“Main production”: account 20 in accounting

The organization's expenses that are allocated to carry out operations on the main types of activities should be attributed to a special accounting account 20 “Main production”.

It should not be assumed that such costs are associated only with production cycles. This accounting account is supposed to take into account the costs of selling products, performing work or providing services, which are enshrined in the constituent documentation as the main type of activity. In other words, Accounting Account 20 for Dummies is used to record expenses for the activities for which the company was created.

Meaning of account for accounting

This position in the Chart of Accounts, referred to as “main production,” is intended to summarize data on the costs incurred in the process of creating goods, works or services. In more detail, this position is used to account for costs such as:

- creation of goods for industrial and agricultural purposes;

- carrying out geological exploration, industrial construction and other works;

- services related to the organization of transportation and communications;

- carrying out research and development work;

- repair and maintenance of highways.

The debit side of the company reflects direct costs associated directly with the company's main activities, as well as indirect costs and expenses of auxiliary production. In the first case, expenses are written off to accounts where production inventories, employee payroll, etc. are taken into account. If we talk about auxiliary production, then in this situation there is a write-off to account 20 from the credit part of position 23, referred to as “auxiliary production”.

If at the end of the reporting period there remains a certain balance at the designated position, then it reflects the value of work in progress. As for analytical accounting, it is carried out taking into account the type of costs and the type of products produced.

Features of accounting on an account 20

All expenses that the company incurs on its main activities or production are accumulated on active account 20. When accepting expenses for accounting, the accounting account is debited; when releasing finished products or providing services, the entries are credited.

A feature of accounting account 20 is that debit turnover cannot be greater than credit turnover. This means that the company cannot consume more raw materials than were written out from warehouses for the production process. Similar conditions apply to other types of expenses.

Postings to account 20 collect information about the cost of OP for the reporting period. In addition to inventories, the following can be written off as main production:

- salaries of key personnel;

- depreciation of equipment;

- administrative staff salaries;

- expenses for renting premises, paying for utilities;

- other expenses.

Brief description of account 20

Accounting costs in account 20 depend on the main activity of the company. These may be expenses for the production of industrial or agricultural products, for construction and installation work, or for the provision of transport services. The purpose of accounting on this account is to form the full or reduced cost of the main production (hereinafter - OS).

Account 20 - Main production - is regulated by the Chart of Accounts, Instructions for its application (Order of the Ministry of Finance dated October 31, 2000 No. 94n), PBU 10/99 “Organization Expenses” and other accounting standards (methodological instructions, recommendations, guidelines) for accounting for production expenses and their reflection in reporting in the context of specific economic sectors (clause 10 of PBU 10/99, letter of the Ministry of Finance of Russia dated April 29, 2002 No. 16-00-13/03).

Account 20 in accounting is an active calculation account that does not have a negative balance.

The following types of production costs are distinguished:

- acquisition of raw materials and materials for production, work, services;

- workers' compensation;

- depreciation and repair of fixed assets;

- modernization and introduction of new technologies;

- losses from marriage, etc.

If there is a positive balance at the end of the month, the account contains work in progress (work in progress, hereinafter referred to as WIP) - material assets that are in production or being processed, as well as finished products, but not yet shipped to storage warehouses.

Analytical accounting on the account is carried out in the context of types of products, cost items and divisions of the organization.

Account 20: accounting entries

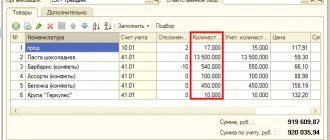

Let's look at typical accounting entries for recording operations related to core activities.

| Operation | Account debit | Account credit |

| Inventories were transferred to our own production | 20 | 10 |

| Salaries and insurance contributions of personnel directly involved in the main activities are included in the OP | 20 | 70 69 |

| Services of third-party companies are included in the costs of OP | 20 | 60 |

| Write-off of management expenses reflected | 20 | 26 |

| General production costs are written off to OP | 20 | 25 |

| Returns for reworking of finished products that were found to be defective are reflected. | 20 | 43 |

| Manufacturing defects identified prior to sale are sent for processing | 20 | 28 |

| Amounts of taxes and fees are allocated to production needs | 20 | 68 |

| Deficiencies and losses are reflected within the norms in the production process, without persons at fault | 20 | 94 |

| Downtime and claims against contractors | 20 | 76/2 |

| Semi-finished products are sent to the production process | 20 | 21 |

| The costs of auxiliary production are reflected in the OP | 20 | 23 |

| The goods were written off for the company's production needs | 20 | 41 |

| Reflects the report issued to the employee for production needs | 20 | 71 |

| The employee was compensated for costs associated with the production process (compensation for fuel and lubricants for the use of a personal car, for example) | 20 | 73 |

| Work in progress was accepted as part of targeted financing | 20 | 86 |

| Work in progress is reflected as a contribution to the authorized capital of the organization | 20 | 80 |

| Excess work in progress is taken into account | 20 | 91/1 |

| The share of deferred expenses was attributed to the OP | 20 | 96 |

Account characteristics/description:

Subaccount 20.01 “Main production” takes into account the costs of production, the products (works, services) of which were the purpose of creating this organization. The debit of subaccount 20.01 “Main production” reflects direct costs associated directly with the production of products, performance of work, provision of services, as well as expenses of auxiliary production, indirect costs associated with the management and maintenance of the main production, and losses from defects. The credit of subaccount 20.01 “Main production” reflects the amounts of the actual cost of products completed by production, work performed and services performed. These amounts can be written off from subaccount 20.01 “Main production” to the debit of accounts 43 “Output of finished products”, 40 “Output of products (works, etc.

Analytical accounting for the account is carried out by production divisions (sub-account “Divisions”), types of products (works, ) and types of production costs (sub-account “Cost Items”). Each type of manufactured product (work, service) is an element of the “Nomenclature Groups” directory. Each type of cost is an element of the “Cost Items” directory. Each production division is an element of the “Divisions” directory.

