Some time ago, the rules for submitting documents at the request of tax inspectors were adjusted, and in June, the format of the notification about the impossibility of submitting them was adjusted. In addition, the latest reports from the Ministry of Finance, the Federal Tax Service and examples of judicial practice reveal new nuances of satisfying the professional curiosity of the Federal Tax Service. Read our material about which tax office the request may come from, where to submit documents if the audit is not carried out within the inspectorate, and what documents the fiscal authorities have the right to request.

The inspectorate must be informed of the impossibility of submitting the requested documents using a new form.

As of 06/09/2019, the Tax Service updated the form for notification of the impossibility of submitting documents within the prescribed period (paper form plus electronic format).

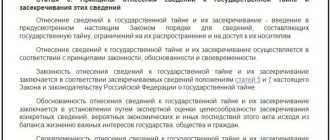

Changing the form was required due to the norm introduced by Law No. 302-FZ of August 3, 2018, which allows you not to send documents to the Federal Tax Service again.

The company is obliged to notify the Federal Tax Service about the impossibility of fulfilling the requirements of the inspectors no later than:

- one day if the materials relate to the work of the organization itself;

- five days if controllers need information about counterparties.

The form contains three blocks for individual cases of filling out:

- the first - to indicate the specific reason for extending the period;

- the second – in case of loss of documents or their transfer to an audit organization;

- third - if the requested documents have already been submitted to the Federal Tax Service earlier.

Order of the Federal Tax Service of the Russian Federation dated April 24, 2019 No. ММВ-7-2/ [email protected] “On approval of the form and format for submitting a notification about the impossibility of submitting documents (information) in electronic form within the established time frame”

Editor's note:

Submission of this notice does not guarantee an extension of the deadline for filing documentation.

However, if the inspectors refuse and a fine is imposed, the fact of sending it will help reduce or even cancel the sanctions.

In what form should the requested documents be sent?

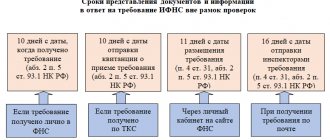

Deadlines are strictly regulated.

For the taxpayer himself, 10 days are allotted from the date of receipt of the corresponding request - clause 3 of Article 93 of the Tax Code of the Russian Federation. 20 days - for a tax audit of a consolidated group of taxpayers;

30 days - during a tax audit of a foreign organization subject to registration with the tax authority in accordance with clause 4.6 of Article 83 of the Tax Code of the Russian Federation.

For counterparties or other persons who have documents (information) relating to the activities of the taxpayer being inspected, a shortened five-day period for responding to the request of a tax authority official is established (clause 5 of Article 93.1 of the Tax Code of the Russian Federation).

The Tax Code provides for the right to submit a petition (application) to extend the deadline for transferring documents and information to the tax office. This right can be exercised if it is impossible to submit documents (information) within the time period allotted by law.

In accordance with clause 3 of Article 93 of the Tax Code of the Russian Federation and clause 5 of Article 93.1 of the Tax Code of the Russian Federation, in order to extend the period, the person interested in this must send a written notification about the impossibility of submitting documents (information) within the established period. The taxpayer being audited must submit such notice within the day following the day on which the request for production of documents is received.

The notice must state the reasons why the requested documents cannot be produced within the established time limits and propose a time frame within which the documents will be provided.

Giving notice does not automatically extend the period.

Within two days from the date of receipt of the notification from the person being inspected, the head (deputy head) of the tax authority has the right to extend the deadline for submitting documents or refuse to extend the deadline, for which a separate decision is made.

The notification may be submitted to the tax authority by the person being inspected personally or through a representative, or transmitted electronically via telecommunication channels or through the taxpayer’s personal account. Persons who are not required by the Tax Code to submit a tax return in electronic form have the right to send the specified notification by registered mail.

The form and format of the notification about the impossibility of submitting documents (information) in electronic form within the established time frame are established by Order of the Federal Tax Service of Russia dated January 25, 2017 N ММВ-7-2/ [email protected] (registered with the Ministry of Justice of Russia on April 3, 2017 N 46230).

The approved form is used from April 15, 2020.

