The essence of the program

The new preferential mortgage lending program provides Russians with the opportunity to purchase housing on the primary market at a rate of up to 6.5%.

Moreover, in the current situation, when the degree of competition is quite high, banks are ready to further reduce interest rates. “For example, recently the PSB lowered the rate further and set it at 5.85%. Sberbank lends at 6.1% when using the electronic registration service (“Discount for SER”),” explains Natalia Kuznetsova, General Director of the BON TON Academy of Sciences. What awaits the Russian housing market: expert forecasts

What kind of government support can you get if you don’t own a home?

Also, in an effort to increase sales, many developers, together with partner banks, are launching joint subsidized programs, where the minimum rate can reach 0%. “The developer will compensate the partner bank for interest on the loan amount for the first 7 months until the end of 2021. Thus, the mortgage rate for the specified period will be from 0.01%, then - 6.5% within the framework of the 2021 State Support program. Or the mortgage rate for the first stage will be from 0% and then 8.39% within the framework of other programs lending to a partner bank,” explains Vyacheslav Priymak, head of mortgage programs at Ingrad Group of Companies.

An important nuance is that the preferential interest rate is valid for the entire loan term. However, in order to take advantage of the advantageous offer, it is usually necessary to insure the life and health of the borrower, as well as the property itself. If one of these requirements is not met, the bank has the right to revise the terms of the loan.

As for the timing of participation in the 2021 State Support program, according to preliminary data, you can take out a mortgage under the existing conditions until November 1 of this year.

Is it worth taking out a mortgage in; 2021 or is it better to wait: what experts say

- Rate level - the lower the rate, the more profitable it is to get a mortgage. In June 2021, the Bank of Russia immediately reduced the key rate by 1 percentage point, and next month by another 0.25%. As a result, the rate dropped to 4.25% per annum. This is a record low level of borrowing in Russian history. Following the reduction in the key rate, banks reduced interest rates on loans, including mortgages. Currently, the weighted average lending rate in the primary market is 5.82% (-2.42 percentage points year-on-year), in the secondary market - 8.02% year-on-year), and a further reduction in rates is possible.

- Prospect for rising property prices – Property prices are constantly rising. But now everything in the market is ambiguous: on the one hand, people’s purchasing power has decreased, on the other, banks are tempting citizens by offering preferential mortgage rates. As a result, most experts agree that real estate prices will increase slightly in the near future.

- The willingness of banks to issue loans - depending on the economic situation, the volume of lending increases or, on the contrary, decreases. Today, the mortgage industry has the highest approval rate - more than 82%, which indicates the readiness of banks to lend in this area.

You may like => Benefits have been restored for Labor Veterans of the Moscow Region Free Subway Travel in Moscow

What is the essence of the program? The state compensates for the difference between the standard and preferential rates, due to which banks are able to reduce the interest rate for their borrowers. Any citizen of the Russian Federation who meets the requirements of a specific bank participating in the program can take out a preferential mortgage.

Mortgage loan restructuring is a change in the terms of an existing loan in the bank from which it was taken out. Mortgage restructuring can only be used if there are no delays and no outstanding debts. Mortgage loan restructuring can take various forms, but many borrowers are trying to get help from the state. According to a special state program, starting from 2021, mortgage restructuring may include part of payments from the budget. Mortgage restructuring is carried out by AHML. The amount of mortgage restructuring cannot be higher than 600 thousand rubles (data for 2021). Moreover, such mortgage restructuring entails additional costs - the state needs to pay a tax.

The advantages include the following features of mortgage refinancing:

- Possibility to change the loan term to a more favorable one. You have the opportunity to choose a loan for a longer term and pay a smaller amount each month.

- Reducing the total loan amount. By maintaining the amount of the monthly payment, you can reduce the interest rate, and due to this, the total overpayment will decrease.

- Obtaining ownership of an apartment. If you take out a consumer loan to pay off your mortgage, the property will become your property. Subsequently, you can also dispose of it at your own discretion, without coordinating your actions with the bank.

- Changing the loan currency. Convenient for those who took out a mortgage in foreign currency and, due to the depreciation of the ruble, are forced to pay more. But it should be borne in mind that not every bank will agree to change the currency.