Description of the parent account: Description of account 20 “Main production”

“Entering initial balances: main production”

ENTRY: Debit 20.01 “Main production” Credit 000 “Auxiliary account”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Entering initial balances

in the “Enterprise” menu, type of business transaction: “

Work in progress (accounts 20, 23)”

“Calculation of depreciation on an item of fixed assets, which is accounted for on account 01 and is used in the main production”

ENTRY: Debit 20.01 “Main production” Credit 02.01 “Depreciation of fixed assets accounted for on account 01”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: -

Regular operation

in the menu “Operations - Closing the month” type of business operation: “

Depreciation and depreciation of fixed assets”

“Calculation of depreciation on an item of fixed assets, which is accounted for on account 03 and is used in the main production”

ENTRY: Debit 20.01 “Main production” Credit 02.02 “Depreciation of fixed assets accounted for on account 03”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: -

Regular operation

in the menu “Operations - Closing the month” type of business operation: “

Depreciation and depreciation of fixed assets”

“Calculation of depreciation on an intangible asset that is used in the main production. Depreciation is calculated by paying off the original cost of an intangible asset."

ENTRY: Debit 20.01 “Main production” Credit 04.01 “Intangible assets of the organization”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Depreciation of intangible assets and write-off of R&D expenses”

“Calculation of depreciation on an intangible asset that is used in the main production”

ENTRY: Debit 20.01 “Main production” Credit 05 “Amortization of intangible assets”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Depreciation of intangible assets and write-off of R&D expenses”

“Acceptance for accounting of returnable waste from the main production: raw materials and supplies at prices of possible use or sale (reversal)”

ENTRY: Debit 20.01 “Main production” Credit 10.01 “Raw materials and materials”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu

“Write-off of the cost of raw materials and supplies to the costs of main production”

ENTRY: Debit 20.01 “Main production” Credit 10.01 “Raw materials and materials”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Requirement-invoice

in the “Production” menu

“Adjustment of the cost of raw materials and supplies written off as main production costs”

ENTRY: Debit 20.01 “Main production” Credit 10.01 “Raw materials and materials”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Adjustment of item cost”

“Write-off of the cost of purchased semi-finished products, components, structures and parts as main production costs”

ENTRY: Debit 20.01 “Main production” Credit 10.02 “Purchased semi-finished products and components, structures and parts”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Requirement-invoice

in the “Production” menu

“Adjustment of the cost of purchased semi-finished products, components, structures and parts written off as main production costs”

ENTRY: Debit 20.01 “Main production” Credit 10.02 “Purchased semi-finished products and components, structures and parts”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Adjustment of item cost”

“Acceptance for accounting of returnable waste from main production: purchased semi-finished products, components, structures and parts at prices of possible use or sale (reversal)”

ENTRY: Debit 20.01 “Main production” Credit 10.02 “Purchased semi-finished products and components, structures and parts”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Write-off of fuel costs as main production costs”

ENTRY: Debit 20.01 “Main production” Credit 10.03 “Fuel”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Requirement-invoice

in the “Production” menu

“Adjustment of the cost of fuel written off as main production costs”

ENTRY: Debit 20.01 “Main production” Credit 10.03 “Fuel”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Adjustment of item cost”

“Write-off of the cost of containers and packaging materials for the costs of main production in organizations engaged in production activities or provision of services”

ENTRY: Debit 20.01 “Main production” Credit 10.04 “Containers and packaging materials”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Requirement-invoice

in the “Production” menu

“Adjustment of the cost of packaging and packaging materials written off as costs of main production in organizations engaged in production activities or provision of services”

ENTRY: Debit 20.01 “Main production” Credit 10.04 “Containers and packaging materials”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Adjustment of item cost”

“Write off the cost of spare parts to the costs of main production”

ENTRY: Debit 20.01 “Main production” Credit 10.05 “Spare parts”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Requirement-invoice

in the “Production” menu

“Adjustment of the cost of spare parts written off as main production costs”

ENTRY: Debit 20.01 “Main production” Credit 10.05 “Spare parts”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Adjustment of item cost”

“Write-off of the cost of other materials to the costs of main production”

ENTRY: Debit 20.01 “Main production” Credit 10.06 “Other materials”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Requirement-invoice

in the “Production” menu

“Adjustment of the cost of other materials written off as main production costs”

ENTRY: Debit 20.01 “Main production” Credit 10.06 “Other materials”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Adjustment of item cost”

“Write-off of the cost of building materials to the costs of main production”

ENTRY: Debit 20.01 “Main production” Credit 10.08 “Building materials”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Requirement-invoice

in the “Production” menu

“Adjustment of the cost of building materials written off as main production costs”

ENTRY: Debit 20.01 “Main production” Credit 10.08 “Building materials”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Adjustment of item cost”

“Acceptance for accounting of returnable waste from the main production: construction materials at prices of possible use or sale (reversal)”

ENTRY: Debit 20.01 “Main production” Credit 10.08 “Building materials”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Write-off of the cost of inventory and household supplies to the costs of main production upon transfer to operation”

ENTRY: Debit 20.01 “Main production” Credit 10.09 “Inventory and household supplies”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Transfer of materials to operation

in the “Production” menu

“Write-off of the cost of special clothing for production of products to the costs of main production during the useful life”

ENTRY: Debit 20.01 “Main production” Credit 10.11.1 “Special clothing in use”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: -

Regular operation

in the menu “Operations - Closing the month” type of business operation: “

Repayment of the cost of work clothes and special equipment”

“Write-off of special clothing from use as a cost of main production”

ENTRY: Debit 20.01 “Main production” Credit 10.11.1 “Special clothing in use”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Disposal of materials from use

in the “Production” menu

“Write-off of the cost of special equipment as costs of main production during its useful life”

ENTRY: Debit 20.01 “Main production” Credit 10.11.2 “Special equipment in operation”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: -

Regular operation

in the menu “Operations - Closing the month” type of business operation: “

Repayment of the cost of work clothes and special equipment”

“Write-off of the cost of special equipment from operation to the costs of main production”

