Financial relations permeate the life of society, and today it is impossible to become a successful person without understanding the essence of the most important economic categories. The concepts of “revenue” and “income” are often confused even by novice businessmen, since in the mass consciousness they are synonymous. In fact, it is very important to understand the difference between them, which will allow you to analyze any economic information more deeply.

Revenue is the amount of money received from the sale of a product or service. It can also be called “dirty” money, since costs are not subtracted when calculating the value. Revenue is always either positive or zero, but can never be negative. It is determined either by the cash method (when actual receipt of funds) or by accrual method (at the time of shipment of goods or provision of services, including deferred payment).

Income is money received by a subject of economic legal relations for a certain period of time. They are formed through the main activities of a legal entity or individual, as well as through attracted investments.

Comparison

So, revenue is a positive value, which only in rare cases can be equal to zero. Receipts are added together to form a certain amount. Income can be negative when the revenue received does not cover the costs of obtaining it. Revenue is generated through the main activities of the enterprise: production (sale) of products or provision of services.

Income can be obtained from the company’s assets (renting space, deposits, attracting investments), as well as from core activities (sale of goods and services).

At the same time, revenue is an attribute of an entity actively working in the economic sector. The income may be from a person who, for one reason or another, is not engaged in socially useful activities (student, disabled person, pensioner, unemployed). These funds are generally not subject to income tax. In rare cases, revenue may be equal to profit. This happens in cases where upon receipt there is no consumable part (provision of a certain list of services). However, most often it is revenue that exceeds income in terms of volume.

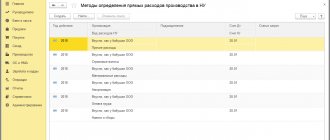

[New in UT 11] Shipment of goods with deferred transfer of ownership

What is this article about?

In the release of the UT 11.1.6 , a new type of operation of the document “Sales of goods and services” called “Sales (goods in transit)” has been added for the shipment of goods with a deferred transfer of ownership.

Let's consider this functionality.

Applicability

The article was written for the editors of UT 11.1

. If you use this edition, great - read the article and implement the functionality discussed.

If you are working with older versions of UT 11, then this functionality is relevant

. The most noticeable difference between UT 11.3/11.4 and 11.1 edition is the Taxi interface. Therefore, in order to master the material in the article, reproduce the presented example on your UT 11 base. Thus, you will consolidate the material with practice

Implementation of shipment of goods with deferred transfer of ownership (goods in transit)

The transaction type in the document is filled in automatically in accordance with the established transaction type in the agreement with the client.

To arrange a shipment with a deferred transfer of ownership (goods in transit), the “Shipment without transfer of ownership is possible” checkbox must be checked in the agreement with the customer.

Let’s open an existing standard agreement in the UT11 program called “Model Sales Rule”.

To enlarge, click on the image.

As you can see, there is no checkbox “Shipment possible without transfer of ownership” in the agreement.

To be able to use the “goods in transit” functionality, you need to enable the “Statuses of sales of goods and services” checkbox in the “Administration” - “CRM and Sales” section of the program.

To enlarge, click on the image.

After this, open our standard agreement again and check the box “Shipment without transfer of ownership is possible.”

To enlarge, click on the image.

We will draw up the document “Sales of goods and services”. If the shipment of goods with a deferred transfer of ownership (“Sales (goods in transit)”) is used, then the shipment of the goods from the warehouse is first processed and the document is posted in the status “In transit.”

Let’s go to the “Sales” program tab – “Sales Documents” and create a new document.

We will fill in all the necessary details. Let’s set the type of operation “Sales (goods in transit)” and the status of the document “In transit”.

When using the “Sales (goods in transit)” transaction type and the “In transit” document status, the “Transfer of Rights” field becomes available for filling, where you need to indicate the date of delivery and transfer of the goods to the client.

If the document status is set to “In transit”, filling in the date of transfer of ownership is not necessary. Therefore, we will leave the field blank for now.

Let's review the document.

To enlarge, click on the image.

I would like to note that the client’s debt to our organization for the goods shipped to him is recorded at the time the document “Sales of goods and .

Let's open the card of the partner for whom we registered the sale of the product. On the navigation panel, select the “Mutual settlements” item and generate the “Statement of settlements with a partner” report.

To enlarge, click on the image.

