Account 51 of accounting is the active “Current Accounts” account, because non-cash funds are the organization’s most mobile asset and lie at the beginning of the “Cash” section of the accounting chart of accounts. This account summarizes information about the availability and flow of funds in Russian currency on the current accounts of an enterprise, which may have several such accounts opened with credit institutions.

Main aspects of accounting for 51 accounts “Current accounts”:

- Transactions are reflected on the basis of statements from the credit institution in combination with monetary settlement documents for them;

- Receipts to the company's current account are reflected as a debit, and write-offs as a credit.

- Account balance shows the balance of funds in the current account:

When checking statements of a credit institution, amounts may be discovered that were erroneously attributed to the debit or credit of account 51 of the accounting account. They are reflected in account 76 “Settlements with various debtors and creditors”, subaccount “Settlements for claims”.

Each operation involving the movement of funds on a current account must be documented with a primary document: a check, a payment order, a collection order, an announcement for a cash deposit, and the corresponding accounting entry:

Important! In case of overdue tax debt, the Federal Tax Service can issue a payment demand to the organization, which the bank will fulfill first of all without the participation of the debtor.

Typical postings and examples of operations

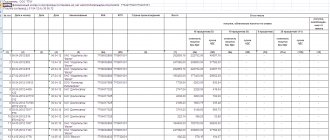

The correspondence of accounts for account 51 “Current accounts” is presented in the table:

Get 267 video lessons on 1C for free:

| Account Dt | Kt account | Operation description |

| 51 | 57 | Funds “on the way” arrived in the account |

| 51 | 58/66,67 | Repayment of the loan provided/receipt from the loan taken and other loans |

| 51 | 86 | Receipt of funds for targeted funding, from other organizations and individuals, the budget |

| 51 | 91 | Sales revenue |

| 81 | 51 | Redemption of shares (own shares) from participants |

| 84 | 51 | Payment for events (by decision of the founders) |

| 99 | 51 | Coverage of uncompensated expenses related to emergencies and natural disasters |

Example 1. Postings when opening a current account

Let’s say Leto LLC has one main bank account. Soon, in addition, Leto LLC opened a corporate card account, to which funds were credited from the current account. The bank's opening fee was also withheld. The main account has been replenished. All transactions were carried out in Russian currency.

Table – Postings for 51 accounts when opening an account:

Example 2. Postings for deposit transactions for 51 accounts

Let’s assume that Osen LLC transferred 2,000,000 rubles to the deposit. at 10.5% per annum (compound interest) for one year. At the same time, 50,000.00 rub. withdrawn from the current account for targeted on-farm expenses.

Posting table – Deposit transactions:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 55.03 | 51 | 2 000 000 | Funds are transferred to deposit | Payment order |

| 76 | 55.03 | 21 000 | Interest accrued on the deposit | Accounting information |

| 51 | 55.03 | 21 000 | Interest on the deposit is credited to the current account | Bank statement |

| 51 | 55.03 | 2 000 000 | Refund of funds transferred to the deposit | Bank statement |

| 50 | 51 | 50 000 | Withdrawing funds from a current account | Bank statement |

Example 3. Postings to 51 accounts when paying by bill of exchange

Let’s say Osen LLC purchased goods for a total amount of 114,550 rubles. An interest-free promissory note was issued to the supplier as payment. Paid after two months.

Table - Postings for payment by bill of exchange:

Analysis of 51 accounts and account cards

Analytical accounting for 51 “Current Accounts” accounts in the 1C Accounting program is carried out using standard reports for each:

- Sub-account, that is, for each current account of the organization, using the Turnover Balance Sheet report;

- Receipt and debit of funds using the Account Card report.

For prompt management of finances, the account balance is monitored daily.

In this article, we will look at how accounting of cash transactions (cash) and non-cash funds is kept at an enterprise, and for this we will consider two accounts: 50 Cash and 51 Current Account. The first is intended for accounting for cash, the second for accounting for non-cash money. Postings for cash transactions and the movement of non-cash money can be found below.

Sample of filling out account card 51 - what is it?

To reflect non-cash transactions related to the receipt and expenditure of funds, account 51 is used in the accounting of a business entity.

In practice, there is often a need to conduct an in-depth analysis of non-cash transactions in order to determine the amounts, sources of income and directions for writing off funds for specific periods of time.

The successful solution of the task becomes possible thanks to the preparation of the 51 account card.

What such a card is, what information it contains, how it is filled out - all these questions require more detailed study.

Accounting for cash on account 50 - “Cash desk”

Accounting account 50 is intended for accounting for cash flows, that is, for accounting for cash transactions. Debit 50 is intended to reflect cash inflows, credit 50 is intended to reflect cash outflows.

