What is a shopping book and what is it for?

A purchase ledger is a summary tax document. It includes information about invoices on the basis of which VAT deductions are applied for the corresponding tax period (quarter).

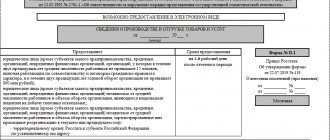

The purchase book is kept in the form of Appendix 4 to Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 (hereinafter referred to as Decree No. 1137). At the moment, the book form is used as amended by Decree of the Government of the Russian Federation dated August 19, 2017 No. 981. The April changes due to the increase in the VAT rate did not affect the purchase book.

Based on information from the purchase book, the amount of VAT deduction is reflected in the tax return. And the book’s indicators are included line by line directly in the VAT return. To do this, its form (approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] , as amended on December 28, 2018) provides for section 8. Such sections must be compiled as many as the number of entries registered in the purchase book for the corresponding quarter.

Maintaining a purchase book is the responsibility of VAT payers (clause 3 of Article 169 of the Tax Code of the Russian Federation). After all, only they have the right to deduction.

See also the materials “ Who is the VAT payer? " and " What are VAT tax deductions? " .

Based on the entries in the purchase book, accounting entries reflect the acceptance of VAT for deduction - through the entry Dt 68 Kt 19.

For details, see the material “ Posting “VAT accepted for deduction”: how to reflect it in accounting? " .

Sample book of purchases and sales from January 1, 2019

They touched the sales book. On January 1, the VAT rate changed, now it is 20%, so it was necessary to make adjustments to the approved form:

- in columns “14” and “17” the tax rate has been corrected to the current 20% - enter data on transactions in 2020 here;

- added columns “14a” and “17a” - in them display information on transactions that were carried out based on the VAT rate of 18%.

Otherwise, the filling rules have not changed.

[ads-pc-3] [ads-mob-3]

Let's take a closer look at the purchase book and fill it out in more detail.

The name of the organization is recorded in strict accordance with the registration documents. Below you must indicate its TIN and KPP, which can be viewed on the corresponding document issued to a legal entity when registering it for tax purposes.

In the “Purchase for” columns, the start and end dates of the reporting period are entered for which invoices are registered in the purchase book. Each entry in the register is numbered. Column 2 reflects the code of the type of operation, which can be found in the lists determined by the Federal Tax Service.

In the appropriate columns, the numbers and dates of the received invoices, corrective, corrective, as well as the document with the correction of the corrective (if any) are recorded.

Column 7 of the book reflects the number and date of the tax payment document in cases where this must be done in accordance with the law (for example, when importing goods into the country).

In the next column you must indicate the date of receipt of the goods, services, or works. Next, data is recorded with the name, tax identification number, checkpoint of the selling organization.

Columns 11 and 12 are filled in if intermediary operations are carried out.

The column “Customs Declaration Number” indicates the details of these documents if the goods are not produced in the country.

Column 14 is filled in if the invoice contains cost indicators expressed in foreign currency. Its name and code are written here. The “Cost of purchases” column reflects the cost of the product (services, work) including VAT, and the last column shows the amount of tax.

The book of purchases and sales is a reporting document in which the taxpayer records the invoices issued by the organization in the tax year. This act is needed in order to receive VAT compensation payments for the costs of various acquisitions.

The magazine is necessary for both sellers and buyers:

- first - to carry out accounting and registration of invoices, cash register receipts, reporting forms, and so on;

- the second - to record invoices issued for purchased goods.

This document is used solely for the purpose of applying value added tax deductions, as well as for creating VAT reports.

The book must be kept strictly adhering to the rules established by law. The legislative framework regulating the procedure for filling out this act includes the following bills:

- paragraph 3 of article No. 169 of the Tax Code of Russia;

- regulatory document No. 1137 dated December 26, 2011;

- Federal Law No. 382-FZ of November 29, 2014;

- clause 5.1 of Article No. 174 of the Tax Code of the Russian Federation;

- clause 8.1 of Article 88 of the Tax Code;

- clause 3, art. 76 NK.

1- Title page – it records information about the organization, such as its name, Taxpayer Identification Number, and dates of the reporting period.

