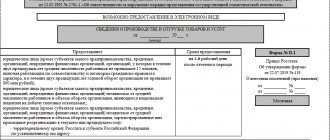

The MP-SP form is a specially approved statistical report for all legal entities engaged in economic activities that are considered small businesses. The document contains information about the financial performance of the company and all its structural divisions for the past year. This report was approved by Rosstat and was developed for continuous statistical monitoring of the work of small enterprises in 2020.

Such monitoring is carried out every 5 years to study and analyze the dynamics in the structure and growth indicators of small and medium-sized businesses across the country. The previous information collection period was 2011, now reporting is submitted for the past 2020.

Who is renting it out?

This form is required to be provided by small and medium-sized trading companies:

- legal entities;

- peasant and farm enterprises;

- companies that have temporarily ceased operations, but carry out commercial activities or investments during the reporting period.

Indicators for the existing divisions and subsidiaries of the organization are supplemented with general information and are submitted to the legal address where the main office of the enterprise is located.

You can get detailed information about this type of reporting from the following video:

Place and due date

The completed document is submitted to the regional department of Rosstat at the location of the reporting company in paper or electronic form.

Since the form is a one-time document, it has a strict deadline: until 04/01/2016 . In case of failure to comply with established standards and entering incorrect information, the law provides for fines:

- per company - from 20 to 70 thousand rubles;

- for responsible persons - from 10 to 20 thousand;

- in case of repeated violation: for a company - from 100 to 150 thousand, for officials - from 30 to 50 thousand.

How to fill out the document?

When entering information, you must adhere to certain instructions:

- sheets must not be connected with paper clips, staplers or clamps;

- You need to enter data in sections specially designated for them;

- correct all errors using the sample document;

- It is unacceptable to use a proofreader and cover up erroneous data with parts of the paper.

On the first sheet of the report, before the section on general information, you need to enter the details of the organization: full name and postal address.

All questions of the form are combined into 4 sections and occupy the same number of sheets.

You will find information about consolidated reporting and the features of its preparation here.

Section 1. General information about the enterprise

- legal and actual address of the company;

- the date when the company began to engage in economic activity;

- the exact number of working months over the past year (for non-permanent organizations);

- information on possible structural changes in joint stock companies in previous years;

- taxation systems used by the company in the reporting period.

If it is necessary to select from the proposed items, the correct answers are indicated in the provided columns with an “X”.

Section 2. Main performance indicators of a legal entity

- 2.1. The total number of employees of the company and the accrued salary is included here: the average number of working people per year, including payroll employees, external part-time workers, employees hired under civil contracts;

- only the number of workers on the payroll;

- the total amount of accrued staff salaries;

- only the monetary volume of salaries of employees on the payroll and external part-time workers;

- the average number of all people working in the company in 2014.

- the cost of products at which they were purchased for subsequent resale in the reporting period, while the year of purchase is not important;

This is interesting: Preparing the mold 2 tp air

Section 3. Fixed assets and investments in fixed capital

- 3.1. The paragraph explains which fixed assets are not indicated in the report lines. Tangible fixed assets include buildings, tools, transmission devices, livestock, computer equipment, transportation, and so on. Intangible ones are developments, computer software, copyrights, monetary costs for the exploration of valuable minerals, high-tech industrial technologies, and others. The section includes:

- information on the availability of fixed assets on the company’s balance sheet at their original book value at the beginning of 2015;

- fixed assets of the company that are on the balance sheet at the initial and residual prices at the end of the reporting period;

- information on investments in fixed capital concerning the costs of creating and purchasing fixed assets.

- 3.2. At this point, the organization needs to indicate the fact that it has freight transport (trucks, pickups, dump trucks, etc.) as of the final reporting date, while transport leased out should be excluded.

- 4.1. It is necessary to reflect whether the company received government support and what kind of support it was.

