Instructions: fill out and submit a report on Form 3-F

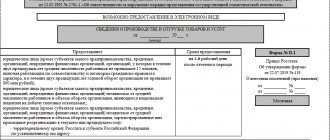

Templates and forms Form 3-F in Rosstat is a statistical reporting form that is used to reflect the wage arrears of an enterprise.

It must be submitted monthly. May 6, 2020 Zadorozhneva Alexandra Statistical form 3-F statistics is necessary to transmit information about the accumulated debt for unpaid wages to employees.

Wage arrears are defined as money accrued, but not handed over or transferred to a bank card on time.

The deadlines within which wages are paid in each specific institution are set out in local regulations - collective agreements, wage regulations and labor agreements with employees.

The delay begins on the day following the official date of payment of wages in the institution.

Who is required to submit Form 3-F

Form 3-F 2020 is submitted by those legal entities that have arrears of wages as of the reporting date (1st day of each month). If there are no salary arrears, then the form is not provided to Rosstat. Individual entrepreneurs and small businesses do not submit the register.

The list of those reporting includes the following categories of legal entities:

- Branches and representative offices of foreign companies operating in the Russian Federation.

- Separate divisions of Russian organizations. The 3-F report is filled out for each separate division.

- Bankrupt companies subject to bankruptcy proceedings.

- Temporarily not operating - enterprises in which the production of goods, works and services took place during the reporting period.

- Management bodies of education, health care, culture of the constituent entities of the Russian Federation. Such reporting institutions provide statistical data on Form 3-F for each registered activity.

All other enterprises submit reports on their main activity. Form 3-F (statistics) is submitted to Rosstat by organizations with OKVED 2, which belong to certain groups:

OKVED code 2 Name of main activities

| 01 | Crop and livestock farming, hunting and provision of related services in these areas |

| 02.20 | Logging |

| 03 | Fishing and fish farming |

| Section B | Mining |

| Section C | Manufacturing industries |

| Section D | Providing electricity, gas and steam, air conditioning |

| Section E | Water supply, sanitation, organization of waste collection and disposal, pollution elimination activities |

| Section F | Construction |

| 49 | Activities of land and pipeline transport |

| 50 | Water transport activities |

| 51 | Air and space transport activities |

| 52 | Warehousing and auxiliary transport activities |

| 59.1 | Production of films, videos and television programs |

| 60 | Activities in the field of television and radio broadcasting |

| 68.32 | Real estate management on a fee or contract basis |

| 72 | Research and development |

| Section P | Education |

| Section Q | Activities in the field of health and social services |

| 90 | Creative activities, activities in the field of art and entertainment |

| 91 | Activities of libraries, archives, museums and other cultural facilities |

| 92 | Recreation and entertainment activities |

Where to take it

Information on statistical form 3-F must be provided to the territorial bodies of Rosstat at the location of the reporting organization. If a separate division or branch is reporting, the report is sent to the statistics department at the location of such division.

Reporting in Form 3-F is submitted monthly. The reporting date is the 1st day of each month following the billing month in which the salary arrears arose. That is, the form must be submitted no later than the 2nd day of each month.

Which form to use

Source: https://gosuchetnik.ru/shablony-i-formy/instruktsiya-zapolnyaem-i-sdaem-otchet-po-forme-3-f

Results

Reporting in form 3-INFORM statistics based on the results of 2020 must be submitted to the statistical observation authorities no later than March 25, 2020. All business entities whose main type of economic activity is listed in the article, with the exception of small enterprises, are required to report on this form.

Sources: Order of Rosstat dated July 18, 2019 No. 410

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Reporting to Rosstat: what will change in 2020

- News

- Other reporting (except taxes and contributions)

Reporting to Rosstat: what will change in 2020 February 9, 2017 Elena Mavritskaya Leading expert, chief accountant with 10 years of experience

In the coming year, as before, organizations and some individual entrepreneurs must report not only to tax authorities and funds, but also to statistical authorities. At the same time, the 2017 statistical reporting has its own distinctive features: the transition from previous OKVED codes to new ones, federal input-output monitoring, forms and a number of other nuances. They are described in detail in our article.

