- The “Invoice” service provides for customizable auto-numbering of Agreements, Invoices, TORG-12 Waybills, Invoices and Acts.

- According to the legislation of the Russian Federation, strict numbering is not provided for bills, acts, delivery notes and invoices (including advance ones). This means that the choice of the type of numbering for these documents remains with the organization.

- You can encode in the account number, for example, the day, month, year, department number, document serial number for the day, for the year, or other information necessary for accounting in your organization.

- In order to remove all possible questions from tax authorities, the principle of document numbering must be reflected in the organization’s accounting policies.

Automatic document numbering

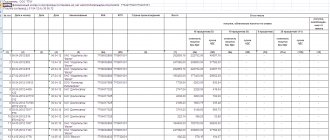

By default, the system uses a continuous numbering order:

- Agreement - %ny%

, serial number for the year (min. length 6 digits, can be changed in the database settings), examples: 000001, 002340, 1000001; - Account - %ny%

, serial number for the year (min. length 6 digits, can be changed in the database settings), examples: 000001, 002340, 1000001; - Waybill - %ey%

, a single serial number for Waybills and Certificates for the year (min. length 6 digits), examples: 000001, 002340, 1000001; - Act - %ey%

, a single serial number for Invoices and Acts for the year (min. length 6 digits), examples: 000001, 002340, 1000001; - Invoice - %ey%

, a single serial number for Advance and regular Invoices for the year (min. length 6 digits), examples: 000001, 002340, 1000001; - Advance Invoice - A%ey%

, a single serial number for Advance and regular Invoices for the year (min. length 6 digits), examples: A000001, A002340, A1000001; - Payment order - %nyi%

(min. length 1 digit), serial number for the year, examples: 1, 2340, 1000001.

Purpose and composition

Initially, the invoice did not have the same semantic load as the other document. Its main purpose was:

- provide the payer with details for transferring funds;

- confirm that the details belong to the supplier organization;

- indicate the subject of payment (goods, work, services), quantity, price, amount;

- certify all information with the signatures of responsible persons and the seal of the organization.

Subsequently, commercial relations became more developed, and the invoice for payment in some cases (for one-time transactions) began to serve as an agreement and contain all contractual terms.

What mandatory details should the invoice for payment contain, how to fill it out - let’s look at it in more detail.

First of all, there is no unified form. Organizations have the right to develop and approve by order of document flow their individual form containing the necessary information. But there are details that must be included in the invoice, and certain requirements are imposed on them.

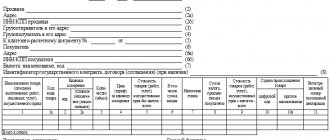

The preparation of an invoice for payment is usually automated in an accounting program and consists of five parts:

- General information.

- Salesman.

- Buyer.

- Product part.

- Responsible persons, performer, full name, phone number.

Numbering format

set default numbering format

| Parameter | Description |

| %d% | number (example: 08) |

| %m% | month (example: 02) |

| %Y% | year (example: 2010) |

| %y% | year (example: 10) |

| %z% | day of year (example: 97, from 1 to 365) |

| %Z% | day of year (example: 097, from 001 to 365) |

| %nd% | serial number of the document for the day (with a minimum number of digits) |

| %ny% | serial number of the document for the year - continuous numbering (with a minimum number of digits) |

| %ndi% | serial number of the document for the day (without minimum number of digits) |

| %nyi% | serial number of the document for the year - continuous numbering (without a minimum number of digits) |

| Additional parameter for uniform numbering of Acts and Invoices | |

| %ed% | a single serial number for Acts and Invoices. per day (with a minimum number of digits) |

| %ey% | a single serial number for Acts and Invoices. per year - continuous numbering (with a minimum number of digits) |

| %edi% | a single serial number for Acts and Invoices. per day (without minimum number of digits) |

| %eyi% | a single serial number for Acts and Invoices. per year - continuous numbering (without minimum number of digits) |

| Additional numbering option for regular and advance Invoices | |

| %ed% | a single serial number for regular and advance invoices per day (with a minimum number of digits) |

| %ey% | a single serial number for regular and advance invoices for the year - continuous numbering (with a minimum number of digits) |

| %edi% | a single serial number for regular and advance invoices per day (without a minimum number of digits) |

| %eyi% | a single serial number for regular and advance invoices for the year - continuous numbering (without a minimum number of digits) |

Fifth part - responsible persons and executor

Despite its apparent simplicity, this part should be taken seriously. It is the persons who signed the invoice for payment who will be responsible for the accuracy of the information and its compliance with the terms of the contract.