2- The second sheet is a table consisting of 12 items, including:

- act number;

- date of compilation of the journal;

- invoice numbers;

- day, month, year when the product was purchased;

- country of origin of purchase;

- tax tax rate;

- VAT amount and other information.

3- A signature is placed and nine more chapters of the document are filled out, namely:

- date and numbers of invoices issued;

- Business name;

- TIN and checkpoint;

- date of payment for the goods;

- purchase price;

- for what amount the goods were purchased (excluding VAT);

- the total amount of the duty;

- final part;

- signature of the responsible person.

The journal is maintained by the company's management or by responsible persons appointed specifically for this matter. When filling out the document, you must ensure that the entered data is correct. The rules for registering the journal are regulated by the document flow law of the Russian Federation. After filling out, the act must be numbered, filed and sealed with the signature of an authorized person, as well as the seal of the organization.

The return of goods to the seller must occur on the grounds provided for by the legislation of the Russian Federation. In this case, the following information is recorded in the corresponding sales act:

- invoices presented upon completion of transactions,

- readings of cash register tapes;

- invoices issued by tax agents;

- adjustment acts drawn up when prices for products or services increase, and so on.

Transaction journals for individual entrepreneurs and LLCs, although similar in many ways, still have some differences. Thus, an individual entrepreneur who is a physical entity may not draw up this act if he is exempt from VAT.

| Column number | Explanations for filling |

| 1 | Sequential numbering of table rows with registration records. |

| 2 | The transaction code is taken from the List attached to the order of the Federal Tax Service MMV [email protected] dated 03/14/16. Codes can be specified separated by commas if the registered s/f simultaneously reflects several operations. |

| 3 | No., day, month, year indicated in the registered document (from column 1 of the s/f). |

| 4 | The number and date are filled in if a corrected s/f is subject to registration, that is, data is transferred from line 1a to s/f. |

| 5 | The number and date of the adjustment type s/f is entered - an independent document drawn up in addition to the original one. |

| 6 | The number and date of the corrected s/f correction type are indicated. |

| 7 | Details of the payment document are filled in if the moment of tax payment precedes the acceptance of this tax for deduction:

|

| 8 | The day on which the valuables, services, and work specified in the s/f are capitalized. |

| 9-10 | Seller details from fields 2 and 2b s/f. |

| 11-12 | Details of the intermediary, if the tax account is drawn up when the company performs the functions of a tax agent. |

| 13 | No. of the customs declaration, if customs declaration is required for valuables imported into the Russian Federation. For adjustment (including corrected adjustment) s/f column you do not need to fill out. |

| 14 | The code and name of the currency are entered if the amounts in the account are expressed in foreign currency. If the amounts are in Russian rubles, the column is not filled in. |

| 15 | The total cost of the s/f, including VAT, from column 9 in the “total” line of the registered s/f. If an advance payment is registered, then the total amount of the advance including VAT is entered. |

| 16 | The total VAT on s/f, which the company has the right to deduct, is taken from column 8 of s/f in the “Total” page. |

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

The purchase book is an important document, since recently its contents have been used when filling out a VAT return. In this regard, special attention must be paid to the correct execution of the document. Errors in the registration records of the purchase book can lead to the Federal Tax Service refusing to reimburse the added tax accepted for deduction or, at least, to the requirement to provide additional explanations to the tax service, which is also very unpleasant.

Reasons for the main errors:

- Accountant's carelessness;

- Ignorance of the rules for filling out the book;

- Insufficiently clearly defined rules regarding individual and non-standard transactions.

The sales book is compiled according to the form of Appendix No. 5 to Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. The same document contains the rules for filling out the book. The basic rules for filling out the document include:

- The sales book is maintained in paper or electronic form.

- All invoices (electronic and paper) are recorded in the sales ledger in chronological order in the quarter in which the liability is incurred.

- All changes after the end of the quarter are made in additional sheets of the sales book.

From 04/01/2019, an updated form of the sales book is used, which takes into account the new VAT rate of 20% (Resolution of the Government of the Russian Federation dated 01/19/2019 No. 15).

See also: “Purchase book and sales book: maintenance and registration for VAT calculations.”

From 04/01/2019 Government Decree No. 15 of 01/19/2019 comes into force. This regulatory act introduced further changes to the current Resolution No. 1137, which defines unified forms of the purchase and sales ledger, as well as additional sheets to them.

