When you may need a certificate of current current accounts

A similar tax certificate may be required in several situations:

- if you negotiate with a potential investor;

- if you are developing a business plan as a legal entity. face;

- you have a desire to take part in competitions or auctions;

- to apply to the courts;

- to respond to requests from prosecutors;

- during reorganization or liquidation of the company;

- if you wish, apply for a loan;

In addition to these situations, such a certificate may be required in the daily activities of the company.

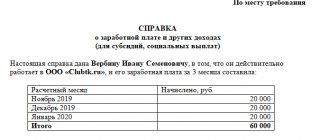

Certificate of turnover on current account

The difference between this document and a certificate of existing accounts is that it reflects information not about open accounts, but about incoming and outgoing transactions for one or more of them.

You may need it:

- for obtaining a loan;

- tax inspectorate for calculating payments;

- in case of a desk tax audit;

- sometimes - to approve your business plan.

Help form

A taxpayer may need a form of a certificate of open current accounts from the Federal Tax Service to monitor accounts included in the tax base. After the bank employee receives an application from the entrepreneur requesting the provision of an act, he registers the request and assigns an incoming number for it. Next, responsibility passes to the employee who works with entrepreneurs and legal entities. A businessman may discover some error in the tax base. He can provide the Federal Tax Service with reliable information on his own in such a situation.

Certificates of open accounts are currently issued by all tax authorities. In order to obtain a certificate from the territorial branch of the tax authority, you must fill out an application. This can be done in any form. It also happens when an entrepreneur submitted an application in accordance with all the rules, but the tax service specialists made a mistake when entering data into the database. In this case, the company’s accountant or lawyer working for the company can also ask for a certificate.

Who issues certificates about the status of current accounts

Where can I get such a certificate? There are 2 options:

- contacting the tax office;

- contacting a credit institution.

In this case, the request is made on the official letterhead of the company, and the manager puts his signature and seal.

A sample certificate could look like this.

The tax service has an obligation to issue this document upon your request. The certificate can be drawn up at any branch of the Federal Tax Service in the Russian Federation.

Contacting a bank is an alternative option. Most often, they simply receive information about whether legal entities are open. persons in a given bank account. In this case, there is no Federal Tax Service stamp.

Checking the received certificate

After the certificate is received, it is necessary to check its composition. It must contain correct information about all current bank accounts of the legal entity. Accordingly, you need to check whether the document contains:

- Indications for bank accounts of a legal entity.

- Names of financial organizations whose client the company is (if the current account is opened in a non-bank organization, the information should still be displayed in the certificate).

- Identification information.

- An indication of the currency in which each current account is opened.

Thus, a legal entity can contact the tax service to obtain a certificate of open accounts. To do this, you need to collect documents and submit a written request to the place of registration. The sample application posted above will allow you to fill out the document without errors.

You can obtain the document from a bank or the Federal Tax Service. In the first case, the certificate will contain information about accounts in only one bank, therefore, if you have open accounts in different banks, you will have to contact each of them.

You can order a certificate from the Federal Tax Service about all open accounts. It takes longer to do, but contains all the necessary information and frees the manager from going to banks.

The document may be necessary if certain situations arise:

- conducting negotiations with investors on further planning for investing funds in the project;

- approval of the enterprise’s business plan;

- planning a desk tax audit;

- preparation of company documentation for participation in tenders, government procurement, auctions;

- reorganization, liquidation of an enterprise;

- request from the Prosecutor's Office, Arbitration Court;

- preparation of documentation for obtaining a loan.

When liquidating an enterprise, the liquidation commission, based on the certificate received, will be able to assess the actual position of the enterprise and make an informed decision about the fate of the business entity.

The obligation to provide information on current accounts is prescribed in Article 86 of the Tax Code of the Russian Federation.

Who can receive

The list of persons authorized to request certificates of current accounts includes:

- the account holders themselves;

- representatives of the judiciary;

- representatives of the Accounts Chamber of the Russian Federation;

- representatives of the Pension Fund and the Social Insurance Fund;

- bailiffs - executors;

- representatives of the Investigative Committee of the Russian Federation;

- other officials who are specified in the Law “On Banks”.

