoid problems, we’ll figure out how to set up cost items and what to follow in the process.

Principles of cost grouping

The basic requirements for the classification and division into groups of all costs in accounting are regulated by the current chart of accounts, the Tax Code of the Russian Federation, PBU No. 10/99, as well as orders of various regulatory and executive departments. In practice, there are 2 approaches to organizing expense accounting:

- accounting (general);

- tax (for tax purposes only).

To address the issue of cost items in 1C, we will consider only the accounting approach to grouping.

Traditionally, all expenses of an enterprise are divided into those that relate to ordinary activities and those that are not related to it (other). The first category of costs includes 4 groups:

- pre-production or those that are spent on the purchase of inventory items used in the main activity;

- production;

- commercial;

- managerial.

According to clause 8 of PBU No. 10/99, several elements are distinguished by grouping costs: materials (purchase, transportation, storage organization), wages, social and pension contributions, depreciation.

The list of expense items is largely determined by the type and industry of the enterprise. For some areas of activity, there are advisory or even mandatory principles for grouping costs.

How to create a cost item

To create a new cost item, click the “Create” button.

How to fill out:

- Enter the title of the article.

- Specify a folder if necessary.

- In the “Type of expense” field, select the type of expense for tax accounting. This field affects the completion of the “Income Tax Return” report. If the cost item is not an expense for tax accounting, indicate the type of expense “Not taken into account for tax purposes.”

- In the “Use as default” field, specify the document into which the cost item should be automatically inserted.

- Save the article using the “Save and Close” button.

Filling out the directory

To start working in the program, you should prepare a reference book (set up cost items in 1C 8.3).

When you turn on 1C for the first time, even if there is no basic information, the section will already contain default data. They are marked with a special icon, they cannot be deleted and it is not advisable to correct them. An important point: after you start accounting for a particular item, you do not need to make changes to it. If there are no changes, the documents will definitely be re-posted.

Types of cost items in 1C are filled out in several stages:

- We go to the “Directories” menu, look for the “Income and Expenses” section and in it open the “Cost Items” link.

- Click the “Create” button to create a new article. The corresponding form opens.

- Enter the name of the new article. At this stage, it is important to analyze the similarity costs and, if possible, combine them into one element. For example, if a company uses regular phones, IP and corporate cellular communications, then it makes more sense to create one article for all this - “Communication”.

- Fill in the “Type of expense” detail. You need to carefully approach this point and enter the data correctly. In the future, tax returns will be filled out using this information.

Another point worth noting is “Default Use”. It is not necessary to fill it out, but it is useful in cases where automatic entry of information into the generated act is required.

Classification of income and expenses for financial accounting purposes

Income and expenses from ordinary activities

Income from ordinary activities is revenue from the sale of products and goods, income associated with the performance of work, provision of services, that is, income from the organization’s core activities - those types of activities that are accepted by the organization as components of its business.

Expenses for ordinary activities are expenses associated with the manufacture and sale of products (including administrative expenses), acquisition and sale of goods, as well as expenses associated with the performance of work and provision of services.

In practice, the charter often includes a phrase stating that the organization will engage in any activity not prohibited by law (the Civil Code requires specifying types of activities only for non-profit and unitary enterprises). But for licensed activities it is necessary to indicate the types of activities.

The principle of matching income and expenses is that expenses are recognized in the income statement taking into account the relationship between expenses incurred and income.

Revenue and cost must always be reflected in the same analytics, otherwise the principle of matching income and expenses will be violated, and reporting information will lose its usefulness.

Operating income and expenses

Operating income is recognized as income from independent business transactions and transactions carried out for the purpose of obtaining these incomes, but at the same time not being the subject of the activities of this organization, namely:

- Income related to the sale of assets other than products or goods: fixed assets, inventories, securities (except for professional participants in the securities market), foreign currency;

- Income received under separate independent agreements, but not related to core activities: income from lease agreements, commercial concessions, interest receivable, income from joint activities.

Accordingly, operating expenses are recognized as expenses for the execution of business operations and transactions that are not the subject of the activities of this organization.