Section 4. State support

After completing all sections at the end of the report, the responsible person who provided the information enters his personal data, date, signature and telephone number.

mp.jpg

Related publications

Micro-enterprises, along with other organizations, are required to prepare and submit reports to statistical authorities. One of the main statistical reports for them is the MP (micro) form, which contains general information about the company’s activities. Are all micro-enterprises required to submit this report? How to fill out the MP (micro) form? The answers to these and other questions are in our material.

Results

In accordance with Law No. 209-FZ, Rosstat carries out continuous statistical observations of the development of the Northern Sea Route once every 5 years. As part of this work, the department collects information provided by firms through special forms.

Based on the results of 2011–2015, all legal entities belonging to small and micro enterprises were required to report to the statistical authorities by April 1, 2020. For this purpose, the MP-SP form , through which key economic indicators were reported to Rosstat (such as business turnover, the number of staff of the company, payroll, etc.).

You can familiarize yourself with other nuances of reporting to Rosstat in the articles:

- “Kids should not shy away from the statistical census”;

- “What are the penalties for failure to submit accounting reports to statistics?”

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Statistical report of MP (micro) for 2018

The MP (micro) report is intended to report information on the activities of microenterprises to the territorial department of Rosstat. The new form of the document was approved by Rosstat order No. 461 dated July 27, 2018 (Appendix No. 13) and will be used starting with reporting for 2018. The report is submitted once a year, but not all organizations should do this, but only those included in the Rosstat sample.

Recommendations for filling out MP (micro) were approved by the same order No. 461. Control ratios for checking the correctness of the report are also given there. Detailed instructions for filling out can be found on the Rosstat website.

What reports do microenterprises submit to statistics in 2019?

The activities of small businesses (including micro-enterprises) are subject to continuous statistical monitoring once every five years. The last such observation was in 2020 based on the results of operations for 2020.

In the interim periods, microbusiness entities are subject to only random observation once a year. Its rules are established by Government Decree No. 79 dated 16.02.2008.

The complete list of statistical reporting for microorganizations consists of 18 forms. The vast majority of them are related to specific types of activities. Main form: MP (micro); Who is required to submit a report will be discussed below.

To understand whether an organization is included in the sample or not, you should refer to Rosstat’s special resource statreg.gks.ru. On the page that opens, by filling out the company data, you can get a list of statistical forms to be submitted. Some regional departments of Rosstat publish a list of organizations included in the sample on their websites. For example, a list of selected organizations in St. Petersburg and the Leningrad region can be found on the Petrostat page in the section Reporting → Statistical reporting → List of reporting business entities.

How and when to submit a report

The MP (micro) form is submitted to the Rosstat department at the location of the microenterprise. If the organization did not conduct business at its location, the report is submitted at the place of actual business activity. You can submit a report not only on paper, but also send it to the department in electronic form.

Micro-enterprises that temporarily did not operate during the reporting year submit an MP (micro) report on a general basis. The document must indicate since when the activity has not been carried out. If no activity was carried out at all, the report is submitted with zero indicators by filling out section 1 “Questionnaire”.

As a rule, Rosstat always notifies respondents included in the sample of the need to submit reports. A corresponding letter should be sent to the legal address of the organization. MP (micro) is available at the end of the article.

The head of the organization can independently check whether the company is included in the sample. To do this, you need to visit the official Rosstat website. On the page that opens, you must enter one of the parameters: INN, OGRN/OGRNIP, OKPO and click on the “Get” button. The system will automatically display a list of forms that an economic entity must submit to Rosstat.

MP (micro) due date 2020

The report must be submitted before April 1, 2020 to the territorial body of Rosstat at the location of the organization. This period is indicated on the title page of the TZV-MP form. However, April 1, 2020 falls on a Saturday. In this regard, the report can be submitted on the next working day. That is, April 3, 2020, Monday.

Moreover, if the organization does not carry out activities at its location, then the TZV-MP can be submitted at the place of actual implementation of the activity (section 1 {amp}lt; Instructions for filling out the TZV-MP {amp}gt;, approved by Order of Rosstat dated July 29. 2016 No. 373).

