Low-income family Cheboksary benefits

Alatyr, Kanash, Novocheboksarsk, Cheboksary, Shumerlya, Alatyrsky district, Alikovsky district, Batyrevsky district, Vurnarsky district, Ibresinsky district, Kanashsky district, Kozlovsky district, Komsomolsky district, Krasnoarmeysky district, Krasnochetaysky district, Mariinsko-Posadsky district, Morgaushsky district, Poretsky district, Urmara district, Tsivilsky district, Cheboksary district, Shemurshinsky district, Shumerlinsky district of Yadrinsky district, Yalchik district, Yantikovsky district.

The level of family income is determined taking into account the subsistence level approved by state regulations. If the total income divided by each family member is below the approved indicator, the family is considered low-income and may qualify for social benefits and a number of benefits. The subsistence level is set at the regional level by local authorities based on the average price level and the cost of the consumer basket. You can apply for low-income family status by visiting the social protection department in Cheboksary. However, there is no clear legislative definition of which organization is responsible for calculating the subsidy. Depending on the region, this is handled by the local social welfare department and housing department. To obtain information about which body is responsible for allocating benefits, you must contact the territorial social protection authority in person or by telephone.

Conditions

- statement;

- passports of family members;

- children's birth certificates;

- certificate of family composition;

- marriage certificate - if available;

- divorce certificate – if available;

- certificates of income of all family members for the last 3 months (for the last 12 months - for registration as those in need of residential premises);

- documents confirming income from owned property (from rent, sale) - if available;

- documents confirming income from the fruits and products of personal subsidiary plots - if available;

- Declaration 3-NDFL – for individual entrepreneurs;

- work book - for unemployed citizens;

- certificates from educational institutions about the issuance of scholarships - if available;

- a certificate from the Pension Fund about the amount of pension - if available;

- an extract from the results of a medical and social examination – for people with disabilities;

- adoption documents – if available;

- power of attorney certified by a notary (when applying through a representative):

- documents confirming ownership of movable and immovable property (if it is not registered in the Unified State Register of Real Estate) - for registration as those in need of residential premises;

- documents confirming the value of movable and immovable property owned - for registration as those in need of residential premises;

- consent to the processing of the applicant’s personal data.

List of documents

- the average per capita income of a family (citizen) is below the regional subsistence level;

- family members live together and run a common household (to recognize the family as low-income);

- able-bodied citizens of the family (able-bodied single citizen) have (have) a permanent place of work or are (are) registered with the employment center;

- lack of use of residential premises that meet established standards (for registering a family/citizen as needy/in need of residential premises).

If the family is low-income and also needs to improve their living conditions, such benefits may be provided. It is important to confirm that there is not enough square footage for one person. Citizens must reside in the region for a certain number of years.

- salary;

- alimony;

- severance pay and other payments;

- pensions;

- income from property (rent, sale);

- scholarships;

- fees;

- dividends from shares;

- other income.

Required documents for low-income family status

Recognition of a low-income family is free of charge. There is no need to pay state duty. The main expense may be making copies of documents. But some branches do them themselves and for free.

During the period of self-isolation, residents can submit documents for registration as a low-income family using the Russian Post, the press service of the Ministry of Labor of Chuvashia reports. To do this, copies of the following documents must be sent to the social protection department at the place of registration:

- Statement on family composition, income, receipt of state social assistance in the form of social services, property owned by him and his family.

- Documents confirming the income of the resident and his family members for the last 3 months preceding the month of filing the application.

- Copy of passport or identity document for adult family members; a copy of the birth certificate for children under 14 years of age.

- Copies of adoption certificates.

- Documents containing information about the composition of the family and property owned by him or his family. If the specified documents are not provided, the department will send an interdepartmental request to obtain them.

- Work book (if not working).

- Extract from the personal account of the apartment.

A social contract can help the poor solve a difficult life situation and increase their income. You must contact the social protection department at your place of registration. You can see the phone number of your department on the Social Portal of Chuvashia.

If the family is low-income and also needs to improve their living conditions, such benefits may be provided. It is important to confirm that there is not enough square footage for one person. Citizens must reside in the region for a certain number of years.