- Facilitation of loan repayment terms. It is easier to pay for a consumer loan than a mortgage, because in the latter case you can use online banking or payment terminals by transferring funds from a card.

Down payment and procedure for obtaining a loan

When the program was first announced, the down payment amount was at least 20% of the cost of housing. However, the government is considering reducing the figure to 15%.

The procedure for obtaining a preferential mortgage is standard: you need to find out whether the bank provides such conditions; submit an application, obtain preliminary approval, etc. The loan is repaid through annuity payments - the amount paid each month remains constant throughout the entire loan period. This mortgage can also be repaid early.

Why do you need a realtor in the modern real estate market?

Is it true that there are people who are unable to save money?

How much in time and how much in money

Initially, the loan was limited to a term of up to 20 years. But some banks offer preferential mortgages for 30 years.

The loan amount under the 2021 State Support program starts from 500 thousand rubles. and cannot exceed 8 million rubles. for Moscow, Moscow region, St. Petersburg and Leningrad region. The limit for others is RUB 3 million. “To a greater extent, the program is aimed at that category of citizens who improve their living conditions in the most massive, voluminous segment - the comfort class. However, the limitation on the loan amount does not mean that using a preferential mortgage you cannot purchase a larger apartment, which, accordingly, will be more expensive, or premium real estate. Everything is possible; only then the amount of the down payment should be higher,” notes Irina Tumanova, sales director at NDV-Real Estate Supermarket.

What can you buy with a preferential mortgage?

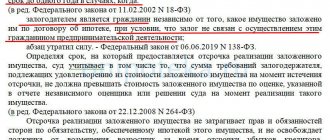

According to the head of the Rentaved project, Ruslan Sukhiy, within the framework of the program it is possible to purchase an apartment in an apartment building under construction or already built. We can also talk about a block building - a residential building no higher than three floors, consisting of a maximum of 10 blocks, each of which is intended for one family. “Theoretically, townhouses with the “apartment” designation also fit this definition. But before issuing a loan for this housing, the bank will carefully study it. At the same time, the program does not apply to private residential buildings (individual housing construction projects), as well as secondary housing and apartments,” adds legal director Vladislav Frolov.

The seller of real estate can only be a legal entity (developer company), but not an investment fund or its management company. As for registration, transactions are concluded under the DDU, DUPT (agreement on the assignment of rights of claim) or a purchase and sale agreement.

20 articles on how to buy an apartment with a mortgage

How to save money if you take out a mortgage?

Who can take out such a mortgage?

A mortgage loan at this rate is designed only for citizens of the Russian Federation, but from any category of borrowers: these can be employees, business owners, individual entrepreneurs, Frolov continues. The big advantage of this program is the ability to get a mortgage loan at 6.5% without providing a certificate of income. You will only need two documents identifying the borrower: for example, a passport of a citizen of the Russian Federation and a military ID or driver’s license.

“The program contains virtually no restrictions and is available regardless of marital status, number of children and the status of the locality in which housing is purchased. Also, one should not lose sight of prompt consideration of applications within up to 3 days and quick access to a deal,” comments Marketing Director of Lenstroytrest Group of Companies Jan Feldman.

There are no specifics here regarding possible reasons for refusing to apply for a preferential mortgage. As in the case of approving a mortgage loan under other conditions, banks look at the age of the borrower (as a rule, mortgages are issued to people over 21 years old and under 65 years old), income level, professional experience, credit history, etc. One way or another, everything remains at the discretion of the bank.