The principle of matching income and expenses does not apply to other income and expenses, including operating ones.

Examples of operating expenses are interest on loans, depository services for storing securities, payment of direct taxes: on advertising, on property, - the formation of valuation reserves, expenses for the conservation of fixed assets.

Non-operating income and expenses

If the expenses incurred do not bring any income, and also if the organization recognizes the emergence of obligations without a counter receipt of assets, then non-operating expenses are recognized in accounting - losses.

Income for which the organization did not incur any expenses will also be non-operating. At the same time, non-operating income is not associated with the processes of production and circulation, and the absence of expenses is due to the fact that they cannot be correlated with targeted actions (operations) specifically aimed at extracting them.

Examples of non-operating income are exchange rate differences, income from receipt of fines and penalties, compensation for losses incurred, gratuitous receipt of property, and write-off of unclaimed accounts payable.

Three types of expenses are recognized as non-operating expenses:

- Expenses that are a by-product of business transactions for which there were no actions taken specifically for their implementation: exchange rate differences, amount differences and other expenses for the acquisition of fixed assets identified after their acceptance for accounting;

- Expenses identified in the case when the actions taken did not lead to the expected or even the opposite of the expected result: losses (paid fines, penalties, penalties, written off bad receivables and other unproductive expenses);

- Charitable and social expenses - expenses for holding sporting events, maintaining catering facilities, medical offices.

Division of income and expenses according to the principle of correspondence

Income and expenses are divided depending on how the principle of matching income and expenses is applied to them.

Income from ordinary activities (revenue) always corresponds to expenses from ordinary activities (cost).

Expenses may or may not correspond to operating income. In the latter case (inconsistency), the opposite part (income or expense) is present in practice, but is not highlighted in accounting due to its high labor intensity and low feasibility.

Non-operating income is never accompanied by expenses, and vice versa. That is, in fact, they are entirely either profit or loss of the organization.

Extraordinary income and expenses

Extraordinary income is considered to be income arising as a consequence of extraordinary circumstances (natural disaster, fire, accident, nationalization): receipt of insurance compensation, the cost of material assets remaining from the write-off of damaged assets (useful returns). Extraordinary expenses include expenses that arise as a consequence of the same emergency circumstances: payments for damage caused to the environment, write-off of the residual value of lost or unsuitable assets for restoration, payments to employees or the population injured as a result of the accident.

List of main costs in accounting

All expense items can be classified according to a number of criteria:

- period of occurrence/write-off: past, current or future period;

- degree of participation in production: direct and indirect;

- change in production volume: conditionally constant and conditionally variable;

- level of influence on the result: regulated and unregulated.

Also, expenses are divided according to belonging to one of the basic elements.

For example, the group of material costs includes basic materials, fuel and fuels and lubricants, semi-finished products of their own production, electricity, as well as costs for work clothes and additional raw materials. The legislation regulating the accounting procedures at enterprises establishes a single rule for the division of costs: there must be expenses of ordinary activities and others. Ordinary activity costs, in turn, are broken down into elemental categories. The company separates expenses by item independently.

Principles for creating a list of cost items

Since accounting has a very strict link to legislation, it is worth looking for the basic principles of grouping costs in regulatory documents. The main ones include those presented in Figure 1 and described below.

1. Accounting Regulations (hereinafter referred to as PBU) 10/99 “Expenses of the organization”

The document reveals the principles of cost accounting. And costs and expenses are different concepts, although they are often confused ( what is the fundamental difference between costs and expenses, read in the Question-Answer section

).

However, paragraph 8 of the document provides a classification of expenses by ordinary activities, which is quite suitable for highlighting cost items. Let's call this grouping - cost items by element

:

- material costs;

- labor costs;

- contributions for social needs;

- depreciation;

- other costs.

Paragraphs 7 and 9 of PBU 10/99 provide grounds for identifying at least three more groups in the list of costs, having received a list of cost items according to their functional role

:

- production;

- commercial;

- managerial.

