An electronic digital signature (EDS) is a tool necessary for electronic document management, interaction with regulatory authorities and receiving government services on the Internet. Digital signatures can be used by individuals, entrepreneurs and companies.

EDS for individual entrepreneurs allows you to submit reports to the tax office without a personal visit, use the signature for remote interaction with counterparties and receive government services online. Such a signature must meet a number of requirements prescribed by law.

In this article, we will understand what an electronic signature is, how an individual entrepreneur can obtain it, and what advantages such a signature creates.

Do you need an EDS? We will select the appropriate type of electronic signature for your business in 5 minutes.

Leave a request and get a consultation.

Electronic signature for small businesses

Today, small and medium-sized businesses still do not widely use the main electronic document management tool. Most likely, there are two reasons for this. The first is the misconception that obtaining and using an electronic digital signature (EDS) is a complex and time-consuming process. And the second is distrust of virtual document management and ignorance of all the advantages and possibilities of its use.

And this is understandable, because the period of active implementation of digital signatures is less than 7 years. Even government agencies and the main regulatory bodies of the Russian Federation began to gradually switch to electronic interdepartmental document flow only in mid-2011. Since 2012, the process of unification and standardization of online document flow began. It was launched in all executive authorities of the Russian Federation, and large progressive businesses began to join the process. Thanks to these steps, today electronic interaction is functioning at full speed and is gradually penetrating all layers of business, including micro-businesses.

An electronic digital signature is an element of personal identification in legal and financial transactions in digital format. The owner of an e-visa is the person for whom the digital signature and certificate were issued. This is always an individual, even if the signature is used for an individual entrepreneur or organization.

At the same time, an electronic digital signature (EDS) serves to identify individuals. persons, entrepreneurs or organizations when they conduct secure, legally significant electronic document management. The use of an electronic digital signature is regulated by Federal Law No. 63 “On Electronic Signatures”.

Video: what is an electronic signature and why is it needed?

Registration at the CA

Let's look at how to make an electronic signature for the tax office. You should collect the necessary documents and appear at the selected organization. You need to contact only accredited Certification Centers. Their list can be viewed on the website of the Ministry of Telecom and Mass Communications of the Russian Federation. Proof of identity will be required. If for some reason the applicant cannot appear at the center himself, then another person who represents his interests and has the authority to officially act on his behalf can draw up the signature. To obtain an electronic signature for individuals and individual entrepreneurs, the tax authorities will need:

- passport;

- SNILS;

- certificate of state registration of individual entrepreneurs;

- certificate from the Unified State Register of Individual Entrepreneurs;

- TIN.

For companies, the list of documents will be slightly different. Legal entities will need:

- power of attorney for the right to act as the owner of an electronic signature certificate for the tax office (in case the signature will be issued to an employee of the enterprise and not to its director);

- passport, INN and SNILS of the person for whom the signature will be drawn up, or his authorized representative;

- certificate from the Unified State Register of Legal Entities;

- copies of the company's charter, its constituent agreement, a certificate of state registration of a legal entity, a certificate of its registration with the Federal Tax Service, an order for the appointment of a director.

The list of required documents is given in Art. 18 of Law No. 63-FZ “On Electronic Signatures”. But the CA may require additional papers, so check in advance what you need to prepare.

After receiving all the documents, CA specialists will begin to prepare an electronic digital signature for the tax office and will notify the applicant when it is ready.

Types of electronic signature

The legislation of the Russian Federation approves 2 types of digital signatures:

- simple,

- reinforced, which can be: qualified,

- unqualified.

A simple electronic signature only indicates the fact that the electronic signature was formed by a certain person. It is used by individuals.

An unqualified electronic signature is, although a more secure version of an electronic signature, but, like a simple one, it has a limited range of actions and is not very suitable for business. It is analogous to the signature of an individual in contracts, acts, and other document flow. It is worth noting that such a signature is practically not used when doing business, since its functions are quite limited. With its help, it is impossible to conduct online reporting from the tax office or receive full communications with the government services portal. But you have to register and pay for such a visa.

