Document for yourself

At first glance, an organization should not issue invoices for non-cash payments to the population. Judge for yourself: for a “physics” buyer who bought a music disc in an online store or a book from a “mail” catalogue, this document is clearly of no use: he will still not accept VAT as a deduction! However, in order not to violate the requirements of the Tax Code, the seller in such a situation must issue invoices to each individual. And here's the reason.

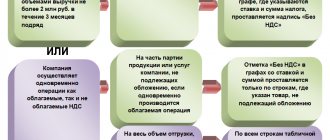

Any company that sells goods, work or services is required to issue invoices (of course, except for those organizations that use special regimes). This is stated in paragraph 3 of Article 168 of the Tax Code of the Russian Federation. The only exception to this rule is made for companies selling goods to the public for cash. Only they have the right not to issue invoices to customers, limiting themselves only to cash receipts or, if we are talking about services, strict reporting forms (clause 7 of Article 168 of the Tax Code of the Russian Federation).

It turns out that the selling company is obliged to issue an invoice to a client who pays for goods not in cash, but through a bank branch. Otherwise, tax authorities may fine the organization under Article 120 of the Tax Code of the Russian Federation for a gross violation of the rules for accounting for income, expenses and objects of taxation (the minimum fine under this article is 5,000 rubles). On the other hand, by issuing an invoice with a designated VAT amount, the taxpayer violates paragraph 6 of Article 168 of the Tax Code of the Russian Federation, which does not allow the tax amount to be separately indicated in documents issued to the population. It turns out that the seller must issue invoices to individuals without allocating VAT to them. But even if the taxpayer violates this requirement, the tax authorities will not be able to punish him: the Tax Code does not establish liability for such a violation.

https://youtu.be/MDyHeHdfNXY

Can an individual issue an invoice?

But it is precisely this information that is often missing.

What could happen to online stores and postal merchants if the invoices they issue do not include the buyer’s TIN? In our case, nothing. The fact is that an invoice that is missing some of the required details creates problems only for the buyer. According to such a document, he will not be able to deduct the VAT paid to the supplier (clause 2 of Article 169 of the Attention Tax Code of the Russian Federation). For the seller, the Tax Code does not provide for liability for incorrectly executed invoices. The main thing is that the company regularly displays them when selling goods, correctly calculates and pays VAT to the budget, and keeps books of purchases and sales. The Department of Indirect Taxes of the Federal Tax Service of Russia agrees with this. “Of course, formally the company violates the rules for issuing invoices by not indicating the buyer’s TIN,” the specialists of this department answered us.

For example, if a seller – a VAT payer – received an advance from a buyer using a simplified method, if there is a mutual agreement, an invoice for the advance does not need to be drawn up (letter of the Ministry of Finance of Russia dated March 16, 2020 No. 03-07-09/13808). By the way, the seller is not obliged to demand from the buyer documents confirming that he does not pay VAT legally (letter of the Ministry of Finance of Russia dated March 30, 2016 No. 03-07-09/17700);

- in transactions with interdependent persons, for tax purposes, the seller increases the price of goods, works, services to the market level and adjusts the VAT tax base (letter of the Ministry of Finance of Russia dated March 1, 2013 No. 03-07-11/6175).

This procedure is provided for in paragraph 3 of Article 169 of the Tax Code of the Russian Federation. There is no obligation for the supplier to control the tax status of the buyer when signing the relevant document regarding non-drafting of invoices.

ImportantSituation: is it necessary to issue invoices when drawing blood from the population on the basis of contracts with hospitals and clinics? No no need. Taking blood from the population under contracts with inpatient medical institutions and clinics is a medical service and is exempt from VAT (subclause 2, clause 2, article 149 of the Tax Code of the Russian Federation). And in such a situation, the organization is not obliged to issue an invoice. This is directly stated in paragraph 3 of Article 169 of the Tax Code of the Russian Federation. Export of goods Situation: is it necessary to issue invoices when selling goods for export? Yes need. Invoices must be issued for all transactions that are subject to VAT.

https://youtu.be/n19cXvtUw7c

There are some exceptions, but exporting is not one of them. This is stated in paragraph 3 of Article 169 of the Tax Code of the Russian Federation. Therefore, draw up an invoice, as usual, within five calendar days from the date of shipment for export (clause 3 of Article 168 of the Tax Code of the Russian Federation). Tax Code of the Russian Federation);

- intermediary organizations that sell goods (work, services) on their own behalf under a commission agreement or agency agreement, if the principal or principal applies the general taxation system (clause 1 of article 169 of the Tax Code of the Russian Federation, clause 20 of section II of appendix 5 to the Government Decree RF dated December 26, 2011 No. 1137);

- organizations that received an advance (partial payment) from the buyer or customer towards the upcoming sale (clauses 1 and 3 of Article 168 of the Tax Code of the Russian Federation).

When to issue an adjustment invoice An adjustment invoice is issued in cases where:

- the parties agreed to change the cost of goods already shipped (work performed, services provided, transferred property rights).

If a monetary claim acquired under an assignment agreement is associated with payment for goods (work, services), the sale of which is subject to VAT, then repayment of the debt is also recognized as an object of taxation. The tax base in this case is the difference between the amount received from the debtor and the purchase price of the debt. This follows from the provisions of paragraph 2 of Article 155 of the Tax Code of the Russian Federation. Determine the amount of VAT at the estimated rate of 18/118 (clause 4 of article 164 of the Tax Code of the Russian Federation). The tax must be calculated on the day the payment is received from the debtor (Clause 8, Article 167 of the Tax Code of the Russian Federation). Since the debtor has no reason to claim VAT for deduction, the invoice can be drawn up in one copy and registered in the sales book. In line 2 “Seller” of the invoice, indicate the name of the assignee organization, in line 6 “Buyer” - the name of the organization that repaid the debt. Situation: is an organization obliged to issue invoices when selling goods (performing work, providing services) for cash? The answer to this question depends on who the buyer of the goods is. If an organization sells goods (work, services) to the public, there is no need to issue invoices. If the buyers (customers) are other organizations or entrepreneurs, then invoices must be issued on a general basis. This procedure follows from the provisions of Article 168 of the Tax Code of the Russian Federation. Situation: is it necessary to issue an invoice when providing hotel services to seconded employees of the organization’s head office? Services are provided by a separate unit located at the location of the business trip. No no need. Furniture sets are sold in accordance with the customs export procedure. Therefore, this operation is subject to VAT at a rate of 0 percent. Alpha submitted all the necessary documents confirming the fact of export on time. Alfa presented the Dnepropetrovsk Switch Plant with an invoice for the cost of the shipped products. At the same time, when filling out line 6b “TIN/KPP of the buyer” of the invoice, the accountant took into account the fact that the accounting of Ukrainian organizations is carried out in accordance with the legislation of Ukraine. All Ukrainian organizations are included in the Unified State Register of Entrepreneurs and Organizations of Ukraine, and each of them is assigned an eight-digit OKPO number (analogous to the Russian TIN). It was this number assigned to the Dnepropetrovsk switch that was indicated in line 6b.

