Accounting for semi-finished products of own production and their evaluation

Semi-finished products of our own production are materials that have been processed at a completed technological stage. They can be used for subsequent processing at the same enterprise or can be sold to a counterparty for further processing.

At full-cycle enterprises, where raw materials go through several stages of processing or reprocessing, account 21 “Semi-finished products of own production” can be used to account for semi-finished products produced in each processing stage.

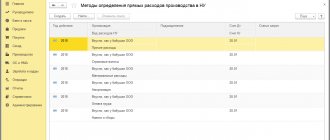

Semi-finished products of own production can be classified as work in progress (clause 63 of the Regulations on accounting and financial reporting No. 34n, approved by the Ministry of Finance on July 29, 1998). There are several methods of assessment:

According to the requirements of Article 319 of the Tax Code of the Russian Federation, the cost of semi-finished products of own production is determined based on the assessment of finished products. Therefore, in tax accounting only one assessment method is used:

- Direct costs of the enterprise.

The accounting policy must include a list of direct expenses (letter of the Ministry of Finance No. 03-03-06/4/78 dated August 26, 2010). For example, the list of direct expenses includes: material costs, labor costs, social contributions, accrued depreciation.

When calculating the cost of finished products, semi-finished products of own production are included in the calculation in the form of a complex item or are included in detailed cost items.

https://youtu.be/OC7Hb33pD-c

The value of which asset is reflected on account 21

Let's assume that an organization has produced semi-finished products and taken into account all the costs for them. The next task is to determine their cost, which is reflected in special account 21 “Semi-finished products of own production.” How to calculate it? We need to think about it this way. Semi-finished products are part of work in progress.

Therefore, their cost is calculated using methods for estimating work in progress.

The wiring should be like this:

DEBIT 20 CREDIT 21,243,811 rub. — semi-finished products were transferred for the production of finished products.

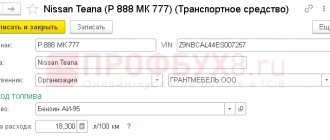

Purpose of auxiliary production

At large enterprises, the organizational structure may include auxiliary units that service the main production and, as a rule, do not produce products.

For example, auxiliary industries include:

- energy workshops for electricity, gas, steam and other various types of energy;

- transport services for transport services;

- OS repair shops;

- workshops for the production of building parts, tools, spare parts or enrichment of building materials in construction organizations;

- auxiliary units for the construction of non-title structures;

- mining of stone, gravel, sand, including other non-metallic materials;

- logging and sawmilling;

- salting, drying, canning agricultural products, etc.

However, ancillary industries may also provide services to third party customers.

The costs of auxiliary production can be direct, that is, for direct activities, and partially indirect for management and maintenance.

Examples of transactions on 21 accounts

Example 1.

The difference is that the PSP at the previous stage of production were brought to a certain degree of readiness and in the future they can be:

- released to the next workshop of the enterprise for the production of a finished product;

- sold externally;

- transferred to a structural unit of the enterprise (for example, auxiliary production).

★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) 8,000 books purchased

Account 21 in accounting: Semi-finished products of own production

Accounting account 21 is the active account “Semi-finished products of own production”, used to record expenses associated with the production and processing of semi-finished products. Using standard postings and practical examples, we will consider the specifics of using account 21 and the features of reflecting transactions for accounting for semi-finished products of our own production

Accounting for semi-finished products of own production and their evaluation

Semi-finished products of our own production are materials that have been processed at a completed technological stage. They can be used for subsequent processing at the same enterprise or can be sold to a counterparty for further processing.

At full-cycle enterprises, where raw materials go through several stages of processing or reprocessing, account 21 “Semi-finished products of own production” can be used to account for semi-finished products produced in each processing stage.

Semi-finished products of own production can be classified as work in progress (clause 63 of the Regulations on accounting and financial reporting No. 34n, approved by the Ministry of Finance on July 29, 1998). There are several methods of assessment:

According to the requirements of Article 319 of the Tax Code of the Russian Federation, the cost of semi-finished products of own production is determined based on the assessment of finished products. Therefore, in tax accounting only one assessment method is used:

- Direct costs of the enterprise.

The accounting policy must include a list of direct expenses (letter of the Ministry of Finance No. 03-03-06/4/78 dated August 26, 2010). For example, the list of direct expenses includes: material costs, labor costs, social contributions, accrued depreciation.

When calculating the cost of finished products, semi-finished products of own production are included in the calculation in the form of a complex item or are included in detailed cost items.