We won't see anything in the report. Everything is correct, since the goods have not yet been delivered to the client and the “Sales of goods and services” document is in the “On the way” status.

Let's imagine that the product was delivered to the client the next day.

Accordingly, after transferring the goods to the client, the “Sales of goods and services” document must be posted in the “Sold” status. Let's set the required status and try to post the document.

The program will display an error that the “Date of transfer of ownership” field is not filled in.

To enlarge, click on the image.

When setting the “Sold” status, you must indicate the date when the product was delivered (transferred) to the client.

Since the goods were delivered to the client the next day, we will set the “Date of transfer of ownership” as document date + 1 day. Let's review the document.

To enlarge, click on the image.

Let’s open the partner’s card and generate a report on mutual settlements:

To enlarge, click on the image.

This time the report contains information - the partner’s debt is 15,000 rubles. That's right.

There is also the possibility of registering a “Customer Order” document when shipping goods with a deferred transfer of ownership.

For this shipment option, a “Customer Order” is issued and on the “Additional” page the type of operation “Sales (goods in transit)” is indicated.

After creating the “Sales of goods and services” document based on the order, the transaction type is filled in automatically in accordance with the customer’s order.

To enlarge, click on the image.

Here is a short educational program on the functionality of shipping goods with a delayed transfer of ownership in the new release UT 11.1.6.

If your activity uses the points described above, then go ahead and use the functionality of the new release UT 11 - 11.1.6.

PDF version of the article for members of the VKontakte group

We run a VKontakte group - https://vk.com/kursypo1c.

If you have not yet joined the group, do so now and a link to download materials will appear in the block below (on this page)

.

Article in PDF format

You can download this article in PDF format from the following link: Link is available for registered users)

Link available for registered users) Link available for registered users) Link available for registered users)

If you are already a member of the group

– you just need to log in to VKontakte again for the script to recognize you.

In case of problems,

the solution is standard: clear the browser cache or subscribe through another browser.

Other articles on new features of UT 11.1:

"Seasonal odds"

“Search and remove duplicate elements”

“Control of provision (reservation) for orders”

Conclusions TheDifference.ru

- Formation. The organization’s revenue comes from the sale of goods and services, and income also comes from the sale of shares, attracting investments, and receiving interest on funds placed in a deposit account.

- Method of origin. The proceeds can only be received by an individual or legal entity conducting economic activity. An unemployed person and a student can have income in the form of a scholarship, financial assistance, or allowance.

- Calculus. Revenue is money received from the sale of goods and services. To calculate income, expenses are subtracted from revenue.

- Meaning. Revenue is either zero or positive. Income can be negative if the costs of generating revenue exceed the profit received.

- Ratio. Revenue is always greater than income, and only in rare cases can they be equal.

The activities of a commercial organization can be characterized by its revenue and sales. What is their specificity?

Revenue, income and gross profit

Revenue is the amount of money received from the sale of goods, work, and services. It can be determined by the “by shipment” method, that is, at the time of actual shipment of the goods or delivery method, that is, at the time of receipt of payment. In addition to funds received directly from the sale of goods and services, it may also include proceeds from the sale of valuable assets and other income.

In accordance with the accounting regulations, “ income is recognized as an increase in economic benefits as a result of the receipt of assets (cash, other property) and (or) repayment of liabilities, leading to an increase in the capital of this organization, with the exception of contributions from participants (owners of property).”

Revenue is an indicator of financial well-being and the starting point for calculating the profit of an enterprise. It can be zero or positive, but never negative.

The concepts of “revenue” and “turnover” are generally identical. At the same time, “turnover” can often be used to refer to a company’s non-cash turnover, that is, the receipt of funds to the current account for goods, works and services sold.

In any case, revenue, income, and turnover are “gross” characteristics that do not take into account the costs (expenses) of the company.

Gross profit is equal to the difference between revenue and expenses (costs) for the main activity (cost of goods or services sold). The financial result, which takes into account expenses in all areas of the company's activities, is called net profit (positive financial result) or net loss (negative).

What is revenue in a business?

The revenue of a commercial enterprise is usually understood as the amount (or a list of property in value terms) that it received as a result of sales or provision of services within a certain period of time. Based on the difference between revenue and expenses (and sometimes only on the basis of the value of the first indicator), the amount of taxes that the company must pay to the state is determined. The exception is the taxation mechanism, in which the corresponding cash receipts to the enterprise account are not taken into account: such schemes include, for example, the UTII system provided for by Russian legislation.