On the other hand, by issuing an invoice with a designated VAT amount, the taxpayer violates paragraph 6 of Article 168 of the Tax Code of the Russian Federation, which does not allow the tax amount to be separately indicated in documents issued to the population. It turns out that the seller must issue invoices to individuals without allocating VAT to them. But even if the taxpayer violates this requirement, the tax authorities will not be able to punish him: the Tax Code does not establish liability for such a violation.

Each has its own shortcomings. It is not as easy to issue an invoice for an individual as for an organization. All details of a legal entity necessary to fill out this document are usually specified in the contract. But a private person, when placing an order, provides a minimum of information about himself - last name, first name and delivery address, and occasionally a telephone number.

But a correctly executed invoice, in addition to these data, must contain one more mandatory detail - the buyer’s TIN. Similar explanations are in letters from the Ministry of Finance of Russia dated July 5, 2007 No. 03-07-08/180 and the Department of Tax Administration of Russia for Moscow dated September 19, 2003 No. 24-11/51717. And although the conclusions in them relate to the previous rules for issuing invoices, they are still valid today. Arbitration practice also shows that invoices must be drawn up when shipping for export (see, for example, Resolution of the Federal Antimonopoly Service of the Moscow District dated September 5, 2005 No. KA-A40/8359-05). An example of issuing an invoice for the sale of goods for export. Alfa JSC is engaged in the production of office furniture. On June 15, Alpha shipped 10 Office furniture sets to Ukraine. The buyer is the Dnepropetrovsk Switch Plant. The selling price of one headset is 150,000 rubles. (taxed at 0% rate). The total transaction amount is RUB 1,500,000. (10 pcs. × 150,000 rub./pc.).

Only they have the right not to issue invoices to customers, limiting themselves only to cash receipts or, if we are talking about services, strict reporting forms (clause 7 of Article 168 of the Tax Code of the Russian Federation). It turns out that the selling company is obliged to issue an invoice to a client who pays for goods not in cash, but through a bank branch. Otherwise, tax authorities may fine the organization under Article 120 of the Tax Code of the Russian Federation for a gross violation of the rules for accounting for income, expenses and objects of taxation (the minimum fine under this article is 5,000 rubles).

On the other hand, by issuing an invoice with a designated VAT amount, the taxpayer violates paragraph 6 of Article 168 of the Tax Code of the Russian Federation, which does not allow the tax amount to be separately indicated in documents issued to the population. It turns out that the seller must issue invoices to individuals without allocating VAT to them.

Everyone has their own shortcomings

It is not as easy to issue an invoice for an individual as for an organization. All details of a legal entity necessary to fill out this document are usually specified in the contract. But a private person, when placing an order, provides a minimum of information about himself - last name, first name and delivery address, and occasionally a telephone number. But a correctly executed invoice, in addition to these data, must contain one more mandatory detail - the buyer’s TIN. But it is precisely this information that is often missing.

What could happen to online stores and postal merchants if the invoices they issue do not include the buyer’s TIN? In our case, nothing. The fact is that an invoice that is missing some of the required details creates problems only for the buyer. According to such a document, he will not be able to deduct the VAT paid to the supplier (clause 2 of Article 169 of the Tax Code of the Russian Federation). For the seller, the Tax Code does not provide for liability for incorrectly executed invoices. The main thing is that the company regularly displays them when selling goods, correctly calculates and pays VAT to the budget, and keeps books of purchases and sales. The Department of Indirect Taxes of the Federal Tax Service of Russia agrees with this. “Of course, formally the company violates the rules for issuing invoices by not indicating the buyer’s TIN,” the specialists of this department answered us. — But in this situation, goods are purchased by individuals who, to put it mildly, do not need input VAT. Therefore, during an audit, the tax inspector most likely will not find fault with the company.”

What if the company receives an advance payment from an individual, draws up an advance invoice and then, at the time the goods are sold, reflects it in the purchase book? Will the tax authorities accept this deduction if they notice that the invoice is missing one of the required details? The Department of Indirect Taxes of the Federal Tax Service of Russia assured us that nothing threatens the taxpayer here either. After all, the peculiarity of an advance invoice is that the seller does not present it to the buyer, but keeps it for himself, first charging VAT and then deducting it. And tax authorities are unlikely to refuse an organization a deduction for such an invoice.

Invoice for an individual: possible without TIN

Any company that sells goods, work or services is required to issue invoices (of course, except for those organizations that use special regimes). This is stated in paragraph 3 of Article 168 of the Tax Code of the Russian Federation. The only exception to this rule is made for companies selling goods to the public for cash. Only they have the right not to issue invoices to customers, limiting themselves only to cash receipts or, if we are talking about services, strict reporting forms (clause 7 of Article 168 of the Tax Code of the Russian Federation).

What could happen to online stores and postal merchants if the invoices they issue do not include the buyer’s TIN? In our case, nothing. The fact is that an invoice that is missing some of the required details creates problems only for the buyer. According to such a document, he will not be able to deduct the VAT paid to the supplier (clause 2 of Article 169 of the Tax Code of the Russian Federation). For the seller, the Tax Code does not provide for liability for incorrectly executed invoices. The main thing is that the company regularly displays them when selling goods, correctly calculates and pays VAT to the budget, and keeps books of purchases and sales. The Department of Indirect Taxes of the Federal Tax Service of Russia agrees with this. “Of course, formally the company violates the rules for issuing invoices by not indicating the buyer’s TIN,” the specialists of this department answered us. — But in this situation, goods are purchased by individuals who, to put it mildly, do not need input VAT. Therefore, during an audit, the tax inspector most likely will not find fault with the company.”

Is it possible to issue an invoice to an individual?

Login to the site Registration Login for registered users: Close Login via Previously, you logged in via Password recovery Registration Password recovery Forum Forum

Seed (author of the question) 0 points

| ||||||||||||||

Does the organization issue an invoice to an individual?