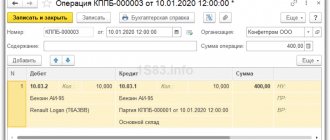

Account 21 in accounting

Semi-finished products of own production are accounted for on account 21 in correspondence with account 20 - when semi-finished products are used in own production, and with account 90 - when semi-finished products are sold to a counterparty:

The debit of account 21 reflects the receipt of semi-finished products and their surpluses discovered during inventory. The account credit takes into account the consumption of semi-finished products during transfer for subsequent processing, their sale or identification of shortages in the warehouse.

On account 21, analytical accounting can be maintained by storage location, by name, type, grade, and so on.

Get 267 video lessons on 1C for free:

Typical postings for 21 accounts “Semi-finished products of own production”

The main entries for 21 accounts used in accounting are shown in the table below:

| Account debit | Account credit | Operation description |

| 21 | 20 | Receipt of semi-finished products of own production |

| 21 | 23 | Receipt of semi-finished products manufactured by auxiliary production |

| 21 | 40 | Receipt of finished products for subsequent use as semi-finished products |

| 21 | 91.01 | Surplus semi-finished products identified during inventory were capitalized |

| 20 | 21 | Semi-finished products are sent to production for subsequent processing |

| 23 (25;26) | 21 | The cost of semi-finished products is included in the costs of auxiliary production (overall production costs; general business expenses) |

| 28 | 21 | Write-off of defective semi-finished products of own production |

| 91.02 | 21 | The cost of semi-finished products of own production, written off or sold, is reflected in other expenses |

| 94 | 21 | The identified shortage of semi-finished products is reflected |

Examples of transactions on 21 accounts

Example 1. The cost of semi-finished products includes only the cost of raw materials and materials

Let's say VESNA LLC produces parts that are used in its own production. In January 2020, 150 parts were manufactured. The costs included:

- Raw materials and materials - 1,200,000 rubles;

- Salary and social contributions - 980,000 rubles;

- Depreciation charges - 450,000 rubles.

Semi-finished products are valued at the cost of raw materials and materials. Generated postings:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 20 | 10 | 1 200 000 | The cost of raw materials and materials written off for the manufacture of parts is taken into account | Requirement invoice |

| 20 | 70 (69); 02 | 1 430 000 | Costs (wages, social contributions, depreciation) for the production of finished products are reflected | Payroll. Depreciation calculation |

| 21 | 20 | 1 200 000 | Semi-finished products are received into the warehouse | Shift production report |

| 20 | 21 | 1 200 000 | Semi-finished products transferred to production | Requirement invoice |

Example 2: Semi-finished products are valued at direct costs

Let's look at the previous example: VESNA LLC produces parts that are used in its own production. In January 2020, 150 parts were manufactured. Costs include:

- Raw materials and materials - 1,200,000 rubles;

- Salary and social contributions - 980,000 rubles;

- Depreciation charges - 450,000 rubles.

Semi-finished products of own production are valued at direct costs: raw materials and materials; salary; social contributions; accrued depreciation and so on, according to accounting policies. Generated postings:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 20 | 10 | 1 200 000 | The cost of raw materials and materials written off for the manufacture of parts is taken into account | Requirement invoice |

| 20 | 70 (69) | 980 000 | The amount of salary and social contributions is reflected | Payroll. |

| 20 | 02 | 450 000 | Accrued depreciation reflected | Depreciation calculation. |

| 21 | 20 | 2 630 000 | Receipt of semi-finished products of own production to the warehouse (1,200,000 + 980,000 + 450,000) | Shift production report |

Example 3. The cost of semi-finished products of own production additionally includes indirect costs

Let's assume that VESNA LLC produces part 1 and part 2, which are used in its own production.

The direct costs for production of the part1 include:

- Raw materials and materials - 1,200,000 rubles;

- Salary and social contributions - 980,000 rubles;

- Depreciation charges - 450,000 rubles.

Direct costs for the production of parts2 include:

- Raw materials and materials - 1,050,000 rubles;

- Salary and social contributions - 950,000 rubles;

- Depreciation charges - 380,000 rubles.

General business expenses (G&C) for the production of semi-finished products, parts 1 and parts 2, amounted to 870,000 rubles. According to the accounting policy, VESNA distributes general business expenses relative to the cost of raw materials.