In addition, your representative can receive the certificate using a power of attorney. Some experts say that there is no need to have a power of attorney certified by a notary, but there are cases where, due to the lack of a notarized power of attorney, a representative was refused to issue a certificate.

In addition, persons who are debt collectors under a court decision can also send a request. Such a request can be sent to any branch of the Federal Tax Service.

As for the companies themselves, the following persons have the right to receive this certificate:

- supervisor;

- Ch. accountant;

- a number of other employees who are indicated in the constituent documentation.

We also note that the certificate of open accounts has its own validity period - 1 month from the date of issue.

Other people's accounts

Paragraph 8 of Article 69 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings” stipulates that if there is no information about the debtor’s property, then the bailiff requests this information from the tax authorities, other bodies and organizations.

The claimant, if he has a writ of execution with an unexpired deadline for presentation for execution, has the right to apply to the tax authority with an application for the provision of this information.

The claimant can apply for the specified information to any territorial tax authority, including the Federal Tax Service Inspectorate (or the Federal Tax Service) at its location.

When contacting the tax authority with a request to obtain information about the debtor’s accounts, in order to confirm your rights to receive this information, you must simultaneously present the original or a copy of the writ of execution certified in the prescribed manner (by a notary or the court that issued the writ of execution to the collector) with an unexpired deadline for presentation for execution.

If a copy of the writ of execution, certified by an authorized official of the organization that is the recoverer, is submitted to the tax authority, the original of the writ of execution must be presented at the same time.

A properly completed request can be sent by mail (if it is necessary to obtain confirmation of receipt by the addressee - by registered mail with notification), or presented to the tax authority in person (through an authorized representative - by power of attorney).

If the claimant personally presents to the tax authority the original of the writ of execution, the tax authority, after documenting the fact of its existence, returns the original of the writ of execution to the claimant.

In all other cases of sending a request with a copy of the writ of execution attached, certified by an authorized official of the collecting organization, the tax authority will verify the accuracy of the received copy of the writ of execution (by sending a corresponding request to the court that issued this writ of execution).

Tax authorities provide the requested information within 7 days from the date of receipt of the request.

Explanations on this issue, in particular, are given in the Letter of the Ministry of Finance dated November 26, 2008 No. 03-02-07/2-207, as well as in the Letter of the Federal Tax Service No. SA-4-9/ [email protected] dated July 24, 2017.

Certificate of current account for bailiffs

If the request is received from a bailiff, then a link to the document that serves as the basis for enforcement proceedings must be attached. Then, when information on the accounts is identified, a resolution is sent to the banking organization to impose a penalty on the funds located in the accounts.

Judicial authorities may need this certificate in several situations:

- when searching for the debtor's property;

- in the case when the company has already been declared bankrupt and supervisory measures are being taken over its accounts.

In accordance with legal requirements, the information contained in the certificate is confidential. But if the banking organization is provided with all the necessary papers for its registration, information about the debtor’s accounts will be issued without fail.

However, information is provided only to the extent necessary to fulfill obligations to the judicial authorities. In this case, a certificate is drawn up no longer than 7 working days from the date of receipt of the official request.

Your accounts

An applicant - citizen (individual), organization, information about their bank accounts can be provided by tax authorities on the basis of the provisions of Federal Law No. 149-FZ dated July 27, 2006 “On informatization, information technologies and information protection.” In accordance with paragraphs 2 and 3 of Article 8 of Law No. 149-FZ:

- a citizen (individual) has the right to receive from government agencies and local governments information that directly affects his rights and freedoms;

- the organization has the right to receive from government agencies and local governments information directly related to the rights and obligations of this organization, as well as information necessary in connection with interaction with these bodies when this organization carries out its statutory activities.

At the same time, it is established that the owner of the information, in this case the Federal Tax Service, which exercises the powers of the owner of the information on behalf of the Russian Federation, has the right to permit or restrict access to information, determine the procedure and conditions for such access, and also, when exercising its rights, is obliged to respect the rights and legitimate interests of others persons, restrict access to information if such an obligation is established by federal laws.

