What is a goods declaration

Developed countries actively use international trade in goods to maintain and improve their economic performance.

One of the tools aimed at complying with the law is the declaration of goods. A customs declaration (CD) is a document for the legal transportation of goods across the border in cases established by law; this definition is enshrined in clause 32 of Art. 2 of the Customs Code of the Eurasian Economic Union (UC EEC). Legal regulation of the filling procedure is carried out:

- TC UES;

- decision of the Customs Union Commission dated May 20, 2010 No. 257;

- Federal Law dated August 3, 2018 No. 289-FZ.

The decision of the Customs Union Commission dated May 20, 2010 No. 257 established instructions for filling out the declaration for goods 2020. On April 16, the latest changes were made to it.

In its form, the DT represents a document consisting of a main sheet and an additional one. Additional sheets are used in case of declaring a large amount of cargo.

The difference between the new passenger declaration and the old one

The main difference between the old form of 2020 and earlier years from 2020 is the number of columns (items and subitems) required to fill out. In the old one: paragraph 3 includes five subparagraphs (3.1 - 3.5); in the new 3 paragraph consists of ten subparagraphs (3.1-3.10), and also in the new one an expanded 5 paragraph has been added, which was previously 3.3.

- New passenger declaration form (View)

- Old passenger declaration form (View)

How to fill out a declaration

To avoid errors associated with declaration and to speed up the registration procedure, the government agency has developed a DT form. By decision of the CCC dated May 20, 2010 No. 257, the goods declaration form and additional sheet were approved.

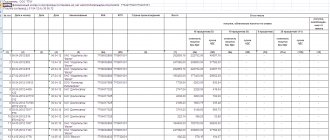

To quickly navigate the text of the document, all information in the DT is divided into columns and delimited by fields within one page. The main sheet of the declaration contains 54 columns. Let's look at filling it out step by step.

1. In this part, three values are indicated: type of movement - export (EC) or import (IM); procedure number in accordance with the decision of the CCC dated September 20, 2010 No. 378 (classifier No. 378); if the document form is electronic, then the ED is indicated

2. In this column the name of the sender is indicated, indicating the full address of the location; in field No. indicate the TIN of the organization and its checkpoint

3. The number of DT sheets and the current sheet are indicated

4. To be completed if shipping specifications are used

5. Quantity of cargo according to DT

6. Number of cargo items used

7. Declaration feature code; decoding of the declaration columns for goods of this item is carried out according to classifier No. 378

8. This part establishes the name of the recipient indicating the full address of location

9. The field contains information about who is the owner of the goods transported via DT, or the person who exports the currency

10. Country from which the cargo originally departed. This field is empty

11. Country of registration of the counterparty for DT, indicating the code

12. Amount of cargo according to DT

13. If the DT has different positions by name, then this column is filled in indicating the cost. This field is empty

14. Name of the person submitting the declaration. If this is an organization, then indicate the OGRN and TIN (if available)

15 a, b. Field “a” contains the name and code of the country from which the shipment is made, in accordance with classifier No. 378; column b in the declaration of goods is not filled in if there is no code for the administrative-territorial division of the country, in this case the value 000 is indicated

16. The country where the item to be declared is manufactured is indicated.

17 a, b. Country where the subject of declaration is sent, indicating a code similar to column 15

18. The numbers of the vehicle transporting the goods are established, indicating the country code

19. Indication in this column 1 is equivalent to transportation of goods by container, 0 - without container

20. Type of delivery according to classifier No. 378

21. The number of the vehicle carrying out transportation upon departure from the customs territory is indicated. If the transport does not change throughout the entire journey, indicate the data in column 18

22. The type of currency and the total amount under the agreement between the parties are determined

23. Currency exchange rate at the time of registration of the DT, based on the data of the Central Bank of the Russian Federation

24. The transaction code is indicated according to classifier No. 378, for example, for purchase and sale it is entered 010

25. Transport code according to the classifier, for example, for railway - 20, for road - 30

26. This column in the goods declaration is filled out in the same way as 25, if the type of transport within the country does not change

27. Place of loading when exporting from the territory of the Russian Federation. This field is empty

28. To be completed in case of export of cargo from the territory of the Russian Federation

29. Government agency number when crossing the territory

30. The address of the place where the subject of declaration is located is entered; it can be inspected at the time of filing the declaration

31. The name and special properties of the subject of declaration, container numbers are indicated

32. Cargo number according to DT

33. The code from the numbers for the transport nomenclature, the procedure for filling out the declaration for goods in this column is established in accordance with the decision of the Council of the Eurasian Economic Commission dated July 16, 2012 No. 54