But who exactly is obliged to submit the TZV-MP form to Rosstat authorities? Before answering this question, we believe it would be appropriate to explain what types of statistical observation, in principle, exist.

The statistical form we are considering was approved by Rosstat order No. 541 dated August 21, 2017. It also contains a brief explanation of how to fill it out.

MP form (micro)

In order to find out which reports a particular organization or individual entrepreneur must submit, you can not only use the official resource, the link to which was given at the beginning of the article, but also contact the territorial body of Rosstat at the place of registration and clarify the list of valid forms. Statistical service employees are required to inform all business entities about all reporting forms and the procedure for filling them out, in accordance with the rules approved by Decree of the Government of the Russian Federation of August 18, 2008 No. 620.

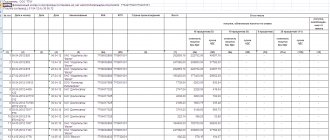

Below we summarize information about the main annual reports to Rosstat (by following the links in the right column of the table, you will see instructions for filling out these reports).

| Statistical report form | Deadline | Form |

| No. 1-T “Information on the number and wages of employees” | Until January 22, 2019 | 1-T |

| No. 7-injuries - about injuries at work and occupational diseases | Until 01/25/2019 | 7-injury |

| No. MP (micro) - data on the main performance indicators of a micro-enterprise | Until 02/05/2019 | MP-micro |

| No. 1-P - about the activities of the organization | Until 04/01/2019 | 1-P |

| No. 12-F - on the use of funds | Until 04/01/2019 | 12-F |

| No. 57-T - on wages of workers by profession and position | Until 30.11.2019 | 57-T |

Any Russian enterprise, in addition to standard tax reporting submitted to the Federal Tax Service of Russia within the time limits established by the Tax Code, must provide information on specially approved forms to the statistics service at its location - the Rosstat branch.

The information provided is necessary for statistical observations on a statewide scale and generalization of various performance indicators of the country as a whole and its individual regions.

Rights and obligations for the presentation of statistical data are regulated by Federal Law No. 282-FZ “On official statistical accounting and the system of state statistics in the Russian Federation” (November 20, 2007), Rosstat Order No. 414 of August 11, 2020, and a number of other legal acts.

Departmental orders of Rosstat establish report forms, rules for their execution and completion.

Reporting is divided into mandatory (provided by each legal entity) and additional, filled out only by those organizations/institutions that were included in the Rosstat sample.

In addition to tax reporting, legislative acts provide for the obligation of a business entity to submit reports to statistics. Which forms to submit are determined by Rosstat independently and communicated to companies and entrepreneurs. Currently, there is a service where you can use your tax identification number (TIN) to view reports to statistics in 2020, a list of forms and deadlines for submission.

Legal norms establish the obligation to submit statistical reports to Rosstat. Moreover, what kind of reports need to be submitted depends on the status of the business entity, the type of activity performed, size, etc.

If a company does not operate, its reporting obligation does not disappear. She still has to fill out the forms and send them to statistics. If she does not have indicators, then she must prepare a letter with explanations and submit it to Rosstat.

Submission of reports to statistics in 2020 is also provided for organizations classified as small businesses and subject to preferential tax treatment. For these entities, the list of forms that need to be sent to statistics has been significantly reduced.

Procedure for filling out MP (micro)

It is not difficult to fill out the MP (micro) form for statistics; the document is compiled in the form of a questionnaire. The form consists of a title and five sections. The filling procedure will be as follows:

This is interesting: How to file a divorce through the registry office

On the title page indicate the name of the microenterprise (full and abbreviated), its postal address, OKPO code, type of activity according to OKVED.

Section No. 1 consists of just one question: “Do you use the simplified tax system?” You need to check the box next to the appropriate answer option.

