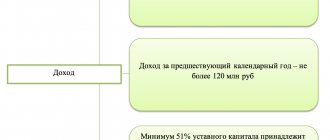

When and where to apply for an income tax refund

A taxpayer writes an application for an income tax refund if during the tax period he has the right to a deduction - property or social, and he wants to receive a deduction through the inspectorate.

For information on how to return personal income tax for treatment and education, read the materials “Procedure for the return of personal income tax (personal income tax) for treatment” and “Procedure for the return of personal income tax (personal income tax) for education” .

An application is also submitted if the taxpayer’s residence status has changed (he was a non-resident - he became a resident) and there is a need to recalculate personal income tax.

In addition, there are cases when a tax agent unnecessarily withholds and transfers the taxpayer’s personal income tax to the budget, and then ceases to exist. The error is identified, but it is no longer possible to return the tax through an agent. In this case, the taxpayer also needs to write an application for a personal income tax refund.

See “You cannot send an employee to the inspectorate for a personal income tax refund .

A taxpayer should apply for a refund of income tax to the tax authority at his place of residence. When changing the residence status, an individual must contact the tax office with which he was registered at the place of his residence or stay (clause 1.1 of Article 231 of the Tax Code of the Russian Federation).

In all other cases, personal income tax must be returned through the employer. ConsultantPlus experts explained step by step how to do this. Get free access to the system and see what steps you need to take to get your tax refund at work.

Application for refund of overpaid tax

Application for a refund of the amount of overpaid (collected, subject to reimbursement) tax (fee, insurance premiums, penalties, fines), form code according to KND 1150058.

To refund overpayments of taxes and insurance premiums, an application is submitted to the tax office; the refund application indicates the reason for the amount to be refunded, its size, information about the recipient of the funds and details for transferring funds.

The application is submitted separately for each type and period of payment for which the overpayment occurred. If an organization is registered with several inspectorates, the application is submitted to the inspection where the overpayment occurred.

Procedure for filling out an application for a tax refund

An application for a refund of overpayment of tax (penalties, fines) is filled out as follows:

- In the “KPP” field, the code assigned by the tax authority to which the application is submitted is indicated.

- The “Application number” field reflects the serial number of the current year’s application.

- In the “Payer status” field, the corresponding figure is set: 1 - taxpayer;

- 4 - tax agent.

- 78 - refund of overpaid tax (penalties, fines);

- 1 - excessive payment;

- 1 - tax;

- The field is filled in in the following format:

- 01 - current account;

Procedure for filling out an application for refund of insurance premiums

An application for refund of overpayment of insurance premiums (penalties, fines) is filled out as follows:

- The “Checkpoint” field reflects the code assigned by the tax authority to which you are submitting the application.

- The “Application number” field reflects the serial number of the current year’s application.

- In the “Payer status” field, enter code “3” - payer of insurance premiums.

- In the field “Based on the article” the article of the Tax Code of the Russian Federation on the basis of which the refund is made is indicated: “78” (refund of overpaid insurance premiums, penalties, fines).

- The following indicates the reason for the overpayment: “1” (excessive payment).

- The type of payment for which you have overpaid is also given: 3 - insurance premiums;

- 4 - fines;

- 5 - fine.

- 01 - current account;

Next, the application for a refund is submitted directly to the tax office in person, by mail or using the electronic document exchange system. The procedure for using the application form for personal income tax refund.

Is it necessary to submit a 3-NDFL declaration and at the same time an application for a refund?

The taxpayer does not have to submit an application for a tax refund along with the 3-NDFL declaration. This can be done later. After all, the declaration will still be cameralized first. And this takes up to 3 months. You can submit your application within these 3 months or upon completion of the review.

See “The Ministry of Finance explained how long to wait for a tax refund under 3-NDFL” .

The application must be accompanied by documents on the right to deduction, on a change of residence and other supporting documents.

How to submit an application to the Federal Tax Service

To return excess funds transferred to the budget as payment of tax obligations, the taxpayer will have to submit an application to the tax office:

- When contacting the tax office in person or through a legal representative on the basis of a general power of attorney;

- Through the Internet portal of the tax service, if you have access to the taxpayer’s personal account. Access can be obtained by contacting the multifunctional;

- Via the postal service by sending a registered letter to the tax office address.

