In what situations do requests for explanations come?

Letters from the tax department about explanations for accrued and paid insurance premiums are not that uncommon. They are usually caused by the fact that tax inspectors did not like something in the reporting submitted to them, for example, they found inconsistencies in the documents submitted by the organization with their own data, or they discovered some erroneous or unreliable information. In particular, doubts may arise in situations where there has been a noticeable decrease in an employee’s salary compared to previous years, when the amount of personal income tax in the 2-NDFL certificate is not identical to the tax payment that “went” to the budget, or a discrepancy between the indicators in the 2-NDFL certificates and the form has been discovered 6-NDFL, etc.

FILES

At the same time, the main parameters that tax authorities pay attention to when monitoring insurance premiums are the total amount of payments made by the organization for its employees.

What you need to know about the requirement

Firstly, in some cases, the inspectorate should be notified of receipt of a request for explanations (see letter of the Federal Tax Service of the Russian Federation dated January 27, 2015 No. ED-4-15/1071).

Read about when and how to do this, and what the consequences of violating this duty are.

Secondly, it should be borne in mind that the request may not have the stamp of the tax authority (see letter of the Federal Tax Service of the Russian Federation dated July 15, 2015 No. ED-3-2/).

Read about when and how to do this, and what the consequences of violating this duty are.

Secondly, it should be borne in mind that the request may not have the stamp of the tax authority (see letter of the Federal Tax Service of the Russian Federation dated July 15, 2015 No. ED-3-2 / [email protected] ).

Read more about this in the material “A requirement without an inspection seal is the norm.”

Allowed sending methods

There are two ways to submit an explanation to the tax authorities. If the company uses an electronic reporting form, then the explanation must be transmitted in this way, otherwise it will not even be considered.

But if an enterprise uses the right to submit reports on paper, then an explanation can be generated on paper and then taken to the tax office in person. If it doesn’t work out in person - no problem, you can send the document through an authorized person (provided that he has a notarized power of attorney) or by regular mail - the date of submission of the explanation in this case will be considered the date when the letter was accepted by the postal employee services.

Is there a fine possible if the requirement is ignored?

Tax liability for failure to comply with the inspection's requirement to provide explanations to the Tax Code of the Russian Federation has not been established. Art. 126 of the Tax Code of the Russian Federation does not apply to this situation, since we are not talking about the requisition of documents (Article 93 of the Tax Code of the Russian Federation), but Art. 129.1 is not applicable, since this is not a counter check (Article 93.1 of the Tax Code of the Russian Federation).

Administrative liability under Art. 19.4 of the Code of Administrative Offenses of the Russian Federation in this case cannot be attracted either. This article applies for failure to appear at the tax authority, and not for refusal to give explanations, which the Federal Tax Service of the Russian Federation itself draws attention to (see clause 2.3 of the letter of the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12837).

Thus, tax authorities have no right to fine people for failure to submit explanations. But still, despite the absence of legal grounds for the fine, it is more appropriate to provide explanations, since this is in the interests of the taxpayer himself. After all, refusal to do so may result in additional tax charges and sanctions, which will then require time and money to appeal.

We invite you to read: Why do we need a property tax?

For information on the procedure for requesting clarification during an on-site audit, read the article “How tax authorities request clarification from a taxpayer.”

For information on the procedure for requesting clarification during an on-site audit, read the article “How tax authorities request clarification from a taxpayer.”

What happens if you do not respond to requests for clarification?

Sometimes employees of organizations, for some reason, do not consider it necessary to respond to letters from the tax authority or, out of absent-mindedness, simply forget to do so. Previously, the legislation did not provide for any sanctions for this, but from January 1, 2017, tax authorities received the right to fine enterprises for failure to provide explanations.

Moreover, the fine is quite large: for the first time it is 5 thousand rubles, but if the tax agent commits such a violation again, the amount will increase to 20 thousand rubles.

In addition, we should not forget that employees of the supervisory agency may interpret the taxpayer’s silence in their own way, as a result of which the enterprise may be placed on the schedule of the next on-site tax audits. And this is a more serious danger, because based on the results of such control measures, companies are often subject to more serious administrative penalties (especially relevant, given that there are some flaws in the work of almost any organization).