It is worth noting that, in accordance with some financial analysis methods, revenue as an economically significant indicator can be reduced by taxes (in this case it is called “net revenue”).

A common approach according to which revenue is classified is:

- on cash receipts from the main type of commercial activity of the company;

- on proceeds from investments (for example, in the form of proceeds from the sale of securities);

- on revenue generated as a result of changes in exchange rates (for example, when exporting goods).

All three types of financial income are combined into total revenue. But, as a rule, business efficiency is assessed based on the income that is associated with the main activities of the enterprise.

A company's revenue can be calculated using two methods: cash and accrual.

Income and revenue, what is the difference: types, features, similarities and differences

In the first case, it is recorded upon the fact that the enterprise accepts funds into its current account or cash register. In the second, it is calculated when the buyer of goods or consumer of services has obligations confirmed by contract or law related to payment for delivered products or services.

The main condition for receiving revenue from the main activity, regardless of the specific method of its calculation, is the sale of goods or services. Let's consider its specifics in more detail.

Shipped and sold products of industrial enterprises

Shipped products (SP) is the cost of products for which all shipping documents have been drawn up in a given period and which have been sent to the buyer, but have not yet been paid for by him (it is also called products on the road).

Can be calculated using the formula:

OP = TP – (Ok – He),

where Ok, He are the balances of products in the warehouse, respectively, at the end and at the beginning of the period.

Commodity products include all products produced for distribution by the enterprise to third parties, prepared by the enterprise for transfer into national economic circulation. But in the products prepared by the enterprise for distribution to the outside, there is or may be a part of the product that, for one reason or another, has not been sold and thus has not entered the national economic circulation. Reasons may include failures in product supply agreements, changes in market demand, market conditions, discrepancies between plans for production and sales of products, production of low-quality products, etc.

Sold products (RP) of an industrial enterprise is the cost of products produced at this enterprise, actually released (shipped) to the side and paid by the buyer and thereby transferred into national economic circulation (money came to the account or cash desk of the enterprise).

The volume of products sold is determined using the factory method, i.e. without intra-factory turnover, without the cost of products of own production, included in further industrial processing at the same enterprise. Exceptions are allowed only for certain industries, subject to the transfer of semi-finished products from workshop to workshop at established wholesale prices. Selling products to your own capital construction and other non-industrial enterprises of your enterprise is also an outsourcing; therefore, these types of holidays are included in sold products. The issue of the cost of the customer's material is resolved in the same way as is customary in relation to commercial products.

The volume of products sold during the reporting period includes products sold externally at the moment money is received from the buyer in the company’s current account, and for turnover within the company at the moment it is reflected by the company itself in the “Sales” account.

Thus, the following elements are included in the sold products of an industrial enterprise for the reporting period, provided that they are actually sold to third parties and paid for by the buyer in the reporting period:

- finished goods; produced by the main and secondary workshops of the enterprise, both from their own material and from the customer’s material (in the latter case, without the cost of this material);

- semi-finished products of their own production;

- products manufactured in subsidiary and auxiliary workshops;

- industrial work;

- major repairs of own equipment;

- in some cases, specifically specified in the instructions of planning and statistical authorities, internal turnover reflected in the reporting period by the enterprise itself on the “Sales” account.

The sold products of an industrial enterprise may differ from its commercial products due to the following elements:

- finished products produced in the reporting period, located in the enterprise’s warehouse and not yet released to the outside;

- finished products, semi-finished products of their own production, products of subsidiary and auxiliary workshops, industrial work supplied to the outside during the reporting period, but not yet paid for by the buyer;

- finished products, semi-finished products of own production, products of subsidiary and auxiliary workshops, industrial work, outsourced to the period in previous periods, but paid by the buyer in the reporting period.

The first two elements reduce sold products compared to marketable products, and the third increases them compared to marketable products. It goes without saying that this increase and this decrease take place or can take place only in relation to a certain reporting period.

Also, sold products can be calculated through shipped products using the formula:

RP = OP – (OOPk – OOPn),

where OOPk, OOPn are the balances of shipped but unpaid products at the end and beginning of the period, respectively.