Posting table:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 20 | 02; 10; 69; 70 | 2 630 000 | The cost of direct costs for manufacturing the part1 is taken into account (450,000 + 1,200,000 + 980,000) | Requirement invoice |

| 20 | 02; 10; 69; 70 | 2 380 000 | The cost of direct costs for manufacturing the part2 is taken into account (1,050,000 + 950,000 + 380,000) | Payroll. Depreciation calculation |

| 2 250 000 | Total costs for raw materials and supplies (1,200,000 + 1,050,000) | Accounting information | ||

| 20 | 26 | 464 000 | The share of OCR coming to part 1 is reflected (870,000 * (1,200,000 / 2,250,000)) | |

| 20 | 26 | 406 000 | The share of OCR coming to part 1 is reflected (870,000 * (1,050,000 / 2,250,000)) | |

| 21 | 20 | 3 094 000 | Semi-finished products part 1 (2,630,000 + 464,000) were credited to the warehouse | Shift production report |

| 21 | 20 | 2 786 000 | Semi-finished products part 2 (2,380,000 + 406,000) were credited to the warehouse |

It is important to note that the standard cost accounting method is advisable to use in the mass production of semi-finished products.

Source: https://BuhSpraa46.ru/buhgalterskiy-plan-schetov/schet-21-v-buhgalterskom-uchete-provodki-po-uchetu-polufabrikatov-sobstvennogo-proizvodstva.html

Semi-finished products what's the score?

Account 21 “Semi-finished products of own production” is intended to summarize information on the availability and movement of semi-finished products of own production in organizations that maintain separate records of them.

In particular, this account can reflect the following semi-finished products manufactured by the organization (with a full production cycle): pig iron in ferrous metallurgy; raw rubber and glue in the rubber industry; sulfuric acid at nitrogen fertilizer plants in the chemical industry; yarn and raw materials in the textile industry, etc.

In organizations that do not maintain separate records of semi-finished products of their own production, these values are reflected as part of work in progress, i.e. on account 20 “Main production”.

In the debit of account 21 “Semi-finished products of own production”, as a rule, in correspondence with account 20 “Main production”, expenses associated with the production of semi-finished products are reflected.

The credit of account 21 “Semi-finished products of own production” reflects the cost of semi-finished products transferred for further processing (in correspondence with account 20 “Main production”, etc.) and sold to other organizations and individuals (in correspondence with account 90 “Sales”).

Analytical accounting for account 21 “Semi-finished products of own production” is carried out by storage locations of semi-finished products and individual items (types, grades, sizes, etc.).

Account 21 “Semi-finished products of own production” corresponds with the accounts:

| by debit | on loan |

| 20 Main production 23 Auxiliary production 40 Output of products (work, services) 79 On-farm payments 80 Authorized capital 91 Other income and expenses | 20 Main production 23 Auxiliary production 25 General production expenses 26 General business expenses 28 Defects in production 45 Goods shipped 76 Cash accounts with various debtors and creditors 79 On-farm settlements 80 Authorized capital 90 Sales 91 Other income and expenses 94 Shortages and losses from damage to valuables 99 Profits and losses |

See what “21 counts” is in other dictionaries:

- Account - (account) 1. A document indicating the debt of one person to another; invoice. A person providing professional services or selling goods may invoice his client or customer; solicitor selling on behalf of... ... Financial Dictionary

- account - take into account, invent on someone else's account, there is no money, live on someone else's account, take on account, on someone else's account, on someone else's account, not on account, end accounts, end accounts, take words into one's own account , walk around at someone’s expense, reduce... ... Dictionary of synonyms

- Capital account - (capital account) 1. Account into which investments in land, buildings, structures, machinery and equipment, etc. are recorded. 2. Budgeted expenditures for major items, especially in public sector financial plans ... Financial Dictionary

- Account - (account) 1. A document indicating the debt of one person to another; invoice. A person providing professional services or selling goods may invoice his client or customer; a solicitor who sells on behalf of... ... Dictionary of business terms

- Vostro account A foreign bank account in a UK bank, usually held in pounds sterling. compare: nostro account. Finance. Dictionary. 2nd ed. M.: INFRA M, Ves Mir Publishing House. Brian Butler, Brian Johnson ... Financial Dictionary

- DEPO NOSTRO ACCOUNT is an active analytical securities account opened in the accounting records of the domiciliant's depository. This account is intended for accounting for securities deposited or for accounting in a domiciliary depository, or securities accounted for by the registrar on ... ... Legal encyclopedia