By virtue of the provisions of Article 84 and Article 102 of the Tax Code, information about the taxpayer from the moment of registration with the tax authority is a tax secret, which is not subject to disclosure by tax authorities or their officials, except in cases provided for by federal law.

The procedure for access to confidential information of tax authorities was approved by order of the Ministry of Taxes of Russia dated March 3, 2003 No. BG-3-28/96.

In accordance with paragraph 11 of the Procedure, a request for confidential information is drawn up and sent in writing on the prescribed form.

When sending requests via TCS, the applicant’s signature is confirmed by an electronic digital signature.

To obtain information about their bank accounts, a citizen has the right to personally submit a request drawn up in any form, presenting an identification document; submit an application through the “Taxpayer Personal Account for Individuals” service (section: “free-form application”) or send a request via TKS, signed with your enhanced qualified electronic signature.

The applicant can apply for information about his bank accounts to any territorial tax authority, including at his location (residence (stay)).

When making a request, the applicant must take into account the fact that information about accounts (deposits) of individuals has been submitted by banks to the tax authorities since July 1, 2014. The tax authorities do not have information about bank accounts previously opened by individuals (if such accounts were not closed or there were no changes to them). Also, the tax authorities do not have information about the flow of funds across accounts. The applicant can request such information from the bank where the account is opened. Explanations on this issue, in particular, are given in letters of the Federal Tax Service No. GD-4-14 / [email protected] dated November 10, 2017, No. OA-19-17/33 dated February 20, 2017.

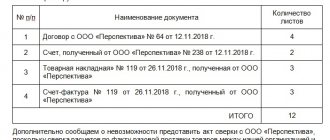

Documents to be received

If you contact a banking organization, you need to provide:

- TIN/KPP;

- your company name;

- contact information to contact you;

- address for sending the document;

- information about the person who will collect the completed certificate.

If you apply to the Federal Tax Service, prepare:

- Your passport;

- extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs;

- application filled out in any form (see sample above).

In the application, you must indicate for what purpose you are asking for the certificate to be issued, as well as provide the legal basis for its issuance.

Application for a certificate

The application is written on a special form and includes the following data:

- Business name.

- Names of banks where accounts are opened.

- Reason for receiving the document.

- Personal information about the recipient.

- Date and signature of the person completing the application.

How to submit a request

If you apply to a banking organization to receive this document, prepare your request in writing. In it, indicate what kind of certificate is needed: about the existence of an account, about the balance of funds, about the absence of debts, and so on. If you need information about account turnover , indicate for what period the certificate should be drawn up.

To summarize, we note that your request must contain the following data:

- company name/your last name and initials (if you are an individual entrepreneur);

- TIN and OGRN of the company;

- legal company address;

- request text;

- the purpose for which the request is made;

- information about persons entitled to receive a certificate;

- date of the request.

Certify the written request with the company seal and assign an outgoing number for internal reporting.

Production time

According to established standards, the permissible period for issuing a certificate of open current accounts is limited; it cannot exceed 1 month from the date of application. In most cases, the document is issued within 5 working days. Delays may occur if there are a large number of registered current accounts in different banks, as well as due to technical problems (for example, performing maintenance work on the Federal Tax Service servers).

As a rule, even when submitting a request for a certificate, the tax representative indicates when the document will be ready or sent to the address specified in the application.

If more than a month has passed since the application, but no document or written explanation has been received from the tax office, then this is a sufficient reason to contact law enforcement agencies or the prosecutor’s office. And even written explanations from the Federal Tax Service are not taken into account. If, due to the lack of a certificate, an entrepreneur, for example, had a profitable deal fall through, then he will be able to demand compensation in the amount of the potential profit that he lost. But in practice such cases are very rare. The final amount of compensation is determined by the court in which the case was heard.