Documentation of cash transactions

All cash receipts and payments must be reflected in the statutory cash book; its maintenance is mandatory for every organization. All entries in the cash book are made on the basis of primary documents: incoming and outgoing cash orders. The entry of cash into the cash register is formalized by a cash receipt order, unified form KO-1, and the write-off of cash from the cash register is formalized by an expenditure cash order, form KO-2.

Analysis of account 50 shows that account 50 is active, intended to reflect assets (cash), its balance is always debit. An increase in an asset is reflected as a debit, a decrease as a credit.

Transactions with cash necessarily involve the use of, with the exception of some types of activities for which strict reporting forms can be used, read more about this in.

For each organization, a cash balance limit is established, that is, the amount of cash that can remain in the cash register at the end of the day; the amount in excess of the limit must be handed over to the bank at the end of each working day. When transferring cash to the bank, a forwarding slip is issued for the bag. The excess amount of cash can be left only to pay wages and benefits, but no more than five working days, including the day the bank issues the money.

The cash desk can store not only cash, but also monetary documents (paid tickets, vouchers).

Conducting cash transactions is regulated by certain regulatory documents that must be studied for proper cash accounting and proper cash management.

Regulatory documents for cash transactions:

- The Regulation “On the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation”, approved by the Bank of Russia on October 12, 2011 No. 373P, is the main document regulating cash transactions.

- Regulations on the use of KKM No. 745 1993 (ed. 08.08.2003)

- Directive of the Bank of Russia dated June 20, 2007 No. 1843-U “On the maximum amount of cash settlements between legal entities.” At the moment, the maximum amount of cash payments between legal entities is limited to 100 thousand rubles.

Postings to account 50

| Debit | Credit | Operation name |

| 50 | 51 | Withdrawing money from a current account |

| 50 | 62 | Receiving payment from the buyer in cash to the cash register |

| 50 | 75 | Contribution to the authorized capital by the founder in cash |

| 60 | 50 | Payment to the supplier in cash |

| 70 | 50 | Payment of wages to employees |

The indicated accounting entries for accounting for cash transactions are the most common typical options; you will find a complete list of entries in the Chart of Accounts ().

Loan movement

The credit of account 51 is formed from write-off (expense) transactions of non-cash funds of the enterprise. The loan turnover shows the total amount of transfers, write-offs and cash withdrawals deposited into account 51. The loan entries are as follows:

- Cash withdrawal (D 50, K 51) - funds are withdrawn from the current account and received at the enterprise's cash desk (cash out occurs on a limited basis, indicating the item of expense). Most often, organizations use part of the funds to pay salaries or for business needs.

- Transfer of non-cash funds (D 51/55, K 51) - this correspondence is carried out when transferring part of the funds to another account or opening special letters of credit intended for settlements with counterparties.

- Payment to suppliers, contractors and other creditors (D 60/62/76, K 51) - transfer of the amount of assets from the current account to counterparties (for goods and services, product returns, etc.).

- Calculations for loans, advances and credits (D 66, K 51) - interest on the use of borrowed funds is listed or the debt on loans is repaid.

- Fulfillment of obligations to budgets of various levels and extra-budgetary funds (D 68/69, K 51) - depending on the tax or fund, the corresponding sub-accounts are indicated in correspondence.

- Salary (D 70, K 51) - salary transferred to employees.

- Settlements with founders (D 75, K 51) - based on the results of activities, payments were made to the founders.

Accounting for non-cash funds to account 51 - “Current account”

All non-cash payments can be made if you have a current account. It opens in a credit institution, otherwise called a bank. How to open a current account and what documents you need to provide, read in.

To record the movement of non-cash funds of the organization, 51 accounting accounts are intended.

Is he active or passive?

Analysis of account 51 proves that it is active, it keeps records of the company's assets (non-cash money), and it always has a debit balance. The debit of account 51 is intended to reflect the receipt of non-cash funds (an increase in an asset), and the credit of account 51 is intended to reflect the write-off of non-cash funds (a decrease in an asset).

Currently, an organization is allowed to have several current accounts. Accounting account 51 () can be divided into several analytical ones, each of which will keep records for each individual current account of the enterprise.

The primary document confirming the fact of debiting and receiving non-cash funds is a bank statement, which contains information about all amounts received and debited from the organization’s current account.

Funds are written off on the basis of a payment order, which is drawn up in 2 copies and sent to the bank; one copy is marked by the bank stating that the order has been accepted and returned. When you deposit money from the cash register to your current account, an announcement is issued for a cash contribution.

What it is?