- citizen's salary;

- funds transferred within the framework of a citizen’s average earnings for a certain period;

- compensation payments assigned for the fulfillment of obligations of a state and public nature;

- benefits due upon termination of an employment contract in connection with the liquidation of the organization;

- social payments determined if a citizen does not work (pensions, unemployment benefits, child care);

- fee transferred for renting premises;

- other transfers (alimony, income from bank deposits, inherited funds).

You might be interested ==> Benefits for 3 children in 2021 for working women in the Kemerovo region

Required documents

- the applicant's civil passport and copies of identity cards of all family members (for children under 14 years of age a birth certificate is provided);

- certificate of registration or divorce;

- certificates that reflect family income for the last three months;

- a certificate showing the composition of the family according to Form No. 9 (or an extract from the house register);

- a copy of the work book or certificate issued by the Employment Center;

- title documents for real estate;

- certificate of disability if there are such citizens in the family.

Assignment of the status of a low-income family occurs only if a particular family does not have enough money to provide itself with everything necessary. However, the determination of the level that each specific family should have is carried out on the basis of a number of regulations.

What assistance is available to low-income families? benefits and benefits for low-income families

One-time assistance to women from low-income families: 1. Benefit paid provided that the woman registers with the antenatal clinic before 12 weeks of pregnancy. 2. Maternity benefits for the unemployed. A monthly amount will be paid to those who were fired due to: - Bankruptcy and liquidation of the organization. — Closing of a company that provided the services of a lawyer and notary. — Closing an individual entrepreneur. — The company that requires a license to carry out professional activities ceases to operate. 3. A one-time benefit for the mother at the birth of the baby. The payment is due to the mother, regardless of which child she gave birth to. When each child is born, a sum of money is transferred to the parent’s account.

Monthly assistance to families with children: 1. Maternity benefit for working citizens. As a rule, it is provided only to mothers who worked. The employer is obliged to pay the employee a monthly amount equal to the established average salary. This benefit is different in different regions. 2. Allowance for a child whose age is less than 1.5 years. One of the parents is entitled to a cash payment in the amount of 40% of average earnings. 3. Payment for a child whose age is not more than 3 years. In accordance with Decree of the Government of the Russian Federation No. 1291, approved on November 30, 2021, the amount of payment is the amount of the subsistence minimum. Remember, this is the amount that must be paid every month for the third or next born child in the family. 4. The child of a serviceman, conscript (and not conscript) is also entitled to monetary compensation. The benefit can be used by parents until the child turns 3 years old. 5. Payment “for the loss of a breadwinner” is due to the child of a military personnel. 6. An additional benefit in an amount close to the subsistence minimum must be paid for a child under guardianship. This amount is different in the constituent entities of the Russian Federation. 7. Payment for a child whose age is from 7 to 16 or 18 years old is due to all low-income parents. For children, they pay an amount ranging from 100 rubles to a thousand. 8. Benefits for low-income families. Every month, a low-income family receives a payment. Its size is set differently in each region, and may not exist at all.

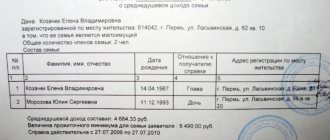

List of documents for a low-income family 2020 Perm

The list is not regulated. If you send an application for a low-income family to the MFC or social security, be prepared for the fact that you will also be asked for other documents. Here is a list of additional documents that are often asked to be attached to your application.

Recognition of a family or citizen as low-income in Cheboksary in 2020

After all, as statistics show, each family spends more than 20% of its income on utility bills. All this is taken into account in subsidies for low-income families in 2021, their size is calculated based on family income, the list of documents is standard. News on this issue can always be found from the media or from social welfare authorities.

You may be interested in:: Benefits for labor in the Oryol region.

There is a government program to help borrowers. If you have children, you can participate in it, but it is necessary that your creditor bank be a participant in this program. Contact your bank where you obtained the loan with questions about participation in this program. If the bank participates in the state program, check the possibility of restructuring and the requirements. The consideration of the restructuring application is carried out directly by the creditor. Upon completion of consideration of the application, he must notify the borrower of the decision made.

Social programs for low-income families in each region can be significantly expanded or supplemented. The amount of additional payments is proportional to the amounts included in the local budget to provide support to low-income groups of the population.