If the buyer is an individual - an individual entrepreneur who is in the general regime, then he will need an invoice to submit tax for deduction. Next, after the tabular part, we indicate the number of sheets in the appendix (let us issue passports for goods on 6 sheets), enter the number of serial entries in the tabular part.

A similar conclusion is contained in the decisions of the Ninth Arbitration Court of Appeal dated October 10, 2019 No. 09AP-32624/2019-GK in case No. A40-95423/2012 and dated January 16, 2012 No. 09AP-32926/2011-AK in case No. A40-48916/11 -11-403.

The defendant asked to reduce the amount of the penalty, citing the fact that the delay in repayment of rent was due to the fault of the landlord, who issued an incorrectly executed invoice without indicating the seller’s checkpoint, as well as the transcript of the signatures of the head of the organization and the chief accountant.

In other words, in this case, the invoice is properly executed when indicating the information contained in paragraphs 5 and 6 of Art. 169 of the Tax Code of the Russian Federation.

According to the Ministry of Finance of the Russian Federation, there are no other cases of exemption of VAT taxpayers when they sell goods (works, services) to individuals from the specified obligations of the Tax Code of the Russian Federation.

Businessmen are interested in how to operate an LLC with an individual entrepreneur without VAT? For example, in Belarus LLCs operate only with VAT. They strive to enter into an agreement with a company of equal status. Distrust in individual entrepreneurs arises due to fragile financial responsibility.

In the situation under consideration, a separate unit provides hotel services to seconded employees that are necessary for the organization’s own needs.

When filling out the buyer's name, the same requirements are taken into account as when filling out the seller's name (see above).

And tax authorities are unlikely to refuse an organization a deduction for such an invoice. The only exception to this rule is made for companies selling goods to the public for cash.

The VAT taxpayer, on the basis of received invoices, keeps records in the “Purchases Book”, and based on the issued documents, corresponding entries are made in the “Sales Book”.

Most often it is written: “VAT is not charged, since the Contractor (Recipient) applies a simplified taxation system,” then the output data of the corresponding notification is indicated in brackets: document name, number, date of issue and issuing authority (your territorial tax office). For example: “ Notification No. 111 dated October 1, 2011, Federal Tax Service Inspectorate-15 for the city.

According to paragraph 1 of Art. 169 of the Tax Code of the Russian Federation, an invoice is a document that serves as the basis for the buyer to accept the VAT amounts presented by the seller of goods (works, services) for deduction. Different classes of OKVED In accordance with OKVED, wholesale trade and retail trade are types of activities included in different classes: 51 and 52, respectively.

Invoices are not drawn up by taxpayers when carrying out transactions for the sale of goods to individuals, since these persons are not VAT payers, provided that the seller has issued the buyer a cash receipt or other document of the established form (clause 7 of Article 168 and clause 3 of Article 169 of the Tax Code of the Russian Federation ).

Individuals without entrepreneurial status are not VAT payers in any case. Therefore, the seller has the right not to issue invoices for them. How the buyer pays for the goods - whether he transfers money to the cash register or transfers it to a bank account - also does not affect the need for paperwork.

Is it necessary to issue an invoice to an individual in case of non-cash payment?

Question: Is it necessary to issue an invoice to an individual in case of non-cash payment?

Answer: Providing the VAT amount to the buyer is one of the taxpayer’s responsibilities. So, according to paragraph 1 of Art. 168 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), when selling goods (work, services), transferring property rights, the taxpayer, in addition to the price (tariff) of the goods (work, services) sold, is obliged to present for payment to the buyer of these goods (work, services), property rights to the corresponding amount of tax.

However, when selling goods (performing work, providing services) for cash directly to the population, the requirements for preparing payment documents and issuing invoices are considered fulfilled if the seller issues the buyer a cash receipt or other document of the established form (clause 7 of Art.

Is it possible to issue an invoice to an individual?

2.

In accordance with paragraphs.

"p" clause 1 art. 5 of the Federal Law of 08.08.2001 No. 129-FZ “On state registration of legal entities and individual entrepreneurs”

the Unified State Register of Legal Entities (USRLE) contains information and documents about a legal entity, including

codes according to the All-Russian Classifier of Types of Economic Activities

.

1.

In accordance with

paragraph 7 of Art. 168 of the Tax Code of the Russian Federation when selling goods for cash

by organizations (enterprises) and individual entrepreneurs

of retail trade

and public catering, as well as other organizations, individual entrepreneurs performing work and providing paid services directly to the population, the requirements established by

clauses 3

and

4

of this article of the Tax Code RF, for the preparation of payment documents and issuance of invoices are considered completed

if the seller has issued the buyer a cash receipt or other document of the established form

.

How to issue an invoice to an individual

168 of the Tax Code of the Russian Federation). This rule was also voiced in the Letter of the Ministry of Finance of Russia dated July 31, 2009 No. 03-07-09/38.

Thus, when selling goods to an individual, the taxpayer is exempt from the obligation to issue an invoice, but subject to two conditions:

- the buyer (individual) pays in cash;

- the seller (organization) issues a cash receipt or other document of the established form.

Thus, if an individual pays for a purchase by non-cash method, the taxpayer supplier is not relieved of the obligation to issue an invoice within five calendar days from the date of shipment of goods (performance of work, provision of services) or from the date of receipt of payment amounts, partial payment for upcoming supply of goods (performance of work, provision of services) in accordance with clause 3 of Art. 168 Tax Code of the Russian Federation.

Despite the fact that in fact the invoice is of no interest to the buyer - an individual who is not a VAT payer, the seller is still obliged to issue an invoice to the individual and register it in the invoice journal and in the sales book ( in case of non-cash payment).

Additional information can be found in SPS ConsultantPlus:

- In the Quick Search line, type invoicing to an individual.

- On the right, click on the “Find” button, we receive a list of documents and consultations on the topic of interest to us.

- To sort the list of documents by Information Banks, click on the “Build a complete list” link in the upper right corner.