In reports submitted to statistical authorities, it is necessary to indicate codes of types of economic activity. When preparing financial statements for 2020, transitional difficulties may arise.

They are due to the fact that in 2020 the OKVED classifier was in effect (OK 029-2007 (NACE Rev. 1.1)). Starting from January 2020, it was replaced by the OKVED2 classifier (OK 029-2014 (NACE Rev. 2)).

It is not entirely clear which classifier companies and entrepreneurs (also called respondents) should use when filling out forms for the past year.

Recently, Moscow City Statistics Service published a letter dated January 11, 2017 No. OA-51-OA/4-DR. It states that in the annual statistical observation forms for 2020, the old OKVED codes (OK 029-2007 (NACE Rev. 1.1)) should be indicated.

Whereas the new OKVED2 codes must be used later, namely when filling out forms, starting from the reporting periods of 2020 (see.

“The capital branch of Rosstat reported which OKVED codes to indicate in statistical reporting for 2020”).

To fill out and submit reports, it is most convenient to use web services, where all relevant details are installed automatically, without user intervention.

Accordingly, the accountant does not need to monitor changes in legislation and independently install updates in his program.

If an accountant, when filling out a form, indicates an outdated or invalid value, the web service will indicate the error and tell him what to do.

What surveys will Rosstat conduct in 2020?

In 2020, statistical monitoring of small businesses will be selective. This means that Rosstat will form a sample that will include organizations and individual entrepreneurs who, in addition to the usual forms, also need to submit additional reports.

In addition, federal statistical observation of production and sales costs (input-output observation) is scheduled for 2020. This examination is provided for by the order of the Government of the Russian Federation dated February 14, 2009 No. 201-r, the frequency of which is once every five years.

For non-financial commercial organizations (except small enterprises), federal input-output observation will be continuous, for small enterprises (including micro-) - selective.

Rosstat specialists should inform him that the respondent was included in the sample. They are also obliged to inform the respondent about the forms and methods of reporting. But an accountant can take the initiative and obtain information using the Rosstat service statreg.gks.ru, or by calling the territorial statistics office.

What determines the composition of statistical reporting?

The composition of statistical reporting depends not only on the fact of participation (or non-participation) in Rosstat surveys, but also on the category of the respondent: micro-enterprise, small or medium-sized enterprise. The criteria for each of the categories are given in Article 4 of the Federal Law of July 24, 2007 No. 209-FZ.

Thus, the category is established depending on revenue, the average number of employees and the fact of participation in the authorized capital of government agencies, foreign companies and some other persons (see.

“The criteria for classifying organizations and individual entrepreneurs as small and medium-sized businesses have changed” and “The Ministry of Economic Development has clarified who is classified as a small business”).

Tax authorities assign one category or another to organizations and entrepreneurs. The results are reflected in the unified register of small and medium-sized businesses. As the name suggests, this register includes small and medium-sized enterprises. Those who do not belong to them are not in the register.

https://www.youtube.com/watch?v=5yKMRvOkKBk

Also, the composition of statistical reporting depends on the type of activity that the company or individual entrepreneur is engaged in. Let's consider what innovations are provided in 2020 for each category, taking into account industry characteristics.

Microenterprises

Changes await micro-enterprises engaged in retail trade. Previously, they submitted the TORG (micro) form, but this report has been canceled since January of this year. Organizations with a license for the retail sale of alcohol from 2020 will no longer submit the “1-accounting” form to Rosstat, and companies with a license for the production, storage and supply of ethyl alcohol will not fill out the “1-alcohol” form.

Microenterprises included in the sample in connection with the observation of small businesses will have to fill out the form “MP (micro)” (Information on the main performance indicators of a microenterprise). The form was approved by order of Rosstat dated August 11.

16 No. 414, and instructions for filling it out were put into effect by Rosstat order No. 704 dated November 2, 2006. The report must be submitted no later than February 5, 2020. Most of the individual entrepreneurs included in the sample need to report in the “1-IP” form no later than March 2 (approved by Rosstat order No. 414 dated August 11, 2016).

We add that the territorial statistics body has the right to request other forms.