The innovations have adjusted the forms that were in effect in the previous edition. It is mandatory to use new forms only from the second quarter of 2020 (from 04/01/2019). However, there is no prohibition on maintaining new forms. Therefore, if the company starts using the updated sales book before April 1, it will not be an error.

What exactly has changed in the form, how to work with updates, what innovations will take effect on April 1 - our innovation memo will help you understand all this.

The register has been brought into line with changes in tax legislation. Namely, new columns have been introduced to reflect VAT amounts at the new rate of 20%.

Now in columns 14 and 17 of the book you should enter the information calculated at the new rate.

Please note that the calculation procedure has not changed. Only a higher tax rate is used.

New columns 14a and 17a have been added - they are used to calculate value added tax at the old rates. Column 14a should indicate the cost of sales taxed at a rate of 18%, excluding VAT. Column 17a indicates the amount of tax calculated at the rate of 18% or 18/118.

Similar changes were made to the header of the tabular part of the document: the name and content of columns 14 and 17 were changed. New columns 14a and 17a were introduced, which should contain information about the 18% tax rate.

https://youtu.be/8JebUP97s3s

What goes into the shopping book

The purchase book records:

- Invoices, including:

- received from sellers (clause 2 of the rules for maintaining a purchase book, approved by Resolution 1137; hereinafter referred to as the Rules for maintaining a purchase book);

- advance invoices for the shipment of goods, works, services (GWS) (clause 22 of the Rules for maintaining the purchase ledger), see the material “ Acceptance for deduction of VAT on advances received ” ;

- adjustment invoices to reduce the cost of shipment from the seller and increase it from the buyer (clauses 9 and 12 of the Rules for maintaining the purchase ledger), see the material “ What is an adjustment invoice and when is it needed? " ;

- for construction and installation works for own consumption, when deducting VAT on them (clause 20 of the Rules for maintaining a purchase ledger).

- Other documents that, along with invoices, serve as the basis for deducting VAT, for example:

- strict reporting forms or copies thereof - when deducting travel expenses (clause 18 of the Rules for maintaining a purchase ledger);

- customs declaration and payment documents confirming payment of import VAT - upon import (clause 6 of the Rules for maintaining a purchase book);

- statements on the import of goods and payment of indirect taxes - when importing goods from the EAEU (clause 6 of the Rules for maintaining a purchase book), etc.

Entries in the purchase book are made as the right to tax deductions arises.

See the material “ What are VAT tax deductions? " .

In this case, invoices are registered in a unified manner (clause 2 of the Rules for maintaining a purchase ledger):

- regular, corrective and corrected;

- received on paper and electronically;

- filled out partly using a computer, partly by hand.

Registration of invoice received

The second way to add an entry to the purchase ledger is to record the invoice received. To do this, go to the “Purchases” menu, section “Invoices received”.

Fig.10 Registration of invoice received

In the journal of received invoices that opens, you can see the first acquisition record, generated in the previous example based on the invoice.

Fig. 11 First acquisition record

When you click the “Create” button, a list of documents available for creation opens.

Fig. 12 List of documents available for creation

Select an invoice for receipt.

Let's look at an example in which on March 2, 2018, the organization purchased goods from the same counterparty - LLC.

Fill in the fields number and date of the document, counterparty. One of the advantages of 1C products is the ability to attach electronic copies of foundation documents. This function is implemented in the “Attached Files” tab, which allows, if necessary, to quickly compare original documents with those created in the system, without accessing document archives.

Fig.13 Attached files

In the Base Document field, click on the “Select” button. In a pop-up window, the program gives you a choice of two documents. This is a delivery note or a reflection of VAT for deduction. The second document relates to the previous operation, so we select the document that serves as the basis for the invoice. It should be noted that if we did not generate an invoice at the stage of posting the invoice (first example), the system allows you to select both base documents at the stage of generating an independent invoice.

Fig. 14 Base document

Also, special attention is required when filling out the “Receipt” field, since this date is the basis for including the amount of the VAT tax deduction for this invoice in the tax period.

What doesn't make it into the shopping book?