How to get

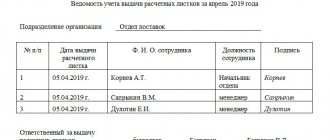

If you contact a banking organization , the receipt procedure is as follows. Bank employees, as soon as they receive your request, register it in a special journal. The document is assigned an incoming number, and the request is transferred to specialists working with individual entrepreneurs and companies.

When contacting the tax department : your request will be assigned an incoming number, then a responsible employee will be assigned who works with individual entrepreneurs and legal entities. persons. You can check all the information with him and then pick up the completed certificate.

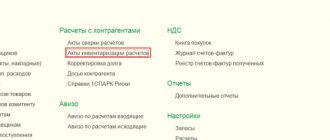

Get it online on the Federal Tax Service website

You can apply for a certificate online via the Internet. This will save a lot of time.

You can order the document on the Federal Tax Service website; just enter your data in a special form. Let us immediately clarify that a certificate received in electronic form is equal in legal force to a paper sample.

Let's take a closer look at the steps of how to obtain this certificate using the Federal Tax Service website.

- Step 1. Go to the official website of the tax authority.

- Step 2. If you already have a personal account, then submit a request through it. If not, register on the site (in the future, an electronic signature will be required to send a request).

- Step 3. Enter your data in a special form.

- Step 4. Confirm the signature using an electronic signature.

- Step 5. We are waiting for a response from the Federal Tax Service specialists.

Procedure for reporting and methods of sending notifications

For individual entrepreneurs, as well as individuals and legal entities, the procedure for reporting accounts is the same. The tax office is notified only if the organization is located abroad; in other cases, it is obliged to notify the bank in which the record is opened.

The pension fund is notified by mail or by visiting your local office. Organizations that do not have employees are not required to notify the insurance fund about opening an account.

Within a calendar week from the date of operation of the account, you must submit a notification about opening a current account to the insurance, social and pension funds. Otherwise, the entrepreneur will be forced to pay a fine of 2,000 rubles. Hiding from the tax authorities the fact of opening an account is punishable by payment of 5,000 rubles.

You can submit your application to the Federal Tax Service directly, through the inspection department, or by sending a letter with acknowledgment of receipt. You can find out the exact address and details of your local branch on the official website of the Federal Tax Service nalog.ru. The third, least recommended option is to submit documentation online using an electronic signature.

Notices to funds are also given in person or by mail. It is necessary to notify the insurance fund about opening an account only if the company is engaged in hiring workers. For a number of individual entrepreneurs this is not relevant.

The amount of payments intended for responsible notifiers in the event of failure to notify government agencies about the opening or closing of an account:

- for delay in notifying the Pension Fund of the Russian Federation, an official of the enterprise is obliged to pay an amount from 1,000 to 2,000 rubles or a reprimand is issued; for legal entities and individual entrepreneurs, the punishment provides for the payment of 5,000 rubles;

- for evading notification of the Social Insurance Fund, the responsible person of the company is subject to a fine in the amount of 1,000 to 2,000 rubles or a reprimand. for legal entities or individual entrepreneurs a fine of 5,000 rubles;

- in case of contacts with the Federal Tax Service. for the responsible person of the company - a fine of 1,000 to 2,000 rubles or a warning. for a legal entity and an individual entrepreneur, the payment amount is 5,000 rubles.

How much does a certificate of opening a current account cost?

At the tax office. When applying for a certificate from the Federal Tax Service, all data in most cases is provided free of charge .

In the bank. When sending a request to a banking institution, the situation is somewhat different: the cost of issuing a certificate directly depends on the urgency of its issuance. In general, the cost varies from 3 to 10 thousand rubles. If you want the certificate to be delivered to your office, you will have to pay about 300 rubles more (depending on the region of registration of the company, as well as the bank’s policy).

We advise you to read: Bank tariffs for opening a current account for individual entrepreneurs and LLCs with the most favorable conditions in Russia

Certificate from the tax office

Information about open and closed taxpayer accounts is transmitted by credit institutions to the Federal Tax Service. The tax office provides a certificate of the availability of current accounts based on an application from an entrepreneur or legal entity. The application is drawn up in any form and must indicate:

- Name of the tax office at the place of registration of the taxpayer;

- Name or full name of the taxpayer;

- TIN/KPP;

- Address of registration of the company or individual entrepreneur;

- In the content of the text, be sure to indicate the reason for issuing the certificate;

- Method of receiving the document (via mail, electronically, in person);

- Date, signature and stamp of the taxpayer.