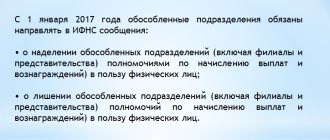

On the transfer of powers to tax authorities to administer insurance premiums

FEDERAL TAX SERVICE PENSION FUND OF THE RUSSIAN FEDERATION SOCIAL INSURANCE FUND OF THE RUSSIAN FEDERATION

LETTER

dated January 26, 2017 No. BS-4-11/ [email protected] /NP-30-26/947/02-11-10/06-308-P

(for additional information, see letter from the Federal Tax Service No. BS-4-11 dated February 21, 2017/ [email protected] )

As part of the organization of work on the administration of insurance premiums in connection with the transfer of relevant powers to tax authorities, the Federal Tax Service (hereinafter referred to as the FTS of Russia), the Pension Fund of the Russian Federation (hereinafter referred to as the PFR) and the Social Insurance Fund of the Russian Federation (hereinafter referred to as the FSS of Russia) report the following.

1. Payment of insurance premiums

1.1. Processing payment orders

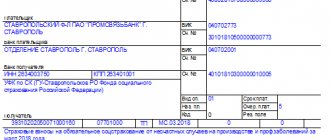

From January 1, 2020, payment of insurance premiums, including for billing periods expired before January 1, 2020, must be made using budget classification codes (hereinafter referred to as BCC), assigned to the Federal Tax Service of Russia by order of the Ministry of Finance of Russia dated December 7, 2016 No. 230n “ On amendments to the Instructions on the procedure for applying the budget classification of the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n.”

When filling out payment orders, special attention should be paid to specifying the following payment order details:

- “TIN” and “KPP” of the recipient of funds - the value of the “TIN” and “KPP” of the relevant tax authority that administers the payment;

- “Recipient” is the abbreviated name of the Federal Treasury authority and in brackets is the abbreviated name of the tax authority that administers the payment;

- budget classification code - a KBK value consisting of 20 characters (digits), while the first three characters, indicating the code of the chief administrator of budget revenues of the budget system of the Russian Federation, must take the value “182” - Federal Tax Service in accordance with the correspondence table;

- “Payer status”—indicator “14”—taxpayer making payments to individuals.

When transferring insurance premiums for yourself, one of the following values is indicated in the “Payer Status” field:

- individual entrepreneur - “09”;

- notary engaged in private practice - “10”;

- lawyer who established a law office - “11”;

- head of a peasant (farm) enterprise - “12”.

1.2. Deadlines for payment of insurance premiums:

| Payer category | Payers of insurance premiums making payments in favor of individuals | Payers of insurance premiums who do not make payments to individuals | Heads of peasant (farm) households |

| Payment deadline | 15th day of the calendar month following the calendar month for which the monthly mandatory payment is calculated | December 31 of the current calendar year for a fixed payment | December 31 of the current calendar year |

| April 1 of the year following the expired billing period, to pay 1% on income amounts over 300,000 rubles. |

2. Submission of reports on insurance premiums

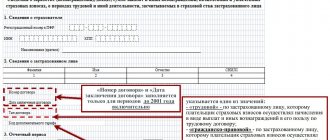

Calculations for accrued and paid insurance premiums, as well as calculations for accrued and paid contributions for additional social security for the 2020 billing period and updated calculations for the periods 2010 - 2020. payers of insurance premiums submit to the territorial bodies of the Pension Fund and the Social Insurance Fund of Russia according to the forms and formats in force during the corresponding billing period.

Calculations of insurance premiums for reporting (settlement) periods, starting with reporting for the 1st quarter of 2020, are submitted by payers of insurance premiums to the tax authorities at the place of their registration in the form and format approved by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11 / [email protected] (registered with the Ministry of Justice of Russia on October 26, 2016, registration number 44141).

Calculation of accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases, as well as expenses for payment of insurance coverage in the 4-FSS form, approved by Order of the Federal Insurance Service of Russia dated September 26, 2016 No. 381 “On approval of the payment form for accrued and paid insurance premiums for compulsory social insurance against accidents at work and occupational diseases, as well as for the costs of paying out insurance coverage and the Procedure for filling it out" (registered with the Ministry of Justice of Russia on October 14, 2016, registration number 44045), is submitted by payers of insurance contributions to territorial bodies of the Federal Social Insurance Fund of Russia, starting with reporting for the 1st quarter of 2020.