ENTRY: Debit 20.01 “Main production” Credit 10.11.2 “Special equipment in operation”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Disposal of materials from use

in the “Production” menu

“Write-off of the amount of non-refundable VAT on material resources used in the main production, exempt from VAT”

ENTRY: Debit 20.01 “Main production” Credit 19.03 “VAT on purchased inventories”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

VAT write-off

in the menu “Purchase — Maintaining a purchase book”

“Inclusion of VAT on acquired material assets in the costs of the main production, to which material assets were previously written off”

ENTRY: Debit 20.01 “Main production” Credit 19.04 “VAT on purchased purchases - Maintaining a purchase book”

“Inclusion in the costs of the main production unit of services provided by another main production unit”

ENTRY: Debit 20.01 “Main production” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu“Transfer of semi-finished products to main production for further refinement”

ENTRY: Debit 20.01 “Main production” Credit 21 “Semi-finished products of own production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu“Inclusion in the costs of the main production of services provided by the auxiliary production division”

ENTRY: Debit 20.01 “Main production” Credit 23 “Auxiliary production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Closing accounts 20, 23, 25, 26″“Inclusion in the costs of the main production of the amount of overhead costs”

ENTRY: Debit 20.01 “Main production” Credit 25 “General production expenses”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Closing accounts 20, 23, 25, 26″“Inclusion of the amount of general business expenses into the costs of the main production. According to the accounting policy, the organization does not use the direct costing method"

ENTRY: Debit 20.01 “Main production” Credit 26 “General expenses”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Closing accounts 20, 23, 25, 26″“Write-off of the cost of defects to the costs of main production”

ENTRY: Debit 20.01 “Main production” Credit 28 “Defects in production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”“Write-off of the cost of finished products as expenses of the main production (rework, re-processing, etc.)”

ENTRY: Debit 20.01 “Main production” Credit 43 “Finished products”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Requirement-invoice

in the “Production” menu“Inclusion of third-party services into the costs of main production. Reflection of debt to the supplier for production services provided under the contract in rubles.”

ENTRY: Debit 20.01 “Main production” Credit 60.01 “Settlements with suppliers and contractors”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt of goods and type of business transaction: “ Purchase, commission”“Reflection of debt to the supplier for rendered production services for processing under a contract in rubles.”

ENTRY: Debit 20.01 “Main production” Credit 60.01 “Settlements with suppliers and contractors”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt from processing

in the “Production” menu“Inclusion of third-party services into the costs of main production. Reflection of debt to the supplier for production services provided under the contract in foreign currency"

ENTRY: Debit 20.01 “Main production” Credit 60.21 “Settlements with suppliers and contractors (in foreign currency)”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt of goods and type of business transaction: “ Purchase, commission”“Reflection of debt to the supplier for rendered production services for processing under a contract in foreign currency”

ENTRY: Debit 20.01 “Main production” Credit 60.21 “Settlements with suppliers and contractors (in foreign currency)”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt from processing

in the “Production” menu“Inclusion of third-party services into the costs of main production. Reflection of debt to the supplier for production services provided under the contract in monetary units.”

ENTRY: Debit 20.01 “Main production” Credit 60.31 “Settlements with suppliers and contractors (in cu)”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt of goods and type of business transaction: “ Purchase, commission”“Reflection of debt to the supplier for rendered production services for processing under the contract in monetary units.”

ENTRY: Debit 20.01 “Main production” Credit 60.31 “Settlements with suppliers and contractors (in cu)”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt from processing

in the “Production” menu“Inclusion of transport tax in the costs of the main production”

ENTRY: Debit 20.01 “Main production” Credit 68.07 “Transport tax”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”“Inclusion in the costs of main production of the amount of insurance premiums in the part transferred to the Social Insurance Fund”

ENTRY: Debit 20.01 “Main production” Credit 69.01 “Social insurance settlements”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Calculation of taxes (contributions) from the payroll

in the “Salary” menu“Inclusion in the costs of main production of the amount of the insurance part of the labor pension”

ENTRY: Debit 20.01 “Main production” Credit 69.02.1 “Insurance part of labor pension”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Calculation of taxes (contributions) from the payroll

in the “Salary” menu“Inclusion in the costs of main production of the amount of the funded part of the labor pension”

ENTRY: Debit 20.01 “Main production” Credit 69.02.2 “Cumulative part of labor pension”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Calculation of taxes (contributions) from the payroll

in the “Salary” menu“Inclusion in the costs of the main production of the amount of insurance premiums in the part transferred to the federal compulsory medical insurance fund”

ENTRY: Debit 20.01 “Main production” Credit 69.03.1 “Federal Compulsory Medical Insurance Fund”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Calculation of taxes (contributions) from the payroll

in the “Salary” menu“Inclusion in the costs of main production of the amount of insurance premiums in the part transferred to the territorial compulsory medical insurance fund”

ENTRY: Debit 20.01 “Main production” Credit 69.03.2 “Territorial compulsory medical insurance fund”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Calculation of taxes (contributions) from the payroll

in the “Salary” menu“Inclusion in the costs of the main production of the amount of unified social tax in the part transferred to the Federal budget”

ENTRY: Debit 20.01 “Main production” Credit 69.04 “Unified social tax in the part transferred to the Federal budget”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Calculation of taxes (contributions) from the payroll

in the “Salary” menu“Inclusion in the costs of main production of expenses for compulsory social insurance against accidents at work and occupational diseases”

ENTRY: Debit 20.01 “Main production” Credit 69.11 “Calculations for compulsory social insurance against industrial accidents and occupational diseases”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Calculation of taxes (contributions) from the payroll

in the “Salary” menu“Inclusion in the costs of main production of expenses for voluntary contributions to the Social Insurance Fund for insurance of employees in case of temporary disability”

ENTRY: Debit 20.01 “Main production” Credit 69.12 “Calculations for voluntary contributions to the Social Insurance Fund for employee insurance in case of temporary disability”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Calculation of taxes (contributions) from the payroll

in the “Salary” menu“Inclusion in the costs of main production of expenses from the Social Insurance Fund for policyholders paying UTII”