And another important principle for grouping costs is given at the very end of paragraph 8: the list of cost items is established by the organization independently

. This phrase suggests that the allocation of cost items within each enterprise is the domain of specialists in the accounting and economic block. It is they who must decide and set by a system of internal regulations (for example, accounting policies) exactly which cost items are needed for correct accounting, analysis, planning and possible optimization of spent resources.

How to quickly develop a directory of cost items - read advice from the experts of the Financial Director System.

2. Chart of accounts for financial and economic activities of organizations

The principles for allocating cost items in this document are set through the system of accounting accounts. Cost accounts include:

- 20 “Main production”;

- 23 “Auxiliary production”;

- 25 “General production expenses”;

- 26 “General business expenses”;

- 29 “Service industries and farms”;

- 44 “Sales expenses”.

This approach to identifying a list of cost items can be called this - by centers of responsibility and places of occurrence

.

This method of classification makes it possible to see the total costs in the context of different types of production, management and sales, and allows you to clearly differentiate costs according to the method of their inclusion in the cost.

.

All expenditures of resources that can be directly attributed to account 20 (immediately including them in the cost of a specific product, work or service) are considered direct. Indirect costs are all that will require:

- preliminary accumulation during the month on other accounts. Of the above - these are 23, 25, 26, 29,

- subsequent distribution by type of product at the end of the month in proportion to the base chosen by the enterprise (direct material costs, salaries of main production workers, total direct costs, etc.),

- assignments to analytical accounts of the 20th account with entries Debit 20 Credit 23, 25, 26, 29.

3. Industry guidelines (recommendations) and instructions

There are quite a lot of documents of this kind. Moreover, some of them were written back in the days of the USSR, and their creators are the USSR State Planning Committee, the USSR Ministry of Finance and the USSR State Committee for Prices, which have long since sunk into oblivion. However, reference and information systems do not classify them as out of force, and this is fair, because the basic approaches to calculating costs, creating cost plans (in modern terms - budgets) and preparing estimates remain the same.

The clearest example of such a normative act is Letter of the USSR State Planning Committee No. AB-162/16-127, USSR Ministry of Finance, USSR State Committee for Prices No. 10-86/1080, USSR Central Statistical Office dated June 10, 1975 “On methodological materials on planning, accounting and calculating production costs at mechanical engineering and metalworking enterprises."

Convenience of accounting in 1C 8.3

The implementation of 1C 8.3 ERP class software at an enterprise provides the opportunity to maintain regulated accounting.

It is convenient, practical and functional, since accounting and tax accounting are carried out together. The system's capabilities will allow you to optimize most business processes, simplify and automate complex tasks. offers innovative ERP-class solutions for large and medium-sized manufacturing companies. In addition to finished products, we provide a wide range of business optimization services. Our capabilities include professional consulting, project implementation of systems (full cycle), improving 1C performance and much more. Fill out the form on the website to contact an ITRP representative.

Concept of Costs. but is it the same?

Reading books and textbooks on accounting, you will find that together with the concept of Costs, the concept of Expenses is often found. Yes, so often that they sometimes even appear together in the same sentence. You can think about the equality of these concepts. However, there is a fundamental difference between them.

Costs in accounting are a reduction in an enterprise's resource, but without its loss. Resources such as money, materials, or others are exchanged for another resource or obligation. For example : We paid the supplier in money for previously received materials - “the money turned into materials.” Or they could first pay the supplier and thereby “fix” his obligation to us. In any case, the resource “money” is not lost, but “transformed” either into materials or into an obligation.

Expenses in accounting are the irrevocable conversion of a company's resources to generate Revenue. For example : We sold a product and transferred it to the buyer. At this point, the cost of the goods is considered an Expense for the company.

Now that the fundamental difference between these concepts has been defined, you should be attentive to the events taking place at the enterprise so that for the words Costs and Expenses you clearly understand what their meaning is.