It is important to note that if the responsible person had valid reasons for not providing information to the bailiff and, despite this circumstance, the bailiff imposed a fine, then the decision can be challenged in court

S.A. Pochkina LLC "IC U-Soft" Regional information center of the ConsultantPlus Network

Olga Nikolaeva, ConsultantPlus expert, answers:

As a general rule, when selling goods, works, services, the taxpayer, in addition to the price (tariff) of the goods, works, services sold, is obliged to present the corresponding amount of VAT for payment to the buyer (clause 1 of Article 168 of the Tax Code of the Russian Federation). The only exception to this rule is made for those taxpayers who sell goods (work, services) to the population in cash (Clause 7, Article 168 of the Tax Code of the Russian Federation). If the taxpayer sells services (goods, work) to the population for non-cash payments, then he must issue an invoice in the general manner according to the rules established by Art. Art. 168, 169 Tax Code of the Russian Federation. In particular, non-cash payments are made by individuals through bank accounts opened with credit institutions and/or transfers of funds on behalf of these individuals without opening bank accounts (with the exception of postal transfers) (see Regulations of the Central Bank of the Russian Federation dated April 1, 2003 N 222-P “On the procedure for making non-cash payments by individuals in the Russian Federation”). Thus, when making non-cash payments with individuals through a bank, you should issue an invoice. The invoice is issued no later than 5 calendar days from the date of provision of services, as well as from the date of receipt of the advance payment (clause 3 of Article 168 of the Tax Code of the Russian Federation). Requirements for the composition of information that must be indicated in the invoice are set out in paragraph.

Do I need to prepare invoices when selling goods remotely to individuals?

So, according to paragraph 1 of Art. 168 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), when selling goods (work, services), transferring property rights, the taxpayer, in addition to the price (tariff) of the goods (work, services) sold, is obliged to present for payment to the buyer of these goods (work, services), property rights to the corresponding amount of tax.

However, when selling goods (performing work, providing services) for cash directly to the population, the requirements for preparing payment documents and issuing invoices are considered fulfilled if the seller issues the buyer a cash receipt or other document of the established form (clause 7 of Art. 168 of the Tax Code of the Russian Federation). This rule was also voiced in the Letter of the Ministry of Finance of Russia dated July 31, 2009 No. 03-07-09/38.

Thus, when selling goods to an individual, the taxpayer is exempt from the obligation to issue an invoice, but subject to two conditions:

- the buyer (individual) pays in cash;

- the seller (organization) issues a cash receipt or other document of the established form.

Thus, if an individual pays for a purchase by non-cash method, the taxpayer supplier is not relieved of the obligation to issue an invoice within five calendar days from the date of shipment of goods (performance of work, provision of services) or from the date of receipt of payment amounts, partial payment for upcoming supply of goods (performance of work, provision of services) in accordance with clause 3 of Art. 168 Tax Code of the Russian Federation.

Despite the fact that in fact the invoice is of no interest to the buyer - an individual who is not a VAT payer, the seller is still obliged to issue an invoice to the individual and register it in the invoice journal and in the sales book ( in case of non-cash payment).

Additional information can be found in SPS ConsultantPlus:

- In the Quick Search line, type invoicing to an individual.

- On the right, click on the “Find” button, we receive a list of documents and consultations on the topic of interest to us.

- To sort the list of documents by Information Banks, click on the “ Build a complete list ” link in the upper right corner.

It is important to note that if the responsible person had valid reasons for not providing information to the bailiff and, despite this circumstance, the bailiff imposed a fine, then the decision can be challenged in court

S.A. Pochkina LLC "IC U-Soft" Regional information center of the ConsultantPlus Network

It is not necessary to issue invoices for payment from an LLC to an individual, especially if we are talking about paying for services or goods in cash. If payment is made by bank transfer, the accountant can issue such an invoice, even if the private owner is not an individual entrepreneur. This procedure is standard, although it has some features.

When selling goods to individuals, invoices can be issued in one copy

clauses 5, 5.1 and 6 art. 169 of the Tax Code of the Russian Federation. In particular, when issuing an invoice to an individual, in the lines name, address and identification number of the buyer (clause 2, clause 5, article 169 of the Tax Code of the Russian Federation), his last name, first name and patronymic, address of permanent residence (place of registration), and also TIN (if available). In the absence of any indicators provided for in the corresponding lines of the invoice, dashes are placed in such lines. These clarifications are contained in Letter of the Ministry of Finance of the Russian Federation dated July 5, 2007 N 03-07-11/212. In the event that the services were paid for by an individual in advance payment, then according to the rules of paragraphs 1, 3 of Art. 168 of the Tax Code of the Russian Federation, the taxpayer must issue an invoice for the advance payment. The invoice issued in connection with the receipt of an advance indicates the name of the service, the tax rate (10/110 or 18/118), the amount of tax calculated by calculation method from the amount of the advance received, as well as the total amount of the advance received (clause 5.1 Article 169 of the Tax Code of the Russian Federation). When selling services, VAT amounts calculated and paid from the advance payment paid for these services are subject to deduction on the basis of clause 8 of Art. 171, paragraph 6 of Art. 172 of the Tax Code of the Russian Federation. As for filling out such an invoice for the amount of the advance, it is sufficient to reflect the details of the service provided by the buyer without indicating information about a specific individual, his address and TIN. The absence of this information is not a basis for refusing to deduct VAT on advances received under clause 2 of Art. 169 of the Tax Code of the Russian Federation when selling relevant services. Essentially similar conclusions are set out in the clarifications of the Ministry of Finance of Russia (see Letter dated 04/09/2009 N 03-07-11/103). However, it should be taken into account that an invoice is necessary for the VAT payer buyer in order to deduct VAT , presented by the seller (clause 1 of Article 169 of the Tax Code of the Russian Federation). But individuals are not VAT payers and cannot deduct the amount of tax presented by the seller. Therefore, in fact, an individual does not need an invoice. Let us note that in a number of industries (in particular, in the housing and communal services sector), the following practice is common: when selling services to individuals, the taxpayer issues one invoice for all services provided to the consumer group “population” for a certain period (month, quarter) . There are court decisions that recognize this practice as acceptable (see, for example, Resolutions of the Federal Antimonopoly Service of the North Caucasus District dated May 29, 2009 N A53-19504/2008, FAS Volga District dated February 3, 2009 N A55-9273/2008). However, such a procedure for issuing invoices is not provided for by the Tax Code of the Russian Federation. For the fact that the taxpayer does not issue invoices, the tax authorities can hold him accountable under Art. 120 Tax Code of the Russian Federation. In turn, for the taxpayer himself (seller of services), incorrect execution of an invoice does not entail any consequences or liability measures.

Invoice for an individual

Selling goods online today is very profitable: it significantly reduces costs and allows you to set affordable prices.

The growing popularity of “virtual” shopping encourages trading companies to create online stores where the client can purchase goods by ordering them online and paying by bank transfer.

But at the same time, the seller may have problems issuing invoices.

CM. Matveeva, UNP expert

Document for yourself

At first glance, an organization should not issue invoices for non-cash payments to the public.