ENTRY: Debit 20.01 “Main production” Credit 69.13.1 “Calculations using Social Insurance Fund funds for policyholders paying UTII”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Calculation of taxes (contributions) from the payroll

in the “Salary” menu“Inclusion in the costs of the main production of expenses from the Social Insurance Fund for insurers using the simplified tax system”

ENTRY: Debit 20.01 “Main production” Credit 69.13.2 “Settlements using Social Insurance Fund funds for policyholders using the simplified tax system”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Calculation of taxes (contributions) from the payroll

in the “Salary” menu“Payroll for workers in primary production”

ENTRY: Debit 20.01 “Main production” Credit 70 “Settlements with personnel for wages”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Calculation of salaries to employees

in the “Salary” menu“Inclusion in the costs of the main production of the amount of expenses incurred by the accountable person in rubles.”

ENTRY: Debit 20.01 “Main production” Credit 71.01 “Settlements with accountable persons”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Advance report

in the “Cashier” menu“Inclusion in the costs of the main production of the amount of expenses incurred by the accountable person in foreign currency”

ENTRY: Debit 20.01 “Main production” Credit 71.21 “Settlements with accountable persons (in foreign currency)”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Advance report

in the “Cashier” menu“Inclusion in the costs of the main production of the amount of accrued compensation to workers for the use of a personal car to perform transport work for the main production”

ENTRY: Debit 20.01 “Main production” Credit 73.03 “Settlements for other operations”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”“Inclusion in the costs of main production of expenses for property and personal insurance in rubles.”

ENTRY: Debit 20.01 “Main production” Credit 76.01.1 “Calculations for property and personal insurance”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt of goods and type of business transaction: “ Purchase, commission”“Inclusion in the costs of main production of expenses for voluntary insurance of employees in case of death”

ENTRY: Debit 20.01 “Main production” Credit 76.01.2 “Payments (contributions) for voluntary insurance in case of death and personal injury”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Write off deferred expenses”“Inclusion in the costs of the main production of the amount of claims not satisfied by arbitration or court (against electricity supply, water supply, etc.) organizations in rubles.”

ENTRY: Debit 20.01 “Main production” Credit 76.02 “Calculations for claims”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt of goods and type of business transaction: “ Purchase, commission”“Inclusion in the costs of the main production of services of other suppliers and contractors under a contract in rubles.”

ENTRY: Debit 20.01 “Main production” Credit 76.05 “Settlements with other suppliers and contractors”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt of goods and type of business transaction: “ Purchase, commission”“Inclusion in the costs of main production of expenses for property and personal insurance in foreign currency”

ENTRY: Debit 20.01 “Main production” Credit 76.21 “Calculations for property and personal insurance (in foreign currency)”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt of goods and type of business transaction: “ Purchase, commission”“Inclusion in the costs of the main production of the amount of claims not satisfied by arbitration or court (against electricity supply, water supply, etc.) organizations in foreign currency”

ENTRY: Debit 20.01 “Main production” Credit 76.22 “Calculations for claims (in foreign currency)”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt of goods and type of business transaction: “ Purchase, commission”“Inclusion in the costs of the main production of services of other suppliers and contractors under a contract in foreign currency”

ENTRY: Debit 20.01 “Main production” Credit 76.25 “Settlements with other suppliers and contractors (in foreign currency)”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt of goods and type of business transaction: “ Purchase, commission”“Inclusion in the costs of the main production of the amount of claims not satisfied by arbitration or court (to electricity supply organizations, water supply, etc.) in monetary units.”

ENTRY: Debit 20.01 “Main production” Credit 76.32 “Calculations for claims (in cu)”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt of goods and type of business transaction: “ Purchase, commission”“Inclusion in the costs of the main production of services of other suppliers and contractors under a contract in monetary units.”

ENTRY: Debit 20.01 “Main production” Credit 76.35 “Settlements with other suppliers and contractors (in cu)”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt of goods and type of business transaction: “ Purchase, commission”“Inclusion in the costs of the main production of production services provided by another separate division allocated to a separate balance sheet”

ENTRY: Debit 20.01 “Main production” Credit 79.02 “Calculations for current operations”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Advice for other transactions included

in the “Operations” menu“Inclusion in the costs of the main production of the amount of identified shortages within the limits of natural loss norms”

ENTRY: Debit 20.01 “Main production” Credit 94 “Shortages and losses from damage to valuables”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”“Attribution to expenses of the main production of a recognized estimated liability (expenses for the formation of a reserve)”

ENTRY: Debit 20.01 “Main production” Credit 96 “Reserves for future expenses”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”“Inclusion in the costs of main production of a part of future expenses for wages”

ENTRY: Debit 20.01 “Main production” Credit 97.01 “Payroll expenses for deferred periods”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Write off deferred expenses”“Inclusion of part of the expenses of future periods into the costs of main production”

ENTRY: Debit 20.01 “Main production” Credit 97.21 “Other deferred expenses”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Write off deferred expenses”“Production of products from customer-supplied raw materials by the main production at planned prices”

ENTRY: Debit 20.02 “Production of products from customer-supplied raw materials” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu“Production of semi-finished products from our own main production at planned cost”

ENTRY: Debit 21 “Semi-finished products of own production” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu“Adjustment of the cost of semi-finished products of own production (main) for the difference between the planned and actual cost”

ENTRY: Debit 21 “Semi-finished products of own production” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Closing accounts 20, 23, 25, 26″“Production of semi-finished products of our own production at the planned cost. According to the accounting policy, the organization produces products without using account 40 “Product Output”

ENTRY: Debit 21 “Semi-finished products of own production” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu“Inclusion in the costs of auxiliary production of the costs of services provided by its own production unit”

ENTRY: Debit 23 “Auxiliary production” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu“Write-off for general production expenses of services provided by its own production unit”

ENTRY: Debit 25 “General production expenses” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu“Write-off for general business expenses of services provided by its own production unit”