3. Transfer of settlement balances for insurance premiums, penalties and fines, as well as information about debts on insurance premiums

In accordance with the Procedures for interaction between the branches of the Pension Fund of the Russian Federation and the Social Insurance Fund of Russia with the departments of the Federal Tax Service for the constituent entities of the Russian Federation (dated July 22, 2016 No. ММВ-23-1/ [email protected] /3И and No. ММВ-23-1/ [email protected] / 02-11-10/06-3098П) the balance of settlements for insurance premiums, penalties and fines, as well as arrears of insurance premiums as of 01/01/2017 must be transmitted in approved formats in electronic form (dated 11/03/2016 No. ZN-4 -1/ [email protected] /5I and No. ZN-4-1/ [email protected] /02-11-02/06-4803P) to the Office of the Federal Tax Service of Russia for the constituent entity of the Russian Federation (hereinafter referred to as the Federal Tax Service of Russia) from the territorial bodies of the Pension Fund of Russia and the Federal Social Insurance Fund of Russia until 02/01/2017.

4. Submission of certificates on the status of calculations for insurance premiums, certificates of fulfillment of obligations and acts of joint reconciliation of calculations for insurance premiums

Before the territorial bodies of the Pension Fund of Russia and the Federal Insurance Service of Russia transfer to the Federal Tax Service of Russia the balance of settlements for insurance premiums, penalties and fines, as well as debts for insurance premiums, penalties and fines as of 01/01/2017, submission of certificates on the status of settlements for insurance premiums and joint reconciliation settlements for insurance premiums are carried out by the territorial bodies of the Pension Fund of Russia and the Social Insurance Fund of Russia according to the forms in force before 01/01/2017.

The form of the act of joint reconciliation of calculations for taxes, fees, insurance premiums, penalties, fines, interest was approved by order of the Federal Tax Service of Russia dated December 16, 2016 No. ММВ-7-17 / [email protected] , which is registered with the Ministry of Justice of Russia (registration number 45194) and published on the “Official Internet Portal of Legal Information” (www.pravo.gov.ru) on January 13, 2017, and, accordingly, comes into force on January 24, 2017.

Taking into account the above, the submission of an act of joint reconciliation of calculations for taxes, fees, insurance premiums, penalties, fines, interest, taking into account the amounts of insurance contributions, is possible only after receiving the balance of calculations for insurance premiums, penalties and fines in established formats from the Pension Fund of the Russian Federation and the Federal Social Insurance Fund of Russia.

Certificates on the status of settlements, as well as certificates on the payer’s fulfillment of the obligation to pay before the orders approving new forms of these certificates come into force, are submitted in the forms approved by order of the Federal Tax Service of Russia dated 06/05/2015 No. ММВ-7-17 / [email protected] " On approval of forms of certificates on the status of settlements for taxes, fees, penalties, fines, interest, the procedure for filling them out and formats for submitting certificates in electronic form" (registered with the Ministry of Justice of Russia on June 30, 2015, registration number 37841) and by order of the Federal Tax Service of Russia dated July 21, 2014 No. ММВ-7-8/ [email protected] “On approval of the form of a certificate about the fulfillment by a taxpayer (fee payer, tax agent) of the obligation to pay taxes, fees, penalties, fines, interest, the procedure for filling it out and the format for its presentation in electronic form via telecommunications communication channels" (registered with the Ministry of Justice of Russia on September 02, 2014, registration number 33929).

5. Reception of decisions from the Pension Fund and the Federal Social Insurance Fund of Russia

The Federal Tax Service of Russia, together with the Pension Fund of Russia and the Federal Social Insurance Fund of Russia, have approved the formats used in the interaction of tax authorities with the bodies of the Pension Fund of the Russian Federation and the Federal Tax Service of Russia regarding the regular exchange of information dated December 30, 2016 No. PA-4-1/ [email protected] /7I and dated December 29, 2016 No. ZN-4-1/ [email protected] /02-11-08/11-08-5765P.

In accordance with these formats, information on the amounts of insurance premiums accrued (reduced) based on the results of inspections for periods before 01/01/2017, information from decisions on the return of amounts of overpaid (collected) amounts of insurance premiums, information from decisions on non-acceptance of payment expenses insurance coverage and information from decisions on reimbursement of the policyholder's expenses for the payment of benefits for temporary disability and in connection with maternity are presented in electronic form.