An enhanced qualified electronic signature (ECES) is one of the most necessary and multifunctional tools for an entrepreneur, which makes it possible to create a convenient and efficient document flow between regulators, government agencies. structures, as well as contractors of individual entrepreneurs.

Obtaining an enhanced skilled visa is a necessary condition for running a private business when interacting with:

- with a single portal of government services of the Russian Federation - obtaining services, information and documents;

- with the Federal Tax Service, Pension Fund, social services. funds, interdepartmental structure of regulators - reporting and document flow;

- with payment and banking systems - generation of payment documents via the Internet;

- with state and municipal entities - in terms of online execution of document flow (permits, official requests, etc.).

Thus, UKEP is a full-fledged official signature of the entrepreneur. According to the legislation of the Russian Federation, it has absolute legal force.

Table: comparison of different types of electronic signature

| Simple | Reinforced unskilled | Reinforced qualified | |

| Method of formation and design | Using a login and password, does not require registration with a certification center. | It is formed using cryptography and certified by a specialized center (which may not be accredited). | Confirmed by a special certificate from an accredited certification center. Such a visa must have an electronic signature verification key. The UKEP code and key are confirmed by the FSB of the Russian Federation. |

| Scope of use | For official requests when solving life situations by individuals (for example, for letters, messages to regulators, municipal authorities, utility companies). | To identify who sent the online document. In this case, it is possible to certify that the document has not changed since the moment it was signed, or to reveal the fact that changes were made to it after approval. For signing electronic documents that do not require a seal (for example, contracts between individual entrepreneurs, accounting reports, requests, etc.). | Acts as an official full signature. |

| Possibility of use in internal and external document flow | Yes | Yes | Yes |

| Possibility of use in arbitration court | Yes | Yes | Yes |

| Possibility of use in regulatory authorities (Federal Tax Service, Social Insurance Fund, Pension Fund of Russia) | No | No | Yes |

| Possibility of use on the public services portal | Yes | Yes | Yes |

| Possibility of use in electronic auctions | No | No | Yes |

What's the result?

So, we looked at the question of how to obtain an electronic digital signature for the tax office. Unfortunately, this cannot be done for free and without leaving your home or office. To fully interact with the Federal Tax Service online, an entrepreneur needs to obtain a qualified electronic signature. To do this, you should contact any certification center. Such an electronic signature will help you submit various legally significant documents through the Personal Account on the Federal Tax Service website, as well as report electronically through third-party services.

Without registering an IP CEP in the taxpayer’s personal account, you can only write a message in free form and see the answer to it. At the same time, an unqualified signature, which can be issued in the personal account of an individual, is not suitable for an individual entrepreneur for exchanging documents and information with the Federal Tax Service.

Pros and cons of digital signature

Electronic signatures are increasingly used in private business activities, as they provide ample opportunities for solving problems of information security, the legal status of document flow, and save time and resources.

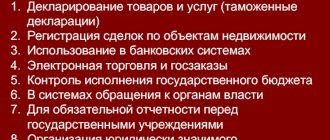

The maximum range of uses of an online visa includes:

- ordering and receiving government services, as well as municipal services;

- operational interaction with the government. institutions (questions and answers);

- submission of full reports in the EDI system of the Federal Tax Service of the Russian Federation, the Pension Fund, and other regulators;

- conclusion of civil transactions;

- participation in electronic auctions.

Pros of using an electronic signature (applies to online qualified visa only):

- confidentiality of document flow;

- control of the integrity and impossibility of falsifying the document;

- instant identification of authorship (who endorsed and sent the document);

- maintaining legal relevance;

- significant time savings on document exchange;

- reducing the cost of delivery, accounting and archiving;

- minimizing risks.