Micro-enterprises included in the sample as part of the federal input-output monitoring will have to report in the form “TZV-MP” (Information on the costs of production and sale of products (goods, works and services) and the results of the activities of a small enterprise for 2016). The form and instructions for filling it out were approved by Rosstat order No. 373 dated July 29, 2016. The report must be submitted no later than April 1, 2017.

Small enterprises (except micro)

Quite a lot of innovations are provided for small businesses. Those involved in road transport of goods will no longer submit the “1-APT” form.

Organizations with a license for the retail sale of alcohol from 2017 will no longer submit the “1-accounting” form to Rosstat, and companies with a license for the production, storage and supply of ethyl alcohol will not fill out the “1-alcohol” form.

Companies selling alcohol wholesale will stop submitting the “1-alcohol (wholesale)” form.

Legal entities belonging to small wholesale trade enterprises, starting with reporting for the first quarter of 2020, will not submit form “3-sb” (export). Another form for wholesalers will change significantly (Information on the export of products (goods)).

From now on, there is no section “Certificate on production, sales and product balances in kind”. At the same time, you will have to submit this form not once a year, as before, but quarterly on an accrual basis.

For January-March, January-June, January-September, information is provided no later than the 5th day after the reporting period; for the year - no later than March 1 after the reporting year.

Subjects included in the sample in connection with the observation of small businesses need to fill out the “PM” form (Information on the main performance indicators of a small enterprise). The form was approved by Rosstat order No. 414 dated August 11, 2016, and instructions for filling it out were put into effect by Rosstat order dated January 25.

17 No. 37. The report is submitted quarterly until the 29th day after the reporting period. Most of the entrepreneurs included in the sample need to report no later than March 2 in form 1-IP (approved by Rosstat order No. 414 dated August 11, 2016). We add that the territorial statistics body has the right to request other forms.

Small enterprises included in the sample as part of the federal input-output monitoring will have to report on the TZV-MP form (Information on the costs of production and sale of products (goods, works and services) and the results of the activities of a small enterprise for 2016) . The form and instructions for filling it out were approved by Rosstat order No. 373 dated July 29, 2016. The report must be submitted no later than April 1, 2017.

Entities not related to small and micro enterprises

Companies (except small and micro ones) engaged in road transportation of goods will no longer submit the “1-APT” form. Organizations with a license for the retail sale of alcohol from 2020 will no longer submit the “1-accounting” form to Rosstat, and companies with a license for the production, storage and supply of ethyl alcohol will not fill out the “1-alcohol” form.

Legal entities selling alcohol wholesale will stop submitting the “1-alcohol (wholesale)” form. Wholesaler organizations (except for small and micro ones), starting with reporting for the first quarter of 2020, will not submit the “3-sb” form (export). Another form for wholesalers has changed significantly (Information on the export of products (goods)).

From now on, there is no section “Certificate on production, sales and product balances in kind”. At the same time, you will have to submit this form not once a year, as before, but quarterly on an accrual basis.

For January-March, January-June, January-September, information is provided no later than the 5th day after the reporting period; for the year - no later than March 1 after the reporting year.

There are innovations for commercial and non-profit organizations that provide paid services to the population (including management companies, housing and housing-construction cooperatives, as well as homeowners associations). In 2017, instead of Appendix No. 3 to the “P-1” form, they will submit “P (services)” (Information on the volume of paid services to the population by type).

The form and instructions for its use were approved by Rosstat order No. 388 dated August 4, 2016. The frequency of reporting depends on the average number of personnel. If this figure exceeds 15 people, the form must be submitted monthly. If the average number of employees is 15 people or less, the form must be submitted quarterly.

All non-financial commercial organizations (except small and microenterprises) must report under federal input-output monitoring no later than April 1, 2020. In particular, it is necessary to submit an appendix to Form 11 “Information on the species composition of commissioned fixed assets” (approved by Rosstat order No. 289 dated June 15, 2016).

In addition, you need to submit one of the annexes to the form “1-enterprise TZV” (Information on expenses for the production and sale of products (goods, works and services)). The application must correspond to the main type of activity. Thus, companies engaged in printing and publishing activities submit an application in the form TZV D-22, construction organizations submit an application in the form TZV F-45, etc.

These forms were approved by Rosstat order No. 374 dated July 29, 2016.