Main types of company expense transactions

Based on the nature and nature of the cost part, within certain commercial areas the following aggregated types of expenses in accounting are distinguished, namely:

- costs for ordinary (or main) commercial activities - they are determined by OKVED taking into account the actual sales volumes in a particular area of work

- other expense items that all legal entities without exception have - costs for maintaining the administrative apparatus and economic unit, costs for training and professional retraining, etc.

These objects can be grouped into elements and articles, based on the specifics of the business. The main thing is that the information necessary for management and reporting can be obtained quickly, it is reliable and has the necessary level of analytics. Expenses in accounting are a complex category that involves an extensive classification that should not be neglected.

Subtleties of recognizing expenses for conducting statutory activities

Recognition of expenses incurred as expenses used to reduce revenue is carried out according to certain rules. They are enshrined, in particular, in PBU 10/99. The document was approved on May 6, 1999 by order No. 33n of the Ministry of Finance. The norms are applied to the extent that they do not conflict with the rules for recording expenses enshrined in the accounting law of December 6, 2011 No. 402-FZ. It does not matter whether the organization intends to receive income, revenue or profit (not to be confused with the norms of tax law, where the periods of receipt of income and expenses for certain operations must coincide). It is important to meet certain conditions. These include:

- accounting for the costs of main production or other groups must be carried out within the framework of specific contractual obligations

- entries in accounting accounts must strictly comply with the information in the primary forms and current regulations

- there must be certainty that the transaction will result in a reduction in the economic benefits of the entity

The professional judgment of the chief accountant comes to the fore. It is this employee who is obliged to comply with all RAS standards and reflect expenses in strict accordance with the available primary documents.

Example

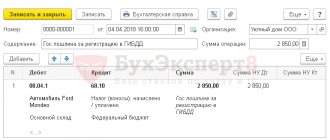

The company made an advance payment for materials under a previously concluded supply agreement, but this will not be recognized as an expense of the company. The accounting entry will be as follows:

Debit of account 60 Credit of account 51 - transfer of advance payment to the supplier of inventories (the operation will not be reflected in the expense accounts)

This interpretation is due to the fact that advance payment for inventories does not fall into the category of expenses for the company according to legal norms. It is also impossible to attribute this part to expenses due to the fact that during the event, the company’s benefits from an economic point of view will not be reduced. There will only be a change in the form of the company's asset, and a receivable will be formed from the money in the bank account.

Costs and characteristics

According to current legislative norms in the RAS segment, expenses in accounting correspond to and are assessed by the amount of reduction in the benefits of the enterprise from an economic point of view and are classified as a result of a decrease in assets and an increase in debt liabilities. This phenomenon entails a reduction in the company’s capital, but at the same time serves as the foundation for the development of the enterprise if one approaches investments in a balanced and reasonable manner.

Synthetic and analytical accounting of expenses involves their reflection in accounting accounts according to the rules for creating a database through the use of a regulated chart of accounts and in accordance with the company’s primary documentation. As part of business activities, there are items that cannot be recognized as consumables and reduce the profit of the enterprise. These must include:

- purchase by founders of assets outside of circulation

- making advance payments for MP3 and other valuables

- direct expenses in accounting for the capital of other companies

- acquisition of securities, currencies and other similar valuables

- costs to repay credit obligations and loans

- indirect expenses in accounting in excess of norms

- making transfers under commission contractual relationships

There is also a completely separate group, the so-called reimbursable expenses . Correctly structured accounting assumes that these are the costs of accounts receivable and some types of investment deposits.

Conditions for accepting expenses for accounting

Perhaps the topic of costs is one of the most important in the life of a company. Neither company owners nor the tax inspectorate pay close attention to it. For some, extra costs mean a decrease in profits. For others, unreasonable expenses are understatement of taxes. The topic of cost accounting in accounting is very extensive, but let’s get acquainted with it in this article.

Reading books and textbooks on accounting, you will find that together with the concept of Costs, the concept of Expenses is often found. Yes, so often that they sometimes even appear together in the same sentence. You can think about the equality of these concepts. However, there is a fundamental difference between them.