EDS keys are stored on digital media

Separately, it is necessary to focus on the advantages of reporting to regulatory authorities through the exchange of EDI (tax) and the so-called EDS (PRF), which is submitted only if there is a UKEP:

- no need to personally visit regulators - reporting can be sent from any convenient place and at any time (saving time);

- no need to duplicate reporting documents on paper;

- filling out reporting forms is automated, which leads to minimizing errors and modifications;

- forms to fill out are always up to date, no need to search for and specify the correct templates;

- the acceptance of the report (or refusal) will be promptly notified: the individual entrepreneur will receive information whether the document has been accepted within one day;

- the reporting will not be able to be viewed or adjusted by third parties;

- You can always receive and save in electronic form reference information on the status of settlements with the state budget, statements, notifications about reporting deadlines, reconciliation reports, and also ask questions to regulators.

It is impossible to forge a qualified electronic signature. It is developed using ciphers; when it is created, a unique chain of symbols is built. Each set of digital signature documentation contains recommendations from the certification center for storing and using the key. If you follow the rules and follow the recommendations, the signature will be completely safe. As authorized centers of the Ministry of Telecom and Mass Communications assure, today there is no computing power in the world that can crack the cryptography of an electronic signature in an adequate time frame.

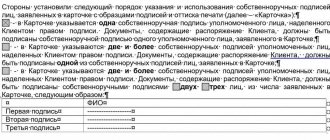

At the same time, on each USB drive of the UKEP there are 2 digital signature keys: private and public. The private key forms a unique generation of numbers and symbols of the electronic signature with which the document is endorsed. The UKEP is located in the body of the signed document, and may also be attached to it. The private key is intended to verify the authenticity of the digital signature. The keys are interconnected and insure each other.

Like other electronic media of confidential information, the EDS key is encoded with the owner’s personal PIN code. There is a limited number of attempts to enter a password (usually three); after entering the code incorrectly, the digital signature is blocked.

It is also impossible to change or falsify the text of an electronic document endorsed with an electronic signature. All adjustments that were made after signing will be immediately visible. Checking the electronic visa will show that the digital signature is distorted.

The electronic digital signature operation scheme includes verification by the receiving party

If the owner of the signature tries to refuse the electronic document endorsed by him, he will not be able to do this. The digital signature contains a number of attributes by which you can determine at any time who owns the personal electronic signature. The combination of a unique certificate number, as well as the data of the certification center, will help you quickly prove the fact and date of signing.

Despite the extreme complexity of the mathematical tools of cryptography and the software that implements them, the use of an electronic signature for its owner is surprisingly simple and accessible to everyone, regardless of the level of personal computer skills, education and occupation.

RosIntegration

https://rosreport.ru/

Having listed all the advantages of a qualified electronic signature, one cannot help but mention its virtually only disadvantage: obtaining UKEP is a paid service of certified certification centers (CA). In this case, any electronic signature (both qualified and unqualified) is valid for only one year. After 365 days it must be received again.

As an example, we present the prices of one of the operators for providing online electronic visas, which provides a wide range of tariffs for various types of digital signatures for individual entrepreneurs, organizations and individuals. persons - authorized certifier. As you can see, the delta between the tariffs is huge: from 700 to 12 thousand rubles. Similar tariffs (plus/minus) apply in other CAs. Which one the business needs is an individual decision for each entrepreneur.

Table: tariffs when using digital signature for the RosIntegration CA

| Rate | Characteristic | Cost for 1 year, rub. |

| Minimum | Designed for individuals to ensure work on the portal of government services and the Federal Tax Service. | 700 |

| Optimal | For individuals to ensure work with basic government information systems. It includes the transfer of a CIPF license, certified media and provision of technical support during the validity period of the certificate. | 3000 |

| Starting | For individual entrepreneurs and legal entities in order to ensure work with basic government information systems, as well as for organizing procurement under 223-FZ. | 3590 |

| Base | For individual entrepreneurs and legal entities in order to ensure work with government information systems, as well as for organizing procurement under 223-FZ. | 4500 |

| Classic | For individual entrepreneurs and legal entities in order to ensure work with the main state information systems, as well as to organize procurement under 223-FZ and 44-FZ at all federal and commercial sites included in the AETP. | 6490 |

| Premium | For individual entrepreneurs and legal entities in order to ensure work with state information systems, to work under 223-FZ and 44-FZ on all federal and commercial sites included in the AETP, including the group of B2B sites. | 7700 |

| Exclusive | Contains a range of services to ensure work with government information systems, work under 223-FZ and 44-FZ at all federal and commercial sites included in the AETP, including a group of B2B sites. | 11700 |