Additional conditions for providing benefits

Family of 4, two of them are 7 year old twins. I haven't worked since 2015. when one of the boys had heart surgery. The husband's income (net) is 38,000 rubles. When the family was wealthy, they purchased an apartment. 111 sq.m., which year the communal apartment is simply suffocating. If 38,000 / 4 people, then this is below the living minimum in our region. Will we be able to receive benefits or subsidies as a low-income family?

There are other reasons, but they are all determined by law. When a refusal occurs without apparent justification, citizens have the right to appeal the decision. If, as a result of the appeal, it turns out that the income information was false, the applicant may incur administrative liability. In addition, he will have to pay a fine.

- Money received from joint property or an individual member. For example, the amount that a family received by renting out living space.

- Severance pay and social benefits. For example, pensions, student scholarships, unemployment contributions, insurance, and salary supplements.

- Compensation.

- Alimony (if the father pays and does not receive it, the amount is deducted).

- Money inherited.

- Royalties and profits from business activities.

What is included in income

You can complete this process yourself, but you will receive a 100% guarantee only as a result of the careful work of specialists. To calculate the total earnings of your relatives, you need to follow a certain algorithm of actions:

These activities do not provide specific benefits to the state, but are an individually developed plan for low-income citizens to help them improve their financial condition. The state may prescribe the following points:

From January, only low-income families will receive maternity capital in Chuvashia

According to the document, those families whose average per capita income is below the subsistence level, that is, only the poorest, can count on the payment. Let us remind you that in the third quarter of 2021, the cost of living per capita in Chuvashia was 8,191 rubles.

Another innovation adopted by the Chuvash authorities concerns the use of maternal capital. Now those families who do receive the payment will be able to spend it on the construction or reconstruction of housing without involving a construction organization, as well as use it to pay for the rental of residential premises (rental fees) and for utilities in the dormitory for students.

Where to apply for benefits

In Russia, there are many types of support for low-income families. However, many do not know about them or do not want to collect a package of documents to obtain them. You can find out more detailed information about helping low-income families from this article.

Who is recognized as a low-income family?

A low-income family is a family whose average per capita income is less than one subsistence minimum per person . Depending on the type of benefit or benefit, the amount of average per capita income can be calculated over a period of 3 months or a year. In addition, different time periods are considered for each type of benefit.

In most cases, the calculation is carried out according to the minimum subsistence level established at the federal level. You can find out how much it is now at the MFC or social security. Compared to 2018, these amounts have changed, so citizens need to make calculations again and submit income certificates. In 2021, it is equal to 10,701 rubles, but low-income people who live in Moscow need to focus on a different figure - 16,160 rubles. This is due to the fact that the capital has a higher standard of living compared to the regions. Moreover, to calculate this amount, it is important that all family members are registered in the capital.

Legislation in 2021 defines the concept of family as a group of people engaged in joint farming and living in the same living space. This is not necessarily a husband with a wife and children. If a family runs a household together with the parents of one of the spouses, then the income of the grandparents must be taken into account. According to the law, the following will be counted in the total number of a low-income family:

Fundamentals of legislation

If all the amounts in the certificate are the same and do not differ for all 3 months, then only the income received for one period is added up. In this case, it is divided only by the number of family members. A low-income citizen receives less than 10,701 rubles for his share in 2021. Please note that regions have the right to apply their own subsistence minimum if it is established by law. Check with the social security authorities at what income a citizen will be considered low-income.

May 12, 2021 vektorurist 328

Share this post

- Related Posts

- Can bailiffs seize a purchased car from the owner if the car is the only source of income?

- How can a widow of a disabled Chernobyl survivor transfer to her husband’s pension after his death in Russia?

- Benefits for paying utility bills for military veterans in the Moscow region

- What area of the apartment is eligible for the 50% discount?

Fill in the form

Citizens who are faced with facts of corruption when receiving social payments to unemployed citizens, including unemployment benefits, can contact the Ministry of Labor and Social Development of the Republic of Dagestan by calling the hotline +7

We thank the Organization of children's parties "Umka", directly, the head Umakhanum Nurmagomedovna for the tickets given to our students for the New Year's show in "Khayal" and for the time spent usefully! Our guys were incredibly satisfied))).

Low-income family in Cheboksary

Childless spouses or a person living alone can also count on receiving benefits for low-income people. Data on the income of each family member is summed up and divided by three, and then by the number of people living in the family. The resulting result is compared with the living wage approved in the region.