This is important to know: How to file a claim for debt collection on a receipt with interest if the debtor does not return the money

https://youtu.be/liv4K1C86Dg

https://youtu.be/eH2CDElM6GY

Results

An application for an income tax refund should be submitted upon submission of the 3-NDFL declaration or upon completion of its desk audit. The application form was approved by order of the Federal Tax Service of Russia dated 02/14/2017 No. ММВ-7-8/ [email protected] From 01/09/2019 its new version is applied.

Sources:

- Order of the Federal Tax Service of Russia dated February 14, 2017 N ММВ-7-8/ [email protected]

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Step-by-step filling out a standard personal income tax refund application form

The applicant will need to fill out, in fact, only 2 pages of the form, since the 3rd page is intended only for those individuals who still do not have a TIN. Visually, the filling process will look like this:

- The application must be assigned a unique serial number for the current year. And regardless of the type of application. If, for example, earlier in the same year an application for a standard deduction with one number was submitted, then the subsequent application will have, accordingly, the next serial number.

- Next, the applicant (individual) writes down: the Federal Tax Service code (where the application is sent), his own FI, as well as his status - code “1”, which means “taxpayer”.

- Then you need to indicate the basis for the refund of the tax amount - one of the following articles of the Tax Code of the Russian Federation: 78, 79, 176, 203 or 333.40. When choosing the right article, you should take into account their content and scope.

Art. 78: offset and return of excess amounts paid for taxes (fees, contributions, penalties, fines). Art. 79: return of excessively collected similar amounts. Art. 176: tax refund. Art. 203: refund of excise tax. Art. 333.40: refund (offset) of state duty.

- The applicant, using the appropriate code, must indicate how much he is asking to return. For example: “1” – overpaid, “1” – tax. All code options with decryptions are written next to the lines. All he has to do is select the required option from them.

- The amount to be refunded is written in numbers in Russian. rub.

- The tax (settlement) period code is indicated taking into account the decoding and explanations presented at the bottom of the form in a footnote. If the refund is made for a month, then they write “ms”, for a quarter – “qv”, for a half-year – “pl”, and for a year – “gd”. After this, the required number of the month (from 1 to 12), quarter (1, 2, 3 or 4), half-year (1 or 2). Finally, the current year is written down.

For example: “MS.09.2020”, which means: refund for September 2020.

- OKTMO is recorded according to the code according to OK 033-2013, and KBC according to the purpose of the application (i.e. for the return of personal income tax or other purposes).

- If 2 pages are completed, then, therefore, the applicant still indicates that he compiled it on three pages with attachments (or without).

- In the section where it is necessary to confirm the accuracy of the submitted data, the applicant must o (payer) or “2” (if the application is submitted by his authorized representative). Along the way, they are given a contact phone number and the corresponding date is entered in numbers, for example: “09/10/2020”.

- If the interests of the applicant are represented by his authorized representative, then the name and details of the document that will confirm his authority should be immediately written down.

- On the second page of the form you need to write down the necessary bank information (name of the credit institution, identification code, type and account number). The recipient is an individual, so you should write code “2” in the appropriate line.

Those individuals who need to fill out the third page of the form write down their full name, identification document code with its details (series, number, by whom and when issued). The application must be signed personally by the applicant.

The section intended for the Federal Tax Service and located on page 1 does not need to be filled out by the applicant. It is filled out by the responsible tax officer when registering the received application.

Example 1. Sample of filling out a standard tax refund application form

The proposed option for filling out the form is in Excel format. The statement uses the following conditional data.

The applicant (Saveliy Vsevolodovich Bortsov), a citizen of the Russian Federation, applies to his Federal Tax Service in order to return the excess amount of tax paid by him in the previous year 2020. The basis for the return is Art. 78 of the Tax Code of the Russian Federation, the amount to be returned is 15,000 Russian rubles. rub. Tax (calculation) period: “GD.00.2018”. The applicant submits the application independently, without an authorized representative.

The form also indicates: INN, OKTMO code 45358000 (Ostankino municipal district), corresponding to the KBK tax refund. Bank details: Sberbank PJSC (its identification code), account type “2” (current), bank no. accounts. Since the applicant S.V. Bortsov has a TIN, on page 3 he writes only his full name.

It should be noted that in this example, the option of filling out the text part of the application (i.e. digital, text, numerical indicators) is proposed. Whereas in the final version of the application, in addition to this, it is also required to put dashes in empty spaces.