Sales of products can also be represented by the following dependence:

RP=OP?Kv?Kt?Ko?Kr,

where KV is a coefficient characterizing the ratio of gross output and gross turnover, and showing how many hryvnias of gross output are per 1 day. units gross turnover;

CT is the marketability coefficient, reflecting how much money. units marketable products account for 1 day. units released gross output;

KO - shipment coefficient, reflecting how many days. units Products shipped per day. units released commercial products (the more KOs, the faster the finished products are shipped to consumers);

KR – sales coefficient, reflecting how much money. units Products sold in this period account for 1 day. units shipped products.

In the reporting of industrial enterprises, products sold are shown at the current wholesale prices of the enterprises.

However, from an accounting point of view, in accordance with the current Accounting Regulations of P(S)BU, all products shipped and released to the consumer outside the enterprise are considered sold, regardless of whether or not payment for the product occurs at that moment. And such products are called released products. This is due to the fact that currently different types, forms, and methods of payment for products are used, which involve prepayment, payment in installments, deferred payments, and so on. Based on this, in the event of non-payment for products, the company has receivables.

What is implementation?

This term corresponds to the direction of activity of a commercial enterprise, which is associated with the supply of goods or services produced or resold by it to the market. In fact, we are talking about meeting the demand generated by consumers. At the same time, the interaction between them and suppliers within the framework of sales may involve not only the actual purchase and sale of goods or services, but also, for example, the organization of their delivery (providing conditions for provision, if we are talking about services), storage, promotion through available channels sales, etc.

The end result of the sale of a product or service is the receipt by the authorized person of payment for the deliveries made, which, in fact, forms revenue from the main activity (or, if we are talking about the cash method of recording income, this will be the buyer’s acceptance of obligations to pay for the goods or class= "aligncenter" width="475″ height="240″[/img] It may be noted that, in accordance with the legislation of the Russian Federation, the following cannot be recognized as implementation, in particular:

- operations related to currency circulation;

- transfer of the company's resources to its legal successors as part of the reorganization of the business entity;

- transfer of company resources to non-profit organizations for non-commercial activities;

- transfer of investment property under a partnership agreement, as well as to mutual funds established in cooperatives;

- transfer of property within the framework of concession legal relations;

- transfer of resources of a business company to one of the participants upon his exit from the business;

- transfer of apartments to citizens as part of privatization;

- operations of seizure of property, handling of ownerless things.

Standing payments

Recurring fees may vary depending on the type of franchise. It is determined how much the franchisee pays when signing the contract. But the payment that is always there is royalty. This is a reward for the franchisor. In general terms, this is the franchisor’s assessment of the cost of using his project.

The royalty amount is determined based on the following factors:

- The volume of transferred rights, materials, documents.

- Amount of support and nature of assistance, advice, etc. provided.

- Business profitability.

- The royalty level that is provided for a particular type of business.

Note! Royalty is not always a percentage of profits or revenue. The franchisor is interested in obtaining maximum benefits, so he can set such different conditions for paying royalties.

Royalty options:

- Percentage of franchise turnover . This amount is paid based on the results of business activities and ranges from 0.5 to 15% depending on the area, area of work, and type of franchise.

- Percentage of franchisee profits . Making this payment is also based on the results of business activities, but in this case the main value is profit, not gross turnover. In this case, the interest will be higher. This method of calculating royalties is not widespread in our country.

- Fixed amount . There is no interest, but a specific agreed amount that must be paid every month. It can be calculated in both rubles and dollars. Basically, this amount is in the same currency as the lump sum payment. The accrual base can be either turnover or profit. The amount is calculated based on the economic activity forecast.

- Average rate . It is formed with an eye to global trends in royalty payments for a specific type of activity. This technique is used by large companies operating in the franchising field.

Note! In some cases, the royalty rate may be zero - these are projects with a long payback period. Some companies offer a certain limited period when the royalty rate is zero.

Other payments

Franchisors often provide for such payment as advertising. Basically, these are large corporations that spend huge amounts of money on brand promotion and promotion. Due to the fact that there are a lot of franchisees, they do not have to be overburdened with such payments. It is about 2-5%.

Sometimes there is a service fee. Not every franchisor has it. This is basically an “add-on” to the royalty. It is presented as a percentage of profit.

Comparison

There is more than one difference between revenue and sales. This is due to the fact that these terms, although used, as a rule, in the same context, nevertheless mean different things.