What is an electronic signature and key certificate

Legislators have defined an electronic signature as information in electronic form attached to other information (signed) and certifying the signatory. Its application is regulated by the Law “On Electronic Signatures” dated April 6, 2011 No. 63-FZ, which reflects the right to use electronic signatures in the provision of municipal or government services when concluding civil agreements or other actions provided for by the relevant legal acts.

The main task of an electronic signature, like a handwritten signature in life, is to certify:

- authorship of the document;

- completeness and correctness of information in the document;

- integrity of the document.

The need for such an analogue of a handwritten signature is dictated by rapidly developing technologies that make it possible to conduct business remotely, using the Internet and telecommunication channels.

For example, an electronic signature is needed for online cash registers. How to do it, see the material “How and where to get an electronic signature for online cash registers.”

In most cases, an electronic signature is a materialized concept of a complex that includes special programs, capabilities for operating a key certificate and its storage. As a rule, the storage is a flash drive or smart card on which the electronic signature verification key certificate is recorded. It is precisely this that is an electronic autograph, which is produced and issued by a certification center (CA).

The electronic signature verification key certificate contains:

- information about the owner of the electronic signature;

- individual unique number;

- certificate validity period (one year);

- name, address and details of the CA that issued and issued the electronic signature.

After a year, the certificate expires and a new one must be purchased.

NOTE! If there can only be one handwritten signature, then the number of electronic signatures that can be issued to one person is unlimited.

In addition to the digital signature enhanced by the electronic signature key, there is also a so-called simple electronic signature - PEP.

How and where to get an electronic signature

Let us note once again that to work on various resources you can use different types of digital signature:

- For the public services portal, both simple and qualified electronic signatures can be used;

- To interact with regulators and complete document flow, an individual entrepreneur needs only UKEP.

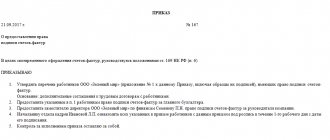

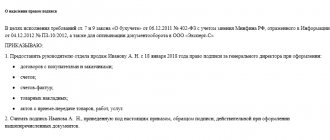

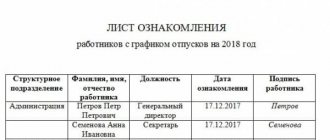

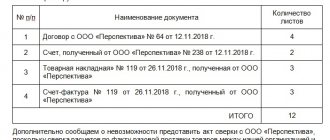

Photo gallery: what digital signature looks like

This is what the signature of the Federal Tax Service of the Russian Federation looks like; banks have similar visas

Personal visa and stamp in electronic document management

Digital signature on a pdf document

Simple digital signature

You can receive and use a simple electronic signature using a simplified account on the government services website. The signature code is encrypted in the login and password. It is assigned to everyone who registers on the Personal Account portal.

The procedure for obtaining an electronic signature is as simple and fast as possible. To do this you only need to go through a few steps:

- When registering a Personal Account (PA), it is enough to enter personal data in the standard form: full name, telephone number, email.

- The portal system automatically generates the first simple electronic signature. Data verification takes a few minutes, after which an access code is sent to the applicant’s specified email or phone number.

- Enter the received password and continue filling out the user profile.

- The second stage requires entering the data of basic documents: passport, SNILS number, INN.

- This data is also verified by the system. Waiting for the result will take no more than 15 minutes, and upon completion you will receive a message about successful completion.

- If all data is entered correctly, an SMS will be sent to the phone number specified in the form and access to a full-fledged Personal Account will be opened. faces.

- The formation of a simple digital signature is completed.

