Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

To organize efficient production, it is important to maintain competent warehouse records. Knowing the documents used to register goods in the warehouse will help you protect your rights and keep records correctly. Correctly executed documentary support will protect against problems with the received goods and facilitate communication with the tax authorities.

Documents for registration of goods receipt

The posting of goods includes the reception and initial accounting of receipts. The goods can be accepted by a financially responsible person or a person by proxy. The receipt of goods is accompanied by the execution of primary documents by the supplier. These include:

- packing list;

- waybill (Bill of Lading) - it is needed to take into account the movements of goods and materials and pay for road transport;

- invoice.

An invoice is issued if the supplier pays VAT. An invoice allows you to offset VAT on the goods received for reimbursement. Organizations and entrepreneurs operating under the simplified taxation system do not pay value added tax and may not issue an invoice, and if the document is issued by the supplier on OSNO, they may not accept input VAT for reimbursement.

Before accepting the goods, check the correctness of the invoice: it must contain the details of the buyer and supplier, name of the product, quantity, price, cost, VAT.

The cloud service Kontur.Accounting allows you to store all information about goods in one place and simplifies the procedure for posting goods. Get free access for 14 days

To post the goods after acceptance, the invoice is stamped and signed by the responsible persons. The invoice is drawn up in two copies: one remains with the buyer, and the other is given to the seller. For the buyer, the invoice is a receipt document, and for the seller it is an expense document.

Why are expenses for the purchase of goods and materials not included in the book of income and expenses? This is the question I get asked by almost all the “simplified people” with whom I start working for the first time. And really, how can this be? The money left the current account, we received the goods. Does the program not see expenses? And most often the fight begins! The accountant and this "one-room girl". Well, let's figure it out. After all, in fact, everything is very simple.

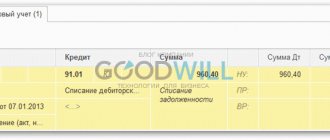

We will talk about the program 1C: Accounting 8, edition 3. And I will begin my article, of course, by considering the tax accounting settings in the program.

In the Main , go to setting up taxes and reports. And on the simplified tax system we expand the Procedure for recognizing expenses :

Actually, this is the same setting, that set of “ticks” that is responsible for when certain expenses should be included in the KUDiR. WE will discuss in detail the costs of purchasing materials and goods:

Please note that some checkboxes can be checked or unchecked, while others cannot. Each checkmark means registration of a specific document in the program required to accept expenses. That is, the more checkboxes are checked, the more operations with goods or materials must be done in the program in order for expenses to be automatically accepted in KUDiR. For example, by default, two checkboxes are selected for materials: receipt of materials and payment for materials. Those. In order for the costs of purchasing material to be included in the book, it is necessary to reflect their payment in the program (debit from the current account, or RKO) and post it to the warehouse. Those. enter the receipt document. Both documents are required! Otherwise, I often hear that I paid with the money, but for some reason the tax base has not decreased. The fact of payment alone is NOT ENOUGH! Things are even “worse” with goods. In this case, to accept the expense, it is not enough to pay and post the goods to the warehouse. It also needs to be SOLD! Let's look at examples. So, let's look at a specific example. Our organization purchased stationery. It often happens that the organization first transfers money to the supplier in advance. Let's create a document Write-off from current account with the transaction type Payment to supplier :

Let’s immediately create a Book of Income and Expenses for the 3rd quarter and make sure that despite the fact that we have already incurred expenses, nevertheless, they are not reflected in the KUDiR:

Now we create the document Receipt of goods and services. We carefully fill out the account. Materials must be capitalized, for example, to account 10.01. How to set up automatic completion of item accounting accounts in documents can be found in our article.

