Having issued a deed of gift for a piece of real estate, the donor must know that the ownership of it will be transferred to another person free of charge. It will be quite difficult to change your mind and regain an apartment transferred under a gift agreement.

You also need to know - How to draw up a deed of gift between close relatives for:

- apartment;

- house and land.

The procedure for completing a transaction is regulated by civil law, as well as the procedure for recognizing its cancellation. Is it possible to revoke or cancel a deed of gift for an apartment in Russia during your lifetime? Yes, if there are compelling reasons provided for by law and the ability to prove their existence in court.

Is it possible to challenge a deed of gift during your lifetime?

After transferring the apartment to the donee, the gift agreement can be canceled on the following grounds in accordance with the provisions of the Civil Code of Article 578:

- paragraph 1 - the donee has made an attempt on the life of the donor, members of his family or close relatives, as well as in the case of intentional harm to the health of the donor. If the donor died as a result of the actions of the donee, his heirs have the right to demand cancellation of the transaction;

- paragraph 2 - the actions of the recipient in relation to the received property entail the loss of its property value or may lead to its loss - the issue of cancellation is resolved in court;

- clause 4 - in the case where the donor lived longer than the donee and if there is a corresponding clause in the deed of gift, it is subject to cancellation;

- clause 5 - when transferring an apartment for public purposes as a donation, but using it for other purposes, the donor has the right to demand cancellation of the transaction.

Before the transfer of property into ownership, the donee has the opportunity to refuse the transaction for the following reasons:

- the parties made a mutual decision to terminate the gift agreement (clause 1 of Article 450 of the Civil Code);

- the recipient voluntarily refused the gift. In this case, it should be taken into account that when drawing up a gift agreement in writing, the refusal must also be written and if the deed of gift has undergone state registration, then the refusal to accept must also be registered (Article 573 of the Civil Code).

It is important to note that the refusal of the donee will be valid only until the transfer of ownership of the apartment, which acts as a gift, is registered.

Conditions for returning a property to the donor

How to return a donated apartment back to the donor? The law does not provide an exhaustive list of grounds for returning an apartment to the donee. That is, it may be his subjective decision, which he came to due to his own circumstances. The return of the apartment to the donee is not necessarily based on a violated right.

REFERENCE: According to Article 573 of the Civil Code, the donee has the right not to justify his desire to refuse to accept real estate. The same article states that he can make such a refusal at any time, at his discretion. Consequently, the return of the apartment.

The only difference is that in order to refuse before making a record of registration of such a transaction in the state register, it is necessary to take less voluminous and costly actions than after it. That is, in order to refuse to accept an apartment under a gift agreement, in other words, to return it, the receiving party only needs to have such a desire and take a number of actions.

Further, in the case when the agreement is concluded orally, it is enough to express your will to the donor, which will be considered the annulment of the agreement. If the gift agreement is signed by both parties, then the refusal must also be made in writing and signed by both parties.

Upon actual transfer of the apartment, it is necessary to draw up a corresponding signed act. If the transaction has passed the stage of state registration, the cancellation of such an agreement is also carried out by making entries in the state register. Read more about the conditions for canceling a gift agreement here, and in this article you will read about the procedure for canceling a transaction.

This applies to cases where both parties to the agreement voluntarily expressed their desire to transfer real estate to the donor. In other cases, a legal challenge to the gift transaction is required by declaring it invalid or void. In this case, the actual transfer of the object is also carried out in writing. Read about how to challenge a deed of gift for an apartment during the life of the donor, and here we talk about the procedure for challenging a transaction after the death of the donor.

Cancellation of a gift agreement

The decision on whether the agreement on the transfer of property as a gift is contested or not is made by the court if there is evidence of the illegality of the transaction and grounds for cancellation. The reasons for this are as follows:

1. Additional conditions specified in the contract. The law prohibits establishing conditions when, in exchange for the property being given, the recipient is obliged to give something away. The donation transaction is free of charge, which distinguishes it from others. If the plaintiff can provide evidence of the substitution of another document, the transaction will be canceled:

- substitution of a will is determined if the agreement states that the property will be transferred only after the death of the donor (based on Article 572 of the Civil Code, such a transaction will be declared void);

- substitution of a rent agreement - if there is a clause stating that the donor has the right to live in the donated apartment for life or the obligation of the donee to provide for the donor for life;

- substitution of a purchase and sale transaction - if the deed of gift states that in exchange for the donated apartment, the donee is obliged to transfer money or other real estate to the donor.

2. The condition of the legality of the gift to the person to whom it is transferred is not met. The transaction is void if the provisions of Art. 575 Civil Code. The law prohibits donating property:

- medical, pedagogical, social workers (the owner of the apartment, as well as their spouses and relatives, do not have the right to donate it in exchange for services received);

- employees of government bodies, municipal structures, as well as bank employees in connection with the performance of their official duties;

- parents or guardians on behalf of young children (under 18 years of age) or incapacitated citizens;

- donation between two commercial organizations.