Invoices that do not comply (clause 3 of the Rules for maintaining a purchase ledger) should not be included in the purchase ledger:

- requirements of Art. 169 of the Tax Code of the Russian Federation ( see the material “ What errors in filling out an invoice are not critical for deducting VAT?” );

- established forms (Appendices 1 and 2 to Resolution No. 1137).

In addition, the book does not record invoices received (clause 19 of the Rules for maintaining a purchase ledger):

- upon gratuitous transfer of industrial and technical materials, including fixed assets and intangible assets;

- commission agent (agent) from the principal (principal) for goods and services transferred for sale, property rights, as well as advances received for this sale;

- commission agent (agent) from the seller of goods and services or property rights acquired for the principal (principal), including for advances issued;

- for the amount of prepayment for goods and materials purchased for VAT-free transactions;

- advance invoices issued or received after the seller has received (issued) shipping invoices.

Please note that from clause 19 of the Rules for maintaining a purchase book in its latest edition, subparagraph “e” was excluded, which read as follows: “e) for the amount of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer property rights in non-monetary forms of payment."

Thus, now a “non-cash” advance is not an obstacle to reflecting an advance invoice in the purchase book and, as a result, does not interfere with VAT deduction.

What's new in the rules for maintaining a purchase ledger?

We are talking about changes:

- In the structure of the document.

In its current structure, the book was approved by Resolution 1137 as amended on August 19, 2017. In particular, the following columns appeared in the document:

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

- to indicate information about forwarders and persons who perform the functions of a developer - as intermediaries (columns 11 and 12);

- to indicate the registration number of the customs declaration when importing goods (columns 3 and 13, also reflected in line 150 of section 8 of the VAT declaration).

- In the rules for filling out the purchase book.

Such changes can be divided into two categories:

- changes as amended by resolution 1137 dated August 19, 2017;

- amended as of 02/01/2018.

Both of these changes to the rules for maintaining a purchase ledger are worth considering in more detail. Innovations in the procedure for filling out the book, which became relevant back in 2020, are still unusual for many taxpayers.

What is reflected in the purchase book

The purchase book reflects the following information:

- in the header - information about the taxpayer-buyer (its full or abbreviated name in accordance with the constituent documents (or full name of the individual entrepreneur), INN and KPP), as well as information about the tax period (its start and end dates);

- in the tabular part - information about the documents serving as the basis for deducting VAT and its amount.

NOTE! If goods and services are purchased for transactions taxed at rates of 20, 10 and 0%, the invoice must be registered in the purchase book in parts - on the dates when the right to deduction arises (clause 6 of the Rules for maintaining the purchase book, letter from the Ministry of Finance of Russia dated March 17. 2015 No. 03-07-11/14238 and 03/02/2015 No. 03-07-09/10695).

See the material “ How to apply VAT deduction on export transactions ” .

If the purchase is intended for taxable and non-taxable transactions, an invoice is registered for the amount accepted for deduction based on the proportion of separate accounting (clause 6 of the Rules for maintaining the purchase ledger).

Purchase book according to resolution 1137

According to Resolution 1137, the purchase book is filled out in the following order (clause 6 of the Rules for maintaining the purchase book):

- Column 1 indicates the serial number of the record of information about the invoice (including adjustment);

- in column 2 the code of the type of operation is entered (see order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] );

- Column 3 generally reflects the serial number and date of the seller’s invoice; if the deduction is confirmed by other documents, then their details are provided (for example, a customs declaration, an application for import, etc.);

The latest edition of Resolution No. 1137 clarifies that in column 3 you need to indicate:

| Data to fill out column 3 | Under what conditions |

| No. and date of the application for the import of goods and payment of indirect taxes with marks from the tax authorities regarding the payment of VAT | When importing goods into the Russian Federation from EAEU countries |

| Registration number of the customs declaration issued upon release of goods in accordance with the customs procedure for release for domestic consumption upon completion of the customs procedure of the free customs zone on the territory of the SEZ in the Kaliningrad region | When reflecting VAT in the purchase book, which is accepted for deduction on the basis of clause 14 of Art. 171 Tax Code of the Russian Federation |

| No. and date of the payment and settlement document or other document containing summary (summary) data registered by the seller in the sales book | When reflecting VAT on an advance (prepayment) received on account of upcoming supplies of goods and materials and subject to deduction from the date of shipment of goods and materials |