- Accounting Account 20 Main Production - an account designed to summarize information about the costs of main production, that is, production, the products (works, services) of which were the purpose of creating this enterprise. In particular, this account is used to record costs: ... ... Dictionary of business terms

- Vostro account - A foreign bank account in a UK bank, usually held in pounds sterling. compare: nostro account. Business. Dictionary. M.: INFRA M, Ves Mir Publishing House. Graham Betts, Barry Brindley, S. Williams ... Dictionary of Business Terms

- INVOICE - an invoice issued by the seller in the name of the buyer and certifying the actual delivery of goods or services and their cost. Issued after final acceptance of the goods by the buyer. Contains details of a sales transaction, including volume (quantity... ... Big Accounting Dictionary

- ACCOUNT(S), REPORTING - (account(s)) A report on activities (operations) for a certain period. Accountability means the obligation to prepare and provide the following reports: company directors are accountable to shareholders, and British ministers are accountable for the performance of... ... Economic Dictionary

- ACCOUNTING ACCOUNT 20 “MAIN PRODUCTION” is an account designed to summarize information about the costs of the main production, that is, production, the products (works, services) of which were the purpose of creating this enterprise. In particular, this account is used to record costs: ... ... Dictionary of business terms

Accounting for semi-finished products of own production - postings

Accounting for semi-finished products of own production - entries for their use and evaluation methods are relevant for those enterprises that have several stages in the production process and determine the cost of the resulting intermediate products. In this article we will talk about the features of accounting for semi-finished products and consider the corresponding transactions.

What is a semi-finished product?

Accounting entries for accounting for semi-finished products

Methods for evaluating semi-finished products

What is a semi-finished product?

There are various cost accounting methods. One of them is the cross-cutting method, which is used by material-intensive industries that produce large volumes of products, where raw materials alternately undergo several processing phases (processing stages).

At the same time, at such enterprises, processing stages, along with types of finished products and cost items, are objects of accounting. There are two options for the cross-cutting method: unfinished and semi-finished.

In the first option, costs are calculated by redistribution, but semi-finished products are accounted for only in quantitative terms, their cost is not calculated.

Enterprises using the semi-finished method of accounting record the amount and quantity of semi-finished products in accounting records, calculating their cost after each redistribution. Semi-finished products are accounted for separately, and their movement from processing stage to processing stage is documented by postings. This method is labor-intensive, but also provides some advantages:

- the ability to control the availability and safety of semi-finished products;

- the ability to monitor production costs at each stage (redistribution) in the manufacturing process;

- the ability to estimate profit/loss from the sale of semi-finished products (if there is such a need), since their cost is precisely known.

Source: https://konkurs-nttm.ru/polufabrikaty-kakoj-schet/

Accounts

All expenses that are directly or indirectly related to the production and manufacture of products are included in their cost. They accumulate on accounts 20-29 balance. At the end of the month, they are recalculated and distributed between main and auxiliary production, individual types of products and completed work.

Primary production

Account 20 in accounting is used to display information about the costs of production, which was the purpose of creating the enterprise. Direct costs that are directly related to the production process are subject to accounting. These include the cost of materials and the cost of paying workers' salaries.

Correspondence 20 accounting accounts

Let's look at typical wiring:

- DT20 KT10 – materials written off.

- DT10 KT20 - return of raw materials to the warehouse.

- DT20 KT10-2 - semi-finished products were released into production.

- DT20 KT10-3 - fuel written off for technological purposes.

- DT20 KT60 - the cost of electricity used in production is taken into account.

- DT20 KT70 – wages accrued to production workers.

- DT20 KT69 - insurance premiums are taken into account.

- DT20 KT23 – costs of auxiliary production are taken into account.

- DT20 KT69 - a reserve has been created to pay for private entrepreneurs and vacations.

- DT20 KT25 (26) - general production (household) expenses are written off.

- DT20 KT28 - losses from defects are displayed.

In the course of its activities, an organization can attract services (products) of its own production. In this case, accounting accounts 20 and 21 are used. Semi-finished products of own production are written off from KT21 to DT20.

The ending balance shows the value of work in progress (WIP). Analytics is carried out by types of costs, products, divisions.

Account 20 in accounting is reflected in the balance sheet in the second section of assets in the line “Inventories”.

General production expenses

Indirect costs associated with servicing production are recorded on account 25. These include:

- depreciation of machinery and equipment;

- OS maintenance costs;

- remuneration of employees;

- insurance deductions;

- rent;

- utility costs for production premises;

- expenses for repairs of machines, buildings for general production purposes, etc.