3. The procedure for concluding and the form of the transaction have been violated. When making a gift transaction, you must comply with the requirements of Art. 574 Civil Code. If the gift agreement does not need to be registered (drawn up after March 1, 2013), then the transfer of ownership is subject to mandatory state registration. Both parties must contact Rosreestr with an application for the transfer of rights, presenting a deed of gift. Otherwise, the transaction will be considered void.

4. The donor disposed of the property without having the right to do so. A transaction is illegal if:

- the donor's controversial right to the donated apartment. The ownership of property that is transferred to another person under a gift agreement must be registered with the donor or such right at the time of the transaction is not disputed by a court decision;

- the donated property was jointly owned, but there was no consent of the spouse;

- there is no consent of one of the owners.

5. The conditions of the gift are recognized as unfavorable for the donor. For example, the apartment was the donor’s only home. When registering a deed of gift in the presence of a notary, both parties are explained all the consequences of the transaction. But even a notarial document can be challenged in court.

6. The transaction was made by deceiving the donor. The donee may deliberately deceive by verbally promising something in return for property. Then, having received the deed of gift, he refuses the promise. The transaction will be declared illegal.

7. The transaction was made by misleading the donor. Proving this fact is quite difficult, since you will have to provide the court with facts of intentional or unintentional actions of the donee.

8. Imaginary or feigned transaction. All transactions that fall within the scope of Art. 170 GK. An imaginary transaction is one that was concluded without the intention of fulfilling its terms. For example, when transferring an apartment as a gift according to documents, but remaining to live and use it. A sham transaction is made to cover up another transaction. For example, close relatives, in order to evade taxes, exchange apartments under a gift agreement.

9. Insanity or incapacity of the donor. In this case, the transaction will be canceled if appropriate documentary evidence is presented. For example, young children are legally incompetent and do not have the right to donate real estate, the owners of which they are, without the consent of their legal representative. Insanity is more difficult to prove, but if there is strong evidence, it is possible.

10. The deal was concluded under the threat of life. The donation transaction is exclusively voluntary, but if it is proven that the agreement was signed under the influence of a threat to the life and health of the donor and his family, it is challenged in court (clause 1 of Article 578 of the Civil Code).

11. If the attitude towards the gift leads to the irretrievable loss of its condition (clause 3 of Article 578 of the Civil Code).

12. If the donor has outlived the recipient, the deed of gift can be canceled only if this condition is specified in the gift agreement (clause 4 of Article 578 of the Civil Code).

Judicial practice on gift agreements shows that claims are not always satisfied - you can find out here.

The donor has the right to cancel the donation if the donee

Optimism can be given at least by the simple fact that in Russian judicial practice quite often a gift agreement is canceled precisely after it has been challenged.

So, you can revoke a deed of gift by taking advantage of mistakes and violations made when concluding a legal act.

We bring to your attention cases when a gift agreement can be annulled:

There is no state registration. If the Federal Registration Service was not involved when concluding the agreement, then the donor remains the full owner of the property, who can do whatever he wants with it.

There is state registration, but there are other violations:

- The contract states that the recipient must perform some service or pay a certain amount for the gift received. Since this contradicts the condition of gratuitousness and becomes a will, the agreement loses its legal force;

- The contract states that the donated property passes to the new owner after the death of the donor. Such a condition characterizes the document as a will, and not as a gift, so it can be canceled;

- taxes are not paid. If there is evidence that the deed of gift was only a false document for the purpose of selling an apartment or house, then the document will be immediately canceled;

- exceeding one's powers. This refers to officials who, due to their position, are able to influence the life and safety of the donor, as well as his close and distant relatives and family members;

- the co-owner of the donated property has not legally certified his consent;

- the donor did not sign the document (intentionally or accidentally). Even experienced lawyers sometimes experience such embarrassment. Of course, if such a glaring error is discovered, the contract immediately loses its force;

- rendering a verdict on the incapacity of one of the parties to the transaction. When the document was signed, one of the participants in the donation process could be drunk or in a state of drug high. Here you will definitely need medical certificates and accurate testimony of witnesses;

- incorrect registration of contact or other personal information. Even one single incorrect figure is a strong argument in favor of terminating the deed of gift.

This is important to know: Transfer of municipal property to state ownership and vice versa

Limitation period for a deed of gift for an apartment in case of cancellation

There is a validity period for the deed of gift for the apartment. Cancellation is only permissible within three years from the date of the transaction. After this period, it is almost impossible to cancel it even with the involvement of the court.