Now let’s create a book again, and we see that now it reflects the costs of materials. Pay attention to the content of the transaction in the report. Those. in the book of income and expenses, the date is the number and content of the document by which expenses are included in tax accounting. In this case, materials were received under invoice No. 547:

OK then. But what will happen if the materials first arrived to us, we received them:

And later they paid:

In this case, entries in the book of income and expenses will be reflected differently. Those. The program records that payment has been made for already supplied material. And the date and document number are the date and number of the debit from the current account.

Those. To accept expenses for materials, we need two documents corresponding to two checkboxes in the tax accounting setup. With goods it’s a little more complicated. Let's look at an example. Our organization purchased goods for resale. Again, I draw your attention to the item accounting accounts.

Then I paid for this item:

Since we are talking about goods, despite the fact that the goods have been posted to the warehouse and even paid for in full, there is no information on these costs in the book of income and expenses:

And only after the goods are sold, the program will take into account our expenses. Please note that we sold the product not completely, but partially:

And KUDiR reflected expenses only in relation to goods sold:

Those. To accept expenses for the purchase of goods, three documents are required - three checkboxes in the tax accounting settings. If you check another box, you will need four documents. That’s the whole big (or small) secret of accepting in the 1C: Accounting program 8 expenses for the acquisition of inventories. I hope you find my article useful. Especially on the eve of the 9-month reporting campaign. If after reading you still have any questions, you can ask them in the comments.

| Head of care service Budanova Victoria |

Subscribe to our channel on Telegram

Channel address t.me/bmaxplus

Social buttons for Joomla

Universal transfer document (UDD)

This document is both a waybill and an invoice. Legislatively introduced in 2013 and not mandatory for use. You can decide for yourself whether you want to draw up two documents or just the UPD. Like an invoice, UTD provides the basis for obtaining a tax deduction.

The use of a universal document simplifies the process of transfer and acceptance of inventory items. Use it to formalize the supply of goods, works or services and the transfer of property rights. The UPD is signed by the authorized person responsible for the preparation of primary documents or purchase and sale transactions.

In the legally established form of the UPD there is a status field. It determines which document you are submitting the UPD instead of:

- Invoice and delivery note;

- Packing list;

- Invoice (for electronic form).

The status of the document changes the order in which it is filled out: for status 2, you do not need to fill out some lines, the UPD number and the required signatures change. To use the UPD in an organization, its form must be approved. The official form is advisory in nature, and the organization may make changes to it. But all mandatory details of the primary documents must comply with the requirements.

Instructions for confirming receipt of goods

Questions often arise about whether it is necessary to confirm receipt of a package from Ebay.

Important! It is believed that simply writing a review is enough. A positive opinion left by a client is very important for the seller. The rating assigned to it depends on this, which other Ebay users will then look at.

Some time ago, the site added the ability to confirm the purchase and receipt of goods. How was confirmation carried out:

- Go to ebay.com.

- Log in to your Personal Account.

- Log in to the tab with all placed orders.

- Find the one you need.

- Open its page and click the “Mark as shipped” button there.

Subsequently, this button disappeared, meaning today there is no need to report receipt of the goods. The seller is more concerned about the lack of claims. They are displayed even when the purchase has arrived, but its quality does not correspond to what was declared.

Related posts:

- Accounting for land plots Accounting for land plots in accounting Features of accounting for land plots Documentary registration of transactions with land…

- Submission for compliance with the position held Submission for certification of a teaching worker Submission for certification - what is it? Submission for certification -...

- Currency control transaction passport Transaction passport to Belarus01/25/2018 A. GordonAdvocate Gordon A.E. For the purpose of currency control over participants in foreign economic activity...

- Public control over labor protection Public control over labor protection The role of trade unions in monitoring compliance with labor protection requirements. Technical…

Acceptance of goods

The cloud service Kontur.Accounting allows you to store all information about goods in one place and simplifies the procedure for posting goods. Get free access for 14 days

At the first stage of acceptance of goods, we check whether the type and quantity of goods corresponds to the information in the accompanying documents. This is necessary to ensure completeness of accounting. The second stage is acceptance of the goods for quality and completeness. Acceptance of goods is carried out by the materially responsible person in the presence of a representative of the supplier, unless other conditions are specified in the contract. If all goods are in place and no defects are found, confirm compliance with the organization’s stamp and signature.

