Statistical customs declaration is the conventional name of a document issued during mutual trade between economic entities of member countries of the Economic Union between the Russian Federation, the Republic of Belarus, the Republic of Kazakhstan, the Kyrgyz Republic and the Republic of Armenia.

The customs legislation of the Eurasian Economic Union establishes that during trade turnover between member countries, control of goods transported across their borders is not carried out. But in order to collect statistical data on mutual trade, the Federal Customs Service of the Russian Federation, by Decree of the Government of the Russian Federation dated December 7, 2015 No. 1329 “On the organization of maintaining statistics of mutual trade of the Russian Federation with member states of the Eurasian Economic Union,” is responsible for collecting and maintaining such statistics. Filling out and submitting this statistical form is not a procedure for customs clearance of export or import. The idea that this report is a customs statistical form is due to the fact that it is submitted to the Federal Customs Service, and not to any other government agency. Customs does not control and does not have the right to detain the corresponding cargo and shipments in case of failure to submit the statistical form or errors in filling it out.

In what cases is the statistical form filled out?

In cases of movement of goods between the Russian Federation and any other member country of the EAEU, carried out within the framework of commercial relations between economic entities, a statistical form for recording the movement of goods of the Customs Union is filled out and submitted to the customs authorities of the Russian Federation. Categories of goods, including those requiring completion of this statistical form, are approved by the Federal Customs Service.

It is not filled out and submitted to the RF Customs Service if the goods being moved are subject to mandatory declaration, and in some other cases approved by the Federal Customs Service.

Read the list of all specified categories of goods and answers to frequently asked questions in the letter from the Federal Customs Service.

When is the statistical form not filled out?

The statistical form is not filled out and submitted if, in accordance with the legislation of the EAEU, the goods being moved are subject to mandatory declaration, and also, in particular, for the following categories of goods:

- moving in transit across the territory of the Russian Federation;

- moved by individuals for personal and other needs not related to business activities;

- exported from the Russian Federation to the territory of the Baikonur complex and imported from the territory of the Baikonur complex into the Russian Federation;

- temporarily imported (exported) for a period of less than 1 year;

- supplied for repair or after repair, which are the subject of repair (subject to repair);

- goods (supplies) to ensure normal operation and maintenance of vehicles engaged in international transportation, intended for consumption by passengers and crew members, intended for sale to passengers and crew members of ships and aircraft;

- currency of the Russian Federation and foreign currency (except for those used for numismatic purposes), securities;

- exhibition items;

- promotional materials and souvenirs;

- reusable packaging.

Who fills out the statistical form

In accordance with Article 278 of Federal Law No. 289-FZ of 03.08.2018 and with the government decree (clause 5 of the “Rules for maintaining statistics...”), a statistical declaration must be provided by a legal or individual person (or his representative acting on his behalf and on his behalf). order) located in the jurisdiction of the Russian Federation, and which:

- or entered into a transaction for the import and export of goods between the territories of the Russian Federation and the member states of the EAEU;

- or, in the absence of such a transaction, had at the time of receipt or shipment of goods the right to possess, use and dispose of them.

Statistical form of accounting for the movement of goods - who delivers

The document is issued by Russian business representatives who import goods into Russia from the countries of the Eurasian Economic Union (or export them to the countries of the EAEU). These include:

- persons who entered into a transaction with a counterparty from a member country of the EAEU;

- persons on whose behalf an agreement was signed with a foreign counterparty (we are talking only about cooperation with the EAEU countries);

- persons who have ownership rights, powers of disposal and operation in relation to goods imported under international contracts.

How and in what form the completed form is submitted to the Federal Customs Service

The statistical form is the basic document for the formation of customs statistics; the personal account of a foreign trade participant on the official website of the Federal Customs Service is the only possible tool for filling it out. Next, the customs export report is submitted either electronically or in paper form. In the latter case, the statistical form filled out on the official website of the Federal Customs Service is printed and either in person or by registered mail transferred to the tax office of the region in which the applicant is registered with the tax authority.

Electronic submission is possible if the applicant has a qualified electronic signature to work with the FCS services. In this case, it is recommended to follow four steps:

- Fill in the form.

- Check.

- Certify with an electronic signature and send to TO.

- Get a registration number.

If the applicant needs to submit a statistical registration form in paper form, the FCS recommends taking seven other steps:

- Fill in the form.

- Check.

- Get the number and print it out.

- Sign and stamp.

- Send the document by mail (registered mail) or bring it in person to the TO.