Costs in accounting are a reduction in the resource of an enterprise, but without its loss. Resources such as money, materials, or others are exchanged for another resource or obligation.

For example: We paid the supplier in money for previously received materials - “the money turned into materials.” Or they could first pay the supplier and thereby “fix” his obligation to us.

In any case, the resource “money” is not lost, but “transformed” either into materials or into an obligation.

Expenses in accounting are the irrevocable conversion of a company's resources to generate Revenue. For example: We sold a product and transferred it to the buyer. At this point, the cost of the goods is considered an Expense for the company.

Now that the fundamental difference between these concepts has been defined, you should be attentive to the events taking place at the enterprise so that for the words Costs and Expenses you clearly understand what their meaning is.

Every enterprise, trying to make money, is forced to spend money and incur costs. The specific list of such costs varies among firms, but there are some common ones.

For example, “office”, “employee salaries”, some types of taxes, “refilling cartridges”, “electricity”, “utilities”, “rent of premises” and many, many others.

Look at the list of specific cost items used in two operating businesses.

list of cost items

cost items list

As you can see, the list is unlimited: the names of cost items depend on the accountant. Of course, three conditions should be adhered to: a) the name must reflect the essence of the cost, b) too much detail in the articles provides a detailed analysis, but increases the complexity of registration,

c) a too general name for a cost item makes the work easier, but the possibility of detailed analysis is lost.

Along with the names of cost items, it is possible to combine them into groups. What name should I give to the group? This question is always relevant for companies. Accounting suggests assigning each cost to one of five groups: “Material costs”, “Depreciation”, “Labor costs”, “Payroll taxes”, “Other”.

If we take these five groups as a basis, then we will certainly lose a detailed cost analysis, since these groups are too generalized. The following “SALT by Account” report shows what the collected costs will look like.

Balance sheet only by cost groups

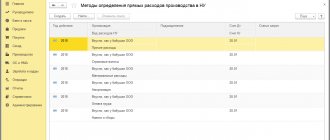

For accounting purposes this may be sufficient. But for the analysis of the activities of the enterprise, for the possibility of management decisions in such groups, detail is lost. The way out of this situation will be a special technique for filling out a list of costs. If we take the 1C Accounting program as a basis, then the “List of Costs” directory can be filled out as follows.

Directory of cost items by group

In each group that accounting offers us, we can enter any name of a cost item, thereby maintaining detail and the possibility of detailed analysis. Now the “Account SALT” report may look like this.

Balance sheet by groups and cost items

As you can see, we were able to use recommended groups and retain the necessary detail for analysis and decision making.

To account for Costs in accounting, you can find a whole list of accounts. If you write down the most basic ones, the list will be like this: 20, 25, 26, 44, 91.2, 90.2, 90.7-90.8. And this is what the settings for these accounts look like in the 1C Accounting program.

Chart of accounts – list of cost and expense accounts

Cost and Expense accounts work on the principle of collecting data and transferring it to the financial result. For most organizations, data is collected within a month. And on the last day, the collected Costs are transferred in a certain way to the financial result (closing the month).

For some accounts, this path goes straight into the financial result formula. For others, this path is not always straight. It also happens that the Cost account in some cases goes directly to the financial result, and in others it goes a long way.

For example, account 44 goes to the financial result, to 90.7. Account 91.2 is already a participant in the financial result formula. Account 26 in some cases will go to 90.

8, in other cases it will go to 20 and there it will be “lost/included” in the cost of the products received. And when the products are sold, this cost will go to 90.2. The account 25 also goes to 20 and is “included” in the cost of production.

Account 20 transmits its data in different ways. In some cases, the data goes to account 40, in others to 43 and even immediately to 90.2

The number of cost accounts a company uses depends on the type of activity. The most common situations are presented in the table.

| Activities | Cost and Expense Accounts |

| production | 20, 23, 25, 26; 44, 91.2, 90.2, 90.7 |

| provision of services | 26, 91.2, 90.8 |

| trade | 44; 91.2, 90.2, 90,7 |

| execution of work | 20, 26, 44, 91.2, 90.2, 90,7 |

Many different events occur in the life of a company. For events related to Costs and Expenses, the following types can be distinguished: a) direct purchase, b) now Cost, future Expense, c) mandatory Expenses, d) Closing of the month.