Based on the results of acceptance of the goods, a TORG-1 act and a TORG-11 product label are drawn up. Product label data is needed to conduct an inventory list.

Violation of the inspection deadlines and acceptance rules will deprive you of the right to file a claim against the supplier or carrier. For certain types of goods, the terms are established by law, for others they are specified in the contract. Registration of the return of low-quality goods depends on the moment of detection of the defect:

- if a shortage of goods or defects is detected during acceptance, the commission draws up a report on the discrepancy in quantity and quality; the act is drawn up in the TORG-2 form; if properly executed, it will serve as the basis for making claims;

- when a defect is discovered after the goods are registered, an invoice is drawn up indicating the quantity of the goods being returned, a statement of identified defects, a letter of claim and a return invoice;

- if one of the types of goods was not delivered to you, cross them out from the invoice and adjust the invoice.

At the end of acceptance, capitalize the received goods and materials according to the actual quantity and amount.

Delivery and receipt of goods from Ebay

When a user purchases goods on Ebay, he receives a tracking number from the seller. This happens when the last one has already sent the parcel.

The track number allows you to track the movement of goods until they are received through the transport company’s portal. It also helps confirm the seller's honesty. If he accepted the order but did not send the necessary information to the client, he must inform him about this.

When a product from Ebay ends up on Russian territory, it will be handled by the Russian Post, and accordingly, it will be possible to track it on the official website pochta.ru until it is received.

Parcels are issued at post offices. When the goods are delivered by the courier, he will contact the recipient by telephone to clarify what day and time of delivery will be convenient. You can come to the service office yourself - sometimes this way you can receive parcels faster.

After figuring out how to buy products on Ebay, some customers begin to worry about receiving low-quality products. To avoid this, appropriate measures should be taken upon receipt of the shipment.

The ideal option is to record the process of opening the package on camera. This recording will become evidence in the dispute and will contribute to the partial or full return of your money from Ebay.

Even if the buyer and seller cannot come to an understanding during the dispute, it will still be resolved, since it will subsequently be transferred to the Ebay administration. Having evidence will help protect against possible encounters with scammers.

What to do if there are no accompanying documents

The cloud service Kontur.Accounting allows you to store all information about goods in one place and simplifies the procedure for posting goods. Get free access for 14 days

For accounting, the main thing is documents. If there is no document, there is no accounting object. When a supply agreement is available, but the supplier has not provided accompanying documents, the goods received must also be capitalized.

For such cases, a TORG-4 acceptance certificate is provided. In the absence of a delivery note and an invoice, it is difficult to determine the price at which the goods arrive. The price must be taken from the contract, and if there is no contract, then the goods are purchased at the market price. The TORG-4 act contains information about the actual availability of the received goods.

The acceptance certificate is drawn up by a special commission that accepts the goods. TORG-4 is drawn up in two copies, one is transferred to the financially responsible person of the supplier, and the other to the accounting department.

What is an invoice

An invoice is an agreement concluded between the buyer and the supplier. It serves as confirmation that the cargo was shipped under certain conditions. The document contains the following information:

- information about both parties to the transaction;

- shipping conditions;

- list of goods;

- price;

- weight, colors, other parameters.

Nothing is written on the invoice from Aliexpress about shipping.

The invoice from Aliexpress in the Russian Federation has no analogues; it is used only in cases of international shipments.

Placing an order with a supplier

We reflect the “Order to Supplier” documents in the system, we consider that we ordered several batches of “Product1” and “Product2”.

For this product, the planned delivery date is “03/05/13”, indicate it in the document field “Receipt”.

For “Product 2” the planned arrival date is “03/12/13”.