- in columns 4–6 - serial numbers and dates of corrected, corrective or amended adjustment invoices;

- in column 7 - the number and date of the document confirming payment of the tax (you must reflect the details of the payment document in column 7 of the purchase book if VAT is deducted only after it is paid: for example, when importing goods into the Russian Federation (see letter from the Ministry of Finance Russia dated November 26, 2014 No. 03-07-11/60221) or return of the advance payment to the buyer in case of termination/change of the contract, letters of the Ministry of Finance of Russia dated March 24, 2015 No. 03-07-11/16044 and March 23, 2015 No. 03-07-11 /15889);

- in column 8 - the date of registration of goods (performance of work, provision of services), property rights;

- in columns 9 and 10 - the name and INN/KPP of the seller, respectively;

- columns 11 and 12 are filled in by the buyer-committee (principal) - they indicate the name, tax identification number and checkpoint of the intermediary commission agent (agent) purchasing the goods and services on his own behalf;

- in column 13 indicate the registration number of the customs declaration when selling goods imported into the Russian Federation, if their customs declaration is provided for by the customs legislation of the Customs Union; the column is not filled in when reflecting data on an adjustment (corrected adjustment) invoice in the purchase book;

- in column 14 - the name and code of the currency (only in the case of purchasing goods and services, property rights for foreign currency);

- in column 15 - the cost of goods and services, property rights or the amount of the advance payment including VAT;

- in column 16 - the amount of VAT accepted for deduction.

Changes from October 1, 2020

Previously, Appendix 4 to the Decree of the Government of the Russian Federation No. 1137 of December 26, 2011 determined the procedure and form for filling out the purchase book. Now, starting October 1, 2020, Russian government decree No. 981 dated August 19, 2017 came into force, according to which not only the form of the document has changed, but also the procedure for maintaining it.

Now let's look at all the changes in more detail.

Change No. 1: import of goods from the EAEU

From October 1, 2017, amendments were made regarding the columns of the purchase book in the case of importing goods from the EAEU. In particular, in the field “Number and date of the seller’s invoice” (column 3) you need to indicate such data as the number and date of the application:

- on the import of goods;

- on payment of indirect taxes.

An example of filling out column 3 of the purchase book is given below in the form of a document fragment:

| № p/p | Operation type code | Seller's invoice number and date |

| 1 | 2 | 3 |

| 1 | 01 | No. 27 from 10/13/2017 |

| 2 | 01 | No. 27 from 10/13/2017 |

Please note that a tax office stamp confirming VAT payment is required!

Change No. 2: import of goods from other countries

If goods are imported from other countries that are not members of the EAEU, then in accordance with the amendments made to the purchase book, the price of these imported goods should be indicated in the document in the same way as in the accounting record.

This information must be reflected in column 15 of the purchase book (fragment of the purchase book):

| Cost of purchases according to the invoice, difference in cost according to the adjustment invoice (including VAT) in the invoice currency |

| 15 |

| – 137 000,00 |

| 232 400,00 |

Note that previously the position on this column was ambiguous. Here are some recommendations in this regard from Letter No. SD-4-3/17657 of the Federal Tax Service dated September 20, 2020, which stated that when indicating the cost of goods that were imported from the EAEU, the following information must be reflected in column 15 of the purchase book:

- the price of goods established by contract or agreement;

- if there is no price in the contract (agreement), then you need to indicate the cost of goods from the accompanying documents;

- if the accompanying documents do not indicate the price, then the cost of the goods is reflected from the accounting data.

Thus, starting from October 1, 2017, the price of goods imported into Russia from other countries (except the EAEU) should be entered into the purchase book in accordance with the accounting.

Change No. 3: registration of an invoice for prepayment

From October 1, 2020, when registering prepayment invoices in the purchase ledger, you will no longer need to mark “partial payment.” Previously, the requirement for the need for this phrase was directly stated in the order of filling out the purchase book:

From October 1, 2017, there is no need to mark “partial payment” in the purchase book of invoices for prepayment. Previously, this was required to be done (in accordance with paragraph 19, subparagraph “e” of the Procedure for filling out the purchase ledger). With the introduction of new amendments from October 1, 2017, this requirement has become invalid.

Change No. 4: customs declaration number: registration, not serial

Changes to the purchase book also affected column 13 of the document. In this column you need to indicate the registration number, not the serial number of the customs declaration.