Judge for yourself: for a “physics” buyer who bought a music disc in an online store or a book from a “mail” catalogue, this document is clearly of no use: he will still not accept VAT as a deduction! However, in order not to violate the requirements of the Tax Code, the seller in such a situation must issue invoices to each individual. And here's the reason.

Any company that sells goods, work or services is required to issue invoices (of course, except for those organizations that use special regimes). This is stated in paragraph 3 of Article 168 of the Tax Code of the Russian Federation.

The only exception to this rule is made for companies selling goods to the public for cash.

Only they have the right not to issue invoices to customers, limiting themselves only to cash receipts or, if we are talking about services, strict reporting forms (clause 7 of Article 168 of the Tax Code of the Russian Federation).

It turns out that the selling company is obliged to issue an invoice to a client who pays for goods not in cash, but through a bank branch.

Otherwise, tax authorities may fine the organization under Article 120 of the Tax Code of the Russian Federation for a gross violation of the rules for accounting for income, expenses and objects of taxation (the minimum fine under this article is 5,000 rubles).

On the other hand, by issuing an invoice with a designated VAT amount, the taxpayer violates paragraph 6 of Article 168 of the Tax Code of the Russian Federation, which does not allow the tax amount to be separately indicated in documents issued to the population.

It turns out that the seller must issue invoices to individuals without allocating VAT to them. But even if the taxpayer violates this requirement, the tax authorities will not be able to punish him: the Tax Code does not establish liability for such a violation.

Everyone has their own shortcomings

It is not as easy to issue an invoice for an individual as for an organization. All details of a legal entity necessary to fill out this document are usually specified in the contract.

But a private person, when placing an order, provides a minimum of information about himself - last name, first name and delivery address, and occasionally a telephone number.

But a correctly executed invoice, in addition to these data, must contain one more mandatory detail - the buyer’s TIN. But it is precisely this information that is often missing.

What could happen to online stores and postal merchants if the invoices they issue do not include the buyer’s TIN? In our case, nothing. The fact is that an invoice that is missing some of the required details creates problems only for the buyer.

According to such a document, he will not be able to deduct the VAT paid to the supplier (clause 2 of Article 169 of the Tax Code of the Russian Federation). For the seller, the Tax Code does not provide for liability for incorrectly executed invoices. The main thing is that the company regularly displays them when selling goods, correctly calculates and pays VAT to the budget, and keeps books of purchases and sales.

The Department of Indirect Taxes of the Federal Tax Service of Russia agrees with this. “Of course, formally the company violates the rules for issuing invoices by not indicating the buyer’s TIN,” the specialists of this department answered us. — But in this situation, goods are purchased by individuals who, to put it mildly, do not need input VAT.

Therefore, during an audit, the tax inspector most likely will not find fault with the company.”

What if the company receives an advance payment from an individual, draws up an advance invoice and then, at the time the goods are sold, reflects it in the purchase book? Will the tax authorities accept this deduction if they notice that the invoice is missing one of the required details? The Department of Indirect Taxes of the Federal Tax Service of Russia assured us that nothing threatens the taxpayer here either. After all, the peculiarity of an advance invoice is that the seller does not present it to the buyer, but keeps it for himself, first charging VAT and then deducting it. And tax authorities are unlikely to refuse an organization a deduction for such an invoice.

Is it possible to issue an invoice to an individual?

Login to the site Registration Login for registered users: Close Login via Previously, you logged in via Password recovery Registration Password recovery Forum Forum

Source: https://rebuko.ru/schet-faktura-na-fizicheskoe-litso/

When does it become necessary to issue an invoice for services?

Despite the fact that an invoice for any organization is a particularly important document confirming payment for a product or service, Russian legislation does not prohibit transactions without issuing an invoice. Most often, a legal entity makes payments based on an agreement, in any convenient way, but there are cases when it is impossible to do without issuing an invoice. An invoice must be issued if the contract does not stipulate the specific cost of a product or service, and a prime example of this is the provision of communication services. It is mandatory to issue an invoice:

- a legal entity, including LLC, that received an advance from the customer;

- if the company operates under an agency agreement, sells a product/service, concluding an agreement on its own behalf;

- LLCs and enterprises of other forms of ownership if they are exempt from paying value added tax.

As for issuing an invoice to an individual, when paying in cash or with a credit card, a regular check issued by a cashier in a supermarket, for example, is considered as such. If you work for cash, then a cash receipt or any other document confirming payment frees you from the need to issue an invoice. The situation is different with non-cash payments.

Can an individual create an invoice?

Most often, a legal entity makes payments based on an agreement, in any convenient way, but there are cases when it is impossible to do without issuing an invoice. An invoice must be issued if the contract does not stipulate the specific cost of a product or service, and a prime example of this is the provision of communication services. It is mandatory to issue an invoice:

- a legal entity, including LLC, that received an advance from the customer;

- if the company operates under an agency agreement, sells a product/service, concluding an agreement on its own behalf;

- LLCs and enterprises of other forms of ownership if they are exempt from paying value added tax.

As for issuing an invoice to an individual, when paying in cash or with a credit card, a regular check issued by a cashier in a supermarket, for example, is considered as such. If you work for cash, then a cash receipt or any other document confirming payment frees you from the need to issue an invoice. The situation is different with non-cash payments.

How to issue an invoice to a private person

If you provide a service to an individual with payment on account, you will first have to enter into an agreement with the individual. When paying funds to the account of a limited liability company, the buyer of a service or product will have to indicate the number of this agreement in the payment receipt. The accountant of the enterprise, meanwhile, will have to issue a single copy of the invoice, in which the following data should be indicated:

- serial number of the document and the date of its issue;

- FULL NAME. client, his TIN and address;

- the name of the LLC, its tax number and legal address;

- names of goods or name of services provided indicating units of measurement (pieces, hours, etc.);

- the volume of services supplied, work performed or goods supplied, taking into account the accepted units of measurement;

- if you provide a service at government rates, including tax, you will have to indicate the price of a unit of goods or the tariff for the service provided without tax;

- total cost of goods/services without tax;

- the tax rate and the total amount of tax are also indicated;

- total cost including tax;

- Finally, the country of origin of the goods is indicated.

Since an individual cannot be a VAT payer, it is not necessary to fill out an invoice in two copies.

If you encounter difficulties when filling out an invoice due to the lack of detailed information about the buyer or service user, you can put dashes in some columns. After filling out the document, you must, based on the results of the tax period, register the account properly (in the enterprise accounting journal), and also do not forget to make a corresponding entry in the sales book.