How to register the purchase of goods through an accountable person

Within three days from the end of the period for which the advance was issued, the employee is required to report on the money spent. To do this, he must submit an advance report to the accounting department using the unified form No. AO-1 or a form developed by the organization independently. The main thing is that the document contains all the necessary details. Whatever form you use, it is first approved by the manager with an order to the accounting policy.*

To receive cash against the report, the employee must write an application in any form. Indicate in it the required amount, as well as for what purposes it will be spent. The head of the organization must make an inscription on the application stating what amount and for what period must be issued according to this application.*

Sales receipt without providing a cash register: legality and registration requirements

- name of the accounting paper (TP);

- date and time of formation;

- name of the party accepting payment;

- information on a product or service;

- quantity of goods/services in physical and financial equivalent;

- indication of the persons responsible for drawing up the document;

- signature and its decoding.

We recommend reading: Characteristics From the Chief to Udo

Ideally, there should be two documents available at retail locations (CC and TC). If the legislator obliges an individual entrepreneur to provide a CP and, at the client’s request, a commodity one, then he must strictly comply with the current legislation.

Approval of the advance report

The verified expense report is approved by the head of the organization or an authorized employee (for example, the head of a department).

An example of preparing an advance report for an employee of a commercial organization

On March 30, Secretary E.V. Ivanova was given 2,000 rubles. for the purchase of stationery for the organization.

On April 1, Ivanova brought the purchased stationery to the organization. On the same day, the employee submitted an advance report to the accounting department in the amount of 1,580 rubles. (with primary documents attached to it), and also returned the unspent balance of the accountable amount to the cashier - 420 rubles. (2000 rub. – 1580 rub.).

Accountant Zaitseva gave Ivanova a receipt stating that the report had been accepted for verification.

On the same day, the head of the organization approved Ivanova’s advance report.

The stated procedure for preparing, checking and approving an advance report is established by instructions approved by Resolution of the State Statistics Committee of Russia dated August 1, 2001 No. 55.

The accountant presented a cash receipt with a list of goods; is it necessary to request a sales receipt?

Taking this into account, the tax authorities explained that when making payments, a cash register check is issued not to an organization, but to an individual - an employee of this organization. The organization's posting of inventory items purchased for it by an employee is carried out on the basis of primary accounting documents, in particular, an advance report, sales receipts, as well as documents confirming the fact of payment - cash register checks, receipts for a cash receipt order. Therefore, the taxpayer has the right to confirm the expenses incurred with a cash receipt, however, in order to account for expenses for tax purposes, along with a cash receipt, other primary documents are necessary that indicate the connection of the expenses incurred with the activities of the organization aimed at generating income.

We recommend reading: Free Travel to the Moscow Region At What Age Are Women

Clause 15 of Art. 1 of Law No. 290-FZ Law No. 54-FZ is supplemented by Art. 4.7 “Requirements for cash receipts and strict reporting forms”, which specifies the mandatory details of cash receipts and strict reporting forms. At the same time, details were introduced that were previously absent among the mandatory details of a cash receipt and a strict reporting form (clause 4 of the Regulations on the use of cash registers when making cash settlements with the population, approved by Decree of the Government of the Russian Federation of July 30, 1993 N 745). Among the new details is “the address of the website of the authorized body on the Internet (paragraph sixteen of Article 4.7 of Law No. 54-FZ), where the fact of recording this calculation and the authenticity of the fiscal attribute can be verified.”

Placing a buyer's order, placing orders with the supplier

We will place the buyer’s order and indicate “Product 1” and “Product 2” in the order. We use the “Buyer’s Order” document.

When entering a buyer’s order with the current date, the “Fill and Post” button will automatically indicate the placement of the buyer’s order in orders to suppliers. If the data on the buyer’s orders is not reflected in the system promptly (for example, when importing from external information systems), it will be additionally necessary to enter the document “Reservation of Goods” based on the buyer’s order to automatically place goods from the buyer’s order in orders to the supplier.