Often, distortion of information in the invoice leads to erroneous transfers of funds.

The details of the executor-employee who generated and issued the document and his direct telephone number are also necessary. There will be an opportunity to contact him if you have any questions, clarify existing information or obtain additional information.

After signing, you can say that the invoice for payment is completed.

How to draw up an act correctly - sample filling

We work with the photographer and stylists on a barter basis, as your service already told me, we sign in addition to the contract 1. Acceptance certificate for services provided (2 copies - where I am the customer and the second where I am the performer) and 2. Settlement certificate (2 copies) .

In the photo given in the article, for example, it is clearly visible that there is no list in the “name” column. It simply states that the work was carried out in accordance with a specific contract. No more detailed information is required in this case.

Any work is considered completed only if this fact is documented. In addition, the costs incurred by the contractor must be taken into account by the accounting department. The example of a work completion certificate given in the article clearly shows how it should look.

Should we date the act of destruction to today or should it be carried out at the end of August, as it should have been initially?

As for the buyer’s application, there is no unified form for such an application; therefore, the organization develops and approves it independently. In this case, the application must contain the mandatory details provided for in Part 2 of Art. 9 of Law No. 402-FZ.

Moreover, if you are stitching papers for submission to government agencies, then incorrectly completed firmware can lead to the fact that the Federal Tax Service, extra-budgetary funds or the court simply refuse to accept them.

In practice, the acceptance certificate is not only a document confirming the fact of the customer’s acceptance of the work, but also as confirmation of the volumes completed to determine the cost of the work that was performed during the reporting period.

The number of copies of the act is agreed upon by the parties, but each participant must receive their own copy.

Is “continuous” numbering of accounting documents important?

If it is customary for an organization to assign identical numbers to primary accounting documents and invoices when selling goods, then how serious can be the consequences of violating the continuous numbering, without gaps or breaks, as a result, for example, of canceling an order?

Experts from the Legal Consulting Service GARANT Liliya Fedorova and Sergey Rodyushkin gave their answer. The organization sells goods based on requests from the buyer. For the convenience of reconciling applications and shipping documents (invoice, form N TORG-12), it was previously decided to number them the same. But there are cases when an application can be cancelled, thus disrupting the continuous numbering of invoices. Are missing numbers acceptable in primary documents and invoices? Are there penalties for violating the numbering of primary accounting documents and invoices?

Primary accounting documents

Each fact of economic life is subject to registration with a primary accounting document (Part 1, Article 9 of Federal Law No. 402-FZ of December 6, 2011 “On Accounting”, hereinafter referred to as Law No. 402-FZ).

With the entry into force of Law No. 402-FZ on January 1, 2013, an organization has the right to decide whether it will use unified forms of primary accounting documents or whether it will independently develop its own forms. The organization must approve all forms (Part 4, Article 9 of Law No. 402-FZ).

Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132 approved unified forms of primary accounting documentation for recording trade operations. One of the approved forms is the consignment note (Form N TORG-12), which is used to formalize the sale (release) of inventory items to a third-party organization. The numbering order is not directly specified in the Instructions for filling out this form.

As for the buyer’s application, there is no unified form for such an application; therefore, the organization develops and approves it independently. In this case, the application must contain the mandatory details provided for in Part 2 of Art. 9 of Law No. 402-FZ. At the same time, we note that by virtue of part 2 of Art. 9 of Law N 402-FZ, the number is not specified as a mandatory detail of the primary accounting document.

In accordance with part 3 of Art. 9 of Law N 402-FZ, the primary accounting document must be drawn up when a fact of economic life is committed, and if this is not possible, immediately after its completion.

Clause 13 of the Methodological Guidelines for Accounting of Inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n, states that primary accounting documents must be numbered in advance, or the number is assigned when drawing up and registering the document. In an organization, the numbering procedure must ensure the presence of non-repeating numbers during one reporting year (see also letter of the Department of Taxation and Taxation of Russia for Moscow dated November 19, 2004 N 26-12/74950).