Column 13 looks like this:

| Registration number of the customs declaration |

| 13 |

| – |

| – |

Column 13 must be completed if the goods are imported into the territory of the Russian Federation and its declaration at customs is provided for by the law of the EAEU.

Let us remind you that VAT declarations also reflect the registration numbers of customs declarations. This is done in section 8 on lines 150 and appendices to the section.

Procedure for filling out the purchase book

Basic rules for working with a purchase book:

- fill out the purchase book in a way convenient for you - on paper or electronically;

- indicate cost indicators in rubles and kopecks (with the exception of column 15, filled in when purchasing goods and services or property rights for foreign currency);

- to correct incorrect entries in the purchase ledger, register or cancel the corrected invoice in the additional list of the purchase ledger in the same quarter when the first invoice was received;

- at the end of each quarter (no later than the 25th day of the month following the end of the quarter), sign the paper version of the purchase book from the manager (or an authorized person), lace and number the pages, seal them (if any);

- Keep sales books for at least 4 years from the date of last entry.

Find out what to consider when filling out an invoice from the materials in this section of our website.

Shopping book, its purpose and procedure for use

[ads-pc-3] [ads-mob-3]

The purchase ledger is a tax accounting ledger designed to record invoices from suppliers with incoming VAT. It is drawn up by the purchasing organization as these documents are received and attached to the declarations at the time of their delivery.

When filling it out, you must use the recommendations of Decree No. 1137 of December 26, 2011, which determines the mandatory form of this document. The register can be filled out manually using printed forms or using a computer. In the latter case, a printout is made for each tax period. In any case, it must be laced, numbered, and sealed with the manager’s signature and seal.

In many specialized accounting programs, the book is generated automatically, subject to the procedure for capitalizing the invoice.

Entries in columns with amounts are made in rubles and kopecks. If the invoice reflects the goods in a foreign currency, then you must first indicate its code in the appropriate column, and then the value. Incorrectly completed documents cannot be reflected in this register. It also does not record invoices received when carrying out activities in the interests of a third party under agreements of agent, commission, assignment, etc. Free receipt of material assets and the purchase and sale of foreign currency are not reflected in the purchase ledger.

For goods for which a VAT deduction is provided, taking into account payment, in case of partial payment it is necessary to make as many entries as the number of transfers made.

The purchase books reflect adjustment and correction invoices, and the values in the cost indicators can be either positive or negative. If you need to cancel an entry in the purchase book that was made in previous periods, then you need to fill out additional sheets to this register for the corresponding quarter. They are an important part of the shopping ledger.

The book needs to summarize the amount of VAT after each tax period so that their value is reflected in the declaration for this tax.

It is important to remember that only incoming invoices are recorded in this register.

The sales ledger is used to register outgoing documents .

Results

So, we found out that:

- the purchase book is maintained by VAT payers in order to determine the amount of tax deduction;

- the form and rules for maintaining a purchase book are strictly regulated by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137;

- information from the purchase book forms the VAT return indicators and is directly included in it;

- Based on entries in the purchase book, VAT deduction is reflected in accounting.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Design rules

Documentation can be maintained both on paper and in electronic form - at the discretion of the taxpayer (clause 1 of the Rules for maintaining books of purchases and sales, approved by the RF Government of December 26, 2011 No. 1137). However, the required documents are sent to the territorial bodies of the Federal Tax Service only electronically, along with the VAT declaration (clause 5 of Article 174 of the Tax Code of the Russian Federation).

If the institution maintains paper document flow, then upon the end of the quarter, before the 25th day of the month following the reporting one, copies of tax registers must be signed, laced, each page numbered and secured with a “living” seal. The hard copy is signed by the head of the institution or a responsible person appointed directly by the head.

If the documentation is maintained in electronic format, the registration procedure is greatly simplified: a printed copy is not required to be provided, and when sent to the local tax authority through an electronic document management system, the generated package is signed using an enhanced qualified electronic signature key.

According to the provisions of the Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] , the data reflected in the registers is indicated directly not only in the accounting, but also in the tax reporting - in sections 8 (purchases) and 9 (sales) ) value added tax returns line by line. Each entry for a given quarter corresponds to a separate section in the return.