The following situations are exceptions:

- the plaintiff is a third party - the period for challenging is one year from the date when he became aware of it;

- the plaintiff is a relative of the donor who became aware of the transaction later - three years from this date;

- the donee prevents the donor from revoking the deed of gift - five years from the date of conclusion of the agreement.

Step-by-step instructions for returning

Expert opinion

Lawyer Consultant

I will help you for free and answer your questions

We invite you to read: How to calculate apartment tax based on cadastral value? 2021

Ask a Question

This article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem, contact our consultant absolutely FREE!

- write a written refusal to accept the donated apartment. In this case, indicate the donor, as well as information about the gift (apartment);

- have the refusal certified by a notary;

- take the document to the state registrar.

You can return the donated apartment back to the donor after accepting the gift. But in this case, joint actions of the two parties to the agreement will be required:

- the recipient of the apartment must write a written refusal of the property in favor of the donor;

- the recipient and the donor notarize the termination of the contract;

- the parties are sent to the State Registration Department for the final cancellation of the contract

In other cases, only filing a claim to cancel the deed of gift will help restore ownership of the apartment.

What documents will be required?

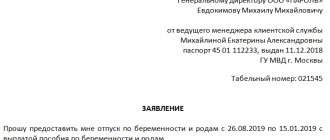

When applying to court to cancel a gift transaction, you will need to submit the following documents:

- statement of claim;

- identification document of the plaintiff;

- deed of gift – deed of gift;

- documentary evidence of the grounds for cancellation of the contract;

- death certificate of the donor, if he died;

- payment document confirming payment of the state duty (its amount is 300 rubles - clause 3, part 1, article 333.19).

- 2021 sample.

If your situation differs from the sample, then contact a lawyer-consultant on competently drafting a claim in court.

Submission of documents

What documents are required? The package of documents includes:

- statement;

- deed of gift;

- passports of the parties;

- extract from the Unified State Register;

- certificate of number of residents;

- consent of residents to cancel a previously drawn up agreement;

- receipt of payment of state duty;

- documents on the subject of ignition of passions - real estate, including a cadastral passport and a paper on the estimated value;

- power of attorney, if one of the parties is represented by a proxy.

This is a basic list; in each specific case, there may be nuances that include the presence of additional papers .

A set of papers is submitted to one of the authorities:

- Registration Chamber of Rosreestr;

- MFC.

Any method of providing papers is suitable: personal visit, postal mail, e-mail (if there is an electronic signature).

Of course, the fastest result will be if the personal appearance of both parties to the transaction is ensured.

Procedure for canceling a transaction

Cancellation of a transaction by court decision occurs in the following form:

- the plaintiff (donor, his heirs, relatives or government agencies) draws up an application to the court, attaching the necessary documents;

- the entire package of documents is transferred to the magistrate at the address of the location of the subject of the gift agreement;

- The court reviews the submitted papers and makes a decision to satisfy, cancel the contract or refuse.

If the plaintiff's demands are satisfied, a situation may arise where the donee cannot return the property in kind. Then he is obliged to pay the donor an amount of material compensation in the amount of its value (Article 1105 of the Civil Code).

Voluntary termination of the transaction is possible only before registration of the transfer of ownership to the person who received the apartment as a gift, in the following order:

- the donor and the donee contact the notary, presenting the gift agreement, documents for the apartment and personal passports;

- the notary examines the submitted documents and draws up an agreement to cancel the transaction;

- after reading the agreement of both parties, the notary carries out the certification procedure;

- the completed and certified agreement is transferred to the registration authority, where the transaction is canceled and an entry about this is made in the register.

Regulating the process

The concept of cancellation of a donation and the regulations for its implementation are contained in Article 578 of the Civil Code of the Russian Federation.

It lists the grounds for the seizure of a donated property already owned.

This is important to know: How to get a housing loan from the state in Moscow

According to this article, under certain circumstances, it is possible to carry out the procedure for revoking (cancelling) a donation for significant or important reasons . It is necessary to prove the significance of the reasons through the court.

Articles of the Civil Code of the Russian Federation, which provide for the invalidation of concluded agreements, are applicable to the procedure for challenging a donation. According to these rules, the following types of transactions are canceled:

- Compiled in violation of the requirements of the law. The donation is absolutely free and unconditional. The presence of conditions that the donee must fulfill in order to become the full owner deprives it of legal force. These include, for example, the transfer of rights after the death of the donor (Article 168 of the Civil Code of the Russian Federation).

Imaginary. Transactions are recognized as such when, under the guise of a gift to reduce the state duty, a purchase, sale or exchange is carried out (Article 170 of the Civil Code of the Russian Federation). In such conditions, the second party will have to return the money paid.- Prisoners with an incapacitated person. These contracts are terminated without fail if the legal representatives of the incapacitated person were not aware of them (Article 177 of the Civil Code of the Russian Federation).