As you know, accounting account 51 refers to the cash section (Section V), which is part of the Chart of Accounts, approved by a special regulatory act of the Ministry of Finance of the Russian Federation (we are talking about order No. 94n dated October 31, 2000).

It is designed to record the receipt, expenditure and balance of non-cash money in the bank account of a business entity.

A characteristic feature of account 51 is the fact that it is used as an active synthetic accounting account, which records all incoming and outgoing transactions made in Russian rubles with non-cash funds of the organization.

The receipt (deposit) of non-cash money in rubles on the bank account of the organization is always recorded by the accountant under debit 51. The expenditure (write-off) of non-cash money in rubles from the bank account of the company is always reflected by the accountant under credit 51.

The corresponding transactions are generated on the basis of a bank account statement, to which supporting documents are usually attached (payments, checks, collection orders, other papers). The bank statement and its annexes are considered primary documentation.

Balance account 51 shows the actual cash balance in the company's bank account.

Analytical accounting of account 51 may provide detailing of transactions and balances for each of the current accounts opened by the organization in different financial institutions.

A detailed picture of the movement and balances of money in the bank current accounts of a business entity for certain periods of time can be obtained by generating and analyzing the card.

For this card, the following information is taken into account and systematized, characterizing the dynamics of non-cash money in a r/account for a specific time period:

- balance recorded at the beginning of the analyzed period;

- debit turnover (receipt of money);

- credit turnover (spending money);

- balance recorded at the end of the analyzed period.

Filling procedure

Account card 51 is a table that indicates data on balances and cash movements for a specific account of an organization for a certain period of time.

It is noteworthy that this table mentions the primary documents that justify each incoming or outgoing transaction.

This card is filled out by entering the following information into the table:

- name of the business entity;

- name of the card indicating the accounting period;

- initial balance (debit balance) of non-cash funds;

- for each incoming and outgoing transaction, the period, confirming document, debit analytics, credit analytics, correspondence of the necessary accounts, the amount of the transaction are separately indicated, and the change in the current balance of non-cash funds caused by the corresponding transaction is also reflected;

- total debit/credit turnover 51;

- the final balance (debit balance) of non-cash funds.

Download free sample and form

filling - link.

| LLC "AVB" Account card 51. Accounting period – 01/11/2019 | ||||||||

| Accounting period | Confirmation document | Analytics | Debit | Credit | Current balance | |||

| Debit | Credit | Check | Sum | Check | Sum | |||

| Opening balance | Debit 7000 | |||||||

| 11.01.2019 | Parish 323 dated 01/11/2019. Payment for the consignment of goods according to invoice No. 32 dated January 10, 2019. | Bank name, account | Start LLC, invoice No. 32 dated January 10, 2019. Parish 323 dated 01/11/2019. | 51 | 5000 | 62 | — | Debit 12000 |

| 11.01.2019 | Payment 256 from 01/11/2019. Calculation under supply agreement No. 23 dated 01/09/2019. | Finish LLC, supply agreement No. 23 dated 01/09/2019. Incoming invoice No. 11-23 dated 01/09/2019. | Bank name, account | 60/01 | — | 51 | 3000 | Debit 9000 |

| 11.01.2019 | Payment 258 from 01/11/2019. Payment of bank commission according to receipt No. 127 dated January 11, 2019. | Payment for banking services | Bank name, account | 91/02 | — | 51 | 10 | Debit 8990 |

| Total turnover, final balance | — | 5000 | — | 3010 | Debit 8990 | |||

Typical transactions for account 51

| Debit | Credit | Operation name |

| 51 | 62 | Receipt of payment or advance from the buyer |

| 51 | 50 | Cash deposit to the bank from the company's cash desk |

| 75 | Contribution to the Authorized Capital by non-cash means | |

| 51 | 66 (67) | Obtaining a short-term (long-term) loan |

| 60 | 51 | Payment to the supplier by bank transfer |

| 50 | 51 | Withdrawing money from an account |

| 75 | 51 | Payment of dividends by bank transfer |

| 66 (67) | 51 | Repayment of credit (loan) |

Summarize:

An organization can use both cash and non-cash money for mutual settlements. To account for the former, a cash register is used, and for the latter, a current account is used. Each cash accounting operation must be documented in primary documents, and the corresponding entry is reflected in the accounting records.

Existing types of payments

So, when opening a bank deposit, a bank account agreement is signed between the company and the credit institution, according to which the latter undertakes to accept and accept financial resources received in the name of the client, carry out the instructions of the account owner to write off monetary resources from the account or issue them, as well as perform other operations according to the account. The bank receives a commission for cash and settlement services to clients.