ENTRY: Debit 26 “General business expenses” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu“Return of raw materials and materials previously released for main production”

ENTRY: Debit 29 “Service production and facilities” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”“Output of finished products, completed works and services provided by the main production at actual production cost (using account 40 “Product Output”)”

ENTRY: Debit 40 “Product output (work, Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Closing accounts 20, 23, 25, 26″“Release of finished products by the main production at planned cost (without using account 40 “Product Output”)”

ENTRY: Debit 43 “Finished products” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu“Adjustment of the cost of finished products produced by the main production for the difference between the planned and actual costs (without using account 40 “Product Output”)”

ENTRY: Debit 43 “Finished products” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Closing accounts 20, 23, 25, 26″“Performance of work by the main production, provision of production services to another separate division allocated to a separate balance sheet”

ENTRY: Debit 79.02 “Calculations for current operations” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Advice for other transactions included

in the “Operations” menu“Performance of work, provision of production services at planned prices for activities not subject to UTII”

ENTRY: Debit 90.02.1 “Cost of sales for activities with the main tax system” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Act on the provision of production“Sales of production services without using planned prices for activities not subject to UTII”

ENTRY: Debit 90.02.1 “Cost of sales for activities with the main tax system” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Sales of goods and type of business transaction: “ Sale, commission”“Performance of work, provision of production services at planned prices for activities subject to UTII”

ENTRY: Debit 90.02.2 “Cost of sales for certain types of activities with a special taxation procedure” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Act on the provision of production“Performance of work, provision of production services without using planned prices for activities subject to UTII”

ENTRY: Debit 90.02.2 “Cost of sales for certain types of activities with a special taxation procedure” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Sales of goods and type of business transaction: “ Sale, commission”“Inclusion of expenses for other types of insurance into the costs of main production”

ENTRY: Debit 20.01 “Main production” Credit 76.01.9 “Payments (contributions) for other types of insurance”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Write off deferred expenses”“Inclusion in the costs of main production of the amount of contributions for additional payments to the pensions of flight crew members”

ENTRY: Debit 20.01 “Main production” Credit 69.02.3 “Contributions to supplement pensions for flight crew members”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Calculation of taxes (contributions) from the payroll

in the “Salary” menu“Inclusion in the costs of main production of the amount of voluntary contributions to the funded part of the labor pension at the expense of the employer”

How to close a 20 account: 3 methods

At the end of the reporting period, for example a month, it is not necessary to close account 20. The debit balance in the account reflects the value of the company's work in progress. The company's accounting department needs to organize an inventory of work in progress while simultaneously checking workshops, warehouses and payroll records.

Postings for closing account 20 are generated when releasing finished products, when transferring produced material assets directly to customers, or when performing work or services.

Current accounting standards provide for three methods for closing accounting accounts 20:

- Direct method.

- Intermediate method.

- Direct sales of manufactured products.

IMPORTANT!

The company must independently determine the method of writing off costs from account 20. The decision must be documented, detailing the chosen method in the accounting policy.

Before closing account 20, the accountant must highlight the balances of work in progress. But only if there are such residues. If the production cycle does not include work in progress balances, account 20 is closed completely.

Important features of account 20

Account 20 “Main production” has a number of distinctive features:

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

- Before closing account 20 - Main production - it is necessary to take an inventory of the balances of work in progress.

- The list of expenses related to the main production, the chosen method of closing account 20, the method of accounting for management expenses (at full or reduced cost), the distribution base when producing several types of products or accounting for work, services under different contracts - all these important accounting elements must be approved in accounting policy.

- Small enterprises have the right to maintain simplified accounting:

- integrated accounting of all production costs only on account 20, without using accounts 21, 23, 26, 29, 44;

- accounting for fixed assets and inventories in a special manner, without the formation of work in progress balances;

- write-off of expenses as current immediately into the cost of sales (information message of the Ministry of Finance dated June 24, 2016 No. IS-accounting-3).

Direct method of closing account 20

The direct method is used when the actual price of goods, works and services produced during the reporting period is unknown. Accounting is carried out according to conditional price indicators, for example, according to planned cost.

At the end of the reporting period, the cost of manufactured products is adjusted to actual cost figures.

Typical wiring:

| Operation | Account debit | Account credit |

| An adjustment to the cost of manufactured products is reflected | 43 | 20 |

| Identified deviations of the actual cost from the planned cost are written off to the cost of sales | 90/02 | 43 |

Examples of closing an account in 20 other ways

The organization's accounting policies may indicate other methods of closing an account 20.

How is account 20 closed at the end of the month using the remaining methods: intermediate and direct implementation?

The conditions of the example remain the same as in the previous section - for ease of comparison of accounting using different methods.

IMPORTANT! The same wiring as the direct method is not repeated. Only differences are shown.

Intermediate method. Account 40 “Product Output” is used:

| 43 | 40 | 77 000 | Production of scooters at planned cost |

| The end of the month | |||

| 40 | 20 | 82 000 | Adjustment of production output |

| 43 | 40 | 5 000 | Adjustment of planned cost to actual cost |

| 90.02 | 43 | 3 636 | Adjustment of cost of sales |

Direct sales of products

| 90.02 | 20 | 56 000 | The planned cost of scooters sold was written off |

| The end of the month | |||

| 90.02 | 20 | 3 636 | Adjustment of cost of sales |

Intermediate method

When using the intermediate method of closing account 20, account 40 “Product Output” is additionally used as an auxiliary account. This account is used to record deviations of the planned cost from the actual cost. The credit of account 40 reflects the planned cost, and the debit shows the actual cost.

At the end of the reporting period, the balance is written off proportionally: part - to account 43 “Finished products” and part - to subaccount 90/02 “Cost of sales”.