- Wait for the form to be registered.

- Get a number.

Nuances of filling out the document

In one document the data can be reflected:

- comprehensively on several facts of acceptance and shipment of commercial products within the framework of one contract;

- with a breakdown for each operation of shipment or arrival of products from a member country of the EAEU.

When you fill out a form, the program assigns a registration number to it automatically. This happens at the stage of registering the finished form in the customs authority database.

If a business entity made a mistake when submitting a report, it can be corrected by canceling this form and submitting a new document in its place. This point is recorded by affixing in the updated version of the reporting form the number code of the form to be cancelled.

If the form is drawn up on paper, then when submitted to the regulatory authority, it is assigned a system number. This happens automatically.

Transaction participants

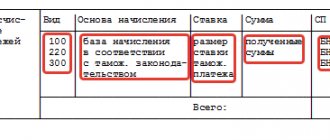

The form provides fields for entering the details of the parties to the transaction:

- their names;

- indication of organizational and legal forms;

- address data;

- if one or both parties to the transaction are individuals, then write down the full name. with the address and passport details (or other document by which a person can be identified).

It is mandatory for all participants in the delivery of goods to enter their tax identification number and checkpoint number.

The person entrusted with the function of financial settlement of tax obligations arising in relation to the subject of the transaction in Russia can be represented by an enterprise or an individual individual.

Export and import

When filling out the form, you must indicate the type of transaction performed - export or import. To do this, in the column about “Direction of movement” (clause 4) enter the designations “EC” or “IM”.

At the next stage of filling out, the trading country is identified by name and code. Thus, when moving a consignment for export, information about the country of destination is filled in.

For the import type of transaction, the data of the country of departure is specified. In separate columns indicate the code and full name of the type of vehicle used for transportation across the border.

Supporting documents

The “Documents” field reflects the following:

- a set of contract details;

- account data;

- designation of shipping forms;

- identification of the transaction passport for currency control;

- documentation confirming the fact of compliance with existing restrictions within the framework of export and technical control.

How to fill out the statistical form correctly

The rules for filling out the statistical form for recording the movement of goods are listed in Appendix No. 2 to Government Decree No. 1329 dated December 7, 2015:

- filling does not depend on the type of vehicle carrying out transportation;

- includes shipments or receipt of goods under the same conditions for the reporting month;

- filled out in Russian;

- through software on the FCS website.

Detailed instructions for filling out the columns are given on the FCS website.

Below is a sample of a completed statistical form.

Statistical reporting when exporting (importing) goods to the EAEU country

Question

What statistical reporting must be submitted to customs authorities when exporting (importing) goods to the EAEU country? What is the penalty for failure to submit and late submission of statistical forms, and what are the statute of limitations in 2017?

Answer

If your Russian organization exported (imported)

goods from the Russian Federation to the countries of the EAEU (Belarus, Kazakhstan, Kyrgyzstan, Armenia) must be filled out a

statistical form for recording the movement of goods

and submitted to any customs authority (hereinafter referred to as the Customs Authority) in the region of activity of which your resident organization is registered with tax authorities <1>.

You must do this no later than the 8th working day of the month following the month in which goods were shipped from the warehouse or goods were received at the warehouse.

The statistical form is submitted using the Personal Account of the foreign trade participant on the website of the customs authorities https://edata.customs.ru/ <2>:

- in electronic form

with certification by the electronic signature (ES) of the applicant in the following order:

- Fill out the electronic statistical form.

- Check that the statistical form is filled out correctly and completely.

- Send the completed statistical form to the technical department, certified by your electronic signature.

- Receive the registration number of the statistical form assigned to it during automatic registration with the TO;

- or on paper

in the following order:

- Fill out the electronic statistical form on the website.

- Check that the statistical form is filled out correctly and completely.

- Get the system number and print the statistical form.

- Confirm the statistical form with a signature and seal.

- Submit the statistical form on paper

in person or by registered mail to the tax office in the region of operation of which your organization - the applicant - is registered with the tax authority. - The TO official, upon receiving the statistical form on paper, will request it in the information system using the system number, check the information and register it by assigning a registration number.

- Request and receive a statistical form registration number.

note

that from January 29, 2020, a new article 19.7.13 was introduced into the Code of Administrative Offences.

“Failure to submit or untimely submission to the customs authority of a statistical form for recording the movement of goods”, according to which for failure to submit a statistical form by customs authorities, an administrative fine

in the amount

of ten thousand to fifteen thousand rubles

;

for organization - from twenty thousand to fifty thousand rubles.