The unified government services portal ensures the receipt of digital signatures

The minimum functionality of the account and a simple signature can be slightly increased if you re-register your standard account on the government services website into a confirmed one and receive a non-qualified digital signature. Re-registration does not change the type of signature itself, but provides expanded opportunities for using the personal account.

When registering a verified account, we recommend that you immediately enter into your account information on your Taxpayer Identification Number (TIN), birth certificate number, compulsory medical insurance policy, driver's license series and number, information about the car registered in your name, military ID, and international passport. When the need arises, complete information on key documents will be concentrated in one place. In addition, you can automatically set up notifications, for example, about traffic fines and pay them off in a timely manner with a 50% discount.

To register for UNEP, you need to personally visit any of the service centers (their list is available on the government services portal) or the MFC. Or make an application from the website for the provision of UNEP through the post office.

At the issuing center you will be asked to present your passport (or a document replacing it) and SNILS. The identification procedure (excluding queues) takes no more than 5 minutes. After which you will receive a password, which you will need to enter when opening your Personal Account.

As a result, the user of the personal account receives expanded rights to use the unified state. portal.

You can apply for UNEP through a personal visit to the MFC

How to quickly get UKEP

Only an enhanced qualified electronic signature has maximum rights when using government services, as well as maintaining document flow with regulators. To get it, you will have to spend a little more time. But these efforts are worth the final result, taking into account all the advantages of UKEP.

The procedure for obtaining an enhanced qualified electronic signature consists of several points:

- choosing a certification center;

- choosing the type of signature, its capabilities and tariff;

- filing an application;

- receiving ES;

- gaining access to e-government resources.

Selecting a CA and submitting an application for an electronic signature

You should choose a certification center (CA) that is convenient for you from among those accredited by the Ministry of Telecom and Mass Communications of the Russian Federation. Today there are about 450 CAs operating in the Russian Federation. Their current list is published on the Ministry’s website in the “Accreditation of Certification Centers” section.

When choosing a CA, be careful, because if the center’s license is revoked, you will have to obtain an electronic signature again, and when transferring functions to a receiver, you will have to re-register the digital signature. But there is no need to worry, training centers close infrequently; in recent years, only 8 centers have been closed for various reasons.

On the federation portal. authority, it is recommended to check the availability of the CA service, go to the organization’s website, call, clarify the center’s capabilities, the cost of digital signature, etc.

You can find a suitable offer on the websites of certification centers

Please note: in some centers, an individual entrepreneur can receive training on how to connect and use a digital signature, get advice on working with different document extensions, learn how electronic trading is carried out with UKEP, etc.

The next step is to select the type and rate of electronic signature depending on the direction and requirements of the business. The type of digital signature depends on what the individual entrepreneur plans to do: whether a full list of services is needed (including federal electronic trading) or the businessman plans to only submit reports to the Federal Tax Service. EDS operators usually have a sufficient choice of options, including individual configuration of parameters.

Subsequently, you must submit an application for an electronic signature. You can do this in two ways:

- Leave a request on the website or by calling an accredited center. In this case, specialists, having clarified the necessary points, will start the process themselves.

- Apply for a visa through the online government services portal.

Receiving an electronic signature

The final action is to obtain a qualified electronic signature, as well as a certificate and UKEP key. This must be done in person at the certification center. An electronic signature can only be obtained upon presentation of a passport; without this, the center does not have the right to issue a signature certificate and a key in hand.

To obtain an online visa, an individual entrepreneur must prepare a package of documents, which includes:

- application (the form to be filled out must be issued by the CA);

- passport (original) or a document replacing it;

- SNILS insurance certificate;

- TIN certificate;

- registration sheet in the Unified State Register of Individual Entrepreneurs (optional).

Many CAs ask you to submit copies of documents along with the originals. This is not the responsibility of the applicant, as stated in Article 18 of Federal Law No. 63. Whether or not to make copies for a visit to the center is the individual entrepreneur’s decision.