________________________________________ name of the tax authority that sent the request for the submission of documents (information), tax authority code Notification No. ____________ about the impossibility of submitting documents (information) within the established time frame ____________ date ___________________________________________________________________________ full name of the organization (responsible participant of the consolidated group of taxpayers), (F.I.O. .{amp}lt;1{amp}gt; individual) - taxpayer (tax payer, insurance premium payer, tax agent), TIN {amp}lt;2{amp}gt;, checkpoint {amp}lt;3{ amp}gt; notifies that it is not able to submit the following requested documents (information) within the established requirement for the submission of documents (information) dated _______ N _____ deadline date number: 1) documents: ______________________________________________________________________; item numbers, names, details, other individualizing features of the documents specified in the request for the submission of documents (information) {amp}lt;4{amp}gt; ______________________________________________________________________________, 2) information: item numbers, information allowing to identify the transaction specified in the request for the submission of documents (information) {amp}lt;4{amp}gt; for reason ________________________________________________________________, the reason is indicated why the requested documents (information) cannot be submitted within the time limits established by the requirement for the submission of documents (information) ________________________________________________ ┌─┬─┐ ________________________________________________ │ │ │ {amp}lt;5{amp}gt;. └─┴─┘ The specified documents (information) can be submitted no later than ____________ {amp}lt;6{amp}gt;. Application date {amp}lt;7{amp}gt;: ____________________________________________________________; ____________________________________________________________. ┌─┐ The accuracy of the information specified in this notice, │ │ {amp}lt;8{amp}gt;: I confirm └─┘ _____________________ ______________________________ __________________ position {amp}lt;9{amp}gt; FULL NAME. {amp}lt;1{amp}gt; signature Contact phone number {amp}lt;10{amp}gt; _______ Email address {amp}lt;10{amp}gt; ______ Name of the document confirming the authority of the representative {amp}lt;11{amp}gt; _____

———————————

We invite you to familiarize yourself with: Deadline for payment of personal income tax in 2020: table for legal entities

10 - it is necessary to extend the deadline for fulfilling the requirement to submit documents (information) for objective reasons (documents are stored in remote storages (archives); significant volumes of requested documents (information); other reasons);

20 - it is impossible to submit the requested documents (information) due to their absence (lost; not received (not compiled).

1 - individual;

2 - representative of an individual;

3 - legal representative of the organization (responsible participant in the consolidated group of taxpayers);

4 - authorized representative of the organization (responsible participant in the consolidated group of taxpayers).

In accordance with clause 4 of Article 93 of the Tax Code of the Russian Federation, the refusal of the audited person to submit the documents requested during a tax audit or failure to submit them within the established time frame is recognized as a tax offense and entails liability provided for in Article 126 of the Tax Code of the Russian Federation (a fine of 200 rubles for each failure to submit document).

In accordance with clause 6 of Article 93.1 of the Tax Code of the Russian Federation, a person’s refusal to submit documents required during a tax audit or failure to submit them within the established time frame is recognized as a tax offense and entails liability provided for in Article 126 of the Tax Code of the Russian Federation (a fine from an organization or individual entrepreneur in the amount of 10 000 rubles, from an individual who is not an individual entrepreneur - in the amount of 1,000 rubles).

Wrongful failure to report (untimely communication) of the requested information is recognized as a tax offense and entails liability under Article 129.1 of the Tax Code of the Russian Federation (fine from 5,000 rubles to 20,000 rubles).

According to Article 93 of the Tax Code of the Russian Federation, the inspectorate has the right to request documents from the taxpayer during desk and field tax audits.

As part of a desk audit, the Federal Tax Service may not include any documents in the request, but only those mentioned in Article 88 of the Tax Code of the Russian Federation. These include, in particular:

- when applying tax benefits - documents confirming these benefits (clause 6 of Article 88 of the Tax Code of the Russian Federation);

- when submitting a declaration in which the right to a VAT refund is declared, - documents confirming the right to deductions for value added tax (clause 8 of Article 88 of the Tax Code of the Russian Federation);

- if contradictions are detected between the data specified in the VAT return and in the reporting of counterparties, either in different fields of the same VAT return, or in the VAT return and in the log of received and issued invoices, - invoices, " primary" and other documents related to conflicting information (clause 8.1 of Article 88 of the Tax Code of the Russian Federation);

- when submitting an updated declaration two years after the deadline for submitting reports, if the “update” states a decrease in tax payable or an increase in loss compared to the indicators in the primary declaration - documents confirming changes in the initial data, and tax accounting registers, which reflect the indicators up to and after changes (clause 8.3 of Article 88 of the Tax Code of the Russian Federation);

- when submitting calculations for insurance premiums - documents confirming the validity of the reflection of non-taxable amounts and the application of reduced tariffs (clause 8.6 of Article 88 of the Tax Code of the Russian Federation).