In section No. 2, you must indicate information about the number of employees, accrued payroll, and hours worked. At the same time, here and further you need to note the presence of the phenomenon by circling one of the options “Yes” or “No” opposite each indicator. The average number does not include external part-time workers, and the line of social payments reflects amounts excluding Social Security benefits (severance pay, financial assistance, etc.). Man-hours worked include actual work time, incl. overtime, on weekends and holidays, while on business trips.

Section No. 3 displays information about general performance indicators: the number of shipped goods of own production, the number of sold goods of non-own production, the amount of investment in fixed capital.

Section No. 4 provides information on wholesale and retail sales, turnover in the catering industry.

Section No. 5 displays information about the transportation of goods and vehicle turnover.

At the end of the document you must indicate the position, full name. and the signature of the person responsible for providing statistical data, his contact phone number, email address.

Entrepreneurs can find a detailed methodology for calculating all indicators for the SE (micro) form in Rosstat Order No. 723 dated November 7, 2017.

MP-SP form for 2020 sample filling

Entrepreneurs submit a similar report, but fill it out using the “1-entrepreneur” form, approved by Rosstat order No. 263 dated 06/09/2015. The deadline for submitting the form is no later than April 1, 2020. You can download the new form on our website by following the link.

Based on materials from: https://www.glavbukh.ru/

PC "Taxpayer PRO"

PC "Taxpayer" - designed for maintaining accounting records, preparing accounting and tax reporting to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund, FSRAR in electronic form on magnetic or paper media in approved forms and formats, including for transmission via telecommunication channels (TCC) with an electronic digital signature (EDS).

download latest version

2020.3.13

Calendar

| 28 | 29 | 30 | 31 | 1 | 2 | 3 |

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 1 |

The functionality for checking reports on individuals in the Pension Fund of the Russian Federation has been implemented using the “PD Software” program recommended by the fund (IF IT IS INSTALLED ON THE COMPUTER)

The format and form of SZV-TD (electronic work books) have been updated in accordance with the version of the format album 2.43d dated December 23, 2019

New formats have been implemented: simplified accounting reporting forms, accounting (financial) reporting forms, corporate property tax declaration forms

Accounting: In standard transactions of documents for write-off (sales) of goods and materials (invoices, UPD, requirements), a formula has been added for calculating the amount of the transaction “At average cost”. Calculation is done automatically

Accounting: The “Accounting certificate” document has been added to the “Group re-posting...” functionality

A PROJECT of reporting in the SZV-TD form has been implemented - electronic work books (the project has not yet been approved). Reporting is planned to be submitted to the Pension Fund on a monthly basis starting in 2020

Accounting: In the Purchases and Sales section, a new “Analytical report on sales” has been added for any time interval by customers and/or product (services) with a large number of settings

In the “Salary statements” mode, the ability to print a list of statements has been added

In the settings on the “Taxation” tab for IT organizations (tariff 06), starting from 2020, the date for receiving accreditation has been added. When filling out this date, the calculation of contributions at a preferential rate is made not from the beginning of the quarter, but from the month of receipt of accreditation

In printed forms for pay slips, a new document has been added - a log of the issuance of pay slips

Form MP-SP and “1-entrepreneur” for 2020, which must be submitted before 04/01/2016

Information on the main performance indicators of a small enterprise

Information on the main performance indicators of a small enterprise is submitted to Rosstat by small enterprises upon request. This document is the main form of providing reliable data on the activities of an individual entrepreneur or legal entity related to small forms of entrepreneurial activity to statistical institutions. It is also called the PM form.

It relates to quarterly reporting and is submitted to the territorial body of Rosstat in a specific constituent entity of the Russian Federation on the 29th day after the reporting period.

When registering, any entrepreneur becomes obliged to submit, in addition to tax and accounting, statistical reporting. Organizations using the simplified tax system are no exception (according to the Tax Code, paragraph 4, article 364.11). This is discussed separately in the document.