Since this document does not disclose the concept of numbering, we borrow this definition from a related industry. So, for example, according to paragraphs. 9 tbsp. 2 of the Federal Law of 07.07.2003 N 126-FZ “On Communications” numbering - digital, alphabetic, symbolic designation or combinations of such designations, including codes intended for unambiguous determination (identification) of a communication network and (or) its nodes or terminals elements.

Thus, the number of the primary document is an identifier, i.e. a unique feature of an accounting object. The only requirement for the procedure for its assignment is its end-to-end nature throughout the reporting year and connection to the chronology of events.

Official documents known to us do not contain requirements for continuous numbering (i.e. numbering without gaps or breaks).

The creation of primary accounting documents, the procedure and timing of their transfer for reflection in accounting are carried out in accordance with the document flow schedule approved by the organization based on the size of the company itself, its internal structure, as well as the intensity of business operations. This follows from clause 15 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 N 34n, as well as from the Regulations on documents and document flow in accounting, approved by the Ministry of Finance of the USSR on July 29, 1983 N 105 ( hereinafter referred to as Regulation No. 105).

In this regard, we believe that the principle (method) of numbering primary documents within the framework of the applicable rules of document flow and technology for processing accounting documentation can be determined by the internal administrative document of the organization (clauses 4 and 7 of PBU 1/2008 “Accounting Policy of the Organization”). The decision made as part of the accounting policy is subject to registration with the relevant organizational and administrative documentation (orders, instructions, etc.) of the organization (clause 8 of PBU 1/2008 “Accounting Policy of the Organization”).

Invoice

According to paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, when selling goods (work, services), transferring property rights, as well as upon receiving amounts of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, the corresponding invoices are issued no later than five calendar days days, counting from the day of shipment of goods (performance of work, provision of services), from the date of transfer of property rights or from the date of receipt of payment amounts, partial payment on account of upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

Invoices are the basis for accepting tax amounts presented to the buyer by the seller for deduction, provided that the requirements established by clauses are met. 5, 5.1 and 6 art. 169 of the Tax Code of the Russian Federation (clauses 1, 2 of Article 169 of the Tax Code of the Russian Federation).

In paragraphs 5, 5.1 and 6 of Art. 169 of the Tax Code of the Russian Federation provides a list of mandatory details that must be indicated in the invoice. In particular, among the mandatory details of the invoice issued by the taxpayer both when selling goods (work, services), transferring property rights, and when receiving payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, the serial number of the invoice and the date of its preparation are provided (clause 1, clause 5, clause 1, clause 5.1, article 169 of the Tax Code of the Russian Federation).

Forms of invoices and the procedure for filling them out, as well as the rules for maintaining logs of received and issued invoices, purchase books and sales books in accordance with clause 8 of Art. 169 of the Tax Code of the Russian Federation are established by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax” (hereinafter referred to as Resolution N 1137).

In accordance with paragraphs. “a” clause 1 of the Rules for filling out an invoice used in VAT calculations approved by Resolution N 1137 (hereinafter referred to as the Rules for Filling Out 1), line 1 of the invoice indicates the serial number and date of the invoice.

The general procedure for assigning a number to an adjustment invoice or invoice is established in paragraphs. “a” clause 1 of the Rules for filling out the adjustment invoice used in calculations for value added tax, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137 (hereinafter referred to as the Rules for filling out 2). According to the specified order of the adjustment invoice number, invoices are assigned in general chronological order.

A special numbering procedure for issued adjustment invoices and invoices is provided only for organizations selling goods (work, services), property rights through separate divisions, and for partnership participants or trustees acting as VAT payers. In these cases, the serial number of the invoice through the dividing line is supplemented with a digital index of a separate division established by the organization in the order on accounting policy for tax purposes, or with a digital index approved by the participant of the partnership or trustee, indicating the completion of the transaction in accordance with a specific agreement of a simple partnership or trust property management accordingly (paragraphs three and four, paragraphs “a”, paragraph 1 of the Rules for filling out 1, paragraphs four and five, paragraphs “a”, paragraph 1 of the Rules for filling out 2).