At the same time, before the implementation of the relevant software by the participants in the information exchange, the specified information from the decisions is submitted to the Federal Tax Service of Russia by the territorial bodies of the Pension Fund of the Russian Federation and the Federal Tax Service of Russia in the following order.

5.1. Making decisions on bringing (refusing to bring) the payer to justice for committing a violation of the legislation of the Russian Federation on insurance contributions and additional social security and on non-acceptance of expenses for the payment of insurance coverage for compulsory social insurance, which came into force on 01.01.2017

Decisions to hold (refuse to hold) the payer accountable for committing a violation of the legislation of the Russian Federation on insurance contributions and additional social security and decisions not to accept the offset of expenses for the payment of insurance coverage for compulsory social insurance, which entered into force on January 1, 2017, are presented by the authorized employees of the territorial bodies of the Pension Fund of the Russian Federation and the Federal Tax Service of Russia in a timely manner to the Federal Tax Service of Russia in the form of certified copies on paper based on the register (the recommended sample of the register is attached) and then promptly transferred to the Federal Tax Service of Russia in the form of scanned images and by courier on paper to the Federal Tax Service of Russia at the place of issue to register insurance premium payers for execution. The register of decisions made is drawn up in two copies.

If such decisions were previously sent by registered mail with return receipt requested, it is necessary to ensure confirmation by the bodies of the Pension Fund of the Russian Federation and the Federal Social Insurance Fund of Russia of the sending of these decisions by the relevant register.

After the start of information exchange in electronic form, previously transmitted decisions on paper are not sent again to the tax authorities in electronic form.

At the same time, the amounts additionally accrued under these decisions that entered into force on January 1, 2017, as well as the amounts of insurance premiums reflected in the calculation of accrued and paid insurance premiums, the desk audit for which was completed in January 2020, should not be reflected in the balance of calculations for insurance premiums, penalties and fines as of 01/01/2017.

Information on the amounts of insurance premiums, penalties, fines from the relevant decisions presented on paper is entered manually using the “Documents with accruals, deferments, installments and offsets” mode by an employee appointed by the head of the Federal Tax Service of Russia into the “Settlements with the Budget” cards (hereinafter - KRSB) with a change in the head of the revenue administrator (1-3 ranks of the KBK) to “182”, with the exception of the KBK:

— 39211620010066000140;

— 39211620050016000140;

— 39311620020076000140.

The procedure for implementing decisions that specify the above-mentioned BCCs will be determined additionally.

After the relevant information is reflected in the CRSB of the Federal Tax Service of Russia within the time limits established by the Tax Code of the Russian Federation, a demand for payment of taxes, fees, insurance premiums, penalties, fines, interest is generated and sent to the payer of insurance premiums.

The Federal Tax Service for the constituent entities of the Russian Federation monitors compliance with collection procedures based on these decisions.

5.2. Making decisions on reimbursement of the insurer's expenses for the payment of benefits for temporary disability and in connection with maternity

Information from decisions on reimbursement of the insurer's expenses for the payment of benefits for temporary disability and in connection with maternity is accepted only in electronic form in approved formats.

5.3. Making decisions on the return of overpaid (excessively collected) insurance premiums for periods before 01/01/2017

Article 21 of the Federal Law of July 3, 2016 No. 250-FZ “On amendments to certain legislative acts of the Russian Federation and the recognition as invalid of certain legislative acts (provisions of legislative acts) of the Russian Federation in connection with the adoption of the Federal Law “On Amendments to Part One and The second of the Tax Code of the Russian Federation in connection with the transfer to tax authorities of powers to administer insurance contributions for compulsory pension, social and medical insurance" established that the decision to return the amounts of overpaid (collected) insurance contributions, penalties and fines for reporting (calculation) periods, expired before January 1, 2020, is accepted by the relevant bodies of the Pension Fund of the Russian Federation, the Federal Social Insurance Fund of Russia within 10 working days from the date of receipt of a written application (application submitted in electronic form with an enhanced qualified electronic signature via telecommunication channels) of the policyholder for the return of overpaid (collected) amounts insurance premiums, penalties and fines (if the policyholder submits an updated calculation - within 10 working days from the date of completion of the desk audit of the specified calculation).