34. Code of the country where the item to be declared is manufactured

35. Cargo weight with all packaging

36. Benefit code according to classifier No. 378

37. Name of the customs procedure according to classifier No. 378

38. Weight without packaging

39. Information is indicated if the cargo is subject to legal norms establishing quotas

40. This column is filled in if the batch consists of several goods. If the movement is single, nothing is indicated

41. Quantity of goods defined in column 31

42. The price paid or payable is indicated.

43. Cost determination code according to classifier No. 378

44. Additional documents that served as the basis for filling out the declaration of goods are indicated; the declaration of goods can use invoices, annexes to the agreement, contracts as a source of information

45. Cost in currency

46. Cost of cargo in US dollars

47. This column indicates the customs duties payable

48. Customs payment code according to classifier No. 378

49. This column indicates the warehouse details if the cargo exported from the Russian Federation falls under the customs warehouse regime

50. To be completed in case of export of cargo for processing outside the customs territory

The column is missing and not filled in

51. Proposed countries and government agencies are indicated

52. Code number for ensuring payment of necessary fees

53. The customs authority is indicated and stamped

54. Date of preparation of the DT, full name. composing person

Customs declaration CN 23 (form)

International postal channels can be used in a variety of ways. This material will take a closer look at the CN 23 customs declaration.

If any goods are transported through MPO in the form of a parcel, then the following papers must be used:

- Documents in the form of a waybill for submitting dispatches;

- Registered shipping address;

- In the case of sending or receiving small parcels - declaration form CN 23, used at customs;

- For small parcels you also need a special “Customs” label in CN 22 format;

- Consolidated accounts for those items that were collected in groups;

When you receive your parcel, you may be charged a fee.

This declaration is needed when certain goods are moved through international postal channels that require clearance through Russian customs. This is possible if the goods are sent in special packages or parcels.

Below you can find a sample of filling out the CN 23 customs declaration.

All of the above accompanying papers are securely and firmly attached to the parcels or packages themselves. Securing is usually done using a special transparent tape through which the information can be read.

At the same time, transparent tape protects these documents from damage, scratches, water, and so on. The customs declaration is issued in a foreign language, that is, the language must correspond to the recipient country so that foreign post offices do not encounter insurmountable difficulties during shipment.

For example, if a parcel with goods is sent to Germany, then the language of the declaration must be German.

The data entered in the CN 23 customs declaration must be concise and clear to understand. Otherwise, the parcel may be delayed indefinitely until the inaccuracies are clarified. In the worst case scenario, an incorrect declaration will lead to monetary fines or even confiscation of the goods.

The CN 23 customs declaration cannot be issued for absolutely all categories of goods. Before sending a parcel, you should look at the list of goods that are prohibited to import or, conversely, export from the territory of the Russian Federation. For example, it is prohibited to transport medicines, works of art, money, etc. across the border.

You should also take care of the documents required for shipment: a goods invoice, a certificate of origin of the goods being transported, an official confirmation of the ownership of the goods that require quarantine.

In the latter case, we mean objects of animal or plant origin, goods for human consumption, and so on. The listed permissions may be required by representatives of post offices in the recipient country of this parcel.

Any item sent through IPO channels and being part of a transaction is called a commercial shipment.

The CN 23 customs declaration is completed according to a number of requirements

Procedure for receiving foreign parcels

Goods that are not of a commercial nature, that is, necessary primarily for individual use and are subject to a CN 23 customs declaration, are not subject to state duties.

Also, the cost of the goods sent must be less than ten thousand rubles.

Otherwise, if the price of the product is above ten thousand rubles, a state duty will be issued equal to thirty percent of the total price of the product.

In other words, if the goods being sent cost twelve thousand rubles, then the duty is applied to the part that is in excess. In this case, it is two thousand rubles. And from 2,000 rubles, thirty percent will eventually be deducted in the form of state duty, which means in total you will pay 12,000 + 30%*(2000) = 12,600 rubles.

If an individual receives a parcel with goods, the sender must write a statement. This application must include the following information:

- About the sender;

- About the documents that are accompanying in this case (including the CN 23 customs declaration);

- As well as information about the product - name, quantity, price and purpose;

This application must be submitted to the customs office at the place of residence within fifteen days from the date of delay in shipment (this information is stated in the notice).

A customs declaration is issued for a certain type of goods

How to fill out the CN 23 customs declaration correctly

The columns and fields of the customs declaration must be filled in, taking into account the following requirements:

- The description of each forwarding object must be detailed. For example, “wool sweater.” You cannot use words that characterize a thing in general terms. That is, “sneakers”, “warm jackets” and “hats” are incorrect wording in the customs declaration.