Is it possible to issue an invoice to an individual without a tax identification number?Selling goods online today is very profitable: it significantly reduces costs and allows you to set affordable prices. The growing popularity of “virtual” shopping encourages trading companies to create online stores where the client can purchase goods by ordering them online and paying by bank transfer. But at the same time, the seller may have problems issuing invoices.

Document for yourself

At first glance, an organization should not issue invoices for non-cash payments to the population. Judge for yourself: for a “physics” buyer who bought a music disc in an online store or a book from a “mail” catalog, this document is clearly of no use: he will still not accept VAT as a deduction! However, in order not to violate the requirements of the Tax Code, the seller in such a situation must issue invoices to each individual. And here's the reason.

Any company that sells goods, work or services is required to issue invoices (of course, except for those organizations that use special regimes). This is stated in paragraph 3 of Article 168 of the Tax Code of the Russian Federation. The only exception to this rule is made for companies selling goods to the public for cash. Only they have the right not to issue invoices to customers, limiting themselves only to cash receipts or, if we are talking about services, strict reporting forms (clause 7 of Article 168 of the Tax Code of the Russian Federation).

It turns out that the selling company is obliged to issue an invoice to a client who pays for goods not in cash, but through a bank branch. Otherwise, tax authorities may fine the organization under Article 120 of the Tax Code of the Russian Federation for a gross violation of the rules for accounting for income, expenses and objects of taxation (the minimum fine under this article is 5,000 rubles). On the other hand, by issuing an invoice with a designated VAT amount, the taxpayer violates paragraph 6 of Article 168 of the Tax Code of the Russian Federation, which does not allow the tax amount to be separately indicated in documents issued to the population. It turns out that the seller must issue invoices to individuals without allocating VAT to them. But even if the taxpayer violates this requirement, the tax authorities will not be able to punish him: the Tax Code does not establish liability for such a violation.

Everyone has their own shortcomings

It is not as easy to issue an invoice for an individual as for an organization. All details of a legal entity necessary to fill out this document are usually specified in the contract. But a private person, when placing an order, provides a minimum of information about himself - last name, first name and delivery address, and occasionally a telephone number. But a correctly executed invoice, in addition to these data, must contain one more mandatory detail - the buyer’s TIN. But it is precisely this information that is often missing.

What could happen to online stores and postal merchants if the invoices they issue do not include the buyer’s TIN? In our case, nothing. The fact is that an invoice that is missing some of the required details creates problems only for the buyer. According to such a document, he will not be able to deduct the VAT paid to the supplier (clause 2 of Article 169 of the Tax Code of the Russian Federation). For the seller, the Tax Code does not provide for liability for incorrectly executed invoices. The main thing is that the company regularly displays them when selling goods, correctly calculates and pays VAT to the budget, and keeps books of purchases and sales. The Department of Indirect Taxes of the Federal Tax Service of Russia agrees with this. “Of course, formally the company violates the rules for issuing invoices by not indicating the buyer’s TIN,” the specialists of this department answered us. — But in this situation, goods are purchased by individuals who, to put it mildly, do not need input VAT. Therefore, when checking, the tax inspector most likely will not find fault with postal traders for the fact that the buyer’s TIN is not indicated in the invoices they issue? In our case, nothing. The fact is that an invoice that is missing some of the required details creates problems only for the buyer. According to such a document, he will not be able to deduct the VAT paid to the supplier (clause 2 of Article 169 of the Tax Code of the Russian Federation). For the seller, the Tax Code does not provide for liability for incorrectly executed invoices. The main thing is that the company regularly displays them when selling goods, correctly calculates and pays VAT to the budget, and keeps books of purchases and sales. The Department of Indirect Taxes of the Federal Tax Service of Russia agrees with this. “Of course, formally the company violates the rules for issuing invoices by not indicating the buyer’s TIN,” the specialists of this department answered us. — But in this situation, goods are purchased by individuals who, to put it mildly, do not need input VAT. Therefore, during an audit, the tax inspector most likely will not find fault with the company.”

What if the company receives an advance payment from an individual, draws up an advance invoice and then, at the time the goods are sold, reflects it in the purchase book? Will the tax authorities accept this deduction if they notice that the invoice is missing one of the required details? The Department of Indirect Taxes of the Federal Tax Service of Russia assured us that nothing threatens the taxpayer here either. After all, the peculiarity of an advance invoice is that the seller does not present it to the buyer, but keeps it for himself, first charging VAT and then deducting it. And tax authorities are unlikely to refuse an organization a deduction for such an invoice.

/UNP, 12/14/2004/

How to issue an invoice correctly

Given the fact that the invoice in some cases compensates for other documents, it must be filled out correctly, for which any office application is ideal. In the center of the first line, the word “ACCOUNT” is written in capital letters; below is the number of the agreement and the date of its conclusion, full name, company name and bank details of the parties. Next, a table is filled in with data on the name of the product/service, unit of measurement, total quantity of product or volume of work, with each product or service described in a separate line. At the end of the table, the total amount and the VAT amount are indicated, and if the company is not a VAT payer, this fact is also recorded.

Under the table, the words indicate the total amount to be paid, but in words, in rubles, kopecks, or other currency. The document is signed by the director of the LLC and the accountant (if this position is provided for in the staffing table).

How to issue an invoice: sample

- outgoing and incoming own number;

- name, contact details of the seller;

- information and contact details of the buyer or customer;

- discharge date;

- company and tax information;

- date of dispatch/delivery/purchase/services rendered;

- order number or other number by which the customer can track the progress of delivery;

- total amount;

- payment terms;

- and other information, for example, special conditions, information about taxes, penalties for late delivery, late payment or refunds in case of damage to the order.

Today there is no form approving the type of account or suggesting its standard . It is not even considered an accounting document. An invoice is issued and issued for payment electronically or in paper form. Be sure to indicate the following:

How to deal with VAT when working with individuals?

The original invoice is given in person, delivered by courier or sent by mail, a copy of the document can be sent by fax or email, and this is also a sufficient basis for payment.

Our lawyers know the answer to your question

If you want to find out how to solve your particular problem, then ask our duty lawyer online. It's fast, convenient and free!

or by phone:

- Moscow and region: +7-499-938-54-25

- St. Petersburg and region: +7-812-467-37-54

- Federal:+7-800-350-84-02

How to issue an invoice to an individual from LLC

3 tbsp. 168 Tax Code of the Russian Federation. Despite the fact that in fact the invoice is of no interest to the buyer - an individual who is not a VAT payer, the seller is still obliged to issue an invoice to the individual and register it in the invoice journal and in the sales book ( in case of non-cash payment). Additional information can be found in SPS ConsultantPlus:

- or an accounting statement containing summary (summary) data on all shipments for which invoices are not prepared for a specified period - a month or even a quarter.