In this case, the decision to return the amounts of overpaid (collected) insurance premiums, penalties and fines for reporting (calculation) periods that expired before January 1, 2020 is made if the payer of insurance premiums does not have any debt incurred for reporting (calculation) periods that expired before January 1, 2020.

The next day after the decision is made to return the amounts of overpaid (collected) insurance premiums, penalties and fines, the territorial body of the Pension Fund of the Russian Federation, the territorial body of the FSS of Russia send it to the Federal Tax Service of Russia.

Before the participants in the information exchange implement the relevant software, the specified decisions are presented by an authorized employee of the territorial bodies of the Pension Fund and the Federal Tax Service of Russia to the Federal Tax Service of Russia in the form of certified copies on paper based on the register compiled in duplicate, and then transferred to the Federal Tax Service of Russia at the place of registration of the payer insurance premiums for execution.

At the same time, after the start of information exchange in electronic form, previously sent decisions on paper are not sent again to the Federal Tax Service of Russia in electronic form.

To return overpaid (collected) amounts of insurance premiums, the Federal Tax Service of Russia fills out an application for the return of these amounts and sends it in the prescribed manner to the Federal Treasury authority at the place of service to make a refund to the policyholder in accordance with the budgetary legislation of the Russian Federation.

The formation of refund applications by the Federal Tax Service of Russia on the basis of decisions received on paper is carried out in the presence of open KRSB only after receiving and reflecting the balance of settlements for insurance premiums, penalties and fines in accordance with the approved Procedures for interaction between the branches of the Pension Fund of the Russian Federation and the Federal Tax Service of Russia with the departments of the Federal Tax Service by constituent entity Russian Federation and formats in accordance with paragraph 3 of this letter.

The Federal Tax Service of Russia sends to the territorial bodies of the Pension Fund of Russia and the FSS of Russia within the framework of the Agreements on information exchange between the Federal Tax Service of Russia and the Pension Fund of the Russian Federation and the FSS of Russia (dated November 30, 2016 No. ММВ-23-11/ [email protected] /AD/09-31/sog/79 and No. ММВ-23-11/ [email protected] /12-11-13/06-5262П) an extract from the settlement documents executed by the Federal Treasury authorities when making the return of insurance premiums (in terms of the Pension Fund for periods before 01/01/2017).

The departments of the Federal Tax Service of Russia in the constituent entities of the Russian Federation, branches of the Pension Fund of the Russian Federation in the constituent entities of the Russian Federation, branches of the FSS of Russia in the constituent entities of the Russian Federation, bring this letter to the attention of the relevant territorial authorities.

Appendix: on the 1st sheet.

Deputy Head of the Federal Tax Service of Russia

S.L. Bondarchuk

Deputy Chairman of the Board of the Pension Fund of the Russian Federation

N.V. Petrova

Deputy Chairman of the Social Insurance Fund of the Russian Federation

A.V. Rudenko

Register of decisions* submitted to the tax authorities, dated __________ No. ______

| No. | Body that made the decision | Name of organization / Full name of individual entrepreneur, individual) | INN\KPP | Type of solution* (1, 2, 3) | Date of decision | Decision number | The amount specified in the decision | Effective date of the decision** |

The registry presented:

(position of authorized person, full name) (date, signature)

The registry accepted:

(position of authorized person, full name) (date, signature) _____________________________

* Decisions to hold (refusal to hold) accountable for committing a violation of the legislation of the Russian Federation on insurance premiums (1), as well as decisions to not accept expenses for the payment of insurance coverage as a result of verification of the validity of the declared expenses for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity, carried out by the Social Insurance Fund based on the results of billing periods before 01/01/2017 (2), or a decision on the return of overpaid (collected) insurance contributions for periods before 01/01/2017 (3)

** Indicated based on decisions to hold (or refuse to hold) accountable for committing a violation of the legislation of the Russian Federation on insurance premiums, as well as decisions not to accept for offset the costs of paying insurance coverage, as a result of checks of the validity of the declared costs of paying insurance coverage under compulsory social insurance in case of temporary disability and in connection with maternity, carried out by the Social Insurance Fund based on the results of billing periods until 01/01/2017

How to write an explanation

An explanation of insurance premiums can be written in any form - there is no unified standard. It is recommended that its structure and content comply with the norms and rules adopted for business papers.