Revenue is the flow of cash received by an organization as a result of carrying out business activities. However, it is not always related to sales. Revenue, as we noted at the beginning of the article, can be, in particular, investment income.

Sales are the part of commercial activity that is most significant from the point of view of the company acquiring revenue from its main type of business. It is almost always associated with sales of goods and services.

Having determined what the difference between revenue and sales is fundamentally, we will reflect the conclusions in a small table.

Shipment and sales difference

ownership of the product has passed from the organization to the buyer;

the expenses that have been or will be incurred in connection with this operation can be determined.

If at least one of the above conditions is not met in relation to cash and other assets received by the organization as payment for sold finished products, then the organization's accounting records accounts payable, not revenue.

The revenue indicator from product sales is interpreted in accordance with current legislation as follows:

in accounting - this is the amount for which the buyer is presented with payment documents for payment for shipped products;

in taxation - this is the amount of money received for shipped products, performed work (services), or the amount for which the buyer is presented with documents for payment;

according to Art.

Table

| Revenue | Implementation |

| What do they have in common? | |

| The successful sale of a product or service is the main condition for the generation of revenue from the company’s main activity | |

| What is the difference between them? | |

| Represents the amount of money received by an organization as a result of commercial activities | Represents the direction of the company’s commercial activity, which is associated with the sale of goods and services |

| Not always related to the sale of goods and services (maybe, for example, investment) | Almost always associated with the sale of goods and services |

Shipment without transfer of ownership 1C: Accounting 8.3

Configuration:

1c accounting

Configuration version:

3.0.54.20

Publication date:

22.11.2017

Views:

19326

In accounting, there are situations when a product is shipped, but ownership of this product does not pass at the time of shipment. Since the goods were not actually sold, there is no time for VAT to arise. For example, there are exchange agreements (barter), these are quite interesting cases when each party acts as both a seller and a supplier of goods. An exchange agreement has some specific features, since in fact payment for the goods is not made, but goods are exchanged, then such goods may not have a price, in which case the goods are recognized as equivalent. In 1C: Accounting, shipment of goods without transfer of ownership can be used for an organization that, under an exchange agreement, ships the goods first. And he transfers the rights to the goods after he receives the goods from another organization. Such a transaction of transfer of goods without transfer of ownership is not recognized as revenue for accounting purposes, because it does not satisfy the most important condition for recognizing the sale of goods as a transfer of ownership! Providing Trade12 brokerage services has a very positive effect on the health of your wallet https://www.malo-deneg.ru/ they have already earned positive reviews and an impeccable reputation.

In order to carry out a shipment operation without transferring ownership, you must go to the Sales - Sales section (acts, invoices)

Click on Sales and select the item Shipment without transfer of ownership .

The sales document is drawn up in the same way as a regular document for the sale of goods and services.

The difference between such a document is in the transactions it generates. As you can see, account 45.01 is involved.

Once the conditions for the transfer of ownership have been met, we must carry out the operation of transferring ownership of the goods. Let's go to Sales - Sales of shipped goods .

We create a new document in which we indicate the Counterparty, the agreement under which we transfer these rights and the document for the shipment of these goods. It is these goods that will be included in the transfer of ownership from the shipment document.

The postings show that account 45.01 is closed for the cost of sales under OSN. And also Accounting for revenue from the sale of goods D62.01 - K90.01.1, that is, revenue is accounted for only at the time of transfer of rights to the goods.

This operation can be used to protect your interests, as well as not to increase your tax base without real implementation. You can also use it to transfer goods for commission to another organization. The operation is simple, does not require any special actions, control is very convenient and simple. If you suddenly do not have this function in the 1C program, then you will need to enable it in the Main - Functionality - Trade - Shipping without transfer of ownership . Check the settings before starting work to avoid program errors in the future.

Comments ()

Write a comment

Features of the concepts of “turnover” and “revenue”: a list of fundamental differences

Why do giant corporations with billions of dollars in trade and revenue suffer losses? And how do small firms show very high profits with a maximum of several hundred employees? Economic terms overlap a lot, and juggling concepts can be used for manipulation. It is especially important to separate categories such as “profit” and “revenue”. Despite their apparent synonymy, they mean completely different concepts.

Revenue is all funds received by an individual or legal entity for goods or services, excluding the costs of their acquisition. Thus, the revenue will include all material benefits received from trade, production, and consulting services.

The difference between revenue and profit: differences and comparisons.