During the month, actual costs are collected by DT from the credit of accounts for inventory, materials, settlements with personnel: DT25 KT02 (05, 10, 60), etc. Then they are written off to account 20 in accounting. This is reflected by the wiring of DT20 KT25. That is, the final balance on the account. 25 equals 0. Analytics is carried out by departments and expense items.

General running costs

Indirect costs associated with servicing the organization are displayed on account 26. These include:

- administration salary;

- social insurance contributions;

- communication costs;

- costs of maintaining security;

- administrative and management costs;

- depreciation of administrative operating systems;

- rental of office space, etc.

Expenses for the month are accumulated according to DT26. At the end of the month, these amounts are written off to account 20 in accounting or 90-2 in full.

Typical transactions for account 26 are presented in the form of a table.

| Operation | DT | CT |

| Accrued depreciation on fixed assets, intangible assets | 26 | 04, 02, 05 |

| Materials were transferred for general business needs | 10 | |

| Electricity costs included | 60 | |

| Salaries paid to workers involved in OS maintenance | 70 | |

| Insurance premiums accrued | 69 | |

| A vacation pay reserve has been created | 96 | |

| General production costs associated with auxiliary production were written off | 23 | 26 |

| General production costs associated with main production were written off | 20 | 26 |

Non-production organizations use account 26 to display information about operating expenses. Cost amounts at the end of the month are written off to DT90 “Sales”. Analytics for account 26 is carried out for each budget item, cost location, etc.

Auxiliary production

Account 23 is used to summarize information about auxiliary costs:

- service by types of energy;

- fare;

- OS repair;

- production of tools, building parts, structures.

- DT23KT10 – materials written off for auxiliary production.

- DT23KT70 – the wages of production workers are taken into account.

- DT23KT69 – insurance premiums have been calculated.

- DT23KT25, 26 – indirect costs are taken into account.

- DT23KT28 – losses from defects are written off.

KT23 reflects the actual cost of production. These amounts are then written off to account 20 in accounting, subaccounts “Crop production” (20-1), “Livestock production” (20-2), “Industrial production” (20-3), “Other production” (20-4). Account balance 23 reflects the cost of the work in progress. Analytics is carried out by type of production.

Accounting for losses

Products that do not meet quality standards or contracts are considered defective. If it is possible to bring the product to the required parameters, then such a defect is considered correctable. DT28 displays the cost of written-off products. According to KT28 - amounts to be withheld from the culprits, suppliers, valuation of the costs of restoring the product.

Let's look at typical transactions (for convenience, we will again present them in the form of a table).

| Operation | DT | CT |

| Materials were released to correct defective products | 28 | 10 |

| Salaries accrued to employees who corrected products | 70 | |

| Insurance premiums accrued | 69 | |

| The cost of rejected products has been written off | 20 | |

| The cost of the marriage was withheld from the salary of the guilty person | 70 | |

| Received defective parts | 10 | 28 |

| Claims filed with suppliers | 76-2 |

The cost of defective products is written off from DT28 to accounting account 20. Closing the account means that all losses from the barque are compensated. Analytics is carried out by departments, expense items, types of products, culprits and causes of defects.

Service farms

Account 29 is intended to display information on production costs not related to the manufacture of products or the provision of services:

- Housing and communal services (operation of houses, dormitories, bathhouses, etc.);

- workshops;

- buffets and canteens;

- children's institutions;

- holiday homes;

- research units.

DT29 reflects expenses associated with the performance of work, which are then written off to the account for auxiliary production. According to KT29 – the cost of work and goods.

| Operation | DT | CT |

| Materials taken into account | 10 | 29 |

| The costs of divisions-consumers of services of service industries are written off | 23, 25, 26 | |

| Products sold to third parties | 90-2 |

Account balance 29 reflects the cost of the work in progress. Analytics is carried out for each production and cost item.

Selling expenses

Account 44 displays information about costs associated with sales. Manufacturing businesses can use this account to show costs for:

- product packaging;

- delivery, loading of products;

- commission fees;

- maintenance of warehouse premises;

- advertising;

- entertainment expenses, etc.

Trade organizations on this account display expenses for:

- transportation of products;

- wages;

- rent;

- maintenance of buildings and equipment;

- storage of goods;

- product promotion;

- entertainment expenses, etc.