Typical transactions during the month:

| Operation | Account debit | Account credit |

| The receipt of finished products at the planned cost is reflected | 43 | 40 |

| Products sold are written off at planned cost | 90/02 | 43 |

At the end of the month, the accounting records reflect:

| Operation | Debit | Credit |

| The write-off of the actual cost of manufactured products is reflected | 40 | 20 |

| Corrective entries are reflected that bring the planned cost to actual figures. | 43 | 40 |

| 90/02 | 40 |

Three Cost Allocation Methods

Three methods have been adopted for allocating costs for main production:

- Straight.

- Indirect (intermediate).

- Direct sales of manufactured products.

Ease of direct sales of manufactured products

The simplest of them is direct implementation. It is suitable for companies that provide services. Since the issue of trade, defects and work in progress does not arise, you can apply the accounting certificate in 1C, regardless of the configuration.

It is necessary to create a balance sheet for account 20 in order to see the final balance at closing. Go to the “Accounting, Taxes, Reporting” menu, “Accounting” submenu. Find the section “Operations entered manually” or “Operations log” and click the “Create” button. You need to enter the following wiring into the operation:

- Dt 90.02 “Cost of sales” Kt 20 - enter the debit balance from the balance sheet.

From the author! With this method, detailed analytics are not carried out. All costs add up to 2-3 standard types, otherwise transactions to close account 20 will take a lot of time.

For example, for Creator LLC, renting its own non-residential premises is the main activity. The cost of rent consists of a variety of direct and indirect costs. Account 20 collected expenses in the amount of 6,000,000 rubles:

- utility costs for the maintenance of rented premises;

- repair and emergency work;

- salaries of employees serving tenants;

- taxes and fees on employee salaries;

- rental of land plots on which buildings stand.

Table 1. Analysis of account 20 for August 2020 Limited Liability Company "Creator"

| Cor. Check | Debit | Credit | ||

| Opening balance | ||||

| 02 | 740.953,52 | |||

| 10 | 633.633,68 | |||

| 23 | 1.589.272,19 | |||

| 26 | 602.185,03 | |||

| 60 | 1.200.496,72 | |||

| 69 | 264.734,74 | |||

| 70 | 882.449,12 | |||

| 71 | 19500,00 | |||

| 76 | 66.775,00 | |||

| 90 | 6.000.000,00 | |||

| Turnover | 6.000.000,00 | 6.000.000,00 | ||

| Closing balance | ||||

Output data: BU (accounting data)

Once a month, the accounting department issues acts to tenants using the document “Sales of services” in 1C, which generates the following transactions:

- Dt 62.01 “Settlements with buyers and customers” Kt 90.01 “Revenue” - for the rental amount of 9,400,000 rubles;

- Dt 90.03 “Value Added Tax” Kt 68.02 “Value Added Tax” - 18% VAT in the amount of RUB 1,433,898.31 is allocated. to be paid to the budget.

When closing a period, the method of direct sales of released products is used:

- Dt 90.02 Kt 20 - the actual cost of 6,000,000 rubles is closed.

Therefore, net revenue will be:

- 9,400,000 - 1,433,898.31 - 6,000,000 = 1,966,101.69 rubles.

When the actual cost is unknown

The direct method is used in manufacturing enterprises if the actual cost of finished products is unknown. Therefore, the company takes into account costs at the planned cost, and at the end of the month makes an adjustment, bringing the price of manufactured products to the actual price. Wiring used:

- Dt 43 “Finished products” Kt 20 - for the amount of adjustment;

- Dt 90.02 Kt 43 - deviations of the actual cost from the planned cost are written off.

Using an intermediate method

The indirect method involves the participation of 40 “Release of products (works, services)”. It simultaneously takes into account the planned (credit) and actual (debit) cost. Balance at 40 is the resulting deviations. The accounting department needs to close interim accounts at the end of the month:

- Dt 43 Kt 40 - finished products are received at the planned price;

- Dt 90.02 Kt 43 - products sold are written off at planned cost;

- Dt 40 Kt 20 - the cost of production is written off in fact;

- Dt 43 Kt 40 - adjustment between two costs;

- Dt 90.02 Kt 40 - all adjustments are written off.

From the author! Using the interim cost allocation method involves manually closing the month.

Method of direct sales of released products

This method of accounting is used when manufactured products are sold to customers immediately and are not stored at the enterprise. In this case, production costs are written off to cost of sales. For example, services provided by organizations are closed on account 20 using the direct sales method.

Typical wiring:

| Operation | Debit | Credit |

| The actual cost of services provided is written off to cost of sales | 90/02 | 20 |

Closing the 20th account in 1C

The topic of closing the 20th account never loses its relevance and raises a large number of questions from both beginners and experienced accountants. We will discuss the procedure for closing an account depending on the nature of the enterprise’s activities and the operations reflected in the program. Using the example of the 1C: Accounting program ed. 3.0 we will look at how the closure of cost accounts is automated, what accounting policy settings affect the correctness of transactions. We’ll also talk about the main mistakes that may occur.

Account 20.01 is closed monthly (except for cases where part of the costs remains in work in progress). Closing an account in the program is automated and occurs as a routine operation at the end of the month. That is, if all operations in which the 20th account is involved are reflected correctly in the program, then it will close automatically.

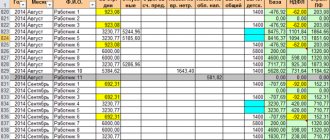

Let's start with the organization's accounting policy settings. To check the accounting policy settings in the 1C: Accounting program 8th ed. 3.0 you need to go to the Main → Accounting Policy section. Here we indicate what types of activities are reflected in account 20.01 “Main production”. The program provides us with a choice of one of two options: “Production of products” or “Performing work, specifying services.” After selecting the setting option in the “Closing the month” processing, the routine operation “Closing accounts 20, 23, 25, 26” appears, which is responsible for automatically closing the account.

Next, you need to determine the procedure for closing the 20th account: “without taking into account revenue”, “taking into account all revenue”, “taking into account revenue only from production services”. In the first case, account 20.01 is closed immediately, secondly, the account will be closed only if there is revenue from the item group selected on the 20th account, and thirdly, it depends on the availability of the document “Provision of production services” in the current period.