For repeated commission of an administrative offense

a fine is imposed on the manager in the amount

of twenty thousand to thirty thousand rubles ;

for organization -

from fifty thousand to one hundred thousand rubles

<3>.

Entrepreneurs pay a fine in the same amount as organizations <4>.

In this case, the statute of limitations for bringing to administrative liability is one year.

<5>.

If you discover that you made errors when filling out the statistical form, or indicated incomplete information about the product that requires changes or clarification, then within 10 working days from the date of discovery of such a fact you must submit to the customs authorities an application for cancellation of the statistical form and submit a new form .

In this case, you will be exempt from the fine if you find and correct the error before the customs authority <6>.

Rationale

<1> Clauses 1-2, 5, 7 of the Decree of the Government of the Russian Federation of December 7, 2015 N 1329 “On the organization of maintaining statistics of mutual trade of the Russian Federation with member states of the Eurasian Economic Union” (together with the “Rules for maintaining statistics of mutual trade of the Russian Federations with member states of the Eurasian Economic Union"). A sample form and the Rules for filling it out are given respectively in Appendix No. 1 and Appendix No. 2 to the Rules for Maintaining Statistics.

<2> On the website https://edata.customs.ru you can find answers to the most frequently asked questions about filling out the statistical form, teaching materials (videos), and addresses of customs authorities authorized to accept this form.

<3> In accordance with Part 1 of Art. 23.8 of the Code of Administrative Offenses of the Russian Federation, protocols on administrative offenses under Art. 19.7.13 are compiled by customs authorities.

<4> Note 1 to Art. 19.7.13 Code of Administrative Offenses of the Russian Federation.

<5> Part 1 art. 4.5 Code of Administrative Offenses of the Russian Federation.

<6> Note 2 to Art. 19.7.13 Code of Administrative Offenses of the Russian Federation.

Responsibility for violations

Failure to submit or untimely submission of reports to customs statistics in foreign trade transactions entails liability under Article 19.7.13 of the Code of Administrative Offenses of the Russian Federation. For violation of deadlines for submitting a report and submitting a statistical report to the customs office of the Customs Union containing false information, fines are provided:

- for officials - from 10,000 to 15,000 (for repeated violations - from 20,000 to 30,000) rubles;

- for legal entities - from 20,000 to 50,000 (from 50,000 to 100,000) rubles.

Information indicated in the statistical form with violation of the rules for filling it out, arithmetic or logical errors is considered unreliable.

“Statistical form for recording the movement of goods” - fines

If errors or inaccuracies are found in the document submitted to the Federal Customs Service, within 10 working days the applicant will be notified of the need to cancel the statistical form and resubmit it with correct data. Cancellation is made on the basis of an application submitted by the business entity simultaneously with the new report. 10 working days are allotted to correct defects.

Punishment for failure to submit the form or delay in filing it is provided for in Art. 19.7.13 Code of Administrative Offenses of the Russian Federation:

- officials are imposed fines equal to 10-15 thousand rubles; for repeated violations, the penalty limit is increased to 30 thousand rubles;

- for legal entities and individual entrepreneurs, a fine is issued in the amount of 20-50 thousand rubles; for a repeated violation, a penalty can be imposed in the amount of up to 100 thousand rubles.

Deadline for submitting the statistical form

The statistical form for recording the movement of goods is submitted to the customs authority no later than the 8th working day of the month following the month in which the goods were shipped (received).

The schedule for presenting the statistical form in 2020 is shown in the table:

| No. | Reporting period (month, year) | Submission deadline by date (inclusive) |

| 1 | December 2020 | January 18, 2020 |

| 2 | January 2020 | February 12, 2020 |

| 3 | February 2020 | March 14, 2020 |

| 4 | March 2020 | April 11, 2020 |

| 5 | April 2020 | May 15, 2020 |

| 6 | May 2020 | June 13, 2020 |

| 7 | June 2020 | July 11, 2020 |

| 8 | July 2020 | August 10, 2020 |

| 9 | August 2020 | September 12, 2020 |

| 10 | September 2020 | October 10, 2020 |

| 11 | October 2020 | November 13, 2020 |

| 12 | November 2020 | December 12, 2020 |

For deliveries within the framework of one contract (agreement), moved in the reporting month from one sender to one recipient, you can provide either several separate statistical forms for each individual shipment (supply), or one statistical form based on the results of all shipments (supplies).