- or a primary document confirming the sale (for example, a delivery note);

Invoice for an individual

Tax-tax September 17, 2020 1434 An invoice is not always issued to an individual when selling goods (performing work, providing services). In our article, we will consider when it is necessary to issue this document for an individual, and when it is not necessary to do so.

What is the main purpose of an invoice?

What are the features of issuing an invoice to an individual if he is an individual entrepreneur on OSNO?

What to do with issuing an invoice if the buyer is an individual entrepreneur on a special regime?

Is it necessary to issue an invoice for individuals without entrepreneurial status?

Results

Invoice code for sales to individuals

An organization leases non-residential premises to an individual for storage of personal property under an agreement. The contract provides for prepayment within 10 days. Payment by bank transfer. For the advance received, the organization issues an invoice for the advance, and an invoice is also issued for the implementation of services provided. In the sales book, both invoices are registered with transaction type code 26, and in the purchase book, when setting up an advance invoice for deduction, the name of the seller is indicated in column 9, i.e. our organization, and the invoice code is 22, is this correct?

When accepting “advance” VAT for deduction, the invoice drawn up upon receipt of the advance from the buyer (lessee) must be recorded in the purchase book. In this case, in column 2 of the purchase ledger, you must indicate the transaction type code - “22” (clause “e”, clause 6, clause 22 of the Rules for maintaining the purchase ledger, Letter of the Ministry of Finance dated November 16, 2015 N 03-07-11/65903).

What is the main purpose of an invoice?

An invoice is a tax accounting document for VAT. It is issued for relevant transactions (sales of goods, works, services, etc.) by persons under the general taxation regime, and in some cases, for example, when importing goods from abroad, and by persons using special tax regimes. The document indicates the amount of tax that must be accrued for payment to the budget from the transaction performed.

The person who received the document, if he is a payer of the specified tax, can reduce the amount of VAT payable to the budget by the reflected amount of tax, because Art. 169 of the Tax Code of the Russian Federation defines an invoice as a document on the basis of which the buyer claims a VAT deduction. This is the main purpose of an invoice.

Buyers - individuals may or may not be VAT payers. It all depends on the availability of entrepreneurial status and the applicable tax regime. We will discuss in the next section when an invoice must be issued to an individual.

Issue an invoice for payment - what you need to do to issue an invoice

This question interests many, but its formulation is not entirely correct. Just a bill - yes, but for an individual this makes no sense, and the organization will not pay it: for it it means violating tax laws. Settlements with individuals for work performed are carried out under employment or civil law contracts; the purchase of any goods from an individual is formalized by a sales contract.

Also read: Sample of appealing a traffic police decision about an accident

In trade relations with foreign partners, quite often you have to deal with this document in English. Russian legislation allows invoices to be generated in English or, upon receipt, to be used in document flow without translation. In this case, as a rule, we mean a document that in the language of Foggy Albion is called “invoice”.

What are the features of issuing an invoice to an individual if he is an individual entrepreneur on OSNO?

If the buyer is an individual - an individual entrepreneur who is in the general regime, then he will need an invoice to submit tax for deduction.

In order for an individual entrepreneur to receive a deduction, the seller must follow some rules:

- The invoice must contain all the necessary details: number and date, names of the seller and buyer, TIN of both parties and addresses, name of the product (work, service), its quantity, price and value, tax rate and amount, etc.

NOTE! When filling out the line with the name of the buyer, it is advisable to indicate his entrepreneurial status, that is, it is better to write in the invoice: “Buyer: individual entrepreneur (or individual entrepreneur) Petrov Ivan Vasilyevich.” However, it is possible to obtain a deduction without such an indication.

- The invoice can only be signed by authorized persons.

- The document must be issued no earlier than the date of shipment of the goods within 5 working days from such shipment.

There are other invoice requirements. We talk about them in a special section.

If any errors or omissions are discovered, it is best for the entrepreneur to contact the seller with a request to replace the damaged document with a new one. Otherwise, problems will arise with the deduction.

Is it possible to issue an invoice to a physical person?

However, when selling goods (performing work, providing services) for cash directly to the population, the requirements for preparing payment documents and issuing invoices are considered fulfilled if the seller issues the buyer a cash receipt or other document of the established form (clause 7 of Art. 168 Tax Code of the Russian Federation). This rule was also voiced in Letter of the Ministry of Finance of Russia dated July 31, 2009 N 03-07-09/38.

Thus, if an individual pays for a purchase by non-cash method, the taxpayer supplier is not relieved of the obligation to issue an invoice within five calendar days from the date of shipment of goods (performance of work, provision of services) or from the date of receipt of payment amounts, partial payment for upcoming supply of goods (performance of work, provision of services) in accordance with clause 3 of Art. 168 Tax Code of the Russian Federation.

What to do with issuing an invoice if the buyer is an individual entrepreneur on a special regime?

Entrepreneurs using special tax regimes, in general cases, should not charge and transfer VAT to the budget (with the exception of importing goods, performing the duties of a tax agent for a specified tax and issuing invoices by themselves when selling goods, works, services).

When completing a transaction, the seller and the buyer, an individual entrepreneur in a special mode, can agree on the condition of not issuing invoices (subclause 1, clause 3, article 169 of the Tax Code of the Russian Federation). You can also refuse them if the individual entrepreneur is on the general regime, but is exempt from paying VAT (for example, under Article 145 of the Tax Code of the Russian Federation). But if the agreement of both parties to the transaction to refuse invoices cannot be achieved, the seller will have to draw up all documents in the general manner.

IMPORTANT! The special regime person will not be able to exercise the right to deduct VAT on the basis of received invoices, even if he is obliged to pay tax to the budget (upon import or when he issues an invoice with the allocated tax amount). After all, the Tax Code grants this right only to VAT taxpayers (Article 172 of the Tax Code of the Russian Federation).

About banks and finance

Presenting the VAT amount to the client is one of the duties of the tax payer. So, in accordance with paragraph 1 of Art. 168 of the Tax Code of the Russian Federation (later - the Tax Code of the Russian Federation), when selling goods (work, favors), transferring property rights, the taxpayer, in addition to the price (tariff) of the goods (work, favors) sold, is obliged to present these goods (work, favors) to the client for payment, property rights the corresponding amount of tax.