Now let’s check the settings for closing the 20th account in tax accounting. Here I want to make a small digression and say that there are often situations when account 20.01 is closed in accounting on 90.02, and in tax account on 90.08. This contradicts the accounting methodology and entails incorrect completion of the “Income Tax Declaration” (direct expenses fall into indirect expenses). To prevent this from happening, you need to go from the “Main” section to the “Taxes and Reports” subsection → “Income Tax” and set the “List of direct expenses”. Here we indicate the main cost items, or more precisely, the main types of expenses specified in them in tax accounting, which should be classified as direct expenses. Typically, the following list of types of expenses is indicated here (if necessary, it can be adjusted): “Depreciation”, “Material costs”, “Taxes and fees”, “Payroll”, “Insurance premiums”, “Other expenses”. In total, each direct cost account has six entries, each of which is filled out, as shown in Figure 1 (only the type of expense in NU and the debit account are selected). Important note: this list must be created annually, since the validity period is set for a specific working year.

After the accounting policy settings have been checked, we will look at examples of how the 20th account is closed. The bakery “Tasty Like Grandma’s”, which produces baked goods, will help us with this.

The organization produces products monthly, issuing them in the “Shift Production Report” program in the “Production” section. This document creates an entry for the debit of account 43 and the credit of account 20 for the planned cost of finished products. When closing the month, the program will adjust the cost of production to the actual cost, calculated based on the actual costs collected on account 20.01.

Now about the actual costs. The most common of them are material expenses, wages of workers employed in the main production and salary taxes, depreciation of fixed assets related to the main type of activity, and services of third-party organizations.

Everything is clear with material expenses, we write it off to the 20th account using the document “Requirement-invoice” or fill out the “Materials” tab in the Production Report for the shift. Be sure to indicate the invoice and cost item, item group.

Salaries of workers in primary production. The way wages are reflected in accounting is determined by the way wages are reflected, which is configured in the “Pay and Personnel” section, subsection “Salary Settings” → “Reflection in Accounting”. We also indicate invoice 20.01, the cost item “Payment” and fill in the fields “Nomenclature group”, “Products”. (Figure 2). Personal income tax and contributions will be automatically charged to the same account.

As for depreciation of fixed assets, the cost account we need is specified in the method of reflecting depreciation selected in Acceptance for accounting of fixed assets. Depreciation is calculated using a routine operation at the end of the month.

If there are services from third-party organizations, then in the document “Receipts (acts, invoices)” select account 20.01 and item group.

After all operations have been completed, you can proceed to closing the month. To do this, go to the “Operations” section → Closing the period → Closing the month. When the closure of the month is completed, open the routine operation “Closing accounts 20, 23, 25, 26”, click “Show transactions”. We see that account 20.01 is closed on 90.02 in accounting and tax accounting (Figure 3). This is the correct behavior of the program in accordance with accounting methodology. If you need to leave a balance on account 20.01 for the current month, you can use the document “WIP Inventory” in the “Production” section indicating the cost account and item group.

If, when performing a routine operation, errors occur or the closing of the month is completed, but the final balance remains on the 20th account and, according to the Accounting Policy settings, the account is closed taking into account all revenue, you need to create a balance sheet for accounts 20.01 and 90.01.1, grouped by nomenclature groups. The item groups of the accounts must match.

This concludes our conversation. We have discussed the procedure for closing the 20th account depending on the operations carried out in the program and the accounting policy settings. I hope you find the information here helpful, thank you for your time, and good luck with your accounting!

If you would like to receive individual advice on this issue, you can contact our 1C Consultation Line. If an oral consultation is not enough, our expert can remotely connect to your computer and help you find the optimal solution to the problem. The first consultation is completely free!

If you liked the article, like it and share it with your colleagues.

Work in 1C with pleasure!

Accounting and write-off of general production and general business expenses.

The costs of maintaining, organizing and managing workshops (other production units) of the main, auxiliary and service industries are classified as general production expenses. General production expenses include:

– cost of materials, spare parts used for maintenance and repair of production equipment;

– labor costs for employees involved in servicing production (foremen, shop managers, technologists, workers performing maintenance and repair of technological equipment), with deductions for social needs;

– depreciation charges and costs for repairs of fixed assets and other property used in production;

– costs of dismantling equipment, costs of materials, parts, purchased semi-finished products used in setting up equipment;

– rent for premises, machinery, equipment and other fixed assets used in production;

– costs associated with the operation of fixed assets directly involved in production (gas, fuel, electricity, etc.);

– depreciation charges for intangible assets used in production;

– the cost of shortages and losses from downtime, damage to valuables in production and warehouses, etc.

During the reporting period, general production expenses are reflected in the debit of account 25 of the same name. At the same time, expenses are recorded on account 25 in the context of each production unit. In accounting, overhead costs are reflected by the following entries:

D 25 K 10 – the cost of materials, spare parts used for maintenance and repair of equipment is written off;

D 25 K 70 – salaries of general production personnel have been accrued;

D 25 K 69 – contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases are accrued from the salaries of general production personnel;

D 25 K 23 (60, 76) – expenses for maintaining premises are written off (repairs, rent for premises, equipment, payment for utilities, etc.);

D 25 K 02 (05) – depreciation was accrued on fixed assets (intangible assets) used in the main (auxiliary) production.

This procedure follows from the provisions of paragraph 9 of PBU 10/99 “Expenses of the organization”, Instructions for the chart of accounts, letter of the Ministry of Finance of Russia dated November 8, 2005 No. 07-05-06/294.

Costs associated with managing an organization, organizing its economic activities, and maintaining its common property are classified as general business expenses.

General business expenses include:

– labor costs for administrative, managerial and general business personnel (with deductions for social needs);

– rent, depreciation, costs for current repairs of buildings, structures and equipment for general corporate and administrative purposes;

– security costs;

– costs of training and personnel selection;

– expenses for payment of communication services;

– office and postal and telegraph expenses;

– labor protection costs, etc.