Upon receipt of the digital signature, a certificate is issued

If an individual entrepreneur plans to engage in electronic trading, for accreditation on trading platforms, scans of documents in electronic form are additionally required (in one of the formats: jpg, pdf, gif, tiff, png). Moreover, they must be scanned in good quality (be readable).

The entire package is generated in one file:

- a scanned copy of the UKEP owner’s passport and verification key certificate (all pages are needed, not just completed ones);

- Bank details of the individual entrepreneur: current account, bank, BIC and checkpoint of the bank.

After registering with the CA, the entrepreneur receives:

- A USB drive (flash drive) that contains information with a cryptographic digital signature cipher;

- software for installation on your computer;

- a license confirming a qualified signature, and a certificate.

Registration of signature on electronic resources

When logging in to the government services portal, you must select the “Login by electronic means” function and follow the path to the removable storage device.

After receiving the digital signature, you can use it to log into your personal account on the Federal Tax Service website

Registration on the portal of the Federal Tax Service of the Russian Federation follows the same path. Having an electronic signature in hand, through taxpayer identification, the entrepreneur must independently register on the portal and receive a “subscriber identifier” in the tax reporting system (section “Electronic services” of the Federal Tax Service).

In this case, with the provision of simple software support, the individual entrepreneur gains access to the “Legal Taxpayer” program. This service allows you to prepare, save and send tax and accounting documents online to the Federal Tax Service. reporting, using templates to calculate the amount of insurance premiums, issue certificates (for example, for personal income tax (2, 3, 4, 6-NDFL), draw up registers, notifications, etc.

This resource can also:

- automatically calculate accounting data using input figures;

- control the correctness of filling out the templates;

- create a transport container for shipment to the Federal Tax Service;

- generate a paper document (if necessary), as well as its electronic form;

- maintain a register and archive of files;

- compile lists of contractors and employees and much more

Program of the Federal Tax Service of the Russian Federation for automating the reporting process, including individual entrepreneurs

EDS validity period, extension

The standard validity period of the UKEP is 1 year. If an individual entrepreneur received an electronic signature on December 1, 2020, he will be able to use it until November 30, 2020, after which the digital signature key certificate will stop working.

To renew your digital signature, you need to contact the CA. The center issues a new key and a certificate for it.

To prolong the UKEP, the entrepreneur must again prepare a package of papers, which includes:

- application for renewal of signature;

- entrepreneur's passport;

- SNILS;

- Certificate of state individual entrepreneur registration;

- TIN;

- extracts from the Unified State Register of Individual Entrepreneurs.

After submitting all documents, the certificate and new key will be ready within one business day. The following is the standard procedure for reloading the new certificate onto the computer.

The EDS service will tell you when to renew the certificate

Verifying the authenticity of the EDS Certificate

The authenticity of the digital signature certificate can be checked online. To do this, the government services website has a special service that is designed to confirm an electronic signature and a certificate for it: just insert a scan of the certificate and click verify. The service will show the result - whether the e-visa is currently valid and whether the center that issued the UKEP certificate is working.

You need to know that this portal service is for informational purposes only and cannot be used as evidence in court.

There is one managerial postulate: what is not controlled does not work. Online resources - taxpayer personal account, electronic signature, Internet services of the Federal Tax Service of the Russian Federation and government services - allow you to keep your business under control online, without leaving your home. Today we are just beginning to master these opportunities, and tomorrow we will not be able to conduct our business without them.

What basic operations are available in your personal account:

- Filing declarations and reporting;

- Obtaining information about taxes, penalties, arrears, debts, overpayments. Carrying out reconciliations;

- Submitting applications for registration of individual entrepreneurs or enterprises, making amendments to the constituent documents;

- Pay taxes online;

- Sending official requests to department specialists and receiving clarifications from them, tracking the status of processing applications.

This is not the entire list of available actions. A full list of personal account options for individuals can be found here and for legal entities here.

With a qualified electronic digital signature, you can submit reports not only to the tax authorities, but also to other government agencies, log in to the Unified State Public Administration and use its services.