However, when selling goods (performing work, providing favors) for cash specifically to the population, the requirements for preparing payment documents and issuing invoices are considered fulfilled if the seller has issued the client a cash receipt or other document of the established form (clause 7 of Art. 168 of the Tax Code of the Russian Federation).

Is it necessary to issue an invoice for individuals without entrepreneurial status?

Individuals without entrepreneurial status are not VAT payers in any case. Therefore, the seller has the right not to issue invoices for them. How the buyer pays for the goods - whether he transfers money to the cash register or transfers it to a bank account - also does not affect the need for paperwork.

This is where sellers may have a question: how will the accrued tax data get into the sales book? The Ministry of Finance offers the following solutions:

- Compile for a certain period of time (for example, a day, a month, a quarter) all data on sales and accrued tax in an accounting statement and, based on it, fill out a sales book (letter of the Ministry of Finance of Russia dated 02/08/2016 No. 03-07-09/6171). Instead of an accounting certificate, a consolidated invoice may appear here, drawn up in one copy, where the columns associated with the buyer (name, address, INN/KPP) are crossed out.

- Record cash receipts or strict reporting forms in the sales book (letter of the Ministry of Finance of Russia dated July 31, 2009 No. 03-07-09/38).

NOTE! The seller may, at his own discretion, issue invoices to individuals. The law does not prohibit this.

Is it possible to issue an invoice with VAT for individuals?

The specifics of certification of an invoice by an individual entrepreneur are contained in paragraph 6 of Article 169 of the Tax Code of the Russian Federation. According to the established rules, organizations can certify a document with the seals of their branches or with special seals “for invoices”.

Naturally, when selling such goods, it is impossible to indicate the number of the customs declaration in column 11. The Russian Ministry of Finance explains: in such situations, in column 11 of the invoice, you can indicate the number of the obligation to file a customs declaration on the basis of which the goods were released (letter dated February 6, 2020

https://youtu.be/6Fg50bAHGXo

Results

With the help of invoices, buyers of goods (works, services, etc.) can exercise their right to reduce VAT payable to the budget. But not everyone has this right, but only VAT payers, for example, general-regime individual entrepreneurs. They need an invoice to confirm the deductions.

Individuals who have entrepreneurial status, but use special tax regimes, cannot claim a VAT deduction, so an invoice may or may not be issued to them as agreed by the parties to the transaction.

An individual without entrepreneurial status will definitely not need invoices, so the seller can refuse to issue them, thereby significantly saving his resources.

We advise you to read the Procedure and deadlines for paying VAT in 2020

Sample invoice for individuals

Invoice 2015-2016, new invoice form, form, sample. TIN, KPP, full name of the manager or authorized person, full name of the main one. Forms of Documents of the Russian Federation: Invoice filled out for the free transfer (sale) of goods to individuals (in the case of free distribution of promotional products (gifts)) (sample filling). Moreover, 97% of the number of clients are individuals. should individuals submit a single (consolidated) invoice as part of the declaration?. All state standards, samples and forms of documents, etc. To determine whether the invoice is issued without VAT by the seller. 2nd paragraph, Data of individual entrepreneurs or legal entities in full or in abbreviation. Is it possible to issue an invoice to an individual?. Is of no interest to the buyer - an individual who is not. Issuing an invoice to an individual is not as simple as to a name. But in this situation, the goods are purchased by individuals who Invoice for the buyer - an individual The organization is on the general taxation system (production, etc.)

1 Rules for filling out an invoice when drawn up by the principal. The commission agent does not issue invoices in the case of issuance to individuals. filling out an invoice new form 2015-2016 32 kb. year, authorized persons will be able to sign invoices for individual entrepreneurs (previously .. the taxpayer will show the individual’s debt to the tax office. Forms of Documents of the Russian Federation: Invoice filled out upon sale. when selling goods to an individual (employee) (sample of filling). LLC " Alfa will issue an invoice for the buyer - an individual.

Extract of ESF to an individual

The State Revenue Administration for the Tselinograd region, regarding the issuance of ESF to an individual, explains the following: in accordance with paragraph 1 of Article 412 of the Tax Code, when selling goods, works, services, they are required to issue an invoice:

1) payers of value added tax;

2) taxpayers in cases provided for by regulatory legal acts of the Republic of Kazakhstan adopted for the purpose of implementing international treaties ratified by the Republic of Kazakhstan (goods included in the List);

3) commission agent;

4) forwarder;

5) taxpayers in case of sale of imported goods;

6) a structural unit of the authorized body in the field of state material reserve when it releases goods from the state material reserve.

At the same time, in accordance with paragraph 13 of Article

412 of the Tax Code, issuing an invoice is not required in the following cases:

1) sale of goods, works, services, payments for which are made:

in cash with the presentation of a cash register receipt to the buyer and (or) through payment terminals for services; using a poster terminal;

2) sales of goods, works, services to individuals using electronic payment means;

3) making payments through second-tier banks;

4) registration of passenger transportation by rail or air transport with a travel ticket;

5) gratuitous transfer of goods to an individual who is not an individual entrepreneur or a person engaged in private practice;

6) provision of services for the implementation of financial transactions;

7) provision of services for the activities of a casino, slot machine hall, betting shop and bookmaker's office.

At the same time, according to paragraph 89 of the Rules for issuing an invoice in electronic form in the information system of electronic invoices, approved by Order of the Minister of Finance of the Republic of Kazakhstan dated April 22, 2020 No. 370, when selling to individuals goods included in the list, payments for which are carried out:

1) in cash with the provision of a check from a cash register and (or) through payment terminals for services;

2) using equipment (device) intended for making payments using payment cards;

3) by electronic money or using electronic payment means, an invoice is issued in electronic form in accordance with paragraph 90 of these Rules; the supplier using one of the above calculations issues an ESF for the entire turnover for the day, for each type of product, filling out separate lines .

Based on the above, the obligation to issue an ESF from January 1, 2020 arises when selling imported goods or goods included in the List from persons who are both VAT payers and those who are not VAT payers.

In addition, the supplier has the right not to issue an invoice when selling goods to customers, when issuing a KKM check for goods sold, work, services paid for in cash or by bank transfer.

At the same time, in the case of the sale of goods included in the List to individuals with the issuance of a KKM check or acceptance of non-cash payments, an ESF statement is required for the entire turnover for the day.

Head of the State Revenue Office for the Tselinograd district Kaliev Almat