Preferences on; base interest rate

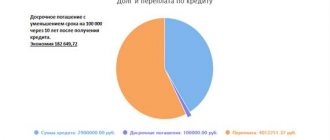

The relationship between real estate agencies and banks is very useful, both for clients and for the organizers themselves. We provide clients, send applications for mortgages, and banks, in turn, give preferences. Preference is the provision of benefits and priorities to create favorable conditions. Banks are well aware that a real estate agency is a good channel for sales and attracting clients. Managers from banks often come to real estate agencies to train mortgage brokers, provide new information on banking products, and bring advertising in the form of leaflets and flyers. Conduct seminars and presentations for realtors. If you have little time, you are a busy person, you need to visit the Arkada real estate agency once, tell your wishes about buying real estate, how much you want to buy a home for. All the rest of the work will be done by specialists: realtors will select an apartment, and a mortgage broker will help with the missing amount. The Arkada real estate agency takes care of all the worries and problems. By spending money on the services of a broker and realtor, you can save much more. The mortgage is taken out for several years, and over time you will recoup all the costs of the real estate agency. At our agency, when you purchase an apartment through a mortgage with our realtor, you receive the services of a mortgage broker as a gift. Which further attracts customers to save money and time. When purchasing a mortgage, an expensive product for both the client and the bank, the borrower tries to save on each service, since there are a lot of costs. And such savings of 0.2-1% are little taken into account by the borrower, but as soon as the benefit is calculated, the client is already ready to meet. When an application for a loan is approved through the Arkada real estate agency, the bank provides discounts in the amount of 0.2-1% of the base interest rate. For example, if your mortgage broker has calculated your monthly payments at a rate of 13%, then upon approval the bank will give you a preference of 1%. You will pay not 13% per annum, but 12% per annum, you will agree that this is very profitable. Or the bank can provide a free real estate appraisal as a gift, as a preference, or any other product at the bank’s discretion. You can calculate how much you will save by taking advantage of preferences from the bank. For example, you take 2,000,000 at 13% per annum for 10 years, monthly payments are 29,862 rubles, the overpayment for 10 years will be 1,583,600 rubles. The bank offered you a 1% preference; as a result, 2,000,000 rubles at 12% per annum for 10 years will amount to an overpayment of 1,443,000 rubles. Saving 140,600 rubles.

You may like => Criminal Code of the Russian Federation Hypothesis

With long-term cooperation with the bank, the heads of two organizations can offer each other cooperation agreements and make exclusive preferences for their clients. But they are usually not long-term, and last for a couple of months. The same agreements can be found between the developer and the real estate agency. By purchasing an apartment through a real estate agency, you can get a discount on the purchase of an apartment starting from 100,000 rubles. Repair organizations offer a lot of cooperation offers. When purchasing an apartment, give gift certificates for a 10-20% discount on apartment renovations. We give our clients Double GIS cards, which you can use as a discount when purchasing goods and services. We also provide preferences from leading banks in Tyumen.

Benefits, maternity capital, refinancing

With a mortgage with a rate of 6.5%, it is quite possible to repay the down payment using maternity capital, as well as use other types of government support (for example, regional benefits). In this matter, according to experts, everything depends on the specific bank. As for the tax deduction, it can also be obtained (according to Article 220 of the Tax Code of the Russian Federation). But it will not be possible to refinance a previously taken out loan under new conditions.

Matkapital in 2021

What benefits and benefits are given at the birth of a child?

How does a mortgage work?

- The population does not keep part of their savings on deposits or under their pillows at home, but invests them in housing, as a result, money works in the economy.

- The construction industry is evolving as real estate is being purchased more often, demand for it is growing and more is being built. At the same time, the production of building materials is also growing.

- Banks, expanding their loan portfolio, work with debts that are secured by collateral. The higher the mortgage share, the more stable the country's banking system.

You may like => Administrative Prejudice in Administrative Law

Mortgage with maternity capital. Maternity capital is a certificate issued by a pension fund after the birth of a second child. Now its size is 466,617 RUR. You are allowed to spend maternity capital after the child turns three years old. There are exceptions, such as paying off the principal or down payment on a mortgage. We have already described in detail how to use maternity capital for a mortgage.

- State - special preferential mortgage terms are based on cash payments from the federal or regional budget. Through government financing, borrowers can be offered a lower interest rate on a loan, pay mortgage interest, or be provided with a property at a price below market value.

- Non-state - with this type of lending, the role of the state is played by large companies and corporations that provide mortgage benefits to their employees.

Such intermediary companies, knowing the specifics of the work of a financial institution and its requirements, can competently assess the risks and direct a person to the right branch. The benefits of a home loan are already visible to the client even with a 0.5% discount on the loan. The period of 7-25 years shows everything on the graph, where the payment decreases significantly.