- 1 What income should a low-income family have

- 3 What documents and certificates are needed for a low-income family

- 4 Terms of production and validity of the certificate

- 5 Benefits and benefits for low-income families in 2021

2 How to obtain the status of a low-income family in the MFC: step-by-step instructions

Legislative basis

Since all of the listed documents will be checked by employees of social protection authorities, in order to confirm information about the actual level of income of a particular family, including based on information from tax authorities, employees of social protection authorities may also require originals and copies of certificates of assignment of individual taxpayer numbers for all family members who make tax payments to the state budget at various levels.

List of basic documents for recognition of a low-income family

Today, a fairly large number of families live on the territory of the Russian Federation that can qualify for the status of low-income people. This is due to the fact that in such families the income for each family member is less than the established minimum subsistence level for a particular category of the population in a particular region. Due to the fact that such families are often forced to live in rather cramped financial conditions, the state provides the opportunity to grant such families low-income status, which will allow them to receive various benefits and subsidies to maintain a normal level of income.

Copies of documents are submitted with the simultaneous presentation of the originals. After verification of documents, the originals are returned to the applicant. In the case of submitting copies of documents whose accuracy has been certified in accordance with the procedure established by the legislation of the Russian Federation, presentation of the originals is not required.

To calculate the average family income, you will need to: add up all the income of its members over the last 3 months. The resulting figure is divided by three. The final result must be divided by the number of people in the family. The resulting number should be compared with the cost of living. A low-income citizen is a person whose average income is below the subsistence level.

When calculating average income, not only wages are taken into account, but also other types of profit. In particular, bonuses, income from rental housing and farming, compensation, social benefits, vacation pay, dismissal payments, etc.

There are other reasons, but they are all determined by law. When a refusal occurs without apparent justification, citizens have the right to appeal the decision. If, as a result of the appeal, it turns out that the income information was false, the applicant may incur administrative liability. In addition, he will have to pay a fine.

With the current instability in the economy, not only in Russia, but throughout the world, financial difficulties affect everyone. The problem is widespread, but an even bigger problem is the fact that not everyone knows how to get proof of low-income status. Citizens can only count on the state, but it is not eager to help either. At least until the person proves that he needs benefits and support. Unfortunately, these are the majority. Some people don’t have enough time to do paperwork, while others are busy with more important things. So it turns out that many people in need continue to remain without government support. Those people who are afraid or do not have time should understand that there is nothing complicated in this process. In addition, it is worth noting that after going through the full legal procedure, it will become even easier for them.

Who is considered poor

This stage is considered no less problematic than the previous one, because many questions arise here too. According to Article 13 of Federal Law No. 44, to start the calculation it is necessary to take the amounts that each family member received in the last three months before applying to the authority.

As of 2021, such subsidy programs operate in 62 regions of Russia. Every year the number and list of participating regions changes, since funding directly depends on the birth rate in the territorial entity. If for the previous calendar year this coefficient has not reached 2, then the state assumes the obligation to pay state benefits, but when it crosses this mark, the region stops participating in the program for a year.

Every family whose average income is lower than the officially established regional subsistence level can qualify for low-income status. To determine this indicator, it is necessary to sum up the entire official family income for the last three months, divide by three, and then by the number of people in the family. The result will be the average monthly income per person. If the value for one person is below the subsistence level established by regional authorities, the family may receive low-income status.

How to calculate income for low-income families (formula)?

Payments for the first child in a large or low-income family are issued by state social protection authorities, benefits for the second and subsequent children - by the Pension Fund. This is explained by the fact that for the first, money is allocated from the Federal budget, and for the rest, maternity capital funds are raised. This procedure may be revised after the new law on maternity capital comes into force, but precise information on this matter has not yet been provided.

You might be interested ==> Standard square meters in Tyumen

For 2021, the Government has established the average cost of living in the Russian Federation - 10,701 rubles ; if the amount received is less, then you have the right to apply to the MFC to obtain the status of a low-income family.

Low-income family Cheboksary benefits

Cheboksary, by virtue of their status, have the right to use tax and utility benefits, receive free advice from a lawyer or lawyer, as well as monthly financial support from the city and district administration.