Amounts of expenses are accumulated according to DT44, and then written off to account 90-2. Analytics is carried out by product and expense items. In case of partial write-off, transportation and packaging costs are subject to distribution between months (in equal amounts, regardless of actual expenses). All other items are charged to the cost of production on a monthly basis in full.

Cost formation

The final stage is determining the cost of production, taking into account the balances of work in progress.

At the end of the month, the costs accounted for DT23 are distributed between basic and general production expenses. Then, overhead costs are written off to account 20 in accounting if reduced accounting is maintained, and all costs if full cost accounting is maintained. That is, this account displays the total amount of expenses. Formula:

S/S = WIP beginning. + Costs – WIP end.

The actual cost is reflected according to CT 20. Costs are written off depending on which valuation method is chosen. If products are accounted for at standard cost, all expenses are charged to account 40 by posting DT40 KT20. If actual cost is applied, the costs are written off to account 43. This is how account 20 is used in accounting.

Source: https://BusinessMan.ru/new-schet-20-v-buxgalterskom-uchete-osnovnoe-proizvodstvo.html

Semi-finished accounting method

The semi-finished method assumes that the produced semi-finished products are taken into account in quantitative and total terms, and their cost is calculated. In this case, accounting for semi-finished products is kept separately in a separate account. Despite the fact that this method is more labor-intensive, it has its advantages. Using it, it is possible to control the costs of production of finished products at each stage of production. In addition, if an organization decides to sell a semi-finished product, knowing its cost, it will be able to realistically assess the financial result of this operation.

In accounting, reflect the costs of producing semi-finished products on account 20 “Main production”, to which open a separate sub-account “Production of semi-finished products”.

Direct costs that are directly related to the production of semi-finished products are reflected in the debit of this account in correspondence with the expense accounts. In this case, do the wiring:

Debit 20 subaccount “Production of semi-finished products” Credit 10 (02, 05, 69, 70...) – direct costs for the production of semi-finished products are taken into account.

First, record general production costs on account 25, and then at the end of the month write them off to account 20. At the same time, make the following entries:

Debit 25 Credit 10 (02, 05, 69, 70...) – general production expenses are reflected;

Debit 20 subaccount “Production of semi-finished products” Credit 25 – general production costs are taken into account as part of the costs for the production of semi-finished products.

General business expenses should be taken into account as part of the costs of producing semi-finished products (i.e., on account 20) if they are not immediately included in the cost of products sold (i.e., not written off on account 90 “Sales”). For more information about this, see How to write off general production and general business expenses. In this case, make the following entries:

Debit 26 Credit 10 (02, 05, 69, 70...) – general business expenses are reflected;

Debit 20 subaccount “Production of semi-finished products” Credit 26 – general business expenses are taken into account as part of the expenses for the production of semi-finished products.

This order follows from the Instructions for the chart of accounts (accounts 20, 25, 26).

What is account 20 used for in accounting?

Existing standards establish that all costs for the production of products, provision of services or performance of work until the completion of the established process are subject to reflection on account 20.

Here the accumulation of expenses associated with the main activity for which the company was created occurs. Therefore, it is called account 20 “Main production”.

All costs accumulated on this account are called work in progress. This is due to the fact that the invoice reflects them until the moment when they form the cost of the product.

This account is used in almost every enterprise, regardless of the field of activity, with the exception of trade. These can be industrial, agricultural enterprises performing construction and installation work, transport and communications, etc.

If a company creates finished products, then closing account 20 means that it is produced. For works and services, closing the 20th account implies that the entity has provided or fulfilled the obligations stipulated by the agreements.

Accounting for information about incurred costs on account 20 is carried out on the basis of supporting documents and is used by management to manage the business entity.

Account 21 in accounting

For example, these may include industrial stocks: tomato paste, starch, vegetable purees, which will be used for the manufacture of finished products.

Account 21 is active, that is, the debit shows the receipt of semi-finished products, and the credit shows a decrease in the balance (for example, transfer to production).

Costs associated with the preparation of semi-finished products are reflected in the debit of the account. 21. Their sale to third parties, putting into production for subsequent processing is reflected on the loan in correspondence with the relevant accounts.

Who is it advisable to use accounting account 21?

For manufacturing enterprises with a single output of products, opening a separate account to account for the receipt and movement of goods and services does not make much sense.

When calculating the cost of production, semi-finished products can be included in the calculation as a complex item, or taken into account under different expense items in detail.

Account 21 is logical to use to account for semi-finished products by category - storage location, names, types and varieties, as well as other significant characteristics.