"DIRECT BUY". These are situations where a company, when making purchases from a supplier, immediately charges the amounts to cost accounts. The most common ones are purchasing a small amount of office supplies, refilling cartridges, renting premises, communication services, etc.

How it looks in the postings, look in the table

| Debit | Credit | Common situations |

| 20, 25, 26, 44 | 60, 71, 76 | rent, office, utilities, communications, consultations, etc. |

| 91.2 | 51 | bank commission for payments, for servicing a bank account (other expenses) |

“NOW A COST, IN THE FUTURE AN EXPENSE” These are situations where the path to the Cost and Expense accounts lies through previous transactions.

A good example is material values. First, we buy them and record them in the appropriate accounts.

However, material assets can deteriorate, can serve as raw materials and will be transferred to production, can be sold, or can be used for the business activities of the company.

In these cases, the cost of material assets begins to influence the financial result. The influence occurs due to the fact that their value falls into the Cost and Expense accounts and further into the financial result formula.

| Debit | Credit | Common situations |

| 10, 41 | 60, 71 | purchase of material assets |

| 20, 25, 26, 44; 90.291.2 | 10, 41 41, 4310 | transfer to production, write-off of those that have become unusable, used for household needs, sale of goods or products, sale of material |

Another example is unfulfilled obligations. The company’s interaction with counterparties is based on the “product/service – money” relationship. Since this relationship is not instantaneous, a gap arises, which can be called obligations. Depending on the situation, the counterparty may have obligations to our company, or it may be the other way around - the company owes the counterparty.

Here are two common situations:1. Our company paid the supplier and did not receive its product/service.

2. Our company sold (sold) a product/service to a counterparty-buyer and did not receive payment.

If debts are not repaid, then over time they may be recognized as debts that are unrealistic for collection or for which the statute of limitations has expired. The company will attribute these amounts to other Expenses and it turns out that it has lost its resources.

| Debit | Credit | Common situations |

| 60,76 | 50, 51 | paid the supplier (prepayment for goods/services) |

| 62 | 90.1 | sold a product/service to a buyer |

| 91.2 | 60, 62,76 | other expenses due to the inability to receive payment or delivery of goods/services from the counterparty |

The list of other Expenses is wide and requires separate study.

“MANDATORY COSTS” If we assume that the company knows how to conduct business without using the direct purchase of Costs and Expenses, there will still be situations within the company where Expenses are necessarily present. Such mandatory expenses include: a) depreciation, b) wages, c) payroll taxes, d) some taxes.

| Debit | Credit | Common situations |

| 20,25,26,44 | 02, 05 | Depreciation of Fixed Assets (Fixed Assets) and Intangible Assets (IMA) |

| 20,25,26,44 | 70 | Payroll for employees |

| 20,25,26,44 | 69.X | Calculation of taxes from the payroll fund (WF) |

| 20,25,26,44 | 68.X | Accrual of taxes that reduce profits: property, land, transport |

“CLOSE OF THE MONTH” The final result of all actions with cost and expense accounts will be the “closing of the month” event. It occurs once a month and is the very last among all actions.

According to clause 5 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated 05/06/1999 N 33n, expenses for ordinary activities are expenses associated with the manufacture of products and the sale of products, the acquisition and sale of goods. Such expenses also include expenses the implementation of which is associated with the performance of work or provision of services.

In organizations whose subject of activity is the provision for a fee for temporary use (temporary possession and use) of their assets under a lease agreement, expenses for ordinary activities are considered expenses the implementation of which is associated with this activity.

In organizations whose subject of activity is the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property, expenses for ordinary activities are considered expenses the implementation of which is associated with this activity.

In organizations whose subject of activity is participation in the authorized capital of other organizations, expenses for ordinary activities are considered expenses the implementation of which is related to this activity.