Cash payments to low-income families with a third child range from 6 to 15 thousand rubles. Their size depends on a number of factors. This benefit is paid separately from others and is maintained regardless of the volume and total value of other benefits and payments. One of the most difficult stages after collecting documents is drawing up an application. It is filled out according to the usual rules of a business letter.

How to get help under a social contract

- There are three or more children in the family under 18 years of age (or studying full-time in educational institutions - until they complete their studies, but not older than 23 years).

- Citizens must own a plot of land that can be used for running private household plots.

- The applicants have no land tax debts.

Duration of the social contract

The amount of one-time assistance depends on the family’s actual need for money, and the amount of payment cannot exceed 50 thousand rubles. Such state assistance can be provided no more than once every three years.

No, low-income family status is not required . It is determined on the basis of submitted certificates of income for the year. Benefits are accrued by the local Social Security Authority, which independently determines the level of family income for applying for a particular benefit.

A tax deduction is provided to citizens with three or more minor children for a land plot in the amount of 600 square meters (6 acres) - Article 391, paragraph 5, subparagraph 10 of the Tax Code of the Russian Federation. The benefit was introduced on April 15, 2021 and applies to legal relations arising from the 2021 tax period.

Payments to low-income families in 2021

Along with durable goods, needy Muscovites can receive food. The scheme is the same: if you have a social card, you will receive points on it, which partner stores will accept for payment. The top-up amount is 2,000 points (or 2,000 rubles). If there is no card, a family with children will be given a food package at the social service center or social assistance center.

For reference , when calculating income, conscripts or students studying at higher military institutions who have not entered into a contract for military service are not included in the family; prisoners or those undergoing compulsory treatment by court decision; are fully supported by the state.

The state supports low-income families. For example, there is a subsidy for housing and communal services, as well as additional monthly payments for the birth or adoption of the first or second child. This was reported in the State Duma group on the VKontakte social network.

Low-income family status can be obtained if the income per person is below the subsistence level in the region. By the way, in Chuvashia its average per capita value for the third quarter of 2021 was 9,285 rubles, for the working-age population - 9,875 rubles, for pensioners - 7,576 rubles, for children - 9,254 rubles. When calculating, all family income is taken before taxes and fees are deducted.

You may be interested in:: Cost of living in Voronezh for January 2021

A family where its members deliberately do not work or engage in bad habits will not be able to apply for benefits. To keep your income to a minimum, you need to register with the Employment Center and actively look for work.

Benefits in Cheboksary in 2021

Attention! If you have any questions, you can consult a lawyer for free by phone. Call right now by phone in Moscow, St. Petersburg, throughout Russia the call is free. Calls are accepted 24 hours a day. It's fast and convenient!

- Schoolchildren using the services of public urban and suburban transport, as well as long-distance trains and buses, have the right to buy a ticket at a significantly reduced cost.

- Schoolchildren in educational institutions of the city and region have the right to free use of library resources, including the right to free rental of textbooks.

- Students in grades 1-4 are entitled to receive free meals a day in the school canteen.

- Students in grades 11 who are 18 years old during their studies are temporarily exempt from military conscription.

Calculator for low-income families in 2021 Cheboksary

This benefit is assigned to children born after one year, provided that the average per capita family income is below the subsistence level. The average benefit per year will be 10.8 thousand. Children from low-income families can take advantage of the right to enter state and municipal higher educational institutions without competition, subject to the following conditions:

Banks Today Live Articles marked with this sign are always relevant. We are monitoring this. And comments to this article are answered by a qualified lawyer, as well as the author of the article himself. The economic situation in Russia in recent years has been far from stable, and this is especially reflected in the incomes of citizens. More and more people are experiencing difficulties with financial support. For citizens and families whose income is less than the subsistence level, the state offers assistance, including payments, benefits and free housing.

State duty

When receiving assistance as a low-income family, the right to receive payments and benefits intended for all families with children is not lost. This refers to one-time and monthly benefits for the birth and upbringing of children, maternity capital, etc.

How to receive social assistance from the state?

- Availability of subsidies for housing and utilities. It is appointed for six months, after which it can be extended. At the same time, the state can provide assistance aimed at creating more decent living conditions.

- Exemption from taxes on amounts received by families from the local or state budget under programs approved at the appropriate level.