Financial statements

Let us immediately make a reservation that no changes are envisaged in relation to financial statements in 2020.

As before, all companies that are required to maintain accounting records (including micro, small and medium-sized enterprises) must submit annual financial statements to Rosstat. This must be done no later than March 31, 2020.

The corresponding rule is enshrined in paragraph 2 of Article 18 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”.

How to submit reports to Rosstat

In 2020, statistical reporting forms can be submitted in the same way as last year: “on paper” (in person, through a representative or by mail), or electronically. Electronic reporting, in turn, can be transmitted in one of two ways.

The first way is through a special operator providing electronic document management services. The second way is through the reporting collection system, if it is organized on the website of the territorial division of Rosstat (at the moment, reporting in this way is possible only in 7 regions). To do this, you need to submit an application and receive a login and password to access the service.

Both the first and second methods of transmitting electronic statistical reporting require a qualified electronic signature key certificate (CES).

Responsibility for failure to submit statistical reports

Respondents who did not report to Rosstat, or did so untimely or provided false information, face administrative liability based on Article 13.19 of the Code of Administrative Offenses of the Russian Federation.

For legal entities, a fine ranges from 20,000 to 70,000 rubles, for repeated violations - from 100,000 to 150,000 rubles.

And entrepreneurs and officials face a fine of 10,000 to 20,000 rubles, for repeated violations - from 30,000 to 50,000 rubles.

Discuss on the forum (4)PrintAdd to bookmarksDiscuss on the forum (4)PrintAdd to bookmarks

Source: https://www.Buhonline.ru/pub/comments/2017/2/11973

What information is reflected in the report?

To calculate overdue debt, data on wages actually accrued but not paid on time (hereinafter referred to as Wages) are used. The deadline for paying the salary is established by law, and in some cases - in a collective or civil agreement.

The day from which the number of days of violation of the deadline for payment of the salary is calculated is the next day from the deadline for payment. It should be borne in mind that if the day of payment of the salary falls on a weekend, then the payment must be made the day before.

When filling out the report, all forms of accrued salary (including in kind) are taken into account, taking into account personal income tax and other deductions for both worked and unworked time. Also taken into account are the obligations to pay compensation related to the working hours, bonuses, allowances/additional payments, one-time payments for incentive purposes, and systematic payments for accommodation/food.

It will be useful to study the procedure for transferring salary to a payment card - this is discussed in our article “Procedure for transferring salary to a bank card.”

Definition and purpose of the 3-F report

Employers sometimes delay or do not pay employees their earnings at all. But such situations do not remain illegal, since enterprises that are not small and individual entrepreneurs report to the Federal Statistics Service on this information by filling out the 3-F form.

What is form 3-F and why do you need it?

The form coded 3-F is intended for providing reporting information to Rosstat on delayed wages. Thus, the Federal Statistics Service monitors the internal economy of the company, as well as the working conditions of workers.

If there were no delays in payments to employees during the reporting period, then there is no need to report to Rosstat in Form 3-F. There is no zero report form for this.

For companies and other legal entities. persons fill out the form for each department, including the main office, separately. That is, if an enterprise has three additional offices, then together with the main one they submit 4 reports.

Who submits the form 3-F

The form must be filled out by all legal entities, with the exception of small enterprises. The types of activities of enterprises reporting the 3-F questionnaire are presented in the Instructions for filling out. The list of species is extensive and consistent with OKVED2.

The completed form is submitted to the nearest statistics department using various methods. The main thing in registration is the reliability of the information and timely submission of the report, since the latter is considered an administrative offense, which is punishable by a fine.

In addition to small businesses, individual entrepreneurs are also exempt from submitting a report on delayed wages.

The questionnaire includes a clause about outstanding debt, in this case to an employee, where the manager prescribes the total amount of debt to workers for the reporting period. This information is automatically sent to the Federal Tax Service, so it is more profitable for management to pay employees on time.

Step-by-step instructions for filling out the 3-F form (salary)

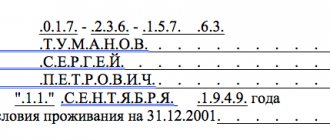

Before submitting the report, the respondent fills out form 3-F “Salaries on Detained Funds for Employees.” Despite the simplicity of the structure of the questionnaire, you need to be careful when filling out some points.