Sample application for current accounts:

To the Head of the Federal Tax Service of Russia No. __ to _______________________ dated ____________ Taxpayer Identification Number __________ KPP __________ Address (legal and actual): _____________________________________

STATEMENT

____________ __________

Based on subparagraph 2 of paragraph 5 of Article 64 of the Tax Code of the Russian Federation and letter of the Federal Tax Service of Russia dated May 23, 2011 No. PA-4-6/8136, we ask you to issue a certificate containing a list of all open bank accounts _____________________________________________.

___________ will use this certificate for _____________________________________

_____________ _______________ ______________________

Sample of filling out an application for current accounts:

To the Head of the Federal Tax Service of Russia No. 6 for the Volgograd region

Gundasova A.O. from IP Sorokina P.T. TIN 3437005269 Checkpoint Address (legal and actual): 403600 Volgograd, Magistralnaya st., 6

STATEMENT

Based on subparagraph 2 of paragraph 5 of Article 64 of the Tax Code of the Russian Federation and letter of the Federal Tax Service of Russia dated May 23, 2011 No. PA-4-6/8136, we ask you to issue a certificate containing a list of all open bank accounts of Individual Entrepreneur P.T. Sorokin. This certificate from IP Sorokin P.T. will provide to obtain a loan.

IP Sorokin P.T. _________ P.T. Sorokin

Based on the application, the tax authority issues a certificate indicating the following information:

- List of names of bank current accounts;

- Name of credit institutions where personal current accounts are opened;

- In what currency;

- Identification information about current accounts.

Such a document can be obtained either by the head of the company or by a representative of the organization by proxy. There is no need to notarize the power of attorney; it must be correctly executed indicating the expiration date of the power of attorney, full name of the authorized person, passport data, name of material assets, signature of the manager and seal of the company. In addition, information about bank accounts may be needed by government officials and law enforcement agencies. At their request, the Federal Tax Service provides them with such information.

Attention: The Federal Tax Service provides a certificate of availability of current accounts within 30 calendar days!

Certificate from a credit institution Information about bank accounts can also be obtained from the servicing bank. To complete the application you must provide the following information:

- TIN/KPP of the organization;

- Name of the legal entity or full name of the Individual Entrepreneur;

- Company contact details;

- Method of sending the document (in person, by mail).

The period for providing such a document is from 1 to 3 days. The document can be received by the head of the company or presented in person on the basis of a power of attorney, since it is necessary to sign the second copy of the statement. Certificates of the availability of current accounts for individuals are issued by the bank at the request of bailiffs, courts, and law enforcement agencies. In the event of the death of the depositor, the credit institution provides such information to the notary's office through the probate process. For foreign citizens, the certificate is submitted to the consular office of foreign states.

It is important to know that when ordering a certificate of availability of current bank accounts, you will have to pay the bank for such a service. But not all institutions accept such certificates, for example: the prosecutor's office or investigative authorities, so you will still need to make a request to the Federal Tax Service.

Conditions for refusal by the Federal Tax Service to issue a certificate of availability of current accounts. Refusal from the tax office may occur if:

- The taxpayer's information was incorrectly indicated in the application for a certificate of availability of current accounts;

- The inspectors themselves may make mistakes when entering the data of an organization or individual entrepreneur. In this case, you will have to provide the passport details of the manager or individual entrepreneur, an extract from the state register of the legal entity and an application.

Be careful when drawing up the application, fill it out without errors, because the period for issuing a certificate from the Federal Tax Service reaches up to 30 calendar days.

The tax office is obliged to provide information on bank accounts at the request of the taxpayer within the time limits specified in the legislation. If the deadlines are violated, then feel free to contact the prosecutor’s office.