Statistical reporting in 2020

In connection with the release of Rosstat order No. 414 dated August 11, 2016, the MP-SP form is not used in 2020, but the same order approved many new statistical reports, including those for submission by small businesses:

- Form 1-IP - on the activities of individual entrepreneurs,

- Form 1-IP (months) – information about products produced by the individual entrepreneur,

- forms of MP (micro) and MP (micro)-nature - about micro-enterprises and the products they produce,

- Form PM-prom – about the production of products by small enterprises.

Also, unlike the MP-SP form, in 2020 the forms previously approved by orders dated May 12, 2012 No. 185, dated August 27, 2014 No. 536, and dated July 15, 2015 No. 320 continue to be valid:

- Form 1-IP (trade) - on retail trade carried out by individual entrepreneurs,

- PM-bargaining form – on the trade turnover of a small enterprise,

- Form 1-TORG – on the sale of goods by trading organizations,

- PM form – about the main performance indicators of small businesses.

Using a special service, you can find out what forms should be submitted to the Rosstat bodies of the organization, including whether the MP-SP form is submitted for 2020. To do this, just go to statreg.gks.ru, select the type of notification and indicate one from the details of your organization - OKPO, INN, or OGRN. The service will issue a table indicating which forms of statistical reporting must be submitted and within what time frame. Obviously, among the reports to statistics, the MP-SP form for 2020 will not be available. If the search result is zero, then in 2020 the company will not have to report to statistics at all.

Types of statistical research

There are two types of statistical observations on a federal scale:

- Solid. They are held for all companies once every five years.

- Selective. Every quarter of the year (or every month, it will depend on the region of the country) a list of organizations is compiled - a representative sample. It provides reports on the basis of which conclusions are drawn.

The last type of research is approved and regulated by Government Decree No. 79 of February 16, 2008. The attached form of paper was approved by Rosstat Order No. 541 of August 21, 2020.

In general, in 2020, Rosstat established six standard forms of annual reports for this category of organizations, two quarterly reports and three monthly ones. And statistical data is accepted only in approved forms.

MP-SP form for 2020

Forms of the MP-SP form (Information on the main indicators of the activities of a small enterprise for 2020) for companies and form No. 1-entrepreneur (Information on the activities of an entrepreneur for 2015) for individual entrepreneurs were approved by Rosstat order No. 263 dated 06/09/15. Information that will be required fill in: address, type of activity, fixed assets, revenue and expenses, staff, payroll, etc. Reports can be submitted both on paper and electronically. Below we have provided a sample of filling out the MP-SP form for 2020.

The need to provide

Statistical institutions form a certain sample of small enterprises. It is the designated list of companies that will be required to provide the completed form attached. You can find out whether a specific organization is included in the sample by calling the government agencies that deal with this issue. Another way is to register on a specialized Rosstat service on the Internet.

But usually those who did not receive a letter demanding that they provide it are not included in the sample. This means that there is no need for an employee of the organization to fill out “information”.

In all cases, without exception, a small enterprise must provide statistical reporting on its activities at least once every 5 years. This is clearly stated in Law No. 209-FZ, namely in paragraph 2 of its article 5.

Why do you need the MP-SP statistics form?

The MP-SP form is a one-time statistical reporting document that, before April 1, 2020, all legal entities belonging to small businesses and microenterprises had to submit to Rosstat. The agency collected data on businesses for 2011–2015 as part of continuous statistical surveillance in the manner established by the norms of Art. 5 Federal Law “On the development of small and medium-sized businesses in the Russian Federation” dated July 24, 2007 No. 209-FZ.

Continuous statistical observations are carried out once every 5 years. And if the legislation does not change, the next time reporting similar to the MP-SP form will be required from respondents no earlier than 2021. However, Art. 5 of Law No. 209-FZ provides for Rosstat to also conduct selective statistical observations: for small businesses monthly or quarterly, for microenterprises annually.

It is possible that for the relevant observations, Rosstat will collect information from enterprises similar to what they submitted in the MP-SP form . So the experience of filling out the form will be useful to the manager or responsible person of the enterprise in terms of readiness to participate in subsequent observations initiated by Rosstat.