Depending on the payment procedure chosen between the counterparties for a particular transaction, cash and non-cash payments are distinguished. In the first case, financial resources are used in kind, i.e. in the form of banknotes. As for non-cash payments, they are made through accounts opened with a credit institution.

If we talk about citizens of the Russian Federation, then this category has no restrictions in choosing the procedure for making payments. But with legal entities and individual entrepreneurs the situation is somewhat different. Thus, in accordance with current legislation, in each transaction carried out, the limit for settlements using cash today is 60.0 thousand rubles.

The Civil Code of the Russian Federation and other regulatory and legal acts regulating banking activities allow the use of four key forms of non-cash payments:

- settlements using payment orders, when, on the instructions of the account owner, funds within the balance on it are transferred in favor of a counterparty who can be serviced by the same or another financial and credit institution;

- letter of credit form of payment;

- collection form;

- payments by checks.

Briefly about count 51 in infographics

The figure below presents all the key information about account 51 and its transactions in infographics.

All typical transactions for account 51 “Current account”

Each enterprise operates, as a rule, with both cash and non-cash funds. If there is a cash register to account for the former (this was written in detail in the article “”), then to account for non-cash funds, a current account is used - 51 accounting accounts. Transactions for accounting for non-cash funds are presented at the end of the article.

Cash is usually used to make cash payments to individuals. Settlements between legal entities are usually carried out using non-cash funds.

For this purpose, each enterprise chooses a suitable bank and opens a current account in it; for settlements in foreign currency, a foreign currency account is opened. Accounting for the sale and purchase of currency, as well as opening a foreign currency account, is discussed in detail. In the article we will take a closer look at the accounting of non-cash funds, its features, and the preparation of primary documents accompanying transactions involving the movement of non-cash funds.

Money can be received into the organization's current account from other legal entities (from buyers as payment, from credit organizations as a loan, etc.), from individuals, and the organization itself can deposit money from the cash register based on an announcement for a cash contribution. In this case, the organization is the recipient of the money.

With non-cash funds, an organization can pay suppliers for goods, services, materials, fixed assets, pay various taxes, contributions and payments, and can also cash out money on the basis of a cash check to pay salaries and accountable amounts to employees. Here the organization will already act as a payer.

Read about how to open a bank account.

The main primary document on the basis of which money is written off is a payment order.

Storing account documentation

An automated system of calculations and information storage has simplified the requirements for primary banking. Unless documents relating to the receipt of cash in accounts should be kept carefully, as before.

But for ease of use, print out bank statements and group them into folders. Sometimes confirmation of payment is urgently required, but connection with the bank is temporarily impossible. Or there were other reasons. Always having everything at hand is a habit that will greatly facilitate the work of an accountant and increase his assessment by management.

Account 51 in the company’s accounting combines information about the availability and movement of funds in open current accounts. Since these assets are highly liquid and the most mobile, and non-cash payments occupy the lion's share in the activities of any company, an important aspect in organizing accounting is the impeccable reflection of information on all transactions carried out in which account 51 appears. About the features of conducting transactions on account 51 and reflecting them in accounting analytical registers, will be discussed in this article.

Accounting in accounting

The Chart of Accounts provides for an accounting account. 51, which is used to reflect all transactions related to the movement of non-cash money.

The debit of account 51 reflects all receipts, and the credit records the debit of money from the account.

Accounting account 51 is an active account. If we carry out the analysis, we see that it keeps records of the assets of the enterprise - non-cash funds, therefore it is characterized by the signs of an active account (this issue was discussed in detail in: the final balance of account 51 is always debit; the debit reflects the increase in the asset, that is, the increase in cash funds in the enterprise account (receipt), and the loan reflects a decrease in the asset, that is, a decrease in funds in the account (their write-off).

Debit

The debit of account 51 is a reflection of the receipt of funds. Enrollment comes from the following sources:

- Enterprise cash register (D 51, K 50) - this entry is drawn up when cash is credited to the current account from the cash register.

- Settlements with counterparties (D 51, K 62/60/76) - the account is credited with the amount from buyers, other debtors, and suppliers (return of advance payment, excessively transferred funds, settlements on outstanding claims).

- Credits, loans, borrowings (D 51, K 66) - the operation is carried out if the received borrowed funds arrive in the current account.

- When making settlements with shareholders and owners (D 51, K 75), the founders’ funds are contributed (as working capital or when increasing the authorized capital).

- Settlements with budgets and non-budgetary organizations (D 51, K 68, 69) - overpaid taxes or amounts of social support for the population (benefits, sick leave, etc.) are listed.

Debit turnover is summed up for the reporting time period and is a generalized indicator of the receipt of funds into the current account of the enterprise. To analyze receipts by item, a balance sheet or account analysis is used.