Basic rules for filling out the 3-F questionnaire

The 3-F salary form contains 2 sheets with one section - a title page and a subsequent table for entering data. The title page contains information about the respondent company, and the table contains information about overdue wages.

To fill out the form directly you need:

- 3-F "Salary".

- If the report is submitted in person or by Russian post, print it out.

- Fill out the title page of the form.

- Fill out the tabular part of the 3-F salary form.

- Sign the form. Double check.

- Send using the selected method.

If the form is filled out manually, then use a pen with blue, black or purple ink and write in printed characters. And if they are designed on a PC, then use the Courier New font and font size 16-18.

How to fill out the title page and table 3-F salary

3-F salary is a standard statistical report with a corresponding title. At the top of the sheet the respondent indicates the reporting period, below is the name and address of the company, as well as the division. The address is indicated by actual and postal address, including postal code. And in the tabular part - OKPO of the organization.

Next, fill out a questionnaire table, which consists of 4 types of overdue wages:

- for paid and unpaid employees;

- due to untimely receipt of money: from the federal budget, local and budgets of constituent entities of the Russian Federation;

- salary fund for the calendar month in which earned funds were paid;

- the number of employees and part-time workers to whom the company owes wages.

The last lines indicate overdue funds for 2020 and 2018, as well as unpaid money to dismissed or resigned employees.

Information is indicated in ruble equivalent in thousands of rubles without a decimal place, according to OK 015-94.

The total amount of debt due to late receipt of money from budgets is made up of lines 04, 05, 06. First, these amounts are written down in the corresponding lines, then the numbers are added up and indicated in the immediate column.

Filling out the 3-F form is not difficult, taking into account the fact that Rosstat Order No. 485 of 08/06/2018, which approved the form, contains instructions for filling out the form.

How and where to submit a report on Form 3-F (salary)

Statistical reporting is submitted to the Rosstat office located near the unit, for which the respondent submits a completed 3-F form with information about delayed wages. You can report to the Federal Statistics Service using various methods.

Report submission methods

The Federal Statistics Service provides companies with free software for generating reports in Form 3-F. You can submit your completed application in three ways:

- Personally. The respondent submits the 3-F form independently. After receiving the form, the Rosstat employee issues a receipt indicating the full name. the employee who received it, as well as the date of receipt of the questionnaire.

- Russian Post. The completed Form 3-F is sent by registered mail with a description of the envelope contents attached. Date the report was sent – the date the letter was sent.

- E-mail, or via telecommunication channels (TCS). When reporting using this method, you need to generate a file in .XML format, which protects information from theft. The file can only be decrypted using the Rosstat program.

Sending a form via TKS requires knowledge of following the algorithm when saving the file. Errors in formatting are comparable to false information, which is punishable by a fine according to the Code of Administrative Offenses of the Russian Federation.

Rosstat also offers another way to electronically send reporting and statistical documentation - through the electronic document management system on the official website of the Federal Statistics Service in your personal account.

Instructions:

- Log in to your personal account.

- Find form 3-F and fill out the information.

- Sign the document with an electronic digital signature (EDS).

- Upload the 3-F salary file in .xml format into the system.

- Send.

Upon receipt, employees will notify the company of receipt of the report within 5 business days. If errors are made when filling out the form, Rosstat will not accept the information and the document will have to be corrected within the specified period. In a positive case, employees also notify the respondent that they have received the report.

Where to submit a report on Form 3-F

The Federal Statistics Service has a single center for receiving statistical reports in each region. If the unit is located far from the receiving center, then it is more convenient to report by Russian Post or by TKS. Before sending a report in any way, you need to register with a single reception center.

The 3-F salary form is filled out for each additional office separately, as well as for the head office. For example, a company has a head office and 4 divisions. This organization submits 5 reports - one report for each branch.

Deadlines and penalties for late submission of reports

The 3-F report is submitted monthly the day after the end of the reporting period. For example, for January they report on information about wage arrears on February 1, and for June on July 1.