- Committed under threats or through deception or misrepresentation. Such documents are often signed under the guise of other papers, and the person does not understand what he is doing. That is, the agreement does not reflect the real will of the owner (Article 179 of the Civil Code of Russia).

These rules apply to cases where the apartment is not transferred to the recipient of his own free will .

Independent refusal of the donated property by the recipient is carried out under Article 573 of the Civil Code of the Russian Federation. A concluded and already executed agreement is revoked by submitting an application to Rosreestr. Unlike a challenge, such a refusal is carried out without the participation of a court.

- The recipient has the right to refuse it at any time before the gift is transferred to him. In this case, the gift agreement is considered terminated.

- If the gift agreement is concluded in writing, the refusal of the gift must also be made in writing. If the gift agreement is registered (clause 3 of Article 574), refusal to accept the gift is also subject to state registration.

- If the gift agreement was concluded in writing, the donor has the right to demand from the donee compensation for real damage caused by refusal to accept the gift.

Article 575 of the Civil Code of the Russian Federation lists unacceptable cases of concluding agreements. Cancellation of the deed of gift is made if:

- The property was registered as a gift by the legal representative or guardian of a minor under 14 years of age or an incapacitated person on his behalf.

- The apartment was received by a municipal employee or a bank representative as an incentive for services rendered.

The property was accepted as a gift by employees of guardianship authorities, educational or medical institutions on behalf of pupils or patients .- The deal was concluded between employees of commercial institutions .

- The transaction was made by a person who does not have legal rights to the property.

All these types of transactions are prohibited by law and are subject to mandatory cancellation .

Find out on our website whether the procedure for donating an apartment with an encumbrance, for example, with the right of lifelong residence or a mortgage, is legal, as well as other special cases.

The deed of gift can be challenged or canceled either by the donor himself or by a third party in the event of his death or recognition as incapacitated. According to Article 56 of the Code of Civil Procedure of the Russian Federation, the responsibility for collecting and presenting evidence of the grounds for challenging a transaction lies with the applicant in court.

If the transfer of the apartment to the new owner has not been registered and the transaction is still in the process of being finalized, it can be canceled by submitting an application to Rosreestr.

The process of transferring the apartment to another person is stopped and canceled automatically .

A document that is not registered with Rosreestr is also considered invalid.

The owner of real estate is considered to be a person who has a Certificate of Ownership ; in this case, a deed of gift does not give rights to the property.

Consequences of cancellation of donation

Civil Code, paragraph 5, art. 578 establishes the consequences of cancellation of the donation. The object of the donation, which is indicated in the contract, as a result of the transaction is transferred to the donee without material costs on the part of the latter. If it is cancelled, everything returns to the moment before the agreement was concluded, i.e. the apartment is returned to the donor. Accordingly, if the donee has registered there, as well as other persons with him, then they are obliged to check out and move out. If they refuse to do this voluntarily, they will be evicted by court order.

Briefly and to the point, the lawyer in the video answers the question - Can a donor cancel a donation agreement for an apartment?

Reasons for return

In order for the donor to return the donated housing or its share, there must be compelling reasons and circumstances.

We invite you to read: How to calculate real estate tax: formulas, examples

Regarding the recipient, the law does not presuppose the existence of reasons or conditions. Article 573 of the Civil Code of the Russian Federation states that the recipient may not explain the reasons why he refuses the gift.

According to the Civil Code of the Russian Federation, the donee may refuse the gift until it has been transferred to him, in which case the contract will be terminated. When concluding a written contract, the refusal will have to be formalized in writing.

If the recipient refuses the gift, the donor may demand compensation from him for damage incurred due to the refusal.

Articles 573, 577 and 578 of the Civil Code of the Russian Federation explain in what cases an apartment can be returned after donation. There are three grounds for returning donated property back to the donor:

- at the initiative or consent of the donee;

- on the personal initiative of the donor;

- due to the agreement being declared invalid.

The person who donated the apartment can receive it back if the person who accepted the property agrees to do so. A deed of gift for real estate is drawn up in writing and registered by an authorized body. Accordingly, those who wish to relinquish the apartment must formalize their refusal in writing, followed by registration of the transfer of rights to the object of donation back to the previous owner.

On his own initiative, the donor has the right to terminate the contract exclusively in court if there are compelling reasons:

- physical or mental pressure from the recipient of the apartment;

- improper maintenance of the apartment, resulting in the risk of its destruction or damage to other real estate;

- the person who received the property died before the donor;

- after the deed of gift was issued, the health, financial or marital status of the donor deteriorated. But only if this led to a noticeable deterioration in the donor’s standard of living.

The existence of these reasons must be proven during the trial. A court decision will also be required to invalidate the deed of gift.