Clause 3 of the Rules for maintaining a log of received and issued invoices used in VAT calculations approved by Resolution N 1137, in particular, determines that invoices (including corrected, adjustment) drawn up on paper or in electronic form , are subject to a single registration in chronological order in Part 1 “Issued invoices” of the accounting journal according to the date of their issuance, as well as compilation (correction).

According to clause 2 of the Rules for maintaining the sales book, used in VAT calculations, approved by Resolution N 1137, registration of invoices in the sales book is carried out in chronological order in the tax period in which the tax liability arises.

Thus, from the norms of Ch. 21 of the Tax Code of the Russian Federation and Resolution N 1137 it follows that invoices must include serial numbers and dates of their preparation, which are written out in chronological order and recorded in the journal of received and issued invoices and the sales book.

The specified regulatory documents do not contain requirements to maintain continuous numbering of invoices and invoices (i.e., without gaps or breaks).

Representatives of the tax authorities in their explanations indicated that the numbering of invoices should be carried out by the organization in ascending order of numbers for the organization as a whole (see letters of the Federal Tax Service of Russia dated July 6, 2005 N 03-1-04/1166/ [email protected] , Ministry of Taxes of Russia dated 05/21/2001 N VG-6-03/404).

The Russian Ministry of Finance clarifies that invoices for advances along with invoices for shipment must be numbered in general chronological order. Financial department specialists noted that separate numbering of invoices for advances is not provided for by Resolution No. 1137 (see letters of the Ministry of Finance of Russia dated October 16, 2012 N 03-07-11/427, dated August 10, 2012 N 03-07-11/284) .

Therefore, when issuing invoices, the sequence of serial numbers must be followed in chronological order.

Please note that neither the Tax Code of the Russian Federation nor Resolution No. 1137 contain any other requirements regarding the method (principle) of numbering invoices.

At the same time, it should be noted that based on the second paragraph of clause 2 of Art. 169 of the Tax Code of the Russian Federation, errors in invoices that do not prevent tax authorities from identifying the seller, buyer of goods (work, services), property rights, the name of goods (work, services), property rights, their value, as well as the tax rate and the amount of tax presented to the buyer is not a basis for refusing to accept VAT amounts for deduction.

The courts noted that in paragraphs. 1 clause 5 art. 169 of the Tax Code of the Russian Federation contains requirements for the presence of a number, but not for the numbering order, and a violation of the chronological order of numbering of invoices committed by the taxpayer cannot in itself be a basis for refusal to deduct VAT amounts (see, for example, the resolutions of the Federal Antimonopoly Service of the Moscow District dated June 24. 2008 N KA-A40/4542-08, FAS North-Western District dated 08/18/2005 N A05-2344/2005-10, Volga-Vyatka District dated 01/13/2005 N A28-9751/2004-433/11, decision of the Arbitration Court Sverdlovsk region dated July 20, 2011 N A60-11248/2011).

Please note that tax legislation does not establish penalties for violating the numbering of primary accounting documents and issued invoices. Responsibility provided for in Art. 120 of the Tax Code of the Russian Federation for a gross violation of the rules for accounting for income and (or) expenses and (or) objects of taxation, does not apply in this case, since a gross violation of the rules for accounting for income and expenses and objects of taxation means only the absence of primary documents or the absence of invoices .

Considering that in the situation under consideration, primary documents and invoices are issued by the organization upon shipment, the grounds for prosecution under Art. 120 of the Tax Code of the Russian Federation are missing (see, for example, information from the Federal Tax Service of Russia for the Chelyabinsk region dated November 30, 2011).

The texts of the documents mentioned in the experts’ response can be found in the GARANT legal reference system.

Application area

Invoices for payment are mainly circulated between legal entities. They can be submitted either electronically, or via mobile or fax - the main thing is that the document is read clearly.

But what if the seller is an individual entrepreneur? Don’t get lost - all the details in this case will be the same. The requirements for issuing an invoice for payment are the same. And it will be signed by the individual entrepreneur himself in three persons - for himself, for the accountant and for the contractor.

There may be such an option - the buyer is an individual. How to be in this case? What to indicate? What will be the procedure for issuing an invoice for payment? In this case, data about the individual is entered - his full name, passport details, place of permanent registration, actual place of residence, telephone number and other necessary information.