We invite you to read: What documents are needed for a tax deduction for education?

Rules for submitting documents have been updated

Tax officials have updated the forms of documents used in control activities, including the request form for the submission of explanations and documents.

In addition, the requirements for documents submitted to the tax authority on paper have been adjusted. The entire volume of papers for inspectors must be divided into parts of no more than 150 sheets each. Each such volume is separately bound, numbered and certified by the personal signature of the person confirming the authenticity of the papers. According to the new rules, a company seal is not needed to certify them. Documents of more than 150 pages are not divided into parts.

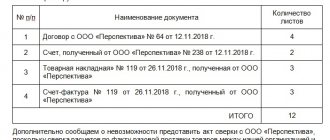

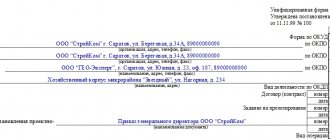

The collected package must be accompanied by a covering letter indicating the details of the inspectors' request or another basis for submitting papers. The letter must contain a list of all documents, or this information must be included as an attachment to it.

Editor's note:

If documents are submitted electronically through TKS or a personal account, a list of data submitted to the inspection is generated automatically. In addition, based on the text of the regulations, a cover letter must be drawn up only when sending papers at the request of the Federal Tax Service.

Their voluntary submission does not fall under the new requirement.

How to quickly send a large number of documents to the Federal Tax Service

In this regard, many companies and entrepreneurs use modern services that make it easier and faster to send documents to the inspectorate. Such services, in particular, include “Connector Kontur.Extern”. It makes it possible to send tens of thousands of electronic documents to tax authorities at a time, while approximately 9 thousand documents are processed per hour.

Through the “Connector” you can transfer to the Federal Tax Service any electronic documents created in approved formats (for example, invoices, TORG-12 invoices, etc.). Such documents are sent in the form of XML files. Also, “Connector” sends scanned images of any documents created on paper: acts, contracts, bills, etc. Scanned images are transmitted in the following formats: pdf, jpg, png, tiff. An inventory of sent documents is generated automatically.

We invite you to familiarize yourself with: Sample application to the bank

Taxpayers who have to submit a lot of “primary information” to the Federal Tax Service proceed as follows. They install the “Kontur.Extern Connector” on different computers and start parallel sending. Thus, the risk of missing the deadlines for submitting documents is reduced to zero.

Connect to the Kontur.Extern system

When inspectors have the right to demand documents, and what are the consequences of disobedience?

The tax authority has the right to require documents:

- necessary in connection with a desk or field audit of the taxpayer (clause 1 of Article 93 of the Tax Code of the Russian Federation);

- relating to the activities of the inspected counterparty (clause 1 of Article 93.1 of the Tax Code of the Russian Federation);

- regarding a specific transaction outside the framework of tax audits (clause 2 of Article 93.1 of the Tax Code of the Russian Federation).

Responsibility for refusal to submit requested documents in relation to one’s own activities or their failure to submit them within the established time frame is provided for in Art. 126 of the Tax Code of the Russian Federation. The penalty is a fine of 200 rubles for each document not submitted.

Other persons for failure to submit documents about the taxpayer, refusal to submit documents they have, or submission of documents with knowingly false information may be held liable under clause 2 of Art. 126 of the Tax Code of the Russian Federation. The amount of the fine for organizations and individual entrepreneurs is 10 thousand rubles.

For unlawful failure to report or untimely communication of the requested information (not documents), liability arises in accordance with Art. 129.1 Tax Code of the Russian Federation. For the first offense, this entails a fine of 5 thousand rubles. A repeated act within a calendar year is punishable by a fine in the amount of 20 thousand rubles.

The Code of Administrative Offenses of the Russian Federation also provides for sanctions for taxpayer officials who fail to provide inspectors or distort documents and information necessary for tax control. Punishment in the form of a fine is imposed in accordance with paragraph 1 of Art. 15.6 of the code and can range from 300 to 500 rubles.

In addition, if the taxpayer does not submit the documents requested during the tax audit on time, the inspectorate may seize them (Clause 4 of Article 93 of the Tax Code of the Russian Federation).