During the reporting period, general business expenses are reflected in the debit of the same name account 26:

D 26 K 10 (21) – materials (semi-finished products of own production) spent on general economic needs are written off;

D 26 K 70 – salaries of administrative, managerial and general business personnel have been accrued;

D 26 K 69 – contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases are accrued from the salaries of administrative, managerial and general business personnel;

D 26 K 60, 76 – the cost of work (services) performed by third parties (for example, auditing, consulting services) is taken into account as part of general business expenses;

D 26 K 02 (05) – depreciation was accrued on fixed assets (intangible assets) for general economic and administrative purposes.

General production and general business expenses are associated with the production of different types of products (works, services), and also ensure the operation of the organization as a whole. Therefore, unlike direct (primary) costs, these costs are considered indirect (overhead).

At the end of the reporting period, accounts 25 and 26 are closed. The expenses accumulated on them are written off to the debit of accounts: 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities” or 90 “Sales” in proportion to the indicators that must be established in the accounting policy for accounting purposes (clause 7 PBU 1/2008 “Accounting policies of the organization).

The basis for the distribution of indirect costs between main, auxiliary and service production can be, for example, the following indicators:

– wages of main production workers;

– direct costs with a workshop structure of the organization;

– the number of machine-hours worked for the equipment;

– size of production area;

– volume of production in natural or cost terms.

For example, in industries with a significant share of labor costs, it is advisable to distribute indirect costs in proportion to the salaries of the main production workers. Indirect costs are distributed in proportion to material costs (cost of raw materials, supplies, spare parts, etc.) if they constitute a significant share of the cost of production.

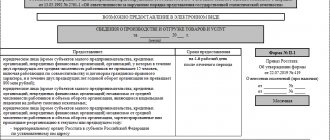

Example. Allocation of indirect costs associated with fulfilling a production order. The organization uses the custom costing method

In April, OJSC “Proizvodstvennaya” accepted and completed two production orders (No. 1 and No. 2) for the manufacture of special transport equipment. The accounting policy of “Master” stipulates that general production and general business expenses are distributed in proportion to the salaries of production workers involved in fulfilling each order.

In April, the actual amount of expenses was:

– general production – 100,000 rubles;

– general business – 125,000 rubles.

Direct costs for order No. 1 were:

– cost of materials used – 82,300 rubles;

– salary of production workers – 68,500 rubles;

– the amount of contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases from the salaries of production workers – 18,427 rubles.

Total for order No. 1 – RUB 169,227.

Direct costs for order No. 2 were:

– cost of materials used – 151,500 rubles;

– the amount of accrued wages of production workers – 55,000 rubles;

– the amount of contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases from the salaries of production workers – 14,795 rubles.

Total for order No. 2 – RUB 221,295.

The total salary of production workers for both orders was 123,500 rubles. (RUB 68,500 + RUB 55,000).

The share of wages of production workers in the total amount of their wages is equal to:

– for order No. 1 – 55% (RUB 68,500 / RUB 123,500);

– for order No. 2 – 45% (55,000 rubles / 123,500 rubles).

The cost of order No. 1 includes:

– part of general production expenses in the amount of 55,000 rubles. (RUB 100,000 * 55%);

– part of general business expenses in the amount of 68,750 rubles. (RUB 125,000 * 55%).

The actual cost of order No. 1 was:

RUB 169,227 + 55,000 rub. + 68,750 rub. = 292,977 rub.

The cost of order No. 2 includes:

– part of general production expenses in the amount of 45,000 rubles. (RUB 100,000 – RUB 55,000);

– part of general business expenses in the amount of 56,250 rubles. (RUB 125,000 – RUB 68,750).

The actual cost of order No. 2 was:

RUB 221,295 + 45,000 rub. + 56,250 rub. = 322,545 rub.

When writing off general production expenses (after distribution), the following entries are made:

D 20 (23, 29) K 25 – general production expenses for the reporting month are written off.

General business expenses can be written off in one of three ways:

– to account 20 “Main production” (23 “Auxiliary production”, 29 “Service production and facilities”);

- to account 90-2 “Cost of sales”.

– on account 97 “Future expenses”.

The chosen method of writing off general business expenses is fixed in the accounting policy for accounting purposes (clause 7 of PBU 1/2008, clause 20 of PBU 10/99).

In the first case, general business expenses form the “full” cost of finished products and are written off at the end of the month.

Write-off of general business expenses (after distribution) is reflected by posting:

D 20 (23, 29) K 26 – general business expenses associated with the activities of the main (auxiliary, servicing) production are written off.

In the second case, a “reduced” cost of finished products is formed, and general business expenses are completely written off for sales, regardless of how many products were sold in the reporting period.

At the moment of transfer of ownership of the shipped products (results of work or services) to the buyer, the proceeds from its sale are reflected and the cost of the products (work, services) sold is written off:

D 62 K 90-1 – revenue from the sale of products is reflected;

D 90-2 K 43 – the actual cost of shipped products (work performed, services rendered) is written off;

D 90-3 K 68 subaccount “Calculations for VAT” - VAT is charged on products sold.

At the end of the month, the amount of general business expenses is written off:

D 90-2 K 26 – general business expenses are included in the cost of sales.

Such rules are established by paragraphs 5 and 12 of PBU 9/99 and the Instructions for the chart of accounts (accounts 20, 25, 26).

In the third case, expenses will not be taken into account in the cost price (form a loss) until the organization begins to receive income. As soon as the organization begins to receive income, these costs will need to be transferred to the cost of the products (works, services) with which they were associated. The organization must determine the procedure for transferring future expenses to the cost price independently (clause 65 of the Regulations on Accounting and Reporting). For example, the following expenses can be written off:

– evenly over the period approved by order of the head of the organization;

– in proportion to income received from sales and in other ways.

The established procedure for writing off future expenses must be fixed in the accounting policy for accounting purposes (clause 4 of PBU 1/2008).

185.154.22.117 © studopedia.ru Not the author of the materials posted. But it provides free use. Is there a copyright violation? Write to us.