It is very important that the explanation clearly describes the reasons for the problem for which tax representatives contacted the company. They need not only to be identified, but also to be argued. In this case, the evidence base should consist not only in words, but also in the presence of relevant supporting papers.

Zero reports RSV and SZV-M

- Submit SZV-M information to the director

, even if an employment contract has not been concluded with him; - Submit a statement

about the absence of labor relations and financial and economic activity. After submitting the application, the company is exempt from filing SZV-M until it begins operations and concludes employment contracts.

Is it necessary to submit a zero RSV if there is no activity?

In this case, in 2020, the individual entrepreneur is required to submit calculations for insurance premiums for the first quarter with data on the salary in January of the second employee and zero calculations with cumulative data for six months, 9 months and a year.

When forming Section 3 Calculation of insurance premiums, you need to pay attention to two types of data. The first type is individual information (full name, SNILS, INN), they are indicated in subsection 3.1 Section 3 of the Calculation. The second type is income-calculation indicators relating to payments made and calculated contributions on a monthly breakdown in favor of the insured persons. This data is entered into subsection 3.2 of Section 3 of the RSV 2020.

The total value of the specified contributions to pension insurance does not coincide with the values of the amounts of pension contributions broken down by insured persons specified in the Calculation. Thus, the value on line 061 in columns 3, 4, 5 of Appendix 1 of Section 1 of the form should be equal to the amounts of lines 240 of Section 3 of the Calculation for each month, respectively.

What errors will cause the form to not be accepted?

In the new Calculation of insurance premiums, introduced by the tax authorities by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11 / [email protected] in the reporting campaign from 2020, when entering individual information about the insured person in the absence of such TIN, in the appropriate field Section 3 needs dashes. The tax authorities reported this in their letter dated November 16, 2017 No. GD-4-11/ [email protected] The absence of this detail will not serve as a reason for refusing to accept the form. It is better to do the same if the correctness of the existing individual number raises questions for the policyholder.

The company does not submit any application to the Federal Tax Service to establish the right to use a reduced tariff for insurance premiums, and tax authorities see this information on the DAM. To confirm this right, they can send a request to provide documents on the basis of which preferential rates for insurance premiums are used.

How to prepare an explanation on paper

For explanations, you can take a regular sheet of paper or a form with company details, but it is better not to write them by hand, but to print them on a computer. After final formation, the document must be signed - it is good if the document contains two autographs: the director and the chief accountant. The explanation should be made in two identical copies, one of which must be sent to the place of request, and the second must be kept with you. If the accounting policy of an enterprise indicates the use of a seal in its current activities, the letter should be endorsed with its help. In the journal of outgoing documentation, you must make a note about the explanation sent (indicating its number and date).

Features of the preparation of explanations for insurance premiums

When drawing up and filing explanations on insurance contributions to the tax office, you must adhere to the following main points:

- indicate the reasons why the tax inspectorate sent a request for clarification;

- argue in connection with which specific problems controversial issues arose;

- indicate and present the evidence base on which the policyholder insists on his position;

- draw up explanations on company letterhead with all the necessary details;

- fill out the paper version of the explanations in printed rather than handwritten form;

- sign the explanations not only of the director, but also of the chief accountant;

- draw up a paper version in two copies: give one of them to the tax office employees, and put a mark of receipt on the second;

- register the document in the journal of outgoing documentation, indicating its number and date.

The video material provides information on how to respond to the requirements of the Federal Tax Service during a desk audit of the calculation of insurance premiums:

Sample explanation to the tax office

If you have received a request from the tax office to provide an explanation regarding insurance premiums, and you have never made such documents before, look at the example below and read the comments to it - with their help you will probably be able to formulate the letter you need.

- First of all, indicate the addressee in the explanation, i.e. the tax office for which the explanation is intended. Then enter information about the organization in more detail: write its name, details, contact information (address, telephone), be sure to mark the outgoing number of the message. After this, you can move on to the main section.

- First, provide here a link to the number and date of the request that came from the supervisory authority, then begin to formulate the actual explanations. In each specific situation, they depend on what particular circumstances led to questions from tax specialists. But in any case, give an explanation both descriptively (for example, if technical problems or incorrect work of an accountant led to the error, write it down) and documented.

- When referring to documents, indicate their numbers and date of creation. If the reason for which the tax authorities have questions has already been corrected, be sure to note this, as well as the fact that in the future you will take all measures to prevent such situations.