- The exact quantity of the goods being sent must be indicated. Next, clarify what units of measurement you used.

- Weigh your goods at the post office on the day the parcel is sent and indicate the received data in the customs declaration. The weight must be indicated in kg, first without packaging, and then with parcel packaging.

- The cost of the goods must also be indicated. First separately, and then in total. Be sure to specify the currency in which you measure the price.

- Carefully compose a six-digit index, which is issued according to the system created by the ICO (International Customs Organization). Here it should be taken into account that the concept of country of origin implies exactly the place where the product was created, and not the place from where it is sent. In the case of a commercial shipment, you need to especially take this detail into account, since otherwise there may be delays in the goods sent.

- Among other things, the amount of tariff that was paid for this postal item is also written down. If there are any other monetary fees (for example, product insurance), then you need to write about them in another column

- When writing shipping categories, you just need to put a cross in the box.

- It is also recommended to make clarification in the case when the product is subject to quarantine. This is usually possible when sending food products, goods of plant or animal origin.

- Official confirmation, on the part of the sender, of the fact of responsibility for sending this product is the signature and the date at the very bottom.

Who is required to fill out

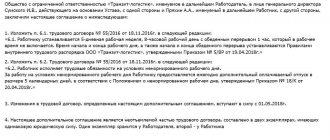

The DT is filled out by a customs representative (broker) included in a special register. In accordance with Art. 346 of the Federal Law of August 3, 2018 No. 289-FZ, the customs representative is an intermediary between one of the parties specified in the declaration and the government agency. Due to the specifics of filling out the declaration and the need for knowledge in the field of customs regulation, the legislator chose the type of filling out the declaration through a broker.

Filling out columns DT 1, 2, 3, 4, 5, 6, 7, 8, 9, 11, 12, 14, 15, 15 (a; b), 16, 17, 17 (a; b), 18, 19 , 20, 21, 22, 23, 24, 25, 26, 29, 30, 31, 32, 33, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45, 46 , 47, B, 48, 54 is made by the declarant; this provision contains instructions on the procedure for filling out a declaration for goods in the eleventh chapter.

On the part of government agency representatives, column 43 (second section) and fields with letters A, C, D of the main and additional sheets of the DT are subject to registration:

- A—the document number is set;

- C - indicates the decision made by the government agency, for example, on the release of the subject of the declaration;

- D - mark and seal of the representative of the government agency who worked with the diesel engine.

In paragraph 43, the code of the cost adjustment attribute according to classifier No. 378 is indicated.

Form and main points of the passenger declaration

In paragraph 1 you need to indicate the necessary information regarding the declarant (full name, passport details, address).

In the 2nd point, you need to select the method of travel: accompanied baggage, unaccompanied baggage, Delivered goods without entry or exit. The main differences are contained in the more detailed 3rd paragraph.

In paragraph 3 of the new passenger customs declaration form, which is called “information about goods,” you must indicate:

Procedure: import (free circulation), export, temporary import, transit.

Sub-items:

- 3.1. Cash

- 3.2. Products eligible for discounts

- 3.3. Goods for which the duty-free import limit has been exceeded

- 3.4. Cultural values

- 3.5. Weapons and weapon components

- 3.6. Narcotic drugs, psychotropic substances, etc.

- 3.7. Animals, plants

- 3.8. Collection materials on mineralogy, paleontology, etc.

- 3.9. Samples of human biomaterials

- 3.10. Other goods subject to prohibitions and restrictions and requiring the submission of supporting documents.

The 4th paragraph should contain additional information about the goods specified in the 3rd paragraph. This is the name of the product, its description, weight and cost.

In addition, paragraph 5 “Information about vehicles” has been added to the New Declaration.

At this point you need to select a procedure: import (free circulation), temporary import, export, temporary export, transit.

Indicate the availability of benefits;

Enter data regarding the specific imported vehicle (automobile, motor vehicle, trailer, watercraft or aircraft) or its part that has been replaced.

Responsibility

The declaration procedure is ensured by the possibility of application of penalties by the state in case of non-compliance. Administrative liability has been established for failure to declare cargo. According to paragraph 1 of Art. 16.2 of the Code of Administrative Offenses of the Russian Federation, the fine for legal entities is equal to ½ the value of undeclared cargo with the possibility of its confiscation.

If the declaration contains inaccurate information, the fine will be from one to two times the amount of customs payment; liability for such an offense is provided for in paragraph 2 of Art. 16.2 Code of Administrative Offenses of the Russian Federation.