There are various ways to calculate this value. Revenue can be cash (at the time of receipt of funds) or accrued (at the time of transfer of goods, regardless of the time of payment for it).

Profit is the difference between the company's revenue and the costs of obtaining it. This value can be either positive or negative. Profit is expressed in cash and in kind and corresponds to the balance of funds after deducting all costs associated with conducting business activities.

Thus, if there are no production costs, then profit will be equal to revenue, but in practice this rarely happens. In other cases, the concepts will be different, reflecting different aspects of the enterprise's activities. So, revenue is always either positive or zero. Profit can be either positive or negative, which is due to the peculiarities of doing business.

Revenue can be calculated based on the volume of products shipped. After all, today factoring, leasing schemes and deferred payment have been established. Profit is calculated only upon receipt of money. Revenue can be calculated by adding up all receipts of funds to the company’s account. To establish the amount of profit, you need to subtract from income all financial costs associated with conducting business activities.

Regardless of the calculation approach (real or nominal), revenue remains constant. As for profit, it can be total (the difference between income and expenses) and net (that which remains after paying taxes and fees). Understating real profits is one of the ways to reduce the tax burden on an enterprise. Inflating revenue, on the contrary, is a means to improve the image and create greater financial “weight” of the company.

Conclusions TheDifference.ru

- Calculus. Revenue is always greater than zero; if it is lower, then they speak of its complete absence. As for profit, this value can be either positive or negative.

- Compound. To calculate revenue, you need to calculate the sum of all funds received by an individual or legal entity over a certain period of time. Calculating profits is more difficult: first you need to know the amount of all income and expenses.

- Real expression. Revenue can be “virtual”, for example, if the company works with deferred payment, giving its customers the opportunity to pay money later. Profit can only be expressed upon completion of all payments, when funds are either received in person or transferred to a bank account.

- Expression. Revenue is a single-digit value, since it consists of all receipts. Profit can be gross (total) and net (remaining after paying all fees to the state).

Revenue concept

Revenue is an economic category that reflects monetary relations between suppliers and consumers.

Revenue indicator is the most important source that participates in the formation of the own financial resources of any enterprise.

Revenue and profit are not equivalent concepts, since profit represents revenue minus costs (expenses). Also, revenue and income are not equivalent, since income is revenue (turnover) minus cost.

Types of revenue

Proceeds from the sale of goods (services) consist of funds or other property in monetary terms that are received or are to be received from the sale of goods (products, services, works) at prices and tariffs in accordance with the concluded agreement.

The activity of the enterprise is characterized in several areas:

- The main activity from which revenue comes from the sale of products (performance of work, provision of services);

- Investment activity, the proceeds from which are expressed in the form of a financial result from the sale of securities or the sale of non-current assets;

- Financial activities (revenue).

Total revenue can be determined by summing the revenue from these three areas. But, nevertheless, the main significance in it is revenue from core activities, which determines the entire meaning of the existence of enterprises.

What is revenue

Revenue is earnings from the direct activities of the company (from the sale of products or services). The concept of revenue is found exclusively in business and entrepreneurship.

Revenue characterizes the overall efficiency of the enterprise. It is revenue, not income, that is reflected in accounting.

There are several ways to account for revenue in an enterprise.

- The cash method defines revenue as the actual money received by the seller for providing services or selling goods. That is, when providing an installment plan, the entrepreneur will receive proceeds only after actual payment.

- Another accounting method is accrual. Revenue is recognized when the contract is signed or the buyer receives the goods, even if actual payment occurs later. However, advance payments do not count towards such revenue.

Types of revenue

Revenue in an organization is:

- Gross – The total payment received for a job (or product).

- Net – used in accounting. Indirect taxes (VAT), excise taxes, duties, and so on are subtracted from gross revenue.

The total revenue of the enterprise consists of:

- Revenue from core activities;

- Investment proceeds (sales of securities);

- Financial revenue.

Value of revenue from product sales

The revenue of an enterprise plays a big role in the functioning of the enterprise. The revenue value is determined as follows:

- Determines the effectiveness and efficiency of the enterprise,

- The timely receipt of revenue determines the financial stability of the company, the state of its working capital, profit margins and timely payment of obligations (payment of wages to employees, settlements with banks on loans, with suppliers for work and services, etc.),

- With revenue, the enterprise covers its costs of production and sales of products, generating profit.