Let's study the basic principles of working with the MP-SP form , the structure of which could potentially become the basis for other reporting forms.

Components of a document

Information about the main performance indicators of a small enterprise is distributed over three separate pages of paper. Before the introductory part there are explanations that, referring to the current legislation, explain all responsibility for violating the procedure for submitting statistical reporting documents to Rosstat.

First page

The first page of the paper provides basic information:

- OKUD form number. It was initially specified in the form - 0601013.

- Title of the document.

- Name of the reporting organization.

- Code of the company filling out the document according to OKPO.

- Code of the company's type of activity according to OKVED2.

- Data on changes to the form (date and document number). In most cases, these columns remain empty.

Second page

The second page contains the main part of the document - the questionnaire. It must disclose the total number of employees in the company, as well as information regarding the total amount of time worked by them since the beginning of the year.

Answers to questions must be marked with a check mark or in block letters. Circle the words “is” or “no”. If a line indicates availability, then there must be a number in the same line (in the corresponding column).

Thus, organizations preparing statistical reports should have the following information after reading the questionnaire:

- Does the small enterprise use the simplified tax system (if yes, then the checkbox should be in the first line).

- How many people work in the company and in what capacity.

- Composition of the employees' payroll fund.

- Were there social payments (for each type of employee separately). If yes, then the amount of these payments is indicated.

- The number of hours worked by employees of the organization's payroll for the corresponding period.

This is interesting: The difference between a major overhaul and a current one

The questionnaire is completed in the form of a table with three explanations to it.

Third page

The third page of the document is devoted to the general economic indicators of the organization. They should not include VAT, various excise taxes and other types of mandatory payments that the company pays. So, the survey questions in this part of the paper concern data about:

- How much the company produced goods or services independently. If the organization is not a manufacturing organization, but is a reseller, then you must circle “No” in this column.

- How many goods or services were sold. This refers to those that were not produced independently.

- Were there any expenses for purchasing inventory items for resale?

- Have there been investments in the company's fixed capital? If yes, how much?

- Did the company have internal costs for research and various types of development?

- Has the organization bought or sold real estate? If yes, then the costs of acquisition and the cost of sold real estate are indicated.

The document ends with a signature and contact details of the person who compiled this statistical report. Namely, the full name, position, telephone number and email address are indicated. The date of completion is indicated in the lower right corner of the third page.

Violation

If the report to the statistical agency was not submitted on time, then the small enterprise will face administrative liability in the form of a fine. Penalties are applied in accordance with the Code of Administrative Offenses, paragraph 1 of Article 13.19. They provide:

- From 20,000 to 70,000 rubles. from the company for the first violation.

- From 100,000 to 150,000 rubles. for repeated violation of reporting.

If the responsibility for failure to submit reports lies with the official, then the amounts will be less: up to 50 thousand rubles.

Instructions for filling out the PM statistics form

Title page

The title page of the form includes standard data: name, address, organization codes. In this case, you should indicate the full name of the company according to the registration documents, and write a short name in brackets. The address line must reflect the full legal address and the actual address (if it differs from the legal address).

In columns 2 and 3 of the title page, you need to note the OKPO and OKVED codes, respectively. Column 4 should be left blank.

All indicators in sections 1 and 2 are entered on an accrual basis.

First section

If the company uses the simplified tax system, you need to make a note in section 1.

Second section

The second section is filled out based on the number of employees and their salaries.

For each indicator you need to make a mark; to do this, you should circle the corresponding word - “is” or “is not”.

The table includes indicators for average headcount, wage fund and social benefits. Line 03 reflects the average number of employees. Line 03 is equal to the sum of lines 04, 05 and 06.

The accrued wage fund (WF) by employee category is reflected in lines 07–11.

Clause 16 of the Instructions describes in detail what amounts need to be taken into account when determining the gross pay.

Line 17 reflects the number of man-hours worked by payroll employees.