- Any legal advice, even defense in court, can be provided free of charge or on preferential terms.

- If several conditions are met, children from such families can enter higher or special educational institutions without taking part in the general competition:

- the presence of one of the parents of the first group of disabilities;

- the child's age does not exceed 20 years ;

- when passing the unified state examinations with at least the minimum number of points required for their successful completion.

You may like => Rate of 1st category worker for 2021 housing and communal services

A list of documents is provided by SZN employees. The list of forms is determined by the individual conditions of individuals. The applicant is responsible for submitting false information. If forgery is detected in the data regarding the amounts received, the list of persons, the special status will be canceled, the amounts provided will be returned to the budget after the involvement of the judiciary.

Low-income family

4.6. In accordance with the decision of the commission, every month after the 20th day of the current month, the Office compiles lists for the payment of financial assistance, which are then submitted to the municipal treasury for the transfer of financial assistance to the personal accounts of applicants.

Russian legislation provides for the provision of assistance to families who, for various reasons, are in a difficult financial situation. Such assistance involves providing benefits and paying benefits to large families, single mothers and fathers, and families raising disabled children. In addition, any family can apply for government support if it is low-income.

We recommend reading: Contribution to the pension fund from salary from what year

Benefits for students and students

- Benefits for paying for housing and utilities.

- Registration of ownership of residential premises suitable for living, provided the family does not have their own.

- Special program for mortgage lending.

- Free legal advice and assistance.

- The right to register children in kindergartens without waiting in line.

- Reduced payment for kindergarten.

- Financial assistance for full-time students in higher education institutions.

- Discounts and compensation payments for travel.

- Free or reduced-price meals at the dairy kitchen for children under 3 years of age.

- Children of disabled people of the first group can be enrolled in higher educational institutions without competition.

- Benefits for food products.

What dates are payments made?

In addition, do not forget that in 2021 another state support measure was introduced. It applies to families with children from 3 to 7 years old. The payment is made in the amount of half the subsistence minimum. The value is taken from the second quarter of 2021.

In 2021, some adjustments were made to the rules, which state that a family in which one person has less income than twice the subsistence level can be considered low-income.

You may be interested :: Altai Territory gave birth before the age of 25

Also, a family with a single mother or father can apply for low-income status. Large families with at least one disabled child first of all apply for low-income status and receive this status without any problems.

How to become a low-income family

These activities do not provide specific benefits to the state, but are an individually developed plan for low-income citizens to help them improve their financial condition. The state may prescribe the following points:

Within 25 working days after submitting the documents, the social security authority makes a decision whether to conclude a social contract or not. If the financial situation is really difficult, government employees will develop a special adaptation program , indicating the type and amount of financial assistance, as well as the requirements that must be met.

The main goal of a social contract is to help citizens get out of a difficult life situation and get a permanent income to support themselves. In particular, money received from the state can be spent on professional retraining, opening a business, or running a personal subsidiary plot.

Who is entitled to a social contract?

The applicant must tell social workers in detail about financial problems, and also fill out a questionnaire about their financial and living situation. In addition, a special commission that will check the living conditions and draw up an inspection report.

One of the most popular areas for concluding a social contract is a lump sum payment for running a personal subsidiary plot (LPH). This type of assistance is especially in demand in rural areas.

When calculating the average per capita income, the social protection authority takes into account the total income for the three months preceding the application. All money (including pensions, alimony, benefits, etc.) that was received during the specified period is divided by 3, and then the resulting amount is divided by the number of family members. The result is an average per capita income for each person. If this amount is less than the minimum wage , then the family can submit documents to draw up a social contract.

How to get help under a social contract

Now families or citizens participating in the program can spend the money received to provide for their children: buying clothes, shoes and school supplies. Funds under the contract can be spent on providing for children

The main regulation of the procedure for recognizing a family as low-income occurs on the basis of Federal Law No. 44-FZ , adopted on April 5, 2003, “On the procedure for recording income and calculating the average per capita income of a family and the income of a single citizen for recognizing them as low-income and providing them with state social assistance.” As can be seen from the name of this law, on the basis of its provisions, the mechanisms that should be used to determine the level of income of a particular family and, in case of their insufficiency, to provide assistance to such families from the state were determined.