If the respondent enters false information, is late in submitting the questionnaire, or does not report, then according to the legislation of the Russian Federation he will be subject to a fine. So, according to Art. 13.19 of the Code of Administrative Offenses of the Russian Federation, in case of a primary violation a fine is charged:

- officials - 10,000-20,000 rubles;

- legal entities – 20,000-70,000 rubles.

For a secondary violation a large fine is imposed:

- officials - 30,000-50,000 rubles;

- legal entities – 100,000-150,000 rubles.

A timely report to Rosstat guarantees the absence of penalties, as well as unnecessary attention from the Federal Tax Service.

Filling out the waybill for a special vehicle

The waybill is issued before leaving for the mission. Make up the paper in one copy. Form No. 3 special used only for one or two customers. If there are more of them during a working day or shift, then a new sheet is drawn up.

Filling out the waybill falls on the shoulders of the dispatcher or other designated employee. You can draw up a waybill on paper, or you can do it on a computer using a special program. The driver usually fills out his part of the form by hand. He enters information about the trip and work completed, and also signs the acceptance and delivery of the car.

Front side

So, the dispatcher begins to enter information from the header of the document. What to include:

- number and series of the waybill (if the series is indicated);

- full name of the organization, address, telephone number, OGRN or ORGNIP;

- OKPO code;

- operating mode;

- column, brigade (name or number);

- information about the car: make, license plate and garage (if available). The information must correspond to that specified in the documentation;

- Full name of the driver, his license number and class or category;

- information about the license card, if the driver works under a license (number, series);

- trailer brand, state and garage number, if a trailer is used.

Next is a table with data on the work of the driver and the vehicle. When leaving the garage, note the scheduled time, mileage numbers, speedometer readings, actual time: day, month, hours, minutes. The dispatcher must indicate the same data at the end of the shift or working day, but only in the “Return to the garage” column.

On the right is a table with information about the movement of fuel. It is necessary to indicate: the brand and code of the fuel, how much was issued, how much was there upon departure, how much was left upon return and how much was returned, the rate change factor. The operating time of the engine and special equipment of the machine is also indicated here. The fuel operator, mechanic, and dispatcher must sign for each of the indicators.

This is followed by a column indicating the series and numbers of issued customer coupons. The coupons themselves are located on a special tear-off part of the document.

The following table contains the task for the driver. It is also filled out by the dispatcher. The following information must be provided:

- at whose disposal the transport with the driver is sent (company name and address);

- time of arrival and departure to the site;

- type of work to be performed;

- notes.

The following are written down:

- dispatcher (he also notes the amount of fuel dispensed);

- a paramedic after a pre-trip examination - that the driver can start working due to health reasons;

- mechanic - that the transport is technically sound when leaving and when returning;

- the driver - that he accepted the car in good condition, and then handed it over.

Important! Each signature is placed at its own time after a thorough inspection. Admission to work is not possible without checking the driver’s health and the technical condition of the car.

Reverse side

The table with data on the completion of the task is filled out by the driver. Things to note:

- route of movement or object of work;

- name of the work and its code;

- time of arrival at and departure from the site;

- Speedometer readings during arrival and during departure.

The last column must be signed by the customer of the work and stamped if the company continues to use it.

The following is a table where you need to indicate those responsible for the safe movement of cargo on the part of the contractor and the customer, the full names of the slingers and the numbers of their certificates.

The next part of the form is filled out in the accounting department. The data is needed to calculate the driver's wages. The following information must be entered:

- fuel consumption according to the norm and actually;

- how long the driver spent in the outfit;

- how long the downtime took, if any;

- mileage.

If there were downtimes, then information about them is entered into the appropriate table. Indicate the name, code, start and end time of the downtime. The responsible person puts his signature.

The last plate indicates the amount of wages for the shift and is signed by the accountant.

Coupons for customers

The waybill contains tear-off coupons for customers. They are needed to issue an invoice to this organization. What should be indicated in such a coupon:

- waybill number;

- date of compilation of the sheet;

- name of the company providing the car;

- vehicle registration number;

- Full name of the customer's representative;

- arrival and departure times;

- speedometer data at the time of arrival and departure;

- signature of the customer's representative;

- name and code of work performed;

- information about the amount of payment;

- signature of the taxi driver - accountant.

The coupon is filled out by the organization that owns the vehicle.