- Finally, be sure to sign the form.

General points for submitting explanations to the Federal Tax Service

Explanations regarding insurance premiums must be submitted to the tax office within 5 working days from the date of receipt of the request. It is mandatory to submit explanations to the Federal Tax Service, since according to clause 1 of Art. 129.1 of the Tax Code of the Russian Federation, an economic entity will be fined 5,000 rubles. for untimely notification or failure to provide the necessary information to the Federal Tax Service. Repeated acts of this kind are punishable by fines in the amount of 20,000 rubles.

When requesting explanations on the DAM, they must be submitted along with an updated calculation in which any errors found will be corrected. However, this requirement is not always related to the fact that there are any violations, errors or inaccuracies in the DAM. Tax authorities may request clarification even if there are doubts about the correctness of determining the amount of insurance premiums, as well as if the amount of insurance premiums has been reduced compared to the previous period.

In addition, clarification may be required if the company applies a reduced rate of insurance premiums or reflects non-taxable amounts in the DAM. Also, in the event of a discrepancy between the information in the DAM and 6-NDFL, the payer of insurance premiums will need to explain the reason for the differences.

It is necessary to pay attention to the following important points:

- the explanation is submitted in response to a request from the tax inspectorate;

- The legislation does not establish a sample of explanations, and therefore they are drawn up in any form. As a rule, the explanations contain characteristics inherent in the company's business papers;

- Explanations must be sent no later than 5 days from the date of receipt of the request to the Federal Tax Service Inspectorate from which the request came;

- Explanations on insurance premiums can be transmitted electronically through TKS, during a personal visit to the tax office, through an authorized representative (with the execution of a notarized power of attorney) or by Russian Post;

- date of submission of the explanation:

— for an electronic document — date of sending;

- for transfer personally or by an authorized person - for direct transfer to a tax inspector;

— for sending by mail — the date of acceptance by an employee of the Russian Post;

- If an explanation is not provided, the company can expect not only a fine, but also its inclusion in the schedule of on-site tax audits.

RSV if there are no employees

To each of them you can attach a cover letter explaining why your reporting is “zero” (this explanation can be written directly on the title page of the report if you submit it on paper, signed and sealed). This is not necessary, but it happens that at the time of submitting “zero” reports in person or after receiving reports by mail or via communication channels, the regulatory authorities themselves ask for clarification.

If I DO NOT have employees, do I submit such a report to the DAM?

The list of employees for each calendar day takes into account both those actually working and those absent from work for any reason. Based on this, the payroll includes entire units, in particular, of workers who were on leave without pay with the permission of the administration. Those who are included in the payroll also end up in the average list.

The Ministry of Finance, in a letter dated March 24, 2020 N 03-15-07/17273, confidently stated that the Tax Code (hereinafter referred to as the Code) does not provide for an exemption from the obligation of the payer of insurance premiums to submit Calculations in the event of the organization’s failure to carry out financial and economic activities. Paragraph 7 of Article 431 of the Code stipulates that payers of insurance premiums who make payments and other remuneration to individuals are required to submit a calculation of contributions no later than the 30th day of the month following the billing (reporting) period to the tax authority at the place of their registration.

It must be said that at one time the Ministry of Labor also insisted that it was necessary to report on contributions even if the indicators were zero (see letter of the Ministry of Labor dated July 13, 2020 N 17-4 / OOG-1055). Allegedly, by submitting calculations with zero indicators, the payer declares to the body monitoring the payment of insurance premiums that there are no payments and rewards in favor of individuals who are subject to insurance premiums, and, accordingly, about the absence of paid amounts of insurance premiums.

This is interesting: Does a child need to wait 3 years to buy a share with maternity capital 2020

Calculation of insurance premiums in the absence of activity

On the other hand, the volume of the new Calculation of Insurance Premiums (approved by Order of the Federal Tax Service dated October 10, 2020 N ММВ-7-11/ [email protected] , hereinafter referred to as the Calculation of Contributions) is quite large. The only advantage is that individual indicators no longer need to be duplicated in different types of reporting. However, in practice another problem arises. We are talking about the need to submit a Calculation in the event that the company does not actually conduct business and does not accrue any payments in favor of individuals. Is it necessary to take the “zero” test in this case?